Академический Документы

Профессиональный Документы

Культура Документы

Marvel Shareholders' Agreement v2 250308

Загружено:

deepanshah17Исходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Marvel Shareholders' Agreement v2 250308

Загружено:

deepanshah17Авторское право:

Доступные форматы

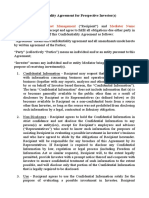

SHAREHOLDERS’ AGREEMENT

BETWEEN

AMIF RE INVESTMENTS IV, LTD

AND

MARVEL LANDMARKS PRIVATE LIMITED

AND

MARVEL EDGE REALTORS PRIVATE LIMITED

MARCH 25, 2008

PRIVILEGED & CONFIDENTIAL

TABLE OF CONTENTS

1. DEFINITIONS AND INTERPRETATION 2

2. TERM AND OBJECTIVES 2

3. CORPORATE STRUCTURE 2

4. ROLE OF THE PARTNER AND ITS UNDERTAKINGS 2

5. PARTNER’S CONTINUING OBLIGATIONS 2

6. FINANCING OF THE COMPANY 2

7. OTHER FINANCIAL MATTERS 2

8. DISTRIBUTION OF RETURNS 2

9. THE DIRECTORS AND MANAGEMENT 2

10. PROCEEDINGS OF MEETINGS OF THE BOARD 2

11. SHAREHOLDER MEETINGS 2

12. INVESTOR AFFIRMATIVE RIGHTS 2

13. FURTHER ISSUANCE OF SHARES 2

14. TRANSFER OF SHARES 2

15. DEFAULT AND CONSEQUENCES 2

16. MERGER OPTION 2

17. COVENANTS OF THE COMPANY 2

18. DISPUTE RESOLUTION 2

19. NOTICES 2

20. MISCELLANEOUS 2

ANNEX 1 –PROPERTY 2

ANNEX 2 - FORM OF DEED OF ADHERENCE 2

SHAREHOLDERS’ AGREEMENT

This shareholders’ agreement (“Agreement”) is made on March 25, 2008

BETWEEN

1. AMIF RE INVESTMENTS IV, LTD., a company incorporated and validly existing

under the laws of Mauritius with its principal place of business at International

Financial Services Limited, IFS Court, Twenty Eight, Cybercity Ebene, Mauritius

(hereinafter referred to as the “Investor”, which expression shall, unless repugnant to

the context or meaning thereof, include its successors and assigns) of the First Part

AND

2. MARVEL LANDMARKS PRIVATE LIMITED, a company incorporated under the

Companies Act, 1956 and having its registered office at A 10/1, Meera Nagar

Koregaon Park, Pune 411 001, India (hereinafter referred to as the "Partner", which

expression shall, unless repugnant to the context or meaning thereof, include its

successors and permitted assigns) of the Second Part

AND

3. MARVEL EDGE REALTORS PRIVATE LIMITED, a company incorporated under the

Companies Act, 1956 and having its registered office at 301-302, Jewel Towers,

Koregaon Park, Pune 411 001, India (hereinafter referred to as the "Company",

which expression shall, unless repugnant to the context or meaning thereof, include

its successors and permitted assigns) of the Third Part.

WHEREAS:

A. Each of the Parties is a signatory to a share subscription agreement dated

March 25, 2008 (the “Subscription Agreement”), pursuant to which the Investor has

agreed to subscribe to the Investor Shares, by itself or through its nominated Affiliate,

representing 90% of the issued and paid up equity share capital of the Company, for

Privileged & Confidential Page 1

a consideration of Rs. 111,95,77,500 (Rupees one hundred and eleven crores ninety

five lacs seventy seven thousand five hundred) (“Investor Amount”).

B. Pursuant to the Subscription Agreement, the Parties are desirous of entering into this

Agreement to set forth their mutual understanding and agreement as to their rights

and obligations as Shareholders and with regard to the capitalisation, organisation,

management and operation of the Company, which shall come into effect from the

Closing Date.

IT IS HEREBY AGREED BY AND BETWEEN THE PARTIES AS FOLLOWS:

1. DEFINITIONS AND INTERPRETATION

1.1 Definitions

In this Agreement, unless the context otherwise requires, the following words and

expressions shall bear the meanings ascribed to them below:

(a) “Additional Shares” shall have the meaning ascribed to the term in

Clause 1.50;

(b) "Affiliate" of a Person (the "Subject Person") means (i) in the case of any

Subject Person other than a natural person, any other Person that, either

directly or indirectly through one or more intermediate Persons, Controls, is

Controlled by or is under common Control with the Subject Person, and (ii) in

the case of any Subject Person that is a natural person, any other Person

that, either directly or indirectly through one or more intermediate Persons,

controls, is controlled by or is under common control with the Subject Person

or who is a spouse, son or daughter of the Subject Person;

(c) “Agreement” shall mean this Shareholders’ Agreement, including the

Recitals above and all the Annexes;

(d) “Annual Lease Rental” shall mean the amount payable over a period of one

year as lease rentals for the Leased Portion net of any maintenance charges,

taxes and property levies;

(e) “Applicable Percentage” shall mean the higher of (i) 11% and (ii) 3.5

percent above the prevailing interest rates offered on 5 year Government of

India securities at the applicable point of time;

(f) “Auditors” shall mean the statutory auditors of the Company;

(g) “Available Surplus” shall have the meaning ascribed to the term in Clause

1.30;

(h) “Board” shall mean the board of directors of the Company;

(i) “Business” shall mean the business of sourcing, establishment, construction,

development, acquisition, leasing, management and operation of real estate

projects (including the Project), including but not limited to commercial, office,

residential, hotel, apartment hotel, townships, special economic zones and/or

other multi use premises, and acquisition of land, or execution of joint

development agreements, in relation thereto;

(j) “Business Plan” shall mean the annual business plan of the Company as

prepared, approved and amended from time to time in accordance with

Clauses 1.13 and 1.14 and other applicable provisions of this Agreement;

Privileged & Confidential Page 2

(k) “Call Notice” shall have the meaning ascribed to the term in Clause 1.53(1)

(b);

(l) “Call Option” shall have the meaning ascribed to the term in Clause 1.53(1)

(a)’

(m) “Chairman” shall mean the Chairman of the Company, being the nominee

Director of the Partner;

(n) “Class B Shares” shall have the meaning ascribed to them under the

Subscription Agreement.

(o) “Closing” shall have the meaning ascribed to the term in the Subscription

Agreement;

(p) “Closing Date” shall have the meaning ascribed to the term in the

Subscription Agreement;

(q) “Completion” shall mean the completion of construction of the Project, lease,

sale or other disposal of all assets comprising the Project and the completion

of marketing and sales programme as per the Business Plan.

(r) “Control” in relation to a Person, shall mean any of: (i) the legal or beneficial

ownership directly or indirectly of more than 50% of the voting securities of

such Person or, (ii) controlling the majority of the composition of the board of

directors of the Person or, (iii) the power to direct the management or policies

of such Person by contract or otherwise. The terms “Controlling” and

“Controlled” shall be construed accordingly.

(s) “Conveyance Deed” shall mean the deed of sale and purchase of the

Property to be executed by the Seller in favour of the Company;

(t) “Deed of Adherence” shall mean a deed substantially in the form set forth in

Annex 2;

(u) “Design Brief” shall have the meaning ascribed to the term in Clause 1.16

(v) “Development Plan” shall have the meaning ascribed to the term in Clause

1.15

(w) “Director” shall mean a director of the Company, being a nominee of the

Investor or the Partner, on the Board;

(x) “Drag Along Notice” shall have the meaning ascribed to the term in Clause

1.54(1)(b);

(y) “Financial Consultant” shall have the meaning ascribed to the term in

Clause 1.28(1)(d);

(z) “Financial Year” shall have the meaning ascribed to the term in

Clause 1.25;

(aa) “Final Valuer” shall have the meaning ascribed to the term in Clause 1.57(1)

(c);

(bb) “FMV” shall mean the fair market price of any shares calculated in

accordance with the FMV Price;

(cc) “FMV Price” shall have the meaning ascribed to the term in Clause 1.57(1)

(c);

Privileged & Confidential Page 3

(dd) “Force Majure Event” shall mean any cause preventing the Partner from

performing its obligations as provided for in Clause 1.75, which arises from or

is attributable to acts of God, war, civil war, riot, civil commotion, strikes or

lockouts, explosion, earthquake, or epidemic.

