Академический Документы

Профессиональный Документы

Культура Документы

23-Copy of Full Funding Analysis - February 2007 Presentation

Загружено:

COASTИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

23-Copy of Full Funding Analysis - February 2007 Presentation

Загружено:

COASTАвторское право:

Доступные форматы

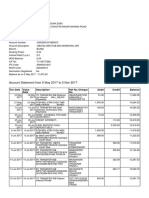

NATIONAL UNDERGROUND RAILROAD Schedule 1

FREEDOM CENTER CONFIDENTIAL DO NOT

"FULL FUNDING ANALYSIS OCFC" COPY OR DISTRIBUTE

February 2007 Presentation

(Update to Early 2005 Presentation) 02/24/07

Project Project

Project Status Status Cont. Fully To

In Millions- Plan 12/31/04 Change 12/31/06 Plan Funded Go NOTES

Private-

Capital Campaign 63.0 63.0 0.0 63.0 0.0 63.0 0.0 2

Other Revenues 3.1 3.1 0.0 3.1 0.0 3.1 0.0

Other Programs 0.8 0.8 0.0 0.8 0.0 0.8 0.0

Total Private Revenues 66.9 66.9 0.0 66.9 0.0 66.9 0.0

Government

City 6.0 6.0 0.0 6.0 0.0 6.0 0.0

State ($4.2 and $2.0 million appropriated 1/05 and 12/06) 15.8 8.8 6.2 15.0 0.0 15.0 0.8 3

Federal-

DOI 15.9 15.9 0.0 15.9 0.0 15.9 0.0

DOE 6.3 6.3 0.0 6.3 0.0 6.3 0.0

Others (private or public-derived from on-going surpluses) 3.8 0.0 0.0 0.0 0.0 0.0 3.8 3

Total Direct Federal Grants 26.0 22.2 0.0 22.2 0.0 22.2 3.8

Total Government 47.8 37.0 6.2 43.2 0.0 43.2 4.6

Total Cash Related Revenues 114.7 103.9 6.2 110.1 0.0 110.1 4.6

Other Fully Funded Initiatives-

Other shortfall preliminary 2004 to be raised 1.2 0.0 0.0 0.0 0.0 0.0 1.2

Other shortfall late 2004, 2005 net of 2006 surplus 1.9 0.0 0.0 0.0 0.0 0.0 1.9

Shortfall Pre Earnings on approved bond financing 117.8 103.9 6.2 110.1 0.0 110.1 7.7 (A)

Reductions In Shortfall-

Commitments as of 12/31/06-Bridge to the Future 0.0 0.0 0.0 0.0 0.8 0.8 (0.8)

Minimal Earnings on approved bond financing 0.0 0.0 0.0 0.0 9.0 9.0 (9.0) 4

Full Funding Requirement Excess-Note 1 117.8 103.9 6.2 110.1 9.8 119.9 2.1

Proof of Full Funding Requirement To Go 12/31/06 (119.9 less 117.8='s 2.1 excess)

Cash & Investments 28.6

Pledges 11.2

Gov't. Receivable for 2006 expenses incurred 0.2

Other Recivables (stock gifts & in transit) 0.3

State of Ohio Appropriation 2.0

Total 42.3

Borrowing 50.0

To Go to Reach Full Funding 7.7 (A)

Note 1-Full Funding Definition

In January 2003 the Freedom Center and the OCFC agreed to a "full funding" total project definition. Under the definition the Freedom Center need

raise, as of the last calculation in April 2005, $115.9 million ($66.9 million in private dollars, $47.8 million in governmental and $1.2 million other.

The aggregate "full funding" as of 12/31/06 is $117.8 million--see attached source and use statement through 12/31/06.

The full funding definition allows for the inclusion of verbal commitments and projected earnings on investments (see note 4 below) in meeting the

"full finding" definition as well as State appropriated dollars. Final determination of the FC achieving "full funding" under the management agreement

is at the discretion of the Executive Director of the OCFC.

Note 2-Private Capital Campaign

The $66.9 million private portion of campaign was achieved in 2004 as previously reported

Note 3-Government

The government revenue does not include remaining $3.8 million in potentially other government or private sources from on-going budget surpluses.

The $15.0 million State includes $2,000,000 appropriation in the last quarter of 2006 with the remaining $850,000 expected in 2008. All other

governmental dollars (outside of the $3.8 million and $850,000) have been received or in the case of the State of Ohio received or appropriated.

Note 4-Earnings (spread) on Investments - Net of Borrowing Cost

As of December 31, 2006 investment balances are approximately $28 million (excludes non earning cash accounts).

The amount of future earnings on these investments remains substantially the same as previously summarized by Banc One Capital

--$9.0 million (see attached projection) compared to $9.4 million in April 2005 presentation.

Management notes that --

(a) it continues to believe that it will be receiving the required remaining State "to go" funding of $850,000 in 2008

(b) it remains confident that the Bridge to the Future Campaign will be successful, as it was in 2006, and result in a surplus in excess of $1.0 million

in 2007 as well as a surplus in 2008 the last year of the three year operating plan.

