Академический Документы

Профессиональный Документы

Культура Документы

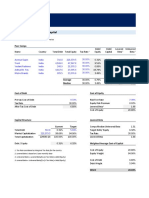

Equity Beta and Asset Beta Conversion Template: Strictly Confidential

Загружено:

Srinivas Korlepara0 оценок0% нашли этот документ полезным (0 голосов)

45 просмотров5 страницCalculations of Equity Beta and Asset Beta

Оригинальное название

Equity-Beta-and-Asset-Beta-Conversion-Template

Авторское право

© © All Rights Reserved

Доступные форматы

XLSX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документCalculations of Equity Beta and Asset Beta

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLSX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

45 просмотров5 страницEquity Beta and Asset Beta Conversion Template: Strictly Confidential

Загружено:

Srinivas KorleparaCalculations of Equity Beta and Asset Beta

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLSX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 5

Equity Beta and Asset Beta Conversion Template Strictly Confidential

Notes

This Excel model is for educational purposes only and should not be used for any other reason.

All content is Copyright material of CFI Education Inc.

https://corporatefinanceinstitute.com/

© 2019 CFI Education Inc.

All rights reserved. The contents of this publication, including but not limited to all written material, content layout, images, formulas, and code, are protected under international copyright and trademark laws.

No part of this publication may be modified, manipulated, reproduced, distributed, or transmitted in any form by any means, including photocopying, recording, or other electronic or mechanical methods,

© Corporate Finance Institute®. All rights reserved.

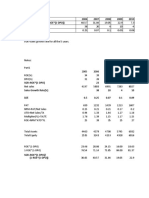

Equity Beta and Asset Beta Conversion

Equity -> Asset Beta

Levered Bet Equity Beta Tax Rate Net Debt ($M) Equity ($M) Debt/Equity Asset Beta

Stock 1 1.21 35% 524 2,542 21% 1.07

Stock 2 1.08 33% - 15,298 0% 1.08

Stock 3 0.87 28% (255) 3,275 -8% 0.92

Stock 4 1.58 34% 785 1,027 76% 1.05

Stock 5 1.35 30% 1,027 9,217 11% 1.26

Average 1.22 32% 416 6,272 20% 1.07

Median 1.21 33% 524 3,275 11% 1.07

Asset -> Equity Beta

Levered Bet Asset Beta Tax Rate Net Debt ($M) Equity ($M) Debt/Equity Equity Beta

Stock 1 1.07 35% 524 2,542 21% 1.21

Stock 2 1.08 33% - 15,298 0% 1.08

Stock 3 0.90 28% (155) 3,275 -5% 0.87

Stock 4 1.05 34% 785 1,027 76% 1.58

Stock 5 1.26 30% 1,027 9,217 11% 1.35

Average 1.07 32% 436 6,272 21% 1.22

Median 1.07 33% 524 3,275 11% 1.21

This file is for educational purposes only. E&OE

Corporate Finance Institute®

https://corporatefinanceinstitute.com/

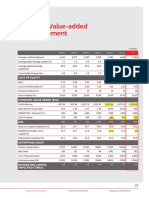

Equity -> Asset Beta

Levered Beta Equity Beta Tax RateNet Debt ($M)Equity ($M)Debt/Equity Asset Beta

Exploration & Production 1.25 38.5% 0.593 1.000 59.3% 0.92

Jackson Energy 0.89 38.5% 6,480 57,931 11.2% 0.83

Wide Plain Petroleum 1.21 38.5% 39,375 46,089 85.4% 0.79

Corsicana Energy 1.11 38.5% 6,442 42,263 15.2% 1.01

Worthington Petroleum 1.39 38.5% 13,098 27,591 47.5% 1.08

Average 1.17 39% 13,079 34,775 43.7% 0.93

Median 1.21 39% 6,480 42,263 47.5% 0.92

Exploration & Production 1.41 38.6% 0.8519 1.0000 85.19% 0.93

Refining & Marketing 1.33 38.6% 0.4493 1.0000 44.93% 1.04

Petrochemicals 0.85 38.6% 0.6667 1.0000 66.67% 0.60

CONSOLIDATED 1.25 38.6% 0.5930 1.0000 59.30% 0.92

2004 2005 2006

17910 37723 30447

7414 12830 11747

41.40% 34.01% 38.58%

Вам также может понравиться

- Equity Beta and Asset Beta Conversion Template: Strictly ConfidentialДокумент3 страницыEquity Beta and Asset Beta Conversion Template: Strictly ConfidentialLalit KheskwaniОценок пока нет

- Equity Beta and Asset Beta Conversion Equity - Asset BetaДокумент1 страницаEquity Beta and Asset Beta Conversion Equity - Asset BetaGolamMostafaОценок пока нет

