Академический Документы

Профессиональный Документы

Культура Документы

Klein, Ramseyer, Bainbridge 5th Ed Outline

Загружено:

Nathaniel WestАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Klein, Ramseyer, Bainbridge 5th Ed Outline

Загружено:

Nathaniel WestАвторское право:

Доступные форматы

http://www.scribd.

com/doc/16459948/Business-Organizations-Outline-Spring-2009

BUSINESS ASSOCIATIONS OUTLINE

Business Associations

Southwestern University School of Law – SCALE I and II

Ted Finamore

Text: Business Associations 5th Edition by Klein, Ramseyer & Bainbridge

Table of Contents

I. Overview of Business Associations.........................................................................................5

A. Are Corporate Lawyers Necessary?.......................................................................................5

B. The Transaction Cost Trade-Off.............................................................................................6

C. Structuring a Business Association........................................................................................6

D. Summary: Introduction to Business Associations..................................................................7

II. AGENCY – THE BUILDING BLOCK OF FIRMS.......................................................................8

I. Who is an Agent?.......................................................................................................................8

II. Liability of Principal to Third Parties in Contract...................................................................9

B. AUTHORITY..........................................................................................................................9

C. Apparent Authority.................................................................................................................9

D. Inherent Authority.................................................................................................................10

E. Authority Summary...............................................................................................................13

F. Ratification............................................................................................................................14

G. Estoppel...............................................................................................................................15

H. Agent’s Liability on Contract.................................................................................................16

I. Summary – Agency Relationship/Liability of Principal in Contracts.......................................16

III. Liability of Principal to Third Parties in Tort........................................................................17

J. What is the Justification for Imposing Liability?.....................................................................17

K. Servant Versus Independent Contractor..............................................................................18

L. Tort Liability and Apparent Agency.......................................................................................19

M. Scope of Employment..........................................................................................................20

N. Statutory Claims...................................................................................................................22

O. Liability for Torts of Independent Contractors......................................................................22

IV. FIDUCIARY OBLIGATIONS OF AGENTS.............................................................................23

P. Duties During Agency...........................................................................................................23

Q. Duties During and After Termination of Agency: Herein of “Grabbing and Leaving”Agency

.....................................................................................................................................24

R. Recap of Agents’ Fiduciary Duties: Miracle on 34th Street.................................................24

S. Summary - Liability of Principal in Torts/Fiduciary Duties of Agents.....................................25

III. PARTNERSHIPS.....................................................................................................................26

A. What is a Partnership? And Who Are the Partners?...........................................................26

B. Partners Compared With Employees...................................................................................30

C. Partners Compared With Lenders........................................................................................32

D. PARTNERSHIP BY ESTOPPEL..........................................................................................34

IV. II. The Fiduciary Obligations of Partners............................................................................34

A. Introduction..........................................................................................................................34

B. After Dissolution...................................................................................................................36

C. Grabbing and Leaving..........................................................................................................36

D. Expulsion.............................................................................................................................37

More Free Outlines: http://c.finamore.home.comcast.net or http://finamore.net

BUSINESS ASSOCIATIONS OUTLINE

E. Summary - Introduction to Partnerships/ Partners’ Fiduciary Duties....................................38

V. III. Partnership Property........................................................................................................38

A. Introduction..........................................................................................................................38

B. Liability in a Partnership.......................................................................................................39

VI. IV. Partnership Capital.........................................................................................................40

A. Overview..............................................................................................................................40

B. Raising Additional Capital....................................................................................................41

VII. V. The Rights of Partners in Management.........................................................................43

VIII. V. Partnership Dissolution.................................................................................................46

A. The Right to Dissolve...........................................................................................................46

B. The Consequences of Dissolution........................................................................................49

C. The Sharing of Losses.........................................................................................................53

D. Buy-out agreements.............................................................................................................53

E. Law Partnership Dissolutions...............................................................................................55

IX. VII. Limited Partnerships......................................................................................................56

X. THE CORPORATION...............................................................................................................58

A. Main Attributes.....................................................................................................................58

B. Comparing Partnerships and Corporations..........................................................................58

C. Public v. Close Corporations................................................................................................58

D. Introduction to the Corporation: ...........................................................................................59

E. Applicable Law.....................................................................................................................60

F. Mechanics of Forming a Corporation....................................................................................60

G. Liability for Pre-Incorporation Activity...................................................................................60

H. “Defective Corporations”......................................................................................................62

I. Enterprise Liability.................................................................................................................64

J. Agency..................................................................................................................................65

K. Piercing the Corporate Veil (PCV)........................................................................................65

L. Justifications for PCV: Contract Creditors............................................................................65

M. Comparing Our Suggested Rationale with the Case Law....................................................66

XI. Introduction to the Corporation: Summary Overview of Issues.......................................69

B. Derivative Actions.................................................................................................................71

C. Introduction – Fiduciary Duty to Corporations......................................................................71

D. Three Hurdles For Derivative Actions:.................................................................................72

E. First Hurdle: Security Req’t..................................................................................................72

F. Second Hurdle: Demand Requirement.................................................................................73

G. The Business Judgment Rule (BJR)....................................................................................75

H. The Demand Requirement in Derivative Actions (Accountability vs Strike Suits)................76

I. The Demand Requirement under MBCA...............................................................................76

J. The Demand Requirement under Delaware Law..................................................................76

K. Excusing the Demand Requirement under Delaware Law ..................................................77

L. Excusing the Demand Requirement under NY Law (Marx v. Akers)....................................77

M. Special Litigation Committees (SLCs).................................................................................78

N. Dismissing Derivative Actions Delaware vs. NY vs. MBCA..................................................78

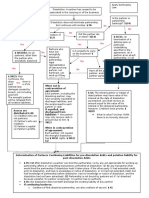

O. Derivative Action Flowchart.................................................................................................78

