Академический Документы

Профессиональный Документы

Культура Документы

Cost Method-Upstreamdownstream

Загружено:

Sha ZhaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Cost Method-Upstreamdownstream

Загружено:

Sha ZhaАвторское право:

Доступные форматы

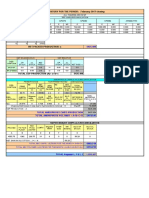

Eliminations: Steps: ORE

Sales/ CGS. AR/AP, Rent 1) Calcuation, allocate and amort AD +NI

inc/exp, Interco divid (R/E 2) intercom eliminations +adj -Dividends

but not on I/S), Due to/ 3) Calculate CNI CRE

from, 4) Calculate CRE

5) Calculate NCI

6) Prepare Consolidated FS

3 Calculate CNI (cost method)

Price paid FV of NiA Share price

(Goodwill P + S prop) (Goodwill P only) (Goodwill P + S calc)

[A] P NI P NI P NI

- interco dividends - interco dividends - interco dividends

- goodwill impairment - p's share of goodwill impair

+/- downstream UnR(cy) + R +/- downstream UnR(cy) + R +/- downstream UnR(cy) + R

[B] + + +

S NI S NI S NI

- amort of AD - amort of AD - amort of AD

- goodwill impairment

+/- upstream UnR(cy) + R +/- upstream UnR(cy) + R +/- upstream UnR(cy) + R

[C] - sub's share goodwill impair

CNI = [A] + [B] = [A] + [B] = [A] + [B] + [C]

P's share of CNI = [A] + 80% [B] = [A] + 80% [B] = [A] + 80% [B]

S's share of CNI = 20% [B] = 20% [B] = 20% [B] + [C]

4 Calculate CRE (cost method)

Price paid FV of NiA Share price

(Goodwill P + S prop) (Goodwill P only) (Goodwill P + S calc)

Opening Closing

[A] P RE P RE P RE

- Acc goodwill imp - P's share of Acc goodwill imp

+/- downstream UnR(cy + py) +/- downstream UnR(cy + py) +/- downstream UnR(cy + py)

[B] + + +

S RE S RE S RE

- S RE @ acq - S RE @ acq - S RE @ acq

- Acc amort AD - Acc amort AD - Acc amort AD

- Acc goodwill imp +/- upstream UnR(cy + py) +/- upstream UnR(cy + py)

+/- upstream UnR(cy + py)

CRE = [A] + 80% [B] = [A] + 80% [B] = [A] + 80% [B]

5 Calculate NCI

Price paid FV of NiA Share price

(Goodwill P + S prop) (Goodwill P only) (Goodwill P + S calc)

[B] Sub RE [B] Sub RE [B] Sub RE

+ Sub SC + Sub SC + Sub SC

+ UnAmort AD + UnAmort AD + UnAmort AD

+/- upstream UnR(cy + py) +/- upstream UnR(cy + py) +/- upstream UnR(cy + py)

+ UnImp Goodwill

+ UnImp Goodwill Sub

NCI = 20% [B] = 20% [B] = 20% [B]+100%Unimp GW Sub

Вам также может понравиться

- GICE Govt Purchase IPIRATED IncomeДокумент3 страницыGICE Govt Purchase IPIRATED IncomeChristy Boyd TurnerОценок пока нет

- She Summary of TransactionsДокумент2 страницыShe Summary of TransactionsKyo YuriОценок пока нет

- SM - 1 - KiesoДокумент15 страницSM - 1 - KiesoYassin DyabОценок пока нет

- RSM 333 Fall 2019 Formula SheetДокумент2 страницыRSM 333 Fall 2019 Formula SheetJoe BobОценок пока нет

- Marathon Session (Part 08) - Class NotesДокумент68 страницMarathon Session (Part 08) - Class NotesSiya GoyalОценок пока нет

- (Vertical) Balance Sheet of Geo PPV at Dd/mm/yy (FA) Fixed AssetsДокумент8 страниц(Vertical) Balance Sheet of Geo PPV at Dd/mm/yy (FA) Fixed AssetsHarsh ChhatrapatiОценок пока нет

- Week 12 - Arithmetic CircuitsДокумент37 страницWeek 12 - Arithmetic Circuits서종현Оценок пока нет

- 02A National IncomeДокумент17 страниц02A National IncomeGaurav GhareОценок пока нет

- F9 ACCA Summary - Revision Notes 2017Документ96 страницF9 ACCA Summary - Revision Notes 2017alihihai113Оценок пока нет

- 26 - Summary of MafaДокумент3 страницы26 - Summary of Mafahina1234Оценок пока нет

- Format of AccrualsДокумент1 страницаFormat of AccrualsVyakt MehtaОценок пока нет

- Interest Rates That Vary With Time: I A I CWДокумент3 страницыInterest Rates That Vary With Time: I A I CWTepe HolmОценок пока нет

- Principles of Finance Formulae SheetДокумент4 страницыPrinciples of Finance Formulae SheetAmina SultangaliyevaОценок пока нет

- Formula Sheet: Evaluation of Financial Policy GBA 546Документ9 страницFormula Sheet: Evaluation of Financial Policy GBA 546Sameer SayyedОценок пока нет

