Академический Документы

Профессиональный Документы

Культура Документы

Mi - ST - ATH: Invest in This Smallcase Here

Загружено:

hamsОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Mi - ST - ATH: Invest in This Smallcase Here

Загружено:

hamsАвторское право:

Доступные форматы

Last Updated on: 12 Dec 2020

Index Value

Mi_ST_ATH

587.84

Concentrated momentum portfolio of

up to 10 high volume stocks which are CAGR

picked near their All Time Highs.

46.48%

High Risk since March 31, 2016

smallcase rationale

An up-to 10 stock concentrated portfolio with equal weights for each

component

Stocks from NSE listed universe (with additional ilters of very high turnover

stocks only)

Stock selection based on Momentum ranking and nearness to their All Time

Highs.

Momentum ranking is basically a ranking of relative out-performance of each

stock with respect to its peer group over the last many periods.

Every week the portfolio is reviewed and stocks which do not hold up the

momentum ranks are shelved while new ones enter.

At times when new momentum picks are not available the portfolio will sit in

cash (in interest bearing instruments like LIQUID BEES).

Created by SEBI Reg. Number Subscription Type

Weekend Investing INA100007532 Paid

Invest in this smallcase here

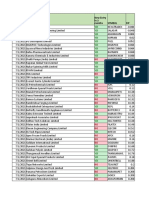

Methodology

De ining the universe

All publicly traded companies on the National Stock Exchange of

India, covering are included in the universe

Constituent Screening

The Weekend Investing team runs proprietary rule based

algorithms once a week to pick or reject individual stocks. Only

quantitative parameters are considered while screening stocks for

the respective strategy.

Weighting

The strategy has a ixed 5% weight age to each new entering

stock. The existing stocks are not equally balanced every week.

Rebalance

This smallcase has a weekly rebalance schedule. Once every

week, the research team reviews this smallcase and drops stocks

which do not meet the criteria and adds new stocks. The re-

balance email comes to the user on Monday and the portfolio can

be updated with a few clicks

Ratios

Ratio smallcase Equity Multi Cap

PE Ratio 13.07 27.26

PB Ratio 1.85 3.41

Sharpe Ratio 5.43 1.15

Dividend Yield (%) 1.08 1.45

Important Fields

Inception Date Launch Date Marketcap Category

March 31, 2016 March 30, 2019 Equity Multi Cap

Review Frequency Last Reviewed Next Review On

Weekly December 12, 2020 December 19, 2020

Market Cap Distribution

Large Cap Mid Cap Small Cap

29.64% 42.69% 27.67%

Past Performance Comparison with Equity Multi Cap

Mi_ST_ATH with Equity Multi Cap

Launch

500

400

300

200

100

2017 2018 2019 2020

Backtested Live

Returns over various periods

3M Returns 6M Returns 1Y Returns 3Y Returns

smallcase smallcase smallcase smallcase

22.86% 79.19% 90.79% 56.88%

Equity Mul… Equity Mul… Equity Mul… Equity Mul…

17.36% 37.78% 13.88% 15.27%

Pricing Plans

3 Months 12 Months

₹ 2,499 ₹ 9,999

Amount includes 18% GST if applicable

How to subscribe

How to invest

De initions and Disclosures

Index Value

Index value for all smallcases start from 100 since their inception date and helps

investors easily calculate the returns generated since inception or between two

speci ic dates. For example, if the current index value of the smallcase is 150, it

means it has generated 50% since its inception. If the index value of a smallcase

was 215 last month and the current index value if 245, it means it has generated

(245/215)-1 = 13.9% return in last one month

CAGR

CAGR (compounded annual growth rate) is a useful measure of growth or

performance of a portfolio. It represents the growth/return rate that gets you to the

current value of the investment, starting from the initial investment value and

assuming that investment has been compounding at the ixed growth/return rate

for the period.

In simple words, it indicates the annual return generated by the smallcase from

the date of inception

Risk Label

Change in value of your investment, due to changing prices of stocks on a daily

basis is called the Risk. If the daily change in the investment value of portfolio is

too drastic, it means prices of stocks in the portfolio are changing very rapidly.

Such portfolios have High Risk.

Every smallcase is categorized into one of the three risk buckets - High Risk,

Moderate Risk and Low Risk. This is done by comparing the volatility of the

smallcase with market volatility since inception. Investing in High Risk smallcases

means that change in your investment values can be very sudden and drastic.

