Академический Документы

Профессиональный Документы

Культура Документы

Balji

Загружено:

Balaji SuburajИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Balji

Загружено:

Balaji SuburajАвторское право:

Доступные форматы

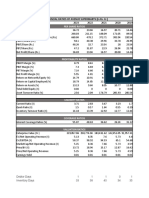

Indian Overseas Bank

Key Financial Ratios ------------------- in Rs. Cr. -------------------

Mar '06 Mar '07 Mar '08 Mar '09 Mar '10

Investment Valuation Ratios

Face Value 10 10 10 10 10

Dividend Per Share 2.6 3 3.2 4.5 3.5

Operating Profit Per Share (Rs) 17.52 23.26 28.16 35.48 17.57

Net Operating Profit Per Share (Rs) 86.15 111.64 153.43 200.27 207.58

Free Reserves Per Share (Rs) 26.15 34.32 42.79 42.83 45.21

Profitability Ratios

Interest Spread 3.81 4.79 4.26 4.29 4.69

Adjusted Cash Margin(%) 16.69 17.12 14.79 12.16 7.1

Net Profit Margin 16.44 16.18 13.94 11.87 6.14

Return on Long Term Fund(%) 107.4 119.88 146.37 145.71 126.87

Return on Net Worth(%) 28.55 29.11 25.35 22.31 11.13

Balance Sheet Ratios

Capital Adequacy Ratio 13.04 13.27 11.96 12.7 14.26

Advances / Loans Funds(%) 72.34 76.58 74.45 75.89 69.78

Debt Coverage Ratios

Credit Deposit Ratio 63.27 68.6 70.22 73.36 72.96

Investment Deposit Ratio 40.06 35.99 34.27 32.36 32.65

Cash Deposit Ratio 7.65 6.51 9.02 8.17 6.45

Total Debt to Owners Fund 16.54 17.75 17.78 16.85 17.45

Financial Charges Coverage Ratio 1.44 1.43 1.34 1.32 1.16

Financial Charges Coverage Ratio

1.36 1.33 1.24 1.21 1.12

Post Tax

Leverage Ratios

Current Ratio 0.03 0.02 0.02 0.02 0.03

Quick Ratio 8 8.07 11.32 11.46 23.61

Cash Flow Indicator Ratios

Dividend Payout Ratio Net Profit 20.61 18.96 16.96 21.63 31.55

Dividend Payout Ratio Cash Profit 19.25 17.87 15.96 20.1 27.24

Earning Retention Ratio 78.17 81 83.02 77.19 68.38

AdjustedCash Flow Times 63.55 64.41 66.09 73.71 135.59

Earnings Per Share 14.38 18.51 22.07 24.34 12.98

Book Value 56.08 71.08 87.05 109.06 116.54

Canara Bank

Key Financial Ratios ------------------- in Rs. Cr. -------------------

Mar '06 Mar '07 Mar '08 Mar '09 Mar '10

Investment Valuation Ratios

Face Value 10 10 10 10 10

Dividend Per Share 6.6 7 8 8 10

Operating Profit Per Share (Rs) 27.6 33.15 33.29 47.02 73.99

Net Operating Profit Per Share (Rs) 221.93 282.24 378.64 441.97 508.62

Free Reserves Per Share (Rs) 87.93 105.56 103.94 108.33 129.43

Bonus in Equity Capital -- -- -- -- --

Profitability Ratios

Interest Spread 3.47 3.57 3.47 3.47 3.32

Adjusted Cash Margin(%) 15.31 12.81 10.65 11.8 14.46

Net Profit Margin 13.82 11.6 9.61 10.89 13.77

Return on Long Term Fund(%) 95.07 111.05 151.48 149.13 134.69

Return on Net Worth(%) 20.65 18.78 18.86 20.64 24.09

Adjusted Return on Net Worth(%) 19.13 17.51 18.85 20.63 24.07

Balance Sheet Ratios

Capital Adequacy Ratio 11.22 13.5 13.25 14.1 13.43

Advances / Loans Funds(%) 74.28 75.55 71.36 78.86 77.49

Debt Coverage Ratios

Credit Deposit Ratio 65.44 68.65 69.4 71.99 72.96

Investment Deposit Ratio 35.11 31.71 32.06 31.55 30.24

Cash Deposit Ratio 6.04 6.56 7.58 6.86 6.11

Total Debt to Owners Fund 16.64 17.55 18.57 18.62 18.71

Financial Charges Coverage Ratio 1.34 1.28 1.2 1.23 1.31

Leverage Ratios

Current Ratio 0.02 0.02 0.02 0.02 0.01

Quick Ratio 10.19 9.49 9.17 11.29 26.98

Cash Flow Indicator Ratios

Dividend Payout Ratio Net Profit 22.97 23.63 24.53 18.51 15.88

Dividend Payout Ratio Cash Profit 20.73 21.4 22.13 17.08 15.11

Earning Retention Ratio 77.02 76.36 75.45 81.48 84.1

