Академический Документы

Профессиональный Документы

Культура Документы

Pension Funds Risk

Загружено:

bobbyroczsИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Pension Funds Risk

Загружено:

bobbyroczsАвторское право:

Доступные форматы

G L O B A L A S S O C I AT I O N O F R I S K P R O F E S S I O N A L S

PENSION FUNDS

Pension Risk Management:

The Importance of Oversight

Contemporary pension plans must hurdle a variety of political and cultural obstacles to implement effective

risk management frameworks, but there is light at the end of the tunnel. Dr. Susan M. Mangiero dissects

this evolving landscape and offers practical advice on risk controls, technology and staffing.

ension oversight has always been important, but Moreover, there is a widely held belief that the delegation of

P perhaps never more so than today. More than a

few public and private retirement programs are in

financial trouble, the regulatory environment is

rapidly changing, “breach of duty” lawsuits are

on the rise and market volatility is a constant.1

The consequences of incomplete or poor oversight are far

from trivial. According to the US Department of Labor,

there are “approximately 730,000 private sector pension

and 401(k) plans, covering 102 million individuals” subject

duties to external money managers completely takes care of

any further responsibilities on the part of fiduciary persons.

In fact, pension plan sponsors still maintain risk monitoring

responsibilities in cases where delegation is permitted. 4,5

Finally, there is the issue of motivation. Unless and until

fiduciaries recognize the need to fully incorporate risk man-

agement as part of the investment process, it will be diffi-

cult — perhaps impossible — to get those in charge to

spend the requisite time and money to identify, measure

to the fiduciary provisions of the Employee Retirement and manage risk. Plan trustees need to assess their comfort

Income Security Act (“ERISA”).2 In addition, there are mil- level with the status quo by asking questions such as: What

lions of government employees and other participants who risk factors currently affect portfolio value and returns?

are in plans not covered by ERISA, but who are nevertheless How is risk mitigated, if at all? And is the risk management

dependent on proper governance of their retirement monies. strategy uniform across investment strategies and outside

Surprisingly, while there is a lot written about general money managers?

investment fiduciary duties as they relate to retirement Whether litigation worries, regulation or interest in imple-

plans, there is relatively little information about pension menting best practices will take fiduciaries to the next step is

risk control. While that is slowly changing, it is important unclear. What is certain is that fiduciaries play a vital role in

to understand attitudes about risk management in the pen- the financial health, good or bad, of a pension plan. How

sion community. they carry out their duties is a question of increasing interest

to beneficiaries, regulators, shareholders and taxpayers.

Risk Management Attitudes Having a clear, logical and well-documented risk manage-

The term “risk management” means different things to dif- ment process in place can make a big difference. This is espe-

ferent people. A traditional interpretation, often used, cially true if the risk policy comports with prevailing law,

refers to the use of insurance products to protect fiduciaries reflects relevant economic characteristics of a plan, promotes

against litigation-related liability. Others define risk man- discipline in the form of adequate checks and balances and

agement as the use of derivative instruments to transform offers an opportunity to improve the risk-adjusted financial

cash flows or minimize market risk. A more comprehensive performance of plan assets on behalf of beneficiaries.

use of the term refers to the management of multiple risk

types — such as financial, operational and legal risks — Getting Started

and assumes some use of derivatives. (This broader defini- A cornerstone of the pension risk management process is a

tion underlies the discussion that follows.) commitment on the part of senior decision-makers to make

Complexity — perceived or otherwise — is another factor. resources available. This is easier said than done. Changes

A fiduciary person who is uncomfortable with investment to municipal plans, and the related operating budgets, fre-

concepts is unlikely to ask tough questions about derivatives, quently require approval by busy legislators who are under

performance metrics or risk control strategies. As a result, increasing pressure to keep taxes low. Terms and condi-

consultants and other advisors may feel it is not necessary to tions of multi-employer plans are often the result of long,

spend time discussing the topic with pension clients.3 and sometimes difficult, labor negotiations. These plans are

