Академический Документы

Профессиональный Документы

Культура Документы

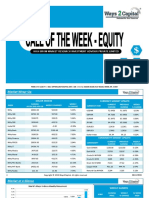

Equity Market Reports For The Week (18th - 22nd April 11)

Загружено:

Dasher_No_1Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Equity Market Reports For The Week (18th - 22nd April 11)

Загружено:

Dasher_No_1Авторское право:

Доступные форматы

WEEKLY REPORT

18th Apr - 22nd Apr 2011

Global Research Limited

STOCKS

R E P O R T

BEARS STAND STRONG AT 6000 LEVEL!!

WEEK WRAP

Indian equity benchmarks shattered after the IT bellwether Infosys' disappointing earnings per share guidance for FY12 and spike up in inflation numbers on

Friday. Unwinding pressure and build up of shorts halted the Wednesday's surprised rally by erasing more than 75% of gains on the Nifty in today's trade.

Indian equity benchmarks shattered after the IT bellwether Infosys' disappointing earnings per share guidance for FY12 and spike up in inflation numbers on

Friday. Unwinding pressure and build up of shorts halted the Wednesday's surprised rally by erasing more than 75% of gains on the Nifty in today's trade.

In smallcap space, Uflex, Timken, C Mahendra Exports, Gemini Comm and Balaji Telefilm rallied 10-13%. However, Prraneta Inds, Banco Products, Atlanta, Infinite

Computer and Kanani Industries lost 6-11%.

ASIAN & EMERGING MARKET

Asian stocks were mixed Thursday amid concerns that rising food and fuel costs could undermine consumer demand, hurting economic growth and company

profits.

Hong Kong's Phoenix TV, citing an unnamed source, reported higher-than-expected increases in Chinese retail sales and industrial output, but also said inflation

in the world's second biggest economy had accelerated.

Singapore's central bank also allowed an immediate rise in the value of its currency to help tackle inflation, which it said would likely stay elevated. The

Singapore dollar -- the world's 12th most

US MARKET

Stocks that outperform in a weak economy helped the Dow and S&P 500 eke out gains on Thursday as concerns about faltering growth and inflation prompted

investors to seek out less volatile names.

“GDP forecasts are continuing to fall, so (bets on defensives) are a safety trade," said Peter Boockvar, equity strategist at Miller Tabak & Co in New York.

The core U.S. Producer Price Index rose faster than expected in March as fuel prices rose strongly, adding to concerns about inflation

Advancing stocks outnumbered declining ones on the NYSE by 1,600 to 1,358, while on the Nasdaq, 1,455 stocks rose and 1,121 fell.

MICRO ECONOMIC FRONT

Inflation rises to 8.98% in March; RBI may hike rates: India's headline inflation rose faster than expected in March on higher fuel and manufacturing prices ,

adding pressure on the central bank to be more aggressive in its monetary policy tightening as it struggles to rein in price pressures.

The 10-year bond yield raised 7 basis points from early levels to 8 percent after the data, while the 1-year swap rate climbed 8 basis points to 7.62 percent. The

5-year swap rate moved up 11 basis points to 8.21 percent.

India, Iran seeking to settle oil payments in non-euro currencies: India and Iran are talking to non-euro countries and territories to settle payments for Iranian oil

imports to the Asian nation, a senior government official told media on Thursday.

1 | APRIL 2011 | www.capitalvia.com

WEEKLY REPORT

18th Apr - 22nd Apr 2011

Global Research Limited

BEARS STAND STRONG AT 6000 LEVEL!!

