Академический Документы

Профессиональный Документы

Культура Документы

TAX Saving Investment Proof

Загружено:

Amit ShuklaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

TAX Saving Investment Proof

Загружено:

Amit ShuklaАвторское право:

Доступные форматы

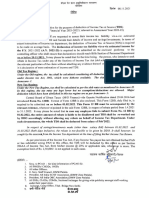

Summary of Invesment proof for claiming Tax Rebates / Deductions

For the Financial Year 2010-2011

Name of the Company

Employee Code

Designation

NAME

Contact No ( Extn or cell No)

Email id

PAN ( Mandatory )

SECTION - I

TAX SAVING ALLOWED U/S 10(13A) OF THE ITAX ACT, 1961)

S.No Description

In Respect of House Rent Paid (Enclosed proff) RENT P.M.

FULL ADDRESS :

SECTION -II

(TAX SAVING ALLOWED U/S 80 OF THE IT ACT, 1961)

In respect of Saving allowed under Chapter VI

I hereby submite my saving during the current financial year as per detail below:-

S.No Description AMOUNT (Rs.)

1 Section 80D - Medical Insurance Premium

2 Section 80DD - Medical treatement for Handicap

3 Section 80U - Peramanent Physical disablility

4 Section 80E - Payment of interest on loan taken for Higher Education

5 Section 80DDB - Medical treatement

6 Others

SECTION -III

PROOF OF SAVING U/S 80C OF THE IT ACT, 1961

Investment under this Sec can be made upto Rs. 1 Lac (Inclucive your contibutaion to PF ) in any of the below

S.No Description AMOUNT

1 LIFE INSURANCE (LIC)

2 Public Provident Fund (PPF)

3 National Savings Certificate Purchased (NSC)

4 Unit Linked Insurance Plan (ULIP)

5 Housing Loan repayment of Principal up to a maximum of Rs.1 Lac P.A

6 Investment u/s. 80CCC will also qualify under this Sec - Rs.1 Lac

7 Mutual Funds

8 Children Tution Fee allowed for maxium of 2 children

Detail to Fill in Below Ist Child | IInd child

Name of Child |

Date of Birth |

School/Institution |

Class |

Proof attached |

Tution Fee for the year |

9 Investment in Tax Saving Infrastructure Bonds

10 Others (Please specify)

SECTION -IV

(PROOF OF DEDUCTION U/S 24 OF THE IT ACT, 1961)

With respect of the amount of any interest payable on borrowed capital for acquiring, constructing , renewal,

repairing or re-constructing property.

Address of the Property against which Loan taken : ________________________________________________

_______________________________________________________________________________________

______________________________________________________________________________________

Self - Occupied / Rented : _______________________________________________________________

Date of loan availed : _________________________________________________________________

Purpose of the Loan (construction / Acquiring property) _________________________________________

Construction of Property will be completed on or before (date)____________________________________

Date of possession of the house property : _______________________________________________

Total amount of interest payable (post construction/possession) during the financial year (April 2010 to March

2011)________________ (Enclose a certificate from the bank/financial institution).

Specify amount of interest paid for pre-construction/possession period________________

Signature of Employee :______________________

Date :

Place :

Вам также может понравиться

- AIL-Investment Declaration Form 2013-2014Документ2 страницыAIL-Investment Declaration Form 2013-2014G A PATELОценок пока нет

- Employee Tax Declaration - AY 2019-20Документ4 страницыEmployee Tax Declaration - AY 2019-20mathuОценок пока нет

- Investment Declaration FY 22-23Документ2 страницыInvestment Declaration FY 22-23Ahfaz ShaikhОценок пока нет

- Income Tax Form Guide for 2006-07Документ9 страницIncome Tax Form Guide for 2006-07Chalan B SОценок пока нет

- SR - No Description Amount Rs A. Investment U/S 80 CДокумент1 страницаSR - No Description Amount Rs A. Investment U/S 80 CMohit ChavanОценок пока нет

- 36 It Declaration Fy1011Документ1 страница36 It Declaration Fy1011nad1002Оценок пока нет

- WLT Proof Form - 2022Документ2 страницыWLT Proof Form - 2022Jebis DosОценок пока нет

