Академический Документы

Профессиональный Документы

Культура Документы

Howard Davies AF

Загружено:

Aarzoo SuriИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Howard Davies AF

Загружено:

Aarzoo SuriАвторское право:

Доступные форматы

24 TIMES BUSINESS * THE TIMES OF INDIA, MUMBAI

TUESDAY, OCTOBER 31, 2006

Input costs

hit Tata Steel The future of central bankingHoward Davies fluence of local politicians on mone-

EXECUTIVE DIGEST

bottomline tary policy. More recently the China

T

he last three decades have been Banking Regulatory Commission has

TIMES NEWS NETWORK a golden age for central banks. been established to give a new focus

Since Paul Volcker’s brave, and and accountability for banking su-

Mumbai: High raw material at the time unpopular attack on in- pervision. But the People’s Bank still

costs hit has the net profit flation at the end of the 1970s, the val- lacks the statutory independence now

growth of Tata Steel. The com- ue of a powerful central bank with a common in the developed world.

pany’s net profit for the sec- single-minded focus on price stabili- In Russia, the central bank has be-

ond quarter ended September ty has been increasingly appreciated. come more prominent, but it contin-

30, 2006, grew 5.4% at Rs 101.5 Following Volcker, Alan Greenspan ues to struggle to establish its opera-

crore, compared with a net bestrode the world like a colossus for tional independence, and its authori-

profit of Rs 1,045 crore, regis- almost 20 years and, on the other side ty over the banking system. The recent

tered in the corresponding of the Atlantic, the Bundesbank ruled assissination of Andre Kozlov, its head

quarter of the previous year. supreme. One after another, developed of Banking Supervision, illustrates

Net income from operations countries chose to emulate these mod- that point very starkly. So what of the

increased by almost 8% to Rs els, and to strengthen the independ- future? Are we likely to see developing

4,185 crore, from Rs 3,884 crore ence of their central banks. It seemed The wor d s wo mos power u cen ra bankers ean C aude Tr che L pres den countries converging on this new mod-

posted in the corresponding the best guarantee of low inflation o he ECB and Ben Bernanke he US Fed cha rman arr ve or he n erna ona el of central banking? I suspect we will

period last year. and financial stability. Mone ary Con erence n h s e pho o not see a simple copying out.

B Muthuraman, MD, Tata The United Kingdom was late to see There is no single template which HOLY FLIGHT: Vishwapati Trivedi is turning up the heat in the

Steel, said, “While raw mate- the strength of these arguments. And These developments have been pos- ble, but in the US, the UK and at the will work in all countries, irrespective Indian skies. His Indian Airlines is mounting a dozen new

rial prices have been on the it was only in 1997 that the bank was itive for financial stability and growth. ECB the responsibility is collective, of their state of development, of the ma- flights as part of a mega expansion strategy for this winter

rise, prices of finished goods liberated from government control, Central bank independence is sup- even though the burden of exposition turity of their political systems, and the

have not risen, thereby im- with a new Bank of England Act en- ported by much theoretical argument, and explanation is bound to rest with condition of their financial markets.

pacting our margins.’’ shrining its independence and estab- though it would be fair to say that some the chairman, governor or president. What works well in a very open, sophis- ITC Q2 net up 19% at Rs 680cr: ITC posted a 18.74% increase

The company’s operating lishing a formal monetary policy com- economists, notably Milton Friedman These trends have not been so evi- ticated and intertwined financial mar- in net profit at Rs 679.60 crore for the quarter ended September

margins fell to 43% from 44% mittee with exclusive power to set in- and Joe Stiglitz not often seen shar- dent in developing countries. While ket like London’s, where the boundaries 30, as compared to Rs 572.33 crore for the same quarter last

during the quarter. Raw ma- terest rates. Shortly afterwards, the Eu- ing the same point of view remain their inflation performance has sim- between banks, securities firms and in- year. Total income of the company increased 31.21% to Rs

terial costs jumped 42% dur- ropean Central Bank was set up with skeptical, and tend to argue that mon- ilarly improved, that looks to be more surance companies are hard to discern, 2,967.12 crore for the quarter ended September 30, from Rs

ing the quarter, pushing total a remarkably high degree of autono- etary policy is too important to be tak- influenced by other factors, notably is not necessarily appropriate in China 2,261.21 crore for the corresponding quarter a year ago.

expenditure up by 11%. my and political dependence. en out of the hands of elected politi- the growing pressures of international or India. And we have to recognise that

There is concern over the At the same time, however, there has cians. For the moment, this remains capital markets. But there has been independent regulatory agencies have a Godrej Consumer Q2 net dips 6%: Godrej Consumer Products

company’s margins in the fu- been a tendency to strip central banks a minority view and in the developed less change to the formal statutes of much more difficult time in countries reported a 6% dip in net profit at Rs 26.14 crore for the quarter

ture owing to the proposed of other responsibilities, notably for world one can see a trend towards the monetary authorities themselves. where large parts of the financial sector ended September 30, as compared to Rs 27.81 crore for the

buyout of UK-based steel gi- banking supervision. That is not the smaller central banks, with a high de- In India, for example, the Reserve are still government owned. Nonethe- corresponding quarter last year. Total income (net of excise)

ant Corus group, which has case in the US, where the Federal Re- gree of autonomy and independence, Bank has been effective in the opera- less, any country would be wise to re- rose to Rs 183.06 crore for the second quarter in 2006-07, up

high operating costs and neg- serve remains a banking supervisor, focused on achieving a target for low tion of anti-inflation policy, and has flect on the implications of these changes 12% from Rs 163.13 crore during the same quarter a year ago.

ative cash flows. though one of a number of comple- inflation. Sometimes those targets are put in place a number of mechanisms for their own systems. And in India,

Tata Steel recently an- mentary and sometimes competing defined by the bank itself. In other cas- which reflect these overseas develop- there is certainly a case for legislative Yes Bank Q2 net jumps 51%: Yes Bank posted a 50.8% jump in

nounced a formal bid for agencies. But in the early 1990s the Scan- es, as in the UK, the target is defined ments, such as its Board for Financial change to recognise more formally the net profit for the quarter ended September 30, at Rs 21.49 crore

Corus. Muthuraman said the dinavian countries began the trend to by the government, with the Bank of Supervision to oversee supervision autonomous role played by the RBI. That as against Rs 14.25 crore in the same quarter previous fiscal.

integration of Corus with Tata establish integrated regulators outside England left with the operational re- within the RBI, and its Technical Ad- might not change in any fundamental Total income of the bank registered a gain of 182.2% at Rs 166

Steel would have an impact on the central bank. Australia and UK fol- sponsibility for delivering it. visory Committee on monetary poli- way the current operations of the bank, crore as compared to Rs 58.82 crore in the same quarter last year.

the latter’s margins but it lowed in the late 1990s. Since then the Within central banks, there has cy. But the Act within which the RBI but would be a “sleeping policeman” in

would be a temporary phase. Bank of Japan has lost its supervisory also been a growing tendency to en- operates, remains essentially the one the road, in the event that a future gov- Asian Paints Q2 profit up 27%: Asian Paints posted 26.79%

responsibilities, and a number of oth- trust this anti-inflation responsibili- put in place in 1934. ernment tried to inflate its way out of increase in profit at Rs 77.56 crore for the quarter ended

Tata Motors ers too. The European Central Bank ty to a committee, rather than an in- In China, the People’s Bank has

was set up as a monetary authority, leav- dividual. In New Zealand, where in- been restructured. Its regional oper-

financial difficulties. September 30, as compared to Rs 61.17 crore for the same

quarter last fiscal. Total income increased 26.91% to Rs 794.95

ing supervision responsibilities with flation targets were invented, the gov- ations have been changed on lines of (The author is the director of crore for the quarter ended September 30, from Rs 626.37 crore

net slips individual European countries. ernor remains personally responsi- the Federal Reserve, to reduce the in- London School of Economics) for the corresponding quarter a year ago.

Mumba Ta a Mo ors nd a s Patel Engg Q2 net doubles: Patel Engg reported a net profit of

arges au omob e company

pos ed a ower han expec ed

ne pro o Rs 441 7 crore or

he second quar er ended Sep

Varun Shipping plans Rs 2000cr expansion Rs 25.5 crore for the quarter ended September, a rise of 103%

over Rs 12.5 crore it had earned a year earlier. Consolidated

revenues for the quarter rose 32.4% to Rs 243.8 crore from Rs

184.2 crore during the same period previous year.

ember 30 2006 a 30 1% TIMES NEWS NETWORK promoters for up to about Rs 233 crore. will come from internal accruals and

grow h over he ne pro o Foreign investors including Cale- debt,” said Yudhishthir Khatau, man- Havell’s Q2 net at Rs 24.3cr: Havell’s India has reported net

Rs 337 8 crore reg s ered n he Mumbai: Varun Shipping plans to in- donia Investments (Rs 114 crore), Sofi- aging director, Varun Shipping Com- profit of Rs 24.3 crore for the quarter ended September, up 59%

prev ous year vest up to Rs 2,000 crore in the next six na (Rs 12 crore), ICG Q, (Rs 9 crore) and pany. The company is essentially fo- over Rs 15.3 crore it earned a year earlier. The company’s total

Praveen Kad e execu ve to eight months to expand its fleet. It Societe Generale (Rs 9 crore) will sub- cusing on new ships and second hand sales were Rs 411.5 crore, a rise of 49.5% .

d rec or nance Ta a Mo ors will acquire Aframax tankers, gas car- scribe to the new equity capital. While vessels which will join the company’s

sa d “Marg ns dur ng he riers and offshore vessels including the IL&FS Trust Company will pick up existing 17-ship fleet. Weekly service from SCI: Shipping Corporation of India has

quar er were under pressure platform supply and offshore supply Rs 11 crore worth equity, the promoter Khatau is hopeful that the compa- announced new weekly service from the Far East to Middle

due o r s ng raw ma er a vessels. In future, the company will the proposed changes will be taken up group company, Khatau International, ny will be able to buy the ships despite East via India beginning November 11. The new service named

pr ces We expec h s rend o also buy oil exploration rigs. To facil- at the extraordinary general meeting will invest about Rs 14 crore. huge demand for ships. “Hyper Galax’’ will offer direct service from Xingang, Qingdao

con nue or he res o he itate the full-fledged entry into the off- in November. Besides this, warrants will also be Khatau was speaking at a press and Ningbo to Nhava Sheva and Mundra in addition to calling

year Ta a Mo ors marg ns shore segment, the company plans to The company has in fact kicked off issued to Mehta (Rs 4.5 crore) and pro- meet to announce the company’s sec- Middle East ports of Jebel Ali, Abu Dhabi and Dammam.

d pped o 11 5% rom 12% dur make appropriate changes in its mem- the fund raising exercise with the moters group companies (Rs 59 crore). ond quarter earnings ending Sep-

ng he quar er under rev ew orandum of association, Arun Mehta, board on Monday approving the plan These warrants can be converted into tember 30. For the quarter, the com- Lanco Infra IPO at Rs 200-240 band: The IPO for Lanco

The Ta a Mo ors scr p e the company’s vice-chairman and to issue fresh equity shares and op- shares in 18 months. pany has reported Rs 170.5 crore as in- Infratech will be priced between Rs 200 and Rs 240 per share.

a mos 4% o c ose a Rs 852 n managing director told TOI. tionally fully convertible warrants to “This money will be enough for us come from operations as against Rs The company is offering about 4.4 crore shares.

a rm BSE TNN The shareholders’ permission for foreign institutional investors and the to do fund our expansion as the rest 146.1 crore last year.