NIFTY WORLD INDICES

NIFTY Properties Values World Indices Close Weekly Chg Points % Chg

Weekly Open 5805.35 Sensex 19451.45 +114.63 +0.59%

Weekly High 5923.60 Nifty 5824.35 +19.02 +0.33%

Weekly Low 5735.55 DOW Jones 12285.15 +94.9 +0.76%

Weekly Close 5824.55 Shanghai Comp. 3050.81 +20.76 +0.69%

Weekly Chg Points +19.02 Nikkei 9568.08 -176.56 -1.80%

Weekly Chg% +0.33% CAC 40 3960.04 -10.87 -2.50%

FTSE 5981.15 -74.65 -1.23%

SECTORIAL INDICES

Indices Open High Low Close

BANK NIFTY 11591 11950.70 11490.55 11735.65

CNX NIFTY JUNIOR 11533.70 11656.80 11396.25 11606.2

S&P CNX 500 4664.60 4736.00 4614.75 4679.80

CNX IT 7107.50 7328.75 6824.05 6842.15

CNX MIDCAP 8287.65 8369.45 8198.70 8317.85

CNX 100 5708.65 5812.00 5640.80 5729.40

GAINERS LOSERS

Scrip GAINERS

Current Close Change Chg % Scrip Current Close Change Chg %

Kanoria Chemical 41.20 34.30 20.12 Alembic Ltd. 70.40 22.25 68.39

IVP Limited 42.90 51.50 20.05 Kwality Dairy 147.25 120.50 18.17

SPIC 19.40 23 18.56 TCI Industries 2304.80 1890 18

GMR Ferro Alloys 110.45 127.55 15.48 Lords Chemicals 205 172.30 15.95

Thangamayil Jeweller 158.65 180.15 13.55 Asahi Infrastructure 12.99 11.03 15.09

DII’S INVESTMENTS FII’S INVESTMENTS

Indices Buy Value Sell Value Net Value Indices Buy Value Sell Value Net Value

11-Apr-2011 531.20 340.80 190.30 11-Apr-2011 2682.80 2325.90 -474.70

13Apr-2011 - - - 13Apr-2011 2021.50 2496.20 356.90

15Apr--2011 - - -

1 | DECEMBER 2010 | www.capitalvia.com

2 | APRIL 2011 | www.capitalvia.com

WEEKLY REPORT

18th Apr - 22nd Apr 2011

Global Research Limited

BEARS STAND STRONG AT 6000 LEVEL!!

WEEK AHEAD SPOT NIFTY

TECHNICALS

Properties Values

Support 1 5750

Support 2 5695

Resistance 1 5925

Resistance 2 6000

Figure: 1 Nifty Weekly

The Nifty futures closed and settled finally at 5825, down by 113.10 points or 1.90 %. It looking bearish in the coming trading

session if it manages to trade below the support level of 5750 else above resistance level of 5925 it would be in an upward

trend.

WEEK AHEAD BANK NIFTY

TECHNICALS

Properties Values

Support 1 11530

Support 2 11335

Resistance 1 12050

Resistance 2 12480

Figure: Bank Nifty Weekly

Bank Nifty Futures shut stop at 11770 down by -133.10 points or -1.90%. It looking bearish in the coming trading session if it

manages to trade below the support level of 11530 else above resistance level of 12050 it would be in an upward trend.

3 | APRIL 2011 | www.capitalvia.com

WEEKLY REPORT

18th Apr - 22nd Apr 2011

Global Research Limited

BEARS STAND STRONG AT 6000 LEVEL!!

STOCK OF THE WEEK - DEWAN HOUSING FINANCE CORPORATION BUY

TECHNICAL PICTURE

DEWAN HOUSING FINANCE IS IN CONSOLIDATION PHASE FROM LAST FEW TRADING SESSION. .IF IT MANAGES TO SUSTAIN

ABOVE 281 IT WILL TAKE UP MOVE .WE RECOMMEND TO BUY DEWAN HOUSING FINANCE IN CASH ABOVE 281 TARGET 291,298

WITH STOP LOSS OF 269.

DEWAN HOUSING FINANCE CORPORATION LIMITED Indices DEWN HOUSING

Support 269

Resistance 281

Symbol DEWANHOUS (NSE)

Company Name DEWAN HOUSING FINANCE CORPORATION LIMITED

Price `277

Change `2.35

Volume 200659

52 Week High 348.50

% From High -20 %

Day High 279.35

EPS 23.77

4 | APRIL 2011 | www.capitalvia.com

WEEKLY REPORT

18th Apr - 22nd Apr 2011

Global Research Limited

BEARS STAND STRONG AT 6000 LEVEL!!

