Академический Документы

Профессиональный Документы

Культура Документы

Activity 005

Загружено:

Kelvin Jay Sebastian SaplaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Activity 005

Загружено:

Kelvin Jay Sebastian SaplaАвторское право:

Доступные форматы

Management Accounting

Assignment #5

1. Aladin Company Manufactures small battery that is used in clocks, toys and some other

electronic devices. The last month’s income statement of Aladin is given below:

Total Per Unit

Sales (30,000 batteries) $300,000 $10

Less variable expenses $180,000 $6

Contribution Margin $120,000 $4

Fixed expenses $100,000

Net operating income $20,000

Required:

Prepare Aladin's new income statement under each of the following conditions:

1. The sales colume increase by 15%.

2. The selling price decreases by 20% per unit, and the sales volume increase by 30%.

3. The selling price increases by 50% per unit, fixed expenses increase by $20,000 and the sales volume

decreases by 5%.

4. Variable expenses increases by 20% per unit, the selling price increase by 12%, and the sales volume

decrease by 10%.

2. TLK Ltd. manufactures small size fans to be used in load shedding areas. Each fan has a

rechargeable battery and a built in charging circuit. TLK sells a fan for $120. The annual sale is

30,000 fans. Variable and fixed cost data is given below:

Variable expenses $84 per fan

Fixed expenses $900,000 per year

Required:

A. Prepare contribution margin income statement and compute the degree of operating leverage.

B. Next year the sales are expected to increase by 7,500 fans. Compute (a) the expected

percentage increase in net operating income (b) expected increase in net operating income and

(c) expected total net operating income for the next year.

3. Contribution Margin Income Statement of a single product company

Total Per unit

Sales $1,200,000 $80

Less variable expenses $840, 000 $56

Contribution Margin 360,000 $24

Less fixed expenses 300,000

Net Operating income $60,000

Required:

1. Calculate break-even point in units and dollars.

2. What is the contribution margin at break-even point?

3. Compute the number of units to be sold to earn a profit of $36,000.

4. Compute the margin of safety using original data.

5. Compute CM ratio. Compute the expected increase in monthly net operating if sales increase by

$160,000 and fixed expenses do not change.

Вам также может понравиться

- Break Even and CVPДокумент2 страницыBreak Even and CVPIshmael OneyaОценок пока нет

- Cost & Managerial Accounting Cost-Volume-Profit Analysis: Page 1 of 3Документ3 страницыCost & Managerial Accounting Cost-Volume-Profit Analysis: Page 1 of 3mohammad bilal0% (1)

- Exam 19111Документ6 страницExam 19111atallah97Оценок пока нет

- Exercise 2 - CVP Analysis Part 1Документ5 страницExercise 2 - CVP Analysis Part 1Vincent PanisalesОценок пока нет

- Break Even Analysis-20!1!222Документ7 страницBreak Even Analysis-20!1!222Zubair JuttОценок пока нет

- CVP Review Problem P 6.29 P 6.30Документ4 страницыCVP Review Problem P 6.29 P 6.30nehal hasnain refath0% (1)

- Additional Practice For MidtermДокумент81 страницаAdditional Practice For MidtermMohmmad OmarОценок пока нет

- Amercian FuelДокумент8 страницAmercian FuelAsh KaiОценок пока нет

- Accounting Day 6Документ3 страницыAccounting Day 6Benjamin0% (1)

- STRAT ReviewerДокумент13 страницSTRAT ReviewerCrisel SalomeoОценок пока нет

- Ex04 Responsibility Accounting & Transfer PricingДокумент17 страницEx04 Responsibility Accounting & Transfer PricingKoitsu100% (2)

- MACP.L II Question April 2019Документ5 страницMACP.L II Question April 2019Taslima AktarОценок пока нет

- CVP AnalysisДокумент5 страницCVP AnalysisAnne BacolodОценок пока нет

- Accounting For Managers-Assignment MaterialsДокумент4 страницыAccounting For Managers-Assignment MaterialsYehualashet TeklemariamОценок пока нет

- 55 - Chapter 6 Exercises With AnswersДокумент4 страницы55 - Chapter 6 Exercises With Answersgio gioОценок пока нет

- Review ch.6Документ15 страницReview ch.6LâmViên100% (9)

- Accounting Questions Week 3Документ2 страницыAccounting Questions Week 3milleranОценок пока нет

