Академический Документы

Профессиональный Документы

Культура Документы

Mutual Fund Performance: Evidence From South Africa: Ömer Faruk Tan

Загружено:

xc123544Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Mutual Fund Performance: Evidence From South Africa: Ömer Faruk Tan

Загружено:

xc123544Авторское право:

Доступные форматы

Mutual Fund Performance: Evidence from South Africa

Ömer Faruk Tan

Research Assistant, MEF University Faculty of Economics, Administrative and Social Sciences, Department of

Economics, Turkey | e-mail: omerfaruk.tan@mef.edu.tr / omerfaruktan34@gmail.com

Volume 5 No 2 (2015) | ISSN 2158-8708 (online) | DOI 10.5195/emaj.2015.83 | http://emaj.pitt.edu

Abstract

This paper aims to evaluate the performance of South African equity funds between January 2009 and November 2014. This

study period overlaps with the period of quantitative easing during which developing economies in financial markets have

been influenced severely. Thanks to the increase in the money supply directed towards the capital markets, a relief was

experienced in related markets following the crisis period. During this 5-year 10-month period, in which the relevant

quantitative easing continued, Johannesburg Stock Exchange (JSE) yielded approximately 16% compounded on average,

per year. In this study, South African equity funds are examined in order to compare these funds’ performance within this

period. Within this scope, 10 South African equity funds are selected. In order to measure these funds’ performances, the

Sharpe ratio (1966), Treynor ratio (1965), Jensen’s alpha (1968) methods are used. Jensen’s alpha is also used in identifying

selectivity skills of fund managers. Furthermore, the Treynor & Mazuy (1966) and Henriksson & Merton (1981) regression

analysis methods are applied to ascertain the market timing ability of fund managers. Furthermore, Treynor&Mazuy (1966)

regression analysis method is applied for market timing ability of fund managers.

Keywords: Mutual Fund, South Africa, Performance Evaluation, Equity Funds

New articles in this journal are licensed under a Creative Commons Attribution 3.0 United States License.

This journal is published by the University Library System of the University of Pittsburgh as part

of its D-Scribe Digital Publishing Program, and is cosponsored by the University of Pittsburgh Press.

Electronic copy available at: https://ssrn.com/abstract=3094754

Volume 5 No 2 (2015) | ISSN 2158-8708 (online) | DOI 10.5195/emaj.2015.83 | http://emaj.pitt.edu

2014. Quantitative easing policy separates four terms

Mutual Fund Performance: QE1 (December 2008- June 2010), QE2 (November

Evidence from South Africa 2010- June 2011), QE3 (September 2012- October

2014) and finally QE4 (January 2013- October 2014).

(Useconomy). During the period, huge amount of

Ömer Faruk Tan money influx from developed countries to developing

countries experienced. Hence, in this paper, it is tried to

analyze fund performances of South African equity

1. Introduction funds between 09 January 2009 - 31 0ctober 2014 in

the era of quantitative easing. South Africa is

Mutual fund performance has always been one of the considered as one of the emerging markets and over the

most researched areas of finance studies. Using diverse study period of 5 years - 10 months, Johannesburg

technical measurement methods, these types of studies Stock Exchange (JSE) grew by 15.9% compounded

analyze fund performances of various markets from annually on average. Johannesburg Stock Exchange

different perspectives. Especially, following the period performed better than major developed European

of liberalization of the financial markets, mutual funds markets. In the sample period, developed market

have gained much more significance in the eyes of indices DAX, FTSE 100, CAC 40 yielded 12.1%, 6.8%

investors, resulting in numerous studies that have been and 4.1%, respectively.

carried out on performance evaluations. Mutual funds

bring investors who share a common goal together. 2. Literature Review

According to Deepak (2011), investors invest the

money they collect into capital market instruments such Beginning from the 1960s, there have been several

as shares, debentures and other investment securities. studies carried out on mutual fund performance.

The total income acquired from investments and the Treynor (1965), Sharpe (1966) and Jensen (1968) are

capital appreciation is equally shared among unit among those who measure fund performance related to

holders by taking into account the units owned by risk and return measurements. Sharpe (1966) measured

them. As a consequence, mutual funds are a suitable 34 open-ended mutual funds between 1954-1963 using

investment for the common man, as they provide the the Sharpe ratio and Treynor ratio. As the result of the

opportunity to invest various professionally managed study, it has been found out that while 11 funds out of

securities at a relatively low cost. The main objective of 34 show a better performance than the index, 23 funds

investing in a mutual fund scheme is to diversify risk. underperform their benchmarks. Jensen (1968)

The mutual funds invest in diversified portfolio and the examined 115 mutual funds - which were active

fund managers take different levels of risk so as to between 1945-1964 – by using an alpha indicator that

achieve the scheme’s objectives. Hence, while he generated. His alpha indicator shows the selectivity

evaluating and comparing the schemes, the returns skills of fund managers. Based on his results, funds

should be measured by taking into account the risks could not outperform the market performance,

involved in achieving the returns. (Rao, 2006). revealing that mutual fund managers, in general, did

not have selective ability.

The global crises emerged in America in 2008 and later

spread to other countries, affecting especially the Malkiel (1995) used the Jensen method to calculate the

economies of Europe and America and their financial performance of American funds between the years

markets a great deal. The American and European 1972 and 1990. He revealed that mutual funds could

economies went into recession and some significant not show positive excess return.

financial investment banks collapsed, such as Lehman

Brothers. Also, in Europe, banking crises occurred in Detzler (1999) searched 19 global bond funds by using

various countries led by Portugal, Ireland, Spain, monthly returns between the years 1985 and 1995. In

Greece, and Italy. This situation, in the eyes of the study, a multiple regression analysis was used and it

investors, made America and Europe lose their was found out that funds could not show better

reputation of being the “safe port” and making performance than indexes.

investors turn towards other stock markets for

investment purposes. Dahlquist, Engström and Söderlind (2000) evaluated

201 Swedish mutual funds – including only domestic

To ease the recession, the FED applied a policy of funds - from the period between 1993 and 1997. They

quantitative easing. Between December 2008 and found that regular equity funds seemed to over perform

October 2014, the FED bought huge quantities of while bond and money market funds performed less.

government bonds and bills from the markets to Furthermore, actively managed funds demonstrated

enhance the money supply for the sake of encouraging better performance than passively managed funds.

the revival of the economy. Quantitative easing policy

started in December 2008 and finished in October

Omer Faruk Tan

Emerging Markets Journal | P a g e |49

Electronic copy available at: https://ssrn.com/abstract=3094754

Volume 5 No 2 (2015) | ISSN 2158-8708 (online) | DOI 10.5195/emaj.2015.83 | http://emaj.pitt.edu

With the aim of detecting the market timing ability of 3. Methodology and Data

the fund managers, Treynor and Mazuy (1966)

established the quadratic regression analysis method. 3.1. Methodology

They applied this method to 57 open-end mutual funds

(25 growth funds and 32 balanced funds). They In this study, it is tried to evaluate both funds and funds

revealed only a single fund as having statistically managers’ performance of South African equity funds.

significant market timing ability. A total of 10 equity funds performances’ are analyzed.

