Академический Документы

Профессиональный Документы

Культура Документы

Banco Filipino Operated As A Ponzi Scheme

Загружено:

akosistellaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Banco Filipino Operated As A Ponzi Scheme

Загружено:

akosistellaАвторское право:

Доступные форматы

NEWS RELEASE

_______________________________________________________________________________________________________________________

FOR IMMEDIATE RELEASE For further information,

contact:

Date: 05 April 2011 Tel. Nos. 523-62-46/ 525-

2738

Ref. Code: NR 2011-073 524-7011 locals 3025/3026

BF OPERATED AS A PONZI; NEW DEPOSITS PAID OLD ONES

Banco Filipino was operating as a pyramid or Ponzi scheme in the past

years, using new deposits to pay old ones, and with its officers paying

themselves and their lawyers much more than the bank was earning.

Their lawyers, led by Perfecto Yasay, former chairman of the Securities

and Exchange Commission, and Harry Roque were paid P245 million in

2010 alone. Of this, P131 million was paid from October to December last

year.

These legal fees alone exceeded the average gross or total income of BF

of P242 million from 2007 to 2009. On the other hand, the officers and

their consultants were paid roughly P250 million in 2010.

The owners, led by Bobby Aguirre, the bank’s directors, officers and so-

called related interests also borrowed P2.2 billion of the depositors’

money and never paid them back. These loans violated existing caps or

limits set by the authorities.

The BSP emphasized that banks are not created for the benefit of its

directors or officers. Instead, BF was being run to the “extreme prejudice

of its depositors” since it was violating various laws and BSP regulations,

including BF’s refusal to submit periodic financial statements for the few

years to hide its true financial weaknesses.

These were all contained in a 170-page Comment/Opposition the Bangko

Sentral ng Pilipinas and the Monetary Board filed Tuesday (April 5) with

the Court Appeals to respond to BF’s petition questioning its being placed

under the receivership of the Philippine Deposit Insurance Corporation last

month after it failed to fund the withdrawals by its depositors, and asking

that it be reopened.

These weaknesses, admitted by Yasay, who is also BF vice chairman, and

Francisco Rivera, executive vice president in open court, included BF’s:

• inability to generate enough income from normal banking

operations;

• accumulated losses of P12 Billion;

• capital deficiency of P1 billion, which prevents BF from covering

deposit liabilities.

• Operations “without safety” to its creditors, depositors and the

general public;

• Failure to hold any meeting of its board of directors and the failure

of its Executive Committee or its Board of Directors to review the

financials of the bank.

Based on a Memorandum submitted by the Integrated Supervision

Department II of the BSP and the Report of Examination cited in the

Comment, Banco Filipino incurred average losses of P2.8 Billion for the

years 2007-2009.

It added that BF is actually insolvent, meaning it has P8.4 billion more

liabilities than assets. Under the law, BSP through the Monetary Board

must put an insolvent bank under receivership to protect the depositors.

The BSP examination revealed that BF’s average gross income for the

years 2007-2009 amounted to around P242.5 Million which would be

insufficient to pay the average interest expense of P1.1 Billion for the

same period.

This was because Banco Filipino, to fund its operations and pay its

officers, consultants and lawyers, offered depositors 6%-13.9% interest for

special savings deposits, while most banks were paying only 1.8%-3.3%.

Instead of investing the deposits, these were instead used to pay the

interest on old deposits and its day-to-day operations, making its

operations akin to a Ponzi or pyramiding scheme which are considered

fraudulent investment operations.

Finally, arguing against Banco Filipino’s prayer for injunction and to be

reopened, BSP argued that to issue an injunction and to reopen the bank

is to allow an unending vicious cycle of Banco Filipino’s inability to service

not only the high deposit interest rates, but also to fund the withdrawals

of the deposits.

“In no uncertain terms, Banco Filipino’s only way of operating is to

continue engaging in a Ponzi scheme where withdrawals are funded by

later deposits,” it said.

“In view of all of these undisputed facts, BSP’s action in recommending

and thereafter placing Banco Filipino under the receivership of PDIC was

the only course left in order to protect Banco Filipino’s depositors,

creditors and the public in general,” it added.

Page 2 of 2

Вам также может понравиться

- Areas Off-Limits To Mining (NTDP - List of Cluster Destinations and TDAs)Документ3 страницыAreas Off-Limits To Mining (NTDP - List of Cluster Destinations and TDAs)akosistellaОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Academy of Television Arts & Sciences 64th Primetime Emmy Award NominationsДокумент64 страницыAcademy of Television Arts & Sciences 64th Primetime Emmy Award NominationsakosistellaОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Letter of Narzalina Lim To DOT U/Sec. Daniel CorpuzДокумент2 страницыLetter of Narzalina Lim To DOT U/Sec. Daniel CorpuzakosistellaОценок пока нет

- Muntinlupa City Council Overrules Ayala Alabang Ordinance On CondomsДокумент2 страницыMuntinlupa City Council Overrules Ayala Alabang Ordinance On CondomsakosistellaОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- ST James The Great Parish's Statement On Brgy. Ayala Alabang's Ordinance Vs CondomsДокумент1 страницаST James The Great Parish's Statement On Brgy. Ayala Alabang's Ordinance Vs CondomsakosistellaОценок пока нет

