Академический Документы

Профессиональный Документы

Культура Документы

The Following Activities and Transactions Are Typical of Those That PDF

Загружено:

Doreen0 оценок0% нашли этот документ полезным (0 голосов)

15 просмотров1 страницаОригинальное название

the-following-activities-and-transactions-are-typical-of-those-that.pdf

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

15 просмотров1 страницаThe Following Activities and Transactions Are Typical of Those That PDF

Загружено:

DoreenАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

(SOLVED) The following activities and transactions are

typical of those that

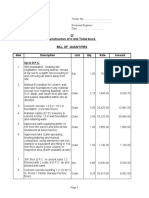

The following activities and transactions are typical of those that may affect the various funds

used by a typical municipal government.Required:Prepare journal entries to record each

transaction and identify the fund in which each entry is recorded.A. The Greenville City Council

passed a resolution

GET THE ANSWER>> https://solutionlly.com/downloads/the-following-activities-and-

transactions-are-typical-of-those-that

The following activities and transactions are typical of those that may affect the various funds

used by a typical municipal government.Required:Prepare journal entries to record each

transaction and identify the fund in which each entry is recorded.A. The Greenville City Council

passed a resolution approving a general operating budget of $5,000,000 for the fiscal year

2012. Total revenues are estimated at $4,900,000.B. The Greenville City Council Passed an

ordinance providing a property tax levy of $6.25 per $100 of assessed valuation for the fiscal

year 2012. Total property valuation in Greenville City is $204,800,000. Property is assessed at

25% of current property valuation.Property tax bills are mailed to property owners. An estimated

3% will be uncollectible.C. Reed City sold a general obligation term bond issue for $1,000,000

at 105 to a major brokerage firm. The stated interest rate is 5%. Proceeds are to be used for

construction of a new Central Law Enforcement Building. (Note: Entries are required in the

Capital Project Fund).D. The premium on bond sale in (C) above is transferred to the Debt

Service Fund.E. At the end of fiscal year 2012, the Greenville City Council approves the write-

off of $52,550 of uncollected 2011 taxes because of inability to locate the property owners. The

tax bills have been referred to the legal department for further action.F. The Reed City Central

Law Enforcement Building [(C) above] is completed. Contracts and expenses total $989,000,

and all have been paid and recorded in the Capital Project Fund. Prepare entries to close this

project and record the completion of the project in all other funds or account groups affected.

Any balance in the Capital Project Fund is to be applied to payment of interest and principal of

the bond issue.G. On May 1, 2012, Hopi City supervised the issue of 6% serial bonds at par to

finance street curbing in an area recently incorporated in the city limits. The face amount of the

bonds is $600,000; interest is payable annually, and bonds are to be retired in equal amounts

over five years from collections from assessments against property owners. The City acts as a

collection agent and has given assurances to the debt holders that it will guarantee payment of

principal and interest even though it is not obligated to do so.(1) Record the issuance of the

bonds on May 1, 2012.(2) Record the payment to bondholders on May 1, 2013.H. The curbing

project in (G) above was completed on November 30 at a total of $590,000. Record summary

entries for expenditure transactions May 1-November 30, 2012, and on completion of the

project.View Solution:

The following activities and transactions are typical of those that

GET THE ANSWER>> https://solutionlly.com/downloads/the-following-activities-and-

transactions-are-typical-of-those-that

1/1

Powered by TCPDF (www.tcpdf.org)

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- DNP825 How Are EthicalДокумент2 страницыDNP825 How Are EthicalDoreenОценок пока нет

- DNP805 Module 2 AssignmentДокумент3 страницыDNP805 Module 2 AssignmentDoreenОценок пока нет

- DNP800 4 DiscussionsДокумент1 страницаDNP800 4 DiscussionsDoreenОценок пока нет

- DNP835 Healthcare Challenges Have Changed Dramatically in The LastДокумент1 страницаDNP835 Healthcare Challenges Have Changed Dramatically in The LastDoreenОценок пока нет

