Академический Документы

Профессиональный Документы

Культура Документы

US Internal Revenue Service: F1040a - 1997

Загружено:

IRSИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

US Internal Revenue Service: F1040a - 1997

Загружено:

IRSАвторское право:

Доступные форматы

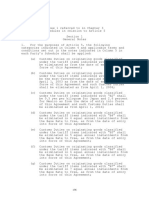

Form Department of the Treasury—Internal Revenue Service

1040A (99) U.S. Individual Income Tax Return 1997 IRS Use Only—Do not write or staple in this space.

Label (See page 14.) Use the IRS label. Otherwise, please print in ALL CAPITAL LETTERS. OMB No. 1545-0085

Your first name Init. Last name Your social security number

L

- -

A If a joint return, spouse’s first name Init. Last name Spouse’s social security number

B

E - -

L

Home address (number and street). If you have a P.O. box, see page 14. Apt. no.

H For Privacy Act and

E Paperwork

R City, town or post office. If you have a foreign address, see page 14. State ZIP code

E Reduction Act

- Notice, see page 42.

Presidential Election Campaign Fund (See page 14.) Yes No Note: Checking “Yes” will

Do you want $3 to go to this fund? not change your tax or

If a joint return, does your spouse want $3 to go to this fund? reduce your refund.

1 Single

2 Married filing joint return (even if only one had income)

3 Married filing separate return. Enter spouse’s social security number

above and full name here. ©

4 Head of household (with qualifying person). (See page 15.) If the qualifying person is a child but not your

dependent, enter this child’s name here. ©

5 Qualifying widow(er) with dependent child (year spouse died © 19 ). (See page 16.)

%

6a Yourself. If your parent (or someone else) can claim you as a dependent on his or her tax return, do not

check box 6a. No. of boxes

checked on

b Spouse 6a and 6b

c Dependents. If more than six dependents, see page 16. (3) Dependent’s (4) No. of No. of your

(2) Dependent’s social relationship months children on

lived in your 6c who:

security number to you home in 1997

(1) First name Last name ● lived with

you

- -

● did not live

- - with you due

to divorce

or separation

- - (see page 17)

- - Dependents

on 6c not

- - entered above

- - Add numbers

entered in

d Total number of exemptions claimed © boxes above

Dollars Cents

7 Wages, salaries, tips, etc. Attach Form(s) W-2. 7 , .

8a Taxable interest income. Attach Schedule 1 if required. 8a , .

b Tax-exempt interest. DO NOT include on line 8a. 8b , .

9 Dividends. Attach Schedule 1 if required. 9 , .

*71A5AAA1*

10a Total IRA 10b Taxable amount

distributions. 10a , . (see page 19). 10b , .

11a Total pensions 11b Taxable amount

and annuities. 11a , . (see page 19). 11b , .

12 Unemployment compensation. 12 , .

13a Social security 13b Taxable amount

benefits. 13a , . (see page 21). 13b , .

14 Add lines 7 through 13b (far right column). This is your total income. © 14 , .

15 IRA deduction (see page 21). 15 , .

16 Subtract line 15 from line 14. This is your adjusted gross income.

If under $29,290 (under $9,770 if a child did not live with you), see the

EIC instructions on page 27. © 16 , .

Attach Copy B of W-2 and 1099-R here. Cat. No. 11327A 1997 Form 1040A

1997 Form 1040A page 2

17 Enter the amount from line 16. 17 , .

18a Check

if: $

You were 65 or older

Spouse was 65 or older

Blind

Blind % Enter number of

boxes checked © 18a

b If you are married filing separately and your spouse itemizes deductions,

see page 23 and check here © 18b

19 Enter the standard deduction for your filing status. But see page 24 if you checked

any box on line 18a or 18b OR someone can claim you as a dependent.

● Single—4,150 ● Married filing jointly or Qualifying widow(er)—6,900

● Head of household—6,050 ● Married filing separately—3,450 19 , .

20 Subtract line 19 from line 17. If line 19 is more than line 17, enter 0. 20 , .

21 Multiply $2,650 by the total number of exemptions claimed on line 6d. 21 , .

22 Subtract line 21 from line 20. If line 21 is more than line 20, enter 0. This is your taxable income.

If you want the IRS to figure your tax, see page 24. © 22 , .

23 Find the tax on the amount on line 22 (see page 24). 23 , .

24a Credit for child and dependent care expenses. Attach Schedule 2. 24a , .

b Credit for the elderly or the disabled. Attach Schedule 3. 24b , .

c Adoption credit. Attach Form 8839. 24c , .

d Add lines 24a, 24b, and 24c. These are your total credits. 24d , .

25 Subtract line 24d from line 23. If line 24d is more than line 23, enter 0. 25 , .

26 Advance earned income credit payments from Form(s) W-2. 26 , .

27 Household employment taxes. Attach Schedule H. 27 , .

28 Add lines 25, 26, and 27. This is your total tax. © 28 , .

29a Total Federal income tax withheld from Forms W-2 and 1099. 29a , .

b 1997 estimated tax payments and amount applied from 1996 return. 29b , .

c Earned income credit. Attach Schedule EIC if you have a qualifying child. 29c , .

d Nontaxable earned income: amount © , . and type ©

e Add lines 29a, 29b, and 29c. These are your total payments. © 29e , .

30 If line 29e is more than line 28, subtract line 28 from line 29e. This is the amount you overpaid. 30 , .

31a Amount of line 30 you want refunded to you. If you want it directly deposited, see 31a , .

page 33 and fill in 31b, 31c, and 31d.

b Routing

number c Type: Checking Savings

d Account

number

32 Amount of line 30 you want applied to your 1998 estimated tax. 32 , .

*71A5AAA2*

33 If line 28 is more than line 29e, subtract line 29e from line 28. This is the amount you

owe. For details on how to pay, see page 34. 33 , .

