Академический Документы

Профессиональный Документы

Культура Документы

Ìvøüòxqmqêùümïøû N Ùûøöøýòxqmòxxøÿêýòøx N

Загружено:

George MattathilОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Ìvøüòxqmqêùümïøû N Ùûøöøýòxqmòxxøÿêýòøx N

Загружено:

George MattathilАвторское право:

Доступные форматы

“Bridging Capability Gaps”SM

ìvøüòxqmqêùümïøû

n

ùûøöøýòxqmòxxøÿêýòøx

n

George Mattathil

“Intellectual efforts create new technologies, products, and services, describe new

ways of doing things, and expand the cultural richness of society. They result in

intellectual assets, pieces of information that may have economic value if put into use

in the marketplace. To the extent that their ownership is recognized, such assets are

called intellectual property. The economic returns on them depend on the costs of

their creation, their desirability to potential users, the structure of markets in which

Strategic Advisory Group • “Bridging Capability Gaps”SM •m LLL{ü&G6&:<NqGDJ"{ :&

they are sold, and the legal rights that permit their owners to control their use.”

- Institute for International Economics1

The U.S. patent system for intellectual property is the best in the world. But,

unfortunately, it is not functioning at its full potential. The current negative

publicity2 and proposals3 for improvement are overlooking the root cause of

the problem, and bypassing problem definition.

The basic reasons for the deficiencies in the U.S. patent system are:

1. Overemphasis of patent as a legal instrument, and

2. Inadequacy of systems for its use as industrial property right.

Effective patent system is critical to modern economy. According to the

Organization for Economic Cooperation and Development (OECD), “Among

the few available indicators of technology output, patent-based indicators are

probably the most frequently used. Most national S&T (science & technology)

publications include a section on patents.”4 An efficient patent system, with

effective commercialization capabilities of innovation, is critical for the vitality

of the economy.

Currently, the value of patents are almost always established through a litigation

process — which is time consuming and expensive. Besides, the patent

valuations are generally based on the negotiating strengths of the parties

involved — capital and legal resources. Since patents do not have intrinsic

value (value without expensive litigation), companies that have significant

marketshare do not license patents until litigation starts. This delays the

economic activities based on the commercialization of the inventions that could

have otherwise started much earlier.

The legal theory inherent in the patent system is property rights. The Federal

Trade Commission describes how the property rights are applicable for patents:

“This (patent) property right can enable firms to increase their expected profits

from investments in research and development, thus fostering innovation that

would not occur but for the prospect of a patent. Because the patent system

requires public disclosure, it can promote a dissemination of scientific and

technical information that would not occur but for the prospect of a patent.”5

However, property rights by itself does not result in economic activity. In his

comparative analysis of the developed and underdeveloped economies,

Hernando De Soto describes how the property rights are transformed into capital

— the force that raises the productivity of labor and creates the wealth of nations.

A - 8/27/05 Copyright © 2005

All Rights Reserved

“Bridging Capability Gaps”SM

Mr. De Soto writes, “Every parcel of land, every building, every piece of

equipment, or store of inventories is represented in a property document that is

the visible sign of a vast hidden process that connects all these assets to the

rest of the economy. Thanks to this representational process, assets can lead

an invisible, parallel life alongside their material existence. They can be used

as collateral for credit.”6

The methods and means for converting the property rights inherent in tangible

goods and properties into capital are well developed in developed countries,

but not in underdeveloped countries. However, such means and methods for

Strategic Advisory Group • “Bridging Capability Gaps”SM •m LLL{ü&G6&:<NqGDJ"{ :&

converting patent rights — intangible property rights — into capital do not exist

even in developed countries. Instead, the value of patents are, more often than

not, established through the litigation process — or lie dormant without ever

becoming commercially valuable. In an increasingly global information economy,

it is critical to develop systems for maximum exploitation of intellectual properties.

