Академический Документы

Профессиональный Документы

Культура Документы

FSET-Recommended HW CH3

Загружено:

tabi10592Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

FSET-Recommended HW CH3

Загружено:

tabi10592Авторское право:

Доступные форматы

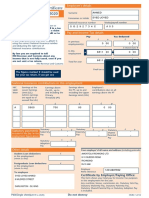

Cash Non Cash Assets -Contra Asset = Liabilities Contributed Capital Earned Capital Revenue -Expenses =Net Income

Account Name $ Amount Account Name $ Amount Account Name $ Amount Account Name $ Amount Account Name $ Amount Account Name $ Amount Account Name $ Amount Account Name $ Amount $ Amount

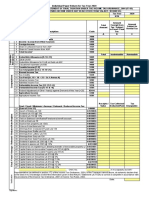

Q3-9

Q3-10

Prepaid insurance was debited w 2 yr premium of $1872

(1872/2-936 /12 =78) Prepaid Insurance -78 RE -78 Insurance Exp 78 -78

Q3-11

A contra account are used to record reductions in or offsets against a related account. The accumulated Depreciation account normally has a credit balance and appears in the balance sheet as a deduction from the related asset amount

Q3-13

a. paid $9,720 for 2 year subscription Cash 9720 Acct Receivable 9720

b. end of Jan (one month passed) (9720 / 2 = 4860, Subscription

4860/12 =405 Liability -405 RE 405 Sub Received 405 405

Q3-14

Wages Payable 190 RE -190 Wage Exp 190 -190

Prepaid Insurance

Unearned Rent

M3-24 Prepaid Insurance 6660 Liability 5250 Rent Revenue 15000 Salaries Exp 3100

Supplies inventory 1930

Office Equipment 5952

1. Prepaid Insurance represents a three year premium

paid on Jan 1, 2019 (6660/3=2220, 2220/12=185) 1

month has passed Prepaid Insurance -185 RE -185 Insurance Exp 185 -185

2. Supplies of 850 were still available (1930-850 = 1080) Supplies inventory -1080 RE -1080 Supplies Exp 1080 -1080

3. Office Equipment is expected to last 8 years Depreciation

(5952/8=744, 744/12=62. So one month has passed -Accumulated Depreciation 62 RE -62 Exp. 62 -62

Unearned Rent

4. Tenant paid rent for one month Liability -875 RE 875 Rent Revenue 875 875

5. accrued employee salaries of $490 Wage Payable 490 RE -490 Wage Exp 490 -490

Prepaid Insurance 6475 Wages Payable 490 RE -942 Rent Revenue 15000 Wage Exp 3590

Unearned Rent

Supplies Inventory 850 Liability 4375 Insurance Exp 185

Office Equipment 5890 Supplies Exp 1080

P3-35

Performance

Obligation Refinishing

Prepaid Rent 5700 Liability 600 Fees Rev. 2500

Prepaid Adv 630

Supplies Inv 3000

1. Firm paid one year's advance rent of $5700 in cash (one

month has passed. 5700/12=475/month) Prepaid Rent -475 RE -475 Rent Exp 475 -475

2. Adv was prepaid for July, Aug, Sept (3 months)

630/3=210 one month has passed Prepaid Adv -210 RE -210 Adv Exp 210 -210

3. Supplies still avail is $1100 (3000-1100=1900) Supplies Inv -1900 RE -1900 Supplies Exp 1900 -1900

4. service performed but not billed to customers Fees Receivable 800 RE 800 Svc Rev 800 800

Performance

5. Paid $600 in advance for a refinishing project. Half Obligation Refinishing

completed now Liability -300 RE 300 Fees Rev 300 300

Totals 0 -1785 -300 -1485 1100 2585 -1485

-1485

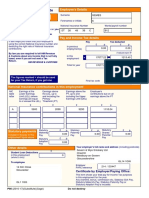

E3-39 Solomon Corporation

Balance Sheet

31-Dec-18

Assets Liabilities

Cash 4000 Notes Payable 10000

Account Receiveable 6500 Equities

Equipment 78000 Common Stock 43000

Accumulated Depreciation -14000 Retained Earnings 12600

Net Equipment 64000 Dividends 8000

Total Assets 74500 Total Liabilities & Equities 73600

Solomon Corporation

Income Statement

For year Ended December 31, 2018

Service Fee Revenue 71000

Rent expense -18000

Salaries expense -37100

Depreciation expense -7000

8900

P3-53 Cash 8500 Inventories 12000 Accounts Payable 5200

Prepaid Rent 3800 Wages payable 100 RE 23500

Accumulated Depreciation

Equipment 7500 Account -3000

1. Sales total $145,850 cash sales Cash 145850 RE 145850 Sales Rev 145850 145850

2 purchases 76200 in inventory on account Inventory 76200 Account Payable 76200

2.a inventory totals $14500 (12000+76200-14500 =73700) Inventory -73700 RE -73700 COGS 73700 -73700