(ee) “GAAP”, unless specified otherwise, shall mean generally accepted

accounting principles applicable in India, consistently applied;

(ff) “Internal Rate of Return” or “IRR” shall mean the discount rate that, (i) when

applied to the Investor’s investment in the Company (determined as of the

first day of the week in which the investment is made) and (ii) any payments

made out to the Investor (determined on the last day of the week in which

such repayment or distribution is made) would result in the net present value

of that stream of repayments and distributions, to be zero. All such

repayments and distributions to the Investor referred to in (ii) shall be

calculated net of all Indian income and distribution taxes and fees levied on

the Investor in Indian Rupees.

(gg) “Investor Amount” shall mean an amount of upto Rs. 111,95,77,500

(Rupees one hundred and eleven crores ninety five lacs seventy seven

thousand five hundred) contributed by the Investor at Closing for subscribing

to the Investor Shares;

(hh) “Investor Director” shall mean a Director appointed by the Investor under

and in accordance with this Agreement;

(ii) “Investor Shares” shall mean the Class A Shares held by the Investor at the

relevant point in time;

(jj) “Key Managerial Personnel” shall mean heads of all departments of the

Company, including Chief Operations Officer, Chief Financial Officer,

Marketing Head and Head of Human Resources;

(kk) "Laws" shall mean all laws, ordinance, statutes, rules, orders, decrees,

injunctions, licences, permits, approvals, authorisations, consents, waivers,

privileges, agreements and regulations of any Governmental Authority having

jurisdiction over the relevant matter as such are in effect as of the date hereof

or as may be amended, modified, enacted or revoked from time to time

hereafter;

(ll) “Leased Portion” shall have the meaning ascribed to the term in

Clause 1.31(1)(b)(i)(bb).

(mm) “Managing Director” shall mean the managing director of the Company,

being the nominee Director of the Partner;

(nn) “MSDCL” shall mean Maharashtra State Distribution Company Limited

(oo) “Outstanding Partner Amount” shall have the meaning ascribed to the term

in Clause 1.23(1)(b);

(pp) "Person" shall mean any natural person, limited or unlimited liability

company, corporation, general partnership, limited partnership,

proprietorship, trust, union, association, court, tribunal, agency, government,

ministry, department, commission, self-regulatory organisation, arbitrator,

board, or other entity, enterprise, authority, or business organisation;

(qq) “PMC” shall mean Pune Municipal Corporation;

Privileged & Confidential Page 4

(rr) “Partner Amount” shall mean the amount of Rs. 12,43,97,500 (Rupees

twelve crores forty three lakhs ninety seven thousand five hundred), paid by

the Partner for the purchase of the Partner Shares prior to the execution of

the Subscription Agreement;

(ss) “Party” shall bear a reference to the Investor, the Company or the Partner, as

the case may be, and “Parties” shall bear a collective reference to all such

persons;

(tt) “Partner Director” shall mean a Director appointed by the Partner under and

in accordance with this Agreement;

(uu) “Partner Shares” shall mean the Class B Shares held by the Partner at the

relevant point in time;

(vv) “Project” shall mean the establishment, construction, development and

consequent lease or sale of a real estate project to be constructed or

developed on the Property;

(ww) “Project Consultant” shall mean the consultant who may be appointed by

the Investor in relation to the Project;

(xx) “Property” shall mean the parcel of land admeasuring 41,952.84 sq. mts

(forty one thousand nine hundred and fifty two point eight four square meters)

or thereabouts, situated at Pune, Maharashtra and more particularly detailed

in Annex I hereto.

(yy) “Seller” shall mean Automotive Wiring Systems Private Limited.

(zz) “Shares” an equity share in the Company of the face value of Rs. 10 fully

paid-up;

(aaa) “Subscription Agreement” shall have the meaning ascribed to the term in

Recital A;

(bbb) “Target Project Completion Date” shall have the meaning ascribed to the

term in Clause 1.10(d);

(ccc) “Transfer” shall mean any sale, transfer, assignment, disposition, or creation

of any Encumbrance over or other transfer, whether directly or indirectly, and

by whatever means, of all or any portion of the Shares.

(ddd) “Transaction Documents” shall mean collectively this Agreement, the

Subscription Agreement and the Articles;

(eee) “Valuers” shall have the meaning ascribed to the term in Clause 1.57(1)(c).

1.2 Interpretation

Unless the context otherwise requires in this Agreement:

(a) words importing the singular include the plural and vice versa;

(b) reference to Laws shall include laws as may, from time to time, be enacted

amended, supplemented or re-enacted;

(c) reference to a gender includes a reference to the other gender;

(d) reference to the words "include" or "including" shall be construed without

limitation;

Privileged & Confidential Page 5

(e) reference to this Agreement or any other agreement, deed or other

instrument or document shall be construed as a reference to such

agreement, deed or other instrument or document as the same may from

time to time be amended, varied, supplemented or novated;

(f) the headings in this Agreement are for reference only and shall not affect the

interpretation or construction hereof;

(g) a time period for a payment to be made or an act to be done shall be

calculated by excluding the day on which that period commences and

including the day on which that period ends. If the last day of such period is

not a Business Day, the due day for the relevant payment to be made or the

act to be done shall be the next Business Day; and

(h) capitalised terms used but not defined in this Agreement shall have the

meaning ascribed to the term in the Subscription Agreement.

2. TERM AND OBJECTIVES

1.3 Term

This Agreement shall come into force only on the Closing Date and shall, continue to

be valid and in force up to the earlier of the following:

(a) the date on which the Partner ceases to hold any Shares; or

(b) the date on which the Investor ceases to hold any Shares; or

(c) upon the completion of the transactions contemplated under Clauses 1.53,

1.54 and 1.57

1.4 Objectives

The objectives of the Parties in entering into this Agreement are as follows:

(a) to use their respective business skills, know how, experience and expertise to

establish, develop, operate and manage the Project;

(b) to outline the method of management and operation of the Company; and

(c) to ensure that the Project yields maximum value to the Company and its

Shareholders.

1.5 Exercise of Powers

(a) In accordance with the terms of this Agreement, each Shareholder

acknowledges its commitment to the success of the Business and the Project

and in recognition of the objectives enumerated in Clause 1.4 above, agrees

to take all reasonable steps that are within its power and are necessary to

procure that (i) its voting rights as a Shareholder in the Company; and (ii) the

voting rights of Directors nominated by it to the Board, are exercised in a

manner, that:

1. the Company is in conformity with the various terms and provisions of the

Transaction Documents;

2. the nominee Directors nominated by it do not act inconsistently with this

Agreement;

Privileged & Confidential Page 6

(b) The Parties agree that in relation to decisions or resolutions relating to

transactions between the Company and any Shareholder or Affiliate of such

Shareholder, the Shareholder interested in such transaction shall not vote on

such matter or use its rights in any meeting of the Board or the Shareholders,

where the matter is to be decided or resolved.

3. CORPORATE STRUCTURE

1.6 Capital structure

As of the Closing Date and upon the issue and allotment of the Investor Shares and

Partner Shares in accordance with the Subscription Agreement, the Partner and the

Investor will collectively hold the entire issued and paid-up equity share capital of the

Company. The authorised, issued and paid-up equity share capital of the Company

as of that date will be as follows:

(a) Authorised share capital

Rs 50,00,000 (Rupees fifty lakhs), comprising 5,00,000 (five lakh Shares of

Rs. 10 (Rupees ten) each.