P. Derivatives Recap ...............................................................................................................81

XII. The Role and Purposes of Corporations............................................................................84

A. Capital Structure 1/12/2005..................................................................................................84

B. Rights of a Shareholder 1/14/2005.......................................................................................85

C. Shareholder Rights (Knipprath) 1/21/2005 1/24/2005........................................................85

More Free Outlines: http://c.finamore.home.comcast.net or http://finamore.net

56932621.doc The Last FUCKING CORPORATIONS CLASS I’LL EVER TAKE! Page 2 of 255

BUSINESS ASSOCIATIONS OUTLINE

D. Change in Control................................................................................................................87

E. Capital Structure Terminology..............................................................................................89

F. Special Types of Securities: Preferred Shares.....................................................................89

G. Special Types of Securities: Convertible Bonds..................................................................90

H. Special Types of Securities: Warrants.................................................................................91

XIII. Introduction to the Corporation: Overview of Issues.......................................................92

A. Forming the Corporation......................................................................................................92

B. Independent Legal Personality.............................................................................................92

C. Separation of Ownership and Control..................................................................................92

D. One last BA type: The Limited Liability Company 1/12/2005...............................................92

E. Hierarchy of Legal Sources .................................................................................................92

F. Governance of the Corporation: Separation of Ownership & Control..................................93

G. Corporate Powers ...............................................................................................................93

H. Corporate Purpose ..............................................................................................................93

I. Stakeholders in the Corporation ...........................................................................................94

J. Centralized Management and the Business Judgment Rule................................................94

XIV. Comparing Partnerships and Corporations: Development of the LLC.........................97

B. Piercing the LLC Veil ...........................................................................................................99

C. LLC Dissolution..................................................................................................................100

D. Duty of Care.......................................................................................................................101

E. Knipprath Fiduciary Duty Summary Review ......................................................................112

F. Duty of Loyalty....................................................................................................................112

G. Corporate Opportunity.......................................................................................................114

H. Ratification.........................................................................................................................116

I. Rule 10b-5 of Exchange Act 1934.....................................................................................117

J. Duty of Care........................................................................................................................119

K. Duty of Loyalty...................................................................................................................122

L. Dominant Shareholders and Parent-Subsidiary Dealings...................................................124

M. Intermediate Standard in Takeover context.......................................................................127

N. Prüfungsaufbau..................................................................................................................128

XV. DISCLOSURE AND FAIRNESS: FEDERAL SECURITIES REGULATION........................128

A. Definition of a Security.......................................................................................................128

B. Registration process...........................................................................................................130

C. Liability under 1933 Act......................................................................................................132

D. Rule 10b-5 of Exchange Act 1934......................................................................................134

E. Insider Trading...................................................................................................................141

F. Short-Swing Profits.............................................................................................................146

XVI. INDEMNIFICATION AND INSURANCE ............................................................................148

XVII. §7. The Question of Corporate Control.........................................................................153

A. PROXY FIGHTS.................................................................................................................153

B. Strategic Use of Proxies.....................................................................................................154

C. Private Actions for Proxy-Rule Violations...........................................................................155

D. Shareholder Proposals.......................................................................................................155

E. Shareholder Inspection Rights Cases................................................................................157

XVIII. PROBLEMS OF CONTROL.............................................................................................158

A. Shareholders Voting Control..............................................................................................158

B. Controlling Shareholders/Transfer of Control.....................................................................158

C. General authorization of transfer of control, except fraud, bad faith or looting:..................159

D. Limitation on transfers of control involving sacrifice of some of the corporation’s assets...160

More Free Outlines: http://c.finamore.home.comcast.net or http://finamore.net

56932621.doc The Last FUCKING CORPORATIONS CLASS I’LL EVER TAKE! Page 3 of 255

BUSINESS ASSOCIATIONS OUTLINE

E. Limitation On Transfers Of Control Made Without Any Compelling Business Purpose At The

Expense Of The Minority...........................................................................................161

F. Illegal Sale of Office without Sale of Control.......................................................................161

G. Control Problems in Close Corporations...........................................................................162

H. Ex Ante Solutions: Contractual Provisions/Agreements....................................................163

I. Long-Term Shareholder Tenure and Salary Agreements....................................................164

J. Comprehensive Shareholder Agreements..........................................................................165

K. Ex Post Solutions: Heightened Fiduciary Duties among Shareholders..............................167

L. Wilkes Doctrine...................................................................................................................168

M. ABUSE OF CONTROL IN CLOSELY HELD CORPORATIONS.......................................170

N. Squeeze-out Merger..........................................................................................................170

O. Control of the corporation..................................................................................................170

XIX. COUNTERMEASURES – CONTROL, DURATION & STATUTORY DISSOLUTION........172

A. Constructive Dividends as an Equitable Remedy...............................................................172

B. Statutory Dissolution..........................................................................................................172

XX. MERGERS AND ACQUISITIONS........................................................................................174

A. Mergers 1/26/2005............................................................................................................174

B. Sale of Assets....................................................................................................................175

C. Tender Offer/Takeover.......................................................................................................177

D. Appraisal Remedy..............................................................................................................177

E. Defacto Merger..................................................................................................................177

F. Defacto Non-Merger?.........................................................................................................178

G. Freezouts...........................................................................................................................178

H. Weinberger Analysis Method For Freeze Out Mergers......................................................181

XXI. Organic Changes in Corporations...................................................................................182

A. Mergers..............................................................................................................................182

B. Asset Sales & Liquidations.................................................................................................183

B. Freeze Out Mergers: Bus. Justification Coggins v. New England Patriots.........................189

C. Law in Delaware................................................................................................................189

D. Parent-Subsidiary Merger (Short Form).............................................................................192

C. Recapitalizations................................................................................................................193

XXII. Policy Issues....................................................................................................................194

A. Liability Issues/Remedies...................................................................................................195