MARKETCAP TOP 10 ADVANCES DECLINES MAJOR INDICES BSE TOP GAINERS BSE TOP LOSERS NSE TOP GAINERS NSE TOP LOSERS

C m %C A A CNX500 CNX500

B N Y CHG

C m R %C C m R %C C m R %C C m R %C

m m m M

M m

TURNOVER R C m

D B N M m

m

m

W

M m m

Co., Prices, [Vol.,] PE 52-Wk H/L Co., Prices, [Vol.,] PE 52-Wk H/L Co., Prices, [Vol.,] PE 52-Wk H/L

STOCKS MUTUAL FUNDS Open-Ended Equ y/Ba anced Schemes (30/10/06)

Cipla 262.50, 264.35, 258, 262.75[359772] . . . . . . . . . 28.2 . . .305/140 ICICI Bank 753, 789.90, 751.15, 785.45[266108] . . . . 25.0 . .790H/440 Pfizer 851.10, 864.95, 848, 853[30683] . . . . . . . . . . . . 24.0 . .1225/621

● B w m 262, 264.30, 257.40, 262.20[759335] . . . . . . . . . . . . 28.1 . . .304/139 758, 791.90, 749.10, 787.90[1743286] . . . . . . . . . . . 25.1 . . .795/435 868, 868, 848, 852.30[14911] . . . . . . . . . . . . . . . . . . 24.0 . .1220/655

m w CMC 639, 678, 632.45, 661.30[7918] . . . . . . . . . . . . . . 20.6 . . .705/335 IDBI 87.70, 87.70, 84.65, 85.10[781293] . . . . . . . . . . . 10.1 . . . .110/49 Pidilite Ind 106, 107.80, 104.30, 104.75[12422] . . . . . 25.1 . . . .123/70 ABN Amro FI STF Reg-MD. . . . . 10.92 FMCG -G. . . . . . . . . . 35.63 FRF LTP Reg-MD . . . 10.00 Eqty & Derv-B . . . . . 10.35

w 655, 680, 650, 663.05[15445] . . . . . . . . . . . . . . . . . . 20.6 . . .700/337 87, 87.80, 84.90, 85.20[1984943] . . . . . . . . . . . . . . . 10.1 . . . .110/48 107, 107, 104.10, 104.50[16120] . . . . . . . . . . . . . . . 25.0 . . . .123/70 Div. Yield-D. . . . . . . . 10.53 Gilt Invest-C. . . . . . . 18.47 FT Balanced -D. . . . . 22.24 Gilt STP -D . . . . . . . . 10.73 Eqty & Derv-D . . . . . 10.35

w w Colgate 377.10, 389.90, 375.05, 385.90[74922] . . . . . 36.0 . . .464/232 IDFC 75.80, 83.10, 74.50, 82.30[3536084] . . . . . . . . . . 22.4 . . . .83H/43 Polaris Soft 135, 136, 133.50, 134[81714] . . . . . . . . . . 43.9 . . . .145/52 Div. Yield-G. . . . . . . . 10.53 Gilt Invest-QD . . . . . 10.16 FT Balanced -G. . . . . 31.22 Gilt STP -G . . . . . . . . 10.92 Eqty & Derv-G . . . . . 11.18

N 380.40, 389.70, 374, 386.55[254028] . . . . . . . . . . . . 36.1 . . .476/231 76.55, 83.20, 75.10, 82.65[11702905] . . . . . . . . . . . 22.5 . . . .83H/43 136, 137, 133.25, 134.25[425549] . . . . . . . . . . . . . . 44.0 . . . .145/52

Equity -D . . . . . . . . . 19.01 Global Adv.-C . . . . . . 13.79 FT Growth . . . . . . . . 27.49 Inc Invt Inst.G . . . . . 12.56 Equity -D . . . . . . . . . 16.39

● m m Equity -G . . . . . . . . . 25.03 Global Adv.-D . . . . . . 12.94 FT Index Tax. . . . . . . 29.39 Inc Invt Reg-D . . . . . 10.42 Equity -G . . . . . . . . . 36.48 W

w B m Container Co 1980, 1980, 1970, 1975.30[7482] . . . . . . 19.7 .2000/1210 IGate Global 231, 234.50, 226, 231.40[9493] . . . . . . .100.6 . . .284/145 Pun.Nat.Bank 525, 536, 517, 518.60[179752] . . . . . . . 11.3 . . .544/300 FlexiDebt Reg-G. . . . 11.13 Growth -C. . . . . . . . . 30.14 Flexi Cap -D . . . . . . . 17.69 Inc Invt Reg-G . . . . . 12.23 Float.LT Prem-D . . . . 10.08

m 1989.85, 1989.85, 1970, 1975[14876] . . . . . . . . . . . 19.7 .2073/1210 234, 234, 224.10, 231.30[17831] . . . . . . . . . . . . . . .100.6 . . .285/146 524, 535.90, 515.90, 519[1105724] . . . . . . . . . . . . . 11.3 . . .545/300 FlexiDebt Rg-DD . . . 10.00 Growth -QD . . . . . . . 16.21 Flexi Cap -G . . . . . . . 19.94 Inc STP Instl-D . . . . 10.03 Float.LT Prem-G . . . . 11.24

● Corpn. Bank 402, 403.75, 396, 397.35[9262] . . . . . . . . 11.7 . . .445/205 India Cement 223, 223, 219, 220.10[384478] . . . . . . . 31.8 . . . .250/78 Pun.Tractors 251, 261, 248.30, 256.35[126517] . . . . . 20.0 . . .293/187 FlexiDebt Rg-HD . . . 10.10 MIP Reg-C . . . . . . . . 13.06 Floater Inst-D . . . . . 10.01 Inc STP Instl-G . . . . 12.43 Floater LTP-D . . . . . . 11.75

401.20, 403.95, 395.30, 397.30[228148] . . . . . . . . . 11.7 . . .445/206 222, 222.90, 219.50, 220[1100347] . . . . . . . . . . . . . 31.7 . . . .249/78 259.80, 259.80, 248.40, 255.60[63597] . . . . . . . . . . 20.0 . . .292/187 FlexiDebt Rg-QD . . . 10.11 MIP Reg-MD . . . . . . 10.31 Floater Inst-G . . . . . 10.70 Inc STP Reg-D . . . . . 10.64 Floater LTP-G . . . . . . 11.71

Crompton Gr. 246.65, 246.65, 239.95, 240.55[56866] . 35.7 . . .270/121 Indian Hotel 146.50, 148.25, 143.25, 143.70[306695] . 40.8 . . . .158/72 Punj Lloyd 775, 784, 766.50, 774.95[160258] . . . . . . .115.1 . .1255/544 FlexiDebt Rg-WD . . . 10.01 MIP Reg-QD. . . . . . . 10.57 Floater ST -D . . . . . . 10.01 Inc STP Reg-G . . . . . 12.29 Floater STP-D. . . . . . 10.09

● w w Future LeadersD . . . . 9.44 MidCap-C . . . . . . . . . 24.90 Floater ST -G . . . . . . 13.06 India Opp.-D. . . . . . . 17.26 Floater STP-G. . . . . . 11.98 W

w w w H 248.10, 248.10, 238.50, 241.10[216738] . . . . . . . . . 35.8 . . .269/120 147.40, 147.95, 143, 143.45[914969] . . . . . . . . . . . . 40.8 . . . .158/72 765, 784, 765, 775.10[326528] . . . . . . . . . . . . . . . .115.2 . .1254/540 Future LeadersG . . . . 9.43 MidCap-D . . . . . . . . . 14.36 GSec Composit-D. . . 10.81 India Opp.-G. . . . . . . 25.92 GSec PF -D. . . . . . . . 19.96

w Cummins (I) 257, 257, 248, 250.10[205978] . . . . . . . . 25.9 . . .269/138 Indian Oil C 524.90, 530, 515.60, 519[57763] . . . . . . . . 9.0 . . .622/310 Ranbaxy Lab. 407, 407.80, 400.60, 401.65[152636] . . 53.0 . . .530/317 MIP -G . . . . . . . . . . . 12.30 MultiCap-C . . . . . . . . 17.89 GSec Composit-G. . . 23.85 MIP Reg -G . . . . . . . 12.11 GSec PF -G. . . . . . . . 21.79

B N H w w H 256, 256, 248.50, 250.25[461169] . . . . . . . . . . . . . . 25.9 . . .268/138 515, 531, 514.10, 519[195739] . . . . . . . . . . . . . . . . . 9.0 . . .622/309 406, 406.85, 401, 402[470948] . . . . . . . . . . . . . . . . . 53.0 . . .530/317 MIP -MD. . . . . . . . . . 10.60 MultiCap-D. . . . . . . . 14.27 GSec PF -D. . . . . . . . 10.48 MIP Reg -MD . . . . . . 10.56 GSec PF Plus -D . . . . 11.02 W

C M G D-Link (I) 94.50, 96.20, 93.05, 93.45[109773] . . . . . . . 13.7 . . . .150/64 Indian Ov.Bk 118.80, 120.90, 113.50, 114.65[274054] . 7.6 . . . .133/66 Raymond 442.90, 456, 441.50, 453.85[7981] . . . . . . . . 24.5 . . .625/289 MIP -QD . . . . . . . . . . 10.53 Opportun.Reg-QD . . 16.60 GSec PF -G. . . . . . . . 10.48 MIP Reg -QD . . . . . . 10.74 GSec PF Plus -G . . . . 11.01

94.80, 96.10, 93.45, 93.80[189285] . . . . . . . . . . . . . 13.7 . . . .150/62 120.05, 120.90, 113.30, 114.60[993422] . . . . . . . . . . 7.6 . . . .134/65 443.30, 455, 440, 452.55[22061] . . . . . . . . . . . . . . . 24.4 . . .630/287 Opportunities-D . . . . 16.01 Opportunities-C . . . . 25.53 GSec Treasury-D . . . 10.70 MIP Savings-G . . . . . 12.92 GSec Reg -D. . . . . . . 10.23

BSE A GROUP/NSE Dabur (I) 141, 151.70, 141, 150.60[344347] . . . . . . . . 38.1 . . . .174/79 Indo Rama Sy 57.50, 58, 57.15, 57.70[9786] . . . . . . . . 40.1 . . . . .85/43 RCF 42.50, 42.60, 41.15, 41.45[285673] . . . . . . . . . . . 14.4 . . . . .72/28 Opportunities-G . . . . 18.61

Tax Advantage-D . . . 12.56

ST FRF -C . . . . . . . . . 10.79

ST FRF -MD . . . . . . . 10.19

GSec Treasury-G . . . 13.65

Index BSE -G . . . . . . 36.29

MIP Savings-MD . . . 10.83

MIP Savings-QD. . . . 11.10

GSec Reg -G. . . . . . . 20.93

GSec Reg -GB. . . . . . 10.18

145, 151.70, 144, 150.65[1462304] . . . . . . . . . . . . . 38.1 . . . .174/79 57.75, 58.65, 56.85, 57.05[29673] . . . . . . . . . . . . . . 39.6 . . . . .85/42 42.40, 42.55, 41.40, 41.60[206963] . . . . . . . . . . . . . 14.5 . . . . .72/28

W Dena Bank 33.85, 34.45, 32.90, 33.05[481088] . . . . . . 3.2 . . . . .42/20 IndusInd Bnk 46.95, 47.80, 46, 46.65[129368] . . . . . .311.0 . . . . .64/27 Rel Capital 570, 583.50, 565.05, 580.80[496497] . . . . 20.1 . . .640/320 Tax Advantage-G . . . 12.56 ST FRF ReInv-DD . . . 10.02 Index Nifty -G . . . . . 29.93 Midcap Eqty-D . . . . . 14.34 HI FI -D . . . . . . . . . . 10.47

BOB ST FRF ReInv-WD . . 10.22 Infotech -D. . . . . . . . 24.82 Midcap Eqty-G . . . . . 17.56 HI FI -G . . . . . . . . . . 10.47

ABB 3691, 3790, 3610, 3633.70[78961] . . . . . . . . . . . . 56.9 3790H/1640 33.90, 34.45, 32.70, 33[1240760] . . . . . . . . . . . . . . . 3.1 . . . . .42/20 47.10, 47.95, 46.50, 46.70[265764] . . . . . . . . . . . . .311.3 . . . . .64/27 568, 584, 565, 580.85[990070] . . . . . . . . . . . . . . . . . 20.1 . . .640/320 Balance -D . . . . . . . . 23.00 TaxSaver-C. . . . . . . . 12.87 Infotech -G. . . . . . . . 50.27 ING Vysya HLF Instl -D . . . . . . . 10.13

