Академический Документы

Профессиональный Документы

Культура Документы

Cash Flow Pr. 16-1A

Загружено:

Kearrion BryantОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Cash Flow Pr. 16-1A

Загружено:

Kearrion BryantАвторское право:

Доступные форматы

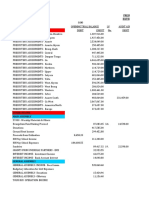

Navaria Inc.

Cash Flow Worksheet, 20Y3

20Y2 Dr. Cr. 20Y3

Assets:

Cash 150,000 155,000

Accounts receivable (net) 400,000 50,000 450,000

Inventories 750,000 20,000 770,000

Investments 100,000 -

Land - 500,000 500,000

Equipment 1,200,000 200,000 1,400,000

Accumulated Depreciation (500,000) 100,000 (600,000)

Total Assets 2,100,000 2,675,000

Liabilities:

Accounts payable 300,000 40,000 340,000

Accrued Expenses Payable 50,000 5,000 45,000

Dividends Payable 25,000 85,000 90,000 30,000

Total Liabilities 375,000 415,000

Stockholder's Equity:

Common Stock ($2 par) 600,000 100,000 700,000

Paid in capital in excess of par 175,000 25,000 200,000

Retained earnings 950,000 90,000 500,000 1,360,000

Total Stockholder's Equtiy 1,725,000 2,260,000

Total Liabilities & Stkhldr. Eq. 2,100,000 2,675,000

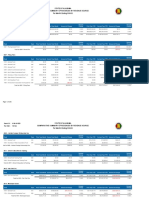

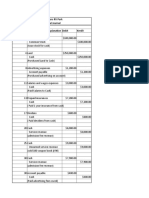

Cash Flows:

From Operating Activities:

Net Income 500,000

Add Depreciation Expense 100,000

Less increase in A/R 50,000

Less increaase in Inventory 20,000

Add increase in A/P 40,000

Less decrease in Acc. Exp. Pay. 5,000

Remove gain on sale of Investments 75,000

Net cash inflow from O/A 490,000

From Investing Activities:

Sold Investments for Cash 175,000

Purchase Land 500,000

Purchase Equipment 200,000

Net cash outflow from I/A (525,000)

From Financing Activities:

Issued Stock for Cash 125,000

Paid Cash Dividends 85,000

Net cash inflow from F/A 40,000

Net increase in Cash for the year 5,000

Add beginning Cash 150,000

Ending Cash 155,000

Вам также может понравиться

- Dispensers of CaliforniaДокумент4 страницыDispensers of CaliforniaShweta GautamОценок пока нет

- 87549654Документ3 страницы87549654Joel Christian Mascariña100% (1)

- FI504 Case Study 1 The Complete Accounting CycleДокумент16 страницFI504 Case Study 1 The Complete Accounting CycleElizabeth Hurtado-Rivera0% (1)

- Primavera PERT Master Risk Analysis ToolДокумент22 страницыPrimavera PERT Master Risk Analysis ToolPallav Paban BaruahОценок пока нет

- Interview Question Senior AuditorДокумент4 страницыInterview Question Senior AuditorSalman LeghariОценок пока нет

- Cash Flow Statement for 2017 ProjectДокумент2 страницыCash Flow Statement for 2017 ProjectShakil ShekhОценок пока нет

- BSNL TM SalaryДокумент1 страницаBSNL TM SalaryDharmveer SinghОценок пока нет

- Chapter 17 Flashcards - QuizletДокумент34 страницыChapter 17 Flashcards - QuizletAlucard77777Оценок пока нет

- Case Study Lyons DocumentДокумент3 страницыCase Study Lyons DocumentSandip GumtyaОценок пока нет

- Cash Flow Statement and Financial Ratio AssignДокумент4 страницыCash Flow Statement and Financial Ratio AssignChristian TanОценок пока нет

- ACC10007 Sample Exam 2Документ9 страницACC10007 Sample Exam 2dannielОценок пока нет

