Академический Документы

Профессиональный Документы

Культура Документы

CIR v. Mitsubishi Metal, 181 SCRA 214

Загружено:

Homer Simpson100%(1)100% нашли этот документ полезным (1 голос)

564 просмотров2 страницыАвторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

100%(1)100% нашли этот документ полезным (1 голос)

564 просмотров2 страницыCIR v. Mitsubishi Metal, 181 SCRA 214

Загружено:

Homer SimpsonАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

CIR v. Mitsubishi Metal Corp.

,

181 SCRA 214, 22 Jan. 1990

*Exclusions from gross income; miscellaneous items

FACTS:

On April 17, 1970, Atlas Consolidated Mining and Development Corporation entered

into a Loan and Sales Contract with Mitsubishi Metal Corporation, a Japanese

corporation licensed to engage in business in the Philippines, for purposes of the

projected expansion of the productive capacity of the former's mines in Toledo, Cebu.

Under said contract, Mitsubishi agreed to extend a loan to Atlas in the amount of

$20,000,000.00, United States currency.

Atlas, in turn undertook to sell to Mitsubishi all the copper concentrates produced for a

period of15 years. Mitsubishi thereafter applied for a loan with the Export-Import Bank of

Japan (Eximbank) for purposes of its obligation under said contract. Its loan application

was approved on May 26, 1970 in the equivalent sum of $20,000,000.00 in United

States currency at the then prevailing exchange rate.

The records in the Bureau of Internal Revenue show that the approval of the loan by

Eximbank to Mitsubishi was subject to the condition that Mitsubishi would use the

amount as a loan to Atlas and as a consideration for importing copper concentrates

from Atlas, and that Mitsubishi had to pay back the total amount of loan by September

30, 1981.

Pursuant to the contract between Atlas and Mitsubishi, interest payments were made by

the former to the latter totaling P13,143,966.79 for the years 1974 and 1975. The

corresponding 15% tax thereon in the amount of P1,971,595.01 was withheld pursuant

to Section 24 (b) (1) and Section 53 (b) (2) of the National Internal Revenue Code, as

amended by Presidential Decree No. 131, and duly remitted to the Government.

On March 5, 1976, private respondents filed a claim for tax credit requesting that the

sum of P1,971,595.01 be applied against their existing and future tax liabilities.

Parenthetically, it was later noted by respondent Court of Tax Appeals in its decision

that on August 27, 1976, Mitsubishi executed a waiver and disclaimer of its interest in

the claim for tax credit in favor of Atlas.

The petitioner not having acted on the claim for tax credit, on April 23, 1976 private

respondents filed a petition for review with respondent court, docketed therein as CTA

Case No. 2801.

On April 18, 1980, respondent court promulgated its decision ordering petitioner to grant

a tax credit in favor of Atlas in the amount of P1,971,595.01. Interestingly, the tax court

held that petitioner admitted the material averments of private respondents when he

supposedly prayed "for judgment on the pleadings without off-spring proof as to the

truth of his allegations.

While CTA Case No. 2801 was still pending before the tax court, the corresponding

15% tax on the amount of P439,167.95 on the P2,927,789.06 interest payments for the

years 1977 and 1978 was withheld and remitted to the Government. Atlas again filed a

claim for tax credit with the petitioner, repeating the same basis for exemption.

ISSUE:

Whether or not the interest income from the loans extended to Atlas by Mitsubishi is

excludible from gross income taxation pursuant to Section 29 of the tax code and,

therefore, exempt from withholding tax.

HELD:

No. The loan and sales contract between Mitsubishi and Atlas does not contain any

direct or inferential reference to Eximbank whatsoever. The agreement is strictly

between Mitsubishi as creditor in the contract of loan and Atlas as the seller of the

copper concentrates. From the categorical language used in the document, one

prestation was in consideration of the other. The specific terms and the reciprocal

nature of their obligations make it implausible, if not vacuous to give credit to the

cavalier assertion that Mitsubishi was a mere agent in said transaction.