XXIII. Takeovers/Tender Offers 1/24/2005..............................................................................195

A. Policy Issues......................................................................................................................195

B. Bidder Tactics....................................................................................................................196

C. Target Tactics....................................................................................................................198

D. Liability Issues....................................................................................................................199

E. Federal and State Regulation of Takeovers.......................................................................213

F. Preemption Review............................................................................................................214

G. Dormant Commerce Clause Review..................................................................................215

XXIV. CORPORATE DEBT........................................................................................................219

XXV. New Class: Business Transactions...............................................................................221

A. Forms of Business Entities:................................................................................................221

B. Comparing Partnerships and Corporations (Knipprath Analysis).......................................224

XXVI. Federal Securities Law...................................................................................................225

A. Financial Markets Do 3 Things...........................................................................................225

B. Different Markets................................................................................................................225

More Free Outlines: http://c.finamore.home.comcast.net or http://finamore.net

56932621.doc The Last FUCKING CORPORATIONS CLASS I’LL EVER TAKE! Page 4 of 255

BUSINESS ASSOCIATIONS OUTLINE

C. Equity Markets...................................................................................................................227

D. Regulatory Framework.......................................................................................................229

E. Distribution of Securities.....................................................................................................230

F. Public Offerings vs. Private Offerings.................................................................................232

XXVII. DISCLOSURE AND FAIRNESS: FEDERAL SECURITIES REGULATION...................234

A. Definition of a Security.......................................................................................................234

B. § 17 Anti Fraud Provision...................................................................................................244

XXVIII. III. Liability under 1933 Act...........................................................................................245

A. 1. Section 11......................................................................................................................245

B. 2. Section 12(a)(1) .............................................................................................................246

C. 3. Section 12(a)(2).............................................................................................................246

I. Overview of Business Associations

A. Are Corporate Lawyers Necessary?

1. Divide the Pie – The Bigger Slice Theory

Lawyers help business owners gain a larger share of the venture. This only works if your lawyer

is better than the other party’s lawyer. Eventually everyone gets an equally competent lawyer;

and then all the lawyers do is take a piece of the deal away from the parties.

2. Expand the Pie – Reduce Transaction Costs Theory

Typical Transactions Costs:

(a) Search costs (cost to find a business partner;

(b) Bargaining costs: defining and agreeing on terms acceptable to all parties;

(c) Enforcement costs: measuring what has been exchanged and ensuring the parties honor the

agreements.

(d) Opportunism costs: (Alaska Packers’ Assn. v. Domenico) when the other party tries to

hold you up for more money knowing that you have no real alternative.

Theoretically, a lawyer can help reduce the first three types of transaction costs by narrowing the

search for partners, understanding the essence of the transaction and thereby shortening the

bargaining period, and by understanding the law and ensuring that any agreement is enforceable

under the law.

3. Addressing Opportunism Costs Through Structure of Business Association

One way to avoid opportunism costs is to bring functions in-house. However, an employee on a

fixed salary doesn’t always see the need to work hard when the extra effort does not result in

additional income – often an employee will simply shirk their responsibilities. The simple fact is

that whenever ownership and control are separated, there is a loss of incentive to be

productive. One response is to try to bond the employee to the company by creating incentives

for the employee to work hard.

In short, in avoiding opportunism costs by bringing functions in-house, the party creates a form of

agency relationship and incurs related costs:

(a) Monitoring Costs: cost to monitor the input and output of the employee; is she being

productive?

(b) Bonding Costs: costs associated with creating the employee incentives;

(c) Residual Loss: the cost of lost productivity caused by shirking.

More Free Outlines: http://c.finamore.home.comcast.net or http://finamore.net

56932621.doc The Last FUCKING CORPORATIONS CLASS I’LL EVER TAKE! Page 5 of 255

BUSINESS ASSOCIATIONS OUTLINE

B. The Transaction Cost Trade-Off

1. Summary: The Choice between Market & Firm (Contracts v. Agency)

(a) Economic activity can be conducted across markets, or within a firm. The choice between

market and firm depends on which transaction costs are lower:

(b) Markets (contracts) are attractive when the costs of opportunism are lower than agency

costs

(1) Intense competition in the market (e.g., many competitors; no transaction-specific costs).

(2) High monitoring and bonding expenditures

(c) Firms (agency) are attractive when agency costs are lower than those of opportunism.

This insight was expressed by Ronald Coase, and is one of the chief contributions for which he

received the Nobel Prize.

C. Structuring a Business Association

Market vs. Firm = Contract vs. Agency = Debt vs. Equity

Market Firm

Economic Activity Contracts Agency Relationships

Capital Structure Debt Equity

Tax Deductibility of Interest

Advantages Access to Capital Markets

Payments

Disadvantages Cost of Debt Service Equity Dilution

More Free Outlines: http://c.finamore.home.comcast.net or http://finamore.net

56932621.doc The Last FUCKING CORPORATIONS CLASS I’LL EVER TAKE! Page 6 of 255

BUSINESS ASSOCIATIONS OUTLINE

1. Table: Rates of Return for Debt vs. Equity Investments

Debt vs. Equity Comparison of Rates of Return

Capital Bank

Contribution Loan

(Equity) (Debt) Total

Initial Investment for Startup 100 900 1,000

Bus iness Im proves 50% & is Sold

Principal to Bank 900

Interest to Bank @ 10% 90

Capital Return 510

Total Payout 510 990 1,500

Less Original Investment 100 900 1,000

Prof it on Transaction 410 90 500

Rate of Return 410% 10% 50%

Bus iness Breaks Even & is Sold

Principal to Bank 900

Interest to Bank @ 10% 90

Capital Return 10

Total Payout 10 990 1,000

Less Original Investment 100 900 1,000

Prof it on Transaction -90 90 0

Rate of Return -90% 10% 0%

Bus iness Fails: Drops 50% & is Sold

Principal to Bank 500

Interest to Bank @ 10% 0

Capital Return 0

Total Payout 0 500 500

Less Original Investment 100 900 1,000

Prof it on Transaction -100 -400 -500

Rate of Return -100% -44% -50%

D. Summary: Introduction to Business Associations

1. The role of corporate lawyers (and corporate law)

• Reducing transaction costs involved in doing business through a firm.