- The Capital Asset Pricing ModelДокумент43 страницыThe Capital Asset Pricing ModelTajendra ChughОценок пока нет

- Presbyterian Church of Ghana 2018Документ55 страницPresbyterian Church of Ghana 2018Daniel Padi100% (1)

- 911 BIZ201 Assessment 3 Student WorkbookДокумент7 страниц911 BIZ201 Assessment 3 Student WorkbookAkshita ChordiaОценок пока нет

- 4 E Precision Manufacturing CompanyДокумент6 страниц4 E Precision Manufacturing Companyyounam318Оценок пока нет

- Brand ValuationДокумент37 страницBrand Valuationmohit.almal100% (2)

- Case 1 AnswerДокумент10 страницCase 1 AnswerEdwin EspirituОценок пока нет

- Comparative Financial Position and Income Statement 2020Документ2 страницыComparative Financial Position and Income Statement 2020Eva Ruth MedilloОценок пока нет

- Acct2015 - 2021 Paper Final SolutionДокумент128 страницAcct2015 - 2021 Paper Final SolutionTan TaylorОценок пока нет

- t10 2010 Jun QДокумент10 страницt10 2010 Jun QAjay TakiarОценок пока нет

- Project Report On Sublimation PrintingДокумент5 страницProject Report On Sublimation PrintingGanpati Gallery100% (1)

- Chapter 15 SolutionsДокумент6 страницChapter 15 SolutionshappysparkyОценок пока нет

- Cash Flow Statement AnalysisДокумент5 страницCash Flow Statement AnalysisJeanelle ColaireОценок пока нет

- Solution To Trina Haldane - Question 4Документ2 страницыSolution To Trina Haldane - Question 4Debbie DebzОценок пока нет

- CH 10 Incomplete RecordsДокумент27 страницCH 10 Incomplete RecordsPawan Poynauth0% (1)

- FIN1161 - Introduction To Finance For Business - Report 2Документ6 страницFIN1161 - Introduction To Finance For Business - Report 2thunlagbd230128Оценок пока нет

- Mirri TaxДокумент10 страницMirri TaxMandanda LovemoreОценок пока нет

- Mac006 A T2 2021 FexДокумент7 страницMac006 A T2 2021 FexHaris MalikОценок пока нет

- POAДокумент7 страницPOAjohnnyОценок пока нет

- Case 20: The Walt Disney Company: Strategic ManagementДокумент31 страницаCase 20: The Walt Disney Company: Strategic ManagementAYU SINAGAОценок пока нет

- Higher National Diploma in Accountancy Hnda 2 Year, Second Semester Examination - 2018 2202-Computer Applications For AccountingДокумент14 страницHigher National Diploma in Accountancy Hnda 2 Year, Second Semester Examination - 2018 2202-Computer Applications For AccountingName of RoshanОценок пока нет

- FIN1161 - Introduction To Finance For Business - Report 1-Case Scenario Briefs - 2023-24Документ2 страницыFIN1161 - Introduction To Finance For Business - Report 1-Case Scenario Briefs - 2023-24Kiên NguyễnОценок пока нет

- CAPR Page - AFSДокумент15 страницCAPR Page - AFSEdgardo Pajo CulturaОценок пока нет

- Tutor 6Документ26 страницTutor 6MERINAОценок пока нет

- Revision Sheet - 2023 - 2024Документ27 страницRevision Sheet - 2023 - 2024Yuvraj Chaudhari100% (1)

- Problem 9-30Документ15 страницProblem 9-30Lê Chấn PhongОценок пока нет

- Tutorial 6Документ4 страницыTutorial 6Muntasir AhmmedОценок пока нет

- FM Question BookletДокумент66 страницFM Question Bookletdeepu deepuОценок пока нет

- Mayes 8e CH05 SolutionsДокумент36 страницMayes 8e CH05 SolutionsRamez AhmedОценок пока нет

- 2014 CommentaryДокумент46 страниц2014 Commentaryduong duongОценок пока нет

- Cat Module 1 Answer KeysДокумент27 страницCat Module 1 Answer KeysLexden MendozaОценок пока нет