Surely, Eximbank had nothing to do with the sale of the copper concentrates since all

that Mitsubishi stated in its loan application with the former was that the amount being

procured would be used as a loan to and in consideration for importing copper

concentrates from Atlas. Such an innocuous statement of purpose could not have been

intended for, nor could it legally constitute, a contract of agency. If that had been the

purpose as respondent court believes, said corporations would have specifically so

stated, especially considering their experience and expertise in financial transactions,

not to speak of the amount involved and its purchasing value in 1970.

The contract between Eximbank and Mitsubishi is entirely different. It is complete in

itself, does not appear to be suppletory or collateral to another contract and is,

therefore, not to be distorted by other considerations aliunde. The application for the

loan was approved on May 20, 1970, or more than a month after the contract between

Mitsubishi and Atlas was entered into on April 17, 1970. It is true that under the contract

of loan with Eximbank, Mitsubishi agreed to use the amount as a loan to and in

consideration for importing copper concentrates from Atlas, but all that this proves is the

justification for the loan as represented by Mitsubishi, a standard banking practice for

evaluating the prospects of due repayment. There is nothing wrong with such stipulation

as the parties in a contract are free to agree on such lawful terms and conditions as

they see fit. Limiting the disbursement of the amount borrowed to a certain person or to

a certain purpose is not unusual, especially in the case of Eximbank which, aside from

protecting its financial exposure, must see to it that the same are in line with the

provisions and objectives of its charter.

Вам также может понравиться

- Marcos II Vs CA Case DigestДокумент2 страницыMarcos II Vs CA Case Digestlucky javellana100% (3)

- CIR v. Hedcor Sibulan, Inc.Документ2 страницыCIR v. Hedcor Sibulan, Inc.SophiaFrancescaEspinosa100% (1)

- CIR Vs MeralcoДокумент2 страницыCIR Vs MeralcoSherry Mae Malabago100% (1)

- CIR vs. Ayala Securities Corp., GR No. L-29485Документ1 страницаCIR vs. Ayala Securities Corp., GR No. L-29485Alyza Montilla BurdeosОценок пока нет

- Fisher V TrinidadДокумент2 страницыFisher V TrinidadEva Marie Gutierrez Cantero100% (1)

- City of Ozamis V LumapasДокумент3 страницыCity of Ozamis V LumapasViolet ParkerОценок пока нет

- INTERNATIONAL TRADE LAW - HTML PDFДокумент111 страницINTERNATIONAL TRADE LAW - HTML PDFVinod Thomas EfiОценок пока нет

- Zomato AnalysisДокумент7 страницZomato AnalysisEton Pinto0% (1)

- NIST Third Party Compliance ChecklistДокумент26 страницNIST Third Party Compliance ChecklistMuchamad SolihinОценок пока нет

- CIR vs. Mitsubishi MetalДокумент3 страницыCIR vs. Mitsubishi MetalHonorio Bartholomew Chan100% (1)

- Western Minolco v. CommissionerДокумент2 страницыWestern Minolco v. CommissionerEva TrinidadОценок пока нет

- YMCA vs. CIRДокумент2 страницыYMCA vs. CIRMichelle100% (1)

- Javier v. AnchetaДокумент1 страницаJavier v. AnchetaGSSОценок пока нет

- Aguinaldo Industries v. CIRДокумент1 страницаAguinaldo Industries v. CIRTon Ton CananeaОценок пока нет

- CITY OF BAGUIO V. FORTUNATO DE LEON, 25 SCRA 938 - PUBLIC PURPOSE - EQUAL PROTECTION - DigestДокумент1 страницаCITY OF BAGUIO V. FORTUNATO DE LEON, 25 SCRA 938 - PUBLIC PURPOSE - EQUAL PROTECTION - DigestKate GaroОценок пока нет

- Roxas v. CTAДокумент2 страницыRoxas v. CTAJf ManejaОценок пока нет

- Philamlife V Cta Case DigestДокумент2 страницыPhilamlife V Cta Case DigestAnonymous BvmMuBSwОценок пока нет

- 11 NDC V CIRДокумент3 страницы11 NDC V CIRTricia MontoyaОценок пока нет

- Digests 1Документ5 страницDigests 1Jopet EstolasОценок пока нет

- 13 Vegetable Oil Corp V TrinidadДокумент2 страницы13 Vegetable Oil Corp V TrinidadRocky GuzmanОценок пока нет