- Extra Questions For Mid Term Test 2 - MA2 - ACCAДокумент10 страницExtra Questions For Mid Term Test 2 - MA2 - ACCANguyễn NgaОценок пока нет

- SCM: Cost Volume Profit AnalysisДокумент2 страницыSCM: Cost Volume Profit Analysiscyrellecelestino1998Оценок пока нет

- ACC101 Cost Accounting. Review For LT1 K.MontejoДокумент2 страницыACC101 Cost Accounting. Review For LT1 K.MontejonicoleОценок пока нет

- BASTRCSX Module 6 Self-Test Responsibility Accounting Part 2Документ8 страницBASTRCSX Module 6 Self-Test Responsibility Accounting Part 2Alyssa CaddawanОценок пока нет

- Chapter 5 Quiz BA 213Документ4 страницыChapter 5 Quiz BA 213alolhasОценок пока нет

- Exam161 10Документ7 страницExam161 10Rabah ElmasriОценок пока нет

- Submitted By: Cabling, Alvin Hachiles, Jomari Honera, Shawn Michael Miranda, Christopher Odonzo, Aldwin Salvador, ChristianДокумент32 страницыSubmitted By: Cabling, Alvin Hachiles, Jomari Honera, Shawn Michael Miranda, Christopher Odonzo, Aldwin Salvador, ChristianKimberly Claire AtienzaОценок пока нет

- Chap 4 - ActivitiesДокумент3 страницыChap 4 - Activities31211022392Оценок пока нет

- MANACO AssignmentДокумент2 страницыMANACO AssignmentKarl Phillip Ramoran Alcarde0% (1)

- CVP H101Документ4 страницыCVP H101poppy2890Оценок пока нет

- Discussion Questions CVP AnalysisДокумент2 страницыDiscussion Questions CVP AnalysisAnnamarisse parungaoОценок пока нет

- Test 2 Sample Questions With Correct AnswersДокумент8 страницTest 2 Sample Questions With Correct AnswersBayoumy ElyanОценок пока нет

- Managerial Accounting - WS4 Connect Homework GradedДокумент9 страницManagerial Accounting - WS4 Connect Homework GradedJason HamiltonОценок пока нет

- COST VOLUME PROFIT ANALYSIS - ExercisesДокумент4 страницыCOST VOLUME PROFIT ANALYSIS - ExercisesLloyd Vincent O. TingsonОценок пока нет

- MidtermsДокумент10 страницMidtermsKIM RAGA0% (1)

- Quiz 4 CAДокумент8 страницQuiz 4 CAbasilnaeem7Оценок пока нет

- A. Calculate The Break-Even Dollar Sales For The MonthДокумент25 страницA. Calculate The Break-Even Dollar Sales For The MonthMohitОценок пока нет

- Cost AssignmentДокумент4 страницыCost AssignmentSYED MUHAMMAD MOOSA RAZAОценок пока нет

- Chapter # 8 Exercise & ProblemsДокумент4 страницыChapter # 8 Exercise & ProblemsZia Uddin0% (1)

- Trắc NghiệmДокумент50 страницTrắc NghiệmNGÂN CAO NGUYỄN HOÀNОценок пока нет

- COMPREHENSIVE PROBLEMS-lordyДокумент8 страницCOMPREHENSIVE PROBLEMS-lordyLordCelene C MagyayaОценок пока нет

- ALl Questions According To TopicsДокумент11 страницALl Questions According To TopicsHassan KhanОценок пока нет

- Module 5 CVP in Class ProblemsДокумент3 страницыModule 5 CVP in Class ProblemsPhát GamingОценок пока нет

- Exercise Sheet 4 - CVP Analysis (Revised)Документ2 страницыExercise Sheet 4 - CVP Analysis (Revised)Kievs GtsОценок пока нет

- NAME: Alessandra Ysabelle C. Conzon Section: Mec 44 MaДокумент3 страницыNAME: Alessandra Ysabelle C. Conzon Section: Mec 44 MaAlessandra ConzonОценок пока нет

- Kuis UTS Genap 21-22 ACCДокумент3 страницыKuis UTS Genap 21-22 ACCNatasya FlorenciaОценок пока нет

- Lecture-11 Relevant Costing LectureДокумент6 страницLecture-11 Relevant Costing LectureNazmul-Hassan Sumon0% (2)

