Академический Документы

Профессиональный Документы

Культура Документы

Stevens Textiles S 2010 Financial Statements Are Shown Below

Загружено:

Amit PandeyИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Stevens Textiles S 2010 Financial Statements Are Shown Below

Загружено:

Amit PandeyАвторское право:

Доступные форматы

Solved: Stevens Textiles s 2010 financial statements are

shown below

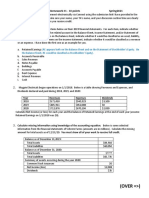

Stevens Textiles’s 2010 financial statements are shown below:

Balance Sheet as of December 31, 2010 (Thousands of Dollars)

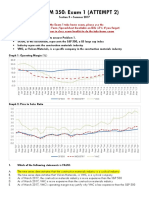

a. Suppose 2011 sales are projected to increase by 15% over 2010 sales. Use the forecasted

financial statement method to forecast a balance sheet and income statement for December 31,

2011. The interest rate on all debt is 10%, and cash earns no interest income. Assume that all

additional debt is added at the end of the year, which means that you should base the

forecasted interest expense on the balance of debt at the beginning of the year. Use the

forecasted income statement to determine the addition to retained earnings. Assume that the

company was operating at full capacity in 2010, that it cannot sell off any of its fixed assets, and

that any required financing will be borrowed as notes payable. Also, assume that assets,

spontaneous liabilities, and operating costs are expected to increase by the same percentage

as sales. Determine the additional funds needed.

b. What is the resulting total forecasted amount of notes payable?

c. In your answers to Parts a and b, you should not have charged any interest on the additional

debt added during 2011 because it was assumed that the new debt was added at the end of the

year. But now suppose that the new debt is added throughout the year. Don’t do any

calculations, but how would this change the answers to parts a andb?

Stevens Textiles s 2010 financial statements are shown below

ANSWER

https://solvedquest.com/stevens-textiles-s-2010-financial-statements-are-shown-below/

Reach out to freelance2040@yahoo.com for enquiry.

Powered by TCPDF (www.tcpdf.org)

Вам также может понравиться

- Practice Questions On Financial Planning and Corporate ValuationДокумент6 страницPractice Questions On Financial Planning and Corporate ValuationsimraОценок пока нет

- Guide to Management Accounting CCC for managers-Cash Conversion Cycle_2020 EditionОт EverandGuide to Management Accounting CCC for managers-Cash Conversion Cycle_2020 EditionОценок пока нет

- BE14e Exercise 12.8 - Solution Under Both MethodsДокумент6 страницBE14e Exercise 12.8 - Solution Under Both MethodsJayMandliyaОценок пока нет

- AFN Forecasting - Practice QuestionsДокумент1 страницаAFN Forecasting - Practice QuestionsMuhammad Ali Samar100% (3)

- Guide to Management Accounting CCC (Cash Conversion Cycle) for ManagersОт EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for ManagersОценок пока нет

- BE14e Exercise 12.8 - Solution Under Both MethodsДокумент6 страницBE14e Exercise 12.8 - Solution Under Both MethodsJayMandliyaОценок пока нет

- Correction ActivityДокумент5 страницCorrection ActivityGlizette SamaniegoОценок пока нет

- Home Depot Financial QuestionДокумент3 страницыHome Depot Financial Questionmktg1990Оценок пока нет

- Cash BasisДокумент4 страницыCash BasisMark DiezОценок пока нет

- On May 5 2012 You Were Hired by Gavin Inc PDFДокумент1 страницаOn May 5 2012 You Were Hired by Gavin Inc PDFFreelance WorkerОценок пока нет

- 2nd Yr Midterm (2nd Sem) ReviewerДокумент19 страниц2nd Yr Midterm (2nd Sem) ReviewerC H ♥ N T Z60% (5)

- Assignment Capital Budgeting Mini ProjectДокумент2 страницыAssignment Capital Budgeting Mini ProjectArslanОценок пока нет

- HW#2Документ6 страницHW#2Kristy WuОценок пока нет

- Chapter 5 ExerciseДокумент7 страницChapter 5 ExerciseJoe DicksonОценок пока нет

