Академический Документы

Профессиональный Документы

Культура Документы

Form Astr-2 (Application For Filing A Claim of Rebate of Duty Paid On Inputs, Service Tax and Cess Paid On Input Services)

Загружено:

Krishan Chander0 оценок0% нашли этот документ полезным (0 голосов)

17 просмотров1 страница1) The applicant declares that they exported taxable services and paid service tax and duty on inputs and input services.

2) They request a rebate of the duty, tax, and cess paid in accordance with export rules and certify that no CENVAT credit was claimed.

3) The sanctioning authority will process the rebate claim within 15 days or provide reasons for any delay.

Исходное описание:

Оригинальное название

ASTR 2

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документ1) The applicant declares that they exported taxable services and paid service tax and duty on inputs and input services.

2) They request a rebate of the duty, tax, and cess paid in accordance with export rules and certify that no CENVAT credit was claimed.

3) The sanctioning authority will process the rebate claim within 15 days or provide reasons for any delay.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

17 просмотров1 страницаForm Astr-2 (Application For Filing A Claim of Rebate of Duty Paid On Inputs, Service Tax and Cess Paid On Input Services)

Загружено:

Krishan Chander1) The applicant declares that they exported taxable services and paid service tax and duty on inputs and input services.

2) They request a rebate of the duty, tax, and cess paid in accordance with export rules and certify that no CENVAT credit was claimed.

3) The sanctioning authority will process the rebate claim within 15 days or provide reasons for any delay.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

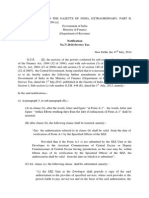

FORM ASTR-2

(Application for filing a claim of rebate of duty paid on inputs, service tax and

cess paid on input services)

(PART A: To be filled by the applicant)

Date………….

Place…………

To,

Assistant Commissioner of Central Excise/Deputy Commissioner of Central Excise

…………………………..(full postal address).

Madam/Sir,

I/We…………………………………..,(name of the person claiming rebate) holding service tax

registration No. …………………………………………, located in……………….………… (address

of the registered premises) hereby declare that I/We have exported

…………………………………service (name of the taxable service) under rule 5 of the Export of

Service Rules, 2005 to ……………………(name of the country to which service has been

exported), and service tax amounting to ……………………. (amount in rupees of service tax) and

education cess amounting to ……………………. (amount in rupees of cess) has been paid on

input services and duty amounting to ………… (amount in rupees of duty) has been paid on

inputs.

2. I/We also declare that the payment against such service exported has already been

received in India in full…………………………………………………. (details of receipt of payment).

3. I/We request that the rebate of the duty, service tax and cess on inputs and input

services used in providing taxable service exported by me/us in terms of rule 3 of the Export of

Service Rules, 2005 may be granted at the earliest. The following documents are enclosed in

support of this claim for rebate.

1.

2.

3.

Declaration:

(a) We hereby certify that we have not availed CENVAT credit on inputs and input services

on which rebate has been claimed.

(b) We have been granted permission by Assistant Commissioner of Central Excise or

Deputy Commissioner of Central Excise, vide C. No. ______, dated ______ for working

under notification No. _____ , dated _____ .

(Signature and name of the service provider

or his authorised agent with date)

(PART B: To be filled by the sanctioning authority)

Date of receipt of the rebate claim: ______________

Date of sanction of the rebate claim: ______________

Amount of rebate claimed: Rs. ______________

Amount of rebate sanctioned: Rs. ______________

If the claim is not processed within 15 days of the receipt of the claim, indicated briefly

reasons for delay.

Place:

Date:

Signature of the Assistant Commissioner/

Deputy Commissioner of Central Excise.

Вам также может понравиться

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesОт EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesОценок пока нет

- Astr 1Документ1 страницаAstr 1Ravi AroraОценок пока нет

- What Is Service Tax ?Документ15 страницWhat Is Service Tax ?Nawab SahabОценок пока нет

- RMO No. 004-16Документ10 страницRMO No. 004-16cool_peachОценок пока нет

- Refund Forms For Centre and StateДокумент20 страницRefund Forms For Centre and StateShail MehtaОценок пока нет

- ITR62 Form 15 CAДокумент5 страницITR62 Form 15 CAMohit47Оценок пока нет

- 1a. Refund Formats17052017 Revised3 28Документ28 страниц1a. Refund Formats17052017 Revised3 28Ravi Kiran KandimallaОценок пока нет

- RR 22-2020 (Notice of Discrepancy) PDFДокумент3 страницыRR 22-2020 (Notice of Discrepancy) PDFilovelawschoolОценок пока нет

- Application For Condonation of Delay in Filing of Form VII & VIII ToДокумент2 страницыApplication For Condonation of Delay in Filing of Form VII & VIII Tokrishna gattaniОценок пока нет

- Bureau of Internal RevenueДокумент5 страницBureau of Internal RevenuegelskОценок пока нет

- Form16fy10 11Документ3 страницыForm16fy10 11atishroyОценок пока нет

- GST RFD 01Документ15 страницGST RFD 01Rajdev AssociatesОценок пока нет

- Circularno 24 CGSTДокумент4 страницыCircularno 24 CGSTHr legaladviserОценок пока нет

