Академический Документы

Профессиональный Документы

Культура Документы

Trust in Investment Banking". I Am Thankful To The Organizers For

Загружено:

karimteli0 оценок0% нашли этот документ полезным (0 голосов)

28 просмотров4 страницыInvestment banking started to take roots in Pakistan in second half of 1980s. Policy makers first time issued charter to investment banks. Downturn also exposed structural weaknesses that investment banks failed to redress during their growth phase.

Исходное описание:

Оригинальное название

Investment_Banking

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документInvestment banking started to take roots in Pakistan in second half of 1980s. Policy makers first time issued charter to investment banks. Downturn also exposed structural weaknesses that investment banks failed to redress during their growth phase.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

28 просмотров4 страницыTrust in Investment Banking". I Am Thankful To The Organizers For

Загружено:

karimteliInvestment banking started to take roots in Pakistan in second half of 1980s. Policy makers first time issued charter to investment banks. Downturn also exposed structural weaknesses that investment banks failed to redress during their growth phase.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 4

Building Trust in Investment Banking

Dr. Izhar-ul-Hasan, Chancellor, PAF Karachi Institute of Economics &

Technology, and distinguished Ladies and Gentlemen

Assalam-o-Alaikum,

It gives me great pleasure to inaugurate this conference on “Building

Trust in Investment Banking”. I am thankful to the organizers for

inviting me for the purpose. I would like to take this opportunity to say

a few words about investment banking in Pakistan, a perspective on

its past performance, its prospects in the coming days, and ways to

revive these institutions to our maximum advantage.

Investments banks play a crucial role in the process of capital

formation which is imperative for breaking the vicious circle of poverty

we are faced with. A conventional investment bank mobilizes the

savings and makes them available for investments in longer-term

projects and provides a number of ancillary services which are

equally instrumental in an economy’s capital formation process.

These services, inter alia, include securities underwriting, stock and

bond trading, facilitating mergers and acquisition, arranging and

funding syndicated loans, arranging and managing public issues, and

providing financial advice to businesses.

The investment banking started to take roots in Pakistan in second

half of 1980s when realizing the need for investment banking services

the policy makers first time issued charter to investment banks. A

broad range of business services were envisaged that included

money and capital market activities, project financing, corporate

financial services, and operations in call and money market. Since

inception the sector showed strong performance and continued to

flourish till the mid 1990s. While this growth was mainly backed by

wide ranging financial liberalization measures and favourable

economic conditions particularly the boom in the stock market,

however, these institutions could not diversify their portfolio and thus

failed to built in shock absorber to withstand the twists of changing

economic and business environment. Resultantly, most of the

investment banks started to face problems. This downturn also

exposed the structural weaknesses that investment banks failed to

redress during their growth phase. A few of these significant

weaknesses are:

• High fragmentation with only a couple of institutions dominating

the market,

• Small capital bases with limited ability to absorb significant

shocks,

• Failure to develop competencies for delivering non-fund based

services,

• Lack of relevant expertise and acumen,

• Failure to develop stable source of long term funds,

• High cost of funds, and

• Limited capacity to expand outreach.

The recent rise of universal banking has further added to the woes of

investment banks as the commercial banks are increasingly taking up

the activities which were once considered to be the exclusive domain

of the former.

Presently the sector is undergoing a transformation process. Under

the regulatory purview of the Securities and Exchange Commission of

Pakistan (SECP), investment banks are classified as Non-Banking

Financial Companies (NBFCs) and are regulated by the NBFC

(Establishment and Regulation) Rules of 2003 which provide an

enhanced framework of operations for investment banks and have

considerably widened their scope of business. Accordingly, they have

started to focus their attention on becoming multi-business entities

instead of retaining their specialized business status so as to remain

commercially viable. Over the last few years, the sector has also

witnessed considerable consolidation; the number of banks came

down to 9 from 16 in 2000. The total assets of these banks stood at

Rs.32.7 billion in FY04 as compared to Rs.34.4 billion in FY03 and

Rs.41.5 billion in FY2000. Similarly their total investments declined to

Rs.16.4 billion in FY04 as compared to Rs.22.1 billion in preceding

year. However, total investment in FY04 increased over its level in

FY2000. Over the last couple of years the industry is shrinking and

the current scenario reflecting a declining trend calls for concerted

efforts by the regulators as well as industry itself to overcome the

situation.

