Академический Документы

Профессиональный Документы

Культура Документы

US Internal Revenue Service: A-02-108

Загружено:

IRSИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

US Internal Revenue Service: A-02-108

Загружено:

IRSАвторское право:

Доступные форматы

Part IV – Items of General Interest

Separate Reporting of Nonstatutory Stock Option Income in Box 12 of the Form

W-2, Using Code V, Mandatory for Year 2003

Announcement 2002-108

I. PURPOSE

This announcement reminds taxpayers that as provided in Announcement

2001-92, 2001-39 I.R.B. 301, the reporting of compensation resulting from

employer-provided nonstatutory stock options in box 12 of the Form W-2, using

Code V, is mandatory for Forms W-2 issued for the year 2003 and subsequent

years. This announcement is consistent with the 2003 Form W-2 and its

instructions that the Service intends to publish near the same time as the

publication of this announcement.

II. BACKGROUND

When an employee (or former employee) exercises nonstatutory stock

options, employers are required to report the excess of the fair market value of

the stock received upon exercise of the option over the amount paid for that

stock. That amount is reported on Form W-2 in boxes 1, 3 (up to the social

security wage base), and 5.

Announcement 2000-97, 2000-48 I.R.B. 557, advised employers that,

beginning for 2001 Forms W-2, income from the exercise of nonstatutory stock

options would also be required to be reported in box 12 and identified by a new

code, Code V – Income from the exercise of nonstatutory stock options.

In response to employer concerns, Announcement 2001-7, 2001-3 I.R.B. 357,

subsequently provided the relief that the use of Code V would be optional for the

2001 Forms W-2. Announcement 2001-92 extended the relief so that the use of

Code V would be optional for the 2002 Forms W-2.

Announcement 2001-92 further requested public comment and suggestions

regarding potential methods that would enable more efficient and cost effective

means of collecting the information that would be reported using Code V.

Specifically, Announcement 2001-92 requested proposals for better and less

burdensome methods of collecting the information about employee income that

arises from the exercise of nonstatutory stock options, including information

about the presence and amount of nonstatutory stock option income on an

employee (or former employee) basis. Announcement 2001-92 noted that

absent further guidance, the Code V reporting requirement would be mandatory

for 2003 Forms W-2.

III. FORM W-2, CODE V REPORTING MANDATORY FOR 2003 FORMS W-2

Treasury and the Service determined that none of the alternatives suggested

in the comments received would provide complete and accurate information of

the type that will be reported through the use of Code V. Accordingly, consistent

with Announcement 2001-92, the reporting of compensation resulting from

employer-provided nonstatutory stock options in box 12 of the Form W-2, using

Code V, is mandatory for Forms W-2 issued for the year 2003 and subsequent

years in accordance with the Form W-2 and its instructions.

IV. DRAFTING INFORMATION

The principal author of this announcement is Stephen Tackney of the Office of

Division Counsel/Associate Chief Counsel (Tax Exempt and Government

Entities). For further information regarding this announcement contact Stephen

Tackney at (202) 622-6040 (not a toll-free number).

Вам также может понравиться

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Data DictionaryДокумент260 страниц2008 Data DictionaryIRSОценок пока нет

- US Internal Revenue Service: 2290rulesty2007v4 0Документ6 страницUS Internal Revenue Service: 2290rulesty2007v4 0IRSОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Credit Card Bulk Provider RequirementsДокумент112 страниц2008 Credit Card Bulk Provider RequirementsIRSОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Objectives Report To Congress v2Документ153 страницы2008 Objectives Report To Congress v2IRSОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Chapter 5 - TBTДокумент8 страницChapter 5 - TBTKatKat Olarte100% (2)

- f1040s8 2021Документ3 страницыf1040s8 2021さくら樱花Оценок пока нет

- Bir Ruling (Da 533 07)Документ2 страницыBir Ruling (Da 533 07)Jeffrey JosolОценок пока нет

- Sales Quotation - 221692 - 20230110 - 165855Документ1 страницаSales Quotation - 221692 - 20230110 - 165855Mukesh Krishna VeniОценок пока нет

- The Archewell Foundation 2022 Public DisclosureДокумент47 страницThe Archewell Foundation 2022 Public DisclosureJustin VallejoОценок пока нет

- Marubeni Corp. vs. CIR, G.R. No. 76573, March 7, 1990Документ1 страницаMarubeni Corp. vs. CIR, G.R. No. 76573, March 7, 1990Jacinto Jr Jamero0% (1)