Note 5-Status of Credit Enhancement With Banks- The Freedom Center met all covenant conditions as of December 31, 2006. The previous two

year credit enhancement was due to expire in April 2007. In February 2007 management and the three participating banks agreed to a new two

year credit enhancement for the period ending April, 09 at the same terms as existed under the current credit enhancement.-see signed attachments.

Copy of Full Funding Analysis- February 2007 presentation.xls

Copy of Full Funding Analysis- February 2007 presentation.xls

Вам также может понравиться

- Cross Tabs of SORTA Tax Increase SurveyДокумент59 страницCross Tabs of SORTA Tax Increase SurveyCOASTОценок пока нет

- Vehr Communications Contract Modification1 SignedДокумент1 страницаVehr Communications Contract Modification1 SignedCOASTОценок пока нет

- Brinkman Closing PieceДокумент2 страницыBrinkman Closing PieceCOASTОценок пока нет

- Foundation For Individual Rights in Education Amicus Brief SBA List & COAST V. DriehausДокумент35 страницFoundation For Individual Rights in Education Amicus Brief SBA List & COAST V. DriehausFinney Law Firm, LLCОценок пока нет

- Desmond E-MailДокумент1 страницаDesmond E-MailFinney Law Firm, LLCОценок пока нет

- American Civil Liberties Union Amicus Brief SBA List & COAST v. DriehausДокумент32 страницыAmerican Civil Liberties Union Amicus Brief SBA List & COAST v. DriehausFinney Law Firm, LLCОценок пока нет

- COAST Petition For CertiorariДокумент65 страницCOAST Petition For CertiorariCOASTОценок пока нет

- Vehr Communications Contract 62-13 SignedДокумент2 страницыVehr Communications Contract 62-13 SignedCOASTОценок пока нет

- Transit Fund Priorities Study SKM - C364e14092610170Документ11 страницTransit Fund Priorities Study SKM - C364e14092610170COASTОценок пока нет

- Susan B Anthony List v. DriehausДокумент20 страницSusan B Anthony List v. DriehausDoug Mataconis100% (1)

- SBA List & COAST v. Driehaus Brief of State RespondentsДокумент85 страницSBA List & COAST v. Driehaus Brief of State RespondentsFinney Law Firm, LLCОценок пока нет

- SBA List & COAST v. Driehaus TranscriptДокумент67 страницSBA List & COAST v. Driehaus TranscriptFinney Law Firm, LLCОценок пока нет

- Republican National Committee Amicus Brief SBA List & COAST V. DriehausДокумент48 страницRepublican National Committee Amicus Brief SBA List & COAST V. DriehausFinney Law Firm, LLCОценок пока нет

- American Booksellers Association, Et Al. Amicus Brief SBA List & COAST V. DriehausДокумент32 страницыAmerican Booksellers Association, Et Al. Amicus Brief SBA List & COAST V. DriehausFinney Law Firm, LLCОценок пока нет

- Biothics Defense Fund Amicus Brief SBA List & COAST v. DriehausДокумент50 страницBiothics Defense Fund Amicus Brief SBA List & COAST v. DriehausFinney Law Firm, LLCОценок пока нет

- Ohio Attorney General Mike DeWine Amicus Brief SBA List & COAST V. DriehausДокумент30 страницOhio Attorney General Mike DeWine Amicus Brief SBA List & COAST V. DriehausFinney Law Firm, LLCОценок пока нет

- Cato SBA List Amicus Merits Filed BriefДокумент24 страницыCato SBA List Amicus Merits Filed BriefFinney Law Firm, LLCОценок пока нет

- GENERAL CONFERENCE OF SEVENTH-DAY ADVENTISTS, Et Al. Amicus Brief SBA List & COAST v. DriehausДокумент33 страницыGENERAL CONFERENCE OF SEVENTH-DAY ADVENTISTS, Et Al. Amicus Brief SBA List & COAST v. DriehausFinney Law Firm, LLCОценок пока нет

- United States Amicus Brief SBA List & COAST V. DriehausДокумент42 страницыUnited States Amicus Brief SBA List & COAST V. DriehausFinney Law Firm, LLCОценок пока нет

- SBA and COASTv. Driehaus, Et Al Petitioner's BriefДокумент79 страницSBA and COASTv. Driehaus, Et Al Petitioner's BriefCOASTОценок пока нет

- Paranoia Sets inДокумент2 страницыParanoia Sets inCOASTОценок пока нет

- SORTA Streetcar ProjectionsДокумент17 страницSORTA Streetcar ProjectionsCOASTОценок пока нет

- COAST Parking Plot Complaint - Exhibits.2013.09.03Документ131 страницаCOAST Parking Plot Complaint - Exhibits.2013.09.03COASTОценок пока нет

- Seelbach Motion On Glass AtriumДокумент3 страницыSeelbach Motion On Glass AtriumCOASTОценок пока нет

- Pure Romance LLC137Документ2 страницыPure Romance LLC137COASTОценок пока нет

- John Curp, Esq. City Solicitor: 801 Plum Street, Suite 214Документ2 страницыJohn Curp, Esq. City Solicitor: 801 Plum Street, Suite 214COASTОценок пока нет

