Академический Документы

Профессиональный Документы

Культура Документы

Lockheed Tristar Project

Загружено:

Durgaprasad Velamala0 оценок0% нашли этот документ полезным (0 голосов)

1K просмотров1 страницаАвторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

XLS, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате XLS, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

1K просмотров1 страницаLockheed Tristar Project

Загружено:

Durgaprasad VelamalaАвторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате XLS, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

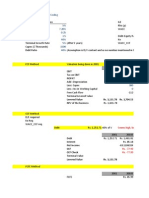

Lockheed Tristar Programme

DCF Analysis of the Lockheed Tristar Programme

Assuming planned production of 210 units ($ millions)

Annual Production 35

Year t Investment Production cost Revenues Total Cash Flow

1967 0 ($100) ($100)

1968 1 ($200) ($200)

1969 2 ($200) ($200)

1970 3 ($200) 140 ($60)

1971 4 ($200) ($490) 140 ($550)

1972 5 ($490) 560 $70

1973 6 ($490) 560 $70

1974 7 ($490) 560 $70

1975 8 ($490) 560 $70

1976 9 ($490) 420 ($70)

1977 10 420 $420

Total ($900) -2940 3360 ($480)

NPV ($584.05)

Lockheed Tristar Programme

DCF Analysis of the Lockheed Tristar Programme

Assuming planned production of 300 units ($ millions)

Production 50

Year t Investment Production cost Revenues Total Cash Flow

1967 0 ($100) ($100)

1968 1 ($200) ($200)

1969 2 ($200) ($200)

1970 3 ($200) 200 $0

1971 4 ($200) ($625) 200 ($625)

1972 5 ($625) 800 $175

1973 6 ($625) 800 $175

1974 7 ($625) 800 $175

1975 8 ($625) 800 $175

1976 9 ($625) 600 ($25)

1977 10 600 $600

Total ($900) -3750 4800 $150

NPV ($274.38)

Evaluation of Tri Star Programme in 1970

($ millions)

Production 35

Year t Investment Production cost Revenues Total Cash Flow

1970 0 140 $140

1971 1 ($200) ($490) 140 ($550)

1972 2 ($490) 560 $70

1973 3 ($490) 560 $70

1974 4 ($490) 560 $70

1975 5 ($490) 560 $70

1976 6 ($490) 420 ($70)

1977 7 420 $420

Total ($200) ($2,940) 3360 $220

NPV $17.73

Assumptions

$700 million of the $900 million in pre-production cost is already sunk.

Future annual slaes volume of 210 units

Any deposit (Here $140 million )received already are not sunk in that they would have

to be repaid if the Tristar Programme is to be cancelled.

Вам также может понравиться

- Ocean Carriers - Case (Final)Документ18 страницOcean Carriers - Case (Final)Namit LalОценок пока нет

- Valuing Capital Investment Projects For PracticeДокумент18 страницValuing Capital Investment Projects For PracticeShivam Goyal100% (1)

- Lockheed Tristar Case Study 11020241041Документ19 страницLockheed Tristar Case Study 11020241041R Harika Reddy100% (7)

- Lockeed 5 StarДокумент6 страницLockeed 5 StarAjay SinghОценок пока нет

- Valuing Capital Investment ProjectsДокумент13 страницValuing Capital Investment ProjectsSiddhesh MahadikОценок пока нет

- Valuing ProjectsДокумент5 страницValuing ProjectsAjay SinghОценок пока нет

- Boston Creamery CaseДокумент9 страницBoston Creamery Caselion_heart3001100% (1)

- Toy World Case ExhibitsДокумент24 страницыToy World Case ExhibitsFrancisco Aguilar PuyolОценок пока нет

- The Home Depot: QuestionsДокумент13 страницThe Home Depot: Questions凱爾思Оценок пока нет

- Bidding For Hertz Leveraged Buyout, Spreadsheet SupplementДокумент12 страницBidding For Hertz Leveraged Buyout, Spreadsheet SupplementAmit AdmuneОценок пока нет

- Sampa Video Financials 2000-2006 Home Delivery ProjectionsДокумент1 страницаSampa Video Financials 2000-2006 Home Delivery ProjectionsOnal RautОценок пока нет