34 Estimated tax penalty (see page 34). 34 .

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the

Sign best of my knowledge and belief, they are true, correct, and accurately list all amounts and sources of income I received during

the tax year. Declaration of preparer (other than the taxpayer) is based on all information of which the preparer has any knowledge.

here

©

Your signature Date Your occupation

Keep a copy of Spouse’s signature. If joint return, BOTH must sign. Date Spouse’s occupation

this return for

your records.

©

Date Preparer’s SSN

Paid Preparer’s Check if

preparer’s signature self-employed - -

use only

©

Firm’s name (or yours EIN -

if self-employed) and

ZIP

address

code -

Вам также может понравиться

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Credit Card Bulk Provider RequirementsДокумент112 страниц2008 Credit Card Bulk Provider RequirementsIRSОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Документ6 страницUS Internal Revenue Service: 2290rulesty2007v4 0IRSОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Objectives Report To Congress v2Документ153 страницы2008 Objectives Report To Congress v2IRSОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Data DictionaryДокумент260 страниц2008 Data DictionaryIRSОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Picasso OperatingInstructions Manual 211018 WEBДокумент27 страницPicasso OperatingInstructions Manual 211018 WEBBill McFarlandОценок пока нет

- EIV Operation ManualДокумент339 страницEIV Operation ManualJJSОценок пока нет

- Opposition To Motion For Judgment On PleadingsДокумент31 страницаOpposition To Motion For Judgment On PleadingsMark Jaffe100% (1)

- Aling MODEДокумент29 страницAling MODEBojan PetronijevicОценок пока нет

- Pipes On DeckДокумент34 страницыPipes On DeckNataly Janataly100% (1)

- Contingent Liabilities For Philippines, by Tarun DasДокумент62 страницыContingent Liabilities For Philippines, by Tarun DasProfessor Tarun DasОценок пока нет

- 3500 System Datasheet: Bently Nevada Asset Condition MonitoringДокумент11 страниц3500 System Datasheet: Bently Nevada Asset Condition MonitoringRujisak MuangsongОценок пока нет

- Epsilon Range Bomba HorizontalДокумент8 страницEpsilon Range Bomba HorizontalsalazarafaelОценок пока нет

- BS en 12285-1-2003 (2006)Документ162 страницыBS en 12285-1-2003 (2006)dahzahОценок пока нет

- Test Help StatДокумент18 страницTest Help Statthenderson22603Оценок пока нет

- a27272636 s dndjdjdjd ansjdns sc7727272726 wuqyqqyyqwywyywwy2ywywyw6 4 u ssbsbx d d dbxnxjdjdjdnsjsjsjallospspsksnsnd s sscalop sksnsks scslcoapa ri8887773737372 d djdjwnzks sclalososplsakosskkszmdn d ebwjw2i2737721osjxnx n ksjdjdiwi27273uwzva sclakopsisos scaloopsnx_01_eДокумент762 страницыa27272636 s dndjdjdjd ansjdns sc7727272726 wuqyqqyyqwywyywwy2ywywyw6 4 u ssbsbx d d dbxnxjdjdjdnsjsjsjallospspsksnsnd s sscalop sksnsks scslcoapa ri8887773737372 d djdjwnzks sclalososplsakosskkszmdn d ebwjw2i2737721osjxnx n ksjdjdiwi27273uwzva sclakopsisos scaloopsnx_01_eRed DiggerОценок пока нет

- Ped Med HandbookДокумент27 страницPed Med HandbookSoad Shedeed0% (1)

- People V AlfecheДокумент4 страницыPeople V Alfechemark kenneth cataquizОценок пока нет

- Electronics World 1962 11Документ114 страницElectronics World 1962 11meisterwantОценок пока нет

- MetasploitДокумент9 страницMetasploitDhamlo KheralaОценок пока нет

- 150 67-Eg1Документ104 страницы150 67-Eg1rikoОценок пока нет

- San Miguel ReportДокумент8 страницSan Miguel ReportTraveller SpiritОценок пока нет

- 1-Page TimeBoxing Planner v2.0Документ2 страницы1-Page TimeBoxing Planner v2.0ash.webstarОценок пока нет

- sb485s rs232 A rs485Документ24 страницыsb485s rs232 A rs485KAYCONSYSTECSLA KAYLA CONTROL SYSTEMОценок пока нет

- Unilift de DGDДокумент36 страницUnilift de DGDLove SemsemОценок пока нет

- Clark Hess1Документ668 страницClark Hess1Jeyner Chavez VasquezОценок пока нет

- HSTE User GuideДокумент26 страницHSTE User GuideAnca ToleaОценок пока нет

- (L) Examples of Machine Shop Practice (1910)Документ54 страницы(L) Examples of Machine Shop Practice (1910)Ismael 8877100% (1)

- LTE Radio Network Design Guideline (FDD)Документ33 страницыLTE Radio Network Design Guideline (FDD)Tri Frida NingrumОценок пока нет

- Contoh CV Pelaut Untuk CadetДокумент1 страницаContoh CV Pelaut Untuk CadetFadli Ramadhan100% (1)

- HCL Corporate-PresentationДокумент14 страницHCL Corporate-Presentationtony_reddyОценок пока нет

- Robert Plank's Super SixДокумент35 страницRobert Plank's Super SixkoyworkzОценок пока нет

- Revised Full Paper - Opportunities and Challenges of BitcoinДокумент13 страницRevised Full Paper - Opportunities and Challenges of BitcoinREKHA V.Оценок пока нет

- Assignment On Industrial Relation of BDДокумент12 страницAssignment On Industrial Relation of BDKh Fahad Koushik50% (6)