Академический Документы

Профессиональный Документы

Культура Документы

Mar 13 - Jubilant Foodworks

Загружено:

Madhukar DasИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Mar 13 - Jubilant Foodworks

Загружено:

Madhukar DasАвторское право:

Доступные форматы

st or’s Focus

Inve -Madhukar Das

Issue 10, Volume 1

Jubilant Foodworks

With crude price still in uncomfortable zone and ongoing political unrest in middle east causing tribulation -March 13, 2011

on world stock markets, the Japanese catastrophe would put more pressure with negative sentiment spread-

ing even more amongst the investors and traders. Other Picks

Fundamentally Speaking BUY :

Jubilant Foodworks is a Jubilant Bhartia group company. It holds the master franchisee rights for Domino's Grasim Industries

Pizza for India, Nepal, Sri Lanka and Bangladesh. The erstwhile Domino’s Pizza India Ltd was rechristened

in September 2009. It is the largest pizza retail chain in India and is one of the fastest growing fast food CMP—`2310

company with a countrywide network of over 339 retail stores. It is the market leader in the organized pizza

market with a 50% overall market share and 65% share in the home delivery segment in India. On February Target—`2500

24, 2011 Jubilant Foodworks announced the strategic alliance with "Dunkin' Donuts". Dunkin Donuts is the Stop Loss—`2200

largest coffee and baked goods chain in the world. The company has entered into a multiple unit develop-

ment and franchise agreement with Dunkin' Donuts Franchising LLC with exclusive rights to establish and

operate Dunkin' Donuts outlets in India. The Indian quick service restaurants industry is growing rapidly

with a 4X increase in the number of outlets between 2003 and 2009 as a lot of demographic and socio- Sell :

economic changes are driving the fast food market. Jubilant Foodworks is well positioned to benefit from Kinetic Engineering

these opportunities.

CMP—`120.10

The same-store-sales have been growing 18-20% annually for past 5 years however sales in first 3 quarters

have grown about 37% from same period last year. Net profit grew 67% in Q3FY11 and 137% in Q2FY11 Target—`109

which is indicative of growth coming from increasing number of outlets. So it would be conservative to

assume that Domino’s sales would continue to grow at 20% or more for the next 5 years and Dunkin Donuts

Stop Loss—`125

would bring in new cash flows. Trailing twelve month’s P/E is 55.7 which is somewhat rich however the

profitability ratios are a lot better than the industry average. The price to sales ratio is 8.3. It is a relatively

debt free company. Honda Siel Power

CMP—`374

Technically Speaking

Target—`340

Stop Loss—`390

Special points of

interest:

The stochastic chart suggests

Since we are looking

The weekly price chart is showing that the scrip has reached over-

at a trading horizon of

a reversal of medium term down- sold region and has rebounded 15-30 days, we shall

trend which may result in retrace- and will retrace some portion give more weightage

ment of previous decline. of its downmove. to technical analysis

and price trend of the

stock.

We shall also study the

fundamental aspects of

a company to avoid

getting into loss mak-

Recommendation : ing trade positions in

BUY case of movement of

market in direction

CMP : `545.50 opposite to that of my

The momentum chart has changed The commodity channel index prediction.

direction and may move above the reinforced the rebound of scrip Target Price : `590

0 line if macro factors don't pull and suggested a short term

the market down. upmove. Stop loss : `520

Вам также может понравиться

- The Well-Timed Strategy (Review and Analysis of Navarro's Book)От EverandThe Well-Timed Strategy (Review and Analysis of Navarro's Book)Оценок пока нет

- Daily Market Analysis & ChecklistДокумент1 страницаDaily Market Analysis & ChecklistAkash BiswalОценок пока нет

- CIS Book Frameworks-1Документ3 страницыCIS Book Frameworks-1Gaurav AgarwalОценок пока нет

- Hero MotocorpДокумент41 страницаHero MotocorpShivprasad ShenoyОценок пока нет

- Vedanta Credit ReportДокумент23 страницыVedanta Credit ReportvishnuОценок пока нет

- Quick Company Analysis PVR Limited: ShikshaДокумент10 страницQuick Company Analysis PVR Limited: ShikshaSuresh PandaОценок пока нет

- 1649497527678investing Strategies To Create Wealth 61445e8aДокумент31 страница1649497527678investing Strategies To Create Wealth 61445e8aVimalahar rajagopalОценок пока нет

- Deep Knowledge On Triangle PatternДокумент14 страницDeep Knowledge On Triangle PatternBIG BILLION DREAMSОценок пока нет