- Circular No.60Документ4 страницыCircular No.60Hr legaladviserОценок пока нет

- Instruction To Fill Form St3Документ9 страницInstruction To Fill Form St3Dhanush GokulОценок пока нет

- Amendments - 23rd August, 2011Документ52 страницыAmendments - 23rd August, 2011Vipul MallickОценок пока нет

- Government of India Office of The Assistant Commissioner of Service Tax: Division - IДокумент10 страницGovernment of India Office of The Assistant Commissioner of Service Tax: Division - IadhipdcОценок пока нет

- GST Automated NoticesДокумент6 страницGST Automated NoticesMaunik ParikhОценок пока нет

- CGST Sixth Amendment Rules 2019Документ5 страницCGST Sixth Amendment Rules 2019Yatrik GandhiОценок пока нет

- Step by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?Документ7 страницStep by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?arpit jainОценок пока нет

- Service Tax Procedures: HapterДокумент25 страницService Tax Procedures: HaptertimirkantaОценок пока нет

- Itr 62 Form 16Документ4 страницыItr 62 Form 16Hardik ShahОценок пока нет

- Forms of Registration Under Contract Labour Act 1970 PDFДокумент7 страницForms of Registration Under Contract Labour Act 1970 PDFGlendaОценок пока нет

- S R A Eem P: (Nonprofit Organization/Special Purpose Local Agency) )Документ15 страницS R A Eem P: (Nonprofit Organization/Special Purpose Local Agency) )MaryroseОценок пока нет

- New Punjab Settlement Scheme 2024Документ8 страницNew Punjab Settlement Scheme 2024Rahul GoelОценок пока нет

- ST 3Документ5 страницST 3Totala Govindprasad RadheshyamОценок пока нет

- Form 16 TDS SummaryДокумент4 страницыForm 16 TDS SummarySushma Kaza DuggarajuОценок пока нет

- 5254__Tax regime_2024_240408_212256Документ3 страницы5254__Tax regime_2024_240408_212256sunil78Оценок пока нет

- BT-Reply Show Cause - GTAДокумент2 страницыBT-Reply Show Cause - GTAapi-3822396Оценок пока нет

- Nation: MarketДокумент9 страницNation: MarketDebashis MitraОценок пока нет

- Income Tax Declaration Form - F.Y. 2020-21Документ8 страницIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagОценок пока нет

- AccordДокумент18 страницAccordKumar AugustineОценок пока нет

- IRD (IT) - 05-01 Eng VersionДокумент2 страницыIRD (IT) - 05-01 Eng VersionZawtun MinОценок пока нет

- Form A1Документ13 страницForm A1Ben DennisОценок пока нет

- Tax HДокумент15 страницTax HDeepesh SinghОценок пока нет

- Sample Protest LetterДокумент2 страницыSample Protest LetterLyceum WebinarОценок пока нет

- Protest Letter Tax AssessmentДокумент2 страницыProtest Letter Tax AssessmentConsciousness Vivid100% (1)

- Service Tax - Form A1Документ5 страницService Tax - Form A1kuriakose_mv3653Оценок пока нет

- b3Документ5 страницb3YesBroker InОценок пока нет

- 003 ITC Mismatch in GSTR 2A Vs 2BДокумент7 страниц003 ITC Mismatch in GSTR 2A Vs 2BAman GargОценок пока нет

- Service Tax Notification No.07/2014 Dated 11th July, 2014Документ3 страницыService Tax Notification No.07/2014 Dated 11th July, 2014stephin k jОценок пока нет

- Form27d Applicable From 01.04Документ2 страницыForm27d Applicable From 01.04sudhrengeОценок пока нет

- Circular No.59Документ6 страницCircular No.59Hr legaladviserОценок пока нет

- Form 16 FormatДокумент2 страницыForm 16 FormatParthVanjaraОценок пока нет

- 2023 Winter Storm Penalty WaiverДокумент2 страницы2023 Winter Storm Penalty WaiverFOX54 News HuntsvilleОценок пока нет

- TDS Payment ChallanДокумент3 страницыTDS Payment ChallanmejarirajeshОценок пока нет

- Salary Bill For Gazetted Government ServantsДокумент2 страницыSalary Bill For Gazetted Government Servantsمحمد حمزة الشاذلي100% (1)

- Formst 1Документ3 страницыFormst 1arulantonyОценок пока нет

- ST 1 (Service Tax Reg)Документ10 страницST 1 (Service Tax Reg)praveensaxena2009Оценок пока нет

- Registration of Collective Bargaining AgreementДокумент3 страницыRegistration of Collective Bargaining AgreementevaОценок пока нет

- Cir 174 06 2022 CGSTДокумент5 страницCir 174 06 2022 CGSTNM JHANWAR & ASSOCIATESОценок пока нет

- (See Rule 31 (1) (A) ) : Form No. 16Документ8 страниц(See Rule 31 (1) (A) ) : Form No. 16Amol LokhandeОценок пока нет

