Академический Документы

Профессиональный Документы

Культура Документы

CLABO Piano-Industriale-2017 20-CLABO IR V4 20170504 PDF

Загружено:

Julio ReyesОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

CLABO Piano-Industriale-2017 20-CLABO IR V4 20170504 PDF

Загружено:

Julio ReyesАвторское право:

Доступные форматы

60°

Strategic Guidelines and Business Plan 2017-2020

Milan, April 06th , 2016

AIM INVESTOR DAY 2017: «Linee strategiche e Business Plan 2017-2020» 1

CLABO HIGHLIGHTS

60°

Leading operator worldwide in the field of professional display cases for

gelato, pastry bakery, bars, cafés and hotels

Top customers including Venchi, Amorino, Haagen Dazs, Nestlé, Unilever

with which the Grouop has established long-lasting relationships

Wide product range, synthesis of design and technology, with more than

1,100 models declinable in several versions due to the many combinations

of equipments, accessories and colors

Over 20 patents related to the technologies of conservation, the design and

the strong focus on innovation

Strong presence in Europe and Asia, strategic markets for the «gelato

industry» with high growth forecasts

As of December 31st , 2016: Euro 37,3 million in consolidated revenues, Euro

4,1 million of EBITDA and Euro 0,7 million in net consolidated profit. Euro

16,8 in consolidated net financial debt

30%+ worldwide market share in the core business (gelato display cases)

Qualification of «innovative» SME according to the Italian Governement law

(“Legge di Stabilità 2017”)

AIM INVESTOR DAY 2017: «Linee strategiche e Business Plan 2017-2020» 2

CORPORATE STRUCTURE

60°

Cla.Bo.Fin. Srl

MARKET 71%

28%

CLABO S.P.A.

* 1% AZIONI PROPRIE SIMEST

100% 100% 100% 100% 51% 49%

CLABO

CLABO USA ORION Int. Trad. CLABO Brasil CLABO HK

Deutschland

100%

QINGDAO

CLABO EASY

BEST

AIM INVESTOR DAY 2017: «Linee strategiche e Business Plan 2017-2020» 3

EASY BEST OVERVIEW

60°

- MAIN OPERATOR IN CHINESE AND ASIAN MARKET OF GELATO SHOWCASES

- MORE THAN 2.000 UNITS PER YEAR

- 90 EMPLOYEES AND EXPORTS TO ALL THE MAIN ASIAN COUNTRIES

AIM INVESTOR DAY 2017: «Linee strategiche e Business Plan 2017-2020» 4

EASYBEST AQUISITION

60°

• Asset Deal Value: RMB 23.250.000 (Euro 3,2 mil.)

• RMB 10.000.000 at signing date

• RMB 5.000.000 at closing date

• RMB 5.000.000 within 8 months from the closing date

• 500.000 Clabo shares within 8 months form the closing date

AIM INVESTOR DAY 2017: «Linee strategiche e Business Plan 2017-2020» 5

ASSET DEAL DETAILS

60°

Assets in RMB/.000 Capital & Liabilities in RMB/.000

Inventory 9.200 Trade payables 6.850

Receivables 650

Current Assets 9.850 Current Liabilities 6.850

Machines 5.000

Equipments 8.000 Capital 20.000 EasyBest brand

Tangible Assets 13.000 acquired

directly by

Goodwill 4.000

Clabo s.p.a.