3769.95, 3791, 3610.10, 3636.20[292042] . . . . . . . . 56.9 3791H/1640 Dr.Reddy’s 749, 774, 745.10, 751.40[338401] . . . . . . . 25.9 . . .877/400 Infosys Tech 2091.55, 2133, 2070.25, 2124.05[138006] 38.7 .2151/1216 Reliance Com 390.15, 398.25, 382, 393.55[3298555] . 39.2 . .398H/186 Balance -G . . . . . . . . 22.93 TaxSaver-D. . . . . . . . 12.87 International * . . . . 10.28 A.T.M. . . . . . . . . . . . . 10.37 HLF Instl -DD . . . . . . 10.02

Abbott (I) 581.95, 584, 573.60, 574.65[3733] . . . . . . . 14.4 . . .785/412 750, 778, 746, 751.50[1266553] . . . . . . . . . . . . . . . . 25.9 . . .877/403 2095, 2135, 2070, 2127.70[712012] . . . . . . . . . . . . . 38.7 .2146/1202 385, 398.40, 383, 393.50[10000603] . . . . . . . . . . . . 39.2 . .398H/186 Childrens Gift. . . . . . 10.48 TripAce -HD . . . . . . . 11.55 LS FOF 20 -D . . . . . . 22.29 A.T.M. -B. . . . . . . . . . 10.37 HLF Instl -G . . . . . . . 12.03

ACC 980, 991, 972.10, 979.70[83761] . . . . . . . . . . . . . 17.3 . .1061/432 Dredging Cor 618, 618, 600.60, 601.80[36415] . . . . . . 10.2 . . .749/460 ING Vysya Bk 162, 173.80, 162, 164.10[105300] . . . . . 40.9 . . . .177/82 Reliance Ene 485, 495, 478.20, 491.55[323239] . . . . . 15.0 . . .701/362 Childrens Study . . . . 10.04 TripAce Reg-B . . . . . 13.27 LS FOF 20 -G . . . . . . 22.29 A.T.M. -D. . . . . . . . . . 10.37 HLF Instl -QD . . . . . . 11.49

615, 615, 599.95, 604.40[10416] . . . . . . . . . . . . . . . 10.2 . . .749/450 163.90, 173.40, 163, 164.10[196958] . . . . . . . . . . . . 40.9 . . . .177/83 482.90, 494.55, 476.15, 491.75[1171901] . . . . . . . . 15.0 . . .670/360 Diversified . . . . . . . . 30.45 TripAce Reg-C . . . . . 23.88 LS FOF 30 -D . . . . . . 17.86 Balanced -D . . . . . . . 12.26 HLF Prem -DD . . . . . 10.00

985, 990.75, 977, 982.85[360621] . . . . . . . . . . . . . . 17.4 . .1063/432 Elss 96 . . . . . . . . . . . 24.32 TripAce Reg-QD . . . . 11.24 LS FOF 30 -G . . . . . . 17.86 Balanced -G . . . . . . . 17.52 Health Care -D. . . . . 12.73

Adani Enterp 141, 142.85, 135, 137.05[141994] . . . . . 26.0 . . . .199/48 EIH 100, 101, 99.50, 100.40[41243] . . . . . . . . . . . . . . . 20.1 . . . .127/57 Ingersoll R 338, 352, 331.40, 333.50[19151] . . . . . . . . 25.4 . . .436/220 Reliance Ind 1215.10, 1239.90, 1215.10, 1232.75[751597] . . 18.0 . . .1240/675

Gilt -D. . . . . . . . . . . . 11.08 DSP Merrill Lynch LS FOF 40 -D . . . . . . 13.72 Dividend Yld-B . . . . . 11.28 Health Care -G. . . . . 16.05

141, 142.90, 134.10, 136.95[177774] . . . . . . . . . . . . 26.0 . . . .199/49 100.45, 102, 99.20, 100.50[106731] . . . . . . . . . . . . . 20.1 . . . .125/58 340, 352, 332.10, 334.80[20559] . . . . . . . . . . . . . . . 25.5 . . .435/220 1225, 1240, 1212.15, 1236.15[2043590] . . . . . . . . . 18.1 .1240H/580 Gilt -G. . . . . . . . . . . . 11.07 Balanced -D . . . . . . . 21.23 LS FOF 40 -G . . . . . . 15.12 Dividend Yld-D . . . . . 10.25 Income -B . . . . . . . . 11.60

Aditya Bir.N 948, 950, 926.10, 934[11458] . . . . . . . . . . 43.0 . .1000/510 Engineers (I 523.95, 525, 520.10, 522.35[12692] . . . . 24.1 . .1020/392 IPCA Lab. 445, 445.10, 427.05, 429.15[13806] . . . . . . 13.3 . . .460/235 Reliance Pet 64.75, 64.90, 64, 64.25[304485] . . . . . . . . .— . . . .102/51 Gilt PF-G. . . . . . . . . . 10.44 Balanced -G . . . . . . . 36.60 LS FOF 50 -D . . . . . . 11.79 Dividend Yld-G . . . . . 11.28 Income -D . . . . . . . . 10.23

945, 949.10, 925, 939.55[74848] . . . . . . . . . . . . . . . 43.3 . . .980/500 525, 525, 517.05, 520.25[13581] . . . . . . . . . . . . . . . 24.1 . .1020/400 439.95, 445.55, 426.05, 430.10[9087] . . . . . . . . . . . 13.4 . . .469/235 64.50, 64.90, 64.05, 64.20[762303] . . . . . . . . . . . . . . . .- . . . .105/58 Global -D . . . . . . . . . 10.39 Bond Retail-D. . . . . . 10.63 LS FOF 50 -G . . . . . . 12.91 Domestic Opp-D. . . . 13.91 Income -G . . . . . . . . 28.35

Alfa Laval 890, 935, 830, 926.40[44894] . . . . . . . . . . . 25.7 . .1280/740 Escorts 130.10, 131.50, 128.10, 128.70[145593] . . . . . 6.1 . . . .136/53 IPCL 295.10, 299.90, 293, 294.85[407224] . . . . . . . . . . 8.3 . . .325/185 Rolta (I) 218.50, 224.10, 213.30, 222.65[463232] . . . . 12.8 . . .285/124 Global -G . . . . . . . . . 10.40 Bond Retail-G. . . . . . 24.56 LS FOF 50 FRP-D . . . 12.07 Domestic Opp-G. . . . 25.36 MIP -AD . . . . . . . . . . 10.89

924, 930, 882.10, 921.70[17200] . . . . . . . . . . . . . . . 25.6 . .1270/729 129.70, 131.60, 128.10, 128.90[661918] . . . . . . . . . . 6.1 . . . .136/53 295.70, 300.40, 291.25, 294.85[963699] . . . . . . . . . . 8.3 . . .322/188 215.05, 224.50, 201.25, 222.80[1012645] . . . . . . . . 12.8 . . .284/123 Growth -D . . . . . . . . 18.13 Bond Retail-MD . . . . 10.36 LS FOF 50 FRP-G . . . 13.27 Domestic Opp.-B . . . 25.36 MIP -G . . . . . . . . . . . 13.09

Essel Propac 90, 92.85, 84.50, 90.30[137548] . . . . . . . 15.3 . . . . .97/61 Ispat Inds. 12.58, 12.60, 12.21, 12.27[250233] . . . . . . .— . . . . .25/10 SAIL 91.50, 92.60, 86.90, 87.55[3827286] . . . . . . . . . . 8.5 . . . . .96/42 Growth -G . . . . . . . . 28.73 Equity . . . . . . . . . . . . 42.38 MIP Eqty-G. . . . . . . . 19.59 Equity -D . . . . . . . . . 14.92 MIP -MD. . . . . . . . . . 10.77 W

Allahabad Bk 89, 93.60, 86.25, 92.70[897589] . . . . . . . 5.8 . . . . .94/53 Income -D . . . . . . . . 12.44 Floating-D . . . . . . . . 10.25 MIP Eqty-HD . . . . . . 12.15 Equity -G . . . . . . . . . 31.30 MIP -QD . . . . . . . . . . 10.78

88.20, 93.70, 87.05, 92.60[2499876] . . . . . . . . . . . . . 5.8 . . . . .95/52 88.25, 93, 88.25, 90.50[130391] . . . . . . . . . . . . . . . . 15.4 . . . . .99/60 12.60, 12.60, 12.20, 12.25[344143] . . . . . . . . . . . . . . . .- . . . . .25/10 91.30, 92.65, 86.80, 87.70[14142252] . . . . . . . . . . . . 8.5 . . . . .96/48

Income -G . . . . . . . . 12.44 Floating-DD . . . . . . . 10.03 Opportun.-D . . . . . . . 17.29 FRF -AD . . . . . . . . . . 10.50 MoneyMgrReg -D. . . 10.00

Alok Inds. 74, 77.70, 73.50, 76.50[364746] . . . . . . . . . 11.2 . . . . .99/54 Exide Inds. 40.80, 41.40, 40, 40.90[202035] . . . . . . . . 23.8 . . . . .49/19 ITC 188.50, 190, 186.50, 187.50[857384] . . . . . . . . . . 30.2 . . .213/116 Satyam Comp 431.40, 432.45, 425.05, 430.35[566564] 21.6 . . .453/271 MIP -G . . . . . . . . . . . 11.53 Floating-G . . . . . . . . 11.99 Opportun.-G . . . . . . . 24.31 FRF -DD . . . . . . . . . . 10.01 MoneyMgrReg -G. . . 10.06 +

73.25, 77.65, 73.05, 76[1103334] . . . . . . . . . . . . . . . 11.1 . . . . .99/51 40.25, 41.50, 40.10, 40.80[1000290] . . . . . . . . . . . . 23.7 . . . . .49/19 189, 190, 186.50, 187.45[3677262] . . . . . . . . . . . . . 30.2 . . .213/116 435, 435, 425.20, 430.90[1870329] . . . . . . . . . . . . . 21.6 . . .459/279 MIP -MD. . . . . . . . . . 11.54 Floating-IDD . . . . 1001.06 Pension -D . . . . . . . . 18.40 FRF -G . . . . . . . . . . . 11.20 MoneyMgrSuper D. . 10.00

Alstom Proj. 399.80, 447, 397.05, 439.05[1897319] . . 57.5 . .447H/164 FDC 42.45, 42.90, 41.50, 41.85[20677] . . . . . . . . . . . . 11.4 . . . . .59/33 J&K Bank 480.10, 483, 473, 479.35[81082] . . . . . . . . . 10.6 . . .564/306 SBI 1066.80, 1102, 1066.80, 1094.70[499886] . . . . . . 14.5 .1102H/684 MIP -QD . . . . . . . . . . 11.54 Floating-IG. . . . . . 1063.41 Pension -G . . . . . . . . 42.07 FRF -HD . . . . . . . . . . 10.22 MoneyMgrSuper G. . 10.07

400.95, 449, 391.40, 439.80[2459495] . . . . . . . . . . . 57.6 . .449H/163 42.10, 43, 41.50, 41.70[26645] . . . . . . . . . . . . . . . . . 11.4 . . . . .60/33 479, 483.05, 472.20, 476.30[99376] . . . . . . . . . . . . . 10.5 . . .568/300 1094, 1102.40, 1070, 1097.85[1559960] . . . . . . . . . 14.5 .1102H/685 Benchmark Floating-IWD . . . . 1001.63 Pharma -D . . . . . . . . 20.32 FRF -QD . . . . . . . . . . 10.26 MoneyMgrSuper+D 10.00

Federal Bank 224.80, 225.90, 220, 221.85[51834] . . . . 8.2 . . .227/137 Jaiprak.Asso 458, 544.50, 458, 544.50[688960] . . . . . 36.7 . . .624/265 Shipp.Corpn. 171.80, 174, 167, 168.20[127069] . . . . . . 4.2 . . .177/118 Bank BeES . . . . . . . 570.39 Floating-WD. . . . . . . 10.04 Pharma -G . . . . . . . . 28.05 FRF -WD. . . . . . . . . . 10.22 MoneyMgrSuper+G 10.07