Segment

Stocks/ETFs belonging to a smallcase are categorized under different segments.

Weightage of a segment is calculated as sum of weights of all stocks belonging to

that segment. Suppose 4 stocks, with each having a weight of 10%, belong to the

Food Products segment. Then the weight of the Food Product segment in the

smallcase will be 40% (4*10)

Review

Rebalancing is the process of periodically reviewing and updating the

constituents of a smallcase. This is done to ensure that stocks & weights in the

smallcase continue to re lect the underlying theme or strategy

Market Cap Categorization of Stocks

All the stocks listed on NSE(National Stock Exchange) are arranged in decreasing

order of Market Cap, so that the stock with the largest market cap gets 1st Rank.

Stocks ranked equal to or below 100 are categorized as Large Cap. Stocks ranked

below or equal to 250, but ranked above 100 are categorized as Mid Cap stocks.

Stocks ranked above 250 are categorized as smallcap

Market Cap Categorization of smallcases

If the sum of weights of constituent large cap stocks is greater than 50%,

then smallcase is categorized as Largecap

If the sum of weights of constituent mid cap stocks is greater than 50%, then

smallcase is categorized as Midcap

If the sum of weights of constituent small cap stocks is greater than 50%,

then smallcase is categorized as Smallcap

If the sum of weights of constituent large cap stocks is greater than 30%,

sum of weights of mid cap stocks are greater than 30%, and sum of weights

of large cap and mid cap stocks are greater than 80%, then smallcase is

categorized as Large & Midcap

If the sum of weights of constituent small cap stocks is greater than 30%,

sum of weights of mid cap stocks are greater than 30%, and sum of weights

of small cap and mid cap stocks are greater than 80%, then smallcase is

categorized as Mid & Smallcap

If none of the above conditions are met, then smallcase is categorized as

Multicap

Marketcap category of a smallcase might be different from the above

mentioned, if the creator/manager of the smallcase speci ically de ines a

particular category

General Investment Disclosure

The content and data available in this document and related material, including

but not limited to index value, return numbers and rationale are for information

and illustration purposes only. Charts and performance numbers are

backtested/simulated results calculated via a standard methodology and do not

include the impact of transaction fee and other related costs. Past performance

does not guarantee future returns.

All information present in this document and related material is to help investors

in their decision making process and shall not be considered as a

recommendation or solicitation of an investment or investment strategy. Investors

are responsible for their investment decisions and are responsible to validate all

the information used to make the investment decision. Investor should understand

that his/her investment decision is based on personal investment needs and risk

tolerance, and information available in this document and related material is one

among many other things that should be considered while making an investment

decision.

Stock and ETF investments are subject to market risks, read all related documents

carefully. Investors should consult their inancial advisors if in doubt about

whether the product is suitable for them.

Please visit Weekend Investing for detailed disclosures, terms and conditions.

Вам также может понравиться

- Quantitative Styles & MultiSector BondsДокумент18 страницQuantitative Styles & MultiSector Bondsdoc_oz3298Оценок пока нет

- Zone Breakout'sДокумент78 страницZone Breakout'sPARTH DHULAM100% (2)

- Chaikin OscillatorДокумент5 страницChaikin Oscillatorrahul dhawanОценок пока нет

- ZSCOREДокумент10 страницZSCORENitin Govind BhujbalОценок пока нет

- Portfolio Construction TechniquesДокумент11 страницPortfolio Construction TechniquesArthur KingОценок пока нет

- TR SupermanДокумент77 страницTR SupermanZerohedge80% (10)

- Assignment 1 FMA 2021Документ8 страницAssignment 1 FMA 2021GanbilegBatnasanОценок пока нет

- Estmo 0001Документ1 страницаEstmo 0001ShahamijОценок пока нет

- PE Ratio 32.22 23.49 PB Ratio 5.31 3.41 Sharpe Ratio 1.26 1.11 Dividend Yield (%) 1.42 1.48Документ1 страницаPE Ratio 32.22 23.49 PB Ratio 5.31 3.41 Sharpe Ratio 1.26 1.11 Dividend Yield (%) 1.42 1.48ഓൺലൈൻ ആങ്ങളОценок пока нет