- Mansfield Relative StrengthДокумент3 страницыMansfield Relative StrengthTrader CatОценок пока нет

- 4 5922281635100755097Документ69 страниц4 5922281635100755097Kumar Amit Singh0% (1)

- Safal Niveshak Stock Analysis Excel Version 5 0Документ47 страницSafal Niveshak Stock Analysis Excel Version 5 0Yati GargОценок пока нет

- Safal Niveshak Stock Analysis Excel (Ver. 3.0) : How To Use This SpreadsheetДокумент32 страницыSafal Niveshak Stock Analysis Excel (Ver. 3.0) : How To Use This Spreadsheetjitintoteja_82Оценок пока нет

- Polymedicure TIAДокумент28 страницPolymedicure TIAProton CongoОценок пока нет

- TTC Workshop Brochure With FeeДокумент4 страницыTTC Workshop Brochure With Feesiddheshpatole153Оценок пока нет

- PAPA SeminerДокумент2 страницыPAPA SeminersouОценок пока нет

- Micro Economics - Demand and SupplyДокумент54 страницыMicro Economics - Demand and SupplyDr Rushen SinghОценок пока нет

- Zomato DamodaranДокумент64 страницыZomato DamodaranCuriousMan87Оценок пока нет

- Fundamental Analysis - : Fundamentals: Quantitative and QualitativeДокумент3 страницыFundamental Analysis - : Fundamentals: Quantitative and QualitativeChandan KokaneОценок пока нет

- Winzo OnboardingДокумент5 страницWinzo Onboardingsaheb167Оценок пока нет

- Stock Market Basics Chart Reading-Convergence of Moving Averages-1Документ62 страницыStock Market Basics Chart Reading-Convergence of Moving Averages-1Abdul Salam SagirОценок пока нет

- A Practical Manual From Professional Traders Academy Mr. YatharthДокумент28 страницA Practical Manual From Professional Traders Academy Mr. YatharthubaidОценок пока нет

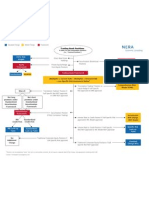

- Market Risk FlowchartДокумент1 страницаMarket Risk FlowchartlardogiousОценок пока нет

- Safal Niveshak Stock Analysis Excel Version 4.0Документ37 страницSafal Niveshak Stock Analysis Excel Version 4.0Ramesh ReddyОценок пока нет

- Nest Trading Platform How To Use It EffectivelyДокумент46 страницNest Trading Platform How To Use It EffectivelyVarun ParihariОценок пока нет

- 20 Ema, Technical Analysis ScannerДокумент4 страницы20 Ema, Technical Analysis ScannerRajesh AdluriОценок пока нет

- Forex QuotationsДокумент13 страницForex QuotationsKamalSoniОценок пока нет

- Assignment Task: Read The Following Scenario, and Prepare A Report With The Guidelines ProvidedДокумент4 страницыAssignment Task: Read The Following Scenario, and Prepare A Report With The Guidelines ProvidedSuraj Apex0% (3)

- Art of SellingДокумент24 страницыArt of SellingVaibhav JagtapОценок пока нет

- Investment Journey and Key Learnings Kumar SaurabhДокумент7 страницInvestment Journey and Key Learnings Kumar SaurabhAASHAV PATELОценок пока нет

- Highlights of The May'21 Edition: Sectors in Order of Their Premium/discount To Their Historical AveragesДокумент38 страницHighlights of The May'21 Edition: Sectors in Order of Their Premium/discount To Their Historical AveragesSAM SMITHОценок пока нет

- Tradingsimplified Episode 56 LowresДокумент24 страницыTradingsimplified Episode 56 LowresĐỗ SơnОценок пока нет

- Lecture 6 - The Basic Principle of Technical Analysis - The TrendsДокумент16 страницLecture 6 - The Basic Principle of Technical Analysis - The TrendsPTA JaipurОценок пока нет

- Entry and Exits: Eurusd Spread: 2 Pips H4Документ1 страницаEntry and Exits: Eurusd Spread: 2 Pips H4Philip okumuОценок пока нет

- Yta School BookletДокумент37 страницYta School BookletAditi100% (1)

- ABFRL - Pinnacle - The Next Big Thing in Indian ApparelДокумент8 страницABFRL - Pinnacle - The Next Big Thing in Indian ApparelSparsh AgarwalОценок пока нет

- Supply DemandДокумент22 страницыSupply DemandAMBWANI NAREN MAHESHОценок пока нет

- Team Shooting Stars: - FMS DelhiДокумент6 страницTeam Shooting Stars: - FMS DelhiAkram KhanОценок пока нет