3. Accounts payable totals $4100 Cash -77300 Accounts Payable -77300

4. annual store rent paid Cash -24000 Prepaid Rent 24000

Prepaid Rent -23800 RE -23800 Rent Expense 23800 -23800

5

Вам также может понравиться

- Richard Feeney w2's 2018 2Документ3 страницыRichard Feeney w2's 2018 2Richy FeeneyОценок пока нет

- Amontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20Документ1 страницаAmontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20shamiaОценок пока нет

- Complete Saas PresentationДокумент36 страницComplete Saas PresentationDavid BandaОценок пока нет

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)От EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Рейтинг: 3.5 из 5 звезд3.5/5 (17)

- Quiz 5 KeyДокумент13 страницQuiz 5 KeyLedayl MaralitОценок пока нет

- Tax Year To 5 April 2020 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsДокумент1 страницаTax Year To 5 April 2020 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsNatalino GuterresОценок пока нет

- Asset Managt - Implementing ISO 55000 - Part 1 - Starting On The Right Foot - AssetivityДокумент6 страницAsset Managt - Implementing ISO 55000 - Part 1 - Starting On The Right Foot - Assetivityfzida8942Оценок пока нет

- Salary Slip MayДокумент1 страницаSalary Slip MayselvaОценок пока нет

- FBR Tax FilingДокумент48 страницFBR Tax FilingMuhammad Waqas Hanif100% (1)

- Introduction To Direct MarketingДокумент14 страницIntroduction To Direct Marketingvishal_shekhar2416Оценок пока нет

- Individual Paper Return For Tax Year 2020: SignatureДокумент26 страницIndividual Paper Return For Tax Year 2020: SignaturejamalОценок пока нет

- Extra PDFДокумент12 страницExtra PDFAjay DesaleОценок пока нет

- Income Tax CalcДокумент7 страницIncome Tax Calckarthik.ragu9101Оценок пока нет

- New Rev Financial Acc1Документ22 страницыNew Rev Financial Acc1ahmedfaiyaz917Оценок пока нет

- In Come Tax Return Form 2019Документ48 страницIn Come Tax Return Form 2019Mirza Naseer AbbasОценок пока нет

- 14-Spring 2017 - SFM - SAДокумент6 страниц14-Spring 2017 - SFM - SASalman Ahmed RabbaniОценок пока нет

- Abante Integrated Management Services Private LimitedДокумент1 страницаAbante Integrated Management Services Private LimitedVishal BawaneОценок пока нет

- Individual Paper Return For Tax Year 2019: SignatureДокумент10 страницIndividual Paper Return For Tax Year 2019: SignatureEngr Saad Bin SarfrazОценок пока нет

- HDFC ERGO General Insurance Company Limited: Policy No. 2312 1004 9473 4600 000Документ3 страницыHDFC ERGO General Insurance Company Limited: Policy No. 2312 1004 9473 4600 000ganeshОценок пока нет

- PDFДокумент19 страницPDFYasin ShaikhОценок пока нет

- Transaction AnalysisДокумент3 страницыTransaction AnalysisJillian Shaindy BuyaganОценок пока нет

- 2021 GeneralДокумент8 страниц2021 GeneralWajiha HaroonОценок пока нет

- Regarding Pay Fixation As Per VII CPC in Respect of SH Ram Prakash, Senior AssistantДокумент2 страницыRegarding Pay Fixation As Per VII CPC in Respect of SH Ram Prakash, Senior AssistantmukeshОценок пока нет

- Acc106 - Test 1 - May 2018 - SSДокумент5 страницAcc106 - Test 1 - May 2018 - SSsyahiir syauqiiОценок пока нет

- Business Expenses Worksheet 2020Документ2 страницыBusiness Expenses Worksheet 2020Dendi MonОценок пока нет

- Adjusted Trial BalanceДокумент4 страницыAdjusted Trial BalanceMonir HossainОценок пока нет

- LK - Menyusun Lap. Keuangan - P1Документ15 страницLK - Menyusun Lap. Keuangan - P1rizeky putriОценок пока нет

- Tax Year To 5 April 2022 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsДокумент1 страницаTax Year To 5 April 2022 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsduhgyusdfuiosОценок пока нет

- Working CapitalДокумент22 страницыWorking Capitalghafoormohsin942Оценок пока нет

- Chapter 3 Class Homework SolutionsДокумент12 страницChapter 3 Class Homework SolutionsAde ArdeliaОценок пока нет

- Tax - Osman Gani - 22-23Документ1 страницаTax - Osman Gani - 22-23M N Sharif MintuОценок пока нет