- Airthreads Valuation Case Study Excel File PDF FreeДокумент18 страницAirthreads Valuation Case Study Excel File PDF Freegoyalmuskan412Оценок пока нет

- 0-Problems Solved PDFДокумент9 страниц0-Problems Solved PDFFlovgrОценок пока нет

- Tutorial On How To Use The DCF Model. Good Luck!: DateДокумент9 страницTutorial On How To Use The DCF Model. Good Luck!: DateTanya SinghОценок пока нет

- Discounted Cash Flow-Model For ValuationДокумент9 страницDiscounted Cash Flow-Model For ValuationPCM StresconОценок пока нет

- Technofunda Investing Excel Analysis - Version 2.0: Watch Screener TutorialДокумент37 страницTechnofunda Investing Excel Analysis - Version 2.0: Watch Screener TutorialVipulОценок пока нет

- Solution To ATCДокумент17 страницSolution To ATCGuru Charan ChitikenaОценок пока нет

- A) Stock Performance of Ahold and Tesco Between Jan-2008 and Dec-2011Документ4 страницыA) Stock Performance of Ahold and Tesco Between Jan-2008 and Dec-2011MANAV ROY100% (2)

- ValueResearchFundcard KotakGiltInvestmentRegular 2010nov24Документ6 страницValueResearchFundcard KotakGiltInvestmentRegular 2010nov24zankurОценок пока нет

- Case 1 MarriottДокумент14 страницCase 1 Marriotthimanshu sagar100% (1)

- Ratio Analysis TemplateДокумент3 страницыRatio Analysis Templateعمر El KheberyОценок пока нет

- Ratio Analysis TemplateДокумент3 страницыRatio Analysis TemplateTom CatОценок пока нет

- Ratios: 1 Return On Equity (ROE)Документ7 страницRatios: 1 Return On Equity (ROE)Rupkatha Podder (181011114)Оценок пока нет

- AMFEIX - Monthly Report (April 2020)Документ16 страницAMFEIX - Monthly Report (April 2020)PoolBTCОценок пока нет

- Pi Daily Strategy 24112023 SumДокумент7 страницPi Daily Strategy 24112023 SumPateera Chananti PhoomwanitОценок пока нет

- Bottom Up Unlevered BetaДокумент12 страницBottom Up Unlevered BetaUyen HoangОценок пока нет

- BOLT Graham Formula ValuationДокумент1 страницаBOLT Graham Formula ValuationOld School ValueОценок пока нет

- Company Profile I5Документ60 страницCompany Profile I5Robert TaylorОценок пока нет

- ACC 2006 2007 2008 2009 2010 SGR ROE (1-DPO) / (1-ROE (1-DPO) ) Sales Growth Rate (%) D/EДокумент10 страницACC 2006 2007 2008 2009 2010 SGR ROE (1-DPO) / (1-ROE (1-DPO) ) Sales Growth Rate (%) D/Estudymat12Оценок пока нет

- Hero Motocorp EvaДокумент1 страницаHero Motocorp EvaproОценок пока нет

- FedEx (FDX) Financial Ratios and Metrics - Stock AnalysisДокумент2 страницыFedEx (FDX) Financial Ratios and Metrics - Stock AnalysisPilly PhamОценок пока нет

- Corporate FinanceДокумент5 страницCorporate FinanceDessiree ChenОценок пока нет

- Corporate Valuation DeonДокумент9 страницCorporate Valuation Deondeonlopes057Оценок пока нет

- FM 2 Real Project 2Документ12 страницFM 2 Real Project 2Shannan Richards100% (1)

- EBLSL Daily Market Update 5th August 2020Документ1 страницаEBLSL Daily Market Update 5th August 2020Moheuddin SehabОценок пока нет

- Calculation of Cost of Equity 3. Calculation For Equity CapitalДокумент4 страницыCalculation of Cost of Equity 3. Calculation For Equity Capitalshivam chughОценок пока нет

- Newfield QuestionДокумент8 страницNewfield QuestionNasir MazharОценок пока нет

- Instruction To Use This Worksheet: WWW - Screener.inДокумент18 страницInstruction To Use This Worksheet: WWW - Screener.inRasulОценок пока нет

- Institute of Actuaries of Australia Course 2A Life Insurance May 2005 Examinations Answer All 6 Questions. (9 Marks)Документ9 страницInstitute of Actuaries of Australia Course 2A Life Insurance May 2005 Examinations Answer All 6 Questions. (9 Marks)Jeff GundyОценок пока нет

- Goodyear Indonesia TBK.: Balance SheetДокумент20 страницGoodyear Indonesia TBK.: Balance SheetsariОценок пока нет

- Soumya Lokhande 1353 - Manmouth CaseДокумент13 страницSoumya Lokhande 1353 - Manmouth CasednesudhudhОценок пока нет

