Академический Документы

Профессиональный Документы

Культура Документы

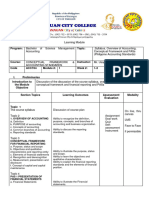

Course Plan

Загружено:

DrVinod KumarИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Course Plan

Загружено:

DrVinod KumarАвторское право:

Доступные форматы

School of Policy Studies

MPA 827 Financial Management in Canada’s Public Sector

2010 Spring Session

Andrew Graham

Adjunct Professor,

School of Policy Studies

Room 421

Andrew.Graham@queensu.ca

Tel: 613 533-6000 ext 77364

Cellular: 613 583 0096

Fax: 613 533-2135

http://post.queensu.ca/~grahama/

All course outlines and lectures are posted to:

http://post.queensu.ca/~grahama/ and are available

through WebCT.

Course Outline – MPA 827 – Financial Management in the Public Sector 1

Objectives of the Course

This course focuses on the tools and understanding that public

managers in all parts of the public sector require to ensure the

successful use of resources to carry out good public policy.

The objective of the course is to give students a good understanding of

the basic elements of public sector financial management. In achieving

this, it will give students an understanding that financial considerations

play in

How the financial planning cycles of government and other

public sector organizations affects policy decision-making

How to understand and interpret financial information

o Basic accounting principles

o Financial statements

The elements of sound financial management in public

sector organization

o Resource allocation

o Effective budget management

o Cash forecasting and management

o Management control

Elements of financial accountability both within public

sector organization and outward to the public.

o Reporting

o Accountability

o Internal and external oversight

Are there any Prerequisites?: “Do I need to be good with

numbers?”

This course assumes little or no previous formal training in financial

management or accounting. In addition, no work experience is

needed. It is an introductory and survey course. Students will need to

have or rapidly acquire some familiarity with Excel spreadsheets or

their equivalent. However, this is at a basic level.

Readings

Text: Canadian Public Sector Financial Management, by Andrew

Graham available through McGill-Queens press at

http://mqup.mcgill.ca/book.php?bookid=2079, through the Campus

Bookstore or amazon.ca

Course Outline – MPA 827 – Financial Management in the Public Sector 2

Structure and Flow of the Course

Course Outline – MPA 827 – Financial Management in the Public Sector 3

Assignment Due Dates

Please Note: Assignments can be submitted in writing or electronically.

Test 1: Due: May 10, 2010

Test 2: Due: May 30, 2010

Cash Management Exercise: Due: June 18, 2010

Late Assignments: Assignments that fail to meet these dates are subject

to deduction. Material that is two weeks beyond the due date will not be

considered. It is important that students communicate with the

Instructor if circumstances beyond their control create deadline

problems.

Evaluation

Tests on Technical Sections Test 1 – 20

Test 2 – 20

Cash Management Exercise 50

Participation: Includes attendance, class work, 10

overall engagement, challenging assumptions

and seeking clarifications

100

Course Outline – MPA 827 – Financial Management in the Public Sector 4

Unit 1: The Framework

Session 1: Financial Management in the Public Sector Context

April 29, 2010, 1300-1600

Reading: Introduction, Chapter 1, Financial Management in the

Public Sector

a. Objectives and structure of the Course

b. Financial Management in the Public Sector Context

c. Defining public sector finances

d. The Relationship of the Budget to Economic

Planning and Policy

e. The Financial Management Framework: Getting

the Money, Spending the Money and Accounting for What

Your Did with It.

Unit 2: Accounting Concepts: Bean Counter’s

Corner

Session 2: Accounting Concepts

May 1, 2010, 1300-1600

Reading: Chapter 2: Public Sector Accounting

Principles/Accrual Budgeting and Accounting and Chapter 4,

Accrual Budgeting and Accounting: The New Basis for Public

Sector Financial Management

a. Defining accounting

b. The role of financial information

c. The users of financial information and reports

d. Financial accounting and management accounting

e. Financial reporting: public and private sector

f. Accounting standards: GAAP

g. Quality of accounting information

h. GAAP: Creation of common definitions and means

to assess financial statements and their meaning

i. Application of GAAP to the public sector

Course Outline – MPA 827 – Financial Management in the Public Sector 5

j. Understanding the cash and accrual basis for

accounting

k. Non-cash transactions

A take-home assignment will be distributed and post on the website and on

WebCT on April 28, 2010. Due date: May 10, 2010. Please note that electronic

returns are preferred. Also, only one file, please.