Investment banks in Pakistan generally had limited success due to

various reasons, primarily due to the weaknesses I have pointed out

earlier. But they are not altogether devoid of opportunities. They are

very much an integral component of our financial infrastructure. The

corporate sector has perennial needs for services such as investment

advisory, corporate restructuring, distressed assets acquisition and

disposal, merger and acquisitions, equity and debt financing. With the

maturing up of economy and financial markets the need for these

services will further intensify thus holding good prospects for the

investment banks proficient in these areas. Commercial banks will not

be able to compete with them on those fronts as they lack specialized

expertise in these areas. But the investment banks will have to

refocus their current strategy of imitating commercial banks; they

should focus on developing competitive advantages in specialized

areas of corporate finance and advisory services. Once they have

developed these competencies, they can leverage it by forming

strategic alliances with commercial banks which lack these

capabilities but have a competitive advantage in the form of wider

outreach and ability to mobilize national savings with greater

efficiency. This strategy not only promises lucrative growth to the

investment banks but will also add much needed value to the society.

In the end, I would also like to express my hopes that this moot would

carefully analyze the critical challenges being faced by the investment

banks and help us in ascertaining the ways to build strong public trust

in these institutions.

Before concluding my observations, I would like to thank again

the organizers for inviting me to this Conference.

Вам также может понравиться

- Merchant Banking New (Repaired)Документ88 страницMerchant Banking New (Repaired)Sunil S SagarОценок пока нет

- DMGT104 Financial Accounting PDFДокумент317 страницDMGT104 Financial Accounting PDFNani100% (1)

- Merchant BankingДокумент539 страницMerchant BankingGyanendra Padhi100% (1)

- Pakistan Banking SectorДокумент100 страницPakistan Banking SectorFaraz50% (2)

- Mergers Acquisitions and Other Restructuring Activities 7th Edition Depamphilis Test BankДокумент19 страницMergers Acquisitions and Other Restructuring Activities 7th Edition Depamphilis Test Banksinapateprear4k100% (33)

- Principles of Financial Accounting 12th Edition Needles Solutions ManualДокумент25 страницPrinciples of Financial Accounting 12th Edition Needles Solutions ManualJacquelineHillqtbs100% (54)

- Case Digest - OPT and DSTДокумент30 страницCase Digest - OPT and DSTGlargo GlargoОценок пока нет

- 4th Quarter Entrepreneurship FinalsДокумент3 страницы4th Quarter Entrepreneurship FinalsShen EugenioОценок пока нет

- Goods and Services Tax (GST) in IndiaДокумент30 страницGoods and Services Tax (GST) in IndiarupalОценок пока нет

- The Role of Mutual Funds in Pakistan TopicДокумент11 страницThe Role of Mutual Funds in Pakistan TopicArif AmanОценок пока нет

- Takaful Investment Portfolios: A Study of the Composition of Takaful Funds in the GCC and MalaysiaОт EverandTakaful Investment Portfolios: A Study of the Composition of Takaful Funds in the GCC and MalaysiaОценок пока нет

- Somaliland: Private Sector-Led Growth and Transformation StrategyОт EverandSomaliland: Private Sector-Led Growth and Transformation StrategyОценок пока нет

- Investment Bank DialogueДокумент4 страницыInvestment Bank DialogueTanvir AhmedОценок пока нет

- Regulation and objectives of financial marketsДокумент5 страницRegulation and objectives of financial marketsmoonaafreenОценок пока нет

- Role of FIs and capital markets in Pakistan's economyДокумент6 страницRole of FIs and capital markets in Pakistan's economyShakil KhanОценок пока нет

- Njuguna Ndung'u: The Kenyan Money Market and Other Key Developments in The Financial SectorДокумент2 страницыNjuguna Ndung'u: The Kenyan Money Market and Other Key Developments in The Financial Sectorbrian mbuthiaОценок пока нет

- Universal BankingДокумент13 страницUniversal BankingShrutikaKadamОценок пока нет

- I Ntroduction: Investment BankingДокумент58 страницI Ntroduction: Investment Bankingkarthikeyan01Оценок пока нет

- Investment Banking: An Overview of Key Concepts and the Indian LandscapeДокумент53 страницыInvestment Banking: An Overview of Key Concepts and the Indian LandscapeChirag BoraОценок пока нет

- Part 2Документ2 страницыPart 2Parul PrasadОценок пока нет

- I Ntroduction: Investment BankingДокумент58 страницI Ntroduction: Investment BankingVineeth KunnathОценок пока нет

- Merchant BankingДокумент76 страницMerchant Bankingleen_badiger911Оценок пока нет

- Summit BankДокумент53 страницыSummit BankJaved Iqbal50% (2)

- NBFC's - An OverviewДокумент5 страницNBFC's - An OverviewneerajtikuОценок пока нет

- "Liberalization, Privatization and Globalization".: Merchant BankingДокумент16 страниц"Liberalization, Privatization and Globalization".: Merchant BankingHema GolaniОценок пока нет