AdjustedCash Flow Times 78.5 90.78 88.86 83.24 73.93

Earnings Per Share 32.76 34.65 38.17 50.55 73.69

Book Value 171.19 197.83 202.33 244.87 305.83

Вам также может понравиться

- Project of Tata MotorsДокумент7 страницProject of Tata MotorsRaj KiranОценок пока нет

- Ratios FinancialДокумент16 страницRatios Financialgaurav sahuОценок пока нет

- Ratios FinДокумент30 страницRatios Fingaurav sahuОценок пока нет

- Ratios FinДокумент16 страницRatios Fingaurav sahuОценок пока нет

- Ratios FinancialДокумент16 страницRatios Financialgaurav sahuОценок пока нет

- Key Financial Ratios of Tata Motors: - in Rs. Cr.Документ3 страницыKey Financial Ratios of Tata Motors: - in Rs. Cr.ajinkyamahajanОценок пока нет

- State Bank of India: Key Financial Ratios - in Rs. Cr.Документ4 страницыState Bank of India: Key Financial Ratios - in Rs. Cr.zubairkhan7Оценок пока нет

- Key Financial Ratios of NTPC: - in Rs. Cr.Документ3 страницыKey Financial Ratios of NTPC: - in Rs. Cr.Vaibhav KundalwalОценок пока нет

- Axis RatioДокумент5 страницAxis RatiopradipsinhОценок пока нет

- RatiosДокумент2 страницыRatiosnishantОценок пока нет

- Reliance GuriДокумент2 страницыReliance GurigurasisОценок пока нет

- Key Financial Ratios of UCO Bank - in Rs. Cr.Документ19 страницKey Financial Ratios of UCO Bank - in Rs. Cr.anishbhattacharyyaОценок пока нет

- RanbaxyДокумент2 страницыRanbaxyamit_sachdevaОценок пока нет

- Ashok Leyland Limited: RatiosДокумент6 страницAshok Leyland Limited: RatiosAbhishek BhattacharjeeОценок пока нет

- Previous Years: Canar A Bank - in Rs. Cr.Документ12 страницPrevious Years: Canar A Bank - in Rs. Cr.kapish1014Оценок пока нет

- Key Financial Ratios of Shree CementsДокумент2 страницыKey Financial Ratios of Shree CementsTrollОценок пока нет

- ICICI Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of ICICI Bank - BSE: 532174, NSE: ICICIBANKДокумент2 страницыICICI Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of ICICI Bank - BSE: 532174, NSE: ICICIBANKr79qwkxcfjОценок пока нет

- RatiosДокумент2 страницыRatioschiragОценок пока нет

- MarutiДокумент2 страницыMarutiVishal BhanushaliОценок пока нет

- Atlas Copco (India) LTD Balance Sheet: Sources of FundsДокумент19 страницAtlas Copco (India) LTD Balance Sheet: Sources of FundsnehaОценок пока нет

- Key Financial Ratios of Bharat Heavy Electricals - in Rs. Cr.Документ6 страницKey Financial Ratios of Bharat Heavy Electricals - in Rs. Cr.Virangad SinghОценок пока нет

- Financial Ratios of Hero Honda MotorsДокумент6 страницFinancial Ratios of Hero Honda MotorsParag MaheshwariОценок пока нет

- CCS G4Документ14 страницCCS G4Harshit AroraОценок пока нет

- Financial Ratios of Federal BankДокумент35 страницFinancial Ratios of Federal BankVivek RanjanОценок пока нет

- RatiosДокумент2 страницыRatiosKishan KeshavОценок пока нет

- Financial Ratios of NHPCДокумент2 страницыFinancial Ratios of NHPCsathish kumarОценок пока нет

- Marico RatiosДокумент8 страницMarico RatiosAmarnath DixitОценок пока нет

- Axis Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of Axis Bank - BSE: 532215, NSE: AXISBANKДокумент2 страницыAxis Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of Axis Bank - BSE: 532215, NSE: AXISBANKr79qwkxcfjОценок пока нет

- Tata Motors: Previous YearsДокумент5 страницTata Motors: Previous YearsHarsh BansalОценок пока нет

- Key Financial Ratios of JK Tyre and IndustriesДокумент3 страницыKey Financial Ratios of JK Tyre and IndustriesAchal JainОценок пока нет

