Академический Документы

Профессиональный Документы

Культура Документы

A P: A P: A O:: Expense Reimbursements and Travel Advances

Загружено:

Chinh Le Dinh0 оценок0% нашли этот документ полезным (0 голосов)

17 просмотров3 страницыОригинальное название

ExpenseReimbursement

Авторское право

© © All Rights Reserved

Доступные форматы

DOC, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOC, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

17 просмотров3 страницыA P: A P: A O:: Expense Reimbursements and Travel Advances

Загружено:

Chinh Le DinhАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOC, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 3

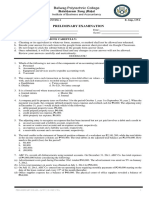

AUDIT PROGRAM: Executive/Employee Expense Reimbursement

AUDIT PERIOD: January 1, 20X1 through December 31, 20X1

AUDIT OBJECTIVES:

A. Expense Reimbursements and Travel Advances

Determine whether:

1. Expense reports have been completed for reimbursements.

2. Expenditures are business related and consistent with Company policy.

3. Payments have been appropriately approved prior to disbursement.

B. Credit Cards

Determine whether:

1. Expenditures are business related and consistent with Company policy.

2. Payments have been appropriately approved prior to disbursement.

AUDIT PROCEDURES:

Done

Procedures Workpaper Ref. By Date Comments

Y/N?

EXPENSE REIMBURSEMENTS AND TRAVEL ADVANCES

1) Obtain formalized policies and procedures for

executive/employee expense reimbursements and

travel advances.

2) Obtain a listing of cash disbursements from

January 1, 20X1 to December 31, 20X1 and

select 2 payments each to the following

individuals:

a. Employee 1

b. Employee 2

c. Employee 3

d. Employee 4

e. Employee 5

f. Employee 6

g. Employee 7

h. Employee 8

i. Employee 9

j. Employee 10

Contributed by Lordi Consulting, LLC (jcehlar@lordiconsulting.com)

Done

Procedures Workpaper Ref. By Date Comments

Y/N?

3) For each payment perform the following:

a. Determine the nature of the payment (e.g.,

expense reimbursement, travel advance,

other).

b. If expense reimbursement:

i. Review the expense report to determine

that the expenses appear to be valid

business expenses.

ii. Examine the expense report for the

inclusion of receipts in accordance with

Company policy.

iii. Recalculate/foot the expense report to

determine that it was accurately

calculated.

c. If travel advance, ensure that the amount,

nature, and timing are in accordance with

Company policy.

d. If other:

i. Review the payment and related support

to determine that the payment appears to

be valid.

ii. Examine the payment for the inclusion

of receipts (if applicable) in accordance

with Company policy.

iii. Recalculate/foot the payment to

determine that it was accurately

calculated.

4) Ensure that payments were processed appropriately

by Account Payable (trace to check remittance).

5) Verify that the expense reports and other cash

disbursements were approved/signed by an

appropriate party.

CREDIT CARDS

6) Obtain formalized policies and procedures for

Credit Card usage.

Contributed by Lordi Consulting, LLC (jcehlar@lordiconsulting.com)

Done

Procedures Workpaper Ref. By Date Comments

Y/N?

7) Obtain a listing of cash disbursements from

January 1, 20X1 to December 31, 20X1 to the

credit card company; sub-select 1 payment to the

credit card company related to the following

individuals:

a. Employee 1

b. Employee 2

c. Employee 3

d. Employee 4

e. Employee 5

f. Employee 6

g. Employee 7

h. Employee 8

i. Employee 9

j. Employee 10

8) For each payment perform the following:

a. Review the credit card statement to

determine that the expenses appear to be

valid business expenses.

b. Examine the expense report for the inclusion

of receipts in accordance with Company

policy.

9) Ensure that payments were processed appropriately

by Accounts Payable (trace to check remittance).

10) Verify that the credit card statements were

approved/signed by an appropriate party.

