Академический Документы

Профессиональный Документы

Культура Документы

US Internal Revenue Service: p2053b

Загружено:

IRSИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

US Internal Revenue Service: p2053b

Загружено:

IRSАвторское право:

Доступные форматы

Community Based Outlet Programs

The Internal Revenue Service and local community businesses and

government across the United States are working together to make

General Assistance Information

tax materials available to the public.

Copy Center Program

Copy centers and office supply stores can offer

taxpayers a wide variety of tax products for

photocopying. 80 Million People Know the Quick, Easy,

Smart Way to Prepare and File Their Taxes

Credit Union Program

IRS e-file is the fastest, easiest and most convenient way to prepare

The IRS provides credit unions and banks with a and file your income tax return. Explore why almost 60 percent of

selection of reproducible tax materials for copying taxpayers have already e-filed their returns and have reaped these

by their members. special benefits.

What are the benefits?

Grocery Store/Pharmacy Program o Split your refund among up to three accounts with Direct Deposit

and get your return in as little as 10 days.

Popular laminated tax forms that attach to a copy

o Sign your return electronically and file a completely paperless,

machine are available to grocery stores and

environmentally friendly return.

pharmacies.

o Receive an acknowledgement from the IRS within 48 hours that

your return was accepted.

Local Government Program

o File now and pay later – schedule an electronic funds withdrawal

Local government agencies can provide a variety of from your checking or savings account or pay by credit card.

reproducible tax products for copying and provide o Prepare and file your Federal and State returns together, saving

access to federal tax materials and information. you time.

Free File is another benefit of IRS e-file and it allows eligible taxpayers

Corporate Program to prepare and send their federal returns for FREE! If you have an

Adjusted Gross income of $54,000 or less, you qualify for Free File

Employers can provide tax materials to employees services. Other low-cost electronic filing options are available on our

of 100 or more by allowing access to the Publication Partners Page at www.irs.gov for those not qualified to Free File.

1796, IRS Tax Products CD, by either using the CD

on a personal computer or local area network. For more information about fast, convenient electronic filing and pay-

ment methods, visit www.irs.gov.

For further information on the above free programs, IRS e-file, THE ENVIRONMENTALLY FRIENDLY WAY

contact our Customer Service Representatives at

TO PREPARE AND FILE YOUR TAXES

1-800-829-2765.

Earned Income Tax Credit (EITC) Taxpayer Advocate Service

The Taxpayer Advocate Service is an independent organization within

If you are a computer user, use the EITC Assistant, an interactive the IRS whose employees assist taxpayers who are experiencing

tool that shows you whether or not you qualify for the EITC, and why. economic harm, who are seeking help in resolving tax problems that

Available in English and Spanish on www.irs.gov/eitc. Or call have not been resolved through normal channels, or who believe that

1-800-829-3676 for a free copy of IRS Publication 596. an IRS system or procedure is not working as it should.

You can reach the Taxpayer Advocate Service by calling toll–free

Taxpayer Advocacy Panel (TAP) 1-877-777-4778 or TTY/TTD 1-800-829-4059 to see if you are eligible.

You can call or write to your Local Taxpayer Advocate, whose phone

The IRS Taxpayer Advocacy Panel is an independent volunteer number and address are listed in your local telephone directory and

advisory group appointed by the Secretary of the Treasury. The TAP in IRS Publication 1546, The Taxpayer Advocate Service of the IRS

assists the IRS in identifying ways and methodologies of improving - How to Get Help With Unresolved Tax Problems. You may also

service and customer satisfaction. For more information, visit their request that an IRS employee complete Form 911 on your behalf.

web site at www.improveirs.org. For more information go to www.irs.gov/advocate.