KEY STATISTICS

C Current Quarter Earning per Share. The Higher The Better.

WHY CAN SLIM?

Primary Factors

Almost 35% increase in Q o Q Earnings.

A Annual Earnings Increases: Look for a significant growth.

Primary Factors

Annual Earnings showed a decline of 64% Y o Y.

N New Products, New Management, New Highs, Buying at

Right Time.

Primary Factors

DEWAN HOUSING LTD. is set to have a breakout as it is being

consolidating with positive biasness from last many trading

sessions.

“CAN SLIM is a formula created by

William J. O'Neil, who is the founder

of the Investor's Business Daily and

author of the book How to Make S Supply and Demand: Shares Outstanding Plus Big Volume

Demand.

Money in Stocks - A Winning System Primary Factors

in Good Times or Bad.

DEWAN HOUSING LTD .is a mid cap stock consisting of Rs. 478192

crores Shares Outstanding (Total Public Shareholding)

Each letter in CAN SLIM stands for

one of the seven chief

characteristics that are commonly

found in the greatest winning

stocks. The C-A-N-S-L-I-M.

L Leader or Laggard: Which is your stock?

Primary Factors

DEWAN HOUSING LTD is a leading stock with a relative strength

above 53.29% in Weekly and 65.42% in Daily.

characteristics are often present

prior to a stock making a significant

rise in price, and making huge

profits for the shareholders! I Institutional Sponsorship: Follow the Leaders.

Primary Factors

Approximately 43.16% of Shares are held by the Institutional

O'Neil explains how he conducted

Investors (FII”s, Mutual Funds etc.)

an intensive study of 500 of the

biggest winners in the stock market

from 1953 to 1990. A model of each

of these companies was built and

M Market Direction

Primary Factors

studied. Again and again, it was

noticed that almost all of the If Market continues to remain in a secular uptrend, hence overall

biggest stock market winners had conditions are appropriate to initiate long position in the stock: A Big

very similar characteristics just plus for the Stock .

before they began their big moves.”

Sources: Sihl.in

5 | APRIL 2011 | www.capitalvia.com

WEEKLY REPORT

18th Apr - 22nd Apr 2011

Global Research Limited

DISCLAIMER

The information and views in this report, our website & all the service we provide are believed to be reliable, but we do not accept any responsibility (or

liability) for errors of fact or opinion. Users have the right to choose the product/s that suits them the most.

Investment in Stocks has its own risks. Sincere efforts have been made to present the right investment perspective. The information contained herein is

based on analysis and up on sources that we consider reliable. We, however, do not vouch for the accuracy or the completeness thereof. This material is

for personal information and we are not responsible for any loss incurred based upon it & take no responsibility whatsoever for any financial profits or

loss which may arise from the recommendations above.

The stock price projections shown are not necessarily indicative of future price performance. The information herein, together with all estimates and

forecasts, can change without notice.

CapitalVia does not purport to be an invitation or an offer to buy or sell any financial instrument.

Analyst or any person related to CapitalVia might be holding positions in the stocks recommended.

It is understood that anyone who is browsing through the site has done so at his free will and does not read any views expressed as a recommendation for

which either the site or its owners or anyone can be held responsible for.

Our Clients (Paid Or Unpaid), Any third party or anyone else have no rights to forward or share our calls or SMS or Report or Any Information Provided by

us to/with anyone which is received directly or indirectly by them. If found so then Serious Legal Actions can be taken.

Any surfing and reading of the information is the acceptance of this disclaimer.

All Rights Reserved.

Contact Number:

Hotline: +91-91790-02828

Landline: +91-731-668000

Fax: +91-731-4238027

C O N TA C T U S

Corporate Office Address:

India: No. 99, 1st Floor, Surya Complex

CapitalVia Global Research Limited R. V. Road, Basavangudi

No. 506 West, Corporate House Opposite Lalbagh West Gate

169, R. N. T. Marg, Near D. A. V. V. Bangalore - 560004

Indore - 452001

Singapore:

CapitalVia Global Research Pvt. Ltd.