Sessions 3: Accounting Concepts – continued

May 17, 1300-1600

Reading: Chapter 3: Reading Financial Statements

a. Accounting Cycle

b. Double entry accounting

c. The fundamental accounting equation

d. Journal and ledger functions

e. Key Definitions of terms: Assets, liabilities, equity,

net assets

f. Types of financial statements:

i. Balance sheet/ Statement of financial

position

ii. Income statement/ Statement of

operations

iii. Changes in financial position

g. Management Discussion and Analysis

h. Entity Definition

i. Relationship of Financial Statements to external

reporting and internal use.

Unit 3: Budgets: Getting the Money

Session 4: Budgets: What They Do and How They Do It

May 18, 1300-1600

Course Outline – MPA 827 – Financial Management in the Public Sector 6

Reading: Chapter 5: Budgets and Budget Processes

a. Budgeting in the policy and administrative

context

b. Budgeting as a management process

c. Types of operating budgets: line, function,

program, performance

d. Budgets by general purpose: Operating and

capital budgets

e. Funds and funds structures

f. Off budget expenditures and funds

g. Trends in budgeting: budget reforms and

changes: historical overview

h. The Budget Game: Winning Ways

Although not required reading, Appendix A to Chapter 3, Budget Games

People Play is posted and recommended.

Session 5: Planning and Budgeting

May 19, 2010, 1300-1600

a. Planning and budgeting cycles

b. Revenue and workload forecasts in budgets

c. Cost analysis and forecasting

d. Costing tools

e. Fixed and variables costs

f. Capital Budgeting: Definition and scope of capital

in budgeting

i. Capital assets, their valuation, depreciation

and replacement costing

ii. Information Technology Assets – planning

complex systems

iii. Funding Major Projects: sources of funds:

methods of evaluation: use of cost-benefit

analysis

g. The Role Of Business Cases: what are they, how

do they work, how to do them.

Reading: Chapter 6 and 7

Course Outline – MPA 827 – Financial Management in the Public Sector 7

Exercise: Teams will review a series of business case proposals

presented in the context of the budget planning documentation. They

will be asked to do the following:

a. Establish a process for reviewing business cases

b. Develop criteria to apply in considering each

submission

c. Discuss the various proposals

d. Propose a priority list of the cases with rationale

e. Recommend modifications, changes and strategies

for improving the business cases for future

application

Session 6: Cutting Your Budget: Reductions and Reallocations

May 20, 2010, 1300-1600

a. Budgeting in a period of deficits

b. Budget review options and experience

a. Program Review

b. Strategic Reviews

c. Reallocation within budgets

d. Setting budget reduction priorities

e. Shields, defenses, managing downsizing

Exercise: Group exercises in budget reduction strategies, reallocation

management.

Evaluation: Take home assignment on Unit 2 and 3: Due May 30, 2010

Unit 4: Managerial Control and Controllership

Session 7: Management Control: A Risk Based Approach

May 21, 2010, 1300-1600

Reading: Chapter 8: Managerial Control

a. The concept of managerial control

b. Management Control Frameworks

c. Management Control Process

d. Risk and risk management

e. Control Procedures and Policies

Course Outline – MPA 827 – Financial Management in the Public Sector 8

f. Materiality and due diligence

g. Trust and ethics in control

Unit 5: Cash Management

Sessions 8 and 9: Cash Management

May 25-26,2010, 0830-1130

These sessions will consist of lecture material and discussion.

The Main Assignment: Given the complex nature of the major

assignment, it will be introduced in class and discussed. The

assignment will be distributed in hard copy and posted along with any

relevant Excel spreadsheets on May 26th. Further, although this is an

individual assignment, the second half of the lecture period on May

27th will be devoted to teams working in collaboration to better

understand the case and issues that are involved.