(b) Issued and paid-up share capital

Investor - Rs. 18,00,000 (Rupees eighteen lakhs) comprising

1,80,000. (one lakh eighty thousand Class A Shares

of Rs. 10 (Rupees ten) each.

Partner - Rs. 2,00,000 (Rupees two lakhs) comprising 20,000

(twenty thousand) Class B Shares of Rs. 10 (Rupees

ten) each.

1.7 Shareholding prior to Closing and on Closing Date

Prior to Closing:

(a) Prior to Closing, the Partner’s Shareholding is 9,999 (nine thousand nine

hundred and ninety nine) Shares, constituting 99.99% of the aggregate

Shareholding in the Company towards a contribution of Rs. 99,990 (ninety

nine thousand nine hundred and ninety) made by the Partner. The Partner

agrees to consolidate the Shareholding of the Company such that, upon

Closing, the Investor and the Partner are the only Shareholders of the

Company.

(b) The Shareholding of the Company prior to Closing would be as follows:

Shareholder Class ‘B’ Shares Total %

Partner 9999 99.99%

Mr. Vishwajeet 1 .01%

Jhavar

Total 10,000 100%

At Closing:

(c) At Closing, the Investor shall contribute Rs. 89,56,62,000 (Rupees eighty

nine crores fifty six lakhs sixty two thousand) for 1,80,000 (one lakh eighty

thousand) fully paid Class ‘A’ Equity Shares of Rs. 10 (Rupees ten) each,

which will constitute 90% of the aggregate shareholding in the Company on

the Closing Date. The Investor shall also contribute Rs. 22,39,15,500

(Rupees twenty two crore thirty nine lakhs fifteen thousand five hundred) as

Investor Share Application Money (as defined in the Subscription

Privileged & Confidential Page 7

Agreement), which shall be converted into Class A Shares in accordance

with Clause 1.48

(d) At Closing, the Partner shall contribute Rs. 9,95,18,000 (Rupees nine crore

ninety five lakhs eighteen thousand) for 10,000 (ten thousand) fully paid

Class ‘B’ Equity Shares of Rs. 10 (Rupees Ten) each which together with the

Class B Shares held by the Partner prior to Closing Date will constitute 10%

of the aggregate shareholding in the Company on the Closing Date. The

Partner shall also contribute Rs. 2,48,79,500 (Rupees two crore forty eight

lakhs seventy nine thousand five hundred) as Partner Share Application

Money (as defined in the Subscription Agreement), which shall be converted

into Class B Shares in accordance with Clause 1.48

(e) The Shareholding of the Company at Closing would be as follows:

Shareholder Class A Shares Class B Shares Total %

Partner NIL 20,000 10%

Investor 1,80,000 NIL 90%

Total 2,00,000 100%

4. ROLE OF THE PARTNER AND ITS UNDERTAKINGS

1.8 Role of Partner

In addition to their obligations under this Agreement, the Partner will also be

responsible for:

(a) all matters in connection with Completion;

(b) ensuring that the Project is established, developed, operated and managed in

accordance with the terms of the Transaction Documents subject to the

provisions of Clause 12; and

(c) making available its expertise and necessary human and technical resources

for the Project.

1.9 Partner undertakings

(a) The Partner confirms that the Investor shall not be required to create any

Encumbrance over the Investor Shares or any other securities of the

Company held by it, or provide any guarantee or any other security or other

support to any third party, including but not limited to the lenders of the

Company, in relation to the Project or otherwise.

(b) The Partner further undertakes that:

(i) within 3 (three) months from the Closing Date, the Company will

establish an internal control system, comprising of policies,

processes and such other features as are necessary or advisable to

ensure (A) the Company’s effective and efficient operation by

enabling it to manage significant business, operational, financial,

compliance and other risks to achieve the Company’s objectives,

(B) the quality of the Company’s internal and external reporting; and

(C) compliance by the Company with applicable Laws;

(ii) within 3 (three) months from the Closing Date, the Company shall

appoint a reputed chartered accountant/ firm of chartered

accountants as the Company’s internal auditors.

Privileged & Confidential Page 8

(iii) Parties shall arrive at a detailed transfer pricing mechanism for

allocating costs related to the development of the Project, at actuals,

from the Partner to the Company.

5. PARTNER’S CONTINUING OBLIGATIONS

1.10 The Partner agrees and acknowledges that it shall be responsible for the

implementation of the Project and Completion, and that the Project will be carried out

by the Partner on terms and conditions as specified in the Transaction Documents.

The responsibilities of the Partner will include:

(a) obtaining all the approvals and authorisations necessary for the Project

including sanctioned plans and environmental clearances within a period of

12 (twelve) months from the Closing Date;

(b) making available to the Company its technical know-how, brand usage and

expertise in real estate development and construction, including without

limitation, with respect to the administration and management of the Project

and the Company, statutory approvals, marketing and sales etc;

(c) ensuring commencement and execution of the Project in strict conformance

with the development specifications and quality compliance provided in the

Development Plan;

(d) ensuring that Completion is achieved, in accordance with the specifications

detailed in the Development Plan and the Design Brief, within a period of 48

(forty eight) months from the Closing Date and in the event any additional

area is available to the Project by way of purchase of transferable

development rights, that portion of the Project that is developed on the basis

of the transferable development rights shall be completed within a period of

28 (twenty eight) months from the date of purchase of such transferable

development rights, assuming this period extends beyond 48 (forty eight)

months from the Closing Date (“Target Project Completion Date”).

1.11 The Partner will commence, execute and construct the Project in strict conformance

with the development specifications and the quality standards included in the

Development Plan. In this regard the Partner shall exercise a duty of care and

diligence and perform its obligations with the care and discipline as is expected from

a firm of international repute. The Investor, at its sole discretion, will be entitled to

select and cause the Company to appoint a third party (the “Project Consultant”) to

monitor the development of the Project and costs in relation to the Project. It is

agreed that the costs of such Project Consultant will be borne by the Company.

1.12 The Partner will ensure that the Partner engages adequate number of employees,

professionals and consultants from time to time as may be required for the

implementation of the Project, as may be mutually agreed between the Investor and

the Partner. The persons so engaged shall not be employees of the Company and

the Partner shall be responsible for ensuring that all applicable Laws relating to the

employment or engagement of the employees, professionals and consultants for the

purpose of the development of the Project are complied with and hereby indemnifies

the Investor and the Company against any liability that may arise due to a failure of

the Partner to comply with such Laws. It is however clarified that all costs related to

the Project execution will be borne by the Company.