Block 2 Balestier Road

#04-665 Balestier Hill

Shopping Centre

Singapore - 320002

6 | APRIL 2011 | www.capitalvia.com

Вам также может понравиться

- Safe Primer: For Example, The California Finance Lenders LawДокумент8 страницSafe Primer: For Example, The California Finance Lenders LawBrendan MedeirosОценок пока нет

- Individual Assignments 2Документ8 страницIndividual Assignments 2Arista Yuliana SariОценок пока нет

- Winning the Trading Game: Why 95% of Traders Lose and What You Must Do To WinОт EverandWinning the Trading Game: Why 95% of Traders Lose and What You Must Do To WinОценок пока нет

- Chapter 4 Valuation of Bonds and Cost of CspitalДокумент24 страницыChapter 4 Valuation of Bonds and Cost of Cspitalanteneh hailie100% (7)

- Equity Reports For The Week (11th - 15th April 11)Документ6 страницEquity Reports For The Week (11th - 15th April 11)Dasher_No_1Оценок пока нет

- Equity Reports For The Week (25th - 29th April '11)Документ6 страницEquity Reports For The Week (25th - 29th April '11)Dasher_No_1Оценок пока нет

- Equity Reports For The Week (2nd - 6th May '11)Документ6 страницEquity Reports For The Week (2nd - 6th May '11)Dasher_No_1Оценок пока нет

- Stock Market Reports For The Week (16th - 20th May '11)Документ6 страницStock Market Reports For The Week (16th - 20th May '11)Dasher_No_1Оценок пока нет

- Stock Market Reports For The Week (9th - 13th May '11)Документ6 страницStock Market Reports For The Week (9th - 13th May '11)Dasher_No_1Оценок пока нет

- Weekly Special Report of CapitalHeight 23 July 2018Документ11 страницWeekly Special Report of CapitalHeight 23 July 2018Damini CapitalОценок пока нет

- Watch Out CapitalHeight Weekly Performance Report From 23 To 27 July.Документ11 страницWatch Out CapitalHeight Weekly Performance Report From 23 To 27 July.Damini CapitalОценок пока нет

- Stock Market Reports For The Week (21st - 25th March - 2011)Документ6 страницStock Market Reports For The Week (21st - 25th March - 2011)Dasher_No_1Оценок пока нет

- Equity Research Report 13 November 2018 Ways2CapitalДокумент17 страницEquity Research Report 13 November 2018 Ways2CapitalWays2CapitalОценок пока нет

- Stock Market Reports For The Week (23rd-27th May '11)Документ7 страницStock Market Reports For The Week (23rd-27th May '11)Dasher_No_1Оценок пока нет

- Equity Reports For The Week (4th October '10)Документ10 страницEquity Reports For The Week (4th October '10)Dasher_No_1Оценок пока нет

- Money Maker Research Pvt. LTD.: Daily Equity ReportДокумент6 страницMoney Maker Research Pvt. LTD.: Daily Equity ReportMoney Maker ResearchОценок пока нет

- Nifty Daily Movement and Stocks Technical AnalysisДокумент5 страницNifty Daily Movement and Stocks Technical AnalysisNiraj KumarОценок пока нет

- Derivative Report 02 May UpdateДокумент6 страницDerivative Report 02 May UpdateDEEPAK MISHRAОценок пока нет

- Equity Research Report 14 August 2018 Ways2CapitalДокумент17 страницEquity Research Report 14 August 2018 Ways2CapitalWays2CapitalОценок пока нет

- Equity Research Report 06 November 2018 Ways2CapitalДокумент17 страницEquity Research Report 06 November 2018 Ways2CapitalWays2CapitalОценок пока нет

- Moneysukh Market Insight Report 25/3/2010Документ5 страницMoneysukh Market Insight Report 25/3/2010MansukhОценок пока нет