PERFORMED BY: REVIEWED BY:

Auditor Audit Manager

Contributed by Lordi Consulting, LLC (jcehlar@lordiconsulting.com)

Вам также может понравиться

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)От EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Рейтинг: 5 из 5 звезд5/5 (1)

- Pediatric Skills For OT Assistants 3rd Ed.Документ645 страницPediatric Skills For OT Assistants 3rd Ed.Patrice Escobar100% (1)

- ISO 9001 2008 Gap AssessmentДокумент65 страницISO 9001 2008 Gap AssessmentChinh Le DinhОценок пока нет

- Man Machine Interface SafetyДокумент9 страницMan Machine Interface SafetyVidyesh Viswanathan NairОценок пока нет

- Issue Management TemplateДокумент4 страницыIssue Management Templatejindalyash1234Оценок пока нет

- Issue Management TemplateДокумент4 страницыIssue Management Templatejindalyash1234Оценок пока нет

- Purchasing Audit ProgramДокумент3 страницыPurchasing Audit ProgramBernie LeBlanc100% (1)

- IA List FilesДокумент140 страницIA List FilesChinh Le DinhОценок пока нет

- IA List FilesДокумент140 страницIA List FilesChinh Le DinhОценок пока нет

- Sap MM Role MatrixДокумент40 страницSap MM Role MatrixClarice GuintibanoОценок пока нет

- Sap MM Role MatrixДокумент40 страницSap MM Role MatrixClarice GuintibanoОценок пока нет

- PWC Cfo Kpi Survey 2013 PDFДокумент20 страницPWC Cfo Kpi Survey 2013 PDFSteven SimpsonОценок пока нет

- PWC Cfo Kpi Survey 2013 PDFДокумент20 страницPWC Cfo Kpi Survey 2013 PDFSteven SimpsonОценок пока нет

- Woodward GCP30 Configuration 37278 - BДокумент174 страницыWoodward GCP30 Configuration 37278 - BDave Potter100% (1)

- Answer Key For Week 1 To 3 ULO 8 To 10Документ7 страницAnswer Key For Week 1 To 3 ULO 8 To 10Margaux Phoenix KimilatОценок пока нет

- 1 PF Audit ChecklistДокумент8 страниц1 PF Audit ChecklistAmbarish Gondhalekar75% (4)

- AP.2807 Liabilities.Документ7 страницAP.2807 Liabilities.May Grethel Joy PeranteОценок пока нет

- Best Practice For The Maintenance of Building Assets: Procurement Practices ManualДокумент26 страницBest Practice For The Maintenance of Building Assets: Procurement Practices ManualChinh Le DinhОценок пока нет

- Best Practice For The Maintenance of Building Assets: Procurement Practices ManualДокумент26 страницBest Practice For The Maintenance of Building Assets: Procurement Practices ManualChinh Le DinhОценок пока нет

- ISO 27001 Assessment QuestionnaireДокумент10 страницISO 27001 Assessment QuestionnaireSaid SakrОценок пока нет

- ISO 27001 Assessment QuestionnaireДокумент10 страницISO 27001 Assessment QuestionnaireSaid SakrОценок пока нет

- OOPS Notes For 3rd Sem ALL ChaptersДокумент62 страницыOOPS Notes For 3rd Sem ALL Chaptersabhishek singh83% (6)

- CPA - Quizbowl 2008Документ10 страницCPA - Quizbowl 2008frankreedh100% (3)

- TNCT Q2 Module3cДокумент15 страницTNCT Q2 Module3cashurishuri411100% (1)

- SOU 2 Md-GrimcoДокумент3 страницыSOU 2 Md-GrimcoJatin ShahОценок пока нет

- Test 1 Q Dec2021Документ6 страницTest 1 Q Dec2021syaza aidaОценок пока нет

- Orientation Phase Emp@Spjimr Finance Management Marks: 100 Time: 90 MinДокумент4 страницыOrientation Phase Emp@Spjimr Finance Management Marks: 100 Time: 90 MinPratap singh chundawatОценок пока нет

- UntitledДокумент30 страницUntitledMANSI JOSHIОценок пока нет

- Quiz SolutionsДокумент4 страницыQuiz SolutionsEDELYN PoblacionОценок пока нет

- DashingДокумент4 страницыDashingabdirahman farah AbdiОценок пока нет

- 28) Substantive Procedures - 9Документ4 страницы28) Substantive Procedures - 9kasimranjhaОценок пока нет