- Long Term Capital ManagementДокумент49 страницLong Term Capital ManagementLiu Shuang100% (2)

- Summary - A Short Course On Swing TradingДокумент2 страницыSummary - A Short Course On Swing TradingsumonОценок пока нет

- Group 9 - SDMДокумент50 страницGroup 9 - SDMPRASHANT KUMARОценок пока нет

- Demand and Supply - DineshДокумент78 страницDemand and Supply - DineshSagar Ranjan Das100% (1)

- Zooming in Market Structure Price Action Trading Guide Deep Explanations High Probability Set Up Candlestick Analysis... (Bintara, Radar)Документ128 страницZooming in Market Structure Price Action Trading Guide Deep Explanations High Probability Set Up Candlestick Analysis... (Bintara, Radar)Hotako100% (1)

- Supply and Demand by Henderson, Hubert D., 1890-1952Документ79 страницSupply and Demand by Henderson, Hubert D., 1890-1952Gutenberg.orgОценок пока нет

- Candlestick ChartДокумент15 страницCandlestick Chartyfhtdbqnm8Оценок пока нет

- MARUTI SUZUKI INDUSTRIAL ANALYSIS FinalДокумент26 страницMARUTI SUZUKI INDUSTRIAL ANALYSIS FinaldhanrajОценок пока нет

- Strategy BookДокумент25 страницStrategy BookjustshubhamsharmaОценок пока нет

- Swing Trade Pro 2.0: The 5-Step Swing Trading BlueprintДокумент11 страницSwing Trade Pro 2.0: The 5-Step Swing Trading BlueprintDharmaraj PОценок пока нет

- Cv1e SM ch06 PDFДокумент10 страницCv1e SM ch06 PDFYu FengОценок пока нет

- Hiren - Presentation - ValuePickr Forum - 20 June 2019 - Final PDFДокумент19 страницHiren - Presentation - ValuePickr Forum - 20 June 2019 - Final PDFPRAVEEENGODARAОценок пока нет

- Fundamental of TA (UOB)Документ46 страницFundamental of TA (UOB)Zulrock KlateОценок пока нет

- Chart Patterns Double Tops BottomsДокумент9 страницChart Patterns Double Tops BottomsJeremy NealОценок пока нет

- Investing For Growth 1Документ8 страницInvesting For Growth 1kegnataОценок пока нет

- Handout # 1 Solutions (L)Документ10 страницHandout # 1 Solutions (L)Prabhawati prasadОценок пока нет

- CMT BookДокумент45 страницCMT BookTalkTech IncorperatedОценок пока нет

- Decnoch 2019Документ466 страницDecnoch 2019IMaths Powai100% (1)

- Section A Group 16 Matrix Footwear CaseДокумент10 страницSection A Group 16 Matrix Footwear Casevarun_muraliОценок пока нет

- Price Behaviour NovemberДокумент53 страницыPrice Behaviour NovemberAnsh RebelloОценок пока нет

- HONY, CIFA, AND ZOOMLION: Creating Value and Strategic Choices in A Dynamic MarketДокумент5 страницHONY, CIFA, AND ZOOMLION: Creating Value and Strategic Choices in A Dynamic MarketJitesh ThakurОценок пока нет

- Nov 14 - Nava Bharat VenturesДокумент1 страницаNov 14 - Nava Bharat VenturesMadhukar DasОценок пока нет

- Dec 12 - Bajaj Auto FinanceДокумент1 страницаDec 12 - Bajaj Auto FinanceMadhukar DasОценок пока нет

- Apr 29 - Godrej IndustriesДокумент1 страницаApr 29 - Godrej IndustriesMadhukar DasОценок пока нет

- May 13 - Omax AutosДокумент1 страницаMay 13 - Omax AutosMadhukar DasОценок пока нет

- Apr 14 - Allied DigitalДокумент1 страницаApr 14 - Allied DigitalMadhukar DasОценок пока нет

- Feb 27 - Gammon IndiaДокумент1 страницаFeb 27 - Gammon IndiaMadhukar DasОценок пока нет

- Jan 30 - Finolex CablesДокумент1 страницаJan 30 - Finolex CablesMadhukar DasОценок пока нет

- Mar 29 - Tata SteelДокумент1 страницаMar 29 - Tata SteelMadhukar DasОценок пока нет

- Oct 14 - HCL InfosystemsДокумент1 страницаOct 14 - HCL InfosystemsMadhukar DasОценок пока нет