- Titanium Dioxide and Super Project Prof. Joshy JacobДокумент3 страницыTitanium Dioxide and Super Project Prof. Joshy JacobSIDDHARTH SINGHОценок пока нет

- Msdi Alcala de Henares, Spain: Click To Edit Master Subtitle StyleДокумент24 страницыMsdi Alcala de Henares, Spain: Click To Edit Master Subtitle StyleShashank Shekhar100% (1)

- Worldwide Paper Company: Case Solution Company BackgroundДокумент4 страницыWorldwide Paper Company: Case Solution Company BackgroundJauhari WicaksonoОценок пока нет

- Clarkson Lumber - Cash FlowДокумент1 страницаClarkson Lumber - Cash FlowSJОценок пока нет

- Spyder Sports: Ashutosh DashДокумент34 страницыSpyder Sports: Ashutosh DashSaurabh ChhabraОценок пока нет

- Sterling Student ManikДокумент23 страницыSterling Student ManikManik BajajОценок пока нет

- Toy WorldДокумент4 страницыToy WorldDhirendra Kumar Sahu100% (1)

- Corporate Finance - PresentationДокумент14 страницCorporate Finance - Presentationguruprasadkudva83% (6)

- Lockheed Case SolutionДокумент3 страницыLockheed Case SolutionKashish SrivastavaОценок пока нет

- Hanson CaseДокумент7 страницHanson CaseLe PhamОценок пока нет

- FBE 529 Lecture 1 PDFДокумент26 страницFBE 529 Lecture 1 PDFJIAYUN SHENОценок пока нет

- New Heritage Capital SimulationДокумент2 страницыNew Heritage Capital Simulationdanvle11Оценок пока нет

- Sneaker Excel Sheet For Risk AnalysisДокумент11 страницSneaker Excel Sheet For Risk AnalysisSuperGuyОценок пока нет

- New Heritage Doll Company Capital Budgeting SolutionДокумент10 страницNew Heritage Doll Company Capital Budgeting SolutionBiswadeep royОценок пока нет

- Income Statements and Balance Sheets for Flash Memory, Inc. (2007-2009Документ25 страницIncome Statements and Balance Sheets for Flash Memory, Inc. (2007-2009Theicon420Оценок пока нет

- Sampa Case SolutionДокумент4 страницыSampa Case SolutionOnal RautОценок пока нет

- Flash Memory AnalysisДокумент25 страницFlash Memory AnalysisaamirОценок пока нет

- World Wide Paper CompanyДокумент2 страницыWorld Wide Paper CompanyAshwinKumarОценок пока нет

- Netscape: Simulation Techniques For Company Valuation: CentreДокумент4 страницыNetscape: Simulation Techniques For Company Valuation: CentreRia MehtaОценок пока нет

- Super ProjectДокумент2 страницыSuper ProjectQiang ChenОценок пока нет

- 1958-1977 Financial Analysis and NPV Calculations of a Potential New ProductДокумент6 страниц1958-1977 Financial Analysis and NPV Calculations of a Potential New ProductDHRUV SONAGARAОценок пока нет

- Lockheed Tri Star Capital Budgeting Case AnalysisДокумент9 страницLockheed Tri Star Capital Budgeting Case AnalysisMichael DevereauxОценок пока нет

- Sampa VideoДокумент24 страницыSampa VideodoiОценок пока нет

- Lockheed Tristar Case SolutionДокумент3 страницыLockheed Tristar Case SolutionPrakash Nishtala100% (1)

- The Super Project: Mark Smukler, Griffin Meyer & Estefania GarciaДокумент8 страницThe Super Project: Mark Smukler, Griffin Meyer & Estefania GarciaMark SmuklerОценок пока нет

- Excel Spreadsheet Sampa VideoДокумент5 страницExcel Spreadsheet Sampa VideoFaith AllenОценок пока нет

- Student SpreadsheetДокумент14 страницStudent SpreadsheetPriyanka Agarwal0% (1)