Intangibles Assets 4.000 through a

Fixed Assets 17.000 capital

contribution

Tot. Assets 26.850 Total Capital & 26.850

Liabilities

AIM INVESTOR DAY 2017: «Linee strategiche e Business Plan 2017-2020» 6

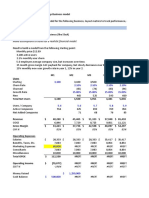

Easy Best Pro-Forma P&L

60°

RMB/.000 2016 % 2015 %

Ricavi 38.700 100% 37.400 100%

CoGS -24.500 -63,3% -24.400 -65,2%

Gross Profit 14.200 36,7% 13.000 34,8%

Selling Exp. -4.650 -12,0% -4.500 -12,0%

G&A Exp. -5.000 -12,9% -4.700 -12,6%

Ebitda 4.550 11,7% 3.800 10,2%

AIM INVESTOR DAY 2017: «Linee strategiche e Business Plan 2017-2020» 7

CLABO + EASY BEST AGGREGATE PRO-FORMA 2016

60°

Clabo +

Euro/.000.000 Clabo % EB % %

EB

Ricavi 37,3 100% 5,3 100% 42,6 100%

Ebitda 4,1 11% 0,6 -11,3% 4,7 11%

Debt 16,8 0 16,8

Debt / Ebitda 4,1 0 3,6

AIM INVESTOR DAY 2017: «Linee strategiche e Business Plan 2017-2020» 8

OUR BRANDS

60°

Wide range of showcases, cells, vertical freezers for the

Ho.Re.Ca. with a strong international presence

Acquired in 2004. Premium brand of gelato and pastry

showcases with a consolidated presence in the mature

markets

Acquired in 2002. Focus on modular shopfitting for bars &

cafeterias, well positioned in the domestic market

Acquired in 2017. Leading brand of gelato and pastry

showcases in chinese and asian markets

AIM INVESTOR DAY 2017: «Linee strategiche e Business Plan 2017-2020» 9

KEY STRENGHTS AND POSITIONING

60°

Consolidated

Well established

market share Focus

Presence in

in the on the

Rapidly

Prestige and Premium Top of the Range

developing markets

market segment

Key Partner for

Prestige Gelato Chains: Revenues by

37% Revenues 25% Revenues

Venchi, Amorino, bySegment

Prestige in

Bacio di Latte Prestige Segment Asia & LATAM

> 11% Ebitda (+3% vs Italian Industry average)

AIM INVESTOR DAY 2017: «Linee strategiche e Business Plan 2017-2020» 10

2017 – 2020 Strategic Guidelines: Clabo Mission Statement

60°

To strengthen our leadership in the “Gelato” Showcases market,

premium and prestige segments, by:

Expansion In Growing markets: acquired the largest manufacture of

Gelato showcases in China and Asia (EasyBest). M&A to grow in latin

America

Efficiency: improving the overall manufacturing processes

R&D: keeping on innovation through R&D activity

AIM INVESTOR DAY 2017: «Linee strategiche e Business Plan 2017-2020» 11

STRATEGIC MILESTONES FROM 2012 TO 2020

60°

2012-2015 2016-2019 2020*

Financial Agreement

Ѵ China Manufacturing Plant

(EASY BEST) REVENUES 52,4M

Jesi Plant Automation EBITDA 16%

Jesi Plant Efficiency

Improvement ROI 13%

Brazilian Manufacturing

Overseas Subsidiaries Plant DEBT 10,9M

IPO Ѵ Flow Chart Reorganization

(SAP)

DEBT/EBITDA 1,5x

Consolidation Investments Value Creation

*The updated Business Plan including Easy Best will be released by the end of May 2017

AIM INVESTOR DAY 2017: «Linee strategiche e Business Plan 2017-2020» 12

KEY INDUSTRY TRENDS: GELATO SHOWCASES MARKET

60°

Premium and Prestige segments profitability structurally superior to overall

segments

Mature economies will still be the best buyer in the Premium and Prestige

segments due to the slow down of renovation during the financial crisis

Higher growth rates in emerging markets will drive the gelato showcases market

in the years ahead with APAC remaining the world’s fastest engine

Increase in global travel that exposes more and more people to artisanal gelato

popularity

Energy efficiency is becoming a “must have” in the business and Clabo’s

showcases are the benchmark in this field

AIM INVESTOR DAY 2017: «Linee strategiche e Business Plan 2017-2020» 13

«GELATO» MARKET

60°

Gelato market is currently worth $40 billion and it is expected to grow at 4% (CAGR ‘15-’18)

Highest Market Value Countries (2014) Highest Growth Rate Countries (2015 – 2018))

Source: Management estimate based on PWC research 2016

AIM INVESTOR DAY 2017: «Linee strategiche e Business Plan 2017-2020» 14

2016 -2020 RESOURCE ALLOCATION

60°

Net Cash Flow Simest Capital

before Contribution

L.181/89 Tot.