- Adjusting Entries ActsДокумент5 страницAdjusting Entries ActsLori100% (1)

- Midterm Exam - Financial Accounting 3 With AnswersДокумент11 страницMidterm Exam - Financial Accounting 3 With Answersjanus lopezОценок пока нет

- University of Cambridge International Examinations General Certificate of Education Ordinary LevelДокумент12 страницUniversity of Cambridge International Examinations General Certificate of Education Ordinary LevelMERCY LAWОценок пока нет

- 00-Text-Ch3 Additional Problems UpdatedДокумент6 страниц00-Text-Ch3 Additional Problems Updatedzombies_meОценок пока нет

- 7110 s11 QP 12Документ12 страниц7110 s11 QP 12mstudy123456Оценок пока нет

- HW2 CF1 Spring 2013Документ3 страницыHW2 CF1 Spring 2013impurewolfОценок пока нет

- Usiness Chool: 7Bsp0173 Financial Economics I-FinanceДокумент11 страницUsiness Chool: 7Bsp0173 Financial Economics I-Financecynical666Оценок пока нет

- 9.liability Questionnaire QUIZДокумент10 страниц9.liability Questionnaire QUIZMark GaerlanОценок пока нет

- Name - Course & Yr. - Schedule - Score - Test I. Multiple Choice. Encircle The Letter of The Best Answer in Each of The Given Question/sДокумент11 страницName - Course & Yr. - Schedule - Score - Test I. Multiple Choice. Encircle The Letter of The Best Answer in Each of The Given Question/sAtty CpaОценок пока нет

- 2013 EXAM I Session1Документ3 страницы2013 EXAM I Session1mathieu652540Оценок пока нет

- BUS ADM 350: Exam 1 (ATTEMPT 2)Документ6 страницBUS ADM 350: Exam 1 (ATTEMPT 2)Maddah HussainОценок пока нет

- WK 3 Textbook AssignmentДокумент4 страницыWK 3 Textbook AssignmentTressa audellОценок пока нет

- DL PT1Q F3 201301Документ14 страницDL PT1Q F3 201301MpuTitasОценок пока нет

- Your Sister Operates Budget Parts Company An Online Boat Parts PDFДокумент1 страницаYour Sister Operates Budget Parts Company An Online Boat Parts PDFAnbu jaromiaОценок пока нет

- Kuis 2 AK 2 GNP 1314 - Leasing Tax - RegulerДокумент4 страницыKuis 2 AK 2 GNP 1314 - Leasing Tax - RegulerBastian Nugraha SiraitОценок пока нет

- Chapter 18Документ12 страницChapter 18ks1043210Оценок пока нет

- BUSN1001 S2 2011 Mid Semester Exam Questions Released On WattleДокумент11 страницBUSN1001 S2 2011 Mid Semester Exam Questions Released On Wattleb393208Оценок пока нет

- Blondia Rocks Budget Project - Prathiba BodlaДокумент33 страницыBlondia Rocks Budget Project - Prathiba BodlaRaam ThammiReddyОценок пока нет

- Finance Practice 5Документ3 страницыFinance Practice 5Puy NuyОценок пока нет

- NOPAT NOPAT2011 - NOPAT20010 (Note ' MeansДокумент5 страницNOPAT NOPAT2011 - NOPAT20010 (Note ' MeansBryan LluismaОценок пока нет

- AFAR Exam Midterms 1Документ4 страницыAFAR Exam Midterms 1CJ Hernandez BorretaОценок пока нет

- FINANCE 6301 Individual Assignment #1 PJM Due February 29, 2016Документ3 страницыFINANCE 6301 Individual Assignment #1 PJM Due February 29, 2016Sijo VMОценок пока нет

- Financial Strategies For Business Development Assignment 1Документ4 страницыFinancial Strategies For Business Development Assignment 1Amel BarghutiОценок пока нет

- 2122 1st AC - FAR Act. 05Документ2 страницы2122 1st AC - FAR Act. 05Airish GeronimoОценок пока нет