- Anyone For Filipino Food? (Tom Parker Bowles, Esquire Aug. 2011)Документ9 страницAnyone For Filipino Food? (Tom Parker Bowles, Esquire Aug. 2011)akosistellaОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Brgy. Ayala Alabang's Ordinance No. 01 (Series of 2011) Banning Sale of ContraceptivesДокумент9 страницBrgy. Ayala Alabang's Ordinance No. 01 (Series of 2011) Banning Sale of ContraceptivesakosistellaОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- What Went On in The Making of 'Pilipinas Kay Ganda'Документ9 страницWhat Went On in The Making of 'Pilipinas Kay Ganda'akosistellaОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- SC Ruling Vizconde Massacre (G.R. No. 176389) 12/14/2010Документ36 страницSC Ruling Vizconde Massacre (G.R. No. 176389) 12/14/2010akosistellaОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Interpol Alert AssangeДокумент3 страницыInterpol Alert AssangeakosistellaОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

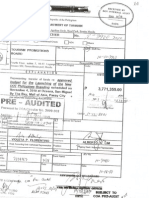

- 'Pilipinas Kay Ganda' Disbursement VoucherДокумент6 страниц'Pilipinas Kay Ganda' Disbursement VoucherakosistellaОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Top 500 Individual and Corp. Taxpayers 2009Документ18 страницTop 500 Individual and Corp. Taxpayers 2009akosistellaОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- PAL Salary, Benefits of Cabin CrewДокумент1 страницаPAL Salary, Benefits of Cabin CrewakosistellaОценок пока нет

- Memorandum Circular No. 1Документ2 страницыMemorandum Circular No. 1Coolbuster.NetОценок пока нет

- Charman's Report On Automated Elections (Complete Document)Документ47 страницCharman's Report On Automated Elections (Complete Document)akosistellaОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Observations, Conclusions and RecommendationsДокумент7 страницObservations, Conclusions and RecommendationsakosistellaОценок пока нет

- On Types of BanksДокумент14 страницOn Types of BanksRahulTikoo100% (1)

- Quaid e Azam Solar ParkДокумент8 страницQuaid e Azam Solar ParkShahzad TabassumОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Borden Knight Trading Columbia SeminarДокумент16 страницBorden Knight Trading Columbia Seminarpurumi77Оценок пока нет

- ©2011 Pearson Education, Inc. Publishing As Prentice HallДокумент72 страницы©2011 Pearson Education, Inc. Publishing As Prentice HallSimon SebastianОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- SBI Project ReportДокумент14 страницSBI Project ReportNick IvanОценок пока нет

- CH 08Документ54 страницыCH 08Chang Chan ChongОценок пока нет

- Public Procurement Regulatory Authority (PPRA)Документ14 страницPublic Procurement Regulatory Authority (PPRA)Salu Shigri100% (1)

- Spectra Foods & Beverages PVT LTD 2006 29697Документ10 страницSpectra Foods & Beverages PVT LTD 2006 29697Bhavana PrettyОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- DRM-5 Options BasicsДокумент22 страницыDRM-5 Options BasicsqazxswОценок пока нет

- Direct Tax Article Taxation of Agricultural LandДокумент7 страницDirect Tax Article Taxation of Agricultural LandmanishdgОценок пока нет

- Arpita MAJOR RESEARCH PROJECTДокумент31 страницаArpita MAJOR RESEARCH PROJECTSukhvinder SinghОценок пока нет

- Understanding Investment ObjectivesДокумент5 страницUnderstanding Investment ObjectivesDas RandhirОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- How Mintoff Killed The NBMДокумент4 страницыHow Mintoff Killed The NBMsevee2081Оценок пока нет

- Materi 3 Materi 3 Rerangka Konseptual IASBДокумент20 страницMateri 3 Materi 3 Rerangka Konseptual IASBgadi3szzОценок пока нет

- Asset and Liability Management ModelДокумент32 страницыAsset and Liability Management ModelSuccess BnОценок пока нет

- Sample QCD With Life EstateДокумент2 страницыSample QCD With Life Estatemarioma12Оценок пока нет

- Johnson Elevator Case StudyДокумент5 страницJohnson Elevator Case StudyPJОценок пока нет

- Ebook How To Become The FTMO Trader PDFДокумент28 страницEbook How To Become The FTMO Trader PDFJohn KaraОценок пока нет

- Project Financing StructuresДокумент17 страницProject Financing StructuresarjunpguptaОценок пока нет

- BIR Form 1700 - Income Tax Return FilingДокумент1 страницаBIR Form 1700 - Income Tax Return FilingMarriz Bustaliño TanОценок пока нет

- Investments in Financial Instruments CompleteДокумент34 страницыInvestments in Financial Instruments CompleteDenise CruzОценок пока нет

- Financial ServicesДокумент12 страницFinancial ServicesarmailgmОценок пока нет

- Compound InterestДокумент16 страницCompound InterestJin ChorОценок пока нет

- Financial Inclusion and Information TechnologyДокумент8 страницFinancial Inclusion and Information TechnologydhawanmayurОценок пока нет

- Equity Derivatives NCFM Ver 1.5Документ148 страницEquity Derivatives NCFM Ver 1.5sanky23Оценок пока нет

- Accounting Standard 1 PDFДокумент4 страницыAccounting Standard 1 PDFChristopher Jacob MurmuОценок пока нет

- 10.1016@S2212 56711300194 9 PDFДокумент5 страниц10.1016@S2212 56711300194 9 PDFsajid bhattiОценок пока нет

- Tax Revenue Performance in KenyaДокумент47 страницTax Revenue Performance in KenyaMwangi MburuОценок пока нет

- Best Practice in Inventory Management Oliver Wight Manufacturing PDFДокумент234 страницыBest Practice in Inventory Management Oliver Wight Manufacturing PDFantehen100% (3)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorОт EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorРейтинг: 4.5 из 5 звезд4.5/5 (132)