In order to evaluate fund performance, Sharpe (1966),

Henriksson and Merton (1981) and Henriksson (1984) Treynor (1965) and Jensen’s alpha (1968) ratios are

developed both parametric and nonparametric statistical computed. Jensen’s alpha method also shows the

models to the test market timing ability of portfolios. selectivity skills of fund managers. In order to test

Having been introduced by Henriksson and Merton mutual fund managers’ market timing ability, the

(1981), the parametric and non-parametric tests in Treynor & Mazuy (1966) and Henriksson & Merton

question were applied by Henriksson (1984) to evaluate (1981) methods are applied.

the market timing ability of 116 open-end funds

between 1968 and 1980 in the U.S. market. The results 3.1.1. Treynor Ratio

revealed that there wasn’t any support for market

timing ability. Moreover, Henriksson found an inverse According to Kouris, Adam, & Botsaris (2011) the

relationship between selection ability and market Treynor ratio is the first risk-adjusted performance

timing ability. measure of mutual funds that was put forward by

Treynor in 1965. It is calculated as the ratio of the

Chang and Lewellen (1984) tested the market timing excess return of the mutual fund divided by its beta

ability of 67 U.S. funds covering the period from 1971 (systematic risk) and is defined as:

to 1979 by using the Henriksson & Merton (1981) Ti = (Rp-Rf) / P (1)

method. It was found that there were weak indications where

of fund manager market timing ability. Ti = Treynor’s performance index

Rp = portfolio’s actual return during a

Gallo and Swanson (1996) tested 37 U.S. mutual funds specified time period

by using the Treynor & Mazuy model for market Rf = risk-free rate of return during the same

timing, yet found no evidence of market timing of period

funds. P = beta of the portfolio

According to Reilly (1992), whenever Rp > Rf

Christensen (2005) evaluated 47 Danish funds between and p > 0, a larger T value means a better portfolio for

January 1996 and June 2003. He found that fund all investors regardless of their individual risk

managers did not have selectivity skills in general and, preferences. In two cases, a negative T value may

in terms of timing ability, the results were also result: when Rp < Rf or when p < 0. If T is negative

negative, due to the fact that only two funds had because Rp < Rf, then we deduce that the portfolio

significant timing ability. performance is very poor, whereas if the negativity of T

comes from a negative beta, the fund’s performance is

Gilbertson and Vermaak (1982) evaluated seven South excellent.

African mutual funds over the period 1974 to 1981.

According to results, in general, returns of funds were 3.1.2. Sharpe Ratio

lower than market indexes. Only one fund - Guardbank

– showed significantly outperformed than indexes. According to Noulas &Lazaridis (2005), the Sharpe

technique was developed in 1966 and is fairly similar to

Manjezi (2008) investigated 15 South African funds the Treynor technique, but the Sharpe technique uses

during the period between 2001 and 2006. According to the total risk of the portfolio rather than systematic risk.

his results, the index showed a better performance than This technique computes the risk premium earned per

funds. In addition, only one fund displayed both unit of the total risk. The Sharpe value can be

selective and market timing ability during the study calculated as follows:

period. Sp =(Rp – Rf /) p (2)

where

Mbiola (2013) examines 64 South African domestic Sp = Sharpe Ratio

general equity unit trusts over the period from 1992 to Rp = the average rate of return for a fund

December 2011. According to his result, funds could Rf = the average risk-free return

not show strong evidence of superior performance than p = the standard deviation of the fund.

market. The Sharpe ratio (Sp) evaluates the performance of its

level of total risk. A higher value of this ratio indicates

Mutual Fund Performance: Evidence from South Africa

Page |50| Emerging Markets Journal

Volume 5 No 2 (2015) | ISSN 2158-8708 (online) | DOI 10.5195/emaj.2015.83 | http://emaj.pitt.edu

that the fund delivers a higher performance by using ability i.e., the investment portfolios of mutual funds

standard deviation ( p). (Duggimpudi, Abdou, & Zaki, are adjusted actively to well-anticipated changes in

2010, p. 79). market conditions. A negative implies that mutual

fund managers do not exhibit market timing ability.

3.1.3. Jensen’s Alpha (Chen et al., 2013).

As Jensen (1968) explained, “a portfolio manager’s 3.1.5. Henriksson&Merton Regression Analysis

predictive ability – that is, his ability to earn returns

through the successful forecast of security prices that Another return-based approach for estimating

are higher than those which we could presume given performance is the option approach developed by

the level of his riskiness of his portfolio” (p. 389). Merton and Henriksson. The regression used is similar

Jensen’s model can be written as: to the Treynor & Mazuy regression. In contrast to the

Rpt – Rft = p + p (Rmt – Rft) + ept linear beta adjustment of the Treynor and Mazuy

(3) framework, the portfolio beta in the Henriksson and

p = the excess return on the portfolio after Merton study is assumed to switch between two betas.

adjusting for the market A large value if the market is expected to do well, i.e.,

Rpt = the return on the portfolio p at time t when Rm>Rf up market and a small value otherwise i.e.,

Rft = the return on a riskless asset at time t when Rm<Rf (down market). Therefore, it is argued that

Rmt = the return on the market portfolio at a successful market timer would select a high up

time t market beta and a low market beta. Thus, such a

p = the sensitivity of the excess return on the relationship can be estimated by equation using a

portfolio t with the excess return on the market. dummy variable (Tripathy, 2005).

The sign of the alpha displays whether the The formula is:

portfolio manager are superior to the market after Rit-Rft = i + i0 (Rmt – Rft) + i [D (Rmt – Rft)] +

adjusting for risk. A positive alpha denotes better (5)

performance relative to the market, and a negative When Rmt>Rft (up market), D is equal to 1 and when

alpha designates poorer performance. (Mayo, 2011). Rmt<Rft, D is equal to 0.

We can rewrite to formula as:

3.1.4. Treynor&Mazuy Regression Analysis Rmt > Rft Rit-Rft = i + i (Rmt – Rft) + i1 +

Rmt<Rft Rit-Rft = i + i (Rmt – Rft) +

Investment managers may well beat the market, if they

are able to adjust the composition of their portfolios in 3.2. Data

time when the general stock market is going up or

down. That is, if fund managers believe the market is In this study, the mutual fund performances of 10 South

going to drop, they alter the composition of the African equity funds are analyzed using the Sharpe

portfolios they manage from more to less volatile (1966), Treynor (1965) and Jensen’s alpha (1968)

securities. If they think the market is going to climb, ratios. Jensen’s alpha also shows the selectivity skills of

they shift in the opposite direction. (Treynor&Mazuy, fund managers. In order to test mutual fund managers’

1966). market timing ability, the Treynor & Mazuy (1966) and

Henriksson & Merton (1981) methods are applied. The

Mutual fund managers may hold a higher proportion of time period between January 2009 and October 2014,

the market portfolio if they are qualified to predict during which quantitative easing (QE) took place is

future market conditions and envisage the stock market chosen. Weekly returns of funds are used and 304

as a bull market. On the other hand, mutual fund weeks are observed for this study. All data are taken

managers may hold a lower proportion of the market from the Thomson Reuters DataStream.

portfolio if they expect the market to underperform in

the future. Treynor and Mazuy (1966) developed the 3.2.1. Selection of Equity Funds

following model to evaluate market-timing

performance: According to the Investment Institute Database

(2014:Q3), there are 1,200 mutual funds in South

(4) Africa. There are two main funds in South Africa: A

where i is the timing-adjusted alpha, which Class and R Class funds. A Class funds are open-end

represents the timing-adjusted selective ability of while R Class funds are close-end. In this study, R

mutual fund managers. The quadratic term in equation Class funds are ignored. There are different fund types

