Академический Документы

Профессиональный Документы

Культура Документы

Stock Cues: Amara Raja Batteries Ltd. Company Report Card-Standalone

Загружено:

kukkuji0 оценок0% нашли этот документ полезным (0 голосов)

30 просмотров3 страницыОригинальное название

amaramu

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

XLS, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате XLS, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

30 просмотров3 страницыStock Cues: Amara Raja Batteries Ltd. Company Report Card-Standalone

Загружено:

kukkujiАвторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате XLS, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 3

Amara Raja Batteries Ltd.

Company Report Card-Standalone

Renigunta Cuddapah Road,Karakambadi

Phone : Tirupati,517520,Andhra Pradesh

Stock Cues

1 Day Return% -0.87 1 Year Return% 88.43

Market Capitalization 13212.35 Daily Vol (BSE) 18109

Enterprise Value 15368.21 Daily Vol (NSE) 82253

Free Float % 47.94 Beta 1.0393

Total No of Shares 85406250 Face Value (INR) 2

TTM EPS 19.56 Book Value 63.65

TTM PE 7.91 Dividend Yield% 0.52

Bloomberg Code AMRJ IN Reuters Code AMAR.BO

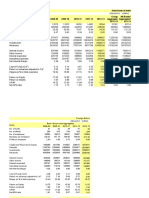

Quarterly Analysis

Particulars 201003 200912 Q on Q Var% 200903 Y on Y Var%

Total Expenditure 3698.95 2982.49 24.02 2712.02 36.39

PBIDT (Excl OI) 633.98 692.34 -8.43 598.88 5.86

PAT 366.99 398.6 -7.93 280.49 30.84

PBIDTM% (Excl OI) 14.63 18.84 -22.35 18.09 -19.13

PBIDTM% 14.77 19.01 -22.3 18.26 -19.11

PATM% 8.47 10.85 -21.94 8.47 0

EPS (Rs) 4.3 4.67 -7.92 3.28 31.1

Shareholding Pattern (Mar-2010)

Description Value

Promoters 52.06

Public & Others 18.07

Institutions 13.91

Foreign 10.29

Corporate Holdings 5.67

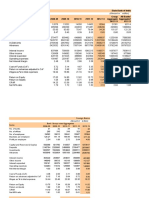

Company Report Card-Standalone (Industry-Auto Ancillary)