22 GLOBAL ASSOCIATION OF RISK PROFESSIONALS MARCH/APRIL 05 ISSUE 23

G L O B A L A S S O C I AT I O N O F R I S K P R O F E S S I O N A L S

PENSION FUNDS

rarely, if ever, open to quick change. tion and experience is also a fine idea. But regardless of

Nevertheless, a top-level commitment to prioritize risk seniority and function, employers need to keep one thing in

management and make it an integral part of the invest- mind when hiring risk management professionals: though

ment process is essential to success. Why? In addition to quantitative skills are paramount, a facility with numbers is

authorizing money to buy or upgrade systems, people have not enough. There is no substitute for understanding what

to be hired to make and to carry out appropriate policies makes markets tick and using common sense to know when

and procedures. Beyond that, a commitment to risk man- something seems wrong. Additionally, the ability to anticipate

agement affects how and why people are compensated. adverse consequences — and investigate further, when neces-

Paying people to take excessive risks, in anticipation of sary — is a hallmark of a savvy risk manager.7

higher returns, can be fatal for a pension plan that is oblig-

ated by law to make good on its promises. The flip side is

to have a structure in place that rewards people for prudent

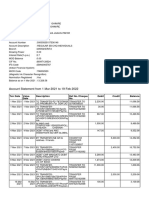

*Exhibit 1:

decision-making. That doesn’t necessarily translate into The “Five C” Approach to Risk ManagementSM

avoiding riskier investments. It just means that promotions,

VARIABLE OBJECTIVE

bonuses and raises should be tied to allocating assets,

Commitment ■ Ensure that adequate resources are made avail-

selecting securities (if not outsourced) and making risk con- able to support risk management activities.

trol decisions that satisfy the goals set forth in the pension ■ Promote an organization-wide risk management

plan’s investment policy statement.6 culture that results in appropriate compensation

and operational policies and procedures.

Of course, establishing a risk management process doesn’t

happen all at once. Making a commitment to managing risk, Comprehension ■ Ensure that all relevant staff members sufficiently

understand risk management basics, including

and implementing an appropriate reward system, is just the the interdependence among departments, to

beginning. As shown in Exhibit 1 (right), training, systems, avoid unnecessary losses.

internal controls and effective communication are other ■ Promote risk management best practices.

essential elements of the risk management process.

Controls ■ Mitigate the adverse effects of rogue trading.

It is also worthwhile to note the fact that the activities

■ Stem losses before they get too large.

required to set up and to implement a risk management

process are rarely executed in sequence — and can be done Computers ■ Review risk-adjusted performance and possibly

revise strategies.

concurrently. So it’s important to ensure that you have the

■ Identify trading limit violations.

necessary education, personnel, strategy and systems in

■ Improve fund governance.

place before making any important decisions. For example,

buying or improving a computer system makes no sense in Communication ■ Ensure budgetary approval for risk management

the absence of adequate training; authorizing limits will do resources.

■ Instill confidence in beneficiaries and regulators

little good without an adequate system in place to track that the plan is well managed.

violations; and failure to communicate results will make it

* This is not an exhaustive list of process components.

hard to support a budget to pay qualified personnel.

Comprehension and Computers In addition, the importance of having a good technology

The human resources dimension is another vital part of the system in place cannot be emphasized enough. Even when

risk management process. That includes hiring and training a pension fund uses outside firms, trustees are unable to do

qualified people, not just in trading and analysis but also in their job effectively without being able to properly collect

operations. The costs of making support staff more fully data, corroborate external numbers and monitor perfor-

aware of proper procedure for processing and settling trades is mance vis-à-vis already established investment goals.

tiny compared to the benefits of minimizing loss. This is espe- Budgetary constraints, type of assets under management,

cially true when reputation is taken into account, since the number of delegate firms and existing infrastructure are

monetary damage associated with a single transgression sel- just a few of the factors that will determine whether to

dom incorporates the lingering effect of bad publicity. A plan lease, buy or internally develop a user-friendly system.

sponsor may lose business or incur additional costs in the Similar considerations determine the requisite functions

form of a special audit or regulatory investigation in response and, by extension, the cost of a system. The ultimate shop-

to news about back-room problems, model mistakes or poor ping list will vary by the type and the size of a pension plan,

oversight. Moreover, pension trustees could be found person- as well as by how much an organization can spend and by

ally liable and incur separate costs to defend themselves. the ability of staff to understand how to use the system.