Reading: Chapter 9: Real Time Control: In-Year Budget

Management and Monitoring

a. Defining Budget Management

b. Objectives of Effective Budget Management,

Monitoring and Control

c. In-Year versus Plan Management

d. Forecasting on a Cash Basis: Cross Walking from

Accrual Budgets

e. Discontinuities between Budgets and the Ability to

Plan

f. Establishing a Budget Management System

g. Preparing a Budget Plan

h. Arriving at an Adjusted Budget

i. Estimating Budget Performance for the Reporting

Period

j. The Basis of Forecasting

k. Monitoring Financial Performance and Variance

Analysis

l. Governance

m. Reallocation and Readjustment

In-class case management exercise

Course Outline – MPA 827 – Financial Management in the Public Sector 9

Cash Management Exercise will be distributed on May 26, 2010. Return

date due: June 18, 2010

Unit 6: Reporting and Accountability

Session 10: External Reporting and Accountability

May 27-28, 2010, 0830-1130

Reading: Chapter 10: Demonstrating Control: Accountability

and Reporting

a. Accountability continuum

b. Nature of public sector accountabilities

c. Defining accountability in the financial management context

d. Objectives of financial and performance reporting

e. Internal applications of accountability

f. Public sector reports: annual reports, performance reports

g. Social accounting and accountability

h. Federal: Public Accounts, Reporting on Plans and Priorities,

Performance Report

Note: The May 27 Session will prove for a 90-minute discussion

in groups of the final assignment.

Session 12, June 25, 2010, 0830-1130:

“Financial Management: A Survivor’s Guide”

An extensive look at how financial management relates to getting

things done, getting them done well and getting them done right. –

Caroline Davis, vice-Principal, Finance and Administration, Queens

University

Session 13: Risk, Audit and Oversight in Managing Your Money

June 26, 2010, 0830-1130

Course Outline – MPA 827 – Financial Management in the Public Sector 10

a. Forms of oversight – internal and external

b. Learning to love your auditors

c. Answering, explaining, educating

d. Risk in determining what to inspect, oversee and audit

e. An exercise in determining risks and setting their level of

potential impact on an organization, discussing what kind of

control should be put in place.

Course Outline – MPA 827 – Financial Management in the Public Sector 11

Вам также может понравиться

- Fin 314 SyllabusДокумент5 страницFin 314 SyllabusDamian VictoriaОценок пока нет

- MODULE 2 Areas of Management Advisory ServicesДокумент5 страницMODULE 2 Areas of Management Advisory ServicesPrinces S. RoqueОценок пока нет

- AC418 Module OutlineДокумент5 страницAC418 Module OutlinetinashekuzangaОценок пока нет

- CFAS Unit 1 Module 1.2Документ13 страницCFAS Unit 1 Module 1.2KC PaulinoОценок пока нет

- The Budget-Building Book for Nonprofits: A Step-by-Step Guide for Managers and BoardsОт EverandThe Budget-Building Book for Nonprofits: A Step-by-Step Guide for Managers and BoardsОценок пока нет

- FM108 Prelim HandoutsДокумент8 страницFM108 Prelim HandoutsKarl Dennis TiansayОценок пока нет

- ch02 TB RankinДокумент7 страницch02 TB RankinSyed Bilal AliОценок пока нет

- Accounting Module PDFДокумент96 страницAccounting Module PDFjanineОценок пока нет

- Financial Statement Analysis: Standard Course OutlineДокумент6 страницFinancial Statement Analysis: Standard Course OutlineMahmoud ZizoОценок пока нет

- Ch02 TB RankinДокумент8 страницCh02 TB RankinAnton VitaliОценок пока нет

- ACC223 Prelim ExamДокумент10 страницACC223 Prelim ExamJun ChingОценок пока нет

- Next Page: Foundations of Business Finance Academic Leveling CourseДокумент15 страницNext Page: Foundations of Business Finance Academic Leveling CourseSunnyОценок пока нет

- Module 1 ARS PCC - Intro To Management Acctg (ANSWERS)Документ24 страницыModule 1 ARS PCC - Intro To Management Acctg (ANSWERS)James Bradley HuangОценок пока нет

- Learning Mod 1 CfasДокумент20 страницLearning Mod 1 CfasKristine CamposОценок пока нет

- Financial Management: 2019-2020 1Документ6 страницFinancial Management: 2019-2020 1RajkumarОценок пока нет