Department of the Treasury Publication 2053-B (Rev. 10-2007)

Internal Revenue Service Catalog Number 30494A

www.irs.gov

5

TLS, have you I.R.S. SPECIFICATIONS TO BE REMOVED BEFORE PRINTING

transmitted all R Action Date Signature

text files for this INSTRUCTIONS TO PRINTERS

cycle update? PUBLICATION 2053A, PAGE 1 OF 2 (page 2 is blank)

MARGINS; TOP 13mm (1/2"), CENTER SIDES. PRINTS: HEAD TO HEAD O.K. to print

PAPER: WHITE WRITING, SUB. 20. INK: BLACK

FLAT SIZE: 216mm (8-1/2") x 279mm (11")

Date PERFORATE: None Revised proofs

DO NOT PRINT — DO NOT PRINT — DO NOT PRINT — DO NOT PRINT requested

Quick and Easy Access to IRS Tax Help and Tax Products

Internet Online Services & Help View & Download Products

You can access the Go to www.irs.gov to: Click on “More Forms and Publications” or go to

● Access Free File, a free commercial income tax www.irs.gov/formspubs

IRS website 24 hours a

day, 7 days a week at preparation and electronic filing service ● For forms and instructions, click on “Form and

www.irs.gov available to eligible taxpayers Instruction number”

● Check the status of your refund, click on ● For publications, click on “Publication number”

“Where’s My Refund” ● For a subject index to forms, instructions, and

● See answers to many questions, click on publications, click on “Topical index”

“Frequently Asked Questions” ● For prior year forms, instructions, and

● Figure your withholding allowances using the publications, click on “Previous years”

s.gov Withholding Calculator at

www.ir www.irs.gov/individuals

➪

● See e-News Subscriptions to get the latest tax Online Ordering of Products

news on a variety of topics by e-mail To order Tax Products delivered by mail, go to

● Send us comments or request help by e-mail www.irs.gov/formspubs

● Get disaster relief information, keyword ● For current year products, click on “Forms and

“Disaster” publications by U.S. mail”

● Safeguard your privacy, keyword “Privacy ● For a tax booklet of forms and instructions,

Policy” click on “Tax packages”

● For Employer Products (e.g. W-4, Pub. 15) and

Information Returns (e.g. W-2, W-3, 1099

series), click on “Employer forms and

Instructions”

● For tax products on a CD, click on “Tax

products on CD-ROM (Pub. 1796)”

See CD/DVD below

Tax Forms & Publications Tax Help & Questions

Telephone

1-800-829-3676 Individuals: 1-800-829-1040

Call to order current and prior year forms, Business & Specialty Tax: 1-800-829-4933

instructions, and publications. Hearing Impaired TTY/TDD: 1-800-829-4059

You should receive your order within 10 working TeleTax - 24 hour tax information:

days. 1-800-829-4477

See instructions 1040, 1040A, or 1040EZ for topic

numbers and details.

Refund Hotline: 1-800-829-1954

Community You can pick up some of the most requested forms,

instructions, and publications at many IRS offices,

Also some grocery stores, copy centers, city and

county government offices, and credit unions have

Locations post offices, and libraries. reproducible tax form products available to

photocopy or print from a CD.

Mail You can receive tax products within 10 working

days after receipt of your order.

National Distribution Center

P.O. Box 8903

Send written request to: Bloomington, IL 61702-8903

● NTIS at 1-877-233-6767

CD/DVD Purchase the IRS Publication 1796 (IRS Tax

Products CD) including a bonus: IRS Tax Products

Telephone:

or

DVD.

● GPO at 1-866-512-1800

Internet:

● National Technical Information Service (NTIS) Availability: First release—early January 2008

at www.irs.gov/cdorders Final release—early March 2008

(*includes IRS Tax Products DVD)

or

● Government Printing Office (GPO) at This CD does not support electronic filing.

http://bookstore.gpo.gov (search for Pub. 1796)

Department of the Treasury

Internal Revenue Service

www.irs.gov

Вам также может понравиться

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- David J StiansenДокумент2 страницыDavid J StiansengaryОценок пока нет

- E-Business Tax Application SetupДокумент25 страницE-Business Tax Application Setuprasemahe4100% (1)

- Chapter 11 Current LiabilitiesДокумент51 страницаChapter 11 Current LiabilitiesMuhammad DanishОценок пока нет

- Revenue Audit Memorandum Order 1-95Документ6 страницRevenue Audit Memorandum Order 1-95azzy_km100% (1)

- FABM2 Q2 MOD3 Income and Business Taxation 1Документ27 страницFABM2 Q2 MOD3 Income and Business Taxation 1Minimi Lovely33% (3)

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- 2008 Data DictionaryДокумент260 страниц2008 Data DictionaryIRSОценок пока нет

- US Internal Revenue Service: 2290rulesty2007v4 0Документ6 страницUS Internal Revenue Service: 2290rulesty2007v4 0IRSОценок пока нет