- 02A National IncomeДокумент21 страница02A National Incomeaashutosh sawantОценок пока нет

- Operations Management. Assignment1Документ3 страницыOperations Management. Assignment1Isaac GumboОценок пока нет

- RKSV Securities India PVT LTD: Details/Breakup of Total MarginДокумент2 страницыRKSV Securities India PVT LTD: Details/Breakup of Total MarginHãrshã SmîlęýОценок пока нет

- TFF FormulasДокумент12 страницTFF Formulastallicahet81Оценок пока нет

- Cost of Capital Cost of Debt I. Cost of Irredeemable DebtДокумент6 страницCost of Capital Cost of Debt I. Cost of Irredeemable DebtAbi ShekОценок пока нет

- 04 Investasi Lanjutan Deni JaenudinДокумент12 страниц04 Investasi Lanjutan Deni JaenudinDENI JAENUDINОценок пока нет

- US Investor Visa $500,000: Sign in Sign OutДокумент5 страницUS Investor Visa $500,000: Sign in Sign OutSantoshKumarОценок пока нет

- FormulasДокумент20 страницFormulasWilliam ZeОценок пока нет

- FIN620 FormulasДокумент1 страницаFIN620 FormulasPinkera -Оценок пока нет

- Adjustment NotesДокумент44 страницыAdjustment NotesNur AiniОценок пока нет

- Brief Exercises Chapter 1 - SolutionsДокумент5 страницBrief Exercises Chapter 1 - Solutions31231020764Оценок пока нет

- 24 Top Financial FormulasДокумент1 страница24 Top Financial FormulasNgọc Linh NguyễnОценок пока нет

- Formula SheetДокумент2 страницыFormula SheetAnarghyaОценок пока нет

- Finance 2 Formula Sheet FinalДокумент2 страницыFinance 2 Formula Sheet Final9bpj6qfyhwОценок пока нет

- Formula Sheet FinanceДокумент2 страницыFormula Sheet Financemostafa daherОценок пока нет

- Funko - Versiã N Avanzada - SOLUCIÃ NДокумент11 страницFunko - Versiã N Avanzada - SOLUCIÃ Nlucia guoОценок пока нет

- InventoryДокумент4 страницыInventorySiva KumarОценок пока нет

- Rules For Debiting and CreditingДокумент2 страницыRules For Debiting and CreditingLucianОценок пока нет

- BM2102 Lecture 7Документ48 страницBM2102 Lecture 7shahnaz chОценок пока нет

- AC330 Exam Notes SampleДокумент3 страницыAC330 Exam Notes SampleRicardo KlnОценок пока нет

- Extra Session Midterm 2023Документ13 страницExtra Session Midterm 2023Yasmine MkОценок пока нет

- Extra Session Midterm 2023Документ13 страницExtra Session Midterm 2023Yasmine MkОценок пока нет

- Important Knowledge and Formulas: Junior SecondaryДокумент14 страницImportant Knowledge and Formulas: Junior Secondarypqp1Оценок пока нет

- L 3 Formulasheetjune 2016 SampleДокумент6 страницL 3 Formulasheetjune 2016 Samplepier AcostaОценок пока нет

- Equations From DamodaranДокумент6 страницEquations From DamodaranhimaggОценок пока нет

- Ratio AnalysisДокумент1 страницаRatio Analysistanveeraddozai1126Оценок пока нет

- Week 3, Chapter 7Документ36 страницWeek 3, Chapter 7Shaheer BaigОценок пока нет

- Selection of Useful FormulasДокумент3 страницыSelection of Useful FormulasМаша СкрипченкоОценок пока нет

- LBCTC W8Документ2 страницыLBCTC W8JF FОценок пока нет

- Rules 2nd TermДокумент4 страницыRules 2nd TermMohamed AbbasОценок пока нет

- Expenses Claim Form 2Документ1 страницаExpenses Claim Form 2shivanidhakaОценок пока нет

- 4 - GroupsДокумент4 страницы4 - GroupsRaza MalikОценок пока нет

- Formula Sheet Short-Term Solvency RatiosДокумент2 страницыFormula Sheet Short-Term Solvency RatiosNguyễn Ngọc Phương LinhОценок пока нет

- 01A Flow of Economic ActivitiesДокумент11 страниц01A Flow of Economic Activitiesaashutosh sawantОценок пока нет

- Economy Prob Set 2Документ9 страницEconomy Prob Set 2Joselito DaroyОценок пока нет

- Shpatt 31march20Документ6 страницShpatt 31march20Vivek GuptaОценок пока нет

- Ratios and Other Metrics, RevisedДокумент1 страницаRatios and Other Metrics, RevisedBayu Aji PrasetyoОценок пока нет

- Fomula Spreadsheet (WACC and NPV)Документ7 страницFomula Spreadsheet (WACC and NPV)vaishusonu90Оценок пока нет

- Accounting Entries SAP MMДокумент2 страницыAccounting Entries SAP MMUMAKANT MAHAPATRA100% (5)