- CIR vs. San Miguel Corp Tax DigestДокумент2 страницыCIR vs. San Miguel Corp Tax DigestCJ100% (3)

- CIR v. LEDNICKY, G.R. Nos. L-18169, L-18262 & L-21434, 11 SCRA 603, 31 July 1964Документ3 страницыCIR v. LEDNICKY, G.R. Nos. L-18169, L-18262 & L-21434, 11 SCRA 603, 31 July 1964Pamela Camille Barredo100% (1)

- Taganito vs. Commissioner (1995)Документ2 страницыTaganito vs. Commissioner (1995)cmv mendozaОценок пока нет

- Vegetable Oil Corp. V Trinidad, G.R. No. 21475, March 26, 1924, 45 Phil. 822Документ2 страницыVegetable Oil Corp. V Trinidad, G.R. No. 21475, March 26, 1924, 45 Phil. 822Maria Fiona Duran MerquitaОценок пока нет

- 22 - GR No. 25299Документ1 страница22 - GR No. 25299Lloyd LiwagОценок пока нет

- CIR v. CAДокумент2 страницыCIR v. CAKristina Karen100% (1)

- Roces vs. Posadas 58 Phil 108Документ4 страницыRoces vs. Posadas 58 Phil 108jack fackageОценок пока нет

- CIR V Ayala Securities CorporationДокумент1 страницаCIR V Ayala Securities CorporationEmil Bautista100% (1)

- Madrigal Vs RaffertyДокумент1 страницаMadrigal Vs RaffertyClaire CulminasОценок пока нет

- Cir Vs Mega GeneralДокумент2 страницыCir Vs Mega GeneralAiken Alagban LadinesОценок пока нет

- Vidal de Roces vs. Posadas (Case Digest)Документ1 страницаVidal de Roces vs. Posadas (Case Digest)Vince Leido100% (2)

- Aguinaldo Industries Corporation vs. Commissioner of Internal Revenue Services Actually RenderedДокумент2 страницыAguinaldo Industries Corporation vs. Commissioner of Internal Revenue Services Actually RenderedCharmila SiplonОценок пока нет

- Renato v. Diaz & Aurora Ma. F. TimbolДокумент3 страницыRenato v. Diaz & Aurora Ma. F. TimbolBernadetteGaleraОценок пока нет

- Philippine Acetylene Co. Inc vs. CirДокумент2 страницыPhilippine Acetylene Co. Inc vs. Cirbrendamanganaan100% (1)

- Cagayan Electric Power V CommissionerДокумент1 страницаCagayan Electric Power V CommissionerTon Ton Cananea100% (1)

- CIR V Marubeni CorpДокумент2 страницыCIR V Marubeni CorpJaz Sumalinog75% (8)

- Cir V Itogon-Suyoc MinESДокумент2 страницыCir V Itogon-Suyoc MinESkeloОценок пока нет

- Howden Vs CollectorДокумент2 страницыHowden Vs CollectorLouise Bolivar DadivasОценок пока нет

- 005 - Collector v. YusecoДокумент2 страницы005 - Collector v. YusecoJaerelle HernandezОценок пока нет

- CIR v. SC Johnson and Son Inc.Документ1 страницаCIR v. SC Johnson and Son Inc.Marie Chielo100% (2)

- Serafica v. City Treasurer of OrmocДокумент1 страницаSerafica v. City Treasurer of OrmocEarl LarroderОценок пока нет

- CIR Vs Batangas Transpo CompanyДокумент2 страницыCIR Vs Batangas Transpo CompanyBam BathanОценок пока нет

- Creba Vs Romulo TaxДокумент3 страницыCreba Vs Romulo TaxNichole LanuzaОценок пока нет

- Gutierrez V CollectorДокумент3 страницыGutierrez V Collectormichee coi100% (1)

- Eastern Telecommunications Phil Inc V CIR - DigestДокумент1 страницаEastern Telecommunications Phil Inc V CIR - DigestKate GaroОценок пока нет

- Manila Gas Corporation v. The Collector of Internal RevenueДокумент1 страницаManila Gas Corporation v. The Collector of Internal RevenueRNicolo Ballesteros100% (1)