2. Transaction Costs and Business Organization

• Doing business incurs transaction costs whether done via the market (using prices as the

coordinating mechanism) or within a firm (using control as the coordinating mechanism).

• Agency Costs: result of a separation of ownership and control.

• Markets incur costs from opportunism (e.g., hold-ups), while firms incur agency costs.

The choice between doing business in markets or firms depends on which transaction

costs are lower for a given type of business.

3. Capital

• Comparing investments – Rate of Return calculations

• Comparing Debt and Equity Capital

• Divergence of interests among capital contributors: Creditors want conservative

management of the firm; equity owners prefer to take more risks.

More Free Outlines: http://c.finamore.home.comcast.net or http://finamore.net

56932621.doc The Last FUCKING CORPORATIONS CLASS I’LL EVER TAKE! Page 7 of 255

BUSINESS ASSOCIATIONS OUTLINE

II. AGENCY – THE BUILDING BLOCK OF FIRMS

I. Who is an Agent?

1. § 1. Agency; Principal; Agent

(1) Agency is the fiduciary relation which results from the manifestation of consent by one

person to another that the other shall act on his behalf and subject to his control, and

consent by the other so to act.

(2) The one for whom action is to be taken is the principal.

(3) The one who is to act is the agent.

2. § 3(1) General Agent

Every now and then, the Restatement of Agency (2nd) makes a distinction between acts done by

a "general" agent and acts done by a "special" agent. The Restatement defines a general agent

as "an agent authorized to conduct a series of transactions involving a continuity of

service."

3. Agent Test

1) Manifestation by the principal that the agent will act for him;

2) Acceptance by the agent of the undertaking

3) Understanding between the parties that the principal will be in control of the undertaking

Gorton v. Doty (p.1) – Mom, a teacher, lends car to High School football coach. Coach is

driving to game w/ student, has accident, is killed. Student in car sues Mom, claiming coach was

agent of Mom. Analyze this agency case.

Parties

Agent Coach

Principal Mom / Teacher /Car Owner

Third Party (3P) Injured Party / Π

Insurance only defends you up to the limits of your policy. And you are not covered for crimes

and torts.

Consent – she consented to use of the car.

Control – she conditioned use of her car on the coach driving.

The Court makes a point of her failure to tell the coach that she was “loaning” the car. Perhaps if

there had been a formalization of a borrowing, then perhaps she would have been excused.

Form vs. Substance – is this a form or a substance case? I think it’s a form case because

substantively I don’t think the mom and coach had a principal / agent relationship.

Case law in Idaho presumes that a driver is agent of the owner unless rebutted.

Mrs. Doty should have had a rental agreement w/ the coach which placed no conditions upon his

use of the car and control is his and disclaiming liability and requiring him to represent that he had

his own insurance and that he will indemnify her if there is an accident.

4. How Cases With Similar Fact Patterns are Determined Differently

Form v Substance

Risk v Control

Interpreting the Facts Differently

5. A. Gay Jenson Farms Co. v. Cargill, Inc. (p. 7)

Agency Relationship – when creditor became active participant in business, an agency

relationship was formed

Warren Grain officers raided the till and Cargill was left holding the bag. Farmers want their

money back. Since Warren was bankrupt they went after Cargill.

Court noted 9 factors of Cargill behavior that led Court to find an agency relationship.

1) Cargill’s constant recommendations to Warren by telephone;

More Free Outlines: http://c.finamore.home.comcast.net or http://finamore.net

56932621.doc The Last FUCKING CORPORATIONS CLASS I’LL EVER TAKE! Page 8 of 255

BUSINESS ASSOCIATIONS OUTLINE

2) Cargill’s right of first refusal on grain;

3) Warrant’s inability to enter into mortgages, to purchase stock or to pay dividends without

Cargill’s approval;

4) Cargill’s right of entry onto Warren’s premises to carry on periodic checks and audits;

5) Cargill’s correspondence and criticism regarding Warren’s finances, officers’ salary and

inventory;

6) Cargill’s determination that Warren needed “strong paternal guidance”;

7) Provision of drafts and forms to Warren upon which Cargill’s name was imprinted;

8) Financing all of Warren’s purchases of grain and operating expenses;

9) Cargill’s Power to discontinue the financing of Warren’s operations.

The Court cites R.2d (Agency) on p. 11 and says that suppliers must show an independent

business before it can be shown he is not an agent. Cargill had an agency relationship at the

point that they exercised defacto control over Warren. Warren was acting as an extension of

Cargill. Form vs. Substance: Cargill had great form but substantively they were in control.

II. Liability of Principal to Third Parties in Contract

B. AUTHORITY

1. § 7. Actual Authority (Principal Agent)

Authority is the power of the agent to affect the legal relations of the principal by acts

done in accordance with the principal's manifestations of consent to him.

2. § 26. Creation Of Authority; General Rule

...authority to do an act can be created by written or spoken words or other conduct of the

principal which, reasonably interpreted, causes the agent to believe that the principal

desires him so to act on the principal's account.

in order to create actual authority a Principal must write, say, or do something that the Agent

could reasonably interpret as giving the Agent authority to act on the Principal's behalf.