- Stock Tips For The WeekДокумент9 страницStock Tips For The WeekDasher_No_1Оценок пока нет

- Derivative Report 6march2017Документ6 страницDerivative Report 6march2017ram sahuОценок пока нет

- Stock Market Analysis by Mansukh Investment & Trading Solutions 27/8/2010Документ5 страницStock Market Analysis by Mansukh Investment & Trading Solutions 27/8/2010MansukhОценок пока нет

- Pre - Market ActionДокумент24 страницыPre - Market ActionVivaan AgarwalОценок пока нет

- Way2Wealth Daily Trading Bites Apr1Документ3 страницыWay2Wealth Daily Trading Bites Apr1Srikanth RamakrishnaОценок пока нет

- Daily Recap August 9 2022 - CopyДокумент2 страницыDaily Recap August 9 2022 - CopyJay-Rald TorresОценок пока нет

- Indian Market Research Daily Market Summary: Paterson Securities PVT LTDДокумент3 страницыIndian Market Research Daily Market Summary: Paterson Securities PVT LTDmuthu_theone6943Оценок пока нет

- Report On Stock Trading Report by Mansukh Investment & Trading Solutions 6/07/2010Документ5 страницReport On Stock Trading Report by Mansukh Investment & Trading Solutions 6/07/2010MansukhОценок пока нет

- Analysis On Market Outlook by Mansukh Investment & Trading Solutions 11/08/2010Документ5 страницAnalysis On Market Outlook by Mansukh Investment & Trading Solutions 11/08/2010MansukhОценок пока нет

- Stock Market Outlook by Mansukh Investment & Trading Solutions 29/07/2010Документ5 страницStock Market Outlook by Mansukh Investment & Trading Solutions 29/07/2010MansukhОценок пока нет

- Analysis On Stock Market Outlook by Mansukh Investment & Trading Solutions 23aug, 2010Документ5 страницAnalysis On Stock Market Outlook by Mansukh Investment & Trading Solutions 23aug, 2010MansukhОценок пока нет

- Equity Research Report 20 November 2018 Ways2CapitalДокумент17 страницEquity Research Report 20 November 2018 Ways2CapitalWays2CapitalОценок пока нет

- Weekly Stock Market Trend and UpdatesДокумент6 страницWeekly Stock Market Trend and UpdatesRahul SolankiОценок пока нет

- Morning Notes 14 July 2010: Mansukh Securities and Finance LTDДокумент5 страницMorning Notes 14 July 2010: Mansukh Securities and Finance LTDMansukhОценок пока нет

- Indian Stock Markets - 06 Sep 2010Документ6 страницIndian Stock Markets - 06 Sep 2010bhavnesh_muthaОценок пока нет

- Presentation Final PaperДокумент21 страницаPresentation Final PaperHoang LeОценок пока нет

- Weekly Equity Market Report of Indian MarketДокумент5 страницWeekly Equity Market Report of Indian MarketRahul SolankiОценок пока нет

- Stock Trading Analysis by Mansukh Investment and Trading Solutions 10/5/2010Документ5 страницStock Trading Analysis by Mansukh Investment and Trading Solutions 10/5/2010MansukhОценок пока нет

- Tech Report 05.01Документ3 страницыTech Report 05.01Swayam MangwaniОценок пока нет

- Equity Research Report 27 November 2018 Ways2CapitalДокумент17 страницEquity Research Report 27 November 2018 Ways2CapitalWays2CapitalОценок пока нет

- Stock Market Outlook by Mansukh Investment 18 Aug, 2010Документ5 страницStock Market Outlook by Mansukh Investment 18 Aug, 2010MansukhОценок пока нет

- Stock Trading Report by Mansukh Investment & Trading Solutions 1/07/2010Документ5 страницStock Trading Report by Mansukh Investment & Trading Solutions 1/07/2010MansukhОценок пока нет

- Stock Tips For The WeekДокумент9 страницStock Tips For The WeekDasher_No_1Оценок пока нет