- ACT 501 - AssignmentДокумент6 страницACT 501 - AssignmentShariful Islam ShaheenОценок пока нет

- (OVER ) : ACCY 201 - Friday Discussion (FD) Homework #1 - 10 Points Spring2021 DeadlineДокумент3 страницы(OVER ) : ACCY 201 - Friday Discussion (FD) Homework #1 - 10 Points Spring2021 DeadlineXiao ZidanОценок пока нет

- Comprehensive Exam EДокумент10 страницComprehensive Exam Ejdiaz_646247100% (1)

- F2 - Financial ManagementДокумент20 страницF2 - Financial Managementkarlr9Оценок пока нет

- On December 31 2010 Clean and White Linen Supplies LTDДокумент1 страницаOn December 31 2010 Clean and White Linen Supplies LTDFreelance WorkerОценок пока нет

- Shown Below Are Data Relating To The Operations of BeachДокумент1 страницаShown Below Are Data Relating To The Operations of BeachAmit PandeyОценок пока нет

- A. 3e PROBLEM 20Документ3 страницыA. 3e PROBLEM 20shuzoОценок пока нет

- Events After The Reporting PeriodДокумент5 страницEvents After The Reporting Periodmusic niОценок пока нет

- Financial Analysis of NestleДокумент5 страницFinancial Analysis of NestleArun AhlawatОценок пока нет

- Problems-Finance Fall, 2014Документ22 страницыProblems-Finance Fall, 2014jyoon2140% (1)

- Accounts Unit 01Документ5 страницAccounts Unit 01Sana JKОценок пока нет

- Week 4Документ5 страницWeek 4Erryn M. ParamythaОценок пока нет

- (169472718) MODAUD1 UNIT 1 - Analysis and Correction of ErrorsДокумент5 страниц(169472718) MODAUD1 UNIT 1 - Analysis and Correction of ErrorsJervin LabroОценок пока нет

- f3 LSBF ExamДокумент12 страницf3 LSBF ExamIlam Acca Kotli AKОценок пока нет

- ACCO 310/4: Concordia University John Molson School of Business Department of AccountingДокумент10 страницACCO 310/4: Concordia University John Molson School of Business Department of AccountingMiruna CiteaОценок пока нет

- 5.AUDITING ProblemДокумент111 страниц5.AUDITING ProblemAngelu Amper68% (22)

- Accounting For TaxДокумент4 страницыAccounting For Taxhcw49539Оценок пока нет

- FIN 514 Financial Management: Spring 2021 InstructionsДокумент4 страницыFIN 514 Financial Management: Spring 2021 InstructionsAkash KarОценок пока нет

- Exercise For Mid TestДокумент11 страницExercise For Mid TestNadia NathaniaОценок пока нет

- Your Company Produces Cookies in A Two Step Process The MixingДокумент1 страницаYour Company Produces Cookies in A Two Step Process The MixingAmit PandeyОценок пока нет

- Zanella S Smart Shawls Inc Is A Small Business That ZanellaДокумент1 страницаZanella S Smart Shawls Inc Is A Small Business That ZanellaAmit PandeyОценок пока нет

- Zits LTD Makes Two Models For Rotary Lawn Mowers TheДокумент1 страницаZits LTD Makes Two Models For Rotary Lawn Mowers TheAmit PandeyОценок пока нет

- You Have Recently Been Hired by Layton Motors Inc LmiДокумент1 страницаYou Have Recently Been Hired by Layton Motors Inc LmiAmit PandeyОценок пока нет

- Your Company Is Considering Investing in Its Own Transport FleetДокумент2 страницыYour Company Is Considering Investing in Its Own Transport FleetAmit Pandey0% (1)

- Yummi Lik Makes Really Big Lollipops in Two Sizes Large andДокумент2 страницыYummi Lik Makes Really Big Lollipops in Two Sizes Large andAmit PandeyОценок пока нет

- Xellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetДокумент2 страницыXellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetAmit PandeyОценок пока нет

- You Have Been Asked To Assist The Management of IronwoodДокумент2 страницыYou Have Been Asked To Assist The Management of IronwoodAmit PandeyОценок пока нет