Renigunta Cuddapah Road,Karakambadi

Phone : Tirupati,517520,Andhra Pradesh

INR Millions

Description 200903 200803 200703 200603 200503

Inc / Exp Performance

Gross Sales 15839.54 13499.87 7451.03 4458.3 2685.44

Total Income 13240.02 11058.92 6041.54 3705.06 2429.05

Total Expenditure 11466.91 9210.83 5112.2 3156.28 2155.48

PBIDT 1773.11 1848.09 929.35 548.79 273.57

Growth% -4.06 98.86 69.35 100.6

PBIT 1427.55 1603.64 759.32 401.78 137.26

PBT 1226.59 1459.38 711.98 373.46 135.81

PAT 804.79 943.63 470.43 238.47 86.9

Growth% -14.71 100.59 97.27 174.42

Cash Profit 1150.35 1188.08 640.46 385.47 223.21

Sources of Funds

Equity Paid Up 170.81 113.88 113.88 113.88 113.88

Reserves and Surplus 3885.05 3217.14 2322.78 1898.98 1692.97

Net Worth 4055.86 3331.01 2436.66 2012.85 1806.85

Total Debt 2858.71 3162.62 1407.08 405.41 233.06

Capital Employed 6914.57 6493.64 3843.74 2418.26 2039.91

Application of Funds

Gross Block 4270.94 3105.84 2577.79 1907.12 1672.3

Investments 470.99 162.01 161.94 320.14 235.63

Cash and Bank balance 702.85 511.45 256 205.21 169.12

Net Current Assets 3416.81 3955.22 2187.92 1126.44 973.68

Total Current Liabilities 1843.09 2020.74 1312.27 1154.04 638.96

Total Assets 6914.57 6493.64 3843.74 2418.26 2039.91

Cash Flow

Cash Flow from Operations 2239.35 -296.47 -375.66 266.37 66.81

Cash Flow from Investing activities -1321.46 -1156.98 -542.77 -349.93 -115.32

Cash Flow from Finance activities -726.5 1708.91 969.21 119.64 65.34

Free Cash flow -842.82 2236.51 1064.37 292.6 302.01

Key Ratios

Debt to Equity(x) 0.82 0.79 0.41 0.17 0.11

Current Ratio(x) 4.62 5.82 4.76 3.38 4.67

ROCE(%) 21.29 31.03 24.25 18.02 6.98

RONW(%) 21.79 32.72 21.15 12.49 4.89

PBIDTM(%) 11.19 13.69 12.47 12.31 10.19

PATM(%) 5.08 6.99 6.31 5.35 3.24

CPM(%) 7.26 8.8 8.6 8.65 8.31

Market Cues

Close Price (Unit Curr.) 36.95 128.73 45.31 31.24 12.35

High Price (Unit Curr.) 143.33 183.27 64.61 37.11 16.59

Low Price (Unit Curr.) 30.5 43.2 19.73 12.27 6.49

Market Capitalization 3155.76 10994.63 3870.04 2668.09 1055.05

EPS 9.42 16.57 8.26 20.94 7.63

Price / Book Value(x) 0.78 2.2 0.21 0.18 0.08

CEPS 13.47 20.87 56.24 33.85 19.6

Equity Dividend % 40 35 35 25 20

Enterprise Value 5311.62 13645.8 5021.13 2868.29 1118.99

Dividend Yield % 2.17 0.36 1.03 1.07 2.16

Valuation Ratio

Adjusted PE (x) 3.92 11.65 41.14 11.19 12.14

PCE(x) 2.74 6.17 0.81 0.92 0.63

Price / Book Value(x) 0.78 2.2 0.21 0.18 0.08

Dividend Yield(%) 2.17 0.36 1.03 1.07 2.16

EV/Net Sales(x) 0.4 1.26 0.84 0.79 0.48

EV/EBITDA(x) 3 7.38 5.4 5.23 4.09

EV/EBIT(x) 3.72 8.51 6.61 7.14 8.15

EV/CE(x) 0.77 2.1 1.31 1.19 0.55

M Cap / Sales 0.24 1.02 0.65 0.73 0.45

Вам также может понравиться

- Securities Operations: A Guide to Trade and Position ManagementОт EverandSecurities Operations: A Guide to Trade and Position ManagementРейтинг: 4 из 5 звезд4/5 (3)

- IOL Chemicals & Pharmaceuticals Ltd. Company Report Card-StandaloneДокумент4 страницыIOL Chemicals & Pharmaceuticals Ltd. Company Report Card-StandaloneVenkatesh VasudevanОценок пока нет

- SBI AbridgedProfitnLossДокумент1 страницаSBI AbridgedProfitnLossRohitt MutthooОценок пока нет

- CEAT Financial Statement AnalysisДокумент10 страницCEAT Financial Statement AnalysisClasherОценок пока нет

- CEAT Financial Statement AnalysisДокумент10 страницCEAT Financial Statement AnalysisYugant NОценок пока нет

- Balancesheet - Tata Motors LTDДокумент9 страницBalancesheet - Tata Motors LTDNaveen KumarОценок пока нет

- Omaxe Ltd. Executive Summary under 40 charactersДокумент2 страницыOmaxe Ltd. Executive Summary under 40 charactersShreemat PattajoshiОценок пока нет

- Ratio Analysis: Balance Sheet of HPCLДокумент8 страницRatio Analysis: Balance Sheet of HPCLrajat_singlaОценок пока нет

- Comapny GlanceДокумент1 страницаComapny GlancebhuvaneshkmrsОценок пока нет

- Tvs MotorДокумент6 страницTvs MotortusharbwОценок пока нет

- Ultratech Cement LTD.: Total IncomeДокумент36 страницUltratech Cement LTD.: Total IncomeRezwan KhanОценок пока нет

- AMULДокумент22 страницыAMULsurprise MFОценок пока нет

- Goodyear Indonesia TBK.: Balance SheetДокумент20 страницGoodyear Indonesia TBK.: Balance SheetsariОценок пока нет

- Mar-19 Dec-18 Sep-18 Jun-18 Figures in Rs CroreДокумент12 страницMar-19 Dec-18 Sep-18 Jun-18 Figures in Rs Croreneha singhОценок пока нет

- Analyzing the financial performance of ACC and Madras CementДокумент13 страницAnalyzing the financial performance of ACC and Madras CementAshish SinghОценок пока нет

- United Breweries Holdings LimitedДокумент7 страницUnited Breweries Holdings Limitedsalini sasiОценок пока нет

- ACCДокумент7 страницACCSabab ZamanОценок пока нет

- Abridged Statement - Sheet1 - 2Документ1 страницаAbridged Statement - Sheet1 - 2KushagraОценок пока нет

- Ashok Leyland Limited: RatiosДокумент6 страницAshok Leyland Limited: RatiosAbhishek BhattacharjeeОценок пока нет