- Practice Q (Capital Budgeting)Документ12 страницPractice Q (Capital Budgeting)Divyam GargОценок пока нет

- Derivatives Report 29 Dec 2010Документ3 страницыDerivatives Report 29 Dec 2010parishkaaОценок пока нет

- 5 Dec 16Документ3 страницы5 Dec 16asifОценок пока нет

- Equity Premium Daily Journal-1st November 2017, WednesdayДокумент13 страницEquity Premium Daily Journal-1st November 2017, WednesdaySiddharth PatelОценок пока нет

- Stock Trading Report by Mansukh Investment & Trading Solutions5/07/2010Документ5 страницStock Trading Report by Mansukh Investment & Trading Solutions5/07/2010MansukhОценок пока нет

- Daily Market Coverage 8th Dec 2017Документ1 страницаDaily Market Coverage 8th Dec 2017Riya ShrivastavОценок пока нет

- Yinguangxia Events: - China'S Enron EventsДокумент11 страницYinguangxia Events: - China'S Enron EventsMohammed I. AzamОценок пока нет

- Stock AnalysisДокумент16 страницStock AnalysisManish GautamОценок пока нет

- Expect Some Materialistic Cushions Around 6000 Level - Market Outlook For 12 Oct 2010Документ5 страницExpect Some Materialistic Cushions Around 6000 Level - Market Outlook For 12 Oct 2010MansukhОценок пока нет

- Stock Trading Report by Mansukh Investment & Trading Solutions 17/06/2010Документ5 страницStock Trading Report by Mansukh Investment & Trading Solutions 17/06/2010MansukhОценок пока нет

- 9th April 2020 Equity 360: Nifty LevelДокумент6 страниц9th April 2020 Equity 360: Nifty LevelanjugaduОценок пока нет

- Nifty Today Previous Change: Nifty Close vs. VIXДокумент4 страницыNifty Today Previous Change: Nifty Close vs. VIXshivratan007Оценок пока нет

- Derivative Premium Daily Journal-16th November 2017, ThursdayДокумент12 страницDerivative Premium Daily Journal-16th November 2017, ThursdaySiddharth PatelОценок пока нет

- Technical and DerivativesДокумент5 страницTechnical and DerivativesSarvesh BhagatОценок пока нет

- Real Estate Cash Flow Waterfall ModelДокумент8 страницReal Estate Cash Flow Waterfall ModelSeleccion Tecnico IndustrialОценок пока нет

- Index Movement:: National Stock Exchange of India LimitedДокумент36 страницIndex Movement:: National Stock Exchange of India LimitedTrinadh Kumar GuthulaОценок пока нет

- MARKET CORRECTIONДокумент5 страницMARKET CORRECTIONThiyaga RajanОценок пока нет

- Equity Premium Daily Journal-16th November 2017, ThursdayДокумент14 страницEquity Premium Daily Journal-16th November 2017, Thursdayyuvani vermaОценок пока нет

- Nifty 50 Reports For The Week (16-20th August '11)Документ52 страницыNifty 50 Reports For The Week (16-20th August '11)Dasher_No_1Оценок пока нет

- Bullion Commodity Reports For The Week (16-20th August '11)Документ8 страницBullion Commodity Reports For The Week (16-20th August '11)Dasher_No_1Оценок пока нет

- Stock Market Reports For The Week (16-20th August '11)Документ5 страницStock Market Reports For The Week (16-20th August '11)Dasher_No_1Оценок пока нет

- Stock Market Reports For The Week (8th - 12th August '11)Документ5 страницStock Market Reports For The Week (8th - 12th August '11)Dasher_No_1Оценок пока нет

- Stock Market Reports For The Week (1st - 5th August '11)Документ5 страницStock Market Reports For The Week (1st - 5th August '11)Dasher_No_1Оценок пока нет

- Nifty 50 Reports For The Week (8th - 12th August '11)Документ52 страницыNifty 50 Reports For The Week (8th - 12th August '11)Dasher_No_1Оценок пока нет