One of the necessary steps needed is to directly link the property rights inherent

in the patents to the already well developed financial systems. Commercial

banks routinely accept real estate, buildings and other tangible property as

collateral, but consider patents as intangible assets with zero value for financing

purposes. For technology businesses, establishing an intrinsic value creation

system for patents would be highly helpful — changing the current situation in

which patents are worthless without significant capital and/or legal resources.

Creating patent valuation expertise (similar to real estate appraisal) within the

banking sector is one way to create intrinsic value for patents.

The U.S. Constitution authorizes Congress “to promote the Progress of Science

and useful Arts, by securing for limited Times to . . . Inventors the exclusive

Right to their respective . . . Discoveries.”7 Therefore, Congress is within its

rights to create legislation to close the gaps between the patent system and the

financial system, which provides for the creation of the means and methods for

the conversion of patent rights into credit and capital.

Closing the gaps between patent and capital will help promote the full potential

of the strengths of American innovation and ingenuity, contribute to economic

prosperity of the nation, and help maintain global technology leadership.

Reference

1. Globalization and the Economics of Intellectual Property Rights, Institute for

International Economics, 2004. http://StrategyGroup.net/links/innov1.shtml

2. Patent litigation worries tech industry, The Washington Times, May 2, 2005.

http://StrategyGroup.net/links/innov2.shtml

3. Town Meetings on Patent System Reform, Federal Trade Commission,

http://StrategyGroup.net/links/innov3.shtml

4. Using Patent Counts for Cross-country Comparisons of Technology Output, OECD,

STI Review No. 27, 2003. http://StrategyGroup.net/links/innov4.shtml

5. To Promote Innovation: The Proper Balance of Competition and Patent Law and

Policy, Federal Trade Commission, 2003, p. 5.

http://StrategyGroup.net/links/innov5.shtml

6. Hernando De Soto,The Mystery of Capital, Basic Books, 2000, p. 6.

7. U.S. CONSTITUTION, article I, § 8.

A - 8/27/05 Copyright © 2005

All Rights Reserved

Вам также может понравиться

- Significance of Utility Patents in The Economic Development of IndiaДокумент7 страницSignificance of Utility Patents in The Economic Development of IndiaLily lolaОценок пока нет

- Intellectual Property and Innovation Protection: New Practices and New Policy IssuesОт EverandIntellectual Property and Innovation Protection: New Practices and New Policy IssuesОценок пока нет

- 08 - Chapter 2 PDFДокумент43 страницы08 - Chapter 2 PDFAa BbОценок пока нет

- A Manifesto On WIPO and The Future of Intellectual PropertyДокумент12 страницA Manifesto On WIPO and The Future of Intellectual PropertyAnantha padmanabhanОценок пока нет

- Introduction To Intellectual Property Rights, Software Protection: Development in The South Mediterranean Countries (2009)Документ18 страницIntroduction To Intellectual Property Rights, Software Protection: Development in The South Mediterranean Countries (2009)ahmed_driouchiОценок пока нет

- The Economics of Intangible Capital: Nicolas Crouzet Janice C. EberlyДокумент37 страницThe Economics of Intangible Capital: Nicolas Crouzet Janice C. EberlyTargetonОценок пока нет

- Module 11 Course Material Ippro Need of Ipr and AwarenessДокумент9 страницModule 11 Course Material Ippro Need of Ipr and AwarenessAkshay ChudasamaОценок пока нет

- Master Thesis Intellectual PropertyДокумент7 страницMaster Thesis Intellectual Propertyqfsimwvff100% (2)

- CwrurevДокумент32 страницыCwrurevAlex RaduОценок пока нет

- Comp 4Документ30 страницComp 4jeevikaОценок пока нет

- Bridging The Gap: Intellectual Property Rights and Sustainable Development Goals Ininnovation EcosystemsДокумент11 страницBridging The Gap: Intellectual Property Rights and Sustainable Development Goals Ininnovation EcosystemsAJHSSR JournalОценок пока нет

- Pharma, Agric and Software David Lca 2008Документ25 страницPharma, Agric and Software David Lca 2008Omid XademОценок пока нет

- IP Management ProjectДокумент12 страницIP Management ProjectJyoti GautamОценок пока нет