Providing tiered training to reflect differences in educa- Whatever your decision, it is wise to allow for time and

MARCH/APRIL 05 ISSUE 23 GLOBAL ASSOCIATION OF RISK PROFESSIONALS 23

G L O B A L A S S O C I AT I O N O F R I S K P R O F E S S I O N A L S

PENSION FUNDS

money to test the system. Find out what resources are sors provide performance numbers. Others add information

available to train staff. Ask about what money mangers use about investment strategies and/or risk management initia-

the system and inquire about the underlying algorithms tives. The key is to shed light on the process, not just the

used to measure risk. It would be a shame to spend a lot of results, and to do so in an understandable manner.8

money on a system that is hard to use, difficult to modify

and incompatible with the performance reports sent by var- The Road Ahead

ious money management firms. As Confucius once said, “A journey of a thousand miles

begins with a single step.” If a plan has no risk management

Controls and Communication process in place, now is the time to move forward. For those

Buying a sophisticated computer system and spending organizations with an established process, a review and pos-

money to train staff is a waste of money unless good con- sible revision are in order. Regardless of where fund trustees

trols are in place. Time and time again, losses can be traced currently stand with respect to risk control, detailed docu-

back to weak (or nonexistent) checks and balances. mentation and justification are crucial.

Internal and external controls should work together to pro- What was the reasoning behind a particular part of the risk

vide an early warning that something is awry. management process? How was the decision made to use

If a problem is not picked up at the outset, ideally there derivatives or to forgo their use in lieu of an alternative

should be a mechanism in place to ensure that someone, at approach?9 What is the current compensation arrangement by

some point, is alerted and can take corrective action. job function and objectives and does it reward speculation?

Trustees should document internal controls and make them Who has the authority to change trading limits? How are

widely available throughout the organization. In addition, money mangers hired and fired as a function of their reported

pension professionals need to ask auditors and outside risk-adjusted returns? What risk metrics are deemed appropri-

money managers about how often their controls are updat- ate and why? Process means little without comprehensive doc-

ed and about the process they go through when a violation umentation that spells out answers to these and many other

occurs. As stated earlier, times are changing. Pension fidu- pertinent questions.

ciaries are being asked to explain mishaps and neither igno- No one is exempt from doing the right thing on behalf of

rance nor benign neglect offers a legitimate excuse. existing and soon-to-be retirees. This is true regardless of

Fiduciaries have two choices. They can adopt a compre- plan type.10 Even honest and well-intended players stand to

hensive risk management policy because they have to or they lose, since fiduciary breach elsewhere has the potential to

can choose to do so voluntarily, recognizing the benefits of accelerate an already fast-moving trend toward increased

being proactive and prudent. Either outcome involves com- regulation. If that occurs, plan sponsors will lose the flexi-

munication. In the first case, foul play, once made public, bility to make important decisions on their own and will

generates ill will and can invite litigation or regulatory incur higher compliance costs, making it that much harder

inspection. In the second case, pension leaders can let others to generate cash flow and to satisfy plan obligations.

know that their money is in good hands. Some pension spon- Waiting is no longer a viable option! ■

FOOTNOTES:

1) According to the Administrative Office of the US Courts, new ERISA cases filed rose from 7) For more information, see Susan M. Mangiero’s “Life in Financial Risk Management: Shrinking Violets

9,167 cases in 2000 to 11,499 cases in 2004. Need Not Apply,” AFP Exchange, July/August 2003. Contact the author for a copy of the article.

2) See the February 17, 2004, press release entitled “Labor Department Issues Guidance on 8) Obtaining information about pension plan performance and investment/risk strategies is far

Fiduciary Duties in Response to Mutual Fund Abuses.” from uniform. Plan type, and related regulation, determines reporting frequency and scope.