- 1 Disposition of ProceedsДокумент8 страниц1 Disposition of ProceedsFrancis LОценок пока нет

- Amol Srivastava April Income TaxДокумент1 страницаAmol Srivastava April Income TaxRemruata FanaiОценок пока нет

- GST ChallanДокумент1 страницаGST ChallanWilfred DsouzaОценок пока нет

- 3 Collector V de LaraДокумент5 страниц3 Collector V de LaraAngelie ManingasОценок пока нет

- Practice Problems - Transfer TaxesДокумент2 страницыPractice Problems - Transfer TaxesuchishaiОценок пока нет

- Agosto 25Документ1 страницаAgosto 25dakpi479Оценок пока нет

- P&A - Taxation of Retirement BenefitsДокумент2 страницыP&A - Taxation of Retirement BenefitsCkey ArОценок пока нет

- Chapter 6 Donor S TaxДокумент9 страницChapter 6 Donor S Taxkatniss0013Оценок пока нет

- August 2022Документ1 страницаAugust 2022amitdesai92Оценок пока нет

- IcilДокумент2 страницыIcilMuhammad WaseemОценок пока нет

- Description: 1) Who Are Required To File Documentary Stamp Tax Declaration Return?Документ2 страницыDescription: 1) Who Are Required To File Documentary Stamp Tax Declaration Return?cristinatubleОценок пока нет

- BIR Ruling 133-13Документ2 страницыBIR Ruling 133-13Kyra DiolaОценок пока нет

- Working With The Client: CHAPTER 24: Canadian TaxationДокумент36 страницWorking With The Client: CHAPTER 24: Canadian Taxationlily northОценок пока нет

- Ajio 1662606230415Документ1 страницаAjio 1662606230415Subbi ReddyОценок пока нет

- Form 16 AДокумент2 страницыForm 16 ANitya NarayananОценок пока нет

- Aaykar Bhawan, Ist Floor, Kawdiar Po, Thiruvananthapuram, Kerala, 695003 Email: TVM - DCIT.IT@INCOMETAX - GOV.IN, Office Phone:04712566715Документ1 страницаAaykar Bhawan, Ist Floor, Kawdiar Po, Thiruvananthapuram, Kerala, 695003 Email: TVM - DCIT.IT@INCOMETAX - GOV.IN, Office Phone:04712566715vijuОценок пока нет

- Foxwood Company Data For 2014Документ2 страницыFoxwood Company Data For 2014Vermuda VermudaОценок пока нет

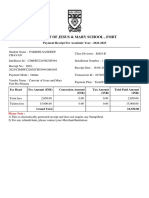

- Convent of Jesus & Mary School, Fort: Payment Receipt For Academic Year - 2022-2023Документ2 страницыConvent of Jesus & Mary School, Fort: Payment Receipt For Academic Year - 2022-2023KDОценок пока нет

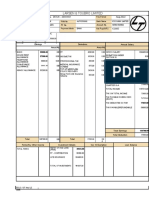

- Reinforced Earth India PVT LTD E-11, B1 EXTN, Mcie Mathura Road, New Delhi NEW DELHI - 110044 Delhi Payslip For April - 2019Документ1 страницаReinforced Earth India PVT LTD E-11, B1 EXTN, Mcie Mathura Road, New Delhi NEW DELHI - 110044 Delhi Payslip For April - 2019Kaushik BiswasОценок пока нет

- U.S. Individual Income Tax Return: Filing StatusДокумент5 страницU.S. Individual Income Tax Return: Filing Statuskristen kindleОценок пока нет

- Income Tax Return Online - WEB ONLINE CAДокумент56 страницIncome Tax Return Online - WEB ONLINE CAwebonlineca2024Оценок пока нет

- 1701Q BIR Form PDFДокумент3 страницы1701Q BIR Form PDFJihani A. SalicОценок пока нет

- Flexible Budget ExampleДокумент2 страницыFlexible Budget Examplebrenica_2000Оценок пока нет

- Various Income Taxes & Income Tax Returns Forms: Group 3 Ortega Angel Duterte Dela Cruz Argonsola Marquez AgustinДокумент26 страницVarious Income Taxes & Income Tax Returns Forms: Group 3 Ortega Angel Duterte Dela Cruz Argonsola Marquez AgustinTophe ProvidoОценок пока нет