- AEC 54 Asynchronous Activity Accounts Payable and Purchases 102922Документ4 страницыAEC 54 Asynchronous Activity Accounts Payable and Purchases 102922Jester LimОценок пока нет

- Audit of CashДокумент4 страницыAudit of CashBromanineОценок пока нет

- Intermediate Accounting Exam SolutionsДокумент11 страницIntermediate Accounting Exam SolutionsDean Craig80% (5)

- AP.3407 Audit of LiabilitiesДокумент6 страницAP.3407 Audit of LiabilitiesMonica GarciaОценок пока нет

- Accounts and Audit 2Документ8 страницAccounts and Audit 2KamarajОценок пока нет

- AP.302 Audit of Cash and Cash Equivalents PDFДокумент7 страницAP.302 Audit of Cash and Cash Equivalents PDFnicole bancoroОценок пока нет

- Basic Accounting Crash CourseДокумент5 страницBasic Accounting Crash CourseJolo RomanОценок пока нет

- Solution Manual For Financial Accounting Information For Decisions 7th Edition by Wild ISBN 0078025893 9780078025891Документ19 страницSolution Manual For Financial Accounting Information For Decisions 7th Edition by Wild ISBN 0078025893 9780078025891dennischavezrmobpyfget100% (28)

- Financial Accounting 2017 Ist Semester FinalДокумент100 страницFinancial Accounting 2017 Ist Semester FinalLOVERAGE MUNEMOОценок пока нет

- AP Review MateiralДокумент15 страницAP Review MateiralAntonette Eve CelomineОценок пока нет

- Client ExamДокумент8 страницClient ExamKimberly May AbayonОценок пока нет

- ACT15 Prelim ExamДокумент8 страницACT15 Prelim ExamPaw VerdilloОценок пока нет

- Adobas Auditing FinalsДокумент10 страницAdobas Auditing FinalsMica BarrunОценок пока нет

- Plus One Question BankДокумент38 страницPlus One Question Bankstuntallen21Оценок пока нет

- Accounting MidtermsДокумент3 страницыAccounting MidtermsromuellashanebОценок пока нет

- Unit 1 Vouching - 1 - FinalДокумент12 страницUnit 1 Vouching - 1 - Finalshoaib shaikhОценок пока нет

- Week 3 Tutorial SolutionsДокумент8 страницWeek 3 Tutorial SolutionsAvneel KumarОценок пока нет

- Midterm Examination Suggested AnswersДокумент9 страницMidterm Examination Suggested AnswersJoshua CaraldeОценок пока нет

- 2acc 102 1a 2023Документ13 страниц2acc 102 1a 2023zanokuhleathandile26Оценок пока нет

- Requirement List For Co-Operative Bank AuditДокумент7 страницRequirement List For Co-Operative Bank AuditVivek Jani100% (3)

- Sample Midterm Exam I Professor Sarath: FALL 2019Документ7 страницSample Midterm Exam I Professor Sarath: FALL 2019Raushan ZhabaginaОценок пока нет

- FA Special 2010Документ10 страницFA Special 2010prakash9735Оценок пока нет

- Audit ProceduresДокумент42 страницыAudit ProceduresRohan ChavanОценок пока нет

- Exam Revision - Chapter 9 10Документ7 страницExam Revision - Chapter 9 10Vũ Thị NgoanОценок пока нет

- ACCT2102-G-I - Ch.1 Tutorial - 1819 (T) v.1Документ8 страницACCT2102-G-I - Ch.1 Tutorial - 1819 (T) v.1AlfieОценок пока нет

- Exam Revision - 9 & 10 SolДокумент7 страницExam Revision - 9 & 10 SolNguyễn Minh ĐứcОценок пока нет

- Factoring Forfaiting TheoryДокумент39 страницFactoring Forfaiting TheoryCharu AroraОценок пока нет

- FABM2 Module 5. Statement of Cash FlowsДокумент7 страницFABM2 Module 5. Statement of Cash FlowsSITTIE RAYMAH ABDULLAHОценок пока нет

- Soutions To Practice Problems For Modules 1 & 2Документ17 страницSoutions To Practice Problems For Modules 1 & 2b1234naОценок пока нет