- Fallen Angels: Invest in This Smallcase HereДокумент1 страницаFallen Angels: Invest in This Smallcase HereSahil ChadhaОценок пока нет

- Bamimo 0001Документ1 страницаBamimo 0001sarha sharma0% (1)

- Nivmo 0001Документ1 страницаNivmo 0001rav prashant SinghОценок пока нет

- SCTR 0014Документ1 страницаSCTR 0014Sumeet SoniОценок пока нет

- SCNM 0012Документ1 страницаSCNM 0012kishoremarОценок пока нет

- WRTNM 0001Документ1 страницаWRTNM 0001p srivastavaОценок пока нет

- Angel One ARQ Prime portfolioДокумент1 страницаAngel One ARQ Prime portfolioMalavShahОценок пока нет

- SCTR 0014Документ1 страницаSCTR 0014tamaldОценок пока нет

- Agbmo 0012Документ1 страницаAgbmo 0012Anushree AyanavaОценок пока нет

- Invest in This Smallcase Here: Top 100 Stocks With Equity Large CapДокумент1 страницаInvest in This Smallcase Here: Top 100 Stocks With Equity Large CapKingui DevОценок пока нет

- CANSLIM-esque stocksДокумент1 страницаCANSLIM-esque stocksssvivekanandhОценок пока нет

- Wydmo 0005Документ1 страницаWydmo 0005Lakshminarayanan RaghuramanОценок пока нет

- Dolphin: Return: 25.87 (8Y CAGR) RISK: LOWДокумент5 страницDolphin: Return: 25.87 (8Y CAGR) RISK: LOWJinesh ShahОценок пока нет

- Turtle Growth: Return: 21.86 (15Y CAGR) RISK: MEDIUMДокумент5 страницTurtle Growth: Return: 21.86 (15Y CAGR) RISK: MEDIUMJinesh ShahОценок пока нет

- Return: 23.12 (8Y Cagr) Risk: Medium: Wealthbasket DescriptionДокумент5 страницReturn: 23.12 (8Y Cagr) Risk: Medium: Wealthbasket DescriptionJinesh ShahОценок пока нет

- COREGOLDДокумент5 страницCOREGOLDSanjeevОценок пока нет

- Diwali Picks 2021Документ5 страницDiwali Picks 2021sparksenterprises2023Оценок пока нет

- Rupeeting Core - Aggressive: Return: - 2.98 (3M ABS) RISK: HIGHДокумент5 страницRupeeting Core - Aggressive: Return: - 2.98 (3M ABS) RISK: HIGHJinesh ShahОценок пока нет

- CoreShares Introduction To Index Investing PDFДокумент10 страницCoreShares Introduction To Index Investing PDFBuyelaniОценок пока нет

- ATARAXIA FUND LP Inception August 2019Документ8 страницATARAXIA FUND LP Inception August 2019JBPS Capital ManagementОценок пока нет

- Rocketship: Return: - 7.46 (3M ABS) RISK: HIGHДокумент5 страницRocketship: Return: - 7.46 (3M ABS) RISK: HIGHJinesh ShahОценок пока нет

- Vanguard Small Cap Value ETFДокумент4 страницыVanguard Small Cap Value ETFKhalilBenlahccenОценок пока нет

- Rupeeting Core - Conservative: Return: - 1.22 (3M ABS) RISK: LOWДокумент5 страницRupeeting Core - Conservative: Return: - 1.22 (3M ABS) RISK: LOWJinesh ShahОценок пока нет

- Analyse Mutual Fund Portfolio - 7 Important ParametersДокумент3 страницыAnalyse Mutual Fund Portfolio - 7 Important Parametersdvg6363238970Оценок пока нет

- Risk Measures: Risk Analysis Distribution of ReturnsДокумент7 страницRisk Measures: Risk Analysis Distribution of ReturnsJBPS Capital ManagementОценок пока нет

- Support Truths About Indexing WP PDFДокумент12 страницSupport Truths About Indexing WP PDFAndy LoayzaОценок пока нет

- Dynamic Asset AllocationДокумент29 страницDynamic Asset AllocationAmaan Al WaasiОценок пока нет

- Smallcap Growth StrategyДокумент4 страницыSmallcap Growth StrategyyashОценок пока нет