- RibbonsДокумент52 страницыRibbonsKunal MehtaОценок пока нет

- Genius: Income-Tax Computation of ARVIND KUMAR 984 A.Y.2020-21Документ2 страницыGenius: Income-Tax Computation of ARVIND KUMAR 984 A.Y.2020-21darshilОценок пока нет

- HDFC ERGO General Insurance Company Limited: Policy No. 2312 1004 7437 3600 000Документ3 страницыHDFC ERGO General Insurance Company Limited: Policy No. 2312 1004 7437 3600 000Sri Sai TravelsОценок пока нет

- HDFC ERGO General Insurance Company Limited: Policy No. 2312 1002 2570 7201 000Документ2 страницыHDFC ERGO General Insurance Company Limited: Policy No. 2312 1002 2570 7201 000Kamal Elumalai100% (4)

- P60-Alberto AndreiДокумент1 страницаP60-Alberto AndreiAndrei AlbertoОценок пока нет

- Provisional Tax Calculation For The Financial Year 2010-2011 Name Divyesh Desai ID Pan No. Designation SexДокумент3 страницыProvisional Tax Calculation For The Financial Year 2010-2011 Name Divyesh Desai ID Pan No. Designation Sexdivyesh_desaiОценок пока нет

- HDFC ERGO General Insurance Company Limited: Policy No. 2311 2017 9721 5301 000Документ3 страницыHDFC ERGO General Insurance Company Limited: Policy No. 2311 2017 9721 5301 000Awad ShriwardhankarОценок пока нет

- "Individual Paper Return For Tax Year 2021: SignatureДокумент25 страниц"Individual Paper Return For Tax Year 2021: SignatureWaqas MehmoodОценок пока нет

- Computation 22-23 AyДокумент2 страницыComputation 22-23 AysonuОценок пока нет

- Notes - Cash Flow Statement and ProblemsДокумент4 страницыNotes - Cash Flow Statement and ProblemsDhruv MalhotraОценок пока нет

- New Business P&L TemplateДокумент9 страницNew Business P&L TemplateJ PОценок пока нет

- This Study Resource Was: Problem 5-3AДокумент6 страницThis Study Resource Was: Problem 5-3AAlche MistОценок пока нет

- IA 3 Chapter 20 River CoДокумент1 страницаIA 3 Chapter 20 River CoPrytj Elmo QuimboОценок пока нет

- Just Dial Joining Salary ChartДокумент2 страницыJust Dial Joining Salary ChartPritam SamantaОценок пока нет

- New ChangeДокумент68 страницNew ChangeAnoop Kamla PandeyОценок пока нет

- Downloads My Downloads 673Документ1 страницаDownloads My Downloads 673Katalin GemesОценок пока нет

- Asse T Balance Sheet: Current Assets Non-Current AssetsДокумент2 страницыAsse T Balance Sheet: Current Assets Non-Current AssetsSapto PhsОценок пока нет

- The Master Budget HandoutsДокумент4 страницыThe Master Budget Handoutscherein6soriano6paelОценок пока нет

- User FileДокумент1 страницаUser FileBattiprolu VenuОценок пока нет

- Ep60 2023Документ1 страницаEp60 2023Bogdan AlecsaОценок пока нет

- P60-Mircea AndreiДокумент1 страницаP60-Mircea AndreiAndrei AlbertoОценок пока нет

- Balances or Values at December 31, 2019Документ6 страницBalances or Values at December 31, 2019KATHERINEMARIE DIMAUNAHANОценок пока нет

- S Pinkerton Statement of Financial PositionДокумент6 страницS Pinkerton Statement of Financial PositionFindley MaringkaОценок пока нет

- 2022-2023 Pay Drawn Particulars of All Staffs - Palayamkottai Taluk PDFДокумент187 страниц2022-2023 Pay Drawn Particulars of All Staffs - Palayamkottai Taluk PDFM. IsmailОценок пока нет

- Mkombozi Commercial Bank - Financial Statement Dec - 2019 PDFДокумент1 страницаMkombozi Commercial Bank - Financial Statement Dec - 2019 PDFMsuyaОценок пока нет

- CHAPTER 3-Solutions Adjusting The Accounts: Discussion QuestionsДокумент52 страницыCHAPTER 3-Solutions Adjusting The Accounts: Discussion QuestionsDNLeonoraF1Оценок пока нет

- CAF 1 Autumn 2020Документ7 страницCAF 1 Autumn 2020Asim MahmoodОценок пока нет

- LU 10 Capital Structure (How Much Should Corporation Borrow)Документ34 страницыLU 10 Capital Structure (How Much Should Corporation Borrow)Yi QiОценок пока нет