Andhra Bank 90.90, 93.80, 90.90, 91.90[103622] . . . . . 8.4 . . . .109/57 Derivative-D. . . . . 1006.89 GSec Pl.A -D. . . . . . . 11.44 Prima -D. . . . . . . . . . 53.97 Float. Rate -B. . . . . . 11.20 STF -D . . . . . . . . . . . 11.03

92.10, 93.65, 91.15, 91.85[863173] . . . . . . . . . . . . . . 8.4 . . . .109/55 225, 225.95, 221, 222.50[156758] . . . . . . . . . . . . . . . 8.2 . . .227/134 475, 544.40, 475, 544.40[929987] . . . . . . . . . . . . . . 36.7 . . .625/261 172.25, 173.10, 167, 168.15[297546] . . . . . . . . . . . . 4.2 . . .177/119

Siemens 1235, 1254.65, 1220, 1236.70[58606] . . . . . . 63.6 . .1262/468 Derivative-G. . . . . 1117.02 GSec Pl.A -G. . . . . . . 22.95 Prima -G. . . . . . . . . 193.84 GPD - GAIP . . . . . . . 11.32 STF -G . . . . . . . . . . . 13.00

Apollo Hosp. 449.50, 449.50, 443, 448.05[3575] . . . . . 35.7 . . .589/340 Fert.&Chem-T 24.95, 24.95, 24, 24.50[8145] . . . . . . . . 3.9 . . . . .40/19 JB Chemicals 93.30, 96.45, 91.70, 93.70[63795] . . . . . 10.9 . . . .140/74 Junior BeES . . . . . . . 69.28 GSec Pl.A -MD . . . . . 10.12 Prima Plus -D. . . . . . 37.34 Gilt . . . . . . . . . . . . . . 11.99 STF Instl -D . . . . . . . 10.31 +

449.70, 450.90, 443, 449.15[16297] . . . . . . . . . . . . . 35.8 . . .592/340 24.50, 24.80, 24.20, 24.35[16814] . . . . . . . . . . . . . . . 3.8 . . . . .40/19 93.50, 96.40, 91, 93.70[69679] . . . . . . . . . . . . . . . . . 10.9 . . . .140/74 1240, 1254, 1219, 1237.50[296022] . . . . . . . . . . . . . 63.7 . .1262/466 Liquid BeES . . . . . 1000.00 GSec Pl.B -D. . . . . . . 10.97 Prima Plus -G. . . . . 127.35 Gilt -D. . . . . . . . . . . . 11.99 STF Instl -G . . . . . . . 12.27 +

Apollo Tyres 335, 336.50, 322.05, 330.10[10819] . . . . 16.1 . . .387/194 Finolex Cabl 441, 452, 435.10, 449.25[44559] . . . . . . . 18.1 . . .452/222 Jet Airways 592, 598.70, 580, 582.90[54946] . . . . . . . 26.8 . .1280/475 SKF India 304.50, 304.50, 295, 297.45[9748] . . . . . . . 19.5 . . .376/209 Nifty BeES . . . . . . . 384.52 GSec Pl.B -G. . . . . . . 16.63 T Income -D . . . . . . . 10.52 Gilt PD Cyc-06 . . . . . 10.29 Kotak Mahindra +

322, 337, 322, 329.10[25838] . . . . . . . . . . . . . . . . . . 16.1 . . .385/194 445, 451, 436.15, 450[44008] . . . . . . . . . . . . . . . . . . 18.1 . . .455/222 593.90, 600, 581.15, 583.65[160971] . . . . . . . . . . . . 26.8 . .1277/475 306, 306, 295.45, 298.60[18938] . . . . . . . . . . . . . . . 19.6 . . .377/210 Birla Sunlife GSec Pl.B -MD . . . . . 10.05 T Income -G . . . . . . . 25.36 Gilt ProvDyn-AD. . . . 10.42 30 -D . . . . . . . . . . . . 36.24 +

Finolex Inds 93.10, 93.80, 91.65, 92.15[115504] . . . . . 19.2 . . . .129/66 Jindal Saw 364.95, 378, 363.10, 374.65[41312] . . . . . 11.9 . . .513/235 Sterl.Biotec 121.90, 126.15, 121, 125.20[1387937] . . . 22.8 . . . .157/87 95 Pl.A -D. . . . . . . . . 78.50 India TIGER -D . . . . . 21.21 TI Growth -D . . . . . . 41.87 Gilt ProvDyn-G . . . . . 11.32 30 -G . . . . . . . . . . . . 63.85 +

Arvind Mills 67.40, 68.90, 67, 67.45[520300] . . . . . . . . 15.9 . . . .118/52 95 Pl.B -G. . . . . . . . 169.91 India TIGER -G . . . . . 29.93 TI Growth -G . . . . . . 64.04 Gilt ProvDyn-HD. . . . 10.19 Balance . . . . . . . . . . 22.73

66.95, 68.80, 66.90, 67.50[1072799] . . . . . . . . . . . . 15.9 . . . .120/51 93.30, 94, 91.40, 92.05[147760] . . . . . . . . . . . . . . . . 19.2 . . . .129/65 385, 385, 362.50, 373.50[48889] . . . . . . . . . . . . . . . 11.8 . . .513/235 122.40, 125.60, 121.50, 124.90[1888044] . . . . . . . . 22.7 . . . .156/87

GAIL (I) 254.20, 261.90, 254.05, 259.55[249810] . . . . . 9.1 . . .325/210 Jindal Stain 126.45, 127.20, 123.50, 126.10[280804] . 11.5 . . . .138/63 Sterl.Inds. 511.40, 528.65, 497, 520.55[262386] . . . . . 12.3 . . .614/140 Bond Index -D . . . . . 10.33 Opportun.-G . . . . . . . 52.02 TMA Instl-Dly. . . . 1000.25 Income -AD . . . . . . . 10.54 Bond Deposit-D . . . . 11.61

Asahi (I) Gl 113.05, 121, 112, 119.05[79842] . . . . . . . 21.3 . . . .130/70 Bond Index -G . . . . . 11.45 Opportunities-D . . . . 28.70 TMA Instl-Wly . . . 1000.79 Income -B . . . . . . . . 10.92 Bond Deposit-G . . . . 18.36

257.05, 262.95, 255.30, 262[778999] . . . . . . . . . . . . 9.2 . . .326/205 125.90, 127.30, 115.30, 126.10[1035527] . . . . . . . . 11.5 . . . .138/63 510, 528, 506.20, 519.95[775234] . . . . . . . . . . . . . . 12.3 . . .612/140 FMP Q’ly Sr.2-D . . . . 10.09 Saving+Agg.-G . . . . 13.37 TMA Liquid Dly. . . 1000.25 Income -G . . . . . . . . 17.91 Bond Reg -AD. . . . . . 12.82

114.55, 120.80, 111.65, 118.80[160193] . . . . . . . . . 21.3 . . . .130/68

GE Shipping 313, 326, 310, 322.05[1672518] . . . . . . . . 7.4 . .326H/171 Jindal Steel 1840, 1852.95, 1780.05, 1799.65[26749] . 9.6 .2180/1151 Sterl.Optica 198.40, 202.40, 194.20, 195.40[1089924] 27.4 . . . .204/73 FMP Q’ly Sr.2-G . . . . 11.37 Saving+Agg.-MD. . . 10.48 TMA SupInst-Dly . 1000.25 Income -HD . . . . . . . 10.20 Bond Reg -B . . . . . . . 12.78 W

Ashok Leylan 47.05, 47.15, 45.80, 46.20[1017720] . . . 18.3 . . . . .54/27 312.50, 326, 311, 322.25[4287817] . . . . . . . . . . . . . . 7.5 . .326H/171 1799, 1850, 1780, 1800.90[27658] . . . . . . . . . . . . . . 9.6 .2188/1152 198.50, 202.25, 193.10, 195[1114432] . . . . . . . . . . . 27.3 . . . .204/73

47, 47.10, 45.80, 46.20[2794062] . . . . . . . . . . . . . . . 18.3 . . . . .53/27 FMP Y’ly Sr.1-D. . . . . 10.04 Saving+Agg.-QD . . . 10.84 TMA SupInst-Wly. 1016.34 Income -QD . . . . . . . 10.18 Bond Reg -G. . . . . . . 19.18

Geometric So 132, 132, 122.20, 123.75[179288] . . . . . 25.3 . . . .135/73 JSW Steel 345.40, 345.40, 336.90, 339.95[153627] . . . 5.0 . . .372/184 Sun Pharma. 912, 915, 900, 902.20[8189] . . . . . . . . . . 27.2 . .1012/591 FMP Y’ly Sr.1-G. . . . . 11.26 Saving+Cons.-G . . . 11.79 Taxshield -D . . . . . . . 38.61 Income Inst-AD . . . . 10.53 Bond Reg -QD . . . . . 10.46

Asian Paints 659, 681.95, 659, 667.75[48198] . . . . . . . 28.5 . . .790/465 130, 130, 122.40, 123.80[348227] . . . . . . . . . . . . . . 25.3 . . . .135/64 344.75, 345, 336.20, 340.80[237219] . . . . . . . . . . . . 5.0 . . .372/184 908.70, 911.95, 900, 903.85[152228] . . . . . . . . . . . . 27.3 . . .954/585 FMP Y’ly Sr.3-D. . . . . 10.57 Saving+Cons.-MD. . 10.24 Taxshield -G . . . . . . 122.45 Income Inst-B . . . . . 11.13 Bond STP -D. . . . . . . 10.09

670, 800, 664, 667.25[17723] . . . . . . . . . . . . . . . . . . 28.4 . . .800/453 Gillette (I) 878.05, 886, 860.10, 867.85[3282] . . . . . .107.1 . .1041/600 Kotak Mah.Bk 338, 343, 338, 342.30[28947] . . . . . . . . 12.6 . . .400/170 Sun TV 1214.90, 1249, 1193, 1196.75[1758] . . . . . . . . 57.0 . .1579/840 FMP Y’ly Sr.3-G. . . . . 11.31 Saving+Cons.-QD . . 10.41 HDFC Income Inst-G . . . . . 18.59 Bond STP -G. . . . . . . 13.13

Aurobindo Ph 607.80, 619, 607.10, 615.05[22336] . . . 31.7 . . .740/287 885, 885, 856.20, 868.80[1563] . . . . . . . . . . . . . . . .107.3 . .1099/650 337.95, 343.80, 332.15, 342.65[59412] . . . . . . . . . . 12.6 . . .400/170 1220, 1220, 1200.20, 1203.85[14357] . . . . . . . . . . . 57.3 . .1620/820 Inc.Pl.D-54EA D . . . . 11.05 Savings+Mod-MD. . 10.93 Balanced -D . . . . . . . 20.28 Income Inst-HD . . . . 10.00 Cash Plus -D . . . . . . 10.20

606, 619.90, 606, 615.55[81313] . . . . . . . . . . . . . . . 31.7 . . .747/287 Inc.Pl.E-54EA G . . . . 25.07 Savings+Mod-QD . . 11.20 Balanced -G . . . . . . . 31.54 Income Inst-QD . . . . 10.00 Cash Plus -G . . . . . . 10.77 W

GlaxoSmith.C 544.90, 562, 533.05, 553.25[18279] . . . 19.9 . . .728/403 L&T 1270, 1306.50, 1266.30, 1299.05[154632] . . . . . . 33.5 . .1458/664 Suzlon Enrgy 1285, 1319.65, 1281, 1315.50[379903] . 39.1 . .1430/656 Inc.Pl.F-54EB D . . . . 11.06 Savings+Mod.-G. . . 14.80 Cap.Builder-D. . . . . . 24.21 Income STP -D. . . . . 11.17 Contra -D . . . . . . . . . 13.60

