Академический Документы

Профессиональный Документы

Культура Документы

Internal External: Prepared by M.T. Sacramed

Загружено:

Lawrence CasullaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Internal External: Prepared by M.T. Sacramed

Загружено:

Lawrence CasullaАвторское право:

Доступные форматы

BASIC ACCOUNTING (FUNDAMENTALS OF ACCOUNTING)

By: Win Ballada and Susan Ballada DEBET DARE=DEBET HABERE

INTRODUCTION TO ACCOUNTING FUNDAMENTAL CONCEPTS

1. Entity Concept

Forms of Business Organization 2. Periodicity Concept

1. Sole Proprietorship 3. Stable Monetary Concept

2. Partnership

3. Corporation CRITERIA FOR GEN. ACCEPTANCE OF AN ACCTG

4. Cooperative PRICIPLES

Principle has RELEVANCE

Purpose of Business Organization Principle has OBJECTIVITY

1. Service Principle has FEASIBILITY

2. Merchandising

3. Manufacturing GENERAL ACCEPTED ACCOUNTING PRINCIPLES (GAAP)

-set of guidelines and procedures that constitute acceptable

Miro, Small and Medium Enterprises accounting practice at a given time

1. Objectivity

Micro Enterprises- are those w/ assets, before financing, of P3 2. Historical Cost

million or less and employ not more than nine workers. 3. Revenue and Expense Recognition

4. Adequate Disclosure

Small Enterprise- are those w/ assets, before financing, of above P3 5. Materiality

million to P15 million and employ 10-99 workers. 6. Consistency

Medium Enterprise- are those w/ assets, before financing, of above R.A. No. 9298 ( Phil. Accountancy Act of 2004)

P15 million to P100 million and employ 100 to 199 workers. Under Sec. 4: Practice of Accountancy

Practice to Public Accountancy

Activities of Business Organization Practice in Commerce and Industry

Financing Activities- require financial resources to obtain Practice in Education/Academe

other resources used to produce goods and services. Practice in Government

Investing Activities- resources from one form to a different

form, w/c is more valuable, to meet the needs of the people. ACCOUNTANTS FUNDAMENTAL PRINCIPLES

It include buying land, equipment, buildings and other 1. Integrity

resources that are needed in the operation of the business 2. Objectivity

and selling these when they are no longer needed. 3. Competence and Due Care

Operating Activities- involve the use of resources to design, 4. Confidentiality

produce, distribute and market of goods and services. 5. Professional behavior

ACCOUNTING BRANCHES OF ACCOUNTING

Art of recording, classifying and summarizing business Auditing

financial transaction and interpreting the result thereof. Bookkeeping

Process of identifying, measuring and communicating Cost Bookkeeping and Accounting

economic information to permit informed judgments and

Financial Accounting

decisions by the users.

Financial Management

Information system that measures processes and

communicates financial information about an identifiable Managerial Accounting

economic entity. Taxation

Service activity and its function are to provide quantitative Government Accounting

information, primarily financial in nature.

USERS OF FINANCIAL INFORMATIONS

Business transaction is the economic activities of the business. Internal Users- individuals that are inside the business entity and

Significant function of accounting is to record transaction in a involved in the day to day operation

historical event. External Users- individuals and others that have current or potential

financial interest and not involved in daily operation

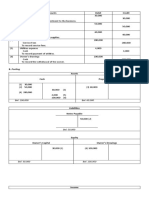

PURPOSE AND PHASES OF ACCOUNTING INTERNAL EXTERNAL

Handles financial operations of the business Investor Prospect Investor

Provides information and advices to both internal and Owner Lenders

external users Directors Suppliers/Creditors

Produce aid to management in planning, control and Head of Offices Customers/Public

decision making and, Employees Government

Comply with regulation

Measuring business transaction FINANCIAL REPORTS/STATEMENTS- the objective is to provide

information about the financial position, performance and changes in

FRA LUCA PACIOLI’S BOOK: SUMMA financial position that is useful to users to make an economic

Fra Luca Pacioli is a Franciscan monk who introduces the double- decisions

entry system in accounting and discusses the three important books.