- York PLC Was Formed Three Years Ago by A GroupДокумент2 страницыYork PLC Was Formed Three Years Ago by A GroupAmit PandeyОценок пока нет

- Xander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeДокумент2 страницыXander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyОценок пока нет

- Winter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsДокумент1 страницаWinter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsAmit PandeyОценок пока нет

- Xerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeДокумент2 страницыXerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyОценок пока нет

- You Are Employed As The Assistant Accountant in Your CompanyДокумент1 страницаYou Are Employed As The Assistant Accountant in Your CompanyAmit PandeyОценок пока нет

- Wise Company Began Operations at The Beginning of 2018 TheДокумент2 страницыWise Company Began Operations at The Beginning of 2018 TheAmit PandeyОценок пока нет

- X PLC Manufactures Product X Using Three Different Raw MaterialsДокумент2 страницыX PLC Manufactures Product X Using Three Different Raw MaterialsAmit Pandey100% (1)

- Warren S Sporting Goods Store Sells A Variety of Sporting GoodsДокумент2 страницыWarren S Sporting Goods Store Sells A Variety of Sporting GoodsAmit PandeyОценок пока нет

- When The Fraud at Pepsico Occurred The Company Had FiveДокумент2 страницыWhen The Fraud at Pepsico Occurred The Company Had FiveAmit PandeyОценок пока нет

- Xy Limited Commenced Trading On 1 February With Fully PaidДокумент2 страницыXy Limited Commenced Trading On 1 February With Fully PaidAmit PandeyОценок пока нет

- Wildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsДокумент1 страницаWildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsAmit PandeyОценок пока нет

- Williams and Dimaggio Architects Have Been Using A Simplified CostingДокумент1 страницаWilliams and Dimaggio Architects Have Been Using A Simplified CostingAmit PandeyОценок пока нет

- Wild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsДокумент1 страницаWild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsAmit PandeyОценок пока нет

- Watercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetДокумент2 страницыWatercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetAmit PandeyОценок пока нет

- Visit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Документ1 страницаVisit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Amit PandeyОценок пока нет

- Wilson Manufacturing Inc Has Implemented Lean Manufacturing IДокумент1 страницаWilson Manufacturing Inc Has Implemented Lean Manufacturing IAmit PandeyОценок пока нет

- West Coast Designs Produces Three Products Super Deluxe and GДокумент1 страницаWest Coast Designs Produces Three Products Super Deluxe and GAmit PandeyОценок пока нет

- Warren LTD Is To Produce A New Product in AДокумент2 страницыWarren LTD Is To Produce A New Product in AAmit PandeyОценок пока нет

- Vassar Corp Has Incurred Substantial Losses For Several Years AДокумент2 страницыVassar Corp Has Incurred Substantial Losses For Several Years AAmit PandeyОценок пока нет

- Wilson Manufacturing Started in 2014 With The Following Account BalancesДокумент1 страницаWilson Manufacturing Started in 2014 With The Following Account BalancesAmit PandeyОценок пока нет

- Wholesome and Happy Foods Is A Farm To Family Grocery Store LocatedДокумент1 страницаWholesome and Happy Foods Is A Farm To Family Grocery Store LocatedAmit PandeyОценок пока нет

- Video Technology PLC Was Established in 1987 To Assemble VideoДокумент3 страницыVideo Technology PLC Was Established in 1987 To Assemble VideoAmit PandeyОценок пока нет

- ECO Exam IMP Questions (March-23) HM Hasnan PDFДокумент54 страницыECO Exam IMP Questions (March-23) HM Hasnan PDFMuhammad ZubairОценок пока нет

- Emirates Ticket 1Документ4 страницыEmirates Ticket 1jkhdaudhiОценок пока нет

- UG BazarДокумент7 страницUG BazarAssignment KoLagiОценок пока нет

- Group 11 - Section A - BRM Project Proposal - Premium HotelДокумент9 страницGroup 11 - Section A - BRM Project Proposal - Premium Hotelpeacock yadavОценок пока нет