- Institution Other: Visit Report Financial Than BankДокумент4 страницыInstitution Other: Visit Report Financial Than BankMaheshwar morghadeОценок пока нет

- Role of Commercial Banks in Development Financing in BangladeshДокумент31 страницаRole of Commercial Banks in Development Financing in Bangladeshfind4mohsinОценок пока нет

- Indian Banking Industry ConsolidationДокумент5 страницIndian Banking Industry ConsolidationBharat A. VashisthaОценок пока нет

- BodyДокумент104 страницыBodySantosh ChhetriОценок пока нет

- 528201450239PMPaper Banking Structure For India 2014Документ19 страниц528201450239PMPaper Banking Structure For India 2014Gaurav RawatОценок пока нет

- New Microsoft Office Word DocumentДокумент3 страницыNew Microsoft Office Word DocumentShivam KarnОценок пока нет

- Role of Merchant Bankers in Financial SystemДокумент27 страницRole of Merchant Bankers in Financial SystemAmbily S Kumar67% (3)

- The Concept of Universal BankingДокумент13 страницThe Concept of Universal BankingRicha VermaОценок пока нет

- Role of Commercial Banks in Development Financing in BangladeshДокумент31 страницаRole of Commercial Banks in Development Financing in BangladeshRahut HridayОценок пока нет

- Success in SME FinancingДокумент33 страницыSuccess in SME FinancingSachin GuptaОценок пока нет

- Merchant Banking in IndiaДокумент14 страницMerchant Banking in IndiaMohitraheja007Оценок пока нет

- Project On Credit Appraisal For Sme SectorДокумент33 страницыProject On Credit Appraisal For Sme Sectoranish_10677953Оценок пока нет

- Blackbook FinalДокумент86 страницBlackbook Finalgunesh somayaОценок пока нет

- Economic Performance Review of Commercial and Investment Banking in PakistanДокумент16 страницEconomic Performance Review of Commercial and Investment Banking in PakistanNayab NoumanОценок пока нет

- Liberalization, Privatization and GlobalizationДокумент16 страницLiberalization, Privatization and GlobalizationHema GolaniОценок пока нет

- Banking Operations and ManagementДокумент6 страницBanking Operations and ManagementAdeel SajjadОценок пока нет

- Banking Sector Reforms Lesson From PakistanДокумент15 страницBanking Sector Reforms Lesson From PakistanMuhammad SaidОценок пока нет

- Investment Banking With Ref to Jp MorganДокумент71 страницаInvestment Banking With Ref to Jp MorganUmair RajpuriyaОценок пока нет

- Jeko 21-5Документ11 страницJeko 21-5elsalem092016Оценок пока нет

- Role of NBFIs in Bangladesh's Financial SystemДокумент2 страницыRole of NBFIs in Bangladesh's Financial SystemShohana Ahmed100% (1)

- Banking Basics and Silk Bank OverviewДокумент47 страницBanking Basics and Silk Bank OverviewShahid MehmoodОценок пока нет

- Banking Structure For IndiaДокумент19 страницBanking Structure For IndiajeganrajrajОценок пока нет

- Universal BankingДокумент30 страницUniversal Bankingdarshan71219892205100% (1)

- Chapter Five: Islamic Banking and TakafulДокумент9 страницChapter Five: Islamic Banking and Takafulali-faycalОценок пока нет

- Identify & Evaluate Marketing OpportunitiesДокумент9 страницIdentify & Evaluate Marketing Opportunitiesmsohail_2004Оценок пока нет

- Banking Sector Reforms Lesson From PakistanДокумент15 страницBanking Sector Reforms Lesson From PakistanBasit SattarОценок пока нет

- An Appraisal OF Investment Banking IN IndiaДокумент22 страницыAn Appraisal OF Investment Banking IN Indiaganesh189Оценок пока нет

- Visit Report Financial Institution Other ThanbankДокумент8 страницVisit Report Financial Institution Other ThanbankBhavik ChaudhariОценок пока нет

- Aan Qureshi IC-2100 Namra Saeed IC-2099 Saad Ahmed Malik IC-2106 Sajeel Abbas Zaidi IC-2107 Sir Malik Mazhar Hussain Business Research MethodДокумент25 страницAan Qureshi IC-2100 Namra Saeed IC-2099 Saad Ahmed Malik IC-2106 Sajeel Abbas Zaidi IC-2107 Sir Malik Mazhar Hussain Business Research MethodNamra SaeedОценок пока нет

- Final Merchant Banking ProjectДокумент81 страницаFinal Merchant Banking Projectlove_3Оценок пока нет

- Banking On Non Banking Finance CompaniesДокумент32 страницыBanking On Non Banking Finance Companiesappao vidyasagarОценок пока нет