- TMB EASTSPRING Global Core Equity Fund (Tmb-Es-Gcore) : YTD 3 Month 6 Month 1 YearДокумент3 страницыTMB EASTSPRING Global Core Equity Fund (Tmb-Es-Gcore) : YTD 3 Month 6 Month 1 Yearaekkasit.seОценок пока нет

- Analyzing Mutal Fund PerformanceДокумент4 страницыAnalyzing Mutal Fund PerformanceMeghananda s oОценок пока нет

- Setting The Record Straight: Truths About Indexing: Vanguard Research January 2018Документ12 страницSetting The Record Straight: Truths About Indexing: Vanguard Research January 2018TBP_Think_TankОценок пока нет

- Analysis of Mutual FundsДокумент14 страницAnalysis of Mutual Fundsnileshbs_2000Оценок пока нет

- Portfolio Management student copyДокумент76 страницPortfolio Management student copyMuhammad HasnainОценок пока нет

- Understanding of Mutual FundДокумент20 страницUnderstanding of Mutual FundshraddhashindeОценок пока нет

- P 09 P Smallcap PKF - EngДокумент5 страницP 09 P Smallcap PKF - EngherbertОценок пока нет

- Gprmo 0003Документ1 страницаGprmo 0003ApОценок пока нет

- Possible Opportunities Are Restricted in The Capital Markets - EditedДокумент6 страницPossible Opportunities Are Restricted in The Capital Markets - EditedthomasОценок пока нет

- Your Essential Guide to Passive InvestingДокумент15 страницYour Essential Guide to Passive InvestinginvestorОценок пока нет

- MF0010 - Security Analysis and Portfolio Management - 4 CreditsДокумент23 страницыMF0010 - Security Analysis and Portfolio Management - 4 CreditsAkash KumarОценок пока нет

- Evaluating CAPM and Portfolio PerformanceДокумент18 страницEvaluating CAPM and Portfolio PerformanceSajith NiroshanaОценок пока нет

- HDFC MF Factsheet - April 2022 - 1Документ92 страницыHDFC MF Factsheet - April 2022 - 1Akash BОценок пока нет

- Financial Planning& Wealth ManagementДокумент10 страницFinancial Planning& Wealth Managementpallavigupta003Оценок пока нет

- Structure Beats Activity: Why DSP Equity Savings Fund Could Be Your Default ChoiceДокумент10 страницStructure Beats Activity: Why DSP Equity Savings Fund Could Be Your Default ChoiceVamshi kodityalaОценок пока нет

- METHODOLOGY AND ProcedureДокумент17 страницMETHODOLOGY AND ProcedureSanjeev JhaОценок пока нет

- Capital Appreciation - All Equity PortfolioДокумент2 страницыCapital Appreciation - All Equity PortfolioDwi Rizki Anisa PandiaОценок пока нет

- Vanguard 500 Index Fund (Adm) : Characteristics Largest Holdings Asset AllocationДокумент1 страницаVanguard 500 Index Fund (Adm) : Characteristics Largest Holdings Asset AllocationyigaplusoneОценок пока нет

- Axis Arbitrage Fund Monthly RecapДокумент3 страницыAxis Arbitrage Fund Monthly RecapYasahОценок пока нет

- Fidelity Funds - China Opportunities Fund: 31 July 2018 年年7⽉月31⽇日Документ2 страницыFidelity Funds - China Opportunities Fund: 31 July 2018 年年7⽉月31⽇日silver lauОценок пока нет

- BCG Matrix AND: General Electric (GE) MatrixДокумент38 страницBCG Matrix AND: General Electric (GE) MatrixChandu SahooОценок пока нет

- Invesco MSCI Sustainable Future ETF: Growth of $10,000Документ3 страницыInvesco MSCI Sustainable Future ETF: Growth of $10,000sarah martinОценок пока нет

- Basic Investment StrategiesДокумент3 страницыBasic Investment StrategiesSatpal SinghОценок пока нет

- Investment Theory #15 - Performance Attribution - Wiser DailyДокумент2 страницыInvestment Theory #15 - Performance Attribution - Wiser DailyVladimir OlefirenkoОценок пока нет

- Attribution GuideДокумент6 страницAttribution Guidevicky.sajnaniОценок пока нет

- Som Distilleries & Breweries LimitedДокумент7 страницSom Distilleries & Breweries LimitedhamsОценок пока нет