(4) is the market timing factor and the coefficient of the in South Africa such as equity, bond, balanced,

market timing factor, , represents mutual fund financial, industrial, money markets and real estate

funds. Among these types of mutual funds, equity

managers’ market timing ability. If is positive,

funds are chosen since they carry company stocks that

mutual fund managers have superior market timing

Omer Faruk Tan

Emerging Markets Journal | P a g e |51

Volume 5 No 2 (2015) | ISSN 2158-8708 (online) | DOI 10.5195/emaj.2015.83 | http://emaj.pitt.edu

are riskier and more vulnerable to volatility in price. In 4. Empirical Results

the study period, funds were disregarded if they were

closed, newly established or had merged with another Descriptive statistics of South African equity funds,

fund. Funds that had less than 50% equity shares in benchmarks and risk-free rates are given in Table 2.

their portfolio were also not considered. In the end, 10 The average column indicates returns of funds,

equity funds were chosen for this study; they are shown benchmarks and risk-free rates. The average returns of

on Table 1. the Foord Equity Fund, the Coronation Equity Fund,

the Sanlam Equity Fund, the Prudential Equity Fund,

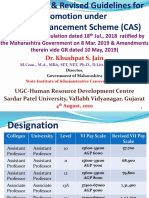

Table 1. South African Equity Funds the Allan Gray Equity Fund, and the Aylett Equity

Fund are higher than the Johannesburg Stock Exchange

Fund Name

(JSE). The Skew column displays the skew of equity

Old Mutual Investors Fund A funds and the corresponding value of their benchmarks.

Allan Gray Equity Fund Class A All funds and benchmarks are skewed negatively,

Sanlam General Equity Fund denoting a distribution with an asymmetric tail

extending toward more negative values. Only 91-Day

Coronation Equity Fund A T-Bills have are skewed positively, which indicates a

Nedgroup Investments Rainmaker Fund A distribution with an asymmetric tail extending toward

Foord Equity Fund more positive values. All funds, benchmarks and risk-

free rates have positive kurtosis, which implies typical

Investec Equity A

heavy tailed financial distributions. The R column

Aylett Equity Fund depicts correlation between funds and benchmarks. The

Huysamer Equity Fund A average correlation of funds and their benchmarks is

0.88835, which means that there is a strong positive

Prudential Equity Fund

correlation. The Investec Equity Fund has the highest

correlation (0.91912) and the Aylett Equity Fund has

3.2.2. Returns on Funds the lowest correlation (0.81560). The Standard

Deviation column shows the volatility of equity funds,

When calculating returns of South African funds, benchmarks and risk-free rates. The JSE has the highest

weekly returns of the price index of funds are standard deviation and the Huysamer Equity Fund, the

logarithmically computed. For the study, 304 weeks Old Mutual Fund Investors Fund A and the Coronation

(January 9, 2009- October 31, 2014) are observed. Equity Fund follows the JSE, in that order. The last

Rp = ln (Pt /Pt-1) column exhibits the betas of equity funds, which

where measure the systematic risks of the funds. All funds’

Rp = return on the fund betas are less than 1, thereby implying all ten funds

Pt = price of the fund at week t carry less risk compared to the benchmark JSE index.

Pt-1 = price of the fund at week t-1

3.2.3. Benchmark

In this study, the Johannesburg Stock Exchange (JSE)

price index is used to find whether or not mutual funds

beat the market.

Rm= ln (Pmt / Pmt-1)

where

Rm = returns on the JSE

Pmt = value of the JSE Price Index on week t

Pmt-1 = value of the JSE Price Index on week t-1

3.2.4. Risk-free Rate

In this study, South African 91-Day T-bills are selected

as the appropriate risk-free rate and are sourced from

the Thomson Reuters DataStream. Manjezi (2008)

previously used this risk-free rate in his study.

Mutual Fund Performance: Evidence from South Africa

Page |52| Emerging Markets Journal

Volume 5 No 2 (2015) | ISSN 2158-8708 (online) | DOI 10.5195/emaj.2015.83 | http://emaj.pitt.edu

Table 2. Descriptive Statistics of South African Mutual Table 3. Results of the Sharpe Ratio for South Africa

Funds

Fund Aver Ske Kurt Std. Bet Fund Name Sharpe Rank

R

Name age w osis dev. a Foord Equity Fund A 0.12015 1

Allan Gray - 0.7

0.00 0.47 0.88 0.01 Allan Gray Equity Fund A 0.10911 2

Equity 0.14 008

294 853 851 671

Fund A 658 2

Aylett Equity Fund A 0.1091 3

Aylett - 0.5

0.00 2.23 0.81 0.01

Equity 0.60 742 Sanlam General Equity Fund A 0.10723 4

274 169 560 491

Fund A 731 0

Prudential Equity Fund A 0.10592 5

Coronation - 0.8

0.00 1.60 0.90 0.01

Equity 0.40 387 Coronation Equity Fund A 0.10194 6

311 011 683 959

Fund A 631 0

Foord - 0.7 Old Mutual Investors Fund A 0.09250 7

0.00 4.79 0.84 0.01

Equity 1.16 577 Nedgroup Invs.Rainmaker Fund A 0.08622 8

341 512 114 908

Fund 657 5

Huysamer - 0.9 Investec Equity Fund A 0.07065 9

0.00 0.73 0.91 0.02

Equity 0.36 086

196 769 590 101 Huysamer Equity Fund A 0.04016 10

Fund A 986 6

Investec - 0.8

0.00 0.87 0.91 0.01

Equity 0.45 427 Table 4 shows the performance of the Treynor ratio. A

249 945 912 942

Fund A 212 5 fund with a higher Treynor ratio indicates that the fund

Nedgroup has a better risk-adjusted return compared to a fund

- 0.7

Invs.Rain 0.00 0.94 0.86 0.01 with a lower Treynor ratio. A higher Treynor ratio

0.43 287

maker 296 558 200 791

856 8 implies that funds have better performances. The Foord

Fund A

Equity Fund, the Allan Gray Equity Fund and the

Old

- 0.6 Aylett Equity Fund have the highest the Treynor ratios.

Mutual 0.00 1.51 0.91 0.02

0.39 758 The Huysamer Equity Fund and the Investec Equity

Investors 266 906 580 002

145 6 Fund have the lowest Treynor ratios.