Contribution

Capex and

Dividends

for China

project for Jesi Plant 26,2M

15,7M

Investment

24M 1.2M 1M

7M

NFP Improvement

3.5M Dividends

REST OF

ITALY NAFTA LATAM APAC

EUROPE

GELATO

PASTRY

VERTICALS

BAR

AIM INVESTOR DAY 2017: «Linee strategiche e Business Plan 2017-2020» 15

Investments Break Down

60°

Total Investments Investment Breakdown Timing per project

2016 -2020 per project

R&D: >15 new products to be devoleped

5 and launched. I.O.T. project and nano 2016-2020

technologies to be apllied

Jesi Plant: new automated processes and

15,7 6,4* SAP integration.

2016-2018

Easy Best aquisition and Latam

4,3 assembling plant

2016-2017

*Clabo will be financed by Invitalia, an Italian government institution, for the

50% of the 6,4M investments at 0% interest rate. Clabo will also benefit of a

15% subsidy (0,96M)

AIM INVESTOR DAY 2017: «Linee strategiche e Business Plan 2017-2020» 16

DATI 60°

Minimo anno (su Rif.) 0.64

Data min. anno (su Rif.) 02/01/2017

Massimo anno (su Rif.) 1.2

Data max. anno (su Rif.) 29/03/2017

Minimo anno precedente 0.535

Massimo anno precedente 1.64

Quotazione inizio anno 0.616

Minimo anno (su Ultimo) 0.627

Data min. anno (su Ultimo) 02/01/2017

Massimo anno (su Ultimo) 1.29

Data max. anno (su Ultimo) 30/03/2017

Minimo ultimi 10 anni 0.535

Massimo ultimi 10 anni 2.7

Variazione % inizio anno 85.06

INDICI BORSA, REDDITIVITA’ e VOLATILITA’

Capitalizzazione (mln) 9.01 PERFORMANCE

Utile per azione 0.09 Performance a 1 mese 26.667

Dividendo per azione 0,03 Performance a 3 mesi 62.857

Volumi medi (media mobile 30 gg) 81.620 Performance a 6 mesi 39.024

Volatilità 12.21 Performance a 1 anno -30.061

AIM INVESTOR DAY 2017: «Linee strategiche e Business Plan 2017-2020» 17

Conclusions

60°

Global leader in growing market with favourable underlying dynamics

Leadership underpinned by superior R&D and technology and a strong

global brand

Stable revenue based coming from replacement and service in Western

Europe

Further profitability improvements from cost optimization in Italy

Material value creation through the planned manufacturing presence in

China and Latam

AIM INVESTOR DAY 2017: «Linee strategiche e Business Plan 2017-2020» 18

60°

Q&A

IR Top Consulting

Investor & Media Relations

Via C. Cantù, 1 - 20123 Milano

Tel. +39 02 45473884/3

info@irtop.com

www.irtop.com

AIM INVESTOR DAY 2017: «Linee strategiche e Business Plan 2017-2020» 19

DISCLAIMER

60°

This presentation contains forward-looking statements regarding future events (which impact the

Clabo’s future results) that are based on current expectations, estimates and opinions of management.

These forward-looking statements are subject to risks, uncertainties and events that are

unpredictable and depend on circumstances that might change in future. As a result, any expectation on

Company results and estimates set out in this presentation may differ significantly depending on changes in the

unpredictable circumstances on which they are based.