- TRADEJINI MCX Margin File For 17/06/2022: Underlying Group Symbol Expiry Total Long Margin Total Short MarginДокумент3 страницыTRADEJINI MCX Margin File For 17/06/2022: Underlying Group Symbol Expiry Total Long Margin Total Short MarginhamsОценок пока нет

- HDFC Securities Institutional Equities Aditya Birla Sunlife AMC Initiating CoverageДокумент13 страницHDFC Securities Institutional Equities Aditya Birla Sunlife AMC Initiating CoveragehamsОценок пока нет

- PB Fintech Icici SecuritiesДокумент33 страницыPB Fintech Icici SecuritieshamsОценок пока нет

- IndicecДокумент2 страницыIndicechamsОценок пока нет

- Anticipation Bo, Technical Analysis ScannerДокумент6 страницAnticipation Bo, Technical Analysis ScannerhamsОценок пока нет

- AIR INDIA - Concessionary FareДокумент2 страницыAIR INDIA - Concessionary FarehamsОценок пока нет

- Why Inflation Matters ?: Rohit ChauhanДокумент9 страницWhy Inflation Matters ?: Rohit ChauhanhamsОценок пока нет

- MH-daily - 5x VOLUME SHOCKERS, Technical Analysis ScannerДокумент2 страницыMH-daily - 5x VOLUME SHOCKERS, Technical Analysis ScannerhamsОценок пока нет

- Sumitomo Chemicals offers strong visibility in CRAMS segmentДокумент7 страницSumitomo Chemicals offers strong visibility in CRAMS segmenthamsОценок пока нет

- Anticipation Bo, Technical Analysis ScannerДокумент6 страницAnticipation Bo, Technical Analysis ScannerhamsОценок пока нет

- Investment Banking: Kotak Mahindra Capital Company LimitedДокумент3 страницыInvestment Banking: Kotak Mahindra Capital Company LimitedhamsОценок пока нет

- Dly 02 May-2022Документ7 страницDly 02 May-2022hamsОценок пока нет

- ET NewsДокумент1 страницаET NewshamsОценок пока нет

- WB Issues 04MAY22Документ8 страницWB Issues 04MAY22hamsОценок пока нет

- Nishtha Hamne - English Literature - Wolves of Cenogratz (Character Traits)Документ2 страницыNishtha Hamne - English Literature - Wolves of Cenogratz (Character Traits)hamsОценок пока нет

- RS RankingsДокумент3 страницыRS RankingshamsОценок пока нет

- Chartlink Watch ListДокумент14 страницChartlink Watch ListhamsОценок пока нет

- Index 12jul2021Документ76 страницIndex 12jul2021hamsОценок пока нет

- Startegy Varaible TreeДокумент1 страницаStartegy Varaible TreehamsОценок пока нет

- Adobe Scan Mar 27, 2021 21Документ1 страницаAdobe Scan Mar 27, 2021 21hamsОценок пока нет

- Date New Entry In3 Months: YES YES YES YES YES YES YES YES YESДокумент6 страницDate New Entry In3 Months: YES YES YES YES YES YES YES YES YEShamsОценок пока нет

- Yes Yes Yes Yes Yes Yes YesДокумент5 страницYes Yes Yes Yes Yes Yes YeshamsОценок пока нет

- 1.why COVID-19 Silent Hypoxemia Is Baffling To Physicians PDFДокумент5 страниц1.why COVID-19 Silent Hypoxemia Is Baffling To Physicians PDFMuhammad Arif HasanОценок пока нет

- Index 12jul2021Документ76 страницIndex 12jul2021hamsОценок пока нет

- Date Mcap Rank Quality Momentu M RankДокумент23 страницыDate Mcap Rank Quality Momentu M RankhamsОценок пока нет

- Pandemic Dairies: by Nishtha HamneДокумент7 страницPandemic Dairies: by Nishtha HamnehamsОценок пока нет

- LPHS 2021-22 Academic Calendar Now OnlineДокумент1 страницаLPHS 2021-22 Academic Calendar Now OnlinehamsОценок пока нет

- Top50-Quality-Jul21 - 601 - 1100Документ12 страницTop50-Quality-Jul21 - 601 - 1100hamsОценок пока нет

- Stock FIP and Quality Momentum DataДокумент12 страницStock FIP and Quality Momentum DatahamsОценок пока нет