Fund A

Prudential - 0.7

0.00 0.75 0.89 0.01

Equity 0.42 673 Table 4. Results of the Treynor Ratio for South Africa

303 831 968 807

Fund A 926 3

Sanlam Fund Name Treynor Rank

- 0.8

General 0.00 1.96 0.91 0.01

0.34 000 Foord Equity Fund A 0.00302 1

Equity 309 319 900 844

637 7

Fund A Aylett Equity Fund A 0.00283 2

Johannesb

- Allan Gray Equity Fund A 0.00260 3

urg Stock 0.00 1.08 0.02

0.37

Exchange 272 352 119 Prudential Equity Fund A 0.00249 4

635

(JSE)

91 Days T- 0.00 1.81 4.05 0.00 Sanlam General Equity Fund A 0.00247 5

Bills 111 350 245 019 Coronation Equity Fund A 0.00238 6

Table 3 shows the performance of the Sharpe ratio. The Old Mutual Investors Fund A 0.00214 7

higher the Sharpe ratio the more return the investor is Nedgroup Invs.Rainmaker Fund A 0.00212 8

getting per unit of risk. The lower the Sharpe ratio, the

Investec Equity Fund A 0.00163 9

more risk the investor is carrying to earn additional

returns. A higher Sharpe ratio implies that funds have a Huysamer Equity Fund A 0.00093 10

better performance. The Foord Equity Fund, the Allan

Gray Equity Fund and the Aylett Equity Fund have the Table 5 displays us the results of Jensen’s

highest the Sharpe ratios. On the other end, the alpha measure that indicates the selectivity skills of

Huysamer Equity Fund and the Investec Equity Fund fund managers. Fund managers have either a higher

have the lowest Sharpe ratios. performance or a lower performance relative to the

market. Nine out of the 10 funds have positive alphas,

but only the Foord Equity Fund is both positive and

statistically significant at the 10% level. On the other

hand, the Huysamer Equity Fund A has only negative

alpha.

Omer Faruk Tan

Emerging Markets Journal | P a g e |53

Volume 5 No 2 (2015) | ISSN 2158-8708 (online) | DOI 10.5195/emaj.2015.83 | http://emaj.pitt.edu

Table 5. Results of Jensen's alpha for South Africa Table 6. Results of the Treynor & Mazuy Regression

Analysis for South Africa

Jensen's p-

Fund Name t Stat p-

alpha value Fund Name T&M t-stat

value

1.8112 0.071

Foord Equity Fund* 0.00108 0.374

5 10 Allan Gray Equity Fund A 0.50666 0.88948

45

1.4202 0.156

Aylett Equity Fund A 0.00071 - - 0.143

7 56 Aylett Equity Fund A

0.93854 1.46723 36

1.5836 0.114

Allan Gray Equity Fund A 0.00070 - - 0.331

4 32 Coronation Equity Fund A

0.59628 0.97207 79

Sanlam General Equity 1.6587 0.098

0.00070 - - 0.118

Fund A 7 20 Foord Equity Fund

1.19570 1.56380 91

1.5036 0.133

Prudential Equity Fund A 0.00068 0.720

1 73 Huysamer Equity Fund A 0.22466 0.35809

53

1.3715 0.171

Coronation Equity Fund A 0.00065 - - 0.602

6 22 Investec Equity Fund A

0.29696 0.52182 18

Old Mutual Investors Fund 1.0024 0.316

0.00046 Nedgroup Invs.Rainmaker 0.645

A 1 95 0.31096 0.46058

Fund A 43

Nedgroup Invs.Rainmaker 0.7188 0.472

0.00038 Old Mutual Investors Fund - - 0.013

Fund A 8 77

A* 1.46072 2.48106 64

0.0480 0.961

Investec Equity Fund A 0.00002 - - 0.311

5 71 Prudential Equity Fund A

0.59436 1.01461 11

-

0.208 Sanlam General Equity Fund - - 0.517

Huysamer Equity Fund A -0.00061 1.2611

24 A 0.35064 0.64866 05

1

Significance levels: * indicates 10%, ** indicates 5%, Significance levels: * indicates 10%, ** indicates 5%,

*** indicates 1% *** indicates 1%

The Treynor & Mazuy (1966) analysis analyzes the Another approach for market timing ability is the

market timing ability of fund managers. If fund Henriksson & Merton (1984) regression analysis

managers believe that the market is going up, they method. Market timing ability allows fund managers to

change their portfolio composition from less volatile to forecast whether returns of funds will be higher than

high volatile securities. When the market is going the risk-free rate or vice versa. Table 7 shows the

down, they shift their portfolio composition from high results of the Henriksson & Merton (1981) method. The

volatile to less volatile securities. If fund managers Allan Gray Equity Fund has positive results, but is

have market timing ability, they create their portfolios statistically insignificant. Nine funds have negative

according to their estimates of the tendency of the market timing ability and are not statistically

markets. Table 6 shows the results of the Treynor & significant.

Mazuy (1966) method. Only the Allan Gray Equity

Table 7. Results of the Henriksson & Merton Regression

Fund A has a positive result, but is statistically

Analysis for South Africa

insignificant. The other nine funds have negative

market timing ability and only the Old Mutual Fund Name H&M t-stat p-value

Investors Fund A is statistically significant at the 10% 0.8968

Allan Gray Equity Fund A 0.00463 0.1298

level. It is concluded that fund managers did not have 1

market timing ability during the quantitative easing - - 0.4153

Aylett Equity Fund A

0.03272 0.81571 1

policy era.

- - 0.3621

Coronation Equity Fund A

0.03503 0.91272 2

- - 0.3667

Foord Equity Fund

0.04335 0.90395 4

- - 0.7221

Huysamer Equity Fund A

0.00686 0.17483 5

- - 0.4217

Investec Equity Fund A

0.02862 0.80443 8

Nedgroup Invs.Rainmaker - - 0.9343

Fund A 0.00348 0.08243 6

Old Mutual Investors Fund - - 0.3060

A 0.03807 1.02526 6

- - 0.3884

Prudential Equity Fund A

0.03166 0.86363 8

Sanlam General Equity - - 0.5362

Fund A 0.02094 0.61917 7

Mutual Fund Performance: Evidence from South Africa

Page |54| Emerging Markets Journal

Volume 5 No 2 (2015) | ISSN 2158-8708 (online) | DOI 10.5195/emaj.2015.83 | http://emaj.pitt.edu

5. Conclusion South African funds performed in the recent

quantitative easing era.

In this study, South African equity funds performances’

are analyzed over the period from 09 January 2009 to REFERENCES

31 October 2014. During this quantitative easing policy

term, Fed increased money supply in order to lower the Chang, E., & Lewellen, W. (1984). Market

interest rates and this excess of money in financial

markets made a significant contribution to capital timing and mutual funds investment

influx from developed countries to developing

performance. Journal of Business, 57,

countries. The study period coincides with the QE era

when stock market sizes have improved remarkably. 57-72.

South Africa is accepted as one of the developing

markets and during the study period 5 years-10 months,

South African stock market surpassed developed stock Chen, D., Gan. C., & Hu, B. (2013). An

market indices. Johannesburg Stock Exchange yielded empirical study of mutual funds

15.9 % compounded on average, per annum. In the

sample period, the developed market indices like S&P performance in China. Social Science

500, DAX, FTSE 100 and CAC 40 yielded 15.1%,

12.1%, 6.8% and 4.1%, respectively. South African Research Network. Retrieved January

equity fund performances and funds managers’

10, 2015 from SSRN:

performances were analyzed in this study by using

Sharpe ratio (1966), Treynor ratio (1965), Jensen alpha http://ssrn.com/abstrat=2220323.