- ITC LTDДокумент27 страницITC LTDSneha BhartiОценок пока нет

- FM WK 5 PmuДокумент30 страницFM WK 5 Pmupranjal92pandeyОценок пока нет

- Revenue, Costs, and Profits Over TimeДокумент19 страницRevenue, Costs, and Profits Over TimeELIF KOTADIYAОценок пока нет

- Financial Forecasting: Revenue, Costs, Profits, EPSДокумент54 страницыFinancial Forecasting: Revenue, Costs, Profits, EPSRonakk MoondraОценок пока нет

- Shree Cement Financial Model Projections BlankДокумент10 страницShree Cement Financial Model Projections Blankrakhi narulaОценок пока нет

- Assignment On Analysis of Annual Report ofДокумент9 страницAssignment On Analysis of Annual Report oflalagopgapangamdas100% (1)

- Company 1 Yr1 Yr2 EPS 10 11 Price 100 110Документ38 страницCompany 1 Yr1 Yr2 EPS 10 11 Price 100 110Bhaskar RawatОценок пока нет

- Accounts Case Study On Ratio AnalysisДокумент6 страницAccounts Case Study On Ratio AnalysisRADHIKA.J 19MCO033Оценок пока нет

- SBI AND ASSOCIATES FINANCIAL PERFORMANCEДокумент9 страницSBI AND ASSOCIATES FINANCIAL PERFORMANCENehal Sharma 2027244Оценок пока нет

- FMUE Group Assignment - Group 4 - Section B2CDДокумент42 страницыFMUE Group Assignment - Group 4 - Section B2CDyash jhunjhunuwalaОценок пока нет

- Dabur India Ltd financial analysisДокумент64 страницыDabur India Ltd financial analysisPawni GoyalОценок пока нет

- APB30091213FДокумент9 страницAPB30091213FAshaОценок пока нет

- APB30091213FДокумент9 страницAPB30091213FMoorthy EsakkyОценок пока нет

- D489 Abhishek JSWphase 2Документ44 страницыD489 Abhishek JSWphase 2Yash KalaОценок пока нет

- 32 - Akshita - Sun Pharmaceuticals Industries.Документ36 страниц32 - Akshita - Sun Pharmaceuticals Industries.rajat_singlaОценок пока нет

- Astra Otoparts Tbk. Financial PerformanceДокумент18 страницAstra Otoparts Tbk. Financial PerformancesariОценок пока нет

- Ashok Leyland DCF TempletДокумент9 страницAshok Leyland DCF TempletSourabh ChiprikarОценок пока нет

- Amara Raja BatteriesДокумент28 страницAmara Raja Batteriesgaurav khandelwalОценок пока нет

- 21 - Rajat Singla - Reliance Industries Ltd.Документ51 страница21 - Rajat Singla - Reliance Industries Ltd.rajat_singlaОценок пока нет

- P&L AccountДокумент2 страницыP&L AccountArpita GuptaОценок пока нет

- UltraTech Financial Statement - Ratio AnalysisДокумент11 страницUltraTech Financial Statement - Ratio AnalysisYen HoangОценок пока нет

- 17 - Manoj Batra - Hero Honda MotorsДокумент13 страниц17 - Manoj Batra - Hero Honda Motorsrajat_singlaОценок пока нет

- Gujarat Mineral Development Corporation Balance Sheet Summary 2007-2016Документ128 страницGujarat Mineral Development Corporation Balance Sheet Summary 2007-2016Riya ShahОценок пока нет

- Tata SteelДокумент66 страницTata SteelSuraj DasОценок пока нет

- Apple V SamsungДокумент4 страницыApple V SamsungCarla Mae MartinezОценок пока нет

- Supreme Annual Report 15 16Документ104 страницыSupreme Annual Report 15 16adoniscalОценок пока нет

- This Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksДокумент32 страницыThis Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksSukanya Shridhar 1 9 9 0 3 5Оценок пока нет

- Punjab National BankДокумент7 страницPunjab National BankSandeep PareekОценок пока нет

- Business Valuation: Shriyan Gattani REGISTER NO. 1720233 5 Bba BДокумент7 страницBusiness Valuation: Shriyan Gattani REGISTER NO. 1720233 5 Bba BShriyan GattaniОценок пока нет

- Financial Modelling CIA 2Документ45 страницFinancial Modelling CIA 2Saloni Jain 1820343Оценок пока нет

- Amit Icici Bank LimitedДокумент25 страницAmit Icici Bank LimitedAmit JainОценок пока нет

- Balance Sheet: Hindalco IndustriesДокумент20 страницBalance Sheet: Hindalco Industriesparinay202Оценок пока нет

- HDFC Bank Annual Report 2009 10Документ137 страницHDFC Bank Annual Report 2009 10yagneshroyalОценок пока нет