- Pacific Grove Spice Company CalculationsДокумент12 страницPacific Grove Spice Company CalculationsJuan Jose Acero CaballeroОценок пока нет

- Burton SensorsДокумент2 страницыBurton SensorsSankalp MishraОценок пока нет

- 25th June - Sampa VideoДокумент6 страниц25th June - Sampa VideoAmol MahajanОценок пока нет

- Toy World - ExhibitsДокумент9 страницToy World - Exhibitsakhilkrishnan007Оценок пока нет

- Chemalite financial analysisДокумент12 страницChemalite financial analysisAimane Beggar100% (1)

- Decision+Analysis+for+UG 2C+Fall+2014 2C+Course+Outline+2014-08-14Документ9 страницDecision+Analysis+for+UG 2C+Fall+2014 2C+Course+Outline+2014-08-14tuahasiddiqui0% (1)

- New Heritage Doll CompanyДокумент5 страницNew Heritage Doll CompanyChris ChanonaОценок пока нет

- Sampa Video: Project ValuationДокумент18 страницSampa Video: Project Valuationkrissh_87Оценок пока нет

- ASSIGNMENT On Investment Analysis and Lockheed Tristar: SUBMITTED TO: Dr. Debaditya Mohanty Submitted byДокумент7 страницASSIGNMENT On Investment Analysis and Lockheed Tristar: SUBMITTED TO: Dr. Debaditya Mohanty Submitted byAbhisek SarkarОценок пока нет

- 09team Bates Pto 2018-2019 Budget - 5-7-19Документ1 страница09team Bates Pto 2018-2019 Budget - 5-7-19api-35122878Оценок пока нет

- Us Music Revenues by Format: Revenue (MM)Документ3 страницыUs Music Revenues by Format: Revenue (MM)Manu MadaanОценок пока нет

- Sales PricesДокумент12 страницSales PricesAlex PetersОценок пока нет

- Book 1Документ3 страницыBook 1Moetassem billah MikatiОценок пока нет

- Lockheed Tristar Case AnalysisДокумент9 страницLockheed Tristar Case AnalysispranavОценок пока нет

- Comercio ExteriorДокумент2 страницыComercio ExteriorEdith SaavedraОценок пока нет

- Nasdaq Aaon 2008Документ37 страницNasdaq Aaon 2008gaja babaОценок пока нет

- W2 - Disney Theme Park - With NPVДокумент15 страницW2 - Disney Theme Park - With NPVChip choiОценок пока нет

- Latihan Balance SheetДокумент10 страницLatihan Balance SheetULAN BATAWENОценок пока нет

- Nombre APELLIDOS Sueldo Dia Hora Cant - Diurnas Valor: Datos Personales Sueldo Horas ExtraДокумент3 страницыNombre APELLIDOS Sueldo Dia Hora Cant - Diurnas Valor: Datos Personales Sueldo Horas ExtrakevinОценок пока нет

- Cost Estimation Tutorial SolutionДокумент11 страницCost Estimation Tutorial Solutionmichellebaileylindsa100% (1)

- Schedule B Amended Budget 2014Документ1 страницаSchedule B Amended Budget 2014RecordTrac - City of OaklandОценок пока нет

- P9-1 Polly and Subsidiaries: Sea's BooksДокумент9 страницP9-1 Polly and Subsidiaries: Sea's BooksFarrell DmОценок пока нет

- IFRS17 IllustrativeExamples May2017 WEBSITE 184Документ82 страницыIFRS17 IllustrativeExamples May2017 WEBSITE 184gdegirolamoОценок пока нет

- IFRS Example 9Документ8 страницIFRS Example 9Durgaprasad VelamalaОценок пока нет

- 3blocks - IFRS 17 PDFДокумент131 страница3blocks - IFRS 17 PDFDurgaprasad VelamalaОценок пока нет

- HDFC BankДокумент39 страницHDFC BankDurgaprasad VelamalaОценок пока нет

- IFRS Example 9Документ8 страницIFRS Example 9Durgaprasad VelamalaОценок пока нет

- Cup Pa Mania ProjectДокумент4 страницыCup Pa Mania ProjectDurgaprasad VelamalaОценок пока нет