Aventis Phar 1548, 1548, 1508.30, 1512.30[8348] . . . 23.6 .2140/1241 541, 559, 537.20, 551.90[9420] . . . . . . . . . . . . . . . . 19.8 . . .719/400 1270.25, 1307.45, 1268, 1301.20[810993] . . . . . . . . 33.6 . .1455/663 1300, 1320.05, 1280.10, 1316.60[7847458] . . . . . . . 39.1 . .1429/656 Inc.Pl.G-54EA G . . . . 24.92 Technology.com . . . . 20.11 Cap.Builder-G. . . . . . 60.17 Income STP -G. . . . . 12.89 Contra -G . . . . . . . . . 13.60

1528, 1548, 1510, 1515.55[1563] . . . . . . . . . . . . . . . 23.7 .2050/1267 GlaxoSmith.P 1165, 1190, 1120, 1133.10[76165] . . . . 17.6 . .1551/863 LIC Hsg.Fin. 177.35, 186, 175.80, 184[344856] . . . . . . 7.3 . . .234/136 Syndicate Bn 83.80, 84.90, 82.50, 83.20[361595] . . . . . 7.8 . . . .104/47 Income Pl.A-D . . . . . 10.59 Top 100 -D . . . . . . . . 21.09 Child Gift Invt. . . . . . 24.54 L.I.O.N -B . . . . . . . . . 12.24 Equity FOF-D *. . . . . 23.84

Bajaj Auto 2775, 2822, 2751, 2799.20[48143] . . . . . . . 26.1 .3325/1663 1168, 1190, 1121, 1133.45[215359] . . . . . . . . . . . . . 17.6 . .1554/857 178, 186, 175, 184.50[805892] . . . . . . . . . . . . . . . . . 7.3 . . .233/136 84.50, 85.10, 80.85, 83.35[1951202] . . . . . . . . . . . . . 7.9 . . . .105/47 Income Pl.B-G . . . . . 25.09 Top 100 -G . . . . . . . . 52.97 Child Gift Sav.. . . . . . 14.89 L.I.O.N -D . . . . . . . . . 12.24 Equity FOF-G *. . . . . 23.84

2770, 2821, 2755.05, 2799.45[176635] . . . . . . . . . . 26.1 .3325/1660 GMR Infrast. 310, 319.95, 299, 310.35[1135748] . . . .145.7 . . .325/205 Lupin 486.10, 519.50, 486.10, 517.75[17739] . . . . . . . 20.4 . . .638/345 Syngenta (I) 332, 332, 325.05, 326.50[3548] . . . . . . . . 12.2 . . .525/250 Income Pl.C-QD . . . . 10.25 Deutsche Core&Satell.-D. . . . . 22.17 L.I.O.N -G . . . . . . . . . 12.24 Flexi Debt -DD . . . . . 10.04

Balaji Tele. 143, 144.90, 141.10, 141.80[4091] . . . . . . 13.8 . . . .197/95 304.70, 319.90, 299.20, 310.15[3206182] . . . . . . . .145.6 . . .325/200 508, 520, 501, 518.05[61367] . . . . . . . . . . . . . . . . . . 20.5 . . .655/333 Tata Chem 235.50, 236.50, 232, 236[69403] . . . . . . . . 14.0 . . .280/181 Income+ Pl.A-D . . . 10.25 Alpha Equity-D . . . . . 18.00 Core&Satell.-G. . . . . 25.05 Liq.AutoSweep-G . . . 10.00 Flexi Debt -G . . . . . . 11.27

142.95, 144.75, 140, 141.55[8912] . . . . . . . . . . . . . . 13.8 . . . .201/98 GNFC 105.40, 106.50, 104.80, 105.05[40515] . . . . . . . . 5.5 . . . .145/79 M&M 764.70, 806.70, 750, 790.45[657691] . . . . . . . . . 16.8 . .807H/351 234.90, 236.40, 232, 236[176862] . . . . . . . . . . . . . . 14.0 . . .280/181 Income+ Pl.B-G . . . 30.07 Alpha Equity-G . . . . . 48.83 Equity -D . . . . . . . . . 41.62 Liq.AutoSweepWD . . 10.00 Flexi Debt -QD . . . . . 10.14

Ballarpur In 125, 125.15, 122.10, 122.70[76199] . . . . . 8.9 . . . .147/84 Index -D . . . . . . . . . . 21.58 InstCash+InstDD . . 10.02 Equity -G . . . . . . . . 139.41 Liq.Sup.Inst-DD . . . . 10.00 Floater LT -G . . . . . . 11.33 W

104.70, 106.90, 104.70, 105[78230] . . . . . . . . . . . . . 5.5 . . . .145/79 750, 806.40, 750, 790.40[1744078] . . . . . . . . . . . . . 16.8 . .806H/351 Tata Consult 1085, 1088.70, 1060, 1078.45[600873] . . 33.1 . .1175/676 Index -G . . . . . . . . . . 39.02 InstCash+InstMD. . 10.05 FRB LTP -D . . . . . . . . 10.20 Liq.Sup.Inst-G . . . . . 10.80 Floater LT -MD . . . . . 10.04

125, 125.40, 122.50, 122.85[195978] . . . . . . . . . . . . 8.9 . . . .150/83 Godrej Cons. 175.60, 193, 166, 182.40[139913] . . . . . 33.0 . . .200/112 Mah.Seamless 417, 417.40, 408, 415.15[27160] . . . . . 12.7 . . .420/213 1076, 1088, 1060.20, 1079.35[1038543] . . . . . . . . . 33.1 . .1170/680 MIP Sav.5-MD . . . . . 10.17 InstCash+InstWD . 10.10 FRB LTP -G . . . . . . . . 12.07 Liq.Sup.Inst-WD. . . . 10.10 Floater LT -WD. . . . . 10.05

Bank of Baro 280.50, 284, 276, 277.85[341731] . . . . . 12.2 . . .296/176 178, 193.50, 178, 181.70[170429] . . . . . . . . . . . . . . 32.9 . . .199/112 418, 418.50, 391.50, 415.40[129765] . . . . . . . . . . . . 12.7 . . .420/205 Tata Elxsi 235, 243.35, 230, 232.75[108499] . . . . . . . . 19.1 . . .262/147 MIP Sav.5B -Pay. . . . 11.39 InstaCash+InstG . . 11.40 Gilt LTP -D . . . . . . . . 10.28 Liquid Inst-DD . . . . . 10.01 Floater ST -G . . . . . . 11.93

281, 284, 276.25, 278.20[1136245] . . . . . . . . . . . . . 12.3 . . .303/176 Grasim Inds. 2725.10, 2768.90, 2701, 2734.85[29142] 18.5 2769H/1113 Maruti Udyog 962, 977.75, 954.10, 960.50[208211] . . 19.3 . . .991/516 236, 243.90, 231.30, 233.70[157946] . . . . . . . . . . . . 19.2 . . .262/147 MIP Sav.5C -G . . . . . 11.39 Invest.Opp.-D. . . . . . 16.91 Gilt LTP -G . . . . . . . . 15.52 Liquid Inst-G . . . . . . 11.41 Floater ST -MD. . . . . 10.04

Bank of Ind. 165, 167.25, 162, 166.50[424768] . . . . . . 11.0 . . . .169/80 2709, 2769.85, 2701.25, 2734.05[180969] . . . . . . . . 18.4 2770H/1105 963, 977, 952.95, 960.60[834111] . . . . . . . . . . . . . . 19.3 . . .991/500 Tata Motors 888, 901, 840.05, 852.10[776746] . . . . . . 20.0 . . .997/465 MIP W25 Pl.A-D. . . . 11.28 Invest.Opp.-G. . . . . . 22.17 Gilt STP -D . . . . . . . . 10.50 Liquid Inst-WD. . . . . 10.07 Floater ST -WD . . . . 10.02 W

165, 167.45, 159.80, 166.50[2274970] . . . . . . . . . . . 11.0 . . . .169/80 GTL 142, 143, 140.20, 140.55[44801] . . . . . . . . . . . . . 14.3 . . . .181/97 Mastek 352.50, 355.75, 350, 353[2482] . . . . . . . . . . . . 12.3 . . .438/227 893, 899.50, 840.25, 849.25[2624191] . . . . . . . . . . . 20.0 . . .998/441 MIP W25 Pl.C-G . . . . 13.30 MIP Pl.A -AD . . . . . . 10.98 Gilt STP -G . . . . . . . . 13.42 MIP Pl.A -AD . . . . . . 10.51 Gilt Sav. -AD . . . . . . . 11.92 W

MIP W25 PlB-Pay. . . 13.30 MIP Pl.A -G . . . . . . . 12.58 Growth -D . . . . . . . . 27.80 MIP Pl.A -B . . . . . . . 11.38 Gilt Sav. -G . . . . . . . . 17.82 W

BASF 240.95, 242.95, 239.05, 239.35[16499] . . . . . . . 12.4 . . .279/148 142.50, 143, 140.10, 140.60[99536] . . . . . . . . . . . . . 14.3 . . . .181/95 355.40, 355.50, 351, 353.20[7464] . . . . . . . . . . . . . . 12.3 . . .438/224 Tata Power 531, 537, 525.55, 534.40[34338] . . . . . . . 17.2 . . .613/390 MIP(Birla)A-D . . . . . 11.15 MIP Pl.A -MD . . . . . . 10.57 Growth -G . . . . . . . . 45.18 MIP Pl.A -G . . . . . . . 11.38 Gilt Sav. -MD . . . . . . 10.45 W

241.90, 243, 238.10, 239.80[23897] . . . . . . . . . . . . . 12.4 . . .287/162 Guj.Amb.Cem. 120.90, 121.15, 119.55, 119.70[362339] 18.0 . . . .128/67 Merck 480, 493, 480, 489.45[5388] . . . . . . . . . . . . . . . . 5.7 . . .639/418 533, 536.90, 526.50, 534.05[353682] . . . . . . . . . . . . 17.2 . . .613/390 MIP(Birla)B Pay . . . . 18.91 MIP Pl.A -QD . . . . . . 10.54 HIF STP -D . . . . . . . . 10.61 MIP Pl.A-HDReI. . . . 10.17 GiltInv.PF&Tr-D . . . . 10.92

Bh.Earth Mov 1098.80, 1098.80, 1060, 1067.45[22974] 21.1 . .1785/723 119.95, 121.25, 119.50, 119.75[1268681] . . . . . . . . 18.0 . . . .130/67 487.15, 491.80, 485, 487.45[2451] . . . . . . . . . . . . . . 5.7 . . .639/422 Tata Steel 501.85, 504.90, 496.55, 498.35[876851] . . . 7.3 . . .679/331 MIP(Birla)C-G . . . . . 18.91 MIP Pl.B -AD . . . . . . 10.58 HIF STP -G . . . . . . . . 13.26 MIP Pl.A-MDReI . . . 10.10 GiltInv.PF&Tr-G . . . . 23.82

1095, 1095.15, 1059.60, 1069.50[62716] . . . . . . . . . 21.1 . .1788/720 Guj.Gas Co. 1207, 1215, 1206, 1210.90[617] . . . . . . . . 18.0 . .1530/920 MICO 3360, 3425, 3353.30, 3371.05[3411] . . . . . . . . . 21.3 .3585/2201 499.80, 505, 496.35, 498.15[2099696] . . . . . . . . . . . 7.3 . . .745/331 STF Pl.A -D. . . . . . . . 10.32 MIP Pl.B -G . . . . . . . 12.01 High Int.-AD. . . . . . . 10.96 MIP Pl.A-QDReI. . . . 10.19 GiltInv.Reg-D . . . . . . 11.33

Bharat Elect 1121, 1146, 1117.50, 1120.50[42930] . . . 15.3 . .1472/716 1205, 1215, 1202, 1210.10[3137] . . . . . . . . . . . . . . . 18.0 . .1540/900 3211, 3390, 3211, 3343.30[4980] . . . . . . . . . . . . . . . 21.1 .3591/2211 Tata Tea 746, 759, 746, 753.05[28380] . . . . . . . . . . . . 22.4 . .1047/560 STF Pl.B -G. . . . . . . . 12.90 MIP Pl.B -MD . . . . . . 10.27 High Int.-G . . . . . . . . 24.45 MIP Pl.B -AD . . . . . . 10.72 GiltInv.Reg-G . . . . . . 23.55