- Module 1 CCA4Документ7 страницModule 1 CCA4tone30412Оценок пока нет

- Shikha - Bhatia@imi - Edu: Page 1 of 6Документ6 страницShikha - Bhatia@imi - Edu: Page 1 of 6Daksh AnejaОценок пока нет

- Course Guide-Basic FinanceДокумент2 страницыCourse Guide-Basic FinanceMoraya P. CacliniОценок пока нет

- IM On ACCO 20033 Financial Accounting and Reporting Part 1 Revised Cover PageДокумент97 страницIM On ACCO 20033 Financial Accounting and Reporting Part 1 Revised Cover PagePatricia may RiveraОценок пока нет

- Priyanka Singh MBAfall22 JDДокумент3 страницыPriyanka Singh MBAfall22 JDSauharda SigdelОценок пока нет

- AEC 213 Course OutlineДокумент2 страницыAEC 213 Course Outlinechie syОценок пока нет

- File 1702544570921 9504754Документ4 страницыFile 1702544570921 9504754yudhistira aditОценок пока нет

- Financial Management Full NotesДокумент72 страницыFinancial Management Full NotesArpit SinghОценок пока нет

- Week 9 - NotesДокумент10 страницWeek 9 - Notesmark stoweОценок пока нет

- Long Duration (Senior) Specialists/Consultants and Short Duration (Senior) Fellows/InternsДокумент13 страницLong Duration (Senior) Specialists/Consultants and Short Duration (Senior) Fellows/InternsRavi Sankar KovvaliОценок пока нет

- FM S24-J25 Syllabus and Study Guide - FinalДокумент20 страницFM S24-J25 Syllabus and Study Guide - Finalyaswanthr12Оценок пока нет

- Chapter 2Документ7 страницChapter 2LeiОценок пока нет

- Course Title: Public Finance Course DescriptionДокумент8 страницCourse Title: Public Finance Course DescriptionBen KudischОценок пока нет

- Accounting Module 2 Accounting Concepts and PrinciplesДокумент6 страницAccounting Module 2 Accounting Concepts and PrinciplesRhudella OrmasaОценок пока нет

- Q1-Module 4-Week 4-Preparation of Budget and Projection of Financial StatementsДокумент36 страницQ1-Module 4-Week 4-Preparation of Budget and Projection of Financial StatementsJusie ApiladoОценок пока нет

- Course Outline AFS Fall 2023Документ5 страницCourse Outline AFS Fall 2023ASIMLIBОценок пока нет

- Course Outline AFS Fall 2023Документ5 страницCourse Outline AFS Fall 2023ASIMLIBОценок пока нет

- Financial Management SyllabusДокумент13 страницFinancial Management Syllabusharshgupta.16018Оценок пока нет

- 1st Pre-Board - MAS October 2011 BatchДокумент8 страниц1st Pre-Board - MAS October 2011 BatchKim Cristian MaañoОценок пока нет

- GID15713037-SBR GRPB Lesson - 1Документ28 страницGID15713037-SBR GRPB Lesson - 1Kat LeighОценок пока нет

- 3.FINA211 Financial ManagementДокумент5 страниц3.FINA211 Financial ManagementIqtidar Khan0% (1)

- Management Advisory Services (Mas) MAS01 Introductioin To Management AccountingДокумент38 страницManagement Advisory Services (Mas) MAS01 Introductioin To Management AccountingEagle OrtegaОценок пока нет

- Business BudgetingДокумент77 страницBusiness BudgetingDewanFoysalHaqueОценок пока нет

- HRTM 134 Course Outline, 2nd 2017-18Документ4 страницыHRTM 134 Course Outline, 2nd 2017-18aireen cloresОценок пока нет

- Solution Manual For Principles of ManageДокумент3 страницыSolution Manual For Principles of Manageprins kyla SaboyОценок пока нет

- BUSI 1038 Management Accounting and Decisions IДокумент30 страницBUSI 1038 Management Accounting and Decisions IbeheОценок пока нет

- PAS 1 Presentation of Financial Statements: Quiz 1: Multiple ChoiceДокумент3 страницыPAS 1 Presentation of Financial Statements: Quiz 1: Multiple Choicetrixie mae88% (8)