Therefore, any forward -looking statement made by or on behalf of the Clabo refer on the date

they are made.

Clabo shall not undertake to update forward-looking statements to reflect any changes in the

Company’s expectations or in the events, conditions or circumstances on which any such statements are based.

Nevertheless, Clabo has a “profit warning policy” , in accordance with Italian laws, that shall notify

the market (under “price-sensitive” communication rules) regarding any “sensible change” that might occur in

Company expectations on future results.

AIM INVESTOR DAY 2017: «Linee strategiche e Business Plan 2017-2020» 20

APPENDIX 1: KEY MARKETS OVERVIEW

60°

Gelato Showcases Market (Prestige & Premium segments)

Market volumes per sales area and growth trends

Sales Area Market Volume (Units per Yyear) Growth Rate Clabo Market Share

Italy 3.700 >30%

Rest of Europe 2.500 >30%

NAFTA 1.200 >30%

LATAM 800 >30%

APAC 3.500 >30%

MEDOA 500 >20%

RoW 800 10%<

TOTAL 13.000

Source: Clabo analysis based on PWC and AT Kearney researches

AIM INVESTOR DAY 2017: «Linee strategiche e Business Plan 2017-2020» 21

APPENDIX 2: COMPETITIVE LANDSCAPE

60°

Gelato Showcases Market Gelato Showcases Market

Market segments description (Prestige & Premium segments)

Market segments and players

Entry Level

Price range € 500 - € 1.500* PLAYERS ENTRY

PRESTIGE PREMIUM INDUSTRY

Refrigeration: gravity SEGMENTS LEVEL

Type of use: Scoop Ice Cream

IARP

Industry

ISA

Price range € 1.500 - €

3.500* Mondial

Refrigeration: gravity

Type of use: Scoop Ice Cream

IFI

Premium

Price range € 3.500 - € 7.500* Easy Best

Refrigeration: air forced

Sevel

Type of use: Artisanal Gelato

Others

Prestige

Price range € 7.500 - € 15.000*

Refrigeration: air forced

Type of use: Artisanal Gelato ~ 13.000/15.000 200.000

units per year units per year

Source: PWC research 2016

* Dealer price

AIM INVESTOR DAY 2017: «Linee strategiche e Business Plan 2017-2020» 22

Вам также может понравиться

- Pacific Private Sector Development Initiative: A Decade of Reform: Annual Progress Report 2015-2016От EverandPacific Private Sector Development Initiative: A Decade of Reform: Annual Progress Report 2015-2016Оценок пока нет

- ACCT 440 FMGT Exams 2021 SandwichДокумент4 страницыACCT 440 FMGT Exams 2021 SandwichNubor RichardОценок пока нет

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesОт EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesОценок пока нет

- Case Study of Hola KolaДокумент5 страницCase Study of Hola KolaRuohui ChenОценок пока нет

- Volvo Car Group Annual Report 2017Документ188 страницVolvo Car Group Annual Report 2017Anonymous VxzkzG03Оценок пока нет

- Annual Report 2019 20 PDFДокумент221 страницаAnnual Report 2019 20 PDFsanjivani maheshwariОценок пока нет

- Report Analysis SIDBI - 2016-2018 - : Vivek V Indian Institute of Management, KashipurДокумент12 страницReport Analysis SIDBI - 2016-2018 - : Vivek V Indian Institute of Management, KashipurVivek VvkОценок пока нет

- LA 2 Construction Contracts PDFДокумент3 страницыLA 2 Construction Contracts PDFliliОценок пока нет

- Highland Malt Accounting Project PDFДокумент12 страницHighland Malt Accounting Project PDFEng Chee Liang100% (1)

- Year-End Presentation 2014Документ29 страницYear-End Presentation 2014stefany IIОценок пока нет

- Hola Kola Case Capital Budgeting MP15030Документ4 страницыHola Kola Case Capital Budgeting MP15030Francisco RomanoОценок пока нет