- DNP830 Module 1 AssignmentДокумент2 страницыDNP830 Module 1 AssignmentDoreenОценок пока нет

- DNP830 Module 6 AssignmentДокумент3 страницыDNP830 Module 6 AssignmentDoreenОценок пока нет

- DNP800 Assignment BENCHMARK Assessment, Implementation, and ReviewДокумент1 страницаDNP800 Assignment BENCHMARK Assessment, Implementation, and ReviewDoreenОценок пока нет

- DNP800 Assignment Successful Data Collection ToolsДокумент1 страницаDNP800 Assignment Successful Data Collection ToolsDoreenОценок пока нет

- DNP810 Module 5 AssignmentДокумент4 страницыDNP810 Module 5 AssignmentDoreenОценок пока нет

- DNP830 Module 3 AssignmentДокумент2 страницыDNP830 Module 3 AssignmentDoreenОценок пока нет

- DNP820 Module 5 AssignmentДокумент2 страницыDNP820 Module 5 AssignmentDoreenОценок пока нет

- DNP805 Module 4 AssignmentДокумент3 страницыDNP805 Module 4 AssignmentDoreenОценок пока нет

- DNP805 Module 3 DiscussionДокумент1 страницаDNP805 Module 3 DiscussionDoreenОценок пока нет

- DNP820 Module 4 AssignmentДокумент2 страницыDNP820 Module 4 AssignmentDoreenОценок пока нет

- DNP835 Using Concepts and Ideas That You Have Learned in ThisДокумент2 страницыDNP835 Using Concepts and Ideas That You Have Learned in ThisDoreenОценок пока нет

- DNP810 Module 7 AssignmentДокумент4 страницыDNP810 Module 7 AssignmentDoreenОценок пока нет

- DNP805 Module 1 AssignmentДокумент4 страницыDNP805 Module 1 AssignmentDoreenОценок пока нет

- DNP805 Module 6 AssignmentДокумент2 страницыDNP805 Module 6 AssignmentDoreenОценок пока нет

- DNP810 Module 4 AssignmentДокумент2 страницыDNP810 Module 4 AssignmentDoreenОценок пока нет

- DNP830 Module 7 AssignmentДокумент3 страницыDNP830 Module 7 AssignmentDoreenОценок пока нет

- DNP800 Assignment Sharing KnowledgeДокумент1 страницаDNP800 Assignment Sharing KnowledgeDoreenОценок пока нет

- DNP825 What Information Is The ECQM LibraryДокумент2 страницыDNP825 What Information Is The ECQM LibraryDoreenОценок пока нет

- DNP820 Module 6 AssignmentДокумент1 страницаDNP820 Module 6 AssignmentDoreenОценок пока нет

- DNP830 Module 4 AssignmentДокумент2 страницыDNP830 Module 4 AssignmentDoreenОценок пока нет

- DNP810 Module 6 AssignmentДокумент1 страницаDNP810 Module 6 AssignmentDoreenОценок пока нет

- Consider A Two Layer Network of The Form Shown in Figure 5 1 With The Addition of ExtraДокумент1 страницаConsider A Two Layer Network of The Form Shown in Figure 5 1 With The Addition of ExtraCharlotteОценок пока нет

- DNP840 Describe The Strategic Planning Process For andДокумент1 страницаDNP840 Describe The Strategic Planning Process For andDoreenОценок пока нет

- DNP820 Module 3 AssignmentДокумент1 страницаDNP820 Module 3 AssignmentDoreenОценок пока нет

- Consider A Setting Where We Have A Faulty Device Assume That The Failure Can Be Caused by AДокумент1 страницаConsider A Setting Where We Have A Faulty Device Assume That The Failure Can Be Caused by ACharlotteОценок пока нет

- DNP825 Explain What Relationships Would Be Helpful To The NurseДокумент1 страницаDNP825 Explain What Relationships Would Be Helpful To The NurseDoreenОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Verma Toys Leona Bebe PDFДокумент28 страницVerma Toys Leona Bebe PDFSILVIA ROMERO100% (3)