- HTN Think Paper-ErlandДокумент4 страницыHTN Think Paper-ErlandErland IlyasaОценок пока нет

- IPRДокумент20 страницIPRnehalokurОценок пока нет

- Forsyth, M 2016 Making The Case For A Pluralisttic Approach To IntellectualДокумент24 страницыForsyth, M 2016 Making The Case For A Pluralisttic Approach To IntellectualPaolo OngsiakoОценок пока нет

- CONCLUSIONДокумент3 страницыCONCLUSIONKriti SinghОценок пока нет

- Role of Ipr in Economic GrowthДокумент9 страницRole of Ipr in Economic GrowthV3N0MОценок пока нет

- Intellectual Capital and Intellectual Property: Julian StephensДокумент2 страницыIntellectual Capital and Intellectual Property: Julian StephensNeha SinghОценок пока нет

- Law Terms Brief DescriptionДокумент210 страницLaw Terms Brief DescriptionManu bhardwajОценок пока нет

- Spring 2005, Vol. 4 No.1 Intellectual Property Rights: Indian ScenarioДокумент8 страницSpring 2005, Vol. 4 No.1 Intellectual Property Rights: Indian ScenarioShubham GandhiОценок пока нет

- Interface Between Sustainable Development Law and Intellectual Property ProtectionДокумент9 страницInterface Between Sustainable Development Law and Intellectual Property ProtectionZeeshan RazviОценок пока нет

- DL170 Module 8v1.2Документ23 страницыDL170 Module 8v1.2Divyansh KumarОценок пока нет

- Tracer MarksДокумент38 страницTracer MarksMarko PopovicОценок пока нет

- Economics of IPRДокумент20 страницEconomics of IPRBhavya AggarwalОценок пока нет

- The Economics of Intellectual Property and Economic EntrepreneurshipДокумент17 страницThe Economics of Intellectual Property and Economic EntrepreneurshipIurie StratulatОценок пока нет

- The Importance of IPR To TMДокумент7 страницThe Importance of IPR To TMChelli AdasaОценок пока нет

- Excerpts From Cornish About IPДокумент4 страницыExcerpts From Cornish About IPelectriiОценок пока нет

- DL170 Module 1v1.2Документ13 страницDL170 Module 1v1.2Dipa SaliОценок пока нет

- Itl FinalДокумент20 страницItl Finalanulekha medisettiОценок пока нет

- Business Intelligence Expert System On SOX Compliance Over The Purchase Orders Creation ProcessДокумент24 страницыBusiness Intelligence Expert System On SOX Compliance Over The Purchase Orders Creation Processعلي ابراهيمОценок пока нет

- Legal Technology For Law Firms Determining Roadmaps For Innovation PG 5Документ22 страницыLegal Technology For Law Firms Determining Roadmaps For Innovation PG 5JulioОценок пока нет

- 1.patent Protection and Foreign Direct InvestmentДокумент17 страниц1.patent Protection and Foreign Direct InvestmentAzan RasheedОценок пока нет

- Trade-Related Aspects of Intellectual Property RightsДокумент97 страницTrade-Related Aspects of Intellectual Property RightsAn TranОценок пока нет

- Ipr 4Документ11 страницIpr 4Mustafa M. PathanОценок пока нет

- Intellectual Property StudyДокумент23 страницыIntellectual Property StudyDeEpaa ManohanОценок пока нет

- The Economics of Intellectual Property Rights in Civil Law SystemsДокумент23 страницыThe Economics of Intellectual Property Rights in Civil Law Systemsvir2000Оценок пока нет

- LLM Assignment - Intellectual Property RightsДокумент31 страницаLLM Assignment - Intellectual Property RightsChandni TiwariОценок пока нет

- Real Estate Tokenization by AkashДокумент29 страницReal Estate Tokenization by AkashProject AtomОценок пока нет

- Report On IPR Workshop-2018-DRAFTДокумент19 страницReport On IPR Workshop-2018-DRAFTDr. Srinivas Chikkol VenkateshappaОценок пока нет