1.13 The Project shall be developed in accordance with the Business Plan. Each Business

Plan shall be on a Project wide basis, in a form and manner and containing such

details as may be agreed to by the Shareholders in writing. The Partner shall procure

and the Company shall present for approval and adoption by the Board no later than

60 (sixty) days from the Closing Date, a proposed Business Plan for the Project for

the Financial Year 2008-09. In the event the Company is not able to present for

Privileged & Confidential Page 9

approval a Business Plan for the Financial Year 2008-09 within 60 (sixty) days, a

further period of 30 (thirty) days shall be granted to the Company to present the

Business Plan. In the event the Partner and the Company are not able to present the

Business Plan within such additional time period, the Investor may prepare a

Business Plan which the Partner shall agree and shall cause its nominee Directors to

accept and adopt as the Business Plan of the Company for the Financial Year 2008-

09. In the event the Partner prepares the Business Plan for the Financial Year 2008-

09 within the time period allowed to the Partner, and the Investor does not approve

the said proposed Business Plan for the Financial Year 2008-09, the Investor shall

within 15 (fifteen) days of receipt of the proposed Business Plan, respond to the

Partner with its comments and suggested changes thereto. The Partner shall within

15 (fifteen) days of receiving the Investor’s comments and suggests, submit a revised

proposed Business Plan to the Investor. In the event that the revised proposed

Business Plan is not accepted by the Investor, till such time as the Business Plan is

agreed by the Investor and approved by the Board, the Board shall apply the

Business Plan with the changes as suggested by the Investor. In the event that the

Investor does not revert with comments or suggestions to the first proposed Business

Plan within 15 (fifteen) (fifteen) days of its submission by the Partner, the Investor

shall be deemed to have no comments thereto and the first proposed Business Plan

shall be approved by the Board. The Business Plan shall be prepared in a format

acceptable to the Investor, containing such details as may be requested for by the

Investor, including but not limited to the following items:

(a) Narrative Description - A narrative description of any

development, management, financing, leasing, renovation, sale or similar

activity proposed to be undertaken;

(b) Projected income statement for the coming year - A

projected income statement (with a monthly break-up shown on an accrual

basis) including key relevant operating statistics like land costs, development

and approval costs, construction costs, average rents, sales rates, operating

costs, management fees, competitive data, etc. (prepared on accrual basis)

on a month-by-month basis;

(c) Projected balance sheet - A projected balance sheet

as of the end of the period;

(d) Financing - Plans for financing of the Property and

regarding the amendment, modification, alteration, change, cancellation, or

prepayment of outstanding indebtedness;

(e) Insurance - Plans to procure title insurance and other

insurance for the Property, or the decrease, increase or other variance in the

insurance;

(f) Projected operating cash flow - A schedule of

projected operating cash flow (including itemized sources and uses of funds)

and projected uses of monies for the coming year on a month-by-month

basis, including a schedule of projected deficits. Also, a projected operating

cash flow on a quarterly basis which includes a projected residual sale and a

projected internal rate of return till the date of final disposition of the properties

and other assets;

(g) Leasing guidelines – To the extent applicable, leasing,

rental or licensing and other operating guidelines for the Property for the

upcoming Financial Year, which shall include to the extent reasonably

feasible, at the time of preparation thereof, (i) a standard form or forms of

lease, licensing or rental documents being offered to prospective tenants, (ii)

a rent schedule setting forth proposed rentals for the commercial, retail and

other areas for the upcoming fiscal year, (iii) a description of any tenant

Privileged & Confidential Page 10

inducements, concessions, or allowances to be offered to prospective

tenants, and (iv) such other reports, schedules or analysis as may be

reasonably requested by the Shareholders;

(h) Projected Construction - A description of any

proposed construction and capital expenditures, including projected dates for

commencement and completion of the foregoing;

(i) Development Schedule - A development schedule

identifying the projected development periods as well as the times for

completion of the various stages of the property and the Project expenses

attributable to each such stage;

(j) Proposed Investments - A description of any proposed

management, development and acquisition opportunities that need to be

evaluated;

(k) Professional Services - A description, including the

identity of the recipient (if known) and the amount and purpose, of all fees and

other payments proposed or expected to be paid for professional services or

other services rendered by third Persons;

(l) Required Capital - A description of all capital required

during the Business Plan year in question, a statement of the projected

source of such capital (i.e. whether from loans or Shareholder capital or

otherwise) and a schedule of the dates on which all capital is expected to be

required (if any);

(m) Review of Prior Year’s Plan - A narrative detailing the

performance against the Business Plan for the prior year, identifying and

analyzing any variances of actual results from projected results;

(n) Staffing - A staffing plan identifying by name the project

or property manager, the assistant project or property manager and all other

personnel anticipated to be necessary to manage the Project or Property,

including employees of the properties or project managers;

(o) Operating Partner Organization - An updated

organization chart with names and titles of all people involved in the

development and management of a property;

(p) Projected Staffing Increases - A list of all new/empty

positions expected to be filled in the coming year, including compensation and

a position description;

(q) Other Information - A detailed description of such other

information, plans, maps, contracts, agreements or other matters necessary

in order to inform the Shareholders of all matters relevant to the development,

operation, management, financing and sale of the property or any portion

thereof or to enable the Shareholders to make an informed decision with

respect to its approval of such Business Plan, and such additional information

and schedules as may be desired by any Shareholder.

1.14 The Partner shall procure and the Company shall prepare a proposed Business Plan

for the Company for each subsequent Financial Year at least 60 (sixty) calendar days

prior to the end of the preceding Financial Year and shall provide the Investor and the

Investor Directors with a copy of such proposed Business Plan to be presented for

approval by the Investor and adoption by the Board, and the vote with respect to such

approval and adoption shall occur prior to the end of the preceding Financial Year. In

the event that the Partner fails to submit a Business Plan, the Board shall apply the

Privileged & Confidential Page 11

Business Plan for the previous Financial Year with a markup of 10% (ten percent) on

all costs and the Investor shall have the option, but not the obligation, to prepare a

Business Plan which the Partner shall agree and shall cause its nominee Directors to

accept and adopt as the Business Plan of the Company. In the event that the Investor

does not approve the Business Plan first proposed by the Partner, it shall within 15

(fifteen) days of receipt of the first proposed Business Plan, respond to the Partner

with its comments and suggested changes thereto. The Partner shall within 15 days

of receiving the Investor’s comments and suggestions, submit a revised proposed

Business Plan to the Investor. In the event that the revised proposed Business Plan is

not accepted by the Investor, till such time as the Business Plan is agreed by the

Investor and approved by the Board, the Board shall apply the Business Plan for the

previous Financial Year with a markup of 10% (ten percent) on all costs. In the event

that the Investor does not revert with comments or suggestions to the first proposed

Business Plan within 15 days of its submission by the Partner, the Investor shall be

deemed to have no comments thereto and the first proposed Business Plan shall be

approved by the Board.

1.15 The Partner shall prepare a Development Plan in a form and manner satisfactory to

the Investor within 90 (ninety) days of the Closing Date or such other date as may be

mutually agreed upon between the Investor and the Partner. The Development Plan

shall allow sufficient time for mobilisation and commencement of works on Site in

accordance with the Development Plan. The Development Plan shall contain all

information required for the development of the Project, including but not be limited

to:

(a) Statement of Development intent Designer/s, contractor/s, supplier/s,

procurement strategy;

(b) Marketing & Sales strategy;

(c) Area schedule;

(d) Financial model/ business case;

(e) Environmental guidelines;

(f) Sustainability guidelines;

(g) Quality guidelines;

(h) Safety guidelines;

(i) Development programme;

(j) Architectural,

(k) Structural,

(l) Mechanical and electrical planning performance criteria;

(m) Planning & staging strategy.

1.16 Upon the finalization of the Development Plan, the Partner shall also prepare a

Design Brief containing complete details under the heads specified hereunder, which

shall be provided to the Company for its review and approval. The Company shall

within 14 days of the Design Brief and the Development Plan being submitted,

approve the same or require modifications, which modifications shall be caused to be

carried out by the Partner forthwith. The Design Brief shall include a final and

complete set of drawings and specifications to permit construction of the project on a

phase wise basis. Such interim plans and specifications shall be presented to the

Investor periodically, for review and approval and finalised within thirty (30) days

there from or as may be mutually agreed upon. When the interim plans and

specifications are presented to the Investor for review, the Investor shall have fifteen

(15) days to conduct its review and to suggest any changes thereto, which changes

shall be carried out by the Partner forthwith. The Design Brief shall include:

(a) Massing diagrams, as applicable

(b) Engineering studies as applicable supporting the design solutions and cost

benefit analysis

(c) Architectural, structural and Mechanical and electrical planning performance

criteria solutions to be applied on the Project

(d) Material finishes and systems to be supplied and installed on the project

Privileged & Confidential Page 12

1.17 In the event of any variation from the Development Plan or Design Brief in terms of

design, cost, intent and performance, the Partner shall provide the Company with a

report containing all relevant details of such variation, the potential consequences

thereof and the proposed steps to mitigate the impact of such variation on the Target

Project Completion Date. The variation reported shall not be deemed to be approved

by the Company unless an explicit approval is issued in writing. The Partner is not

permitted to make any variation from the Development Plan or the Design Brief

unless the same is approved in accordance with the provisions of this Clause 1.17

1.18 The Partner shall procure that the all books, papers and records of the Company and

all books, papers and records relating to the Project are, during normal business

hours, available for inspection by the Investor or its authorised representative and the

Partner shall provide full cooperation and assistance in this regard and shall also

provide the Investor with such copies, extracts and memoranda of such documents

and material as may be sought for by the Investor or its authorised representative.

