Академический Документы

Профессиональный Документы

Культура Документы

US Internal Revenue Service: f8546

Загружено:

IRSИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

US Internal Revenue Service: f8546

Загружено:

IRSАвторское право:

Доступные форматы

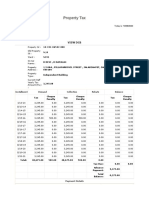

Department of the Treasury - Internal Revenue Service

Form 8546

(Rev. July 2007)

Claim for Reimbursement of Bank Charges Incurred Due to

Erroneous Service Levy or Misplaced Payment Check

Instructions

Please carefully read the instructions on the back of this form and provide the information requested. Use additional

sheet(s) if necessary. Submit this form to the address of the IRS office which served the levy or the address of the office

that misplaced the payment.

1. Name and address of claimant (Number, street, city, state, and ZIP code) 2. Telephone number (including area code)

3. Best time 4. Amount of claim

to call

$

5. Social security or employer identification number

(Disclosure is voluntary. Omission may delay your claim or

prevent locating your records.)

Electronic Funds Transfer (EFT) Information

(See instructions on the back of this form.)

6. Name(s) on bank account 7. American Bankers Association (ABA) number

8. Bank name and address (Number, street, city, state, ZIP code) 9. Bank account number

10. Type of account

Checking Savings

11. Description of claim (State the circumstances which resulted in the loss for which you are claiming reimbursement.)

I certify that the amount of my claim covers only bank charges which resulted from either

Certification an erroneous IRS levy or having to stop payment on a check which was lost or misplaced

by the IRS. I agree to accept this amount in full satisfaction and final settlement of this incident.

12. Signature of claimant (This signature should be used in all future correspondence.) 13. Date of claim

Civil Penalty for Presenting Civil Penalty for Presenting

Fraudulent Claim Fraudulent Claim or Making False Statements

The claimant shall be liable to the United States for the sum of Fine of not more than $10,000 or imprisonment for not more

$2,000 plus double the amount of damages sustained by the than 5 years or both. (See 62 Stat. 698, 749; 18 USC 287, 1001.)

United States. (See R S § 3490, 5438, 31 USC 3729.)

Catalog Number 63488O www.irs.gov Form 8546 (Rev. 7-2007)

Instructions

Please complete all blocks. Write "NONE" if the block does not apply.

Use this form only for reimbursement of bank charges for: Records to support your claim must include bank statements and

correspondence.

1. an erroneous levy, or

2. stopping payment on a check that the IRS lost or misplaced. If you have any questions about this claim, please contact the IRS

office that issued the levy or requested replacement of your

The claimant must sign this form. However, an authorized agent check. The address is on your copy of the levy or the request for

or legal representative can file and sign the claim if the claimant a new check.

can't because of disability, death, or other acceptable reason.

Include proof of authorization if the claim is being filed on behalf If IRS approves your claim, the money can be sent to your bank by

of someone. electronic funds transfer (EFT), or we can send you a check.

Payment by EFT will be faster, safer, and more convenient for you.

Claims must be made within one year of the date the claim If you want us to pay your claim by EFT, we need the bank

accrues and are limited to $1,000. (See 31 USC 3723) information in items 6 through 10. The American Bankers

Association (ABA) number (item 7) is the first nine digits in the

Please attach verification of the amount you are claiming. Include number at the bottom of your checks. If you have no checking

any documentation you may have explaining or acknowledging account, ask your bank what its ABA number is. If you do not

the IRS error. Also, include: complete items 6 through 10, a check will be sent to you.

1. a copy of the levy (if the charges were caused by an

erroneous levy),

2. records showing the bank charges caused by the erroneous

levy or the request for replacement of a lost or misplaced

check, and

3. records showing that the bank charges have been paid.

Internal Revenue Policy P-5-39

Reimbursement of Bank Charges Due to Erroneous Levy and

Service Loss or Misplacement of Taxpayer Checks

The Service recognizes that there are circumstances when an The following criteria must be present in all erroneous levy

erroneous use of its unique enforcement powers may cause tax- cases:

payers to incur certain bank charges. Taxpayers who incur bank (1) The Service acknowledges the levy was erroneous;

charges due to an erroneous levy may file a claim for reimburse- (2) The taxpayers must not have contributed to the continuation

ment of those expenses. Bank charges include a financial institu- or compounding of the error; and

tion's customary charge for complying with the levy instructions (3) Prior to the levy, the taxpayer did not refuse (either orally or

and charges for overdrafts that are a direct consequence of an in writing) to timely respond to Service inquiries or provide infor-

erroneous levy. In addition, there are times when a taxpayer's mation relevant to the liability for which the levy was made.

check may be lost or misplaced in processing. When the Service The following criteria must be present in all lost check cases:

asks for a replacement check, the taxpayer maybe reimbursed (1) The Service acknowledges it lost or misplaced the check

for bank charges incurred in stopping payment on the original during processing;

check. The charges must have been paid by the taxpayer and (2) the Service asks the taxpayer for a replacement of the pay-

must not have been waived or reimbursed by the financial institu- ment; and

tion. Claims must be filed with the District Director or Service (3) the Service is satisfied that the replacement payment has

Center Director within one year after accrual of the expense. been received.

In compliance with the Privacy Act of 1974, the following is provided.