(1968), Treynor& Mazuy (1966) and

Henriksson&Merton (1981) regression analysis

method. To the best of knowledge, this is the first study Christensen, M. (20059. Danish mutual fund

that considers how South African funds performed in

performance; Selectivity, market

the recent quantitative easing era. In order to find fund

performances, it has been utilized Sharpe (1966) and timing and persistence. Working

Treynor (1965) ratio. Higher Sharpe and Treynor ratio

implies funds have better performances. In general, Paper, Department of Accounting,

these risk-adjusted performance ratios give similar

rankings of mutual funds. The Foord Equity Fund, the Finance and Logistics, Aarhus School

Allan Gray Equity Fund and the Aylett Equity Fund

of Business, 1-37.

have the highest the Treynor and Sharpe ratio. Jensen’s

alpha (1968), Treynor&Mazuy (1966) and

Henriksson&Merton (1981) regression analysis Dahlquist, M., Engström, S., & Söderlind, P.

methods are used for determining selectivity skills and

(2000). Performance and

market timing ability of fund managers, respectively. In

this study, it is revealed that in the era of quantitative characteristics of Swedish mutual

easing, although the financial market in South Africa

made an incredible progress, South African fund funds. Journal of Financial and

managers could not display a good performance both in

selectivity skills and market timing abilities. Jensen Quantitative Analysis, 35, 409-423.

(1968) alphas indicate that over this period fund

managers did not have selective ability, only 1 of the 14 Deepak, A. (2011). Measuring performance

funds had statistically significant positive alpha.

Furthermore, Treynor&Mazuy (1966) regression of Indian mutual funds. Social

analysis shows that over the same period fund

managers did not also have market timing ability, as Science Research Network. Retrieved

none of the 14 funds had statistically significant

November 15, 2014 from SSRN:

positive coefficients. It can be deduced that South

African fund managers had neither selective ability nor http://papers.ssrn.com/sol3/papers.cf

market timing ability during the quantitative easing era.

At the end of this research, along with the outcomes, it m?abstract_id=1311761.

is observed similarities with the results of earlier

studies in literature. In future, this study can be

developed using persistence analysis. To the best of

knowledge, this is the first study that considers how

Omer Faruk Tan

Emerging Markets Journal | P a g e |55

Volume 5 No 2 (2015) | ISSN 2158-8708 (online) | DOI 10.5195/emaj.2015.83 | http://emaj.pitt.edu

Detzler, M. L. (1999). Performance of global Investment company institute (ICI) -Unit

bond mutual funds. Journal of investments trust data. Retrieved

Banking & Finance, 23, 1195-1217. from February, 15, 2015 from

http://www.ici.org/research/stats.

Duggimpudi R. R., Abdou, H. A., & Zaki, M.

(2010). An investigation of equity Jensen, M.C. (1968). The performance of

diversified mutual funds: The case of mutual funds in the period 1945-

Indian market. Investment 1964. The Journal of Finance, 23(2),

Management and Financial 389-416.

Innovations, 7(4), 77-84.

Kouris, A., Beneki, C., Adam, M., &

Gallo, J, G., & Swanson, P. E. (1996). Botsaris, C. (2011). An assessment of

Comparative measures of the performance of Greek mutual

performance for U.S. – based equity funds selectivity and market

international equity mutual funds. timing. Applied Mathematics

Journal of Banking & Finance, 20, Sciences, 5(4), 159-171.

1636-1650.

Malkiel, B, G. (1995). Returns from investing

Gilbertson, B. P., & Vermaak, M. N. (1982). in equity funds: 1971-1991. Journal

The performance of South African of Finance, 50, 549-572.

mutual funds: 1974-1981. Investment

Manjezi, L. (2012). Portfolio performance

Analysts Journal, 11(20), 35-45.

evaluation of South African mutual

Henriksson, R. D. (1984). Market timing and funds 2001-2006. Unpublished

mutual fund performance: An master’s thesis. University of Agder,

empirical investigation. The Journal Kristiansand, Norway.

of Business, 57(1), 73-96.

Mayo, H. B. (2011). Introduction to

Henriksson, R. D., & Merton, R. C. (1981). investments (10th. Edition).

On market timing and investment Southwestern Cengage Learning,

performance. II. Statistical Mason, USA.

procedures for evaluating forecasting

skills. The Journal of Business, 54(4),

513-533.

Mutual Fund Performance: Evidence from South Africa

Page |56| Emerging Markets Journal

Volume 5 No 2 (2015) | ISSN 2158-8708 (online) | DOI 10.5195/emaj.2015.83 | http://emaj.pitt.edu

Mbiola, O. J. (2013). Performance evaluation Tripathy, N. P. (2005). An empirical

of unit trusts in South Africa over the evaluation of market timing abilities

last two decades. Unpublished of Indian fund managers on equity

master’s thesis. University of linked savings scheme. Delhi

Witwatersrand, Johannesburg, South Business Review, 6(2), 19-27.

Africa.

What is quantitative easing? Definition and

Noulas, G., Papanastation, J. A., & Lazaridis, explanation. Retrieved January 23,

J. (2005). Performance of mutual 2015 from

funds. Managerial Finance, 31(2), http://useconomy.about.com/od/gloss

101-112. ary/g/Quantitative-Eaing.htm.

Rao, D. N. (2006). Investment styles and

performance of equity mutual funds

in India. Social Sciences Research

Network. Retrieved November 15,

2014 from SSRN:

http://ssrn.com/abstract=922595 or

http://dx.doi.org/10.2139/ssrn.922595

Reilly, F, R. (1992). Investments (3rd.

edition). Orlando, Florida: The

Dryden Press.

Sharpe, W. F. (1996). Mutual fund

performance. Journal of Business, 34,

119-138.

Treynor, J. L. (1965). How to rate

management of investment funds.

Harvard Business Review. 43(1),

131-136.

Treynor, J. L., & Mazuy, K.K. (1966). Can

mutual funds outguess the market?

Harvard Business Review, 44, 131-

136.

Omer Faruk Tan

Emerging Markets Journal | P a g e |57

Вам также может понравиться

- EIB Working Papers 2019/11 - Macro-based asset allocation: An empirical analysisОт EverandEIB Working Papers 2019/11 - Macro-based asset allocation: An empirical analysisОценок пока нет

- Impact of Stock Index on Mutual Fund NAVДокумент58 страницImpact of Stock Index on Mutual Fund NAVrini08Оценок пока нет

- TradingДокумент13 страницTradingkumarkeshavОценок пока нет

- 2Документ67 страниц2Rahul AnandОценок пока нет

- Risk-Adjusted Performance, Selectivity and Timing Ability of Hong Kong Mutual FundsДокумент31 страницаRisk-Adjusted Performance, Selectivity and Timing Ability of Hong Kong Mutual FundslZbrunoZlОценок пока нет

- The Performance of Diversified Emerging Market Equity FundsДокумент16 страницThe Performance of Diversified Emerging Market Equity FundsMuhammad RoqibunОценок пока нет

- The Determinants of Mutual Fund Performance: A Cross-Country StudyДокумент53 страницыThe Determinants of Mutual Fund Performance: A Cross-Country StudyAlok SinghОценок пока нет

- 09 - Chapter 3 PDFДокумент42 страницы09 - Chapter 3 PDFZahid HussainОценок пока нет

- 162 310 1 SMДокумент14 страниц162 310 1 SMMohamedОценок пока нет

- Management StudiesДокумент11 страницManagement StudiesAmanuelОценок пока нет

- International Financial Flows On India'S Economic Growth - in View of Changing Financial Market ScenarioДокумент19 страницInternational Financial Flows On India'S Economic Growth - in View of Changing Financial Market ScenarioIkrar KhanОценок пока нет