- SnailДокумент7 страницSnailTope AyeniОценок пока нет

- Mma's Business PlanДокумент8 страницMma's Business PlanIgbani VictoryОценок пока нет

- SQUP Pitch Deck 2023Документ18 страницSQUP Pitch Deck 2023rpeacre837Оценок пока нет

- Hola Kola Case Capital BudgetingДокумент4 страницыHola Kola Case Capital BudgetingFrancisco RomanoОценок пока нет

- Year-End Presentation 2020Документ32 страницыYear-End Presentation 2020stefany IIОценок пока нет

- Aditya Birla Fashion and Retail Ltd. - EdelweissДокумент8 страницAditya Birla Fashion and Retail Ltd. - EdelweissrahulОценок пока нет

- 04-Revenue-Cost CashFlowДокумент7 страниц04-Revenue-Cost CashFlowdina mutia sariОценок пока нет

- Carpentry Pro Plan v1664134062229Документ30 страницCarpentry Pro Plan v1664134062229jweremaОценок пока нет

- Year-End Presentation 2016Документ31 страницаYear-End Presentation 2016stefany IIОценок пока нет

- Business Plan! ReañoДокумент19 страницBusiness Plan! ReañoAlexandra ZubiriОценок пока нет

- Thulsidass Velayudha N TharayilДокумент230 страницThulsidass Velayudha N TharayilrojaОценок пока нет

- Financial ASSI 1Документ7 страницFinancial ASSI 1Karim YousryОценок пока нет

- GACC SummaryДокумент16 страницGACC Summaryjip leornaОценок пока нет

- Financial Tables CONAIDДокумент11 страницFinancial Tables CONAIDCarl Ammiel P. LapureОценок пока нет

- Bop Kzar ConsultancyДокумент40 страницBop Kzar Consultancyapi-628837449100% (1)

- Multichannel Customer Strategy Project: Agenda 1. 2. 3. 4. 5. 6. 7. 8Документ40 страницMultichannel Customer Strategy Project: Agenda 1. 2. 3. 4. 5. 6. 7. 8Money HavenОценок пока нет

- Aqua Chilled - MARKETING PLAN DraftДокумент4 страницыAqua Chilled - MARKETING PLAN DraftKyle TimonОценок пока нет

- Analysis and Interpretation of FS-Part 1Документ2 страницыAnalysis and Interpretation of FS-Part 1Rhea RamirezОценок пока нет

- Year-End Presentation 2015Документ31 страницаYear-End Presentation 2015stefany IIОценок пока нет

- Marketing PlanДокумент8 страницMarketing PlanJoanna JacobОценок пока нет

- Business PlanДокумент7 страницBusiness PlanRoem LongakitОценок пока нет

- Coffee PresentationДокумент19 страницCoffee Presentationregister onlineОценок пока нет

- Business Model and Financial Projection of Caneblast JuiceДокумент16 страницBusiness Model and Financial Projection of Caneblast Juiceankita sharmaОценок пока нет

- Presentasi Company Valuation Method Project On PT. SampoernaДокумент30 страницPresentasi Company Valuation Method Project On PT. SampoernaGicchiОценок пока нет

- Problem 1: Chapter 1 - Introduction To Corporate Finance - Chapter 2 - Financial Statement, Taxes, and Cash FlowДокумент2 страницыProblem 1: Chapter 1 - Introduction To Corporate Finance - Chapter 2 - Financial Statement, Taxes, and Cash FlowChristy YouОценок пока нет

- Acl 2017Документ136 страницAcl 2017RiyasОценок пока нет

- Q No. 1 Assume That You Are Given Assignment To Evaluate The Capital Budgeting Projects of The CompanyДокумент3 страницыQ No. 1 Assume That You Are Given Assignment To Evaluate The Capital Budgeting Projects of The CompanyMuneeb Qureshi0% (1)