- BC Feasibility StudyДокумент104 страницыBC Feasibility StudyDurgaprasad VelamalaОценок пока нет

- Marriott Corporation - K - AbridgedДокумент9 страницMarriott Corporation - K - AbridgedDurgaprasad Velamala100% (5)

- Bank Statement SummaryДокумент4 страницыBank Statement SummaryMr SimpleОценок пока нет

- SYBCO AC FIN Financial Accounting Special Accounting Areas IIIДокумент249 страницSYBCO AC FIN Financial Accounting Special Accounting Areas IIIctfworkshop2020Оценок пока нет

- FIN WI 001 Image Marked PDFДокумент10 страницFIN WI 001 Image Marked PDFGregurius DaniswaraОценок пока нет

- Journal entries for lamp production costs and inventoryДокумент2 страницыJournal entries for lamp production costs and inventoryLucy HeartfiliaОценок пока нет

- Presentation of Expertise Training CourseДокумент74 страницыPresentation of Expertise Training CourseOmnia HassanОценок пока нет

- ACCA P4 Advanced Financial Management Mock Exam QuestionsДокумент16 страницACCA P4 Advanced Financial Management Mock Exam QuestionsSyedAliRazaKazmi100% (2)

- Definition of 'Multinational Corporation - MNC'Документ1 страницаDefinition of 'Multinational Corporation - MNC'runaap9_307684415Оценок пока нет

- MOA BlankДокумент4 страницыMOA Blankclarisa mangwagОценок пока нет

- Maintenance Planing & ManagementДокумент3 страницыMaintenance Planing & ManagementMir OsailОценок пока нет

- Sustainable Development Statement Arupv-2023Документ1 страницаSustainable Development Statement Arupv-2023James CubittОценок пока нет

- Business Plan of Electronic BicycleДокумент9 страницBusiness Plan of Electronic BicycleSabdi AhmedОценок пока нет

- Is Services India's Growth EngineДокумент42 страницыIs Services India's Growth EngineDivya SreenivasОценок пока нет

- Merchant and Investment BankingДокумент22 страницыMerchant and Investment BankingAashiОценок пока нет

- Qdoc - Tips - Carter Cleaning Company Case HRMДокумент7 страницQdoc - Tips - Carter Cleaning Company Case HRMYến VyОценок пока нет

- AutomotiveSectorSupplement Pilot GRIДокумент18 страницAutomotiveSectorSupplement Pilot GRIkc72Оценок пока нет

- Cfa RC 2020 Ufe Monstars ApuДокумент31 страницаCfa RC 2020 Ufe Monstars ApuoyunnominОценок пока нет

- Castle (Met BKC)Документ38 страницCastle (Met BKC)aashishpoladiaОценок пока нет

- Foreign ExchangeДокумент25 страницForeign ExchangeAngelica AllanicОценок пока нет

- Air France Case StudyДокумент7 страницAir France Case StudyKrishnaprasad ChenniyangirinathanОценок пока нет

- Capital flight affects exchange ratesДокумент4 страницыCapital flight affects exchange ratesTunggal PrayogaОценок пока нет

- Modify Monthly Budget TemplateДокумент32 страницыModify Monthly Budget TemplateMohammed TetteyОценок пока нет

- Production Planning and ControlДокумент16 страницProduction Planning and Controlnitish kumar twariОценок пока нет

- Practical Project Execution Alloy Wheels Manufacturing PlantДокумент5 страницPractical Project Execution Alloy Wheels Manufacturing PlantSanjay KumarОценок пока нет

- How Competitive Forces Shape StrategyДокумент11 страницHow Competitive Forces Shape StrategyErwinsyah RusliОценок пока нет

- InflationДокумент25 страницInflationsyedrahman88Оценок пока нет

- FinanceanswersДокумент24 страницыFinanceanswersAditi ToshniwalОценок пока нет

- Debtors Ageing AnalysisДокумент1 страницаDebtors Ageing AnalysisMehul BhanushaliОценок пока нет

- EntrepreneurshipДокумент64 страницыEntrepreneurshipWacks Venzon79% (19)