- Cosset 1995Документ18 страницCosset 1995beastisback404Оценок пока нет

- SYNOPSISДокумент3 страницыSYNOPSISAkanksha SinghОценок пока нет

- LinkagesДокумент15 страницLinkagesPritam KarmakarОценок пока нет

- Indian Stock Market Integration and Cross Country Analysis: Krishna08d@cds - Ac.inДокумент17 страницIndian Stock Market Integration and Cross Country Analysis: Krishna08d@cds - Ac.inChandni MaheshwariОценок пока нет

- Delhi Business Review X VolДокумент7 страницDelhi Business Review X VolMohit VanawatОценок пока нет

- The Profitability of Momentum StrategiesДокумент15 страницThe Profitability of Momentum StrategiesDessy ParamitaОценок пока нет

- Integration of Financial Markets: by Mahesh Kumar TambiДокумент19 страницIntegration of Financial Markets: by Mahesh Kumar TambiAlex JrrОценок пока нет

- International Portfolio Diversification Benefits: The Relevance of Emerging MarketsДокумент16 страницInternational Portfolio Diversification Benefits: The Relevance of Emerging MarketsDhanshyam LuckooОценок пока нет

- Hedge Funds Strategies Are They ConsisteДокумент26 страницHedge Funds Strategies Are They ConsistesaadОценок пока нет

- Investigating The Performance of Selected Real Estate CompaniesДокумент12 страницInvestigating The Performance of Selected Real Estate CompaniesggsitmsОценок пока нет

- How ETFs Amplify The Global Financial Cycle in Emerging Markets (Converse Et Al 2020)Документ62 страницыHow ETFs Amplify The Global Financial Cycle in Emerging Markets (Converse Et Al 2020)MarcoKreОценок пока нет

- Chapter - Ii Review of Literature & Research MethodologyДокумент32 страницыChapter - Ii Review of Literature & Research Methodologypratik0909100% (1)

- How ETFs Amplify The Global Financial Cycle in Emerging Markets (Converse Et Al 2020)Документ61 страницаHow ETFs Amplify The Global Financial Cycle in Emerging Markets (Converse Et Al 2020)MarcoKreОценок пока нет

- T W F E S A M: Esting EAK ORM Fficiency in The Outh Frican ArketДокумент12 страницT W F E S A M: Esting EAK ORM Fficiency in The Outh Frican ArketDohaОценок пока нет

- Mansourfar Et AlДокумент7 страницMansourfar Et AlGurvinder Singh DhillonОценок пока нет

- Foreign Portfolio Flows and Their Impact On Financial Markets in IndiaДокумент22 страницыForeign Portfolio Flows and Their Impact On Financial Markets in IndiaAdarsh KumarОценок пока нет

- Effects of Macroeconomic Variables On Stock Returns in The East African Community Stock Exchange MarketДокумент16 страницEffects of Macroeconomic Variables On Stock Returns in The East African Community Stock Exchange MarketIslam GalalОценок пока нет

- 165 165 Brucehearn Pricing Southern African Shares in The Presence of Illiquidity-2Документ33 страницы165 165 Brucehearn Pricing Southern African Shares in The Presence of Illiquidity-2Ammi JulianОценок пока нет

- 10 - Chapter 2 PDFДокумент32 страницы10 - Chapter 2 PDFirfana hashmiОценок пока нет

- South Africa and Turkish Financial System Development A Comparative AnalysisДокумент13 страницSouth Africa and Turkish Financial System Development A Comparative AnalysisInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Impact of Monitary Policy in Tourism IndustryДокумент47 страницImpact of Monitary Policy in Tourism IndustryGURUKRIPA COMMUNICATIONОценок пока нет

- European Fin SystemДокумент65 страницEuropean Fin SystemNidhi SharmaОценок пока нет

- A Comparative Analysis of Mutual Fund SchemesДокумент9 страницA Comparative Analysis of Mutual Fund SchemesVimal SaxenaОценок пока нет

- Pavan Project On Equity Derivatives 2222222222222222222222222222Документ55 страницPavan Project On Equity Derivatives 2222222222222222222222222222ravan vlogsОценок пока нет

- Reviewed - Stock Market Integration A Study of Indian Stock Market With Foreign Capital MarketsДокумент10 страницReviewed - Stock Market Integration A Study of Indian Stock Market With Foreign Capital Marketsiaset123Оценок пока нет

- A Research Proposal FOR Grand Project ON Perrformance Evaluation of Mutual Fund Submitted ToДокумент11 страницA Research Proposal FOR Grand Project ON Perrformance Evaluation of Mutual Fund Submitted TokkrathodОценок пока нет

- The Relationship Between Stock Market Performance and Economic Growth in The EacДокумент23 страницыThe Relationship Between Stock Market Performance and Economic Growth in The EacheisPazito newdayОценок пока нет

- RelianceДокумент78 страницRelianceSurinder KumarОценок пока нет

- Exchange Rates Regimes and Price EfficiencyДокумент14 страницExchange Rates Regimes and Price Efficiencypremsid28Оценок пока нет

- Kavita Goel Kavita Goel Kavita Goel Kavita Goel Kavita Goel R R R R Rak Ak Ak Ak Akesh Gupta Esh Gupta Esh Gupta Esh Gupta Esh GuptaДокумент16 страницKavita Goel Kavita Goel Kavita Goel Kavita Goel Kavita Goel R R R R Rak Ak Ak Ak Akesh Gupta Esh Gupta Esh Gupta Esh Gupta Esh GuptaUpender KumarОценок пока нет

- The Impact of The Arab Spring and The Ebola Outbreak On African Equity Mutual Fund Investor DecisionsДокумент13 страницThe Impact of The Arab Spring and The Ebola Outbreak On African Equity Mutual Fund Investor DecisionsKelsey GaoОценок пока нет

- Mutual Fund PDFДокумент22 страницыMutual Fund PDFRajОценок пока нет

- Market Timing Performance of The Open enДокумент10 страницMarket Timing Performance of The Open enAli NadafОценок пока нет

- Testing For Spillovers in Naira Exchange Rates: The Role of Electioneering & Global Financial CrisisДокумент8 страницTesting For Spillovers in Naira Exchange Rates: The Role of Electioneering & Global Financial Crisissonia969696Оценок пока нет

- Derivatives Market and Econmoicn Growth Is There A RelationshipДокумент45 страницDerivatives Market and Econmoicn Growth Is There A RelationshipPratik ChourasiaОценок пока нет

- Performance of Momentum Investment StrategiesДокумент1 страницаPerformance of Momentum Investment Strategieskaaviraj2020Оценок пока нет

- Interdependence of Stock Markets During Financial CrisesДокумент34 страницыInterdependence of Stock Markets During Financial CrisesDeepika Nekhelesh100% (1)

- Mutual Fund Performance Studies Across Countries and FactorsДокумент13 страницMutual Fund Performance Studies Across Countries and Factorselsan reddyОценок пока нет

- Cointegration Analysis of Major African Stock MarketsДокумент9 страницCointegration Analysis of Major African Stock MarketsDhanshyam LuckooОценок пока нет