Memorandum- book where all transactions are recorded, in a In preparing the Financial Reports/Statements there are underlying

currency in which they are conducted, at the time they are conducted, assumption to be followed by the bookkeeper or the accountant.

prepared in a chronological order, is a narrative description of the 1. Accrual Basis. Revenues are recorded as they earned and

business’s economic event and no document to support transactions expenses as they incurred. Transactions are recognized

when they occur and not as cash is received or paid.

Journal- merchant’s private book, entries made here in one currency, 2. Cash Basis. Transactions is recorded when the cash is

in chronological order and narrative form receive or paid.

Ledger- alphabetical listing of all the business’s accounts along with 3. Going Concern. FS/FR normally prepared assuming that an

the running balances of each particular account enterprise will continue its operation for the foreseeable

future.

THE ACCOUNTING EQUATION AND DOUBLE ENTRY

Concept of Pacioli’s Double Entry System SYTEM

Page 1 of 2

Prepared By; M.T. Sacramed

Every transaction may require addition and subtraction to both

PARTS OF AN INFORMATION SYSTEM sides that makes equal to both side.

Debit (Dr) Credit ( Cr)

1. People- competent end users working to increase their

+ +

productivity. End users use hardware and software to solve - -

information-related or decision-making problems.

2. Procedures- manuals and guidelines that instruct end users *Logic of Debiting and Crediting is related to the Accounting

on how to use the software and hardware. Equation.

3. Software-programs or instructions that tell the computer

how to process the data. Two kind of software are the ff. DEBITS and CREDITS- THE DOUBLE ENTRY SYSTEM (DES)

a) System Software

b) Application Software DES means has a dual effects of the business transaction is recorded.

4. Hardware- consist of the ff. devices

a) Input Devices Rules of Debit and Credit

b) System Unit

c) Secondary Storage Dr Cr

d) Output Devices

e) Communication Devices ASSETS LIABILITIES AND EQUITY

5. Data- raw materials/information/transactions to be process

ACCOUNTING INFORMATION SYSTEM Balance Sheet Accounts

Dr Cr

Assets Liabilities and Equity

+ - - +

Normal Normal

Balance Balance

Income Statement Accounts

Dr Cr

Expenses Income

*Debit for decreases in owner’s equity *Credit for increases in Owner’s Equity

+ - - +

ELEMENTS OF FINANCIAL STATEMENTS and Normal Normal

ACCOUNTING EQUATION Balance Balance

ASSETS= LIABILITIES + CAPITAL

NORMAL BALANCES OF AN ACCOUNT

Assets- resources controlled by the entity as the result of past Normal Balances

events and from which has future benefits are expected to flow. *It means an increase when it

It includes the obligation of the entity and the investment of the Recorded

owner, expenses and income of the business. Acct Category Debit Credit

Assets=Liabilities + Owner’s Equity or Capital ASSETS /

Liability- obligations of the entity to outside parties who have

LIABLITIES /

furnished resources. OWNER’S EQUITY

Liabilities= Assets - Owner’s Equity or Capital Capital /

Equity/capital- residual interest in the assets of the enterprise Withdrawals /

after deducting all the liabilities. Includes here are the

investment, income and expenses in the business operation.

Income /

Owner’s Equity or Capital =Assets - Expenses /

Income- increases in economic benefits during accounting

period in form of inflows or enhancement of assets or decreases Economic/financial occurrence or accounting event and transactions

of liabilities that result in increase the equity. It compasses the may cause changes in entity’s assets, liabilities and/or equity.

revenue and gain deducting the expenses.

TYPES and EFFECTS OF TRANSACTION

Expenses- the form of outflows or depletions of assets or 1. Source of Assets

incurrence of liabilities that result in decreases of equity. 2. Exchange of Assets

Encompasses the loss and outflows arises in the course of 3. Use of Assets

ordinary activities. 4. Exchange of Claims

THE “T” ACCOUNT Expanded effects:

1. (+ in A)= (+ in L)

Ac count Tit le 2. (+ in A) = (+ in E)

Left side or

Right Side 3. (+ in one A) = (+ in another A)

Debit Side or Credit 4. (- in A) = (- in L)

Side

5. ( - in A) = (- in E)

6. (+ in L) = (- in E)

Basic summary device of accounting is the “ACCOUNT”.