- Exam135 08Документ3 страницыExam135 08Rabah ElmasriОценок пока нет

- 20211016231949-A4362 - 201093M 2Документ4 страницы20211016231949-A4362 - 201093M 2bucin yaОценок пока нет

- NameДокумент13 страницNameNitinОценок пока нет

- Managerial Accounting Exam 2 With SolutionsДокумент13 страницManagerial Accounting Exam 2 With Solutionskwathom1Оценок пока нет

- CVP AnalysisДокумент16 страницCVP AnalysisMustafa ArshadОценок пока нет

- CVP AnalysisДокумент7 страницCVP AnalysisSyeda Fakiha Ali100% (2)

- Tutorial 1Документ5 страницTutorial 1FEI FEIОценок пока нет

- DMMR CVP MathДокумент2 страницыDMMR CVP MathSabbir ZamanОценок пока нет

- Exercise Topic 4Документ7 страницExercise Topic 4jr ylvsОценок пока нет

- Bài Tập Tự LuậnДокумент5 страницBài Tập Tự Luậnhn0743644Оценок пока нет

- Chapter 2 Test Study Guide MSДокумент4 страницыChapter 2 Test Study Guide MSdestinyv07100% (1)

- Accounting Study GuideДокумент45 страницAccounting Study Guidelfrei003Оценок пока нет

- CH 22 Exercises ProblemsДокумент3 страницыCH 22 Exercises ProblemsAhmed El Khateeb100% (1)

- Assigment 4Документ12 страницAssigment 4lobo.larisseОценок пока нет

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryОт EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsОт EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsОценок пока нет

- Module 3Документ3 страницыModule 3Kelvin Jay Sebastian SaplaОценок пока нет

- Module 3Документ4 страницыModule 3Kelvin Jay Sebastian Sapla100% (2)

- Module 3Документ3 страницыModule 3Kelvin Jay Sebastian SaplaОценок пока нет

- Bayle Sa Kayle: Note 1 Note 2 Note 3Документ3 страницыBayle Sa Kayle: Note 1 Note 2 Note 3Kelvin Jay Sebastian SaplaОценок пока нет

- Culminating Activity: Quarter 1 - Module 1Документ38 страницCulminating Activity: Quarter 1 - Module 1Kelvin Jay Sebastian Sapla95% (19)

- Most Essential Learning Competency: 1. 2. 3Документ3 страницыMost Essential Learning Competency: 1. 2. 3Kelvin Jay Sebastian SaplaОценок пока нет

- Module 2 - OkДокумент7 страницModule 2 - OkKelvin Jay Sebastian Sapla67% (3)

- A Reading From The Holy Gospel According To MatthewДокумент1 страницаA Reading From The Holy Gospel According To MatthewKelvin Jay Sebastian SaplaОценок пока нет

- Lesson 1: The Nature and Forms of Business OrganizationsДокумент5 страницLesson 1: The Nature and Forms of Business OrganizationsKelvin Jay Sebastian SaplaОценок пока нет

- A. Contrasting Naturopathy With Allopathic Medicine: Prevention vs. CureДокумент1 страницаA. Contrasting Naturopathy With Allopathic Medicine: Prevention vs. CureKelvin Jay Sebastian SaplaОценок пока нет

- Application Letter - LuckyДокумент1 страницаApplication Letter - LuckyKelvin Jay Sebastian Sapla100% (1)

- Sapla & Arrieta Joint Account: Month AmountДокумент1 страницаSapla & Arrieta Joint Account: Month AmountKelvin Jay Sebastian SaplaОценок пока нет

- Teachers ProfileДокумент1 страницаTeachers ProfileKelvin Jay Sebastian SaplaОценок пока нет

- Ethics Audit and Risk AssessmentsДокумент2 страницыEthics Audit and Risk AssessmentsKelvin Jay Sebastian SaplaОценок пока нет

- Quarter 1st Quarter 2nd Quarter 3rd Quarter 4th QuarterДокумент3 страницыQuarter 1st Quarter 2nd Quarter 3rd Quarter 4th QuarterKelvin Jay Sebastian SaplaОценок пока нет

- RICA CIELO SANTIAGO - OkДокумент3 страницыRICA CIELO SANTIAGO - OkKelvin Jay Sebastian SaplaОценок пока нет