- Loote CHEMICASДокумент3 страницыLoote CHEMICASFahad KashmiriОценок пока нет

- Implied Risk Premium Calculator: Intrinsic Value EstimateДокумент3 страницыImplied Risk Premium Calculator: Intrinsic Value EstimateSeleccion Tecnico IndustrialОценок пока нет

- Capital Structure Analysis OF Tvs Motors & Maruthi LTDДокумент5 страницCapital Structure Analysis OF Tvs Motors & Maruthi LTDsangeethasadhasivam0% (1)

- Levered and Unlevered BetaДокумент27 страницLevered and Unlevered BetaJatin NandaОценок пока нет

- Bagi Yang Masih Awam Memakai Google Sheet, File Ini Bisa Didownload Dengan Klik File Download MS. ExcelДокумент67 страницBagi Yang Masih Awam Memakai Google Sheet, File Ini Bisa Didownload Dengan Klik File Download MS. Excelwisnu pranata adhiОценок пока нет

- Presented D by Ankit Vardhan (10DF016) Abhishek Charaborty (10DF017) Satish Umar (10DF 018) (PDGM FC)Документ23 страницыPresented D by Ankit Vardhan (10DF016) Abhishek Charaborty (10DF017) Satish Umar (10DF 018) (PDGM FC)Satish KumarОценок пока нет

- Growth, Profitability, and Financial Ratios For Starbucks Corp (SBUX) From MorningstarДокумент2 страницыGrowth, Profitability, and Financial Ratios For Starbucks Corp (SBUX) From Morningstaraboubakr soultanОценок пока нет

- DCF Modelling - WACC - CompletedДокумент6 страницDCF Modelling - WACC - Completedkukrejanikhil70Оценок пока нет

- EQTY Research Property Development UPDCДокумент13 страницEQTY Research Property Development UPDCavomanijОценок пока нет

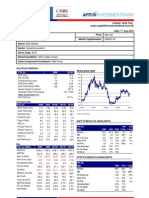

- Hiap Teck RN 20100701 AffinДокумент3 страницыHiap Teck RN 20100701 Affinlimml63Оценок пока нет

- Stryker Corporation - Assignment 22 March 17Документ4 страницыStryker Corporation - Assignment 22 March 17Venkatesh K67% (6)

- CIA III-calculationДокумент9 страницCIA III-calculationVAISHALI HASIJA 1923584Оценок пока нет

- DCF Modelling - 12Документ24 страницыDCF Modelling - 12sujal KumarОценок пока нет

- Dupont Analysis ModelДокумент278 страницDupont Analysis ModelKartikay GoswamiОценок пока нет

- Key Ratio Analysis: Profitability RatiosДокумент27 страницKey Ratio Analysis: Profitability RatioskritikaОценок пока нет

- The State of South Carolina: Investment Analysis and Portfolio ManagementДокумент46 страницThe State of South Carolina: Investment Analysis and Portfolio ManagementhellolauraОценок пока нет

- Industry Median 2018 2017 2016 2015 2014 2013 2012Документ10 страницIndustry Median 2018 2017 2016 2015 2014 2013 2012AnuragОценок пока нет

- Group - 4 PPT DraftДокумент15 страницGroup - 4 PPT Draftrufus carvalhoОценок пока нет

- Account ExcelДокумент5 страницAccount ExcelDennis Korir0% (1)

- Combined Valuing Yahoo in 2013Документ12 страницCombined Valuing Yahoo in 2013Þorgeir DavíðssonОценок пока нет

- Purchases / Average Payables Revenue / Average Total AssetsДокумент7 страницPurchases / Average Payables Revenue / Average Total AssetstannuОценок пока нет

- GP PetroleumsДокумент44 страницыGP Petroleumssingh66222Оценок пока нет

- Weighted Average Cost of Capital (WACC) - 2017 Value Weight Required Rate of ReturnДокумент4 страницыWeighted Average Cost of Capital (WACC) - 2017 Value Weight Required Rate of ReturnravinyseОценок пока нет

- Retail Company With Simple DCFДокумент51 страницаRetail Company With Simple DCFJames Mitchell100% (1)

- NPV Function: Discount Rate Time Periods 2 3 4 Cash Flows NPV $35.9Документ11 страницNPV Function: Discount Rate Time Periods 2 3 4 Cash Flows NPV $35.9Ali Hussain Al SalmawiОценок пока нет

- Midland EnergyДокумент7 страницMidland EnergyNischal UpretiОценок пока нет

- Apple Inc., Dividends Per Share (DPS) Forecast: Calcualation of Terminal ValueДокумент45 страницApple Inc., Dividends Per Share (DPS) Forecast: Calcualation of Terminal ValueRadОценок пока нет