7. (+ in E) = (- in L)

Separate account is maintained for each element that appears in

8. (+ in one L) = (- in another L)

the Balance Sheet (Assets, Liabilities and Equity) and in the

Income Statement (Income and Expenses). Account may be 9. (+ in one E) = (- in another E)

defined as detailed record of the increase, decreases and balance

of each element.

Page 2 of 2

Prepared By; M.T. Sacramed

Вам также может понравиться

- Bethesda Mining CompanyДокумент9 страницBethesda Mining Companycharles100% (3)

- Quantitative Strategic Planning Matrix (QSPM) For AirasiaДокумент4 страницыQuantitative Strategic Planning Matrix (QSPM) For AirasiamaliklduОценок пока нет

- MACCДокумент7 страницMACCGerry SajolОценок пока нет

- Q1Документ3 страницыQ1Joylyn CombongОценок пока нет

- SCM AgreementДокумент6 страницSCM AgreementankitaprakashsinghОценок пока нет

- Principles in Halal PurchasingДокумент15 страницPrinciples in Halal PurchasingIvanPamuji100% (1)

- Chapter 14Документ5 страницChapter 14RahimahBawaiОценок пока нет

- Preparing Financial StatementsДокумент14 страницPreparing Financial StatementsAUDITOR97Оценок пока нет

- AF The World of AccountingДокумент11 страницAF The World of AccountingEduardo Enriquez0% (1)

- Strategic GroupsДокумент3 страницыStrategic GroupsTharindu SilvaОценок пока нет

- Cash Flow Statement - Direct & Indirect MethodДокумент8 страницCash Flow Statement - Direct & Indirect MethodAshokОценок пока нет

- State The Establish Service Standards of ABC Travel AgencyДокумент5 страницState The Establish Service Standards of ABC Travel AgencyJewel Colleen Cardenas100% (1)

- Financial Statements For Manufacturing BusinessesДокумент9 страницFinancial Statements For Manufacturing BusinessesTokie TokiОценок пока нет

- Business CombinationДокумент8 страницBusiness CombinationShanmuka NalliОценок пока нет

- Q2euxhyim - Activity - Chapter 10 - Acctg Cycle of A Merchandising BusinessДокумент8 страницQ2euxhyim - Activity - Chapter 10 - Acctg Cycle of A Merchandising BusinessLyra Mae De BotonОценок пока нет

- DAWN Editorials - November 2016Документ92 страницыDAWN Editorials - November 2016SurvivorFsdОценок пока нет

- How To Know If A Product Is Fake or NotДокумент2 страницыHow To Know If A Product Is Fake or NotElai SwiftОценок пока нет

- ACC 205 Complete Class HomeworkДокумент41 страницаACC 205 Complete Class HomeworkAvicciОценок пока нет

- FinmanДокумент3 страницыFinmanKaren LaccayОценок пока нет

- Bookkeeping PDFДокумент4 страницыBookkeeping PDFYo Yo0% (1)

- HW1Документ4 страницыHW1Annie JuliaОценок пока нет

- ACCT 330-Intermediate Accounting 1Документ81 страницаACCT 330-Intermediate Accounting 1Fer LeroyОценок пока нет

- Chapter 2 ALMOST DONEДокумент12 страницChapter 2 ALMOST DONEayieeОценок пока нет

- Reniel A. Agito BSN 1-Y2-2 Instruction: Take A Few Minutes To Think and Write Your Thoughts About The Lecture Discussion QuestionДокумент2 страницыReniel A. Agito BSN 1-Y2-2 Instruction: Take A Few Minutes To Think and Write Your Thoughts About The Lecture Discussion QuestionRENIEL AGITOОценок пока нет

- 8501 Financial AccountingДокумент9 страниц8501 Financial AccountingAhmad RazaОценок пока нет

- Adjusting Entries ProblemsДокумент5 страницAdjusting Entries ProblemsDirck VerraОценок пока нет

- Midterm Exam ACTG22Документ2 страницыMidterm Exam ACTG22Jj Abad BoieОценок пока нет

- A. Journal Entries Accounts Debit CreditДокумент3 страницыA. Journal Entries Accounts Debit CreditAnne AlagОценок пока нет

- 1.2 Development of Accounting DisciplineДокумент7 страниц1.2 Development of Accounting DisciplineRomario PetersОценок пока нет