1130, 1148, 1112.55, 1119.70[147000] . . . . . . . . . . 15.3 . .1476/720 Guj.Ind.Pow. 58.05, 58.40, 56.55, 56.85[92456] . . . . . . 6.0 . . . . .83/45 Micro Inks 337.65, 347.90, 337.60, 344[8153] . . . . . . . .— . . .670/237 755, 759, 746.10, 752.40[71596] . . . . . . . . . . . . . . . 22.4 . .1078/555 Canbank MIP Pl.B -QD . . . . . . 10.25 High Int.-HD. . . . . . . 10.27 MIP Pl.B -B . . . . . . . 11.89 Global India -D. . . . . 19.48

58.10, 59, 56.60, 56.85[124963] . . . . . . . . . . . . . . . . 6.0 . . . . .83/44 341, 348.45, 341, 345.05[4823] . . . . . . . . . . . . . . . . . .— . . .660/242 Thermax 314, 319, 310, 318.10[9079] . . . . . . . . . . . . . 27.6 . . .410/157 Canbalance -G . . . . . 27.09 Money Plus -D . . . . . 10.09 High Int.-QD. . . . . . . 10.55 MIP Pl.B -G . . . . . . . 11.89 Global India -G. . . . . 24.36

Bharat Forge 332.20, 353.70, 332.20, 351.65[61942] . 35.6 . . .485/221 Canbalance -I . . . . . 16.86 Money Plus -G . . . . . 10.47 Income -D . . . . . . . . 10.26 MIP Pl.B-HDReI. . . . 10.46 Income Plus-G . . . . . 12.87

348, 353.85, 336.90, 351.65[220838] . . . . . . . . . . . . 35.6 . . .488/221 Guj.Mineral 371, 371, 350, 352.45[3083] . . . . . . . . . . . 56.6 . . .491/237 MIRC Electr. 24.70, 24.75, 23.75, 24[363198] . . . . . . . 10.2 . . . . .30/14 320, 320, 315, 318.65[24122] . . . . . . . . . . . . . . . . . . 27.6 . . .405/156 Canbalance II . . . . . 37.20 Money Plus -WD . . . 10.04 Income -G . . . . . . . . 16.59 MIP Pl.B-MDReI . . . 10.54 Income Plus-MD . . . 10.96

Bharti Artl 528, 545, 528, 541.95[562068] . . . . . . . . . . 42.4 . .545H/310 360.15, 362, 350.10, 352.10[3007] . . . . . . . . . . . . . . 56.5 . . .530/235 24.45, 25, 23.75, 24[261389] . . . . . . . . . . . . . . . . . . 10.2 . . . . .30/14 Titan Inds. 790, 799, 782.15, 784.15[51152] . . . . . . . . 41.3 . . .895/406 Cancigo -G . . . . . . . . 18.50 MoneyPlus-DD . . . . . 10.03 LT Advantage-D . . . . 43.79 MIP Pl.B-QDReI. . . . 10.60 Income Plus-QD. . . . 11.01

534, 545, 527.65, 542.05[1618955] . . . . . . . . . . . . . 42.4 . .545H/307 HCL Infosys. 134.70, 136, 130.05, 130.75[34667] . . . . 20.2 . . .279/116 Moser-Baer 233.80, 238.40, 230, 235.35[317039] . . .114.2 . . .268/162 799, 799, 782.35, 784.25[193315] . . . . . . . . . . . . . . 41.3 . . .895/401 Cancigo -I . . . . . . . . 11.90 PremBond -R . . . . . . 10.83 LT Advantage-G . . . . 87.71 Midcap -B. . . . . . . . . 16.62 Life Style -D . . . . . . . 10.27

BHEL 2460, 2471, 2414, 2439.55[59502] . . . . . . . . . . . 31.6 .2498/1090 136.70, 136.80, 130.10, 130.70[103113] . . . . . . . . . 20.2 . . .279/116 233.20, 238.50, 229.60, 234.75[490366] . . . . . . . . .114.0 . . .268/161 TN Newsprint 96.15, 99, 96.15, 97.35[20557] . . . . . . . 7.4 . . . .138/76 Candmat. . . . . . . . . . 29.16 PremBond Reg-G . . . 12.07 MIP LTP -G. . . . . . . . 14.41 Midcap -D. . . . . . . . . 15.20 Life Style -G . . . . . . . 10.27

HCL Techno. 630, 640, 622.10, 637.25[98264] . . . . . . . 27.4 . . .707/362 Mphasis BFL 232.50, 233.45, 220, 231.30[207786] . . . 28.5 . . .238/121 97.50, 98.80, 97.25, 97.50[40526] . . . . . . . . . . . . . . . 7.4 . . . .138/79 Caneqty Diver-I . . . . 17.74 PremBond Reg-MD . 10.65 MIP LTP -MD . . . . . . 11.58 Midcap -G. . . . . . . . . 16.62 MNC . . . . . . . . . . . . . 25.80

2475.40, 2475.40, 2410.10, 2441.65[299746] . . . . . 31.7 .2500/1090 CaneqtyTaxsaver . . . 20.52 PremBond Reg-QD. . 10.32 MIP LTP -QD . . . . . . 11.81 Nifty Plus -B. . . . . . . 19.38 MidCap -D .

Birla Corp. 321.80, 331, 319, 324[252185] . . . . . . . . . 15.1 . . .413/164 620.40, 641, 620.40, 638.25[594187] . . . . . . . . . . . . 27.4 . . .708/358 231, 233.15, 221.10, 231.05[1065554] . . . . . . . . . . . 28.4 . . .238/121 Torrent Phar 198.50, 203.85, 198, 201.30[26123] . . . . 44.5 . . .337/148

HDFC 1470, 1470, 1444.05, 1451.55[21331] . . . . . . . . 26.3 . .1552/930 MRPL 42.65, 43.50, 42.60, 42.80[154250] . . . . . . . . . . 20.2 . . . . .64/30 197.50, 203, 197.50, 201.05[29250] . . . . . . . . . . . . . 44.5 . . .298/145 Canexpo (I) . . . . . . . 19.18 Short Mat.-MD . . . . . 10.13 MIP STP -G . . . . . . . 12.75 Nifty Plus -D. . . . . . . 12.90

320.95, 330.90, 317.20, 325.25[396654] . . . . . . . . . 15.2 . . .414/163 Canexpo -G . . . . . . . 50.40 Short Mat.-WD. . . . . 10.25 MIP STP -MD . . . . . . 10.38 Nifty Plus -G. . . . . . . 19.38 W

Bombay Dyein 672, 678.90, 655, 665.50[333054] . . . . 42.7 . . .989/277 1475, 1500, 1443, 1453.15[196556] . . . . . . . . . . . . . 26.4 . .1737/938 42.50, 43.45, 42.05, 42.80[400703] . . . . . . . . . . . . . 20.2 . . . . .64/30 TVS Motor Co 109, 111, 106.40, 108.50[201733] . . . . 24.3 . . . .187/77 Canfloat STP-D. . . . . 10.67 Short Maturity . . . . . 12.29 MIP STP -QD . . . . . . 10.66 Select Debt -B . . . . . 11.03

672.10, 678.70, 652, 665.35[545188] . . . . . . . . . . . . 42.7 . . .986/278 HDFC Bank 995, 1033, 978.30, 1024.60[60784] . . . . . . 34.8 . .1075/604 MTNL 151, 151.50, 147.50, 148.30[914823] . . . . . . . . 18.9 . . .226/108 108.35, 111, 105.95, 108.35[573084] . . . . . . . . . . . . 24.2 . . . .187/78 Canfloat STP-G. . . . . 11.09 Tax Saving -D . . . . . . 10.28 Multi.Yld.05-D . . . . . 10.88 Select Debt-AD . . . . 10.35

990.30, 1037, 979.30, 1029.35[494409] . . . . . . . . . . 34.9 . .1065/604 149, 153.50, 147.85, 148.45[2607795] . . . . . . . . . . . 18.9 . . .229/108 Union Bank 129.95, 132, 128.20, 129.70[408672] . . . . 8.9 . . . .142/81 Cangilt PGS -G . . . . . 18.19 Tax Saving -G . . . . . . 10.28 Multi.Yld.05-G . . . . . 10.88 Select Debt-G. . . . . . 11.03

Bongaigaon R 57.15, 58.90, 56.80, 57.60[131996] . . . . 6.1 . . . . .80/40

Hero Honda 742, 753.80, 736.25, 745.80[187594] . . . 15.2 . . .950/637 National Alu 227, 238.80, 226.85, 236.50[366898] . . . . 8.0 . . .335/154 129.90, 132, 127.35, 129.95[1427584] . . . . . . . . . . . 8.9 . . . .141/81 Cangilt PGS -I . . . . . 10.38 Fidelity Multiple Yld.-D . . . . . 10.06 Select Debt-HD . . . . 10.20

57, 59, 56.60, 57.55[238551] . . . . . . . . . . . . . . . . . . . 6.1 . . . . .80/40 Cangrowth Plus . . . . 37.33 Equity -D . . . . . . . . . 16.93 Multiple Yld.-G . . . . . 11.94 Select Debt-QD . . . . 10.17

731.10, 752, 730.30, 745.80[441541] . . . . . . . . . . . . 15.2 . . .940/635 227.80, 238.90, 226.40, 236.75[968160] . . . . . . . . . . 8.0 . . .338/154 United Phos. 291.50, 298.85, 287, 295.05[99628] . . . . 23.5 . . .315/199

BPCL 395, 405, 392, 400.60[106645] . . . . . . . . . . . . . . . .— . . .503/291 291.50, 298.20, 288, 294.35[316338] . . . . . . . . . . . . 23.4 . . .316/195 Canincome -B. . . . . . 11.90 Equity -G . . . . . . . . . 19.19 Nifty FV10.326 . . . . . 36.80 Select Stocks-D . . . . 13.82

Hexaware Tec 173.25, 177, 172.10, 173.70[43750] . . . 21.7 . . . .182/99 National Fer 34.30, 34.65, 34, 34.30[10147] . . . . . . . . 14.0 . . . . .53/27 +

393, 403.50, 390, 399.55[380457] . . . . . . . . . . . . . . . . .- . . .505/291 173.50, 177.50, 172.15, 175.95[119275] . . . . . . . . . 22.0 . . . .182/96 Nestle (I) 1050, 1058, 1041.05, 1053.25[3640] . . . . . . 31.9 . .1348/800 UTI Bank 415, 427, 411.05, 425.85[47932] . . . . . . . . . 21.9 . . .432/222 Canincome -G. . . . . . 12.99 STI Instl-D . . . . . . . . 10.01 Pre.MultiCap-D . . . . 15.60 Select Stocks-G . . . . 26.13

+

Britannia 1238.50, 1238.50, 1174.05, 1190.15[25869] 20.7 .1955/1025 Canincome -I . . . . . . 11.82 STI Instl-G . . . . . . . . 10.12 Pre.MultiCap-G . . . . 17.54 Tax Savings -B . . . . . 24.21 +

Hind.Zinc 889, 918.70, 883, 891.75[1223473] . . . . . . . 17.1 . .1119/206 Neyveli Lign 66.70, 68.65, 64.80, 66.45[92858] . . . . . . 21.0 . . . .100/47 418.45, 429.50, 415, 427.85[419788] . . . . . . . . . . . . 22.0 . . .431/220 Canindex -G . . . . . . . 20.62 STI NonInstl-D. . . . . 10.01 Prudence -D. . . . . . . 29.97 Tax Savings -D . . . . . 15.76