1.19 The Partner shall procure that the Company keeps the Property, its assets and the

Project adequately insured in amounts representing their full replacement or

reinstatement value with a reputable insurance company, against all risks (including

fire, earthquake, damage, injury, third party loss and loss of profits) as are generally

insured against by responsible companies in the same industry and such other risks

as may be reasonably required by the Shareholders and/or any lender of the

Company.

1.20 The Partner shall procure that the Company shall, within 30 (thirty) calendar days of

the execution of this Agreement, obtain a ‘Directors & officers’ insurance policy for the

benefit of the Directors, the value of which shall be determined by the Board. The

Company shall, during the validity of this Agreement, bear the cost of all premia due

in respect of such insurance policy. The Partner agrees that the value of an insurance

policy per Investor Director shall be not less than the Indian Rupee equivalent of

USD 1,000,000 (United States Dollars One Million).

1.21 The Partner shall exercise its rights and powers so that the Company will maintain

and duly administer the internal control system established pursuant to Clause 1.9(1)

(b)(i), to ensure the fulfilment of the intention of the Parties under the said Clause.

6. FINANCING OF THE COMPANY

1.22 Use of Investor Amount

Unless otherwise agreed in writing by the Investor, the Investor Amount and the

Partner Amount shall be applied only for the following purposes:

(a) Partial funding of the acquisition by the Company of ownership interest in the

Property to the extent of Rs.112,17,47,500 (Rupees one hundred and twelve

crores seventeen lacs forty seven thousand five hundred) by payment to the

Seller in accordance with the Conveyance Deed in addition to the stamp

duty, brokerage, legal fees and other incidental expenses in relation thereto;

(b) funding the initial development costs of the Property and any other expenses

in relation to the formation of the Company; and

(c) as provided in the Business Plan to be finalised in accordance with

Clause 1.13 above.

1.23 Further financing

(a) The Parties intend that post the investment of the Investor Amount, the

Company should be self financing and should make its best efforts to obtain

additional funds by debt from third parties without recourse to its

Privileged & Confidential Page 13

Shareholders. The Parties shall procure that the Company shall make its best

efforts to negotiate and execute contracts with commercial banks, financial

institutions and other third parties to avail debt financing facilities required in

the ordinary course of the Company’s business, while ensuring that such

arrangements are in accordance with the terms hereof, the Business Plan,

and are subject to the receipt of regulatory and government approvals

required under applicable Laws in this regard. The Investor and the Partner

shall use their best efforts to extend their reasonable cooperation and support

in this regard.

(b) The Parties agree that that the cost of the Property is Rs.167,42,50,000/-

(Rupees one hundred sixty seven crores forty two lacs fifty thousand)

including the amount of Rs. 15,00,00,000 (Rupees fifteen crores) paid as

security deposit by the Partners (the “Outstanding Partner Amount”) but

exclusive of stamp duty and brokerage. Pursuant to the partial funding as

contemplated under Clause 1.22(1)(a), a further amount of Rs. 55,25,02,500

(Rupees fifty five crores twenty five lacs two thousand five hundred) will be

due and payable to the Seller upon the delivery of complete possession of

the Property, .

(c) In the event that the Company is not able to raise funds in the manner

contemplated in Clause 1.23(1)(a), for the purposes mentioned in Clauses

1.23(1)(a) and 1.23(1)(b), the Investor and the Partner shall contribute the

same in the form of additional equity funding to the extent and in the manner

contemplated in Clause 13.

1.24 Refund of Outstanding Partner Amount

The Parties agree that the Outstanding Partner Amount has been paid by the Partner

as a security deposit to enable the purchase of the Property and the Company shall

refund this amount in full within a period of 4 (four) days from the Closing Date.

7. OTHER FINANCIAL MATTERS

1.25 Financial Year

The Company shall have its financial year beginning on the first day of April of a

calendar year and ending on the last day of March in the succeeding calendar year,

unless otherwise mutually agreed between the Parties in writing (“Financial Year”).

1.26 Auditors

The Auditors shall be one of Ernst & Young, KPMG, PriceWaterhouseCoopers or

Deloitte Haskins & Sells, as appointed by the Board for the Financial Year

commencing from April 1, 2008, unless otherwise agreed to by the Investor in writing.

The Investor may, at its own cost and expense, audit the operations of the Company,

using its own employees, or external auditors/ chartered accountants/ consultants.

The Partner shall facilitate such audit/ investigation and cause the Company to

provide sufficient access to its books and records and reasonable co-operation of its

officers and employees.

1.27 Accounting principles

The Company shall adopt the GAAP in relation to its financial statements.

1.28 Financial statements, provision of financial and operational data

(a) The Company shall maintain proper books of account and records in order to

provide financial statements drawn up in compliance with all relevant Indian

Privileged & Confidential Page 14

statutory and accounting standards. All books of accounts, statutory records

and financial statements shall be maintained in the English language.

(b) The Partner shall procure that the Company shall promptly provide to each

Director:

(i) as soon as available, but in any event within 90 (ninety) calendar

days following the close of each Financial Year, a true copy of the

audited consolidated balance sheet of the Company as at the end of

such Financial Year and the related consolidated statements of

income, statements of changes in shareholding pattern and

statements of cash flows of the Company for such Financial Year, in

reasonable detail and stating in comparative form the figures as at

the end of and for the immediately preceding Financial Year. All such

financial statements shall be complete and correct in all material

respects and shall be prepared in conformity with GAAP and applied

on a consistent basis throughout the periods reflected therein except

as stated therein;

(ii) minutes of meetings of the Board, its committees and the

Shareholders’ within 14 (fourteen) calendar days of the occurrence of

such meetings;

(iii) copies of all documents and other information regularly provided to

any other Shareholder, including any management or audit or

investigative reports provided to any other Shareholder;

(iv) additional information and details of any event or development at the

Company which has a significant impact on the Business, operations,

conditions (financial or otherwise), prospects, results of operations,

properties, assets or liabilities of the Company; and

(v) relevant material information in respect of the Project, including the

Business Plan, capital expenditure budgets and management

reporting information not set forth above.

(c) The Partner agrees and undertakes to keep confidential and shall procure

that its Representatives (as hereinafter defined) will provide such information

on strictly a need to know basis, keep confidential at all times all information

and documents under Clause 1.28(1)(b) and shall not use or disclose such

information for any purpose, except with the prior written consent of the

Investor.

(d) The Investor shall have the right (but not the obligation), to appoint the Chief

Financial Officer (“CFO”), who shall be responsible for the day to day

financial management of the Company and will be a joint signatory of the

Company. In the event that the Company has not appointed a CFO as above,

the Investor shall have the right to appoint a qualified and competent person

to act as the Financial Consultant to the Company (“Financial Consultant”).

The Partner and the Company shall cause the Auditor to co-operate with and

provide any information requested by the Financial Consultant. At the sole

option of the Investor, the Financial Consultant may have joint signing

authority for any release of moneys by the Company. The cost of the

Financial Consultant shall be paid for by the Company. The Financial

Consultant shall be actively involved with the day to day activities of the

Company.