- Class Assignment BALLB 8th SemДокумент11 страницClass Assignment BALLB 8th SemAaryan M GuptaОценок пока нет

- Justificatory Theories For Intellectual Property Viewed Through The Constitutional PrismДокумент38 страницJustificatory Theories For Intellectual Property Viewed Through The Constitutional PrismRakesh SahuОценок пока нет

- Discovering Institutional Demand For Digital AssetsДокумент75 страницDiscovering Institutional Demand For Digital AssetsForkLogОценок пока нет

- Cointelegraph Crypto Research Report Discovering Institutional Demand For Digital Assets in Dach Region November 2020Документ75 страницCointelegraph Crypto Research Report Discovering Institutional Demand For Digital Assets in Dach Region November 2020RuslanОценок пока нет

- IPR and ECONOMICS PDFДокумент6 страницIPR and ECONOMICS PDFKeerti GuptaОценок пока нет

- The Law, Technological Advancement and Innovation (Part 2)Документ33 страницыThe Law, Technological Advancement and Innovation (Part 2)sisiphoОценок пока нет

- White House Patent Troll ReportДокумент17 страницWhite House Patent Troll ReportGina SmithОценок пока нет

- Patent Pools at The Interface of Patent and Competition RegimesДокумент12 страницPatent Pools at The Interface of Patent and Competition Regimesaryagautam7714Оценок пока нет

- The Role of Intellectual Property Rights in The InnovationДокумент5 страницThe Role of Intellectual Property Rights in The InnovationOBERT CHIBUYE100% (1)

- Intellectual Property Rights: A Grant of Monopoly or An Aid To Competition?Документ17 страницIntellectual Property Rights: A Grant of Monopoly or An Aid To Competition?Core ResearchОценок пока нет

- Capturing ValueДокумент26 страницCapturing ValueSugata DasОценок пока нет

- Online Answer Sheet Submission Name-Mohd Izaan Rizvi Class - 8 Semester (Regular) Roll No - 33 SUBMISSION DATE - 30/05/2020 SESSION - 2019-2020Документ31 страницаOnline Answer Sheet Submission Name-Mohd Izaan Rizvi Class - 8 Semester (Regular) Roll No - 33 SUBMISSION DATE - 30/05/2020 SESSION - 2019-2020Izaan RizviОценок пока нет

- Importance of Intellectual Property RightsДокумент8 страницImportance of Intellectual Property RightsIrina Tivig100% (1)

- Harvard BaHa Aff Northwestern Round 3Документ50 страницHarvard BaHa Aff Northwestern Round 3godogk50Оценок пока нет

- Summary Law and Economics - Arsilla Chairunissa - 2006606832 PDFДокумент4 страницыSummary Law and Economics - Arsilla Chairunissa - 2006606832 PDFZayyan QotrunnadaОценок пока нет

- Role of Ipr in Pharma Industry and EducationДокумент3 страницыRole of Ipr in Pharma Industry and EducationShreyaОценок пока нет

- Dutfield & Suthersanen 2008 Global Intellectual Property LawДокумент380 страницDutfield & Suthersanen 2008 Global Intellectual Property LawCristóbal AstorgaОценок пока нет

- Intellectual Property Protection and Globalization of World EconomyДокумент15 страницIntellectual Property Protection and Globalization of World EconomyPoorna prasathОценок пока нет

- Parliamentary Brief AI IPR 2022 - FebДокумент36 страницParliamentary Brief AI IPR 2022 - FebPavi SasiОценок пока нет

- Properties of Public DominionДокумент1 страницаProperties of Public DominionAljay DAHANОценок пока нет

- Algarme IPДокумент6 страницAlgarme IPKym AlgarmeОценок пока нет

- London Rental Standard - May 2014Документ11 страницLondon Rental Standard - May 2014Stryke ChngОценок пока нет

- Reading 1 STECKER - Definition of ArtДокумент10 страницReading 1 STECKER - Definition of ArtyopyopОценок пока нет