- Impact of Nigeria's Capital Market on Economic Growth and Sustainable DevelopmentДокумент12 страницImpact of Nigeria's Capital Market on Economic Growth and Sustainable Developmenthayatudin jusufОценок пока нет

- Macroeconomic Forces and Stock Prices in BangladeshДокумент55 страницMacroeconomic Forces and Stock Prices in BangladeshSayed Farrukh AhmedОценок пока нет

- Relevant Cash Flows Journal - 1 TitleДокумент6 страницRelevant Cash Flows Journal - 1 TitleMonishaОценок пока нет

- Performance Analysis of Mutual Funds - A Comparative Study On Equity Diversified Mutual FundДокумент17 страницPerformance Analysis of Mutual Funds - A Comparative Study On Equity Diversified Mutual FundAnjali KajariaОценок пока нет

- Literature Review: Stock Exchange & SEBI An Evolution in Indian Financial Market & Economy As A WholeДокумент6 страницLiterature Review: Stock Exchange & SEBI An Evolution in Indian Financial Market & Economy As A WholeRaghunath AgarwallaОценок пока нет

- 208 400 1 SMДокумент14 страниц208 400 1 SMMohamedОценок пока нет

- (Finance) Stock Market Development and Economic Growth Evidence From Underdeveloped Nation Nepal (5044)Документ41 страница(Finance) Stock Market Development and Economic Growth Evidence From Underdeveloped Nation Nepal (5044)Surendra ManandharОценок пока нет

- Review of Literature on Mutual Fund Performance EvaluationДокумент9 страницReview of Literature on Mutual Fund Performance EvaluationananthakumarОценок пока нет

- JRN0 WBER0 Box 0377291 B00 PUBLIC0Документ31 страницаJRN0 WBER0 Box 0377291 B00 PUBLIC0Sachin DegavekarОценок пока нет

- SSRNДокумент12 страницSSRNAnujaОценок пока нет

- 2 PBДокумент14 страниц2 PBxc123544Оценок пока нет

- A Study On Performance Evaluation of Equity Linked Saving Schemes (ELSS) of Mutual FundsДокумент22 страницыA Study On Performance Evaluation of Equity Linked Saving Schemes (ELSS) of Mutual Fundsxc123544Оценок пока нет

- The Entrepreneur: Emad Saif Entrepreneurship TrainerДокумент42 страницыThe Entrepreneur: Emad Saif Entrepreneurship Trainerxc123544Оценок пока нет

- Investment Pattern of Salaried IndividualДокумент62 страницыInvestment Pattern of Salaried IndividualRanjana Singh83% (60)

- A Study On Customer Perception Towards Green Banking-A Special Reference To State Bank of India-Bangalore and Mysore CityДокумент8 страницA Study On Customer Perception Towards Green Banking-A Special Reference To State Bank of India-Bangalore and Mysore Cityxc123544Оценок пока нет

- A Study On The Customer Awareness On Green Banking Initiatives 1Документ13 страницA Study On The Customer Awareness On Green Banking Initiatives 1xc123544Оценок пока нет

- Lecture By: Srinivas MethukuДокумент36 страницLecture By: Srinivas Methukuxc123544Оценок пока нет

- Behavior of Investor's Towards Different Investment Boulevard in The Market: Surat City, Gujarat, IndiaДокумент23 страницыBehavior of Investor's Towards Different Investment Boulevard in The Market: Surat City, Gujarat, Indiaxc123544Оценок пока нет

- Consumer Attitudes Towards Ambush Marketing: Sport Management Review August 2014Документ12 страницConsumer Attitudes Towards Ambush Marketing: Sport Management Review August 2014xc123544Оценок пока нет

- BJVM Conference PDFДокумент1 страницаBJVM Conference PDFxc123544Оценок пока нет

- The Fundamentals of R - Dhaval MahetaДокумент16 страницThe Fundamentals of R - Dhaval Mahetaxc123544Оценок пока нет

- UGC CAS TITLEДокумент75 страницUGC CAS TITLExc123544Оценок пока нет

- New Evidence on Performance of Ethical Mutual Funds in CanadaДокумент14 страницNew Evidence on Performance of Ethical Mutual Funds in CanadaVamja BrijeshОценок пока нет

- Green Banking in BangladeshДокумент6 страницGreen Banking in BangladeshmjoyroyОценок пока нет

- MS Singhvi Processors Pvt. Ltd.Документ84 страницыMS Singhvi Processors Pvt. Ltd.xc123544Оценок пока нет

- FM Course Outline 2014 15Документ2 страницыFM Course Outline 2014 15xc123544Оценок пока нет

- Please Inform Us On Following Mail: (Only Participants Who Do Not Want To Publish Their Paper Has To Mail)Документ1 страницаPlease Inform Us On Following Mail: (Only Participants Who Do Not Want To Publish Their Paper Has To Mail)xc123544Оценок пока нет

- BDT Problems AssignmentДокумент4 страницыBDT Problems Assignmentxc123544Оценок пока нет

- XYZДокумент27 страницXYZxc123544Оценок пока нет

- Shree MaheshwariДокумент69 страницShree Maheshwarixc123544Оценок пока нет

- Investor Sentiment and Stock Returns Some International EvidenceJournal of Empirical FinanceДокумент15 страницInvestor Sentiment and Stock Returns Some International EvidenceJournal of Empirical Financexc123544Оценок пока нет

- 01 Multivariate AnalysisДокумент40 страниц01 Multivariate Analysisxc123544100% (1)

- MRP - Format For DetailДокумент5 страницMRP - Format For Detailxc123544Оценок пока нет

- MRP - Format For DetailДокумент5 страницMRP - Format For Detailxc123544Оценок пока нет

- Hypothesis TestingДокумент3 страницыHypothesis Testingxc123544Оценок пока нет

- Zero Based Budgeting ExplainedДокумент31 страницаZero Based Budgeting Explainedxc123544Оценок пока нет

- 4Документ6 страниц4xc123544Оценок пока нет

- Financial9 ManagementДокумент327 страницFinancial9 Managementxc123544Оценок пока нет

- 79.1 Enrico vs. Heirs of Sps. Medinaceli DigestДокумент2 страницы79.1 Enrico vs. Heirs of Sps. Medinaceli DigestEstel Tabumfama100% (1)

- Codex Magica Texe MarrsДокумент588 страницCodex Magica Texe MarrsAndrew D WadeОценок пока нет

- Godbolt RulingДокумент84 страницыGodbolt RulingAnthony WarrenОценок пока нет

- Week 1 and 2 Literature LessonsДокумент8 страницWeek 1 and 2 Literature LessonsSalve Maria CardenasОценок пока нет

- B SДокумент36 страницB SkeithguruОценок пока нет

- PÉREZ MORALES, E. - Manumission On The Land, Slaves, Masters, and Magistrates in Eighteenth-Century Mompox (Colombia)Документ33 страницыPÉREZ MORALES, E. - Manumission On The Land, Slaves, Masters, and Magistrates in Eighteenth-Century Mompox (Colombia)Mario Davi BarbosaОценок пока нет

- I Am The One Who Would Awaken YouДокумент5 страницI Am The One Who Would Awaken Youtimsmith1081574Оценок пока нет

- ISO 50001 Audit Planning MatrixДокумент4 страницыISO 50001 Audit Planning MatrixHerik RenaldoОценок пока нет