- HUL FinancialsДокумент5 страницHUL FinancialstheОценок пока нет

- 17pgp216 ApolloДокумент5 страниц17pgp216 ApolloVamsi GunturuОценок пока нет

- Icici Bank CMP: Rs. 956.05: Result UpdateДокумент6 страницIcici Bank CMP: Rs. 956.05: Result UpdatemahasagarОценок пока нет

- Institute Program Year Subject Project Name Company Competitor CompanyДокумент37 страницInstitute Program Year Subject Project Name Company Competitor CompanyEashaa SaraogiОценок пока нет

- Understanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyОт EverandUnderstanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyОценок пока нет

- Bill Poulos - Quantum Swing TraderДокумент124 страницыBill Poulos - Quantum Swing Traderbruce1976@hotmail.com100% (4)

- DocДокумент1 страницаDocaccounts 3 life100% (1)

- Instructions For Using Texas Instruments BA II Plus CalculatorДокумент3 страницыInstructions For Using Texas Instruments BA II Plus Calculatorsir bookkeeperОценок пока нет

- Quantitative Analyst Chicago Neuberger BermanДокумент2 страницыQuantitative Analyst Chicago Neuberger BermanYue CongluОценок пока нет

- Investment Analysis - Chapter 3Документ34 страницыInvestment Analysis - Chapter 3Linh MaiОценок пока нет

- BEmlДокумент2 страницыBEmlcmit17Оценок пока нет

- Forex Scalping Strategy: 80% of Your Trades Will Be TrueДокумент28 страницForex Scalping Strategy: 80% of Your Trades Will Be Trueassaad74783% (12)

- BUS 110 Project Tabs and DefinitionsДокумент3 страницыBUS 110 Project Tabs and DefinitionsGopiGunigantiОценок пока нет

- Beta SahamДокумент20 страницBeta SahamunkownОценок пока нет

- Margin of Saftey Book ReviewДокумент5 страницMargin of Saftey Book Reviewmanjunath hatagaleОценок пока нет

- Chapter 1 and 2 MC and TFДокумент17 страницChapter 1 and 2 MC and TFAngela de MesaОценок пока нет

- Accounting Final ExamДокумент6 страницAccounting Final ExamKarim Abdel Salam Elzahby100% (1)

- Final ExamДокумент6 страницFinal ExamOnat PОценок пока нет

- Sample Final Solutions PDFДокумент10 страницSample Final Solutions PDFrealdmanОценок пока нет

- Role of Merchant Bankers in Capital MarketsДокумент23 страницыRole of Merchant Bankers in Capital MarketschandranilОценок пока нет

- Barclays State of The Industry March 2019Документ198 страницBarclays State of The Industry March 2019Divyansh GuptaОценок пока нет

- Accounting Equation WorksheetДокумент2 страницыAccounting Equation WorksheetMelu Jean MayoresОценок пока нет

- Hedging Uncertainty in Financial Markets with Options StrategiesДокумент52 страницыHedging Uncertainty in Financial Markets with Options StrategiesRupinder GoyalОценок пока нет

- Examination Practice Questions 80Документ31 страницаExamination Practice Questions 80Amit SinghОценок пока нет

- Apznza 1Документ27 страницApznza 1jason manalotoОценок пока нет

- Forex Terminology Free PDFДокумент7 страницForex Terminology Free PDFKiran Krishna100% (1)

- Wiley CFA Society Mock Exam 2020 Level III Morning QuestionsДокумент55 страницWiley CFA Society Mock Exam 2020 Level III Morning QuestionsAbhinav AgrawalОценок пока нет

- Set B Quiz 2 Final Basic Earning and Diluted Earning Per ShareДокумент1 страницаSet B Quiz 2 Final Basic Earning and Diluted Earning Per ShareMega MindОценок пока нет

- Unilever Indonesia Financial AnalysisДокумент17 страницUnilever Indonesia Financial AnalysissaridОценок пока нет

- Current Valuation AS139437103Документ6 страницCurrent Valuation AS139437103Kiran KumarОценок пока нет

- AUD-90 PW (Part 2 of 2)Документ7 страницAUD-90 PW (Part 2 of 2)Elaine Joyce GarciaОценок пока нет

- BBA II Chapter 3 Depreciation ProblemsДокумент4 страницыBBA II Chapter 3 Depreciation ProblemsSiddharth SalgaonkarОценок пока нет

- Internship Report Sindh BankДокумент34 страницыInternship Report Sindh BankAl RafioОценок пока нет

- Zerodha ChargesДокумент4 страницыZerodha ChargesHancock willsmithОценок пока нет

- Stock Screening For Tiny TitansДокумент9 страницStock Screening For Tiny Titansthiend100% (1)