3. Mill Street Church of Christ v. Hogan,

(The “I’ll paint the church, you paint the steeple” case.) P. 14

Authority that had been granted in the past was assumed reasonably granted under subsequent

similar circumstances absent notice to the contrary. Guy had hired his brother in the past,

assumed it was OK to do so now; church needed painting, it was his job to paint it, and he

couldn’t do it alone. Court ruled actual implied authority. Also, the brother hired by the church

(Bill) had apparent authority in the eyes of his brother, b/c he had been so authorized in the

past.

KEY QUESTION:

Is the third parties belief that the communication gave the agent the authority to enter into the

contract reasonable?

C. Apparent Authority

1. § 8. Apparent Authority (Principal 3rd Party)

Apparent authority is the power to affect the legal relations of another person by

transactions with third persons, professedly as agent for the other, arising from and in

accordance with the other's manifestations to such third persons.

To determine whether apparent authority exists we look at the principal's manifestation of consent

from the point of view of the third party, as made clear in § 27 of the Restatement:

More Free Outlines: http://c.finamore.home.comcast.net or http://finamore.net

56932621.doc The Last FUCKING CORPORATIONS CLASS I’LL EVER TAKE! Page 9 of 255

BUSINESS ASSOCIATIONS OUTLINE

2. § 27. Creation Of Apparent Authority: General Rule

...apparent authority to do an act is created as to a third person by written or spoken

words or any other conduct of the principal which, reasonably interpreted, causes the

third person to believe that the principal consents to have the act done on his behalf by

the person purporting to act for him.

Read sections 8 and 27 together: To create apparent authority a principal must write, say, or do

something that the third person could reasonably interpret as giving the (apparent) agent

authority to act on the principal's behalf. Apparent authority might exist even when there is no

agency relationship between the principal and the person who appears to be an agent of the

principal.

3. Lind v. Schenley Industries, Inc.

(The “Let’s screw the DM” case.) P. 16

Lind accepted a job as DM w/ 1% of gross commissions. Pretty good for the 1950’s. Of course,

the company tried to screw him out of his commission and he sued. The District Court, obviously

never having worked in retail, kept obsessing about the change in his base pay. The legal issue

was whether his boss had authority to make the offer and whether a reasonable person would

believe the offer. Answer: yes and yes b/c it was his direct boss and when you figure in total

earnings per annum the jump was commensurate w/ his increased responsibilities.

Lind talked to the big cheese of sales – Herrfeldt, who welcomed him and sent him to Kaufman

for the details. Did Herrfeldt do something to make Lind believe that Kaufmann was

authorized to do the deal? Yes, he said, “Go see Kaufmann and he’ll explain your salary to

you.” And then Lind went to Kaufmann and Kaufmann indeed did tell him his salary. Apparent

authority existed to bind the company. Also, the discussion between Lind and the president of

the company wherein the two discussed applying the commission toward the purchase price of a

plant that Lind wanted to buy from the company. So, that could be indicative of ratification by

the company.

4. Three-Seventy Leasing v. Ampex

(The “Hard time about the hard drives” case.) P.22

apparent authority – it is reasonable for parties to believe a salesman has authority to bind

employer to sell. Buyer was never informed that salesman did not have authority to make

sale, therefore letter confirming delivery date was construed to mean sale occurred

binding defendant

Π made deal to buy and simultaneously lease out some computer drives; they were basically

middleman on an equipment leasing deal. Correspondence was received from Ampex confirming

the order, so even though they never signed a contract, π reasonably relied on their

representation. It was reasonable to believe that the sales guy from Ampex had authority to sell

drives. Credit check bs later on was not π’s issue, Ampex should have gotten their approval

process straight b/c they represented to π that he had a deal. Ampex credit department was

worried about lending such a large sum to a one-man company with 5 year terms. Ampex could

have put on the form “not valid without proper signature of officer” to let all parties know that the

agent did not have authority to sign for the company

D. Inherent Authority

1. Inherent Authority (Agent 3rd Party Foreseeable Act By Agent)

Inherent authority is authority to take an action that a reasonable person in the principal's position

should have foreseen the agent would be likely to take, even though the action would be in

violation of the agent's instructions.

Inherent authority involves situations where an agent creates liability for the principal simply

because of an act done or a transaction entered into by an agent -- even though the act or

More Free Outlines: http://c.finamore.home.comcast.net or http://finamore.net

56932621.doc The Last FUCKING CORPORATIONS CLASS I’LL EVER TAKE! Page 10 of 255

BUSINESS ASSOCIATIONS OUTLINE

transaction was not actually or apparently authorized and there is no tort, contract, or restitutional

theory upon which the liability can be grounded.

2. Watteau v. Fenwick (The I Feel Your Pain Case) P. 25

apparent authority – while Humble did not have actual authority to purchase cigars, the

plaintiff had no reason to believe that he did not. The establishment appeared to be the

Humble’s establishment and the cigars would have been bought in the normal course of

business. The revelation that Humble was actually an agent for the defendant owner and

did not have authority to buy cigars does not relieve the actual owners of the obligation to

pay for the cigars.

Because of undisclosed principal, there could be no case for apparent authority. So, the

Court invented inherent authority.

FACTS: mgr beerhouse, name over the door, owned by the D’s. He had no authority to buy any

goods for the business except bottled ales and mineral waters, however he bought, on credit from

the Plaintiff other stuff

HELD: The principal is liable for all the acts of the agent which are within the authority

usually confided to an agent of that character, notwithstanding limitations, as between the

principal and the agent put upon that authority. If you give a manager/ agent a “secret limit”

which he knows but the outside world does not the principal will still be bound.

Issue 1: Was Humble an agent of Watteau’s?

Three part test (acting on behalf of principle, subject to control by principle, agent consents to

arrangement).

Defining an agent

Agency is the fiduciary relationship which results from the manifestation of consent by one

person to another that the other shall act on his behalf and subject to his control, and consent by

the other so to act. Restatement of Agency 2nd, § 1.