- ILRF Soccer Ball ReportДокумент40 страницILRF Soccer Ball ReportgabalauiОценок пока нет

- Tank Emission Calculation FormДокумент12 страницTank Emission Calculation FormOmarTraficanteDelacasitosОценок пока нет

- Hyundai Himap BcsДокумент22 страницыHyundai Himap BcsLim Fung ChienОценок пока нет

- Rules On Evidence PDFДокумент35 страницRules On Evidence PDFEuodia HodeshОценок пока нет

- Type BOQ For Construction of 4 Units Toilet Drawing No.04Документ6 страницType BOQ For Construction of 4 Units Toilet Drawing No.04Yashika Bhathiya JayasingheОценок пока нет

- Failure of A Gasket During A Hydrostatic TestДокумент7 страницFailure of A Gasket During A Hydrostatic TesthazopmanОценок пока нет

- Learner Guide HDB Resale Procedure and Financial Plan - V2Документ0 страницLearner Guide HDB Resale Procedure and Financial Plan - V2wangks1980Оценок пока нет

- I.V. FluidДокумент4 страницыI.V. FluidOdunlamiОценок пока нет

- Theories of Economic Growth ReportДокумент5 страницTheories of Economic Growth ReportAubry BautistaОценок пока нет

- Planas V Comelec - FinalДокумент2 страницыPlanas V Comelec - FinalEdwino Nudo Barbosa Jr.100% (1)

- SOP No. 6Документ22 страницыSOP No. 6Eli CohenОценок пока нет

- Seminar Report of Automatic Street Light: Presented byДокумент14 страницSeminar Report of Automatic Street Light: Presented byTeri Maa Ki100% (2)

- MOL Breaker 20 TonДокумент1 страницаMOL Breaker 20 Tonaprel jakОценок пока нет

- The April Fair in Seville: Word FormationДокумент2 страницыThe April Fair in Seville: Word FormationДархан МакыжанОценок пока нет

- Developments in Prepress Technology (PDFDrive)Документ62 страницыDevelopments in Prepress Technology (PDFDrive)Sur VelanОценок пока нет

- DC0002A Lhires III Assembling Procedure EnglishДокумент17 страницDC0002A Lhires III Assembling Procedure EnglishНикола ЉубичићОценок пока нет

- 8524Документ8 страниц8524Ghulam MurtazaОценок пока нет

- Oddball NichesДокумент43 страницыOddball NichesRey Fuego100% (1)

- Summary - A Short Course On Swing TradingДокумент2 страницыSummary - A Short Course On Swing TradingsumonОценок пока нет

- Business Plan GROUP 10Документ35 страницBusiness Plan GROUP 10Sofia GarciaОценок пока нет

- Volvo B13R Data SheetДокумент2 страницыVolvo B13R Data Sheetarunkdevassy100% (1)

- 19-2 Clericis LaicosДокумент3 страницы19-2 Clericis LaicosC C Bờm BờmОценок пока нет

- scx4521f SeriesДокумент173 страницыscx4521f SeriesVuleticJovanОценок пока нет

- Https Code - Jquery.com Jquery-3.3.1.js PDFДокумент160 страницHttps Code - Jquery.com Jquery-3.3.1.js PDFMark Gabrielle Recoco CayОценок пока нет

- Installation Manual EnUS 2691840011Документ4 страницыInstallation Manual EnUS 2691840011Patts MarcОценок пока нет

- How To Attain Success Through The Strength of The Vibration of NumbersДокумент95 страницHow To Attain Success Through The Strength of The Vibration of NumberszahkulОценок пока нет

- Best Practices in Developing High PotentialsДокумент9 страницBest Practices in Developing High PotentialsSuresh ShetyeОценок пока нет

- Tax Accounting Jones CH 4 HW SolutionsДокумент7 страницTax Accounting Jones CH 4 HW SolutionsLolaLaTraileraОценок пока нет

- 1.functional Specification PTP With EDIДокумент36 страниц1.functional Specification PTP With EDIAnil Kumar100% (4)