1240, 1240, 1183, 1189.80[23587] . . . . . . . . . . . . . . 20.7 .1960/1025 Hindalco 188, 191.40, 186.05, 187.95[1052910] . . . . . 10.1 . . .251/106 68.80, 68.80, 65.10, 66.50[200983] . . . . . . . . . . . . . 21.0 . . . .100/44 Vijaya Bank 56.90, 58.20, 55.85, 57.55[606121] . . . . . 12.5 . . . . .72/33 +

Canindex -I . . . . . . . 20.62 STI NonInstl-G. . . . . 10.12 Prudence -G. . . . . . 106.54 Tax Savings -G . . . . . 24.17

Cadila Healt 335.25, 354.80, 335.25, 352[59485] . . . . 24.7 . . .400/222 187, 191.40, 186.10, 188.20[2418469] . . . . . . . . . . . 10.1 . . .251/106 Nicholas Pir 230, 231, 226.75, 227.30[33405] . . . . . . . 38.1 . . .300/150 58.90, 58.90, 55.55, 57.55[1424351] . . . . . . . . . . . . 12.5 . . . . .71/32 Canshort Pl.G. . . . . . 11.88 Sp.Situations-D . . . . 11.93 STP -D . . . . . . . . . . . 10.35 ING Vysya Optimix

340, 355, 330, 351.65[103569] . . . . . . . . . . . . . . . . . 24.7 . . .400/218 Hinduja TMT 520, 521.70, 513.05, 516.50[11911] . . . . 10.7 . . .867/315 230, 231.50, 225.50, 226.85[125394] . . . . . . . . . . . . 38.0 . . .300/148 Visual Soft 84.90, 85.50, 83, 83.75[39895] . . . . . . . . . 11.6 . . . .266/58 Canshort Pl.I . . . . . . 11.69 Sp.Situations-G . . . . 11.93 STP -G . . . . . . . . . . . 13.08 AA MultiMgr-D*. . . . 11.78

Canara Bank 303.50, 303.50, 295.10, 296.05[111089] . 8.6 . .304H/165 523, 523, 513.15, 515.80[26236] . . . . . . . . . . . . . . . 10.7 . . .866/315 Nirma 390, 390, 375.15, 379.15[10308] . . . . . . . . . . . . 8.1 . . .555/336 84.90, 85.20, 83.40, 83.80[75117] . . . . . . . . . . . . . . 11.6 . . . .266/58 Diversified-B . . . . . . 17.74 TaxAdvantage-D. . . . 11.54 Sensex FV32.161 . . 121.47 AA MultiMgr-G*. . . . 11.78

300, 301.50, 295.10, 296.65[813715] . . . . . . . . . . . . 8.7 . . .302/152 HLL 230, 230, 226.90, 228.75[455705] . . . . . . . . . . . . . 29.7 . . .296/158 385.05, 387.60, 377.05, 380.65[9320] . . . . . . . . . . . . 8.2 . . .580/325 VSNL 440, 449.90, 433.25, 446.95[965764] . . . . . . . . . 28.9 . . .515/274 Diversified-G . . . . . . 28.48 TaxAdvantage-G. . . . 11.54 Sensex+FV32.161. 138.45 IGMM 15% EQ-D* . . 10.38

Castrol (I) 231, 234.40, 225.50, 226.55[54063] . . . . . . 18.9 . . .279/155 Emerg.Eqties-B . . . . 14.92 Franklin Templeton TaxSaver -D . . . . . . . 67.24 IGMM 15% EQ-G* . . 10.38

227.10, 230, 226.10, 228.85[1924927] . . . . . . . . . . . 29.7 . . .296/153 Novartis (I) 440, 447, 435.60, 438[32621] . . . . . . . . . . 14.5 . . .635/365 442, 450, 433, 447.15[2512892] . . . . . . . . . . . . . . . . 28.9 . . .516/273 Emerg.Eqties-G . . . . 14.92 Bluechip -D. . . . . . . . 41.12 TaxSaver -G . . . . . . 140.55 IGMM 30% EQ-D* . . 10.24

Century Enka 147, 148.80, 145, 145.85[51044] . . . . . . 28.5 . . .244/114 HMT 82.10, 83.50, 80.75, 81.65[125738] . . . . . . . . . . . . .— . . . .104/38 NTPC 130, 130.50, 128.15, 129.90[410524] . . . . . . . . . 17.7 . . . .145/91 Welspun Guj. 71.95, 72, 70.10, 70.65[130346] . . . . . . 10.7 . . . .106/47 Emerg.Eqties-I. . . . . 12.72 Bluechip -G. . . . . . . 123.98 Top 200 -D . . . . . . . . 39.33 IGMM 30% EQ-G* . . 10.24

145.25, 147.65, 145, 145.15[39051] . . . . . . . . . . . . . 28.4 . . .256/108 81.50, 83.50, 80.65, 81.85[287827] . . . . . . . . . . . . . . . .- . . . .104/37 129.05, 130.30, 128.05, 129.85[1045036] . . . . . . . . 17.7 . . . .145/85 71.55, 72.05, 70.30, 70.50[122611] . . . . . . . . . . . . . 10.7 . . . .105/47 Float STP-W Drp . . . 10.27 ChildAssetEdu-G . . . 24.54 Top 200 -G . . . . . . . 105.08 JM

Century Text 520, 534.30, 520, 526.80[303069] . . . . . . 24.5 . . .699/260 HPCL 314.70, 325, 312, 320.65[330534] . . . . . . . . . . . 35.6 . . .361/206 ONGC 794, 810.90, 781.55, 804.65[216470] . . . . . . . . 11.3 . .1014/616 Wipro 562, 562, 550.15, 555.40[162992] . . . . . . . . . . . 35.2 . . .599/357 Infrastruc.-D . . . . . . 13.09 ChildAssetGiftD . . . . 29.26 HSBC Arbitrage Adv-D. . . . 10.19

532.40, 534.50, 522.50, 527.35[679119] . . . . . . . . . 24.5 . . .699/258 309.35, 325, 309.35, 320.95[1215536] . . . . . . . . . . . 35.6 . . .367/198 794.95, 811.90, 780.10, 805.40[1506648] . . . . . . . . 11.3 . .1014/615 561, 561, 550.15, 554.55[894751] . . . . . . . . . . . . . . 35.2 . . .599/356 Infrastruc.-G . . . . . . 13.09 ChildAssetGiftG . . . . 29.26 Advant.India-D. . . . . 11.76 Arbitrage Adv-G. . . . 10.19

CESC 315.65, 320.50, 314.25, 318.15[37546] . . . . . . . 13.6 . . .370/181 I-flex Solu 1540.10, 1562.90, 1450.15, 1527.70[28487] 44.6 . .1581/840 Orchid Chem 205.10, 211.50, 203.25, 210.15[188853] 15.2 . . .400/142 Wockhardt 393.05, 397.50, 388, 390.35[53330] . . . . . 21.6 . . .562/318 canfortune 94 . . . . . 31.71 Dynamic PE -D . . . . . 24.05 Advant.India-G. . . . . 11.76 Auto Sector -D . . . . . 16.68

313.60, 320.25, 313.60, 317.30[147906] . . . . . . . . . 13.5 . . .370/181 1550, 1554, 1521, 1528.15[98424] . . . . . . . . . . . . . . 44.7 . .1580/832 204.95, 211.80, 204.50, 209.75[413193] . . . . . . . . . 15.2 . . .400/142 398, 398, 388.35, 390.35[114730] . . . . . . . . . . . . . . 21.6 . . .562/316 DBS Chola Dynamic PE -G . . . . . 24.05 Equity -D . . . . . . . . . 29.62 Auto Sector -G . . . . . 21.77

Chambal Fert 37.65, 38, 36.30, 36.45[182179] . . . . . . . 8.2 . . . . .47/27 Contra -Cum. . . . . . . 11.23 Eqty Income-D . . . . . 11.10 Equity -G . . . . . . . . . 66.49 Balanced -D . . . . . . . 16.62

IBP 530, 530, 524, 524[708] . . . . . . . . . . . . . . . . . . . . . .— . . .629/311 Oriental Bnk 264, 272.50, 257.15, 259.65[341035] . . . 10.7 . . .281/139 Wyeth 567.15, 570.95, 560.50, 561.85[1556] . . . . . . . 19.5 . . .790/441 Contra -D . . . . . . . . . 11.23 Eqty Income-G . . . . . 11.10 FRF LTP Inst-G. . . . . 11.17 Balanced -G . . . . . . . 21.87

37.55, 37.55, 36, 36.45[367176] . . . . . . . . . . . . . . . . 8.2 . . . . .47/27 530, 531, 521.10, 527.15[3214] . . . . . . . . . . . . . . . . . . .- . . .622/307 263, 272.25, 256, 259.70[1892663] . . . . . . . . . . . . . 10.7 . . .284/139 565, 569.85, 560, 560.10[1751] . . . . . . . . . . . . . . . . 19.4 . . .825/451 FI STF Cum-Inst. . . . 11.66 FI Balanced -D. . . . . 29.14 FRF LTP Inst-MD . . . 10.05 Basic . . . . . . . . . . . . 17.47

Chennai Pet. 189.70, 205.50, 186, 200.85[304850] . . . 7.4 . . .274/143 ICI (I) 347, 354.95, 344.65, 349.80[27396] . . . . . . . . . 27.2 . . .421/243 P&G Hygiene 910, 910, 900, 901.50[12160] . . . . . . . . 21.0 . .1160/628 Zee Telefilm 304, 304.50, 299.80, 300.65[312575] . . . 64.8 . . .329/139 FI STF Reg-C . . . . . . 11.52 FI Balanced -G. . . . . 33.72 FRF LTP Inst-WD . . . 10.25 Emerg.Leader-D. . . . 10.55

191, 205.90, 185.20, 201.05[670068] . . . . . . . . . . . . 7.4 . . .272/135 337.30, 350.05, 337.30, 349.15[8714] . . . . . . . . . . . 27.2 . . .425/230 898.95, 906.90, 898.95, 903.20[1369] . . . . . . . . . . . 21.0 . .1182/694 305, 305, 300, 301.05[1217801] . . . . . . . . . . . . . . . . 64.9 . . .329/139 FI STF Reg-HD . . . . . 11.43 FMCG -D. . . . . . . . . . 25.89 FRF LTP Reg-G . . . . . 11.12 Emerg.Leader-G. . . . 10.52

Вам также может понравиться

- All Lost in Flood, Villagers Thank Stars For Being Alive: State Pulls Out All Stops in Rescue MissionДокумент1 страницаAll Lost in Flood, Villagers Thank Stars For Being Alive: State Pulls Out All Stops in Rescue MissionPartha ChaudhuryОценок пока нет

- Lean Breakthrough MomentsДокумент1 страницаLean Breakthrough MomentsLongОценок пока нет

- Purchaseworkbook PDFДокумент56 страницPurchaseworkbook PDFNikkie WhiteОценок пока нет

- Ship specs: length, breadth, draft, speedДокумент2 страницыShip specs: length, breadth, draft, speedKyaw Win TunОценок пока нет

- DMM 1 e 007Документ1 страницаDMM 1 e 007mahesh reddy mОценок пока нет

- Akash 18.11.22Документ1 страницаAkash 18.11.22Vijay DubeyОценок пока нет

- (R4) Details of Mother Slab PDFДокумент1 страница(R4) Details of Mother Slab PDFsurya prakashОценок пока нет

- NakshaДокумент1 страницаNakshaRavinder Deep Singh BrarОценок пока нет

- Hromatska ModulacijaДокумент2 страницыHromatska ModulacijaGorazd DobrevskiОценок пока нет

- BAUTISTA - VILLAMOR Residential Second Floor PlanДокумент1 страницаBAUTISTA - VILLAMOR Residential Second Floor Planerwin leeОценок пока нет

- Autodesk Student Home DesignДокумент1 страницаAutodesk Student Home DesignMohamed AbuthalibОценок пока нет

- Apiic Nuzivid IpДокумент1 страницаApiic Nuzivid IpAPSFC VijayawadaОценок пока нет

- CHP19011112Документ8 страницCHP19011112bindu.gОценок пока нет

- April 16, 2021 Strathmore TimesДокумент12 страницApril 16, 2021 Strathmore TimesStrathmore TimesОценок пока нет