1.29 Cash Flow / Bank Accounts management

Privileged & Confidential Page 15

(a) The cash flows of the Company will be conducted out of two account; the

Collection Account and the Construction Account (as defined below).

(b) All the proceeds received from the sale / lease of units in the Project will be

received by way of cheques favouring the Collection Account which will be

set up by the Parties in the manner contemplated under the Subscription

Agreement with a reputed bank and shall be appropriately accounted for. The

Investor and the Promoters will be joint signatory for the Collection Account.

The Collection Account will be used only for distributions to Shareholders and

for funding the Construction Account.

(c) The Parties will set up a separate escrow account (“Construction

Account”), monies from which shall, until Completion, be utilized only

towards the development of the Project. The Construction Account shall be

operated by the Company acting through the CFO or through the Financial

Consultant (as the case may be) and the Investor shall have the option to act

as a joint signatory if it so chooses. All records and documents relating to the

withdrawals made from and deposits made to the Construction Account shall

be provided (in formats acceptable to the Investor) to the Project Consultant

on the 2nd (second) business day of every calendar week. Any use of the

Construction Account monies or any part of thereof for any purpose other

than the development of the Property shall constitute breach/default of this

Agreement. All monies in the Construction Account shall be utilized only for

construction related activities with payments either being made directly to

suppliers to the Project or for labour engaged in the Project. Any monies

remaining in the Construction Account on the Completion of the Project shall

be utilized for distribution to Shareholders. The Construction Account shall be

funded from the Collection Account, in accordance with the Business Plan.

8. DISTRIBUTION OF RETURNS

1.30 Distribution Policy

(a) The Board shall adopt a policy of distributing to the Shareholders, on a pari

passu basis in proportion to their respective Shareholding in the Company, all

distributable cash balances available to the Company generated by the

operations of the Business, consistent with prudent financial management

and having regard to Applicable Law, the Business Plan, taxation, working

capital and operational requirements of the Company and the terms of any

financing agreements under which the Company has borrowed funds in

relation to the Project (“Available Surplus”). The Investor and the Partner

will co-operate to ensure judicious use of mechanisms including buy back of

Shares, capital reduction, liquidation or any other means permitted by

applicable Laws, for the purpose of making the distributions to the

Shareholders to minimise the incidence of taxes on the Company and on the

Shareholders. Each Party shall be solely liable or responsible to bear and

pay the corporate income tax or any other tax payable on their respective

incomes, earned by them by way of dividend or otherwise, from out of the

business of and/or distributions by the Company.

(b) The Board may, subject to and in accordance with applicable Laws, at any

time declare and pay interim dividends to the Shareholders which shall be

paid from the Company’s net profits determined from the most recent interim

un-audited financial statements of the Company.

1.31 Promote

(a) All distributions shall be made by the Company simultaneously to the

Promoters and the Investor in the following manner:

Privileged & Confidential Page 16

(i) Until Investor achieves an IRR of 24% (“First Hurdle”):

Such that the returns to the Investor and the returns to the Partner stand in

the ratio of 90:10; and

(ii) After the Investor Achieves an IRR of 24% :

Such that the returns to the Investor and the returns to the Partner stand in

the ratio of 67:33.

Post the achievement of the First Hurdle, the Company shall take all steps to

vary the rights attached to the Class B Shares in order that the distributions

calculated in accordance with this Clause 1.31(1)(a)(ii) are achieved.

Notional Promote

(b) Upon Completion of the Project, in the event that any part of the Project

remains unsold, then the rights of the Class B Shares will be varied such that

the Class B Shares will be entitled to a higher proportion of the distributions

by the Company computed in the proportion of Notional Partner Promote to

the Deemed Free Cash Flows. Upon the computation of the Notional Partner

Promote, all distributions to be made to the Partner will be 10% plus the

Notional Partner Promote and the remainder shall be distributed to the

Investor.

For the purposes of this Clause 1.31(1)(b):

(i) “Deemed Free Cash Flows” shall mean:

(aa) all amounts available for distribution to the Investor and the

Promoter at the time of computation of the Deemed Free

Cash Flows; plus

(bb) in the case of the lease of any portion of the Project

(“Leased Portion”), the value of the Leased Portion

(the “Fair Property Value”), calculated as per the following

formula:

Fair Property Value = 98% x Annual Lease Rental

--------------------------------------

Applicable Percentage

Less any outstanding debts and liabilities and any capital

gains or other taxes to be paid if the property were to be

sold.

(ii) “Notional Partner Promote” shall mean Deemed Free Cash flows

as reduced by Deemed Investor IRR and thereafter multiplied by

23%.

(iii) “Deemed Investor IRR” shall mean the notional amount to be

distributed to the Investor out of the Deemed Free Cash Flows as

would result in the achievement of an IRR of 24% to the Investor

taking into account all distributions made till the date of computation

of the said Deemed Investor IRR.

Upon the computation of the Notional Partner Promote, all distributions to be made to

the Partner will be 10% plus the Notional Partner Promote and the remainder shall be

distributed to the Investor.

Privileged & Confidential Page 17

9. THE DIRECTORS AND MANAGEMENT

1.32 Supervision by the Board

The Board shall be responsible for the overall direction, supervision and management

of the Company. The Parties shall exercise their respective voting rights and shall

cause the Directors nominated by them to exercise their powers, in a manner so as to

ensure compliance with this Clause 9.

1.33 Chairman and Managing Director

(a) The office of Chairman shall be held by a Partner Director (“Chairman”). The

Chairman shall have no casting vote either in a general meeting of the

Company or at any meeting of the Board. In addition to the duties under the

Act, the Chairman shall be entitled to preside over all meetings of the Board

or committees thereof and at all shareholder meetings of the Company. In the

absence of the Chairman at a meeting of the Board or committee or the

shareholders, the Directors present shall nominate one of the Partner

Directors to act as the Chairman of such meeting.

(b) The office of Managing Director shall be held by a Partner Director

(“Managing Director”), who shall be in charge of day to day management of

the Company, with such additional powers as may be decided by the Board

from time to time.

1.34 Constitution of Board

(a) On Closing, and so long as the Investor and the Partner hold any shares in

the Company, the Board shall consist of atleast 5 (five) Directors, of whom 3

(three) shall be Investor Directors and 2 (two) shall be Partner Directors. The

Investor shall have the option to nominate 1 (one) more Investor Director to

the Board, in which case the Board shall consist of 6 (six) Directors, of whom

4 (four) shall be Investor Directors and 2 (two) shall be Partner Directors.

(b) The Investor shall, additionally, be entitled to nominate and maintain one

non-voting observer on the Board. The observer shall be entitled to receive

notice of and attend all Board meetings, but shall not be entitled to vote at

such meetings. Further, the observer shall be provided all information and

materials provided to a Director, whether under this Agreement or under

applicable Law.

(c) The Shareholders shall vote at general meetings of the Company so as to

ensure that the nominees of the Investor and the Partner are duly appointed

on the Board.

1.35 Qualification shares and votes

(a) The Directors shall not be required to hold any qualification Shares.

(b) Each Director shall be entitled to cast 1 (one) vote at any Board meeting and

in respect of all circular resolutions proposed to be passed.

1.36 Removal or replacement of nominee Directors

(a) The Partner and the Investor shall be entitled by notices in writing to the

Company at its registered office to appoint, remove or replace their

respective nominee Directors. In the event of a casual vacancy arising on

account of the resignation of a nominee Director or the office of a nominee

Director becoming vacant for any reason, the Party who has appointed such

Director shall be entitled to fill the vacancy. The Parties shall exercise all their

Privileged & Confidential Page 18

rights and powers in support of the appointment or removal or replacement of

such person forthwith (and in any event within 7 (seven) Business Days of

such nomination or at the next Board meeting, whichever is earlier) as a

Director and unless the nominating Party changes or withdraws such

nomination, such person shall be confirmed as a Director at the forthcoming

annual general meeting of the Company.