In other words:

1. Consent- can be either express or implied (but needs to be mutual consent in order

to have an agency relationship, can’t force someone to be an agent)

2. Benefit- the principal must benefit in some way from what the agent is doing for them

(the agent does not need any benefit but usually does like pay)

3. Control- how much control by the principal will determine the type of agent (i.e.

master and servant for tort liability).

Note: An agency relationship can be entirely voluntary and does not require

compensation from the principal to the agent.

Conclusion: Yes.

Issue 2: Did Humble have authority to purchase cigars and Bovril from Fenwick?

Actual Express Authority? No.

Actual Implied Authority? No. It was specifically prohibited.

Apparent Authority? No. Fenwick did not even know of Watteau’s connection to Humble at the

time of the transaction.

Inherent Authority? Apparently, yes.

Fenwick thought he was dealing with Humble, and gave him credit without checking his financial

situation and asking for guarantees of payment. Now, seemingly in a windfall, he gets Watteau

as a ‘guarantor’. Justifications for this rule?

Justifications for this rule?

Cheaper cost avoider (preventing principal from hiding behind agent to shirk from policing the

agent).

Principal can sue agent (if he can find him).

Restatement §194: “A general agent for an undisclosed principal authorized to conduct

transactions subjects his principal to liability for acts done on his account, if usual or necessary in

such transactions, although forbidden by the principal to do them.”

Restatement §195: “An undisclosed principal who entrusts an agent with the management of his

business is subject to liability to third persons with whom the agent enters into transactions usual

More Free Outlines: http://c.finamore.home.comcast.net or http://finamore.net

56932621.doc The Last FUCKING CORPORATIONS CLASS I’LL EVER TAKE! Page 11 of 255

BUSINESS ASSOCIATIONS OUTLINE

in such businesses and on the principal’s account, although contrary to the directions of the

principal.”

3. Kidd v. Thomas A. Edison, Inc. (The Is It Live Or Is It Memorex? Case) P. 28

INHERENT AUTHORITY is authority to take an action that a reasonable person in the

principal's position should have foreseen the agent would be likely to take, even though

the action would be in violation of the agent's instructions.

APPARENT AUTHORITY – must measure scope of agent’s authority not merely by words

used but the setting in which they were used, including customary powers of that type of

agent. Singer misunderstood terms and relied upon misunderstanding, agent’s manner of

work was misunderstood but binding to principal.

FACTS: Kidd signed recital tour. Edison’s agent not authorized to contractually bind Kidd for

regular non-Tone-test recitals. Kidd assumed that he was so authorized and detrimentally relied

on that assumption.

Hand’s characterization liability for acts of agents arises from status and not authority.

HELD: This is not an apparent authority argument. There has been no communication between

the principal and the 3rd party. No statement of “Fuller’s our man; deal with him.”

Instead this case deals with inherent authority. If the corporation puts someone out there as

its agent, the corporation bears a risk as principal that It has clothed its representatives

with a certain status so that it becomes liable for the actions its representatives takes that

would seem to be within that authority. This is how it was always done in that business. So,

Edison had to compensate Kidd for failing to give her the tour she expected. Merely putting an

agent out in the field is indirect communication to a 3rd party, thereby distinguishing it from

apparent authority’s direct communication between principal and the third party. If P has

reasonable grounds that is sufficient for agent to bind principal (customary in business, incidental

to transaction)

Kidd could have called the company and checked out Fuller’s status. Find out who had

authorization from the Board of Directors. Edison could have printed form agreements in

advance stating the limitations of the agreement.

What if PR knows agent is flaky & may bind co in undesirable way? Form K & tie bonus to use of

K or consider if risk of hiring ee is worth it thereby recognizing that PR responsible for agents

actions

Edison hired Fuller to engage singers for promotions of its phonograph records. Maxwell, an

Edison’s employee, told Fuller that Edison would act as a booking agent and guarantee payment

of the dealers who will agree to hire the singers for recitals, as well as cover the singers’ travel

expenses. Maxwell was also told to contract with the singers himself, and not bring them to

Maxwell. Fuller engaged Kidd, but Kidd proved that Fuller offered her a singing tour.

The usual custom in the industry was to promise a full singing tour (as Kidd claimed Fuller

promised her).

4. Nogales Service Center v. ARCO (The Pumped for Success Case) P. 31

Inherent authority is authority to take an action that a reasonable person in the principal's

position should have foreseen the agent would be likely to take, even though the action

would be in violation of the agent's instructions.

NSC wanted to build a truck stop. ARCO lent them money and signed an agreement to supply

their fuel. After facing financial difficulties, Terpenning, one of the owners of NSC, agreed orally

with Tucker, ARCO’s manager of truck stop marketing, that ARCO will lend NSC additional

money, receive a 1¢/gal discount on diesel fuels, and that ARCO will keep NSC “competitive”.

ARCO approved the loan application but not the diesel discount. ARCO sued after NSC

defaulted on the loan, and NSC counter-claimed compensation for not providing the discount

Tucker agreed to.

More Free Outlines: http://c.finamore.home.comcast.net or http://finamore.net

56932621.doc The Last FUCKING CORPORATIONS CLASS I’LL EVER TAKE! Page 12 of 255

BUSINESS ASSOCIATIONS OUTLINE

NSC loses for procedural reasons. But this case is useful to understand subtleties between

apparent and inherent authority. What sort of evidence would support apparent authority?

Inherent Authority? Terpenning could have asked for a signature from a higher-up at ARCO.

What Sort Of Evidence Would Support Apparent Authority? Inherent Authority?

Apparent Authority

Statements from Tucker’s superiors stating that Tucker is the person with whom to make the

deal; Evidence of other people who dealt with Tucker in similar deals and knew or believed he

had authority.

Inherent Authority

Prove it is an industry custom that agents such as Tucker have the authority to grant modest

price discounts (such as the one NSC got).