- Nov 26 - HCL InfosystemsДокумент1 страницаNov 26 - HCL InfosystemsMadhukar DasОценок пока нет

- Oct 29 - Reliance InfrastructureДокумент1 страницаOct 29 - Reliance InfrastructureMadhukar DasОценок пока нет

- Nov 14 - Nava Bharat VenturesДокумент1 страницаNov 14 - Nava Bharat VenturesMadhukar DasОценок пока нет

- Sep 28 - VideoconДокумент1 страницаSep 28 - VideoconMadhukar DasОценок пока нет

- Dec 12 - Bajaj Auto FinanceДокумент1 страницаDec 12 - Bajaj Auto FinanceMadhukar DasОценок пока нет

- Crisis ManagementДокумент26 страницCrisis ManagementSebin Sebastian100% (2)

- Summit Brings Together Three Different Cultures: Walks Raises Thousands For Local SchoolДокумент20 страницSummit Brings Together Three Different Cultures: Walks Raises Thousands For Local SchoolgrossepointenewsОценок пока нет

- Tellspec Edt321Документ14 страницTellspec Edt321api-267215065Оценок пока нет

- Brew 2014 MapДокумент2 страницыBrew 2014 MapChris HughesОценок пока нет

- Final Outline For SubmissionДокумент3 страницыFinal Outline For SubmissionTesda CACSОценок пока нет

- Application of The Business Model Canvas in Farm Management EducationДокумент7 страницApplication of The Business Model Canvas in Farm Management EducationRubick MagusОценок пока нет

- The Positive Aspect of GlobalizationДокумент4 страницыThe Positive Aspect of GlobalizationHena SafeeОценок пока нет

- Consumer PerceptionДокумент15 страницConsumer PerceptionHarmeet Anand100% (1)

- Unit 8 - Meals. Lunch (II)Документ7 страницUnit 8 - Meals. Lunch (II)Veronica BakerОценок пока нет

- Fact SheetДокумент18 страницFact SheetRigoumi PreciousОценок пока нет

- 1349122940100212diggerДокумент24 страницы1349122940100212diggerCoolerAdsОценок пока нет

- Retail Management Project - : Franchisee Business of KFCДокумент16 страницRetail Management Project - : Franchisee Business of KFCLi PanОценок пока нет

- Project Report On CadburyДокумент25 страницProject Report On CadburyAnilGoyal67% (3)

- Davao Tourism PresentationДокумент34 страницыDavao Tourism PresentationKERVINJOSEPH ELIJAYОценок пока нет

- Primus 2012Документ72 страницыPrimus 2012Adrian KozelОценок пока нет

- PACANational Shipper Contact ListДокумент105 страницPACANational Shipper Contact Listjosean50% (4)

- An Introduction To Vending: The MarketДокумент8 страницAn Introduction To Vending: The MarketAnkit SinghОценок пока нет

- Joy Young Cafe & GroceryДокумент10 страницJoy Young Cafe & GroceryJohn Jung100% (1)

- Colgate Marketing PlanДокумент22 страницыColgate Marketing Plancoolaysuh9Оценок пока нет

- Assignment 1 - UnileverДокумент5 страницAssignment 1 - UnileverRchard Gomez50% (4)

- Internship at Pran RFL Group Nov'21Документ25 страницInternship at Pran RFL Group Nov'21Sakib SparrowОценок пока нет

- Strategic Management Paper of JollibeeДокумент25 страницStrategic Management Paper of JollibeeVince Pereda0% (2)

- Professional Refrigeration ProductsДокумент4 страницыProfessional Refrigeration ProductsMeghana YedunuthalaОценок пока нет

- Nestle Case StudyДокумент50 страницNestle Case StudyMANIKA PURIОценок пока нет

- Presentation On: By: Jagdish Chhapolia Roll No. 06 Mayank Gupta Roll No. 08 Section: BДокумент18 страницPresentation On: By: Jagdish Chhapolia Roll No. 06 Mayank Gupta Roll No. 08 Section: BSwayam GuptaОценок пока нет

- RRLДокумент27 страницRRLDavid100% (2)

- MKTG. DatabaseДокумент8 страницMKTG. DatabaseNeil Francel D. MangilimanОценок пока нет

- MK230 - Unit3: "Chicken of Sea" Case StudyДокумент11 страницMK230 - Unit3: "Chicken of Sea" Case StudyLennon Design, Student.Оценок пока нет

- TeluguДокумент6 страницTeluguSanarthana Radha Krishnan NaiduОценок пока нет

- Chapter 3CДокумент16 страницChapter 3CFerdinand GeliОценок пока нет