- Quarter 1st Quarter 2nd Quarter 3rd Quarter 4th QuarterДокумент3 страницыQuarter 1st Quarter 2nd Quarter 3rd Quarter 4th QuarterKelvin Jay Sebastian SaplaОценок пока нет

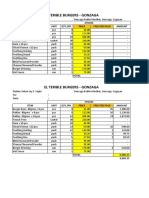

- El Terible Burgers-Gonzaga: Percentage 100.00% 58.87% Net Sales 41.13% 29.35% Net Profit 11.78%Документ6 страницEl Terible Burgers-Gonzaga: Percentage 100.00% 58.87% Net Sales 41.13% 29.35% Net Profit 11.78%Kelvin Jay Sebastian SaplaОценок пока нет

- Quarter 1st Quarter 45,000.00 2nd Quarter 48,300.00 3rd Quarter 53,333.33 4th Quarter 57,025.00Документ3 страницыQuarter 1st Quarter 45,000.00 2nd Quarter 48,300.00 3rd Quarter 53,333.33 4th Quarter 57,025.00Kelvin Jay Sebastian SaplaОценок пока нет

- MADRIAGA, NORALYN - OkДокумент3 страницыMADRIAGA, NORALYN - OkKelvin Jay Sebastian SaplaОценок пока нет

- Quarter 1st Quarter 2nd Quarter 3rd Quarter 4th QuarterДокумент3 страницыQuarter 1st Quarter 2nd Quarter 3rd Quarter 4th QuarterKelvin Jay Sebastian SaplaОценок пока нет

- El Terible Burgers - Gonzaga: Stocks Item Unit QTY./PK. Price Free Per Pack AmountДокумент4 страницыEl Terible Burgers - Gonzaga: Stocks Item Unit QTY./PK. Price Free Per Pack AmountKelvin Jay Sebastian SaplaОценок пока нет

- Quarter 1st Quarter 60,000.00 2nd Quarter 45,000.00 3rd Quarter 55,000.00 4th Quarter 60,000.00Документ3 страницыQuarter 1st Quarter 60,000.00 2nd Quarter 45,000.00 3rd Quarter 55,000.00 4th Quarter 60,000.00Kelvin Jay Sebastian SaplaОценок пока нет

- Enidal Mosmera - OKДокумент3 страницыEnidal Mosmera - OKKelvin Jay Sebastian SaplaОценок пока нет

- LICUAN, NOLIMAR - OkДокумент3 страницыLICUAN, NOLIMAR - OkKelvin Jay Sebastian SaplaОценок пока нет

- TONY PUTDAAN - OkДокумент3 страницыTONY PUTDAAN - OkKelvin Jay Sebastian SaplaОценок пока нет

- Thelma Saldo - OKДокумент3 страницыThelma Saldo - OKKelvin Jay Sebastian SaplaОценок пока нет

- Quarter 1st Quarter 2nd Quarter 3rd Quarter 90,000.00 4th Quarter 53,333.33Документ3 страницыQuarter 1st Quarter 2nd Quarter 3rd Quarter 90,000.00 4th Quarter 53,333.33Kelvin Jay Sebastian SaplaОценок пока нет

- Frances Leah Sapla - OKДокумент3 страницыFrances Leah Sapla - OKKelvin Jay Sebastian SaplaОценок пока нет

- Activity 1: Roygbiv Color Rainbow To BranchesДокумент4 страницыActivity 1: Roygbiv Color Rainbow To BranchesKelvin Jay Sebastian SaplaОценок пока нет

- Decision MakingДокумент8 страницDecision MakingkhandakeralihossainОценок пока нет

- Answer Key Relevant CostingДокумент6 страницAnswer Key Relevant CostingMc Bryan BarlizoОценок пока нет

- Cost Management Problems CA FinalДокумент131 страницаCost Management Problems CA Finalmj192100% (1)

- FA06: Drills On CVP Sensitivity Analysis, Margin of Safety and Operating Leverage SubmissionsДокумент5 страницFA06: Drills On CVP Sensitivity Analysis, Margin of Safety and Operating Leverage Submissionsbaron medinaОценок пока нет

- Relevant CostingДокумент8 страницRelevant CostingaceОценок пока нет

- Exercise 6-4 ,: Nora Aldawood - By: Alanoud AlbarakДокумент6 страницExercise 6-4 ,: Nora Aldawood - By: Alanoud AlbarakmichelleОценок пока нет