Moreover, in some cases, it is downright difficult to get timely and detailed data. For a

3) In June 2004, the US Department of Labor launched an education program called, “Getting It detailed discussion about pension fund reporting, see chapter four of Risk Management for

Right — Know Your Fiduciary Responsibilities,” to assist plan sponsors and other fiduciaries in Pensions, Endowments, and Foundations, by Susan M. Mangiero.

discharging their duties.

9) For further information about the role of derivatives in discharging fiduciary duties, see

4) Plan sponsors need to seek the advice of a legal professional about relevant delegation rules, George Crawford’s “A Fiduciary Duty to Use Derivatives” (Stanford Journal of Law, Business &

including the way assignment should take place, who can be a delegated fiduciary and when Finance,1995) and Randall H. Borkus’s “A Trust Fiduciary’s Duty to Implement Capital

delegation can occur. Preservation Strategies Using Financial Derivatives Techniques” (Real Property, Probate and

Trust Journal, 2001).

5) Thomas Z. Reicher. “Pension Alert: Selecting Asset Managers,” Journal of Financial Planning,

April 1993. 10) Plan type determines the exact obligations of fiduciary persons.

6) It makes no sense to invest without first establishing a clear, comprehensive and appropriate

policy statement. It provides the roadmap to guide trustees for every aspect of the invest-

ment and related risk management processes

✎ DR. SUSAN M. MANGIERO, CFA, is a managing member of BVA LLC, an independent valuation and risk analysis firm. An Accredited

Valuation Analyst and certified Financial Risk Manager, Dr. Mangiero is leading an upcoming GARP training course on risk management for pen-

sion funds (for locations and dates, please go to http://www.garp.com/events/pensionfunds/). Dr. Mangiero, who can be reached at

smm@bvallc.com, is also the author of Risk Management for Pensions, Endowments, and Foundations (John Wiley & Sons, 2005).The information

provided by this article should not be construed as financial or legal advice; the reader should consult with his or her own advisors.

24 GLOBAL ASSOCIATION OF RISK PROFESSIONALS MARCH/APRIL 05 ISSUE 23

Вам также может понравиться

- Group 7: OF Management StudiesДокумент7 страницGroup 7: OF Management StudiesKarthik SoundarajanОценок пока нет

- Topic Eight Risk ManagementДокумент24 страницыTopic Eight Risk ManagementKelvin mwaiОценок пока нет

- Foreword: ©association For Investment Management and ResearchДокумент80 страницForeword: ©association For Investment Management and Researchhelvian adeОценок пока нет

- Investment Management Operational Risks BSCДокумент6 страницInvestment Management Operational Risks BSCPoCheng SunОценок пока нет

- Institutionalisation of Risk ManagementДокумент2 страницыInstitutionalisation of Risk Managementyin920Оценок пока нет

- Module 5 Chapter QuizДокумент5 страницModule 5 Chapter QuizCarrie DangОценок пока нет

- A Strategic View: Them With Uncompensated Risks - Often, Strategic Risks Are "Compensated"Документ4 страницыA Strategic View: Them With Uncompensated Risks - Often, Strategic Risks Are "Compensated"Hassan KhawajaОценок пока нет

- Chapter 3 - Risk AnalysisДокумент33 страницыChapter 3 - Risk AnalysisJeremiah PlatinoОценок пока нет

- Risk Appetite - How Hungry Are You?: by by Richard BarfieldДокумент6 страницRisk Appetite - How Hungry Are You?: by by Richard BarfieldNczthОценок пока нет

- L7 Risk ManagementДокумент21 страницаL7 Risk ManagementMia FayeОценок пока нет

- 18 Risk ManagementДокумент28 страниц18 Risk ManagementReyansh SharmaОценок пока нет

- 3 Risk ManagementДокумент10 страниц3 Risk ManagementRahul YelangeОценок пока нет

- Risk ManagerДокумент2 страницыRisk ManagerPriyanka VarmaОценок пока нет

- Governance Business Ethics Finals-FinalsДокумент15 страницGovernance Business Ethics Finals-Finalsjp bОценок пока нет