- Proposal On Civil BankДокумент12 страницProposal On Civil Banksampurna maharjan100% (2)

- Visit Report Financial Institution Other Than BankДокумент49 страницVisit Report Financial Institution Other Than BankAMIT K SINGH69% (29)

- The Challenges and Opportunities For Financial Services in IndonesiaДокумент43 страницыThe Challenges and Opportunities For Financial Services in IndonesiaSamuel SahataОценок пока нет

- 'DFI, MUTUAL FUNDS, RRB' With YouДокумент5 страниц'DFI, MUTUAL FUNDS, RRB' With YouSuccess ForumОценок пока нет

- Efficiencies of Pakistani Banking Sector: A Comparative StudyДокумент20 страницEfficiencies of Pakistani Banking Sector: A Comparative StudyZohaib HayatОценок пока нет

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)От EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Оценок пока нет

- Emerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaОт EverandEmerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaОценок пока нет

- Marketing of Consumer Financial Products: Insights From Service MarketingОт EverandMarketing of Consumer Financial Products: Insights From Service MarketingОценок пока нет

- Banking India: Accepting Deposits for the Purpose of LendingОт EverandBanking India: Accepting Deposits for the Purpose of LendingОценок пока нет

- Bcoc 136Документ2 страницыBcoc 136Suraj JaiswalОценок пока нет

- Renewal Premium Receipt - 00755988Документ1 страницаRenewal Premium Receipt - 00755988Tarun KushwahaОценок пока нет

- Part Char 4Документ9 страницPart Char 4Denise Jeon25% (4)

- Activities FXДокумент5 страницActivities FXWaqar KhalidОценок пока нет

- PROFILE FINTECH MENARA JAMSOSTEK - ContohДокумент18 страницPROFILE FINTECH MENARA JAMSOSTEK - ContohRioz GonzalezОценок пока нет

- Template Excel Pengantar AkuntansiiДокумент15 страницTemplate Excel Pengantar AkuntansiiKim SeokjinОценок пока нет

- W5 ADDRESS SolutionДокумент169 страницW5 ADDRESS SolutionDemontre BeckettОценок пока нет

- Review ArticleДокумент20 страницReview ArticleVira ImranОценок пока нет

- Types of CapitalДокумент24 страницыTypes of CapitalAnkita N VyasОценок пока нет

- Accounting For Cash and Cash TransactionДокумент63 страницыAccounting For Cash and Cash TransactionAura Angela SeradaОценок пока нет

- Abacus v. AmpilДокумент11 страницAbacus v. AmpilNylaОценок пока нет

- Tips - Butler Lumber Company Case SolutionДокумент18 страницTips - Butler Lumber Company Case Solutionsara_AlQuwaifliОценок пока нет

- Textbook PDFДокумент367 страницTextbook PDFRiaОценок пока нет

- Online BankingДокумент38 страницOnline BankingROSHNI AZAMОценок пока нет

- ConsiderДокумент284 страницыConsiderGhulam NabiОценок пока нет

- Consumer Mathematics: Gwendolyn TadeoДокумент14 страницConsumer Mathematics: Gwendolyn TadeoproximusОценок пока нет

- Chapter 1 History and Development of Banking System in MalaysiaДокумент18 страницChapter 1 History and Development of Banking System in MalaysiaMadihah JamianОценок пока нет

- ZF-02 Posting Credit Note SPPLДокумент10 страницZF-02 Posting Credit Note SPPLGhosh2Оценок пока нет

- Chapter 13 In-Class Exercise Set SolutionsДокумент10 страницChapter 13 In-Class Exercise Set SolutionsJudith Garcia0% (1)

- ISOM 5510 Data Analysis Group Project 14 - 3Документ7 страницISOM 5510 Data Analysis Group Project 14 - 3Ameya PanditОценок пока нет

- Ark Israel Innovative Technology Etf Izrl HoldingsДокумент2 страницыArk Israel Innovative Technology Etf Izrl HoldingsmikiОценок пока нет

- Dissolution and Incorporation of a PartnershipДокумент26 страницDissolution and Incorporation of a PartnershipJohn LouiseОценок пока нет

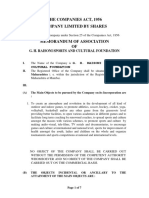

- The Companies Act, 1956 Company Limited by Shares: G. H. Raisoni Sports and Cultural FoundationДокумент8 страницThe Companies Act, 1956 Company Limited by Shares: G. H. Raisoni Sports and Cultural FoundationanilОценок пока нет

- SECP Form 6Документ4 страницыSECP Form 6mirza faisalОценок пока нет