- Coca ColaДокумент42 страницыCoca Colahaseeb ahmadОценок пока нет

- Uts Akmen (Fix)Документ10 страницUts Akmen (Fix)Oppa Massimo MorattiОценок пока нет

- BRS3B Assessment Opportunity 1 2019Документ11 страницBRS3B Assessment Opportunity 1 2019221103909Оценок пока нет

- Presentation - CompressedДокумент9 страницPresentation - CompressedAnimomo AdminОценок пока нет

- African Startup Funding Landscape 2020 - Startuplist AfricaДокумент21 страницаAfrican Startup Funding Landscape 2020 - Startuplist Africaace1870% (1)

- Intercompany Sale of Merchandise - AdditionalДокумент4 страницыIntercompany Sale of Merchandise - AdditionalJaimell LimОценок пока нет

- E. Ch02 P15 Flujo Caja, EVA, MVA SolutionДокумент3 страницыE. Ch02 P15 Flujo Caja, EVA, MVA SolutionDarling Desirée Togna SalasОценок пока нет

- Financial Statement Consolidation1 4Документ4 страницыFinancial Statement Consolidation1 4crookshanksОценок пока нет

- Group 2: Jeff Allen Muyano Rhea Paulene MananganДокумент30 страницGroup 2: Jeff Allen Muyano Rhea Paulene MananganJeff Allen MuyanoОценок пока нет

- Practice Problem Set #1 Capital Budgeting - Solution - : FIN 448, Sections 2 & 3, Fall 2020 Advanced Financial ManagementДокумент5 страницPractice Problem Set #1 Capital Budgeting - Solution - : FIN 448, Sections 2 & 3, Fall 2020 Advanced Financial ManagementAndrewОценок пока нет

- Solution: Year Cash Inflows Present Value Factor Present Value $ @10% $Документ10 страницSolution: Year Cash Inflows Present Value Factor Present Value $ @10% $Waylee CheroОценок пока нет

- Calculo Wacc - AlicorpДокумент14 страницCalculo Wacc - Alicorpludwing espinar pinedoОценок пока нет

- CF Assignment 1 Group 9Документ51 страницаCF Assignment 1 Group 9rishabh tyagiОценок пока нет

- Fina6000 Module 4 - Capital Budgeting BДокумент20 страницFina6000 Module 4 - Capital Budgeting BMar SGОценок пока нет

- PaybackДокумент14 страницPaybackHema LathaОценок пока нет

- Global Marketing Export Strategy AssignmentДокумент19 страницGlobal Marketing Export Strategy AssignmentYisfalem AlemayehuОценок пока нет

- L5M4 Additional SlidesДокумент7 страницL5M4 Additional SlidesTlotlo RamotlhabiОценок пока нет

- Finance Case Study For Tech Startup Video.01Документ10 страницFinance Case Study For Tech Startup Video.01koenigОценок пока нет

- Case Study - MonicДокумент16 страницCase Study - MonicPhilip SembiringОценок пока нет

- Module 2 - Partnership Operations and Financial ReportingДокумент85 страницModule 2 - Partnership Operations and Financial ReportingxxxОценок пока нет

- 92 Fuel Gas Station - Sta. InesДокумент10 страниц92 Fuel Gas Station - Sta. InesterminatrixОценок пока нет

- ProfitabilityДокумент17 страницProfitabilityJenina Augusta EstanislaoОценок пока нет

- CBIM Assignment No. 1Документ4 страницыCBIM Assignment No. 1Kalyan Gowda.SОценок пока нет

- Impairment of Loans and Receivable Financing PDFДокумент9 страницImpairment of Loans and Receivable Financing PDFJoy UyОценок пока нет

- Discussion Forum 7: How Might A SWOT Analysis Have Helped Electronic Arts Assess Its Slippage in The Video-Game Market?Документ4 страницыDiscussion Forum 7: How Might A SWOT Analysis Have Helped Electronic Arts Assess Its Slippage in The Video-Game Market?রাফি ইসলামОценок пока нет