Why did NSC appeal the case just to contend the failure to instruct the jury on inherent authority?

To keep their options open.

What do you need to show with inherent agency? Because inherent agency allows you to cast a

broader net and look at industry standard. You are no longer limited to what the principal did or

represented in that same deal. You can now look at other service stations in the same area and

see what kind of discount that they got. Π wants to show that persons in Tucker’s position

normally have authority to give such discounts. You want to look for statements by ARCO that

Tucker was their “go to” guy for these affairs.

E. Authority Summary

Actual authority -- the agent reasonably interpreted manifestations of consent form the principal

that the act was authorized;

1. Apparent Authority – Elements:

1) Manifestations by the principal to a third party

2) That are the source of:

3) The third party’s actual belief that the agent has authority to act; and

4) The third party’s reasonable belief that the agent has authority to act.

2. Mitigating Risks of Apparent Authority

1) Attack elements 1 & 2:

a. Train employees (Herrfeldt/Kaufmann/Mueller/Kays) not to make representations of

authority;

b. Insist that employees only offer written contracts requiring signature of an authorized

person, or making explicit scope of authority.

2) Attack elements 3 & 4:

a. Make third parties belief of authority unreasonable by giving notice (actual or

constructive);

b. E.g., develop a publicly-available employee manual with clear rules as to who has

authority to what.

Inherent authority -- an agency relationship existed, although it may have been limited, but the

principal should be liable for the acts of the agent that are reasonably foreseeable.

3. Inherent Authority

1) Restatement, §8A: “Inherent agency power is a term used… to indicate the power of an agent

which is derived not from authority, apparent authority or estoppel, but solely from the agency

relation and exists for the protection of persons harmed by or dealing with a servant or other

agent.

2) Inherent authority requires an agency relationship, but doesn’t look to the principal at all as a

source for authority.

More Free Outlines: http://c.finamore.home.comcast.net or http://finamore.net

56932621.doc The Last FUCKING CORPORATIONS CLASS I’LL EVER TAKE! Page 13 of 255

BUSINESS ASSOCIATIONS OUTLINE

3) Why do we have inherent authority?

a. A cynical view: The people writing the restatement faced case law that did not fit into

existing categories (actual authority, apparent authority, estoppel or ratification).

They created a new category (inherent authority) to explain these cases.

4) How to analyzel with inherent authority:

a. Identify the situations in which case law tends to find inherent authority. If you face

such a situation, suggest application of inherent authority and analogize to the case

law.

5) Situations likely to invoke inherent authority:

a. Undisclosed principal [Restatement §§194, 195];

b. Disclosed general agent asserting authority that is in line with industry norms

[Restatement §161].

c. Restatement §161: “A general agent for a disclosed or partially disclosed principal

subjects his principal to liability for acts done on his account which usually

accompany or are incidental to transactions which the agent is authorized to conduct

if, although they are forbidden by the principal, the other party reasonably believes

that the agent is authorized to do them and has no notice that he is not so

authorized.”

d. General Agent – an agent authorized to conduct a series of transactions involving a

continuity of service [Restatement §3(1)]. Otherwise, agent is a ‘special agent’.

F. Ratification

1. § 82Ratification Defined

Restatement §82: The affirmance by a person of a prior act which did not bind him but which

was done or proffessedly done on his account. Ratification requires acceptance of the results of

the act with an intent to ratify, and with full knowledge of all the material circumstances.

2. Ratification Test

1) Was the act done on the party’s behalf?

2) Did the party accept the act or the benefits of the act?

3) Did the party have full knowledge of all the material circumstances?

3. Ratification Questions

What types of acts constitute an affirmation by the principal?;

What affect should we give to that affirmation?

1. Ratification requires acceptance of the results of the act with an intent to ratify, and with full

knowledge of the material circumstances.

2. Examples Of Affirmance:

a. Express Affirmance;

b. Implied Affirmance By:

i. acceptance of benefits of the transaction at a time in which it is possible to

decline the benefits; also,

ii. no implied affirmance if principal has reasonable claim to the benefits other

than due to the transaction;

iii. Implied affirmance through silence or inaction;

iv. Implied affirmance through bringing a lawsuit to enforce the contract.

4. Botticello v. Stefanovicz (What Do You Mean I Bought Half A Farm?) P. 36

Ratification requires the agent to have acted on behalf of the party, the party must either

expressly ratify, or accept the benefits of the act with full knowledge of the consequences.

Husband and wife are half owners of farm. Π discussed purchase of farm with husband and wife,

haggled over price, and eventually executed a lease to own transaction with the husband. Π, an

experienced real estate businessman, did not do a title search and was unaware of wife’s part

More Free Outlines: http://c.finamore.home.comcast.net or http://finamore.net

56932621.doc The Last FUCKING CORPORATIONS CLASS I’LL EVER TAKE! Page 14 of 255

BUSINESS ASSOCIATIONS OUTLINE

ownership. After lease, ∆ refused to transfer title due to wife’s refusal. Trial court ruled that

husband was agent of wife and that wife ratified. Appellate court reversed because the wife

manifested no intent to have the husband act on her behalf nor did she manifest any intent to

ratify.

5. Ratification: Limits on Valid Affirmance

1) Ratification is an all-or-nothing process. A principal must affirm the entire transaction or

repudiate it entirely.

a. Creative bypass: Breaking up the transaction into a series of severable

transactions (each of which can be affirmed or repudiated), or combining several

transactions into one (to force the other side into all-or-nothing).

2) Affirmance is valid only if at the time of the alleged affirmance the principal knew all material

facts (facts which substantially affect the existence or extent of the obligations involved in the

transaction).

3) A transaction can only be ratified if the principal could have entered it both at the time the

agent acted and the time the principal affirmed.