- 1 Section 80CДокумент2 страницы1 Section 80CcssumanОценок пока нет

- Employees Provisional Savings (EPS) Form For Calculation of TDS To Be Deducted For The Financial Year 2021-2022Документ3 страницыEmployees Provisional Savings (EPS) Form For Calculation of TDS To Be Deducted For The Financial Year 2021-2022neeta rautelaОценок пока нет

- Investment Declaration FormДокумент3 страницыInvestment Declaration FormRahul BahalОценок пока нет

- Annexure To Income Tax CircularДокумент6 страницAnnexure To Income Tax CircularDipti BhanjaОценок пока нет

- IT Declaration Form 2019-20Документ1 страницаIT Declaration Form 2019-20KarunaОценок пока нет

- PGINVIT Tax Exemption Category1-Appendix4Документ2 страницыPGINVIT Tax Exemption Category1-Appendix4thirurajaОценок пока нет

- Employee Tax Declaration - AY 2019-20Документ1 страницаEmployee Tax Declaration - AY 2019-20mathuОценок пока нет

- PL - NO. Name: Corporate Id: Pan No. Mob - No.: Savings Declaration (Other Than Through Salary)Документ3 страницыPL - NO. Name: Corporate Id: Pan No. Mob - No.: Savings Declaration (Other Than Through Salary)TA ED,SafetyОценок пока нет

- De Smet Engineers & Contractors India Private Limited Investment Declaration Form For Financial Year 2019 - 2020Документ5 страницDe Smet Engineers & Contractors India Private Limited Investment Declaration Form For Financial Year 2019 - 2020Lakshmanan SОценок пока нет

- BUFIN ITDeclarationFormДокумент2 страницыBUFIN ITDeclarationFormdpfsopfopsfhopОценок пока нет

- Investment Declaration Form FY 2019-20 v2Документ5 страницInvestment Declaration Form FY 2019-20 v2Rehan ElectronicsОценок пока нет

- Atria Institute of TechnologyДокумент3 страницыAtria Institute of TechnologykiranОценок пока нет

- Pensioners - IT Declaration Form - Annexure1Документ3 страницыPensioners - IT Declaration Form - Annexure1Sudeep MitraОценок пока нет

- IT Declaration Form 2016-17Документ11 страницIT Declaration Form 2016-17JoooОценок пока нет

- Yuken India Savings Declaration FY 2010-11Документ3 страницыYuken India Savings Declaration FY 2010-11maiudayОценок пока нет

- Guidelines For Income Tax Deduction FY15-16Документ14 страницGuidelines For Income Tax Deduction FY15-16Sharad ShahОценок пока нет

- Vistamalls Potential Bond IssuanceДокумент6 страницVistamalls Potential Bond IssuanceOnyeta HICUwnaОценок пока нет

- Investment Declaration Form - 2022-2023Документ3 страницыInvestment Declaration Form - 2022-2023Bharathi KОценок пока нет

- National Institute of Wind Energy Chennai-600100: Provision Savings Declaration For The Year 2020-21Документ2 страницыNational Institute of Wind Energy Chennai-600100: Provision Savings Declaration For The Year 2020-21Lavanya ChandranОценок пока нет

- New IT Declaration FormДокумент2 страницыNew IT Declaration FormMahakaal Digital PointОценок пока нет

- IT Declaration Format-05-12-2023Документ6 страницIT Declaration Format-05-12-2023somaОценок пока нет

- General Deductions (Under Section 80) : Basic Rules Governing Deductions Under Sections 80C To 80UДокумент67 страницGeneral Deductions (Under Section 80) : Basic Rules Governing Deductions Under Sections 80C To 80UVENKATESAN DОценок пока нет

- 2307 Jan 2018 ENCS v3 SignedДокумент2 страницы2307 Jan 2018 ENCS v3 SignedStanleyMarkPardiñanLazagaОценок пока нет

- IT Deductions Allowed Under Chapter VI-A Sec 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB Etc - APTEACHERS WebsiteДокумент13 страницIT Deductions Allowed Under Chapter VI-A Sec 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB Etc - APTEACHERS WebsiteKIMS IECОценок пока нет

- SSS - Employee - Investment - Declaration - Form12BB - FY 2022-23Документ10 страницSSS - Employee - Investment - Declaration - Form12BB - FY 2022-23gowtham DevОценок пока нет