- 2008 Objectives Report To Congress v2Документ153 страницы2008 Objectives Report To Congress v2IRSОценок пока нет

- 2008 Credit Card Bulk Provider RequirementsДокумент112 страниц2008 Credit Card Bulk Provider RequirementsIRSОценок пока нет

- TAX QUIZ 1 ReviewerДокумент8 страницTAX QUIZ 1 ReviewerArrianne ObiasОценок пока нет

- Hemarus Industries Income Tax Declaration Form SummaryДокумент4 страницыHemarus Industries Income Tax Declaration Form SummaryShashi NaganurОценок пока нет

- Tax 04 10 Estate TaxationДокумент9 страницTax 04 10 Estate TaxationLab Dema-alaОценок пока нет

- Flexible Spending Account (FSA) Frequently Asked Questions: WWW - Irs.govДокумент2 страницыFlexible Spending Account (FSA) Frequently Asked Questions: WWW - Irs.govRobinhoodОценок пока нет

- CV Raun Sintiya Daftar Akun Periode 31 Desember 2021Документ4 страницыCV Raun Sintiya Daftar Akun Periode 31 Desember 2021BeertyavrillianОценок пока нет

- PLEDGELTR11711Документ1 страницаPLEDGELTR11711MarkYamaОценок пока нет

- Types of EmploymentДокумент17 страницTypes of EmploymentDylan GonzalezОценок пока нет

- Scanner CAP II Income Tax VATДокумент162 страницыScanner CAP II Income Tax VATEdtech NepalОценок пока нет

- General Income Statement Format and Types of LeverageДокумент8 страницGeneral Income Statement Format and Types of LeverageNawazish KhanОценок пока нет

- Employee Declaration Form 11-12Документ3 страницыEmployee Declaration Form 11-12Amit KhotОценок пока нет

- PRINCIPLES OF TAXATIONДокумент6 страницPRINCIPLES OF TAXATIONGerard Relucio OroОценок пока нет

- Tax Invoice for Noise ColorFit Pro 3 SmartwatchДокумент1 страницаTax Invoice for Noise ColorFit Pro 3 SmartwatchbadboyОценок пока нет

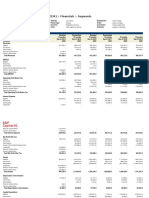

- Dangote Cement PLC NGSE DANGCEM Financials SegmentsДокумент6 страницDangote Cement PLC NGSE DANGCEM Financials SegmentsDavid HundeyinОценок пока нет

- Taxation Document SummaryДокумент7 страницTaxation Document SummaryPutera IzwanОценок пока нет

- Settlement Commissionb Tax FDДокумент15 страницSettlement Commissionb Tax FDhani diptiОценок пока нет

- CIR vs. Primetown Property GroupДокумент3 страницыCIR vs. Primetown Property GroupRobОценок пока нет

- Analysis of Pakistan's 7th National Finance Commission AwardДокумент24 страницыAnalysis of Pakistan's 7th National Finance Commission Awardfaw03Оценок пока нет

- Banas, Jr. V CA Banas, Jr. V CA: B2022 Reports Annotated VOL 55 (10 February 2000)Документ3 страницыBanas, Jr. V CA Banas, Jr. V CA: B2022 Reports Annotated VOL 55 (10 February 2000)carlo del mundoОценок пока нет

- BCTA UJ Question PaperДокумент10 страницBCTA UJ Question PaperFresh LoverzzОценок пока нет

- FDI in Nepal FinalДокумент6 страницFDI in Nepal FinalBidur GautamОценок пока нет

- Qrmp-Scheme NovДокумент2 страницыQrmp-Scheme NovVishwanath HollaОценок пока нет

- Santosh Ulpi - May 2023 - BillДокумент4 страницыSantosh Ulpi - May 2023 - BillSantosh UlpiОценок пока нет

- Unit 18Документ20 страницUnit 18Raja SahilОценок пока нет

- Over Not Over Tax: Basic Income Table (Tax Code, Section 24 A)Документ2 страницыOver Not Over Tax: Basic Income Table (Tax Code, Section 24 A)Juliana ChengОценок пока нет

- Taxation policies' effect on employee investment practicesДокумент64 страницыTaxation policies' effect on employee investment practicesprashanthОценок пока нет