- TRANSACTION ANALYSIS To Financial StatementsДокумент3 страницыTRANSACTION ANALYSIS To Financial StatementsJillian Shaindy BuyaganОценок пока нет

- Corona Safety PDFДокумент3 страницыCorona Safety PDFArunachalam NarayananОценок пока нет

- Consolidation of Less-than-Wholly Owned Subsidiary: Douglas CloudДокумент32 страницыConsolidation of Less-than-Wholly Owned Subsidiary: Douglas CloudkaniyaОценок пока нет

- The Basics of Capital Budgeting: Evaluating Cash FlowsДокумент56 страницThe Basics of Capital Budgeting: Evaluating Cash FlowsVinit KadamОценок пока нет

- Plug Power GenDrive™ Fuel Cells Support Green OperationsДокумент1 страницаPlug Power GenDrive™ Fuel Cells Support Green OperationsI. SANCHEZОценок пока нет

- ISO-CASCO - ISO - IEC 17060 (2022) - Conformity Assessment - Code of Good PracticeДокумент23 страницыISO-CASCO - ISO - IEC 17060 (2022) - Conformity Assessment - Code of Good PracticeKatherine chirinosОценок пока нет

- NATO STO CPoW 2021Документ71 страницаNATO STO CPoW 2021iagaruОценок пока нет

- Basic Financial Statement AnalysisДокумент34 страницыBasic Financial Statement AnalysisArpit SidhuОценок пока нет

- MGT-303 EntrepreneurshipДокумент10 страницMGT-303 EntrepreneurshipAli Akbar MalikОценок пока нет

- Bus 5112 Marketing Management Written Assignment Unit 5Документ5 страницBus 5112 Marketing Management Written Assignment Unit 5rueОценок пока нет

- Assignment-3-CSR REPORTДокумент9 страницAssignment-3-CSR REPORTHarsh PatelОценок пока нет

- Feasibility Study Final Na Ba To Haha 1Документ126 страницFeasibility Study Final Na Ba To Haha 1Neil Frank A. LorenzoОценок пока нет

- RBC Spherical Plain Bearings: Interchange TablesДокумент2 страницыRBC Spherical Plain Bearings: Interchange Tablesjake leiОценок пока нет

- Chapter 8 Unit 8Документ47 страницChapter 8 Unit 8cutefeetОценок пока нет

- Research Proposal: Lee Hui Chien (Erica) B00374777Документ12 страницResearch Proposal: Lee Hui Chien (Erica) B00374777John LimОценок пока нет

- Assessing The Effects of Interactive Blogging On Student Attitudes Towards Peer Interaction, Learning Motivation, and Academic AchievementsДокумент10 страницAssessing The Effects of Interactive Blogging On Student Attitudes Towards Peer Interaction, Learning Motivation, and Academic AchievementsSimonОценок пока нет

- 英文合同印尼 泰国23 05 27Документ3 страницы英文合同印尼 泰国23 05 27ard.durianОценок пока нет

- Registration Form 16TH Wsho Conference 2018 FinalДокумент1 страницаRegistration Form 16TH Wsho Conference 2018 FinalSuresh ThevanindrianОценок пока нет

- Blaw SummativeДокумент3 страницыBlaw SummativeChristine Ramirez GardoñaОценок пока нет

- Held v. HeldДокумент5 страницHeld v. HeldKenneth SandersОценок пока нет

- New Dyeing Technology's Green Credentials: by AZM Anas, Jens Kastner, Keith Nuthall, Raghavendra Verma 12 August 2019Документ4 страницыNew Dyeing Technology's Green Credentials: by AZM Anas, Jens Kastner, Keith Nuthall, Raghavendra Verma 12 August 2019JUAN SEBASTIAN BUSTOS GARNICAОценок пока нет

- Nov-Dec 2011Документ9 страницNov-Dec 2011Usuf JabedОценок пока нет

- Acc Quiz Class 12thДокумент3 страницыAcc Quiz Class 12thTilak DudejaОценок пока нет

- Social Studies Grade 9 PDFДокумент9 страницSocial Studies Grade 9 PDFJudith BandaОценок пока нет

- 4xiaomi - WikipediaДокумент1 страница4xiaomi - Wikipediaamitsinghdaredevil12Оценок пока нет

- T.D. Williamson, Inc.: Piping SolutionsДокумент59 страницT.D. Williamson, Inc.: Piping SolutionsMelele MuОценок пока нет

- BSBHRM501 Student Workbookpdf 2001Документ126 страницBSBHRM501 Student Workbookpdf 2001Suraj Kumar S75% (4)

- ContractДокумент20 страницContractgur0% (1)

- 1e1 S4hana2022 BPD en UsДокумент60 страниц1e1 S4hana2022 BPD en UsprajeethОценок пока нет