- Risk MGMT in Bank Full N FinalДокумент57 страницRisk MGMT in Bank Full N FinalBhaveen JoshiОценок пока нет

- CHAPTER 12: Practical Guidelines in Reducing and Managing Business RisksДокумент29 страницCHAPTER 12: Practical Guidelines in Reducing and Managing Business RisksMerigen OcampoОценок пока нет

- Risk Management Course Prepares Students for Business CareersДокумент36 страницRisk Management Course Prepares Students for Business CareersPhrexilyn Pajarillo0% (2)

- Risk and Crisis ManagementДокумент16 страницRisk and Crisis ManagementHabib AntouryОценок пока нет

- Irda March 2010Документ96 страницIrda March 2010ShantanuОценок пока нет

- Explained Risk AppetiteДокумент30 страницExplained Risk Appetiteeftychidis100% (3)

- Practical Guidelines in Reducing and Managing Business RisksДокумент6 страницPractical Guidelines in Reducing and Managing Business RisksSherilyn PicarraОценок пока нет

- GX Fsi Ecrs Riskappetite 16072013Документ24 страницыGX Fsi Ecrs Riskappetite 16072013Esteban MartinОценок пока нет

- E2303 Risk Management Chapter 2Документ4 страницыE2303 Risk Management Chapter 2Jeremy Marquez AmbongОценок пока нет

- GBERMIC - Module 11Документ8 страницGBERMIC - Module 11Paolo Niel ArenasОценок пока нет

- Risk Management An IntroductionДокумент5 страницRisk Management An IntroductionRajesh KumarОценок пока нет

- Chap - 9 Risk ManagementДокумент54 страницыChap - 9 Risk ManagementMd. Mamunur RashidОценок пока нет

- Strategic Risk Management: The New Competitive EdgeДокумент11 страницStrategic Risk Management: The New Competitive EdgesammirtoОценок пока нет

- Lisa K. Meulbroek - A Senior Manage's Guide To Integrated Risk Management PDFДокумент17 страницLisa K. Meulbroek - A Senior Manage's Guide To Integrated Risk Management PDFimran jamilОценок пока нет

- Addressing Talent Shortages and Increased Retention DemandsДокумент5 страницAddressing Talent Shortages and Increased Retention DemandsHeralynn BaloloyОценок пока нет

- Effect of Uncertainty On Objectives) Followed by Coordinated and Economical Application of Resources ToДокумент6 страницEffect of Uncertainty On Objectives) Followed by Coordinated and Economical Application of Resources ToKatrina Vianca DecapiaОценок пока нет

- RSK4802 Notes To Exam 2021Документ61 страницаRSK4802 Notes To Exam 2021bradley.malachiclark11Оценок пока нет

- Risk Management: Learning OutcomesДокумент16 страницRisk Management: Learning OutcomesNATURE123Оценок пока нет

- Board Perspectives Risk Oversight Issue 73 - Ensuring Risk Management SuccessДокумент4 страницыBoard Perspectives Risk Oversight Issue 73 - Ensuring Risk Management SuccessJason SpringerОценок пока нет

- Risk Management PDFДокумент10 страницRisk Management PDFAlok Raj100% (1)

- Risk ManagementДокумент3 страницыRisk ManagementMITHUN MOHANОценок пока нет

- Research Paper On Enterprise Risk ManagementДокумент7 страницResearch Paper On Enterprise Risk Managementafnhekkghifrbm100% (1)

- 3 RMДокумент18 страниц3 RMNirmal ShresthaОценок пока нет

- Risk & Internal Controls - Synergy Often ForgottenДокумент2 страницыRisk & Internal Controls - Synergy Often ForgottenKalaiyalagan KaruppiahОценок пока нет

- Module 7 Risk MnagementДокумент10 страницModule 7 Risk MnagementddddddaaaaeeeeОценок пока нет

- Insurance Planning and Risk ManagementДокумент52 страницыInsurance Planning and Risk ManagementGouri Pillay67% (3)