- Ringkasan Materi - Akuntansi ManajemenДокумент7 страницRingkasan Materi - Akuntansi ManajemenFahmi Nur AlfiyanОценок пока нет

- AC2105 Seminar 3 Group 3Документ37 страницAC2105 Seminar 3 Group 3Kwang Yi JuinОценок пока нет

- StratДокумент20 страницStratDhea MaligayaОценок пока нет

- Sales MixДокумент20 страницSales MixJohn Evander FloresОценок пока нет

- Flexible Budgets, Variances, and Management Control: IДокумент57 страницFlexible Budgets, Variances, and Management Control: IJowjie TVОценок пока нет

- Variable Costing: A Decision-Making Perspective: True-False StatementsДокумент8 страницVariable Costing: A Decision-Making Perspective: True-False StatementsJanina Marie GarciaОценок пока нет

- EBOOK Etextbook 978 1259565403 Fundamentals of Cost Accounting 5Th Edition Download Full Chapter PDF Docx KindleДокумент61 страницаEBOOK Etextbook 978 1259565403 Fundamentals of Cost Accounting 5Th Edition Download Full Chapter PDF Docx Kindleandrew.sharp585100% (42)

- Shoes For Moos IncДокумент5 страницShoes For Moos IncKar LeongОценок пока нет

- Homework 2: Q1:: Is Should IncludeДокумент35 страницHomework 2: Q1:: Is Should IncludeMichael MaОценок пока нет

- Alpha University College Project Cost Accounting Group Assignment 1 (10marks) Submission Date: 23 April 2016 1Документ3 страницыAlpha University College Project Cost Accounting Group Assignment 1 (10marks) Submission Date: 23 April 2016 1AndinetОценок пока нет

- Cost-Volume-Profit Analysis: Managerial Accounting 14eДокумент39 страницCost-Volume-Profit Analysis: Managerial Accounting 14ecykenОценок пока нет

- A 2021MBA030 YuddhaveerSingh CaseScenariosRBCДокумент7 страницA 2021MBA030 YuddhaveerSingh CaseScenariosRBCmohammedsuhaim abdul gafoorОценок пока нет

- Kingfisher Senior High School: Marketing PlanДокумент38 страницKingfisher Senior High School: Marketing PlanMuyano, Mira Joy M.Оценок пока нет

- StratCost Quiz 2Документ6 страницStratCost Quiz 2ElleОценок пока нет

- PM Revision NotesДокумент70 страницPM Revision NotesAmir ArifОценок пока нет

- Group9 Morrissey ForgingsДокумент6 страницGroup9 Morrissey ForgingsVarun GargОценок пока нет

- Variable Costing: A Decision-Making Perspective: Summary of Questions by Objectives and Bloom'S TaxonomyДокумент35 страницVariable Costing: A Decision-Making Perspective: Summary of Questions by Objectives and Bloom'S Taxonomym6030038Оценок пока нет

- BBQfun Sales Data Worksheet - ASSESSMENT TASK 2 Part AДокумент4 страницыBBQfun Sales Data Worksheet - ASSESSMENT TASK 2 Part AbabluanandОценок пока нет

- MAS - Agamata - 2012 Ed. (Solution Manual)Документ175 страницMAS - Agamata - 2012 Ed. (Solution Manual)King Mercado100% (2)

- Chapter 11 Relevant Costs For Non Routine Decision MakingДокумент24 страницыChapter 11 Relevant Costs For Non Routine Decision MakingCristine Jane Moreno Camba50% (2)

- ACTG 243 Decision Making With Accounting Information Final Exam 01Документ3 страницыACTG 243 Decision Making With Accounting Information Final Exam 01Đinh Ngọc Minh ChâuОценок пока нет

- Topic 3: CVP Analysis: Part 3. BEP On Multiple ProductsДокумент3 страницыTopic 3: CVP Analysis: Part 3. BEP On Multiple ProductsAnonymous dJ6gzA6b2MОценок пока нет

- Buttercup's Apparel Marketing PlanДокумент30 страницButtercup's Apparel Marketing PlanKaren PahunangОценок пока нет

- Diskusi Akuntansi Manajemen Oleh Kelompok 6 (EX 1&2 Variable Costing)Документ3 страницыDiskusi Akuntansi Manajemen Oleh Kelompok 6 (EX 1&2 Variable Costing)Hafizd FadillahОценок пока нет