(b) The Party removing or replacing its nominee Director shall indemnify and

keep indemnified the Company against any liability suffered by the Company

a result of such nominee Director’s removal from office or replacement.

(c) Each Party shall be entitled in accordance with the Act, through its nominee

Director, to nominate an alternate in his place, and the Board shall, on receipt

of a notice in this regard, appoint such nominated person as an alternate

Director. The Directors shall also be entitled to remove and replace their

nominated alternate Director and nominate another in his place.

(d) An alternate Director shall be entitled to receive notice of all meetings of the

Board, to attend and vote at any such meeting at which the Director for whom

he acts as an alternate is not personally present, to exercise and discharge

all the functions, powers and duties as a Director.

(e) An alternate Director shall, in addition to any ground under the Act on which

he vacates his office, automatically vacate his office as an alternate Director

if the Director for whom he is appointed ceases to be a Director.

1.37 Project Control Group

(a) The Partner and the Company shall jointly establish a project control group

(“PCG”) comprising 2 representatives of the Company, who will be nominated

by the Investor, and 2 of the Partner.

(b) The Partner and the Company shall agree upon a meeting schedule for the

PCG ensuring that meetings are held at least once every calendar month

through the duration of the development of the Project.

(c) The PCG will be a forum for the discussion, review and approval by the SPV

of matters of cost, design, quality and programme including, and the PCG

report shall include but not be limited to, the following:

i. status of discussions, negotiations,

approvals and conditions pertaining to the Site, relevant authorities,

design consultants, suppliers and contractors, sales and marketing

and tenants and occupation

ii. safety, environment and quality

assurance issues.

iii. the development of the design and

design changes.

iv. the Contract Programme.

v. matters affecting the construction value

and the Date for Completion, such as changes to the scope of work,

delays and extensions of time.

vi. reports, submissions, prototypes and

samples.

vii. progress and Completion and parts

thereof

viii. rectification of matters not in

accordance with the agreement.

ix. Commissioning completion and

handover, and

Privileged & Confidential Page 19

x. Financial model/ business plan

(d) The PCG shall issue a monthly report in a format satisfactory to the Investor.

1.38 Pricing policy

All policy decisions regarding lease or sales including pricing in relation to the Project

shall be taken by the Partner and the Investor (it being clarified that these decisions

shall be applicable for an identified period of time and not on a case to case basis) at

Board meetings or as may be mutually agreed upon.

10. PROCEEDINGS OF MEETINGS OF THE BOARD

1.39 The Board shall meet at such intervals as may be necessary to discharge its duties,

but in any case in accordance with the Act, the Articles and this Agreement. In

addition to physical meetings of the Board, the Board may, subject to applicable Law,

resolve and act by circulation of resolutions.

1.40 At least 5 (five) Business Days’ prior written notice of each Board meeting shall be

given to each Director at his address in India or elsewhere notified to the Company in

writing, unless in any particular case all Directors agree in writing to a shorter notice

period. Every such notice shall contain an agenda identifying sufficient details of the

business to be transacted with all necessary accompanying papers and no item shall

be transacted at any such meeting of the Board unless the same has been stated in

full and in sufficient detail in the notice convening the meeting, provided however, that

with the unanimous consent of all the Directors present at the meeting, any item or

business, other than items covered under the affirmative rights referred to Clause 12,

not included in the agenda may be transacted at the meeting.

1.41 The quorum at meetings of the Board shall be 2 (two) Directors, one of whom shall be

an Investor Director. If there is no quorum within 30 (thirty) minutes of the time

specified in the notice calling the Board meeting, the meeting shall stand adjourned to

the same day of the immediately following week at the same time and place (if such

day is not a Business Day, then the meeting shall be held on the next Business Day

at the same time and place). If there is no quorum within 30 (thirty) minutes of the

appointed time for such adjourned meeting, then the Directors present (not being less

than two) shall constitute quorum. The meetings will be subject to the provisions of

Clause 12 and the rights of the Investor therein.

1.42 The CFO or the Financial Consultant appointed by the Investor may be invited, at the

sole discretion of the Investor to be present in any meeting of the Board, committee

or Shareholders, but shall not be entitled to vote.

1.43 Notwithstanding the provisions of Clause 1.40, to the extent permitted by the Act, a

resolution by circulation shall be as valid and effectual as a resolution duly passed at

a meeting of the Directors called and held provided it has been circulated in draft

form, together with the relevant papers, if any, to all the Directors and has been

approved by a majority of the Directors entitled to vote thereon. It is clarified that in

case of a circular resolution, the requirement of affirmative votes, as provided in

Clause 12, shall be applicable.

11. SHAREHOLDER MEETINGS

1.44 Subject to Clause 12, all resolutions in relation to the Company which are required by

applicable Laws to be referred to or passed by Shareholders must be passed by the

majority required under applicable Laws for such matters in respect of which a

resolution is required.

Privileged & Confidential Page 20

1.45 All meetings of the Shareholders shall be held in accordance with the Act, the Articles

and this Agreement.

1.46 The quorum for a general meeting of the Shareholders shall be arrived at in

accordance with the Act, provided that there shall be no quorum unless the Investor

is present throughout the meeting. If there is no quorum within 30 (thirty) minutes of

the time specified in the notice calling the Shareholders’ meeting, then the meeting

shall stand adjourned to the same day of the immediately following week at the same

time and place (if such day is not a Business Day, then the meeting shall be held on

the next Business Day at the same time and place). If there is no quorum within 30

(thirty) minutes of the appointed time for such adjourned meeting, then the

Shareholders present shall constitute quorum, provided that no matters requiring the

affirmative votes of the Investor pursuant to Clause 12 shall be discussed or voted

upon at any Shareholders’ meeting which the Investor’s representative shall not have

attended.

12. INVESTOR AFFIRMATIVE RIGHTS

1.47 The Company shall not take any of the following actions unless such actions have

been approved by an Investor Director/ authorised representative, and if such matter

requires the approval of the Shareholders of the Company, unless the Investor shall

have voted in favour of the relevant resolution. Notwithstanding any provision to the

contrary in this Agreement, no resolution passed with respect to any of the following

matters shall be valid unless it has received the affirmative vote of an Investor

Director/ authorised representative:

(i) Any issue of Shares or convertible securities or granting of any rights or

options to acquire Shares

(ii) Investment into any company, partnership, joint venture or any similar

transactions

(iii) Commencement of any other business

(iv) Merger, Amalgamation, De-merger, Restructuring or other similar transactions

involving the Company or subsidiaries or any asset of the Company

(v) Disposition of whole or part of the assets or other similar dealings of any

nature other than sale, lease or license to bonafide purchasers, lessees,

licensees

(vi) Change in composition of the Board

(vii) Acquisition of land / property or interests therein other than the Property

(viii) Carrying out any sale, transfer or assignment in respect of any intellectual

property rights

(ix) Allowing the transfer of Shares held by the Partner

(x) Effecting a recapitalization or reclassification of any outstanding capital stock

of the Company

(xi) Approval and amendment of the Project budget, development brief or plan

(xii) Appointment of, architects, engineers, general contractors, and other

consultants whose total fees or contract value exceeds Rs. 20,000,0001;

(xiii) Declaration of payment of any dividends or distribution of profits;

(xiv) Incurring any capital expenditure or giving any commitments not specifically

approved as part of the Project budget in excess of Rs. 2,000,000;

(xv) Delegation of the authority or any powers of the Board to any committee of

the Board or any person;

(xvi) Any transfer of the whole or part of any undertaking of the Company or

substantially all of the assets of the Company;

(xvii) Creation of any encumbrances to secure any obligations(s) of the Company;

(xviii) Undertaking or agreeing to undertake any commitment on behalf of the

Company, whether or not in the nature of a undertaking, indemnity, surety,

including any commitment not specifically approved as part of the approved

Development Plan, except for commitments made to the PMC or its

departments or MCDCL;

1

Privileged & Confidential Page 21

(xix) Incurring of any debt from any bank/ financial institution (or the refinancing

thereof) other than as approved in the Development Plan / Business Plan;

(xx) Any related party transaction including transactions with individuals or entities

affiliated to or controlled by the Partner;

(xxi) Any alterations to the Memorandum or the Articles of Association;

(xxii) Appointment and Removal of the Auditor, the statutory auditors of the

Company shall be one of Ernst & Young, KPMG, Price Waterhouse Coopers,

Deloitte Haskins & Sells, as appointed by the Board from time to time.