- Emerging Risk MitigationДокумент36 страницEmerging Risk MitigationgatotgОценок пока нет

- Enterprise Risk ManagementДокумент16 страницEnterprise Risk ManagementSahil Nagpal100% (1)

- BSBPMG632 Manage Program Risk (Answers)Документ15 страницBSBPMG632 Manage Program Risk (Answers)gurpreet0% (4)

- Challenges of Risk ManagementДокумент17 страницChallenges of Risk Managementmorrisonkaniu8283Оценок пока нет

- Why Is It Important To Identify and Prioritize Risk?Документ2 страницыWhy Is It Important To Identify and Prioritize Risk?John Dexter CallaoОценок пока нет

- Risk Management Essay SampleДокумент16 страницRisk Management Essay SampleGreyGordonОценок пока нет

- PWC Risk AppetiteДокумент6 страницPWC Risk Appetitelucasgio100% (1)

- Risk management tools for multinational firmsДокумент16 страницRisk management tools for multinational firmsnandu_mОценок пока нет

- The Significant Transformation of The Banking Industry in India IsДокумент45 страницThe Significant Transformation of The Banking Industry in India IsMamta JaiswarОценок пока нет

- BusinessДокумент8 страницBusinessManvi GeraОценок пока нет

- Overview of Financial Risk TypesДокумент8 страницOverview of Financial Risk TypesMark Levin LegoОценок пока нет

- PHD Thesis On Risk Management PDFДокумент5 страницPHD Thesis On Risk Management PDFlizbrowncapecoral100% (2)

- Enterprise Risk ManagementДокумент51 страницаEnterprise Risk ManagementKajal Tiwary100% (2)

- 2021 12 Risk Management ManualДокумент39 страниц2021 12 Risk Management ManualSHERIEFОценок пока нет

- Risk Management (SM) ICMAP Attempts Qs - xlsx-1Документ8 страницRisk Management (SM) ICMAP Attempts Qs - xlsx-1Sibgha FayyazОценок пока нет

- Risk Mangament in InsursnceДокумент40 страницRisk Mangament in InsursnceAlaa AlikОценок пока нет

- Strategically Speaking October 2015Документ9 страницStrategically Speaking October 2015sakamotoОценок пока нет

- RM Finals ReviewerДокумент7 страницRM Finals ReviewerErika May EndencioОценок пока нет

- Financial Intelligence: Navigating the Numbers in BusinessОт EverandFinancial Intelligence: Navigating the Numbers in BusinessОценок пока нет

- New Microsoft Office Word DocumentДокумент15 страницNew Microsoft Office Word DocumentbobbyroczsОценок пока нет

- Wind Energy and Wind PowerДокумент4 страницыWind Energy and Wind PowerbobbyroczsОценок пока нет

- SBH QuestionsДокумент3 страницыSBH QuestionsbobbyroczsОценок пока нет

- Questions Would Be Based OnДокумент1 страницаQuestions Would Be Based OnbobbyroczsОценок пока нет

- About BhelДокумент3 страницыAbout BhelbobbyroczsОценок пока нет

- Regulator Wants Cap On Short-Term Tariffs For Coal-Fired PlantsДокумент4 страницыRegulator Wants Cap On Short-Term Tariffs For Coal-Fired PlantsbobbyroczsОценок пока нет

- Chapter Two & Three: Priciples & Basis of Accounting For NFP Entities and Accounting & Budgeting ProcessДокумент51 страницаChapter Two & Three: Priciples & Basis of Accounting For NFP Entities and Accounting & Budgeting ProcessabateОценок пока нет

- CA Certificate For VisaДокумент4 страницыCA Certificate For VisaVamshi Krishna Reddy Pathi0% (1)

- ABM 12 (Cash Flow Statement) CFSДокумент6 страницABM 12 (Cash Flow Statement) CFSWella LozadaОценок пока нет

- Week 1 Lecture Material MOISДокумент57 страницWeek 1 Lecture Material MOISshashwat kushwahaОценок пока нет