- Quiz No. 3 - Installment Sales - Set BДокумент5 страницQuiz No. 3 - Installment Sales - Set BJam SurdivillaОценок пока нет

- PRE572 OgbeideДокумент22 страницыPRE572 OgbeideChukwudi DesmondОценок пока нет

- Unit 7-Trade and Environment, Health (Elearning)Документ41 страницаUnit 7-Trade and Environment, Health (Elearning)Lương Nguyễn Khánh BảoОценок пока нет

- SMZ - HEF Funding Application - 2Документ1 страницаSMZ - HEF Funding Application - 2SamОценок пока нет

- Midterm Reviewer DM101 1ST SemesterДокумент15 страницMidterm Reviewer DM101 1ST SemesterRevic DolotОценок пока нет

- Question PaperДокумент8 страницQuestion Paperqixin chenОценок пока нет

- Unit 4Документ19 страницUnit 4Dawit NegashОценок пока нет

- TAX05-05 Income Taxation of Partnership Estate and TrustДокумент6 страницTAX05-05 Income Taxation of Partnership Estate and TrustJeth ConchaОценок пока нет

- Indian Oil Corporation Limited: Supplier ConsigneeДокумент1 страницаIndian Oil Corporation Limited: Supplier ConsigneeMONTUPROОценок пока нет

- Muqeet 1 - MergedДокумент8 страницMuqeet 1 - MergedsafwaanahmedОценок пока нет

- Retirment of Partner and Addition Opartner of Blue Leaf HospitalityДокумент6 страницRetirment of Partner and Addition Opartner of Blue Leaf HospitalitypurvapichabykОценок пока нет

- PT CC Jan 31-Feb 7Документ5 страницPT CC Jan 31-Feb 7augustapressОценок пока нет

- AFS-deepak Bhoir-Karanjade-Mundkar and Kasardekar-3-3-20 PDFДокумент11 страницAFS-deepak Bhoir-Karanjade-Mundkar and Kasardekar-3-3-20 PDFsupriya kadamОценок пока нет

- Lbhyd00002731694 IciciДокумент1 страницаLbhyd00002731694 IciciSurya GoudОценок пока нет

- Sam's Club Acquisition Landing PageДокумент1 страницаSam's Club Acquisition Landing PageNisarОценок пока нет

- IntermediateAccounting (PPE)Документ5 страницIntermediateAccounting (PPE)belle crisОценок пока нет

- EEFM Assignment 1 ModifiedДокумент2 страницыEEFM Assignment 1 ModifiedChinmay Swain0% (1)

- Catalogo Generale ItalgranitiДокумент160 страницCatalogo Generale Italgranitinassim25Оценок пока нет

- A Study On Lifting of Corporate Veil With Reference To Case LawsДокумент7 страницA Study On Lifting of Corporate Veil With Reference To Case LawspriyaОценок пока нет

- South China Morning Post (2023!07!08)Документ24 страницыSouth China Morning Post (2023!07!08)murielОценок пока нет

- Kiluwa Lease Form 1Документ12 страницKiluwa Lease Form 1yrdcfwbhgmОценок пока нет

- Chapter 05 - Conceptual Framework Elements of Financial StatementsДокумент5 страницChapter 05 - Conceptual Framework Elements of Financial StatementsKimberly Claire AtienzaОценок пока нет

- Managerial Accounting and Cost Concepts: Assigning Costs To Cost ObjectsДокумент7 страницManagerial Accounting and Cost Concepts: Assigning Costs To Cost ObjectsGolam Mehbub SifatОценок пока нет

- Last Will and TestamentДокумент4 страницыLast Will and TestamentMolly ClarkОценок пока нет

- Latihan Ap1Документ3 страницыLatihan Ap1debora yosikaОценок пока нет

- Índice Compuesto para La Evaluación de La Eficiencia Energética Del Sector Industrial Comparación SubsectorialДокумент9 страницÍndice Compuesto para La Evaluación de La Eficiencia Energética Del Sector Industrial Comparación SubsectorialJeferson HernandezОценок пока нет