- Lufthansa GroupДокумент2 страницыLufthansa GroupAnjanaОценок пока нет

- Imperfect Competition IssuesДокумент21 страницаImperfect Competition IssuesVina OktavianiОценок пока нет

- 2007 Full SpecbookДокумент1 080 страниц2007 Full SpecbookGuillermo LuchinОценок пока нет

- Contemporary Business Mathematics For Colleges 17th Edition Deitz Test Bank 1Документ12 страницContemporary Business Mathematics For Colleges 17th Edition Deitz Test Bank 1jonathan100% (37)

- Chapter 6 Homework QuestionsДокумент4 страницыChapter 6 Homework QuestionsAccount YanguОценок пока нет

- NSPE Code of Ethics For Engineers-2Документ2 страницыNSPE Code of Ethics For Engineers-2franco antonio jimenez vazquezОценок пока нет

- Tally SejdaДокумент143 страницыTally Sejdaapaptech96Оценок пока нет

- 37 Practice+Questions+ (Working+Capital+Management)Документ4 страницы37 Practice+Questions+ (Working+Capital+Management)bahaa madiОценок пока нет

- Case Study #9 - A RenovationДокумент6 страницCase Study #9 - A RenovationAssignment HelpОценок пока нет

- PROJECT REPORT On - Equity Research On Indian Banking SectorДокумент100 страницPROJECT REPORT On - Equity Research On Indian Banking Sectoryogeshmahavirjadhav40% (5)

- Report Website e CommerceДокумент10 страницReport Website e CommerceAhmad AL AminОценок пока нет

- Ibps Clerk Prelims English Day 10 165520060174-1Документ19 страницIbps Clerk Prelims English Day 10 165520060174-1Aditya SahaОценок пока нет

- How To Measure Bank SizeДокумент24 страницыHow To Measure Bank SizeAsniОценок пока нет

- B2B Marketing: Price: Rs600Документ2 страницыB2B Marketing: Price: Rs600Sandeep KadyanОценок пока нет

- M2Topic1 Strategic Project Management NEWДокумент10 страницM2Topic1 Strategic Project Management NEWMelisa May Ocampo AmpiloquioОценок пока нет

- IIC - Schemes & ImplementationДокумент17 страницIIC - Schemes & Implementationelangoprt1Оценок пока нет

- Accountancy - Class XII - Sample Question PaperДокумент276 страницAccountancy - Class XII - Sample Question PaperKhushi SinghaniaОценок пока нет

- Monitoring of OHS Objectives & TargetsДокумент2 страницыMonitoring of OHS Objectives & TargetsNomaan MalikОценок пока нет

- Quest - BourcherДокумент24 страницыQuest - BourchercchlouisОценок пока нет

- Successful Women Entrepreneurs 510Документ16 страницSuccessful Women Entrepreneurs 510MamtaОценок пока нет

- The HR Service Delivery Model Canvas (LIVE)Документ2 страницыThe HR Service Delivery Model Canvas (LIVE)Mustafa KamalОценок пока нет

- 11 May 2020 EconomicsДокумент32 страницы11 May 2020 EconomicsErkin GasimzadeОценок пока нет

- Personal Real Nominal McqsДокумент6 страницPersonal Real Nominal Mcqsasfandiyar100% (3)

- RFID TagsДокумент255 страницRFID Tagsdiego83777Оценок пока нет

- Pilipinas Shell Petroleum Corporation vs. Royal Ferry Services, Inc.Документ1 страницаPilipinas Shell Petroleum Corporation vs. Royal Ferry Services, Inc.Donnie Ray Olivarez SolonОценок пока нет

- Edexcel Business U1 CompiledДокумент104 страницыEdexcel Business U1 CompiledCasey WangОценок пока нет

- Internal Quality Audit Plan Dilg Region 10Документ8 страницInternal Quality Audit Plan Dilg Region 10Cess AyomaОценок пока нет