- IT Declaration Form 2014-15 - After BudgetДокумент2 страницыIT Declaration Form 2014-15 - After BudgetAkram M. AlmotaaОценок пока нет

- Income Tax Declaration Form - F.Y. 2020-21Документ8 страницIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagОценок пока нет

- Deductions From Gross Total Income: HapterДокумент20 страницDeductions From Gross Total Income: HapterJAWED MOHAMMADОценок пока нет

- Filinvest ReitДокумент75 страницFilinvest ReitAtty. Rheneir MoraОценок пока нет

- (Company Name) : Income Tax Declaration Form For Fy 2022-23Документ3 страницы(Company Name) : Income Tax Declaration Form For Fy 2022-23Jude Philip WilfredОценок пока нет

- INVESTMENT DECLARATION FOR FY 2022-23Документ4 страницыINVESTMENT DECLARATION FOR FY 2022-23Ankush SinghОценок пока нет

- 2307 Jan 2018 ENCS v3Документ2 страницы2307 Jan 2018 ENCS v3Analyn DomingoОценок пока нет

- Investment and tax saving proofs for 2017-18Документ5 страницInvestment and tax saving proofs for 2017-18vishalkavi18Оценок пока нет

- 1.7.7.1. Entertainment Allowance (U/s 16 (Ii) ) : 1.7.7. Deduction Out of Gross Salary (Section 16)Документ5 страниц1.7.7.1. Entertainment Allowance (U/s 16 (Ii) ) : 1.7.7. Deduction Out of Gross Salary (Section 16)Vinod PillaiОценок пока нет

- FILREIT - SEC Form 17-C - Press Release - Filinvest REIT Declares Dividends (8.31.21)Документ4 страницыFILREIT - SEC Form 17-C - Press Release - Filinvest REIT Declares Dividends (8.31.21)Christian John RojoОценок пока нет

- DownloadДокумент6 страницDownloadpankhewalegОценок пока нет

- Sav 1851Документ5 страницSav 1851MichaelОценок пока нет

- Investment Declaration Form F.Y 2023-24Документ4 страницыInvestment Declaration Form F.Y 2023-24Aditi Suryavanshi100% (1)

- Form CCF NonaadharДокумент1 страницаForm CCF Nonaadharwanna.wohОценок пока нет

- Withholding Tax Alert: Key Points To NoteДокумент3 страницыWithholding Tax Alert: Key Points To NotemusaОценок пока нет

- Check List For Loan Process-1Документ8 страницCheck List For Loan Process-1kiran.3ddesignerОценок пока нет

- Issues Related To Taxation of NPOsДокумент17 страницIssues Related To Taxation of NPOsCA Poonam GuptaОценок пока нет

- Investment Declaration Form 2016-17Документ2 страницыInvestment Declaration Form 2016-17JitendraОценок пока нет

- VREIT_Board Resolutions_Div Dec_15Apr24_PSEДокумент14 страницVREIT_Board Resolutions_Div Dec_15Apr24_PSEcounsellorsОценок пока нет

- Tax Calculator FASTДокумент20 страницTax Calculator FASTdamani.manojОценок пока нет

- To: Corporate Taxation, ICOMM Tele Limited, Head OfficeДокумент52 страницыTo: Corporate Taxation, ICOMM Tele Limited, Head OfficesandeepОценок пока нет

- Republic of the Philippines CertificateДокумент2 страницыRepublic of the Philippines CertificateLe Lhiin CariñoОценок пока нет

- Income Tax Proof Submission GuidelinesДокумент11 страницIncome Tax Proof Submission Guidelinesdeepakraj610Оценок пока нет

- Deductions From Gross IncomeДокумент3 страницыDeductions From Gross IncomeKezОценок пока нет

- SEC 17Q - IPO & Subs Conso - Q3 2020 - 11112020 - FinalДокумент80 страницSEC 17Q - IPO & Subs Conso - Q3 2020 - 11112020 - Finaldawijawof awofnafawОценок пока нет

- Instructions For Form 1098: Future Developments What's NewДокумент4 страницыInstructions For Form 1098: Future Developments What's NewjengОценок пока нет

- Application For MSME and Corporate BorrowersДокумент1 страницаApplication For MSME and Corporate BorrowersDeepak SinghОценок пока нет

- Aviaition InsuranceДокумент81 страницаAviaition Insurancehenamontena0% (1)