- Prob 5Документ1 страницаProb 5Mitch Tokong MinglanaОценок пока нет

- FINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)Документ2 страницыFINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)ISABELA QUITCOОценок пока нет

- 2016 CommentaryДокумент41 страница2016 Commentaryduong duongОценок пока нет

- Love Merchandising Co. Year-End WorksheetДокумент6 страницLove Merchandising Co. Year-End Worksheetvomawew647Оценок пока нет

- FY 2022 Revenue TotalsДокумент296 страницFY 2022 Revenue TotalsCaleb TaylorОценок пока нет

- Taxation Questions on MinersДокумент8 страницTaxation Questions on MinersDanisa NdhlovuОценок пока нет

- Chapter 3 DiscussionsДокумент22 страницыChapter 3 Discussionsの変化 ナザレОценок пока нет

- Assignment # 2 - Chapter 3 - March 2023Документ2 страницыAssignment # 2 - Chapter 3 - March 2023GIAN ALEXANDER CARTAGENA100% (1)

- JARRETT M6-2 Budget Form - Project.Документ2 страницыJARRETT M6-2 Budget Form - Project.evans kirimi100% (1)

- Revised cash accountability and bond scheduleДокумент1 страницаRevised cash accountability and bond scheduleZhanice RulonaОценок пока нет

- Johannes Period 1 To 3 SolutionДокумент5 страницJohannes Period 1 To 3 SolutionHue PhamОценок пока нет

- 20 Additional Practice IAS 7Документ20 страниц20 Additional Practice IAS 7Nur FazlinОценок пока нет

- Beefeaters RV Park General Journal Date Account Titles and Explanation Debit KreditДокумент1 страницаBeefeaters RV Park General Journal Date Account Titles and Explanation Debit Kredityogi fetriansyahОценок пока нет

- Accounting Assignment1Документ4 страницыAccounting Assignment1Muhammad HannanОценок пока нет

- Salary Sep 2019 PDFДокумент1 страницаSalary Sep 2019 PDFAnonymous eHnCyk7DYОценок пока нет

- Accounting Assignment Acc1103Документ13 страницAccounting Assignment Acc1103api-549748043Оценок пока нет

- Wacc 5.52%Документ2 страницыWacc 5.52%Rica CatanguiОценок пока нет

- Landing On You Travel ServicesДокумент4 страницыLanding On You Travel ServicesAngelica EndrenalОценок пока нет

- 3 Closing EntriesДокумент2 страницы3 Closing EntriesRyoma Echizen0% (1)

- Chapter 15 Questions V1Документ6 страницChapter 15 Questions V1coffeedanceОценок пока нет

- Book-Keeping Form Three PDFДокумент4 страницыBook-Keeping Form Three PDFdesa ntosОценок пока нет

- Statement of Cash Flows Lecture Questions and AnswersДокумент9 страницStatement of Cash Flows Lecture Questions and AnswersSaaniya AbbasiОценок пока нет

- Accounting Journal Entries for A&CL Company Over 10 YearsДокумент12 страницAccounting Journal Entries for A&CL Company Over 10 YearsApoorv SinghalОценок пока нет

- CH 5Документ2 страницыCH 5tigger5191Оценок пока нет

- Project On Pharmaceuticals DistributionДокумент13 страницProject On Pharmaceuticals Distributiongourav rameОценок пока нет

- Managerial Accounting-Solutions To Ch07Документ7 страницManagerial Accounting-Solutions To Ch07Mohammed HassanОценок пока нет

- ACC10007 Sample Exam 2 - SolutionДокумент10 страницACC10007 Sample Exam 2 - SolutiondannielОценок пока нет

- GPV & SCF (Assignment)Документ16 страницGPV & SCF (Assignment)Mica Moreen GuillermoОценок пока нет

- AST 229 Notes Burbank&Cooper4Документ3 страницыAST 229 Notes Burbank&Cooper4Kearrion BryantОценок пока нет