- Adlabs InfoДокумент3 страницыAdlabs InfovineetjogalekarОценок пока нет

- DR Reddy RatiosДокумент6 страницDR Reddy RatiosRezwan KhanОценок пока нет

- Mehran Sugar Mills - Six Years Financial Review at A GlanceДокумент3 страницыMehran Sugar Mills - Six Years Financial Review at A GlanceUmair ChandaОценок пока нет

- Icici 1Документ2 страницыIcici 1AishwaryaSushantОценок пока нет

- CBRMДокумент14 страницCBRMSurajSinghalОценок пока нет

- Investment Valuation Ratios Years Mar-19 Mar-18 Mar-17 Mar-16 Mar-15Документ4 страницыInvestment Valuation Ratios Years Mar-19 Mar-18 Mar-17 Mar-16 Mar-15honey08priya1Оценок пока нет

- Sambal Owner of ZeeДокумент2 страницыSambal Owner of Zeesagar naikОценок пока нет

- Berger Paints RatiosДокумент1 страницаBerger Paints RatiosDeepОценок пока нет

- Balance Sheet: Sources of FundsДокумент14 страницBalance Sheet: Sources of FundsJayesh RodeОценок пока нет

- Per Share RatiosДокумент3 страницыPer Share RatiosRuchy SinghОценок пока нет

- Annual Accounts 2021Документ11 страницAnnual Accounts 2021Shehzad QureshiОценок пока нет

- Ratio AnalysisДокумент2 страницыRatio AnalysisSEHWAG MATHAVANОценок пока нет

- Punjab National Bank: BSE: 532461 - NSE: PNB - ISIN: INE160A01014 - Banks - Public SectorДокумент7 страницPunjab National Bank: BSE: 532461 - NSE: PNB - ISIN: INE160A01014 - Banks - Public Sectorsheph_157Оценок пока нет

- Financial RatiosДокумент2 страницыFinancial Ratiosranjansolanki13Оценок пока нет

- Ratio Analysis: Liquidity RatiosДокумент2 страницыRatio Analysis: Liquidity RatiosSuryakantОценок пока нет

- 12 - Ishan Aggarwal - Shreyans Industries Ltd.Документ11 страниц12 - Ishan Aggarwal - Shreyans Industries Ltd.rajat_singlaОценок пока нет

- Jio Financial Analysis (5 Yrs)Документ2 страницыJio Financial Analysis (5 Yrs)Yash Saxena KhiladiОценок пока нет

- Relaxo Footwear - Updated BSДокумент54 страницыRelaxo Footwear - Updated BSRonakk MoondraОценок пока нет

- Wip Ro Key Financial Ratios - in Rs. Cr.Документ4 страницыWip Ro Key Financial Ratios - in Rs. Cr.Priyanck VaisshОценок пока нет

- Excel Brittaniya 2Документ3 страницыExcel Brittaniya 2Adnan LakdawalaОценок пока нет

- DABUR Easy Ratio AnalysisДокумент4 страницыDABUR Easy Ratio AnalysisLakshay TakhtaniОценок пока нет

- Ace AnalyserДокумент4 страницыAce AnalyserRahul MalhotraОценок пока нет

- Shinansh TiwariДокумент11 страницShinansh TiwariAnuj VermaОценок пока нет

- Nerolac - On Ratio - SolvedДокумент6 страницNerolac - On Ratio - Solvedricha krishnaОценок пока нет

- Per Share Ratios: Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05Документ4 страницыPer Share Ratios: Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05alihayatОценок пока нет

- Ratio Analysis of Bata IndiaДокумент2 страницыRatio Analysis of Bata IndiaSanket BhondageОценок пока нет

- Equity Share Data HDFC Bank Mar-20 SBI Mar-19 HDFC Bank/ SBIДокумент8 страницEquity Share Data HDFC Bank Mar-20 SBI Mar-19 HDFC Bank/ SBIAkshaya LakshminarasimhanОценок пока нет

- NestleДокумент4 страницыNestleNikita GulguleОценок пока нет

- FINANCIAL ANALYSIS of ONGCДокумент13 страницFINANCIAL ANALYSIS of ONGCdipshi92Оценок пока нет

- Understanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyОт EverandUnderstanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyОценок пока нет

- Government and Not For Profit Accounting Concepts and Practices 6th Edition Granof Solutions ManualДокумент26 страницGovernment and Not For Profit Accounting Concepts and Practices 6th Edition Granof Solutions Manualadelarichard7bai100% (29)

- 2015 Part II Case Syllabi Civil LawДокумент335 страниц2015 Part II Case Syllabi Civil LawNeapolle FleurОценок пока нет