- Wk14 Summary Quizzer 1 - Set AДокумент6 страницWk14 Summary Quizzer 1 - Set Amariesteinsher0Оценок пока нет

- BUSINESS FINANCE 12 - Q1 - W3 - Mod3Документ26 страницBUSINESS FINANCE 12 - Q1 - W3 - Mod3LeteSsie0% (1)

- 19MST22Документ1 страница19MST22sibi chandanОценок пока нет

- 2nd Year 1st SemesterДокумент11 страниц2nd Year 1st SemesterShamim Ahmed AshikОценок пока нет

- 1MIE21Документ1 страница1MIE21sibi chandanОценок пока нет

- Primarily For External Users Exclusively For Internal UsersДокумент3 страницыPrimarily For External Users Exclusively For Internal UsersKim Taehyung100% (1)

- Final ExamsДокумент7 страницFinal ExamsRiriОценок пока нет

- Financial Management in The Sport Industry 2nd Brown Solution Manual DownloadДокумент12 страницFinancial Management in The Sport Industry 2nd Brown Solution Manual DownloadElizabethLewisixmt100% (41)

- Exam - FMДокумент6 страницExam - FMdkaluale16Оценок пока нет

- DLP in ABMДокумент3 страницыDLP in ABMA.Оценок пока нет

- Management AccountingДокумент3 страницыManagement AccountingC AОценок пока нет

- Module 1Документ4 страницыModule 1Beatrice TehОценок пока нет

- Master Budgeting and Forecasting for Hospitality Industry-Teaser: Financial Expertise series for hospitality, #1От EverandMaster Budgeting and Forecasting for Hospitality Industry-Teaser: Financial Expertise series for hospitality, #1Оценок пока нет

- Navigating Professional Paths: A Guide to CA, MBA, UPSC, SSC, Banking, GATE, Law, and UGCОт EverandNavigating Professional Paths: A Guide to CA, MBA, UPSC, SSC, Banking, GATE, Law, and UGCОценок пока нет

- Public Financial Management Systems—Fiji: Key Elements from a Financial Management PerspectiveОт EverandPublic Financial Management Systems—Fiji: Key Elements from a Financial Management PerspectiveОценок пока нет

- From Data to Decisions: Harnessing FP&A for Financial Leadership: FP&A Mastery Series, #1От EverandFrom Data to Decisions: Harnessing FP&A for Financial Leadership: FP&A Mastery Series, #1Оценок пока нет

- Public Financial Management Systems—Sri Lanka: Key Elements from a Financial Management PerspectiveОт EverandPublic Financial Management Systems—Sri Lanka: Key Elements from a Financial Management PerspectiveОценок пока нет

- Ten Commitments For A Blessed DayДокумент2 страницыTen Commitments For A Blessed DayDrVinod KumarОценок пока нет

- Big BazaarДокумент1 страницаBig BazaarDrVinod KumarОценок пока нет

- Motivate Students With DelightДокумент5 страницMotivate Students With DelightDrVinod Kumar100% (1)

- Ba9251 Brand ManagementДокумент15 страницBa9251 Brand ManagementDrVinod KumarОценок пока нет

- Namagunga Primary Boarding School: Primary Six Holiday Work 2021 EnglishДокумент10 страницNamagunga Primary Boarding School: Primary Six Holiday Work 2021 EnglishMonydit santinoОценок пока нет

- Drilling Jigs Italiana FerramentaДокумент34 страницыDrilling Jigs Italiana FerramentaOliver Augusto Fuentes LópezОценок пока нет

- EXPERIMENT 1 - Bendo Marjorie P.Документ5 страницEXPERIMENT 1 - Bendo Marjorie P.Bendo Marjorie P.100% (1)

- 19 71 Hydrologic Engineering Methods For Water Resources DevelopmentДокумент654 страницы19 71 Hydrologic Engineering Methods For Water Resources DevelopmentMartha LetchingerОценок пока нет

- PH-01 (KD 3.1) Filling Out Forms (PG20) - GFormДокумент4 страницыPH-01 (KD 3.1) Filling Out Forms (PG20) - GFormLahita AzizahОценок пока нет