- SAP MM Account EntriesДокумент2 страницыSAP MM Account EntriesRajaravi reddy50% (2)

- Financial Management - 2 Return and Risk: Beg EndДокумент6 страницFinancial Management - 2 Return and Risk: Beg EndYoseph WooОценок пока нет

- FIN10670 - Formula Sheet - Final TestДокумент2 страницыFIN10670 - Formula Sheet - Final TestSean ZhangОценок пока нет

- Worksheet 1. Input Information: Schedule F Data Taxable YearДокумент5 страницWorksheet 1. Input Information: Schedule F Data Taxable Yearchandra_kumarbrОценок пока нет

- Chap06Mankiw - The Open EconomyДокумент66 страницChap06Mankiw - The Open EconomyopankbukanОценок пока нет

- Corporate Finance Formulas: A Simple IntroductionОт EverandCorporate Finance Formulas: A Simple IntroductionРейтинг: 4 из 5 звезд4/5 (8)

- Productivity Now: Social Administration, Training, Economics and Production DivisionОт EverandProductivity Now: Social Administration, Training, Economics and Production DivisionОценок пока нет

- Operation ManagementДокумент10 страницOperation ManagementPritam RoyОценок пока нет

- CLO Summit 2013Документ20 страницCLO Summit 2013saurs2Оценок пока нет

- User Guide For UbooksДокумент107 страницUser Guide For UbooksRama KrishnaОценок пока нет

- Unilever Mission StatementДокумент5 страницUnilever Mission StatementvampireweekendОценок пока нет

- Mostafa Karem: ObjectivesДокумент3 страницыMostafa Karem: Objectivesatia fawzyОценок пока нет

- Customer AnalysisДокумент33 страницыCustomer AnalysisMuhammad Ali Khan NiaziОценок пока нет

- Project Management - QuestionsДокумент24 страницыProject Management - QuestionsFarid HaqverdiyevОценок пока нет

- 9 Partnership Question 4Документ7 страниц9 Partnership Question 4kautiОценок пока нет

- Management Process Audit Checklist Template ReportДокумент19 страницManagement Process Audit Checklist Template ReportYang LishengОценок пока нет

- Audit of ExpensesДокумент18 страницAudit of Expenseseequals mcsquaredОценок пока нет

- BBA01-470474-V1-BBA PM - Banking On CloudДокумент22 страницыBBA01-470474-V1-BBA PM - Banking On Cloudeleman13Оценок пока нет

- Value Stream MappingДокумент16 страницValue Stream MappingF13 NIECОценок пока нет

- Hindustan Motors' Struggle For Survival 1Документ1 страницаHindustan Motors' Struggle For Survival 1Chaitanya ThotaОценок пока нет

- Internal Analysis For Cathay Pacific Airways EssayДокумент3 страницыInternal Analysis For Cathay Pacific Airways EssayN_NorthОценок пока нет

- AirtelPaymentsBank - XXXXXX5056 (5) - UnlockedДокумент3 страницыAirtelPaymentsBank - XXXXXX5056 (5) - Unlockedzxcv826066Оценок пока нет

- Terms of Reference FOR M&EДокумент28 страницTerms of Reference FOR M&ERonald MatsikoОценок пока нет

- Mock Test of Jaiib Principles & Practices of Banking.: AnswerДокумент12 страницMock Test of Jaiib Principles & Practices of Banking.: Answeraao wacОценок пока нет

- RFBT - Law On SalesДокумент4 страницыRFBT - Law On SalesHelpieОценок пока нет

- International MarketingДокумент7 страницInternational MarketingNikunj BajajОценок пока нет

- SC Licensing HandbookДокумент75 страницSC Licensing HandbookYff DickОценок пока нет

- Gbu Brochure PDFДокумент17 страницGbu Brochure PDFAmit YadavОценок пока нет

- Engagement MemorandumДокумент2 страницыEngagement Memorandumapi-175773514Оценок пока нет

- Int McKesson CaseStudyДокумент4 страницыInt McKesson CaseStudyIntelligratedОценок пока нет

- ISO 27001 Client GuideДокумент4 страницыISO 27001 Client GuideAlea ConsultingОценок пока нет

- Assignment & Licensing of Trademarks in IndiaДокумент16 страницAssignment & Licensing of Trademarks in IndiaHarsh Gupta100% (1)

- Project Report On Havemor Ice-CreamДокумент54 страницыProject Report On Havemor Ice-Creammann2015Оценок пока нет

- Accounting For Developers 101Документ7 страницAccounting For Developers 101Albin StigoОценок пока нет

- Mckinsey'S Elements of Success: Strategy Structure Systems Style Staff SkillsДокумент2 страницыMckinsey'S Elements of Success: Strategy Structure Systems Style Staff Skillshus2020Оценок пока нет

- Sap Withholding Tax Configuration Tds GuideДокумент28 страницSap Withholding Tax Configuration Tds GuideDipak Banerjee100% (2)

- Documentation Assistant (Theory Exam) : Signature of The CandidateДокумент4 страницыDocumentation Assistant (Theory Exam) : Signature of The CandidateOsmania MbaОценок пока нет