- Self Assessment QuizesДокумент41 страницаSelf Assessment QuizesStephanie NaamaniОценок пока нет

- Accountancy Class 11 Most Important Sample Paper 2023-2024Документ12 страницAccountancy Class 11 Most Important Sample Paper 2023-2024Hardik ChhabraОценок пока нет

- TOA Midterm Exam 2010Документ22 страницыTOA Midterm Exam 2010Patrick WaltersОценок пока нет

- Audit Final To PrintДокумент6 страницAudit Final To PrintKHathy AsoiralОценок пока нет

- Multiple Choice Questions 1 Halifax Corporation Has A December 31 FiscalДокумент1 страницаMultiple Choice Questions 1 Halifax Corporation Has A December 31 FiscalLet's Talk With HassanОценок пока нет

- Loan Settlement Audit ProgramДокумент3 страницыLoan Settlement Audit ProgramJohn MfumyaОценок пока нет

- ACAI Chapter 17 PowerpointДокумент28 страницACAI Chapter 17 PowerpointKathleenCusipagОценок пока нет

- Adjusting EntriesДокумент7 страницAdjusting EntriesRyou ShinodaОценок пока нет

- Audit NotesДокумент11 страницAudit NotesNavjyoti SinghОценок пока нет

- 2nd Quarter Final Exam Oct. 2019Документ3 страницы2nd Quarter Final Exam Oct. 2019awdasdОценок пока нет

- 1) Match The Type of Accounting With The Skills RequiredДокумент3 страницы1) Match The Type of Accounting With The Skills RequiredThảo NhiОценок пока нет

- Final Exam of WCAДокумент5 страницFinal Exam of WCABereket K.ChubetaОценок пока нет

- B6110 Fall 2018 Test 1 With SolutionДокумент17 страницB6110 Fall 2018 Test 1 With SolutionadamОценок пока нет

- 8 Cash Flow StatementДокумент10 страниц8 Cash Flow StatementBAZINGAОценок пока нет

- Understand of Business Process and Audit Check ListДокумент13 страницUnderstand of Business Process and Audit Check ListDharmendra SinghОценок пока нет

- Auditing Theories and Problems Quiz WEEK 1Документ19 страницAuditing Theories and Problems Quiz WEEK 1Sarah GОценок пока нет

- Review Materials The Accounting Process To Accounts ReceivableДокумент7 страницReview Materials The Accounting Process To Accounts ReceivableMarin, Nicole DondoyanoОценок пока нет

- AP05 - Final Preboard ExaminationДокумент10 страницAP05 - Final Preboard ExaminationJessa Delos SantosОценок пока нет

- GG Ifa QMSCL PH v5 3-Gfs Protected enДокумент56 страницGG Ifa QMSCL PH v5 3-Gfs Protected enChinh Le DinhОценок пока нет

- Execution Internal ControlДокумент28 страницExecution Internal ControlFaizan ChОценок пока нет

- Njdot Risk Management: Quantitative Risk Analysis WorksheetДокумент2 страницыNjdot Risk Management: Quantitative Risk Analysis Worksheetanalysis of packaging materials department responsible quality control managementОценок пока нет

- SAP Project Management: Dr. Djamal ZianiДокумент14 страницSAP Project Management: Dr. Djamal ZianiChinh Le DinhОценок пока нет

- Ops 8level MatrixДокумент51 страницаOps 8level MatrixarunradОценок пока нет

- Apuc Procurement ManualДокумент47 страницApuc Procurement ManualChinh Le DinhОценок пока нет

- TT MatrixДокумент13 страницTT MatrixChinh Le DinhОценок пока нет

- Process RC MatrixДокумент6 страницProcess RC MatrixChinh Le DinhОценок пока нет

- Execution Internal ControlДокумент28 страницExecution Internal ControlFaizan ChОценок пока нет

- Njdot Risk Management: Quantitative Risk Analysis WorksheetДокумент2 страницыNjdot Risk Management: Quantitative Risk Analysis Worksheetanalysis of packaging materials department responsible quality control managementОценок пока нет

- Ops 8level MatrixДокумент51 страницаOps 8level MatrixarunradОценок пока нет

- Apuc Procurement ManualДокумент47 страницApuc Procurement ManualChinh Le DinhОценок пока нет