- Request of Atty. ZialcitaДокумент2 страницыRequest of Atty. ZialcitaAngelo Castillo100% (1)

- Board of Assessment Appeals, Province of Laguna v. National Waterworks and Sewerage Authority, 8 Phil. 227Документ2 страницыBoard of Assessment Appeals, Province of Laguna v. National Waterworks and Sewerage Authority, 8 Phil. 227Icel Lacanilao100% (1)

- CIR v. CA and Castaneda GR 96016 October 17, 1991Документ1 страницаCIR v. CA and Castaneda GR 96016 October 17, 1991Vel JuneОценок пока нет

- Madrigal Vs RaffertyДокумент2 страницыMadrigal Vs RaffertyKirs Tie100% (1)

- Procter & Gamble V Municipality of JagnaДокумент2 страницыProcter & Gamble V Municipality of JagnaJackie Canlas100% (3)

- Kuenzle v. CIRДокумент2 страницыKuenzle v. CIRTippy Dos Santos100% (2)

- Maceda Vs MacaraigДокумент3 страницыMaceda Vs MacaraigAnonymous 5MiN6I78I0100% (2)

- Aguinaldo Vs CIR #Tax-1Документ2 страницыAguinaldo Vs CIR #Tax-1Earl TagraОценок пока нет

- Tax Digest Finals RevisedДокумент26 страницTax Digest Finals RevisedronasoldeОценок пока нет

- CIR Vs CA & CastanedaДокумент1 страницаCIR Vs CA & CastanedaArmstrong BosantogОценок пока нет

- Collector v. LaraДокумент2 страницыCollector v. LaraJaypoll DiazОценок пока нет

- ANPC vs. BIRДокумент2 страницыANPC vs. BIRAnneОценок пока нет

- Esso Standard Eastern, Inc Vs CirДокумент2 страницыEsso Standard Eastern, Inc Vs CirCeresjudicataОценок пока нет

- Tax2 Cases 2Документ87 страницTax2 Cases 2MaryStefanieОценок пока нет

- CIR vs. MitsubishiДокумент13 страницCIR vs. MitsubishiColeen Navarro-RasmussenОценок пока нет

- CIR V Mitsubishi Metal Corp,. 181 SCRA 214Документ3 страницыCIR V Mitsubishi Metal Corp,. 181 SCRA 214Iris Mikaela P. RamosОценок пока нет

- Cir Vs MitsubishiДокумент5 страницCir Vs MitsubishiKimberly SendinОценок пока нет

- in Re Probation of The Will of Jose Riosa, 39 Phil., 23Документ7 страницin Re Probation of The Will of Jose Riosa, 39 Phil., 23Homer SimpsonОценок пока нет

- Maricalum Mining Corporation v. Florentino (DATILES)Документ4 страницыMaricalum Mining Corporation v. Florentino (DATILES)Homer SimpsonОценок пока нет

- Ancheta v. Dalaygon, 490 SCRA 140Документ20 страницAncheta v. Dalaygon, 490 SCRA 140Homer SimpsonОценок пока нет

- Zambrano v. Phil. CarpetДокумент2 страницыZambrano v. Phil. CarpetHomer Simpson100% (1)

- Child Learning Center, Inc. v. Tagario (Valeros)Документ2 страницыChild Learning Center, Inc. v. Tagario (Valeros)Homer SimpsonОценок пока нет

- First International v. CA, 252 SCRA 259Документ56 страницFirst International v. CA, 252 SCRA 259Homer SimpsonОценок пока нет

- Lao v. NLRC (Hilario)Документ2 страницыLao v. NLRC (Hilario)Homer SimpsonОценок пока нет

- Boy Scout of The Philippines v. COA (Sales)Документ2 страницыBoy Scout of The Philippines v. COA (Sales)Homer SimpsonОценок пока нет

- Republic v. Evangelista, 466 SCRA 544Документ13 страницRepublic v. Evangelista, 466 SCRA 544Homer SimpsonОценок пока нет

- Heirs of Pajarillo v. CA (Sales)Документ3 страницыHeirs of Pajarillo v. CA (Sales)Homer Simpson100% (1)