(xxiii) Initiation of any bankruptcy or insolvency proceedings by the Company;

(xxiv) Any disbursement of cash in excess of Rs. 10,00,000 (Rupees ten lakhs) in a

year from any bank account of the Company, except for labour related

payments backed by sufficient documentation;

(xxv) Entering into, amending, modifying or terminating any material agreement to

which the Company is a party other than those entered into in the normal

course of business;

(xxvi) Institution of any legal proceedings in the name of the Company.

(xxvii) Hiring of any employee performing functions equivalent to that of department

head or any controller or compliance officer

(xxviii) Determining and amending the terms of employment of the Key Managerial

Personnel of the Company

(xxix) Issuance of any loans to Key Managerial Personnel

(xxx) Change in the status of the Company from private to public

(xxxi) Change to accounting or tax compliance policies

(xxxii) Changes in the financial year for preparation of audited accounts

(xxxiii) Making any amendments to the Development Plan / Business Plan or any

financing agreements

(xxxiv) Making a general assignment for the benefit of the Company’s creditors or

admitting in writing the Company’s inability to pay its debts when they become

due

(xxxv) Entering into any hedging or forward contracts for currency or any other

commodity;

(xxxvi) Capitalization of reserves

In respect of the matters set out above, all decisions of the Company, insofar as the

decisions relate to any subsidiary of the Company will not be valid, unless the

Investor Director consents to the same; provided always that the Company itself has

the requisite power and authority to decide such matter in respect of such subsidiary,

whether by reason of majority ownership or control of the board of directors of the

subsidiary or otherwise.

13. FURTHER ISSUANCE OF SHARES

1.48 It is agreed that the Company is likely to require a sum of Rs. 24,87,95,000 (Rupees

twenty four crores eighty seven lakhs ninety five thousand), which will be contributed

by the Investor and the Partner in the ratio of 90:10. The Investor and the Partner

have already brought in this amount by way of Investor Share Application Money and

Partner Share Application Money. Upon receiving written notice from the Investor, the

Company shall issue 45,000 (forty five thousand) Class A Equity Shares to the

Investor and 5,000 (five thousand) Class B Shares to the Partner. In the event that

the notice as contemplated under this Clause is not issued by the Investor within 5

(five) months from the date of Closing, the Investor Share Application Money and the

Partner Share Application Money shall be refunded forthwith.

1.49 It is agreed that should the Company require an additional equity funding for the

purposes contemplated in Clause 1.23 above, subject to a maximum of

Rs. 50,00,00,000 (Rupees fifty crores), such requirement would be funded by the

Investor and the Partner in the ratio of 90:10, and failure by the Partner to fund the

above requirement would amount to a default under Clause 15 of this Agreement.

Privileged & Confidential Page 22

1.50 Any further issue of Shares by the Company, over and above the additional equity

funding in Clause 1.48 above (“Additional Shares”), shall be carried out only with the

prior written consent of the Investor. On procuring such written consent, the Shares

shall be offered to the Shareholders on terms and conditions which, subject to

applicable Laws, are identical to the existing Shares held by them.

1.51 Any such additional equity capital infusion into the Company for Additional Shares will

be funded by the Investor and the Partner in proportion to their respective ownership

percentages in the Company. In case one of the Parties is unable to fund its

proportionate share, the other Party shall have the right to fund such shortfall at a

33% discount to the FMV and the shareholding of the non-funding Party in the

Company shall be accordingly diluted. The Partner agrees that the Investor shall

have the discretion to nominate its Affiliate or a third party to subscribe to such

additional Shares.

14. TRANSFER OF SHARES

1.52 Transfers

The Partner agrees that so long as the Investor holds any Shares in the Company,

neither the Partner nor any of its Affiliates shall directly or indirectly Transfer any

Shares without the prior written consent of the Investor. The Investor agrees that till

the Completion, it shall not transfer its shares to another real estate developer.

1.53 Investor’s Call Option

(a) Post Completion, the Investor shall have the right but not the obligation to

purchase all but not less than all the shares held by the Partners based on

the FMV (the “Call Option”).

(b) In such an event, the Investor shall send a written notice (the “Call Notice”)

to the Partner, informing the Partner of its intention to purchase the Shares

held by the Partner. Upon receipt of the Call Notice by the Partner, the

Partner and the Investor shall forthwith (not being later than 15 days from

receipt of the Call Notice) complete all steps as may be necessary to give

effect to the proposed transfer of Shares as specified in the Call Notice.

1.54 Drag Along post Completion

(a) Post Completion, if the Investor or its Affiliates intend to sell their Shares to

any non affiliated third Party, the Investor will have the right to require the

Partner to sell its entire shareholding in the Company to the third party at the

same terms as those being offered to the Investor or its Affiliate. This right

shall be exercised by the Investor only in the event of the Investor or its

Affiliates selling and / or transferring all and not less than all its Shares in the

Company.

(b) In such an event, the Investor shall send a written notice (the “Drag Along

Notice”) to the Partner, informing the Partner of its intention to sell its Shares.

Upon receipt of the Drag Along Notice by the Partner, the Partner and the

Investor shall forthwith initiate and complete such steps (not being later than

15 (fifteen) days from receipt of the Drag Along Notice) initiate such steps as

may be necessary for the determination of FMV of the Partner Shares, and if

the price offered to the Investor or its Affiliates is greater than or equal to

FMV of the Partner Shares, then the Partner shall initiate all such steps as

may be necessary to give effect to the proposed transfer of Shares as

specified in the Drag Along Notice, within a period of 15 (fifteen) days from

the date of determination of the FMV of the Partner Shares.

1.55 Other restrictions on transfer

Privileged & Confidential Page 23

(a) The Parties acknowledge that any transfer or attempted transfer of the

Shares or any interest therein, not expressly permitted by this Agreement

shall be null and void ab initio, and the Parties shall do all acts, deeds or

things to prevent such transfer from being given effect to. Any calculation of

a Shareholder’s shareholding in the Company shall also take into account

any Shares held by an Affiliate of such Shareholder. Any reference in this

Clause 14 to the terms “Investor”, “Partner” or “Shareholder” shall (unless

specifically stated in this Agreement to the contrary), be construed as also

including a reference also to such Parties’ Affiliate(s) which hold(s) any

Shares or to any transferees.

(b) Notwithstanding any provision to the contrary, any transfers by a Shareholder

to a third party in the manner permitted by this Agreement shall be subject to

such transferee executing a Deed of Adherence agreeing to be bound by the

terms of this Agreement. A transfer of Shares by the Investor shall also be

subject to the restrictions in Clause 14.

(c) Without prejudice to the other provisions of this Clause 14, a Shareholder

shall not transfer, assign or dilute any interest in its Shares if the transfer

would be in breach or constitute an event of default under any provision of

the Company’s lending facilities (if any). Each Shareholder indemnifies and

holds harmless the Company and all other Shareholders from and against

any claims, Damages, expenses or losses of any kind whatever arising out of

a breach of this Clause.