- Foreign Investment Is Boon or Bane For IndiaДокумент19 страницForeign Investment Is Boon or Bane For IndiaAbhimanyu SinghОценок пока нет

- Appendix Master C1D VisaДокумент6 страницAppendix Master C1D VisaJared YehezkielОценок пока нет

- Trust and Reliability: Chap 6Документ24 страницыTrust and Reliability: Chap 6Zain AliОценок пока нет

- ابحاث اولي اداب مادة الترجمةДокумент3 страницыابحاث اولي اداب مادة الترجمةomarОценок пока нет

- Mepa Unit 5Документ18 страницMepa Unit 5Tharaka RoopeshОценок пока нет

- Data Loss Prevention (Vontu) Customer Community (Ask Amy) : Archiving IncidentsДокумент3 страницыData Loss Prevention (Vontu) Customer Community (Ask Amy) : Archiving IncidentsatiffitaОценок пока нет

- Annex CДокумент2 страницыAnnex CCruz LheoОценок пока нет

- Exploring The World's First Successful Truth Commission Argentina's CONADEP and The Role of Victims in Truth-SeekingДокумент19 страницExploring The World's First Successful Truth Commission Argentina's CONADEP and The Role of Victims in Truth-SeekingEugenia CabralОценок пока нет

- I. Definitions 1. "Agreement" Means This Settlement Agreement and Full and Final ReleaseДокумент27 страницI. Definitions 1. "Agreement" Means This Settlement Agreement and Full and Final Releasenancy_sarnoffОценок пока нет

- Financial Statement Analysis: Submitted By: Saket Jhanwar 09BS0002013Документ5 страницFinancial Statement Analysis: Submitted By: Saket Jhanwar 09BS0002013saketjhanwarОценок пока нет

- Aurbach VS Sanitary Wares CorpДокумент3 страницыAurbach VS Sanitary Wares CorpDoll AlontoОценок пока нет

- Outbound Inbound Calls From External ToДокумент3 страницыOutbound Inbound Calls From External TorajueeguОценок пока нет

- 9707 s12 Ms 13Документ7 страниц9707 s12 Ms 13Muhammad Salim Ullah KhanОценок пока нет

- Book No. 3 Ashraf Ali Thanvi Attestation & Al Muhannad (FINAL)Документ47 страницBook No. 3 Ashraf Ali Thanvi Attestation & Al Muhannad (FINAL)Kabeer AhmedОценок пока нет

- Body Art EstablishmentДокумент1 страницаBody Art Establishmentmilagro AlleyneОценок пока нет

- Letter - For - Students - 1ST - Year - Programmes (Gu)Документ2 страницыLetter - For - Students - 1ST - Year - Programmes (Gu)Ayush SinghОценок пока нет

- Moz PROCUREMENT COORDINATOR JOB DESCRIPTIONДокумент2 страницыMoz PROCUREMENT COORDINATOR JOB DESCRIPTIONTsholofeloОценок пока нет

- Long List SundayДокумент4 страницыLong List SundayOmary MussaОценок пока нет

- Serrano de Agbayani Vs PNB - DigestДокумент2 страницыSerrano de Agbayani Vs PNB - DigestG Ant Mgd100% (1)

- Addition Worksheet2Документ2 страницыAddition Worksheet2JoyceОценок пока нет

- Jurisdiction (Three Hours) Lesson OutlineДокумент7 страницJurisdiction (Three Hours) Lesson OutlineChaОценок пока нет

- Inter Regional Transfer FormДокумент2 страницыInter Regional Transfer FormEthiopian Best Music (ፈታ)Оценок пока нет

- Example in ElectrostaticsДокумент36 страницExample in ElectrostaticsJoseMiguelDomingo75% (4)

- Ethics AssignmentДокумент10 страницEthics AssignmentRiyad HossainОценок пока нет

- Separation of East Pakistan Javed Iqbal PDFДокумент22 страницыSeparation of East Pakistan Javed Iqbal PDFsabaahat100% (2)

- ROXAS Vs DE LA ROSAДокумент1 страницаROXAS Vs DE LA ROSALiaa AquinoОценок пока нет

- 13 Stat 351-550Документ201 страница13 Stat 351-550ncwazzyОценок пока нет

- PLC - Litigation Support - The PricewaterhouseCoopers' Guide To Forensic Analysis and Accounting Evidence, 5th EditionДокумент8 страницPLC - Litigation Support - The PricewaterhouseCoopers' Guide To Forensic Analysis and Accounting Evidence, 5th EditionSoniaChichОценок пока нет