- Sample Securitization Audit by Robert RamersДокумент25 страницSample Securitization Audit by Robert RamersBob Ramers100% (4)

- Tenancy Agreement For 8 Berkeley Court, Reading, Berkshire, RG1 6LH - Encrypted - PDFДокумент46 страницTenancy Agreement For 8 Berkeley Court, Reading, Berkshire, RG1 6LH - Encrypted - PDFsbuxguyhotmail.co.ukОценок пока нет

- Qatar Civil Code - EnglishДокумент283 страницыQatar Civil Code - Englishlondoncourse100% (4)

- Sales Case Digest Part 2Документ6 страницSales Case Digest Part 2lchieSОценок пока нет

- Royal LePage 2022 Market Survey Forecast TableДокумент1 страницаRoyal LePage 2022 Market Survey Forecast TableCTV CalgaryОценок пока нет

- Crime Free Lease AddendumДокумент1 страницаCrime Free Lease AddendumjmtmanagementОценок пока нет

- IbtДокумент3 страницыIbtTakuriОценок пока нет

- 562 Supreme Court Reports Annotated: Tibo vs. The Provincial CommanderДокумент10 страниц562 Supreme Court Reports Annotated: Tibo vs. The Provincial CommanderEllis LagascaОценок пока нет

- Cohabitation Agreement 1. PartiesДокумент3 страницыCohabitation Agreement 1. Partiessembarang88Оценок пока нет

- Section 54 Sale by Raghav GuptaДокумент16 страницSection 54 Sale by Raghav GuptaRaghav GuptaОценок пока нет

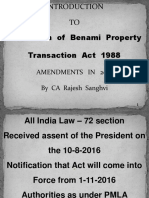

- Benami Law PPT 2 12 16 1Документ49 страницBenami Law PPT 2 12 16 1Anonymous 2zXIyHVОценок пока нет

- MEMORANDUM OF AGREEMENT On House ConstructionДокумент2 страницыMEMORANDUM OF AGREEMENT On House ConstructionAecuine Estrada-Pestaño100% (4)

- YFrenkel Water DamascusДокумент23 страницыYFrenkel Water DamascusyfrenkelОценок пока нет

- National Differences in Economic Development: True / False QuestionsДокумент73 страницыNational Differences in Economic Development: True / False QuestionsNgơTiênSinhОценок пока нет

- IC Property Management Rental Application TemplateДокумент3 страницыIC Property Management Rental Application Templatelaundromat360Оценок пока нет

- The Vendors ObligationsДокумент3 страницыThe Vendors ObligationsJann Aldrin PulaОценок пока нет

- Income Tax Act, 1961Документ13 страницIncome Tax Act, 1961Sanketh_Surey_6489Оценок пока нет

- Deeds OfficeДокумент6 страницDeeds Officesiphamandla_mabesiОценок пока нет

- Pre Week Lecture and TipsДокумент14 страницPre Week Lecture and TipsMyn Mirafuentes Sta AnaОценок пока нет

- Notes On Law On Natural ResourcesДокумент6 страницNotes On Law On Natural ResourcesMailene Almeyda Caparroso100% (2)

- Law On Agency (Business Organization 1) ADMUДокумент66 страницLaw On Agency (Business Organization 1) ADMUMaria Cecilia Oliva100% (1)

- Katigbak v. Tai Hing CoДокумент1 страницаKatigbak v. Tai Hing CoJDR JDRОценок пока нет

- California Residential Lease Agreement22Документ8 страницCalifornia Residential Lease Agreement22richard_sazoОценок пока нет

- Detroit Lakes Short-Term Rental Ordinance, Nov. 2022Документ10 страницDetroit Lakes Short-Term Rental Ordinance, Nov. 2022Michael AchterlingОценок пока нет

- Fmlyy Law 6th SemДокумент16 страницFmlyy Law 6th SemKanchan ManchandaОценок пока нет

- Deed of Absolute Sale of Registered LandДокумент2 страницыDeed of Absolute Sale of Registered LandSamuel CorpuzОценок пока нет