- Employee Benefits Whitepaper BambooHRДокумент17 страницEmployee Benefits Whitepaper BambooHRMuhammad SaadОценок пока нет

- Quiz On Global Production and Supply Chain Management Name: Section: Date: ScoreДокумент2 страницыQuiz On Global Production and Supply Chain Management Name: Section: Date: ScoreDianeОценок пока нет

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeОт EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeРейтинг: 4.5 из 5 звезд4.5/5 (85)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurОт Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurРейтинг: 4 из 5 звезд4/5 (2)

- Creating Competitive Advantage: How to be Strategically Ahead in Changing MarketsОт EverandCreating Competitive Advantage: How to be Strategically Ahead in Changing MarketsРейтинг: 5 из 5 звезд5/5 (2)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldОт Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldРейтинг: 5 из 5 звезд5/5 (19)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedОт EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedРейтинг: 4.5 из 5 звезд4.5/5 (38)

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelОт EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelРейтинг: 5 из 5 звезд5/5 (51)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveОт EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveОценок пока нет

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryОт EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryРейтинг: 4 из 5 звезд4/5 (26)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureОт EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureРейтинг: 4.5 из 5 звезд4.5/5 (100)

- Summary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:От EverandSummary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:Рейтинг: 5 из 5 звезд5/5 (2)

- Don't Start a Side Hustle!: Work Less, Earn More, and Live FreeОт EverandDon't Start a Side Hustle!: Work Less, Earn More, and Live FreeРейтинг: 4.5 из 5 звезд4.5/5 (30)

- Without a Doubt: How to Go from Underrated to UnbeatableОт EverandWithout a Doubt: How to Go from Underrated to UnbeatableРейтинг: 4 из 5 звезд4/5 (23)

- The Corporate Startup: How established companies can develop successful innovation ecosystemsОт EverandThe Corporate Startup: How established companies can develop successful innovation ecosystemsРейтинг: 4 из 5 звезд4/5 (6)

- How to Prospect, Sell and Build Your Network Marketing Business with StoriesОт EverandHow to Prospect, Sell and Build Your Network Marketing Business with StoriesРейтинг: 5 из 5 звезд5/5 (21)

- Your Next Five Moves: Master the Art of Business StrategyОт EverandYour Next Five Moves: Master the Art of Business StrategyРейтинг: 5 из 5 звезд5/5 (795)

- Anything You Want: 40 lessons for a new kind of entrepreneurОт EverandAnything You Want: 40 lessons for a new kind of entrepreneurРейтинг: 5 из 5 звезд5/5 (46)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsОт EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsРейтинг: 5 из 5 звезд5/5 (48)

- Get Scalable: The Operating System Your Business Needs To Run and Scale Without YouОт EverandGet Scalable: The Operating System Your Business Needs To Run and Scale Without YouРейтинг: 5 из 5 звезд5/5 (1)

- Enough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursОт EverandEnough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursРейтинг: 4.5 из 5 звезд4.5/5 (23)

- Summary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesОт EverandSummary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesРейтинг: 4.5 из 5 звезд4.5/5 (99)

- Expert Secrets: The Underground Playbook for Creating a Mass Movement of People Who Will Pay for Your AdviceОт EverandExpert Secrets: The Underground Playbook for Creating a Mass Movement of People Who Will Pay for Your AdviceРейтинг: 5 из 5 звезд5/5 (363)

- Summary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizОт EverandSummary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizРейтинг: 4.5 из 5 звезд4.5/5 (112)

- What Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessОт EverandWhat Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessРейтинг: 4.5 из 5 звезд4.5/5 (24)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andОт EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andРейтинг: 4.5 из 5 звезд4.5/5 (708)

- Summary of The 33 Strategies of War by Robert GreeneОт EverandSummary of The 33 Strategies of War by Robert GreeneРейтинг: 3.5 из 5 звезд3.5/5 (20)

- Level Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeОт EverandLevel Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeРейтинг: 5 из 5 звезд5/5 (22)

- AI Money Machine: Unlock the Secrets to Making Money Online with AIОт EverandAI Money Machine: Unlock the Secrets to Making Money Online with AIОценок пока нет