- Kisarta 5E - The Lost Codex of KisartaДокумент52 страницыKisarta 5E - The Lost Codex of KisartaКaloyan Panov100% (1)

- NS500 Basic Spec 2014-1015Документ58 страницNS500 Basic Spec 2014-1015Adrian Valentin SibiceanuОценок пока нет

- Maxwell McCombs BioДокумент3 страницыMaxwell McCombs BioCameron KauderОценок пока нет

- Everything You Need to Know About DiamondsДокумент194 страницыEverything You Need to Know About Diamondsmassimo100% (1)

- The Futures Game: Who Wins, Who Loses, and WhyДокумент17 страницThe Futures Game: Who Wins, Who Loses, and WhySergio Pereira0% (1)

- F1 English PT3 Formatted Exam PaperДокумент10 страницF1 English PT3 Formatted Exam PaperCmot Qkf Sia-zОценок пока нет

- 2011 Grade Exam ResultДокумент19 страниц2011 Grade Exam ResultsgbulohcomОценок пока нет

- Hwa Tai AR2015 (Bursa)Документ104 страницыHwa Tai AR2015 (Bursa)Muhammad AzmanОценок пока нет

- Application For A US PassportДокумент6 страницApplication For A US PassportAbu Hamza SidОценок пока нет

- Emanel Et - Al Informed Consent Form EnglishДокумент6 страницEmanel Et - Al Informed Consent Form English4w5jpvb9jhОценок пока нет

- Data Mahasiswa Teknik Mesin 2020Документ88 страницData Mahasiswa Teknik Mesin 2020Husnatul AlifahОценок пока нет

- Bushnell / Companion To Tragedy 1405107359 - 4 - 001 Final Proof 8.2.2005 9:58amДокумент1 страницаBushnell / Companion To Tragedy 1405107359 - 4 - 001 Final Proof 8.2.2005 9:58amLeonelBatistaParenteОценок пока нет

- Multimodal Transport Bill of Lading PDFДокумент3 страницыMultimodal Transport Bill of Lading PDFJulia TombakОценок пока нет

- How To Configure User Accounts To Never ExpireДокумент2 страницыHow To Configure User Accounts To Never ExpireAshutosh MayankОценок пока нет

- Rapport 2019 de La NHRC de Maurice: Découvrez Le Rapport Dans Son IntégralitéДокумент145 страницRapport 2019 de La NHRC de Maurice: Découvrez Le Rapport Dans Son IntégralitéDefimediaОценок пока нет

- Mixed 14Документ2 страницыMixed 14Rafi AzamОценок пока нет

- Adw Ethical Stewardship of Artifacts For New Museum ProfessionalsДокумент15 страницAdw Ethical Stewardship of Artifacts For New Museum Professionalsapi-517778833Оценок пока нет

- Censorship Is Always Self Defeating and Therefore FutileДокумент2 страницыCensorship Is Always Self Defeating and Therefore Futileqwert2526Оценок пока нет

- Ricoh MP 4001 Users Manual 121110Документ6 страницRicoh MP 4001 Users Manual 121110liliana vargas alvarezОценок пока нет

- INFOSYS120 2014 D2 Daniela Avellaneda HernandezДокумент11 страницINFOSYS120 2014 D2 Daniela Avellaneda HernandezdaniaveОценок пока нет

- Answers and Equations for Investment Quotient Test ChaptersДокумент3 страницыAnswers and Equations for Investment Quotient Test ChaptersJudeОценок пока нет

- Cost of DebtДокумент3 страницыCost of DebtGonzalo De CorralОценок пока нет

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesОт EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesРейтинг: 4.5 из 5 звезд4.5/5 (8)

- Kaizen: The Ultimate Guide to Mastering Continuous Improvement And Transforming Your Life With Self DisciplineОт EverandKaizen: The Ultimate Guide to Mastering Continuous Improvement And Transforming Your Life With Self DisciplineРейтинг: 4.5 из 5 звезд4.5/5 (36)

- The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetОт EverandThe Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetОценок пока нет

- The Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldОт EverandThe Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldРейтинг: 4 из 5 звезд4/5 (16)

- The Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaОт EverandThe Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaОценок пока нет

- How an Economy Grows and Why It Crashes: Collector's EditionОт EverandHow an Economy Grows and Why It Crashes: Collector's EditionРейтинг: 4.5 из 5 звезд4.5/5 (102)

- Narrative Economics: How Stories Go Viral and Drive Major Economic EventsОт EverandNarrative Economics: How Stories Go Viral and Drive Major Economic EventsРейтинг: 4.5 из 5 звезд4.5/5 (94)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassОт EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassОценок пока нет

- Look Again: The Power of Noticing What Was Always ThereОт EverandLook Again: The Power of Noticing What Was Always ThereРейтинг: 5 из 5 звезд5/5 (3)

- Chip War: The Quest to Dominate the World's Most Critical TechnologyОт EverandChip War: The Quest to Dominate the World's Most Critical TechnologyРейтинг: 4.5 из 5 звезд4.5/5 (227)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingОт EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingРейтинг: 4.5 из 5 звезд4.5/5 (97)

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomОт EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomОценок пока нет

- Economics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsОт EverandEconomics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsРейтинг: 5 из 5 звезд5/5 (2)

- Principles for Dealing with the Changing World Order: Why Nations Succeed or FailОт EverandPrinciples for Dealing with the Changing World Order: Why Nations Succeed or FailРейтинг: 4.5 из 5 звезд4.5/5 (237)

- Nudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentОт EverandNudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentРейтинг: 4.5 из 5 звезд4.5/5 (92)

- The Technology Trap: Capital, Labor, and Power in the Age of AutomationОт EverandThe Technology Trap: Capital, Labor, and Power in the Age of AutomationРейтинг: 4.5 из 5 звезд4.5/5 (46)

- Second Class: How the Elites Betrayed America's Working Men and WomenОт EverandSecond Class: How the Elites Betrayed America's Working Men and WomenОценок пока нет

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 4.5 из 5 звезд4.5/5 (14)

- The Lords of Easy Money: How the Federal Reserve Broke the American EconomyОт EverandThe Lords of Easy Money: How the Federal Reserve Broke the American EconomyРейтинг: 4.5 из 5 звезд4.5/5 (69)

- Against the Gods: The Remarkable Story of RiskОт EverandAgainst the Gods: The Remarkable Story of RiskРейтинг: 4 из 5 звезд4/5 (352)

- Poor Economics: A Radical Rethinking of the Way to Fight Global PovertyОт EverandPoor Economics: A Radical Rethinking of the Way to Fight Global PovertyРейтинг: 4.5 из 5 звезд4.5/5 (263)

- Bottle of Lies: The Inside Story of the Generic Drug BoomОт EverandBottle of Lies: The Inside Story of the Generic Drug BoomРейтинг: 4 из 5 звезд4/5 (44)

- The New Elite: Inside the Minds of the Truly WealthyОт EverandThe New Elite: Inside the Minds of the Truly WealthyРейтинг: 4 из 5 звезд4/5 (10)

- The Finance Curse: How Global Finance Is Making Us All PoorerОт EverandThe Finance Curse: How Global Finance Is Making Us All PoorerРейтинг: 4.5 из 5 звезд4.5/5 (18)