Solicitation of the information is authorized by Title 31 USC claim. We may disclose the information on this form relevant to

3723; 31 CFR 3.20 et seq. Disclosure of the information is the processing of your claim or to any court proceedings resulting

voluntary. from your claim. We may give the information to the Department

of Justice for the purpose of seeking legal advice or recommend-

The principal purpose of this information will be for our internal ing prosecutions for fraudulent claims or the making of false

use in processing your claim under 31 USC 3723, or for any statements.

court proceedings which may ensue from the filing of this

Form 8546 (Rev. 7-2007)

Вам также может понравиться

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Data DictionaryДокумент260 страниц2008 Data DictionaryIRSОценок пока нет

- US Internal Revenue Service: 2290rulesty2007v4 0Документ6 страницUS Internal Revenue Service: 2290rulesty2007v4 0IRSОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Credit Card Bulk Provider RequirementsДокумент112 страниц2008 Credit Card Bulk Provider RequirementsIRSОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Objectives Report To Congress v2Документ153 страницы2008 Objectives Report To Congress v2IRSОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- 2015 Financial ReturnДокумент27 страниц2015 Financial ReturnChad O'CarrollОценок пока нет

- Foundations - Tax Exempt Foundations Their Impact On Our Economy US Gov 1962 140pgs PDFДокумент140 страницFoundations - Tax Exempt Foundations Their Impact On Our Economy US Gov 1962 140pgs PDFjulianbreОценок пока нет

- 3657 Atmpa0825cДокумент5 страниц3657 Atmpa0825cnithinmamidala999Оценок пока нет

- The Price System and The Micro Economy: Ideas For Answers To Progress QuestionsДокумент6 страницThe Price System and The Micro Economy: Ideas For Answers To Progress QuestionsChristy NyenesОценок пока нет

- Babylon Is Fallen For DummiesДокумент12 страницBabylon Is Fallen For Dummiesadequatelatitude1715Оценок пока нет

- Politics of Economic Growth in India, 1980-2005: Part II: The 1990s and BeyondДокумент10 страницPolitics of Economic Growth in India, 1980-2005: Part II: The 1990s and BeyondDinesh KumarОценок пока нет

- Acc f125 Bir Computation 2019Документ33 страницыAcc f125 Bir Computation 2019AlliyahLynneUlepCorcueraОценок пока нет

- Hoover Digest, 2013, No. 4, FallДокумент175 страницHoover Digest, 2013, No. 4, FallHoover Institution100% (1)

- Modeling Peak ProfitabiliytДокумент23 страницыModeling Peak ProfitabiliytBrentjaciow100% (1)

- EOI NoДокумент72 страницыEOI NoMurali GawandeОценок пока нет

- Hector SДокумент3 страницыHector SFerrer Benedick50% (2)

- Bir 1600Документ13 страницBir 1600Adelaida TuazonОценок пока нет

- Carbide Chemical Company-Replacement of Old Machines-Discounting of CashflowsДокумент1 страницаCarbide Chemical Company-Replacement of Old Machines-Discounting of CashflowsRajib Dahal50% (2)

- Temporal Goods NotesДокумент21 страницаTemporal Goods NotesAdriano Tinashe Tsikano80% (5)

- Air India Final ProjectДокумент51 страницаAir India Final Projectaditya jainОценок пока нет

- U.S. vs. Tommy CryerДокумент7 страницU.S. vs. Tommy CryerBetty TaylorОценок пока нет

- Direct Tax Case LawsДокумент54 страницыDirect Tax Case LawsHemanath NarayanaОценок пока нет

- Data Analytics For Accounting, 2nd Edition Vernon Richardson PDFДокумент1 026 страницData Analytics For Accounting, 2nd Edition Vernon Richardson PDFjie100% (1)

- 22Документ2 страницы22TWCОценок пока нет

- Certificate Action in Service TAxДокумент3 страницыCertificate Action in Service TAxSUSHIL KUMARОценок пока нет

- House Tax ReceiptДокумент2 страницыHouse Tax ReceiptAkshaya Raman RamОценок пока нет

- Sensata Technologies Holland B.V: InvoiceДокумент2 страницыSensata Technologies Holland B.V: InvoiceDayana IvanovaОценок пока нет

- Marketing Audit.Документ6 страницMarketing Audit.abdulwahab harunaОценок пока нет

- 中美冠科與JSR Corporation合併案投資人問答 PDFДокумент6 страниц中美冠科與JSR Corporation合併案投資人問答 PDF段潔帆 JessieОценок пока нет

- List of Importables ExcelДокумент4 страницыList of Importables ExcelRACОценок пока нет

- EthiopiaДокумент46 страницEthiopiaace187Оценок пока нет

- Joy Global Inc: FORM 10-KДокумент123 страницыJoy Global Inc: FORM 10-KfiahstoneОценок пока нет

- Invoice IFBДокумент1 страницаInvoice IFBarindam kumarОценок пока нет

- CMC Global - Offer Letter - Mr. Nguyen Huu Phuoc - 170122Документ1 страницаCMC Global - Offer Letter - Mr. Nguyen Huu Phuoc - 170122kamusuyurikunОценок пока нет

- LOC Taxed Under ITAДокумент3 страницыLOC Taxed Under ITARizhatul AizatОценок пока нет