- CM TreasuryДокумент12 страницCM TreasuryChinh Le DinhОценок пока нет

- TT MatrixДокумент13 страницTT MatrixChinh Le DinhОценок пока нет

- Process RC MatrixДокумент6 страницProcess RC MatrixChinh Le DinhОценок пока нет

- DA6 - KCN Bac Cu ChiДокумент22 страницыDA6 - KCN Bac Cu ChiChinh Le DinhОценок пока нет

- Treasury Department ApgДокумент8 страницTreasury Department ApgChinh Le DinhОценок пока нет

- Carry Trade Calculator 1.54Документ3 страницыCarry Trade Calculator 1.54Gabriel RomanОценок пока нет

- Effective Communication LeaderДокумент4 страницыEffective Communication LeaderAnggun PraditaОценок пока нет

- Hoja Tecnica Item 2 DRC-9-04X12-D-H-D UV BK LSZH - F904804Q6B PDFДокумент2 страницыHoja Tecnica Item 2 DRC-9-04X12-D-H-D UV BK LSZH - F904804Q6B PDFMarco Antonio Gutierrez PulchaОценок пока нет

- MMMДокумент6 страницMMMReet KanjilalОценок пока нет

- Pie in The Sky 3Документ5 страницPie in The Sky 3arsi_yaarОценок пока нет

- Mathematical Geophysics: Class One Amin KhalilДокумент13 страницMathematical Geophysics: Class One Amin KhalilAmin KhalilОценок пока нет

- Key Features of A Company 1. Artificial PersonДокумент19 страницKey Features of A Company 1. Artificial PersonVijayaragavan MОценок пока нет

- Bell WorkДокумент26 страницBell WorkChuột Cao CấpОценок пока нет

- Bharat Heavy Electricals LimitedДокумент483 страницыBharat Heavy Electricals LimitedRahul NagarОценок пока нет

- จัดตารางสอบกลางภาคภาคต้น53Документ332 страницыจัดตารางสอบกลางภาคภาคต้น53Yuwarath SuktrakoonОценок пока нет

- 16 Easy Steps To Start PCB Circuit DesignДокумент10 страниц16 Easy Steps To Start PCB Circuit DesignjackОценок пока нет

- 8524Документ8 страниц8524Ghulam MurtazaОценок пока нет

- 14 CE Chapter 14 - Developing Pricing StrategiesДокумент34 страницы14 CE Chapter 14 - Developing Pricing StrategiesAsha JaylalОценок пока нет

- Sec2 8 PDFДокумент3 страницыSec2 8 PDFpolistaОценок пока нет

- Harga H2H Pula-Paket Data - Saldo EWallet v31012022Документ10 страницHarga H2H Pula-Paket Data - Saldo EWallet v31012022lala cemiОценок пока нет

- BBCVДокумент6 страницBBCVSanthosh PgОценок пока нет

- A.2 de - La - Victoria - v. - Commission - On - Elections20210424-12-18iwrdДокумент6 страницA.2 de - La - Victoria - v. - Commission - On - Elections20210424-12-18iwrdCharisse SarateОценок пока нет

- List of Light Commercial LED CodesДокумент8 страницList of Light Commercial LED CodesRenan GonzalezОценок пока нет

- Saic-M-2012 Rev 7 StructureДокумент6 страницSaic-M-2012 Rev 7 StructuremohamedqcОценок пока нет

- VB 850Документ333 страницыVB 850Laura ValentinaОценок пока нет

- Planas V Comelec - FinalДокумент2 страницыPlanas V Comelec - FinalEdwino Nudo Barbosa Jr.100% (1)

- Marketing Management - Pgpmi - Class 12Документ44 страницыMarketing Management - Pgpmi - Class 12Sivapriya KrishnanОценок пока нет

- bz4x EbrochureДокумент21 страницаbz4x EbrochureoswaldcameronОценок пока нет

- Business-Model Casual Cleaning ServiceДокумент1 страницаBusiness-Model Casual Cleaning ServiceRudiny FarabyОценок пока нет

- 1 s2.0 S0304389421026054 MainДокумент24 страницы1 s2.0 S0304389421026054 MainFarah TalibОценок пока нет