- Abs-Cbn v. Hilario (Alariao)Документ3 страницыAbs-Cbn v. Hilario (Alariao)Homer SimpsonОценок пока нет

- Fontanilla v. Maliaman, 179 SCRA 685Документ12 страницFontanilla v. Maliaman, 179 SCRA 685Homer SimpsonОценок пока нет

- Sarmiento v. Sps. Cabrido, G.R. 141258, 9 Apr. 2003Документ7 страницSarmiento v. Sps. Cabrido, G.R. 141258, 9 Apr. 2003Homer SimpsonОценок пока нет

- Simon v. CHR (Digest)Документ2 страницыSimon v. CHR (Digest)Homer SimpsonОценок пока нет

- Bache & Co. v. Ruiz (Santiago)Документ1 страницаBache & Co. v. Ruiz (Santiago)Homer SimpsonОценок пока нет

- Liban v. Gordon (Valeros)Документ4 страницыLiban v. Gordon (Valeros)Homer SimpsonОценок пока нет

- Bustos V Millians Shoe (Jumamil)Документ2 страницыBustos V Millians Shoe (Jumamil)Homer SimpsonОценок пока нет

- Homar v. People, 768 SCRA 584Документ1 страницаHomar v. People, 768 SCRA 584Homer Simpson100% (1)

- Stradcom v. OrpillaДокумент2 страницыStradcom v. OrpillaHomer SimpsonОценок пока нет

- (Case Digest) Fuji Television v. Espiritu, 744 SCRA 31, 3 Dec. 2014Документ3 страницы(Case Digest) Fuji Television v. Espiritu, 744 SCRA 31, 3 Dec. 2014Homer SimpsonОценок пока нет

- Santos Ventura v. Santos, G.R. 153004, 5 Nov. 2004Документ6 страницSantos Ventura v. Santos, G.R. 153004, 5 Nov. 2004Homer SimpsonОценок пока нет

- Crisostomo v. CA, G.R. 138334, 25 Aug. 2003Документ9 страницCrisostomo v. CA, G.R. 138334, 25 Aug. 2003Homer SimpsonОценок пока нет

- Cetus Development v. CA, G.R. No. 77648, 7 Aug. 1989Документ3 страницыCetus Development v. CA, G.R. No. 77648, 7 Aug. 1989Homer SimpsonОценок пока нет

- Sps. Velarde v. CA, G.R. 108346, 11 July 2001Документ12 страницSps. Velarde v. CA, G.R. 108346, 11 July 2001Homer SimpsonОценок пока нет

- de Guia v. Manila Electric Railroad, G.R. No. L-14335, 28 Jan. 1920Документ3 страницыde Guia v. Manila Electric Railroad, G.R. No. L-14335, 28 Jan. 1920Homer SimpsonОценок пока нет

- Gutierrez v. Gutierrez, G.R. 34840, 23 Sept. 1931Документ2 страницыGutierrez v. Gutierrez, G.R. 34840, 23 Sept. 1931Homer SimpsonОценок пока нет

- Vazquez v. de Borja, G.R. No. L-48930, 23 Feb. 1944Документ3 страницыVazquez v. de Borja, G.R. No. L-48930, 23 Feb. 1944Homer SimpsonОценок пока нет

- Song Fo v. Hawaiian PH, G.R. 23769, 16 Sept. 1925Документ3 страницыSong Fo v. Hawaiian PH, G.R. 23769, 16 Sept. 1925Homer SimpsonОценок пока нет

- Woodhouse v. Halili, G.R. L-4811, 31 July 1953Документ4 страницыWoodhouse v. Halili, G.R. L-4811, 31 July 1953Homer SimpsonОценок пока нет

- Supreme Court: Natividad T. Perez For Petitioner. Bito, Lozada, Ortega & Castillo For Private RespondentДокумент7 страницSupreme Court: Natividad T. Perez For Petitioner. Bito, Lozada, Ortega & Castillo For Private RespondentHomer SimpsonОценок пока нет