- Stock Futures and Options Reports For The Week (8th - 12th August '11)Документ4 страницыStock Futures and Options Reports For The Week (8th - 12th August '11)Dasher_No_1Оценок пока нет

- Rollover Statistics (From July 2011 Series To September 2011 Series)Документ10 страницRollover Statistics (From July 2011 Series To September 2011 Series)Dasher_No_1Оценок пока нет

- Agri Commodity Reports For The Week (16-20th August '11)Документ6 страницAgri Commodity Reports For The Week (16-20th August '11)Dasher_No_1Оценок пока нет

- Agri Commodity Reports For The Week (8th - 12th August '11)Документ6 страницAgri Commodity Reports For The Week (8th - 12th August '11)Dasher_No_1Оценок пока нет

- Bullion Commodity Reports For The Week (8th - 12th August '11)Документ8 страницBullion Commodity Reports For The Week (8th - 12th August '11)Dasher_No_1Оценок пока нет

- Nifty 50 Reports For The Week (1st - 5th August '11)Документ52 страницыNifty 50 Reports For The Week (1st - 5th August '11)Dasher_No_1Оценок пока нет

- Stock Futures and Option Reports For The Week (25th - 29th July '11)Документ4 страницыStock Futures and Option Reports For The Week (25th - 29th July '11)Dasher_No_1Оценок пока нет

- Agri Commodity Reports For The Week (1st - 5th August '11)Документ6 страницAgri Commodity Reports For The Week (1st - 5th August '11)Dasher_No_1Оценок пока нет

- Stock Market Reports For The Week (25th - 29th July '11)Документ5 страницStock Market Reports For The Week (25th - 29th July '11)Dasher_No_1Оценок пока нет

- Stock Market Reports For The Week (4th - 8th July '11)Документ5 страницStock Market Reports For The Week (4th - 8th July '11)Dasher_No_1Оценок пока нет

- Bullion Commodity Reports For The Week (1st - 5th August '11)Документ8 страницBullion Commodity Reports For The Week (1st - 5th August '11)Dasher_No_1Оценок пока нет

- Stock Market Reports For The Week (11th - 15th July '11)Документ5 страницStock Market Reports For The Week (11th - 15th July '11)Dasher_No_1Оценок пока нет

- Bullion Commodity Reports For The Week (25th - 29th July '11)Документ8 страницBullion Commodity Reports For The Week (25th - 29th July '11)Dasher_No_1Оценок пока нет

- Nifty 50 Reports For The Week (25th - 29th July '11)Документ52 страницыNifty 50 Reports For The Week (25th - 29th July '11)Dasher_No_1Оценок пока нет

- Agri Commodity Reports For The Week (11th - 15th July '11)Документ6 страницAgri Commodity Reports For The Week (11th - 15th July '11)Dasher_No_1Оценок пока нет

- Rollover Statistics (From June 2011 Series To July 2011 Series)Документ10 страницRollover Statistics (From June 2011 Series To July 2011 Series)Dasher_No_1Оценок пока нет

- Agri Commodity Reports For The Week (25th - 29th July '11)Документ6 страницAgri Commodity Reports For The Week (25th - 29th July '11)Dasher_No_1Оценок пока нет

- Bulion Commodity Reports For The Week (11th - 15th July '11)Документ8 страницBulion Commodity Reports For The Week (11th - 15th July '11)Dasher_No_1Оценок пока нет

- Nifty 50 Reports For The Week (11th - 15th July '11)Документ52 страницыNifty 50 Reports For The Week (11th - 15th July '11)Dasher_No_1Оценок пока нет

- Nifty 50 Reports For The Week (4th - 8th July '11)Документ52 страницыNifty 50 Reports For The Week (4th - 8th July '11)Dasher_No_1Оценок пока нет

- Agri Commodity Reports For The Week (4th - 8th July '11)Документ6 страницAgri Commodity Reports For The Week (4th - 8th July '11)Dasher_No_1Оценок пока нет