- On January 1 2015 Evers Company Purchased The Following Two: Unlock Answers Here Solutiondone - OnlineДокумент1 страницаOn January 1 2015 Evers Company Purchased The Following Two: Unlock Answers Here Solutiondone - OnlineAmit PandeyОценок пока нет

- Tema 6 - Teste Me AlternativaДокумент3 страницыTema 6 - Teste Me AlternativaKlejda ElezajОценок пока нет

- GOMS No 94 Price AdjustmentДокумент3 страницыGOMS No 94 Price AdjustmentVizag Roads100% (8)

- Advanced Industrial Organization - Exercises An Solutions - Week 2Документ4 страницыAdvanced Industrial Organization - Exercises An Solutions - Week 2irene.billuОценок пока нет

- Tutorial 7 PC & MONOPOLYДокумент3 страницыTutorial 7 PC & MONOPOLYCHZE CHZI CHUAHОценок пока нет

- CH 14 Basic PPT SlidesДокумент18 страницCH 14 Basic PPT SlidesKanha BatraОценок пока нет

- Index Numbers Lesson NotesДокумент21 страницаIndex Numbers Lesson Noteskaziba stephenОценок пока нет

- 4ec1 02r Que 20220615Документ20 страниц4ec1 02r Que 20220615Kuok Hei LeungОценок пока нет

- Business CycleДокумент5 страницBusiness Cyclenil4u always rememberОценок пока нет

- Buzz Chronicles - Thread 16508Документ4 страницыBuzz Chronicles - Thread 16508pksОценок пока нет

- (VCE Further) 2008 Insight Unit 34 Exam 2 and SolutionsДокумент80 страниц(VCE Further) 2008 Insight Unit 34 Exam 2 and SolutionsKawsarОценок пока нет

- Retail pricing strategies and factorsДокумент13 страницRetail pricing strategies and factorsMunna MunnaОценок пока нет

- Barangay San Vicente Grande: Request For QuotationДокумент1 страницаBarangay San Vicente Grande: Request For QuotationQuentine TarantinoОценок пока нет

- CVP Analysis of Billings CompanyДокумент3 страницыCVP Analysis of Billings CompanyAhmed El Khateeb100% (1)

- County Government Tenders for Solar Water HeatersДокумент69 страницCounty Government Tenders for Solar Water HeatersSami Al-aminОценок пока нет

- Hand OutДокумент17 страницHand OutMae CherryОценок пока нет

- Coke's Market Dominance & Pricing StrategiesДокумент5 страницCoke's Market Dominance & Pricing StrategiesAsutosh TiwaryОценок пока нет

- RRB NTPC Quantitative Aptitude QuestionsДокумент5 страницRRB NTPC Quantitative Aptitude QuestionsRahul SinghОценок пока нет

- Questions - Business Valuation, Capital Structure and Risk ManagementДокумент5 страницQuestions - Business Valuation, Capital Structure and Risk Managementpercy mapetereОценок пока нет

- Solved The Following Relations Describe Monthly Demand and Supply Conditions inДокумент1 страницаSolved The Following Relations Describe Monthly Demand and Supply Conditions inM Bilal SaleemОценок пока нет

- Managerial Economics and Accounting ConceptsДокумент5 страницManagerial Economics and Accounting Conceptskruthi reddyОценок пока нет

- AF2110 Mid Term Questoin OnlyДокумент2 страницыAF2110 Mid Term Questoin OnlyannaОценок пока нет

- Quality Investing Strategies - Mistakes That Can Ruin Your Quality Stock Portfolio & How To Avoid Them - The Economic TimesДокумент17 страницQuality Investing Strategies - Mistakes That Can Ruin Your Quality Stock Portfolio & How To Avoid Them - The Economic Timesv pavanОценок пока нет

- EconomicsДокумент13 страницEconomicsLuna EAОценок пока нет

- CLAT Classroom Prep Material: MathematicsДокумент8 страницCLAT Classroom Prep Material: MathematicsHrituraj SrivastavaОценок пока нет

- Today's Objectives: - Review Chapter One - QUIZ To Be Uploaded TomorrowДокумент14 страницToday's Objectives: - Review Chapter One - QUIZ To Be Uploaded Tomorrowwen jing yuОценок пока нет

- Share Structure QuestionsДокумент18 страницShare Structure QuestionsmikiОценок пока нет