- Capital BudgetingДокумент33 страницыCapital BudgetingJimsy AntuОценок пока нет

- Introduction To Credit ManagementДокумент48 страницIntroduction To Credit ManagementHakdog KaОценок пока нет

- Don Honorio Ventura State University: Lesson 5: Sources of Short-Term and Long-Term FinancingДокумент12 страницDon Honorio Ventura State University: Lesson 5: Sources of Short-Term and Long-Term FinancingNicki Lyn Dela CruzОценок пока нет

- 4.3. Obligations of Borrowers: Questions To PonderДокумент6 страниц4.3. Obligations of Borrowers: Questions To PonderTin CabosОценок пока нет

- Af 212 Financial ManagementДокумент608 страницAf 212 Financial ManagementMaster KihimbwaОценок пока нет

- Auditing TheoryДокумент31 страницаAuditing TheoryKingChryshAnneОценок пока нет

- Accounting TheoryДокумент28 страницAccounting Theoryjsofv5533Оценок пока нет

- Week 5 - AEC 201 - Activities-PrelimДокумент7 страницWeek 5 - AEC 201 - Activities-PrelimNathalie HeartОценок пока нет

- Cpa f2.1 - Management Accounting - Revision GuideДокумент90 страницCpa f2.1 - Management Accounting - Revision Guidepaul saguda100% (1)

- Set IДокумент2 страницыSet IAdoree RamosОценок пока нет

- Managerial Accounting Project ReportДокумент15 страницManagerial Accounting Project ReportNaveed Mughal AcmaОценок пока нет

- PERMALINO - Learning Activity 12 - Short Term BudgetingДокумент2 страницыPERMALINO - Learning Activity 12 - Short Term BudgetingAra Joyce PermalinoОценок пока нет

- Question Bank 2021 E2 6Документ8 страницQuestion Bank 2021 E2 6Abanoub AbdallahОценок пока нет

- Correction of ErrorsДокумент2 страницыCorrection of ErrorsJean Emanuel100% (1)

- Analyzing Business TransactionsДокумент13 страницAnalyzing Business TransactionsEricJohnRoxasОценок пока нет

- Ass. in AE10 - WPS OfficeДокумент6 страницAss. in AE10 - WPS Officevhane majellОценок пока нет

- Journalizing CorporationsДокумент61 страницаJournalizing CorporationsBridgett Florence CaldaОценок пока нет

- PESTELДокумент14 страницPESTELAmy LlunarОценок пока нет

- Basic AccountingДокумент6 страницBasic AccountingViolet Gomez RedОценок пока нет

- Accountant Interview Questions and AnswersДокумент36 страницAccountant Interview Questions and Answersheehan6Оценок пока нет

- LESSON 10 Business TransactionsДокумент8 страницLESSON 10 Business TransactionsUnamadable UnleomarableОценок пока нет

- South Asialink Finance Corporation (Credit Union)Документ1 страницаSouth Asialink Finance Corporation (Credit Union)Charish Kaye Radana100% (1)

- Accounting Lesson Notes ExercisesДокумент14 страницAccounting Lesson Notes Exercisesqueen030% (1)

- Business Plan TemplateДокумент7 страницBusiness Plan TemplateRohan LabdeОценок пока нет

- Pre Final EditДокумент170 страницPre Final EditRenato MesiasОценок пока нет

- Final Term Assignment 2 On Financial Accounting and Reporting - Partnership OperationsДокумент2 страницыFinal Term Assignment 2 On Financial Accounting and Reporting - Partnership OperationsAnne AlagОценок пока нет

- IEB WireframeДокумент7 страницIEB WireframeVictor PaigeОценок пока нет

- CHAPTER 6 - Adjusting EntriesДокумент25 страницCHAPTER 6 - Adjusting EntriesMuhammad AdibОценок пока нет

- Adjusting EntriesДокумент7 страницAdjusting EntriesJon PangilinanОценок пока нет

- Forms of Small Business OwnershipДокумент26 страницForms of Small Business OwnershipGerckey Rasonabe100% (2)

- Accounting Equation Problems and SolutionДокумент7 страницAccounting Equation Problems and SolutionNilrose EscartinОценок пока нет

- C1 Financial ReportingДокумент23 страницыC1 Financial ReportingSteeeeeeeephОценок пока нет