- 2 Plano1Документ1 страница2 Plano1celeste yutОценок пока нет

- Jadwal PTMT Kode (31 Jan 2022)Документ1 страницаJadwal PTMT Kode (31 Jan 2022)Fajar BОценок пока нет

- TheConservancy SitePlan 230404Документ1 страницаTheConservancy SitePlan 230404Monish SinthalaОценок пока нет

- Workshop Drawings Combined-333Документ53 страницыWorkshop Drawings Combined-333majojerogersОценок пока нет

- Stadium Auto Stair InfoДокумент1 страницаStadium Auto Stair Infokatar kumarОценок пока нет

- Q17017 0100D PK4b (Ii) A TD GN MI 858 1OF1 REV00Документ1 страницаQ17017 0100D PK4b (Ii) A TD GN MI 858 1OF1 REV00Elektrikal InhinyeroОценок пока нет

- Onshore Facilities FEED North Field Expansion Project: Qatargas OperatingДокумент1 страницаOnshore Facilities FEED North Field Expansion Project: Qatargas OperatingAbid AyubОценок пока нет

- Natural History Museum Temporary Markup PlanДокумент1 страницаNatural History Museum Temporary Markup PlanAditiОценок пока нет

- Batttaaadddd-Model pdf2Документ1 страницаBatttaaadddd-Model pdf2black pantherОценок пока нет

- Texas A&M Engineering Extension Service Airport Familiarization CertificateДокумент1 страницаTexas A&M Engineering Extension Service Airport Familiarization CertificateJavier Carazas VariОценок пока нет

- WCC-MCS-ST-DR-000-00-70020 - C02 - Staircase Part Plan of PS-04Документ1 страницаWCC-MCS-ST-DR-000-00-70020 - C02 - Staircase Part Plan of PS-04Rose VigillaОценок пока нет

- LA501 - Site Details Rev.1Документ1 страницаLA501 - Site Details Rev.1Amogh SwamyОценок пока нет

- A65-22 Sakeel - Koolsum Hasan-ModelДокумент1 страницаA65-22 Sakeel - Koolsum Hasan-ModelAlok VermaОценок пока нет

- Toi Edition - 3-11-2017Документ1 страницаToi Edition - 3-11-2017api-243049963Оценок пока нет

- 3 Terrece House ModelДокумент1 страница3 Terrece House ModelipoujpijОценок пока нет

- AR1Документ1 страницаAR1erwin sarmientoОценок пока нет

- Kia Cup L&T e - Ex L0 DWG 1013 1 PDFДокумент1 страницаKia Cup L&T e - Ex L0 DWG 1013 1 PDFSingh MastermindОценок пока нет

- Autocad Plant3d Quick Reference GuideДокумент1 страницаAutocad Plant3d Quick Reference GuidemaninderpreetОценок пока нет

- Kia Cup L&T e - Ex L0 DWG 1013 1 PDFДокумент1 страницаKia Cup L&T e - Ex L0 DWG 1013 1 PDFSingh MastermindОценок пока нет

- V609073001V01AДокумент1 страницаV609073001V01AB OoОценок пока нет

- GROW Lite PaperДокумент8 страницGROW Lite PaperLaxman SharmaОценок пока нет

- Zoleta Residence - Structural PlansДокумент5 страницZoleta Residence - Structural PlansJc SulitОценок пока нет

- Steel Drawing For LvupДокумент1 страницаSteel Drawing For LvupvivekОценок пока нет

- Structural Concrete Paving Blocks DesignДокумент1 страницаStructural Concrete Paving Blocks Designalezandro del rossiОценок пока нет

- 4239-Aa-Dc-21u10rn016-Is00 TCM Comments 240322Документ1 страница4239-Aa-Dc-21u10rn016-Is00 TCM Comments 240322amitОценок пока нет

- QP10 Q 2426 - TypicalSteelTank10,000m TopInlet Rev0Документ1 страницаQP10 Q 2426 - TypicalSteelTank10,000m TopInlet Rev0Nassif Abi AbdallahОценок пока нет

- H041675001V00Документ1 страницаH041675001V00Mohammed IrfanОценок пока нет

- Trans Studio Mall Makassar New Development: R.Capasitor 21 20Документ1 страницаTrans Studio Mall Makassar New Development: R.Capasitor 21 20allam furqanОценок пока нет

- Trans Studio Mall MakassarДокумент1 страницаTrans Studio Mall Makassarallam furqanОценок пока нет

- Install New AC System Step-by-StepДокумент1 страницаInstall New AC System Step-by-Stepamir barekatiОценок пока нет

- 3 Mahoney CT New City, NY 10956: ProjectДокумент7 страниц3 Mahoney CT New City, NY 10956: ProjectBogdan IvkovicОценок пока нет

- 4660d1090015632-pcb Fab Wall ChartДокумент3 страницы4660d1090015632-pcb Fab Wall ChartMcael Timanta GintingОценок пока нет

- PCB Fab WallchartДокумент1 страницаPCB Fab Wallchartsmtdrkd100% (8)

- Working drawing of temporary markup planДокумент1 страницаWorking drawing of temporary markup planAditiОценок пока нет

- Composite Wall Type Schedule BДокумент1 страницаComposite Wall Type Schedule BfereetОценок пока нет

- 1x1.2x1.2 BOX CULVERT REINFORCEMENT DETAILS-4-LANE PDFДокумент1 страница1x1.2x1.2 BOX CULVERT REINFORCEMENT DETAILS-4-LANE PDFbakhteyar shaikhОценок пока нет

- Bm.2 Bang - Sadap ModelДокумент1 страницаBm.2 Bang - Sadap ModelsumarlinОценок пока нет

- Approved Plan PDFДокумент1 страницаApproved Plan PDFpavan kumar sudaОценок пока нет

- Coal Output Wanes Great Britain Problem: LekkekdДокумент1 страницаCoal Output Wanes Great Britain Problem: LekkekdJames ScottОценок пока нет

- Magazine 01Документ16 страницMagazine 01Leo Club of NIBMОценок пока нет

- Waktu Pelaksanaan B1 B2 B3 M1 M2 M3 M4 M5 M6 M7 M8 M9 M10: Durasi % Ket. Bobot/ DurasiДокумент5 страницWaktu Pelaksanaan B1 B2 B3 M1 M2 M3 M4 M5 M6 M7 M8 M9 M10: Durasi % Ket. Bobot/ DurasiIan SaputraОценок пока нет

- Wa0024Документ15 страницWa0024Ian SaputraОценок пока нет

- TMBA RUKUN SEJAHTERA DUTA DHARMA ASIA RUKUN SEJAHTERA TEKNIK JAYA METAL TEKNIKA KALINGGA MOTOR TAMI POWER MACHINE TOOLSДокумент1 страницаTMBA RUKUN SEJAHTERA DUTA DHARMA ASIA RUKUN SEJAHTERA TEKNIK JAYA METAL TEKNIKA KALINGGA MOTOR TAMI POWER MACHINE TOOLSRicky AngkawidjajaОценок пока нет

- Instant Assessments for Data Tracking, Grade 2: MathОт EverandInstant Assessments for Data Tracking, Grade 2: MathОценок пока нет

- Instant Assessments for Data Tracking, Grade 1: MathОт EverandInstant Assessments for Data Tracking, Grade 1: MathРейтинг: 4 из 5 звезд4/5 (1)

- Amended Complaint Federal Reserve WhistleblowerДокумент12 страницAmended Complaint Federal Reserve WhistleblowerOldereb100% (9)

- PK Annual Report 2016Документ121 страницаPK Annual Report 2016faisal_ahsan7919Оценок пока нет

- Wadi'ahДокумент20 страницWadi'ahMahyuddin Khalid100% (2)

- $8.9Bln of U.S. CMBS Prices During 3Q: 3Q Investment-Sales in NYC Up 110% From 10Документ10 страниц$8.9Bln of U.S. CMBS Prices During 3Q: 3Q Investment-Sales in NYC Up 110% From 10danielpmoynihanОценок пока нет

- List of Recapitalized CMOs As at February 16 2017 For CMO Data UpdateДокумент525 страницList of Recapitalized CMOs As at February 16 2017 For CMO Data UpdateMarketing B100% (1)

- Deutsche Postbank: Broad Deployment of Sap For Banking Smooths IntegrationДокумент4 страницыDeutsche Postbank: Broad Deployment of Sap For Banking Smooths IntegrationErich BasurtoОценок пока нет

- Demo Contract FormДокумент4 страницыDemo Contract FormMuslim RazviОценок пока нет

- 1k PaypalДокумент110 страниц1k PaypalMariana FuentesОценок пока нет

- Bank ATM Use CasesДокумент4 страницыBank ATM Use CasesJayati AgrawalОценок пока нет

- Sample SLA Agreement PDFДокумент13 страницSample SLA Agreement PDFSusan EmmanuelОценок пока нет

- Depreciation Expense AdjustmentДокумент10 страницDepreciation Expense AdjustmentKaiОценок пока нет

- 1483359574102tSvHHxmdPTXgADD1 PDFДокумент3 страницы1483359574102tSvHHxmdPTXgADD1 PDFAnonymous FgurPrRОценок пока нет

- Bank Details As On Oct 22 2020Документ12 страницBank Details As On Oct 22 2020Bala BalaОценок пока нет

- Basic Theory of Financial AccountingДокумент26 страницBasic Theory of Financial AccountingArjun SureshОценок пока нет

- Hyperinflation and Current Cost Accounting ProblemsДокумент4 страницыHyperinflation and Current Cost Accounting ProblemsMaan CabolesОценок пока нет

- Myob - Chart of AccountsДокумент4 страницыMyob - Chart of AccountsAr RaziОценок пока нет

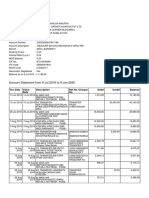

- Account Statement From 9 Jul 2019 To 9 Jan 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceДокумент4 страницыAccount Statement From 9 Jul 2019 To 9 Jan 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancemauryapiaeОценок пока нет

- AISДокумент2 страницыAISChristian Joseph SiocoОценок пока нет

- Implementing Risk-Based Supervision in LesothoДокумент120 страницImplementing Risk-Based Supervision in LesothoandriОценок пока нет

- Novation NotesДокумент11 страницNovation NotesMaria Recheille Banac KinazoОценок пока нет

- HDFC AgroДокумент2 страницыHDFC Agrovinit kumar singhОценок пока нет

- Philam Vs Auditor GeneralДокумент1 страницаPhilam Vs Auditor GeneralRenz Aimeriza AlonzoОценок пока нет

- HSBC Dispute Form - 20150330Документ2 страницыHSBC Dispute Form - 20150330percysmithОценок пока нет

- HDFC Bank Was Amongst The First To Receive An PDFДокумент83 страницыHDFC Bank Was Amongst The First To Receive An PDFSairam SajaneОценок пока нет

- Credit PolicyДокумент32 страницыCredit PolicyAman BachhrajОценок пока нет

- CMS PDFДокумент5 страницCMS PDFRecordTrac - City of OaklandОценок пока нет

- Equifax Credit Information Services PVT LTD.: Credit Report Dispute Investigation FormДокумент5 страницEquifax Credit Information Services PVT LTD.: Credit Report Dispute Investigation FormNarayana RaoОценок пока нет

- Effects of Cashless Economy Policy On Financial Inclusion in Nigeria An Exploratory Study PDFДокумент8 страницEffects of Cashless Economy Policy On Financial Inclusion in Nigeria An Exploratory Study PDFAshutosh HОценок пока нет

- Venmo Carding Method by DsДокумент2 страницыVenmo Carding Method by DsKwaku RicoОценок пока нет

- Branch Banking Immersion Report: Presentatio N Under The Guidance OF Mr. G.S.Arun PrasadДокумент25 страницBranch Banking Immersion Report: Presentatio N Under The Guidance OF Mr. G.S.Arun PrasadAkash ChoudharyОценок пока нет