- Ncfe-Nflat Detailed Syllabus Final 1.0Документ4 страницыNcfe-Nflat Detailed Syllabus Final 1.0sawrajОценок пока нет

- Port Covington Official Limited Offering MemorandumДокумент1 236 страницPort Covington Official Limited Offering MemorandumBaltimore Business JournalОценок пока нет

- HDFC Bank provides nationwide banking services with 2000+ branchesДокумент16 страницHDFC Bank provides nationwide banking services with 2000+ branchesVenkateshwar Dasari NethaОценок пока нет

- Rock Clinton FinalДокумент31 страницаRock Clinton FinalNgwa Godrick AtangaОценок пока нет

- Macroeconomics Canadian 14th Edition Mcconnell Test BankДокумент32 страницыMacroeconomics Canadian 14th Edition Mcconnell Test Bankadeleiolanthe6zr1100% (27)

- Multi Sports FacilityДокумент7 страницMulti Sports FacilityDivyanshu ShekharОценок пока нет

- NIDHI CementpVT LTD MBA Project Report Prince DudhatraДокумент50 страницNIDHI CementpVT LTD MBA Project Report Prince DudhatrapRiNcE DuDhAtRaОценок пока нет

- Modern Management: Concepts and Skills: Fifteenth Edition, Global EditionДокумент20 страницModern Management: Concepts and Skills: Fifteenth Edition, Global EditionnotsaudОценок пока нет

- Chapter 04 Proj Change 1Документ24 страницыChapter 04 Proj Change 1Dr Ricardo VincentОценок пока нет

- Public Debt ManagementДокумент7 страницPublic Debt ManagementNwigwe Promise ChukwuebukaОценок пока нет

- Salon and Wellness Business PlanДокумент43 страницыSalon and Wellness Business PlanShanu MehtaОценок пока нет

- (BAFI 1045) T01 & T02 (Investments Setting, Asset Allocation, Professional Portfolio Management, Alternative Assets, & Industry Ethics)Документ43 страницы(BAFI 1045) T01 & T02 (Investments Setting, Asset Allocation, Professional Portfolio Management, Alternative Assets, & Industry Ethics)Red RingoОценок пока нет

- Ar Rahn and Pawn Broking PDFДокумент9 страницAr Rahn and Pawn Broking PDFaim_naina100% (1)

- ZFVOq FVIDt 2 Flru YДокумент15 страницZFVOq FVIDt 2 Flru Ybhairav ghimireОценок пока нет

- CBR Swing BasicДокумент29 страницCBR Swing BasickrisnaОценок пока нет

- Systems, Processes and Challenges of Public Revenue Collection in ZimbabweДокумент12 страницSystems, Processes and Challenges of Public Revenue Collection in ZimbabwePrince Wayne SibandaОценок пока нет

- Exam 3 Review and Sample ProblemsДокумент14 страницExam 3 Review and Sample ProblemsCindy MaОценок пока нет

- UntitledДокумент1 страницаUntitledapi-260945806Оценок пока нет

- What Is KYCДокумент3 страницыWhat Is KYCPrateek LoganiОценок пока нет

- Lecture Notes Chapters 1-4Документ28 страницLecture Notes Chapters 1-4BlueFireOblivionОценок пока нет

- Burkina Inflation FactorsДокумент29 страницBurkina Inflation Factorskaidi chaimaaОценок пока нет

- Chapter 13 The Stock MarketДокумент7 страницChapter 13 The Stock Marketlasha KachkachishviliОценок пока нет

- Working CapitalДокумент102 страницыWorking CapitaldasaripandurangaОценок пока нет

- Zscaler AnalysisДокумент3 страницыZscaler AnalysisChuheng GuoОценок пока нет

- The Unofficial Guide To Real Estate InvestingДокумент507 страницThe Unofficial Guide To Real Estate InvestingAlessandro Costa100% (11)

- Davey Brothers Watch Co. SubmissionДокумент13 страницDavey Brothers Watch Co. SubmissionEkta Derwal PGP 2022-24 BatchОценок пока нет