- CH 22 Various Exercises Setup 27 Ed.Документ6 страницCH 22 Various Exercises Setup 27 Ed.Kearrion BryantОценок пока нет

- Griffin 8e PPT ch03Документ44 страницыGriffin 8e PPT ch03Kearrion BryantОценок пока нет

- Griffin Understanding The Managers JobДокумент45 страницGriffin Understanding The Managers JobLovely GregorioОценок пока нет

- Griffin 8e PPT ch07Документ30 страницGriffin 8e PPT ch07Kearrion BryantОценок пока нет

- Griffin 8e PPT ch08Документ47 страницGriffin 8e PPT ch08Kearrion BryantОценок пока нет

- Shinepukur Ceramics Limited: Balance Sheet StatementДокумент9 страницShinepukur Ceramics Limited: Balance Sheet StatementTahmid Shovon100% (1)

- NLG - Annual Report 2016Документ48 страницNLG - Annual Report 2016Kiva DangОценок пока нет

- Istilah-Istilah Akuntansi & Pajak Dalam Bahasa InggrisДокумент24 страницыIstilah-Istilah Akuntansi & Pajak Dalam Bahasa Inggrisgaluh vindriarsoОценок пока нет

- Concepts and Cases: Strategic ManagementДокумент58 страницConcepts and Cases: Strategic ManagementFreddy MurrugarraОценок пока нет

- Bond Prices and Yields: Bodie, Kane, and Marcus 9 EditionДокумент20 страницBond Prices and Yields: Bodie, Kane, and Marcus 9 EditionBerry FransОценок пока нет

- Reject Allowance Problem - 2 ProblemsДокумент17 страницReject Allowance Problem - 2 Problemschristinahaddadin02Оценок пока нет

- Ratio Analysis of The Annual Report On Standard BankДокумент15 страницRatio Analysis of The Annual Report On Standard BankShopno Konna Sarah80% (5)

- Accounting Changes CH 22Документ62 страницыAccounting Changes CH 22chloekim03Оценок пока нет

- Viva Africa Consulting ProfileДокумент9 страницViva Africa Consulting ProfileNyandia KamaweОценок пока нет

- Chapter 3 - Journal Entry Workshop WorksheetДокумент13 страницChapter 3 - Journal Entry Workshop WorksheetShenika WrotenОценок пока нет

- Conventional BricksДокумент8 страницConventional BricksChenna Vivek KumarОценок пока нет

- CHAPTER 5 ADJUSTING PROCESS - AssignmentДокумент1 страницаCHAPTER 5 ADJUSTING PROCESS - AssignmentjepsyutОценок пока нет

- CURRICULUM VITAE-FP SPV Tax Widasa Group Update 2Документ11 страницCURRICULUM VITAE-FP SPV Tax Widasa Group Update 2febrikafitriantiОценок пока нет

- What Would You Do With A Million Dollars?: Philip BrewerДокумент4 страницыWhat Would You Do With A Million Dollars?: Philip BrewerKatarina JovanovićОценок пока нет

- Valartis Annual-Report 2017Документ152 страницыValartis Annual-Report 2017Miguel Couto RamosОценок пока нет

- QuestionДокумент29 страницQuestionMichael Johnson0% (1)

- Taxation IIДокумент5 страницTaxation IIAnandОценок пока нет

- Pricing Strategies of Airtel: Under The Supervision of Submitted byДокумент31 страницаPricing Strategies of Airtel: Under The Supervision of Submitted byAnurag RahejaОценок пока нет

- MA Final Exam Prep Sample 4 PDFДокумент18 страницMA Final Exam Prep Sample 4 PDFbooks_sumiОценок пока нет

- RSM230 Chapter NotesДокумент15 страницRSM230 Chapter NotesJoey LinОценок пока нет

- CH # 2: Introduction To Financial Statements and Other Financial Reporting TopicsДокумент14 страницCH # 2: Introduction To Financial Statements and Other Financial Reporting TopicsgazmeerОценок пока нет