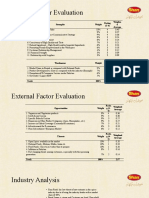

- Internal Factor Evaluation: Strengths Weight Rating (3-4) Weighte D AverageДокумент3 страницыInternal Factor Evaluation: Strengths Weight Rating (3-4) Weighte D AverageHira NazОценок пока нет

- Ihab Yacoub - Resume - JoДокумент5 страницIhab Yacoub - Resume - JoMuthanna AladwanОценок пока нет

- AIRTEL Marketing ProjectДокумент23 страницыAIRTEL Marketing ProjectAnirban Dubey0% (1)

- Zomato BillДокумент1 страницаZomato Billhrh84v4j8kОценок пока нет

- 2021 Annual Member StatementДокумент9 страниц2021 Annual Member Statementkz2w4tx6prОценок пока нет

- Green Marketing Goes NegativeДокумент8 страницGreen Marketing Goes NegativeFrankОценок пока нет

- Exercise 1 - Chapter 1Документ4 страницыExercise 1 - Chapter 1ᴀǫɪʟ RᴀᴍʟɪОценок пока нет

- Electronic Banking and Employees' Job Security in Lafia Nasarawa State, Nigeria Taiwo Olusegun AdelaniДокумент19 страницElectronic Banking and Employees' Job Security in Lafia Nasarawa State, Nigeria Taiwo Olusegun AdelaniNayab AkhtarОценок пока нет

- ThePowerMBA GLOBALДокумент6 страницThePowerMBA GLOBALrosadomingobernausОценок пока нет

- Surendra Gupta Refuse To Pay NSELДокумент2 страницыSurendra Gupta Refuse To Pay NSELBhoomiPatelОценок пока нет

- Farhana SultanaДокумент37 страницFarhana Sultanakazi mahmudurОценок пока нет

- Design and Construction of Offshore Concrete Structures: February 2017Документ18 страницDesign and Construction of Offshore Concrete Structures: February 2017Suraj PandeyОценок пока нет

- Market Segmentation, Targeting and Positioning Strategy Adaptation For The Global Business of Vodafone Telecommunication CompanyДокумент4 страницыMarket Segmentation, Targeting and Positioning Strategy Adaptation For The Global Business of Vodafone Telecommunication CompanymullopОценок пока нет

- MA Project Report - Group 01 - Section DДокумент18 страницMA Project Report - Group 01 - Section DAnil KumarОценок пока нет

- Policy On Performance EvaluationДокумент5 страницPolicy On Performance EvaluationSathish Haran100% (1)

- Buying Merchandise 1.1 Related TermsДокумент5 страницBuying Merchandise 1.1 Related TermsAryanОценок пока нет

- Economic Planning For OrganizationsДокумент3 страницыEconomic Planning For Organizationszionne hiladoОценок пока нет

- Implementation of Fake Product Review Monitoring System and Real Review Generation by Using Data Mining MechanismДокумент10 страницImplementation of Fake Product Review Monitoring System and Real Review Generation by Using Data Mining MechanismAjayi FelixОценок пока нет

- Jawaharlal Nehru Technological University Hyderabad 13mba22 EntrepreneurshipДокумент20 страницJawaharlal Nehru Technological University Hyderabad 13mba22 Entrepreneurshipmba betaОценок пока нет

- Renault - FMEAДокумент36 страницRenault - FMEAGanesh Natarajan100% (2)

- The Box MethodДокумент9 страницThe Box MethodDiyonata KortezОценок пока нет

- Group 6Документ4 страницыGroup 6999660% (3)

- Hospitality: Our Custom Solutions Will Ensure That Each of Your Client's ClientДокумент20 страницHospitality: Our Custom Solutions Will Ensure That Each of Your Client's ClientgauravchauОценок пока нет

- A Case Study Ford Motor CompanyДокумент5 страницA Case Study Ford Motor Companysaleem razaОценок пока нет

- Paper 4 Jeff BezosДокумент5 страницPaper 4 Jeff Bezosapi-535584932100% (1)

- R3 PT Canggu International-1 PDFДокумент2 страницыR3 PT Canggu International-1 PDFkarina MEPОценок пока нет

- QozievДокумент2 страницыQozievolegdanyleiko2Оценок пока нет