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesОт EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesРейтинг: 5 из 5 звезд5/5 (3)

- Unit 7 The Wall Street CrashДокумент5 страницUnit 7 The Wall Street Crash7/5 - 16 - Phạm Phương NhiОценок пока нет

- General Elective Course List SEMESTER 1, 2021 Hanoi Campus: Please Click For Course Guide InformationДокумент3 страницыGeneral Elective Course List SEMESTER 1, 2021 Hanoi Campus: Please Click For Course Guide InformationQuynh NguyenОценок пока нет

- A. B. C. D. E.: Capital Costs, Operating Costs, Revenue, Depreciation, and Residual ValueДокумент30 страницA. B. C. D. E.: Capital Costs, Operating Costs, Revenue, Depreciation, and Residual ValueAfroz AlamОценок пока нет

- Public Sector Accounting AssignmentДокумент9 страницPublic Sector Accounting AssignmentitulejamesОценок пока нет

- Procedure of Incorporation of CompanyДокумент13 страницProcedure of Incorporation of CompanySahaj KukdeОценок пока нет

- Reidin Uae Monthly Report - 202001 - Jan2020 PDFДокумент21 страницаReidin Uae Monthly Report - 202001 - Jan2020 PDFDiptiranjan PandaОценок пока нет

- Financial Accounting PrinciplesДокумент522 страницыFinancial Accounting PrinciplesSovanna HangОценок пока нет

- SHA FormatДокумент32 страницыSHA Formatajay khandelwalОценок пока нет

- Oyo Project Report PDFДокумент71 страницаOyo Project Report PDFPrakash JhaОценок пока нет

- Business Studies Textbook Grade 10Документ292 страницыBusiness Studies Textbook Grade 10Keren KotoloОценок пока нет

- Amazon'S Supply Chain: Danh Sách Thành ViênДокумент61 страницаAmazon'S Supply Chain: Danh Sách Thành ViênTấn Lê Minh100% (1)

- Habib Resume PDFДокумент4 страницыHabib Resume PDFAshief AhmedОценок пока нет

- GeM Bidding 4032739Документ4 страницыGeM Bidding 4032739Harini IyerОценок пока нет

- Which of The Following Will Not Improve Return On Investment If Other Factors Remain Constant?Документ3 страницыWhich of The Following Will Not Improve Return On Investment If Other Factors Remain Constant?Kath LeynesОценок пока нет

- FBI TBCh10Документ5 страницFBI TBCh10vincewk179Оценок пока нет

- Data Backtest - Forex Riset IdДокумент9 страницData Backtest - Forex Riset Idtoro chanelОценок пока нет

- Crypto Mindset NotesДокумент10 страницCrypto Mindset NotesmanavОценок пока нет

- RMC No. 15-2021Документ1 страницаRMC No. 15-2021nathalie velasquezОценок пока нет

- Ch. 8 - Malhotra 6th EditionДокумент12 страницCh. 8 - Malhotra 6th EditionCarlos Andres RodriguezОценок пока нет

- 2022 Chemical Management Progress ReportДокумент10 страниц2022 Chemical Management Progress ReportKee SarakarnkosolОценок пока нет

- Service Vision Strategy - Ch2 PDFДокумент20 страницService Vision Strategy - Ch2 PDFRavi Satyapal100% (1)

- RL Fund Management Quarterly Report For Q1 2023Документ14 страницRL Fund Management Quarterly Report For Q1 2023jvОценок пока нет

- BC Lecture Notes DCSДокумент63 страницыBC Lecture Notes DCSBipul KumarОценок пока нет

- What Are CPC, CPM, CPA & CTR ? - Publift 1Документ10 страницWhat Are CPC, CPM, CPA & CTR ? - Publift 1Rahul MishraОценок пока нет

- Presentasi Alumnas - Jimmy Gani 17 FebДокумент25 страницPresentasi Alumnas - Jimmy Gani 17 FebJeanne Clarissa SusantoОценок пока нет

- M1Topic1 Principles and Concepts of Project Management NEWДокумент10 страницM1Topic1 Principles and Concepts of Project Management NEWMelisa May Ocampo AmpiloquioОценок пока нет

- Samsung Porter's 5 Forces ModelДокумент5 страницSamsung Porter's 5 Forces ModelPooja GairolaОценок пока нет

- Debit Note: Abexome Biosciences PVT LimitedДокумент7 страницDebit Note: Abexome Biosciences PVT LimitedJoseph FrankОценок пока нет

- Fusion Payables White Paper - Modify Proration Method in MPA V 1.0 PDFДокумент20 страницFusion Payables White Paper - Modify Proration Method in MPA V 1.0 PDFMaqbulhusenОценок пока нет

- Maggi NoodlesДокумент32 страницыMaggi NoodlesAmit MalhotraОценок пока нет