- Sworn Application For Tax Clearance For Bidding Purposes Non-Individual TaxpayersДокумент1 страницаSworn Application For Tax Clearance For Bidding Purposes Non-Individual TaxpayerscharmedbytinnieОценок пока нет

- Undetaking For Remittance For NRДокумент5 страницUndetaking For Remittance For NRhds1979Оценок пока нет

- New rules for income tax formsДокумент4 страницыNew rules for income tax formsBibhuChhotrayОценок пока нет

- GST Icai 15072023Документ98 страницGST Icai 15072023Selvakumar MuthurajОценок пока нет

- ShowfileДокумент4 страницыShowfileMkОценок пока нет

- Amendments in Service TaxДокумент15 страницAmendments in Service TaxShankar NarayananОценок пока нет

- Project To Expand Puerto Rico - Vieques - Culebra Maritime Service OK'd For Federal Funding - News Is My BusinessДокумент2 страницыProject To Expand Puerto Rico - Vieques - Culebra Maritime Service OK'd For Federal Funding - News Is My BusinessCORALationsОценок пока нет

- P15 Business Strategy Strategic Cost Management PDFДокумент4 страницыP15 Business Strategy Strategic Cost Management PDFkiran babuОценок пока нет

- A Project Report Submitted To: Market Survey of Consumer Perception About Cement IndustryДокумент36 страницA Project Report Submitted To: Market Survey of Consumer Perception About Cement Industryriteshgautam77Оценок пока нет

- Price Comparisson - Bored Piling JCDC, Rev.02Документ2 страницыPrice Comparisson - Bored Piling JCDC, Rev.02Zain AbidiОценок пока нет

- 7 Logistics - WarehousingДокумент20 страниц7 Logistics - Warehousingashish.bms9100% (4)

- VAS EngineerДокумент2 страницыVAS EngineerJM KoffiОценок пока нет

- Maintainance Contract FormatДокумент3 страницыMaintainance Contract Formatnauaf101Оценок пока нет

- ARISE Spa Struggles to Keep Employees SatisfiedДокумент21 страницаARISE Spa Struggles to Keep Employees Satisfiedarjunparekh100% (6)

- Carriage and Insurance Paid To CIPДокумент16 страницCarriage and Insurance Paid To CIParun arunОценок пока нет

- Venkatesh ResumeДокумент6 страницVenkatesh ResumeSantosh Reddy Chennuru100% (1)

- Sesi 14 - Pemodelan Berbasis Agen - 2Документ20 страницSesi 14 - Pemodelan Berbasis Agen - 2nimah tsabitahОценок пока нет

- Understanding Hotel Valuation TechniquesДокумент0 страницUnderstanding Hotel Valuation TechniquesJamil FakhriОценок пока нет

- 02062019105858t13pdxmwzeiag20kby Estatement 052019 997 PDFДокумент3 страницы02062019105858t13pdxmwzeiag20kby Estatement 052019 997 PDFNikhil KumarОценок пока нет

- Estimate Cost of Building Fifty PensДокумент4 страницыEstimate Cost of Building Fifty PensHelloLagbajaHelloLagbajaОценок пока нет

- 01 - IntroductionДокумент19 страниц01 - IntroductionchamindaОценок пока нет

- Product Diversification and Financial Performance The Moderating Role of Secondary Stakeholders.Документ22 страницыProduct Diversification and Financial Performance The Moderating Role of Secondary Stakeholders.R16094101李宜樺Оценок пока нет

- Frequently Asked Questions Transition From UL 508C To UL 61800-5-1Документ6 страницFrequently Asked Questions Transition From UL 508C To UL 61800-5-1nomeacueroОценок пока нет

- CSR TrainingДокумент12 страницCSR Trainingskdwivediindia0% (1)

- Business ProposalДокумент4 страницыBusiness ProposalCatherine Avila IIОценок пока нет

- Silicon Valley Community Foundation 2008 990Документ481 страницаSilicon Valley Community Foundation 2008 990TheSceneOfTheCrimeОценок пока нет

- Oranjolt - Rasn-WPS OfficeДокумент3 страницыOranjolt - Rasn-WPS OfficeKaviya SkОценок пока нет

- Incoterms QuestionsДокумент6 страницIncoterms Questionsndungutse innocent100% (1)

- 06 Guide To Tender EvaluationДокумент9 страниц06 Guide To Tender Evaluationromelramarack1858Оценок пока нет

- Case StudyДокумент7 страницCase StudynarenderОценок пока нет

- Pump and Dump - Print 1Документ7 страницPump and Dump - Print 1Zahid FaridОценок пока нет

- Concord Final Edition For GBSДокумент35 страницConcord Final Edition For GBSMahamud Zaman ShumitОценок пока нет

- Accounting principles, concepts and processesДокумент339 страницAccounting principles, concepts and processesdeepshrm100% (1)

- Case Study 1Документ5 страницCase Study 1Abubakar MoazzamОценок пока нет

- Condition Classification For New GST ConditionsДокумент3 страницыCondition Classification For New GST ConditionsVenugopal PОценок пока нет