- CKRE Lab (CHC 304) Manual - 16 May 22Документ66 страницCKRE Lab (CHC 304) Manual - 16 May 22Varun pandeyОценок пока нет

- 74 Series Logic ICsДокумент6 страниц74 Series Logic ICsanon-466841Оценок пока нет

- Classroom Management PlanДокумент14 страницClassroom Management PlancowlesmathОценок пока нет

- Gates Crimp Data and Dies Manual BandasДокумент138 страницGates Crimp Data and Dies Manual BandasTOQUES00Оценок пока нет

- Operation and Service 69UG15: Diesel Generator SetДокумент72 страницыOperation and Service 69UG15: Diesel Generator Setluis aguileraОценок пока нет

- Practice Test - Math As A Language - MATHEMATICS IN THE MODERN WORLDДокумент8 страницPractice Test - Math As A Language - MATHEMATICS IN THE MODERN WORLDMarc Stanley YaoОценок пока нет

- Manual HobartДокумент39 страницManual HobartВолодимир БроОценок пока нет

- Unit 3Документ5 страницUnit 3Narasimman DonОценок пока нет

- Electronic Parts Catalog - Option Detail Option Group Graphic Film Card DateДокумент2 страницыElectronic Parts Catalog - Option Detail Option Group Graphic Film Card DatenurdinzaiОценок пока нет

- Plastic Hinge Length and Depth For Piles in Marine Oil Terminals Including Nonlinear Soil PropertiesДокумент10 страницPlastic Hinge Length and Depth For Piles in Marine Oil Terminals Including Nonlinear Soil PropertiesGopu RОценок пока нет

- 61annual Report 2010-11 EngДокумент237 страниц61annual Report 2010-11 Engsoap_bendОценок пока нет

- HP Scanjet N9120 (Service Manual) PDFДокумент394 страницыHP Scanjet N9120 (Service Manual) PDFcamilohto80% (5)

- Sensor de Temperatura e Umidade CarelДокумент1 страницаSensor de Temperatura e Umidade CarelMayconLimaОценок пока нет

- Energy BodiesДокумент1 страницаEnergy BodiesannoyingsporeОценок пока нет

- Handbook On National Spectrum Management 2015Документ333 страницыHandbook On National Spectrum Management 2015Marisela AlvarezОценок пока нет

- Davis A. Acclimating Pacific White Shrimp, Litopenaeus Vannamei, To Inland, Low-Salinity WatersДокумент8 страницDavis A. Acclimating Pacific White Shrimp, Litopenaeus Vannamei, To Inland, Low-Salinity WatersAngeloОценок пока нет

- Powerplant QuestionsДокумент19 страницPowerplant QuestionsAshok KumarОценок пока нет

- 1988 Mazda 323 Workshop Manual V1.0 (Turbo Only)Документ880 страниц1988 Mazda 323 Workshop Manual V1.0 (Turbo Only)Mike Marquez100% (2)

- Configuring Hyper-V: This Lab Contains The Following Exercises and ActivitiesДокумент9 страницConfiguring Hyper-V: This Lab Contains The Following Exercises and ActivitiesMD4733566Оценок пока нет

- History of Psychotherapy FinalДокумент38 страницHistory of Psychotherapy FinalMarco BonettiОценок пока нет

- Empowerment Series Social Work With Groups Comprehensive Practice and Self Care 10Th Edition Charles Zastrow Full ChapterДокумент67 страницEmpowerment Series Social Work With Groups Comprehensive Practice and Self Care 10Th Edition Charles Zastrow Full Chapterruby.levi441100% (5)

- Summative Test in Foundation of Social StudiesДокумент2 страницыSummative Test in Foundation of Social StudiesJane FajelОценок пока нет

- Diltoids Numberletter Puzzles Activities Promoting Classroom Dynamics Group Form - 38486Документ5 страницDiltoids Numberletter Puzzles Activities Promoting Classroom Dynamics Group Form - 38486sinirsistemiОценок пока нет

- Swot Matrix Strengths WeaknessesДокумент6 страницSwot Matrix Strengths Weaknessestaehyung trash100% (1)

- Ab 2023Документ5 страницAb 2023Cristelle Estrada-Romuar JurolanОценок пока нет