- To Be Considered For Endorsement. Non-Responsive Answers Will Not Be ConsideredДокумент3 страницыTo Be Considered For Endorsement. Non-Responsive Answers Will Not Be ConsideredCOASTОценок пока нет

- 2013.09.03.oak Hills LetterДокумент3 страницы2013.09.03.oak Hills LetterCOASTОценок пока нет

- COAST Motion Costs.2013.09.03Документ2 страницыCOAST Motion Costs.2013.09.03COASTОценок пока нет

- COAST Motion For Temporary Restraining Order September 3, 2013Документ10 страницCOAST Motion For Temporary Restraining Order September 3, 2013COASTОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Manana Mobile International SIM CardДокумент9 страницManana Mobile International SIM CardManana Mobile International SIMОценок пока нет

- CompendiumДокумент18 страницCompendiumpranithroyОценок пока нет

- HuiДокумент5 страницHuiShiv SinghОценок пока нет

- Banking ChicagoДокумент2 страницыBanking ChicagoIsrael ZepahuaОценок пока нет

- The Prons and Cons of Internet and World Wide WebДокумент6 страницThe Prons and Cons of Internet and World Wide WebMohamad Razali RamdzanОценок пока нет

- Ds Iron Condor StrategiaДокумент43 страницыDs Iron Condor StrategiaFernando ColomerОценок пока нет

- Basel II- RBI Guidelines SummaryДокумент70 страницBasel II- RBI Guidelines SummaryHarsh MehtaОценок пока нет

- Digital Banking Project - BubunaДокумент20 страницDigital Banking Project - BubunaRaghunath AgarwallaОценок пока нет

- Chief Financial Officer CFO in Los Angeles CA Resume David YodkovikДокумент2 страницыChief Financial Officer CFO in Los Angeles CA Resume David YodkovikDavidYodkovikОценок пока нет

- Project On Kotak Mahindra BankДокумент34 страницыProject On Kotak Mahindra BankMcbc Promax Ultrahd100% (1)

- Description: 1. Question Details Jmodd7 5.4.001.cmi. (1639656)Документ3 страницыDescription: 1. Question Details Jmodd7 5.4.001.cmi. (1639656)Suvaid KcОценок пока нет

- BMO Annual Report 2020Документ218 страницBMO Annual Report 2020Bilal MustafaОценок пока нет

- RecoveriesДокумент45 страницRecoveriesSona ElvisОценок пока нет

- Cityam 2011-09-12Документ44 страницыCityam 2011-09-12City A.M.Оценок пока нет

- Exxon Mobil: Rank Company Country Sales Profits Assets Market ValueДокумент10 страницExxon Mobil: Rank Company Country Sales Profits Assets Market ValuePetrescu PaulОценок пока нет

- INVITATION FOR FOREIGN LIQUOR SUPPLYДокумент37 страницINVITATION FOR FOREIGN LIQUOR SUPPLYRoddy RodriguesОценок пока нет

- Credit Risk Management at State Bank of HyderabadДокумент86 страницCredit Risk Management at State Bank of HyderabadSagar Paul'g100% (1)

- Banking Law B.com - Docx LatestДокумент38 страницBanking Law B.com - Docx LatestViraja GuruОценок пока нет

- GR No. 7593, March 27, 1913: Supreme Court of The PhilippinesДокумент6 страницGR No. 7593, March 27, 1913: Supreme Court of The PhilippinesM A J esty FalconОценок пока нет

- Negotiable Instruments - Meaning, Types & UsesДокумент3 страницыNegotiable Instruments - Meaning, Types & UsesQuishОценок пока нет

- Caf-1 IaДокумент5 страницCaf-1 IaZohaad HassanОценок пока нет

- Bank & BankingДокумент6 страницBank & BankingSourav BhattacharjeeОценок пока нет

- Payment Bank Impact On Digital BankingДокумент78 страницPayment Bank Impact On Digital BankingSudharshan Reddy P0% (1)

- 7 P's of Service Marketing MixДокумент22 страницы7 P's of Service Marketing MixAlekha MittalОценок пока нет

- Indian Economy QuestionsДокумент25 страницIndian Economy QuestionsPadyala SriramОценок пока нет

- Gomal University: Journal of ResearchДокумент13 страницGomal University: Journal of ResearchsdsОценок пока нет

- Solved in The Documentary Movie Expelled No Intelligence Allowed TherДокумент1 страницаSolved in The Documentary Movie Expelled No Intelligence Allowed TherAnbu jaromiaОценок пока нет

- False Alarm Bjorn LomborgДокумент2 страницыFalse Alarm Bjorn LomborgGraham DawsonОценок пока нет

- Comparative Financial Analysis of SBI and HDFC BankДокумент85 страницComparative Financial Analysis of SBI and HDFC Bankshshant kashyap50% (4)

- Gregory Feb 2020 Wells StatementДокумент4 страницыGregory Feb 2020 Wells StatementYoooОценок пока нет