- View and Print Ads - Place Classifieds - View This Week's Edition Online Links To ALL Local Townships & Schools - 100's of Articles To ReadДокумент28 страницView and Print Ads - Place Classifieds - View This Week's Edition Online Links To ALL Local Townships & Schools - 100's of Articles To ReadtodaysshopperОценок пока нет

- Mrunal Lecture 6 @upscmaterialsДокумент7 страницMrunal Lecture 6 @upscmaterialsAnonymous Rs28SnОценок пока нет

- New Bajaj Policies PDFДокумент11 страницNew Bajaj Policies PDFexcel.syed0% (1)

- FAR.3405 PPE-Acquisition and Subsequent ExpendituresДокумент6 страницFAR.3405 PPE-Acquisition and Subsequent ExpendituresMonica GarciaОценок пока нет

- Lic Club Rules & BenefitsДокумент29 страницLic Club Rules & BenefitsManjunath50% (2)

- LatihanДокумент2 страницыLatihanHafiz khalidОценок пока нет

- Accounts Per Book Per AuditДокумент4 страницыAccounts Per Book Per AuditWaye EdnilaoОценок пока нет

- 2010 CAFR WisconsinДокумент257 страниц2010 CAFR WisconsinVen Geancia0% (1)

- Construction Contracts - Law and Management (2015) 61Документ1 страницаConstruction Contracts - Law and Management (2015) 61ZeeshanОценок пока нет

- Visa Letter and Certificate of InsuranceДокумент7 страницVisa Letter and Certificate of InsuranceThuy TaОценок пока нет

- Transfer TaxДокумент11 страницTransfer TaxShieryl BagaanОценок пока нет

- ACAS Taxation 2 (Income Tax - Full Midterm Coverage)Документ15 страницACAS Taxation 2 (Income Tax - Full Midterm Coverage)Steven OrtizОценок пока нет

- NILДокумент10 страницNILJulius Lester AbieraОценок пока нет

- 2023-10-18 EA Perez, J Auto DocaДокумент3 страницы2023-10-18 EA Perez, J Auto Doca88dianavargasОценок пока нет

- Money PlanДокумент166 страницMoney PlancamelocoОценок пока нет

- RICS 2014 Contract Practice DiscussionДокумент14 страницRICS 2014 Contract Practice Discussionbrene88100% (7)

- Harshad Shah V LIC - AgentДокумент8 страницHarshad Shah V LIC - AgentAtulОценок пока нет

- Finman VS CaДокумент2 страницыFinman VS Camario navalezОценок пока нет

- Thelma Vda. de Canilang, Petitioner, vs. Hon. Court of Appeals and Great Pacific Life Assurance Corporation, Respondents. GR No. 92492 June 17, 1993Документ2 страницыThelma Vda. de Canilang, Petitioner, vs. Hon. Court of Appeals and Great Pacific Life Assurance Corporation, Respondents. GR No. 92492 June 17, 1993ChaОценок пока нет

- Ang Giok Chip V Springfield GДокумент6 страницAng Giok Chip V Springfield GLiDdy Cebrero BelenОценок пока нет

- The Digester: Sunlife V CA G.R. No. 105135 June 22, 1995Документ4 страницыThe Digester: Sunlife V CA G.R. No. 105135 June 22, 1995roy rebosuraОценок пока нет

- Board DiversityДокумент21 страницаBoard DiversityShivani VohraОценок пока нет

- Claims Forms Mediplus Claim Intimation Form - PDF 225bfd110e PDFДокумент2 страницыClaims Forms Mediplus Claim Intimation Form - PDF 225bfd110e PDFNamasteОценок пока нет

- CF CaseДокумент10 страницCF Caseশাহরিয়ার মৃধা100% (1)

- BARECON 2017 v2Документ22 страницыBARECON 2017 v2rafaelОценок пока нет

- E-Medical: Revenue Cycle Management (RCM) SolutionДокумент23 страницыE-Medical: Revenue Cycle Management (RCM) SolutionJehan ZebОценок пока нет

- Too Big To FailДокумент247 страницToo Big To Failwwfpyf100% (3)

- CAHFOverview Re Authorization of AB 1629 4Документ3 страницыCAHFOverview Re Authorization of AB 1629 4christina_jewettОценок пока нет