- Bookkeeping ProposalДокумент6 страницBookkeeping ProposalPaaforiОценок пока нет

- Controlling Payroll Cost - Critical Disciplines for Club ProfitabilityОт EverandControlling Payroll Cost - Critical Disciplines for Club ProfitabilityОценок пока нет

- Fund Card Sample PDFДокумент4 страницыFund Card Sample PDFSandeep SoniОценок пока нет

- Chapter 13 Human Resource ManagementДокумент37 страницChapter 13 Human Resource ManagementKashif Ullah KhanОценок пока нет

- Income and Substitution EffectsДокумент1 страницаIncome and Substitution EffectspenelopegerhardОценок пока нет

- Chapter 7: Internal Controls I: True/FalseДокумент10 страницChapter 7: Internal Controls I: True/FalseThảo NhiОценок пока нет

- Managerial Economics Presentation On Gulf AirlinesДокумент16 страницManagerial Economics Presentation On Gulf AirlinesSaquib SiddiqОценок пока нет

- Program/Course Bcom (A&F) Class Tybcom (A&F) Semester VI Subject Financial Accounting-Vii Subject Code 85601 Exam Date 05.10.2020Документ28 страницProgram/Course Bcom (A&F) Class Tybcom (A&F) Semester VI Subject Financial Accounting-Vii Subject Code 85601 Exam Date 05.10.2020hareshОценок пока нет

- Mayor Kasim Reed's Proposed FY 2015 BudgetДокумент585 страницMayor Kasim Reed's Proposed FY 2015 BudgetmaxblauОценок пока нет

- Vision 2050Документ34 страницыVision 2050Vishal KaliaОценок пока нет

- Question : Andalas University, Faculty of EconomicsДокумент1 страницаQuestion : Andalas University, Faculty of EconomicsNaurah Atika DinaОценок пока нет

- Expand/Collapsesd Expand/Collapse SD-BF Sd-Bf-AcДокумент18 страницExpand/Collapsesd Expand/Collapse SD-BF Sd-Bf-AcserradajaviОценок пока нет

- Characteritics of An EntrepreneurДокумент3 страницыCharacteritics of An EntrepreneurjonadhemondejaОценок пока нет

- International TaxationДокумент46 страницInternational TaxationsridhartksОценок пока нет

- Daniyal - Business Plan ...Документ19 страницDaniyal - Business Plan ...kamran bajwaОценок пока нет

- Punjab Spatial Planning StrategyДокумент12 страницPunjab Spatial Planning Strategybaloch47Оценок пока нет

- BBB EXAM REVIEW 2023Документ12 страницBBB EXAM REVIEW 2023osbros10Оценок пока нет

- I. Questions and AnswersДокумент5 страницI. Questions and AnswersMinh MinhОценок пока нет

- Contemporary Issues in Sustainable Finance Exploring Performance Impact Measurement and Financial Inclusion Mario La Torre Full ChapterДокумент68 страницContemporary Issues in Sustainable Finance Exploring Performance Impact Measurement and Financial Inclusion Mario La Torre Full Chapterterrance.acevedo969100% (5)

- WmsДокумент43 страницыWmssanthosh kumarОценок пока нет

- Reves v. Ernst & Young, 494 U.S. 56 (1990)Документ21 страницаReves v. Ernst & Young, 494 U.S. 56 (1990)Scribd Government DocsОценок пока нет

- Ortiz, John Paul HRM 1-4Документ5 страницOrtiz, John Paul HRM 1-4John Paul Aguilar OrtizОценок пока нет

- Nigeria Civil Aviation Policy (NCAP) 2013: Tampering With NCAA's Safety & Economic RegulationДокумент3 страницыNigeria Civil Aviation Policy (NCAP) 2013: Tampering With NCAA's Safety & Economic RegulationDung Rwang PamОценок пока нет

- MCS CH 13 PPT FixДокумент27 страницMCS CH 13 PPT FixArtikaIndahsariОценок пока нет

- Tonota Lephaneng Ward ReportДокумент11 страницTonota Lephaneng Ward Reportmokane.mokane1Оценок пока нет

- Value Added TaxДокумент46 страницValue Added TaxBoss NikОценок пока нет

- Quiz 7Документ38 страницQuiz 7nikhil gangwarОценок пока нет