- Bullion Commodity Reports For The Week (4th - 8th July '11)Документ8 страницBullion Commodity Reports For The Week (4th - 8th July '11)Dasher_No_1Оценок пока нет

- CH 6 DRsДокумент25 страницCH 6 DRsNamrata NeopaneyОценок пока нет

- Project From IntroductionДокумент90 страницProject From IntroductionSaidi ReddyОценок пока нет

- Ratio Analysis: Tesla vs Automotive IndustryДокумент7 страницRatio Analysis: Tesla vs Automotive IndustryZahid MalikОценок пока нет

- Paper Exchange Demutualization May2006Документ78 страницPaper Exchange Demutualization May2006raheel00093Оценок пока нет

- MFRS 133 Earnings Per SharesДокумент51 страницаMFRS 133 Earnings Per SharesNFN FaraОценок пока нет

- 09 Jitendra KumarДокумент6 страниц09 Jitendra Kumarsurya prakashОценок пока нет

- Asquith Mullins (1986) Signalling With Dividends, Stock Repurchases Equity IssuesДокумент19 страницAsquith Mullins (1986) Signalling With Dividends, Stock Repurchases Equity IssuesAbdullahОценок пока нет

- Problem 8 ACCOUNTINGДокумент15 страницProblem 8 ACCOUNTINGdiane camansagОценок пока нет

- FBI TBCh10Документ5 страницFBI TBCh10vincewk179Оценок пока нет

- Corporations: Organization, Capital Stock Transactions, and DividendsДокумент87 страницCorporations: Organization, Capital Stock Transactions, and DividendsAwandaTitisNiandharaОценок пока нет

- Details of shareholders whose equity shares are proposed to be transferred to IEPF Demat AccountДокумент1 страницаDetails of shareholders whose equity shares are proposed to be transferred to IEPF Demat AccountHarveyОценок пока нет

- Tata Motors Ratio CalculationsДокумент3 страницыTata Motors Ratio CalculationssukeshОценок пока нет

- About Venture CapitalДокумент8 страницAbout Venture CapitalKishor YadavОценок пока нет

- SSRN Id3044108Документ14 страницSSRN Id3044108syifa frОценок пока нет

- Assets - Transferable Securi ... Etc.Документ51 страницаAssets - Transferable Securi ... Etc.orizontasОценок пока нет

- Random Walk TheoryДокумент17 страницRandom Walk TheorylostОценок пока нет

- Healthcare dividend analysisДокумент6 страницHealthcare dividend analysisRITESH A/L C.B. RAMANI studentОценок пока нет

- Adani Wilmar Limited: Please Read Section 32 of The Companies Act, 2013Документ398 страницAdani Wilmar Limited: Please Read Section 32 of The Companies Act, 2013davidОценок пока нет

- Seychelles Horizon Investments SPV StructureДокумент4 страницыSeychelles Horizon Investments SPV StructureYayan HermansyahОценок пока нет

- Nifty Consumer Durables Index OverviewДокумент2 страницыNifty Consumer Durables Index Overviewdohare41Оценок пока нет

- STOCK VALUATION TUTORIALДокумент3 страницыSTOCK VALUATION TUTORIALSen Siew Ling0% (1)

- IDX Annualy Statistic2011 (Revisi)Документ139 страницIDX Annualy Statistic2011 (Revisi)SutanОценок пока нет

- Gordon Growth Model Dividend Payout RatioДокумент3 страницыGordon Growth Model Dividend Payout RatioCoryОценок пока нет

- Corporation: Issuance: JPIA Mentor's CircleДокумент18 страницCorporation: Issuance: JPIA Mentor's CircleartОценок пока нет

- St. Vincent de Ferrer College Financial Management 2 Exam ReviewДокумент4 страницыSt. Vincent de Ferrer College Financial Management 2 Exam ReviewNANОценок пока нет

- Comparative Analysis of Indiabull Securities With Other CompaniesДокумент66 страницComparative Analysis of Indiabull Securities With Other CompaniesPratyushJoshiОценок пока нет