4) If ratification results in harm to innocent third parties, they may receive an option to deny the

ratification. Typically, this occurs when there has been a material change between the time

of the transaction and the time of the affirmance.

a. Example: A sells P’s house without authority. P’s house then burns down. P

cannot ratify the sale.

6. Ratification’s Effect on Authority

1) Ratification without notice to T that A was unauthorized may result in A

having apparent authority in future similar transactions.

2) Similarly, no notice to A that the act was unauthorized may result in

actual implied authority.

3) Restatement §43:

a. Acquiescence by the principal in conduct of an agent whose previously conferred

authorization reasonably might include it, indicates that the conduct was

authorized; if clearly not included in the authorization, acquiescence in it

indicates affirmance.

b. Acquiescence by the principal in a series of acts by the agent indicates

authorization to perform similar acts in the future.”

G. Estoppel

1. §8B Estoppel Defined:

1) A person who is not otherwise liable as a party to a transaction purported to be done on his

account is nevertheless subject to liability to persons who have changed their positions

because of their belief that the transaction was entered into by or for him, if:

a. he intentionally or carelessly caused such belief, or

b. knowing of such belief and that others might change their positions because of it, he

did not take reasonable steps to notify them of the facts.

2) An owner of property who represents to third persons that another is the owner of the

property or who permits the other so to represent, or who realizes that third persons believe

that another is the owner of the property, and that he could easily inform the third persons of

the facts, is subject to the loss of the property if the other disposes of it to third persons who,

in ignorance of the facts, purchase the property or otherwise change their position with

reference to it.

3) Change of position… indicates payment of money, expenditure of labor, suffering a loss or

subjection to legal liability.”

More Free Outlines: http://c.finamore.home.comcast.net or http://finamore.net

56932621.doc The Last FUCKING CORPORATIONS CLASS I’LL EVER TAKE! Page 15 of 255

BUSINESS ASSOCIATIONS OUTLINE

2. Estoppel Defined in Plain English:

1. Act or omission of principal leads public to believe 3rd party isacting as agent of principal;

2. 3rd Party relies in good faith;

3. 3rd Party changes postion.

3. Hoddeson v. Koos Bros. (The Phantom Furniture Salesman) P. 40

A merchant must take reasonable care to protect its customers from the harmful acts of 3rd

parties acting on the merchant’s premises.

Woman pays clerk in furniture store cash and he tells her the furniture must be ordered. Months

later store denies any record of the order. No one can find the phantom salesman. Trial court

rules that the phantom was an agent of the store. Appellate court reverses because no indicatin

that the store wanted him to act on their behalf. Failed agent test. But, they remanded with order

for a new trial recommending π pursue an estoppel argument because a furniture store has a

duty to protect their customers by doing “more than the dilligent observance and removal of

banana peels from the aisles.” How could they have an imposter operating in their store

swindling reasonable customers? Fallback position: if you’re Hoddeson’s lawyer, be sure to

make an argument for apparent authority.

H. Agent’s Liability on Contract

1) Disclosed Principal - No liability unless:

a. Clear intent of parties that agent will be bound (Rest. §323); or

b. Agent made contract without authority – the legal basis:

i. Party to the contract? In few states. Rest. rejects this basis (Rest. §328)

ii. Fraud/deceit? In some states. Rest. §330 allows this basis.

iii. Implied warranty of authority? In most states. Rest. §329 adopts this – third

party entitled to “amount by which he would have benefited had the authority existed.”

2) Undisclosed of Partially Disclosed (Unidentified) Principal

a. Agent treated as a party to the contract.

b. Third party must elect who to sue – agent or principal.

1. Atlantic Salmon A/S v. Curran (The Fishy Fish Dealer) P. 43

When an agent acts on behalf of an undisclosed or partially disclosed principal, he is a

party to the K unless he specifically discloses his role as an agent and structures all K’s

as between 3rd parties and the principal

Fish dealer never incorporated. Held himself out as a corporation, ran up bills, then tried to claim

he was an agent for a defunct holding company with no assets. When an agent acts on behalf of

an undisclosed or partially disclosed principal, he is a party to the K unless he specifically

discloses his role as an agent and structures all K’s as between 3rd parties and the principal.

1) What could Curran do to protect himself from liability?

a. Revive his corporation sooner and change its name. Easy to do, though it would

have done little good for Atlantic Salmon.

2) What could Atlantic Salmon do to prevent the need to litigate to enforce their claims?

a. Do a credit check of the corporations;

b. Demand a personal guarantee by Curran.

I. Summary – Agency Relationship/Liability of Principal in Contracts

1. The Principal-Agent Relationship

a. Three-part test;

b. Creditors dilemma regarding control.

2. Liability of P in Contracts – Depends on existence of authority:

a. Actual Authority (express or implied): P’s behavior causes A to reasonably

believe she has authority.

More Free Outlines: http://c.finamore.home.comcast.net or http://finamore.net

56932621.doc The Last FUCKING CORPORATIONS CLASS I’LL EVER TAKE! Page 16 of 255

BUSINESS ASSOCIATIONS OUTLINE

b. Apparent Authority: P’s behavior causes T to reasonably believe he has

authority.

c. Inherent Authority

i. Undisclosed Principal

ii. Disclosed general agent asserting authority that is in line with industry

norms

d. Ratification

e. Estoppel

3. Liability of Agent in Contracts

III. Liability of Principal to Third Parties in Tort

J. What is the Justification for Imposing Liability?

1. Justifications

1) Make injured party whole

2) Deep Pockets – Principal may be more solvent than agent

3) Risk Spreading – Even if the principal is not more solvent than the agent, two pockets are

bigger than one.

4) Mitigate likelihood of future injuries by creating incentives for an efficient level of care

5) Control – Insolvent agents are out of tort law’s reach and are thus undeterred; but if P is

able to control A, he could force A to be careful (affects A’s level of care);

6) Interest in or familiarity with A – P is likely better able to prevent A’s torts, or recoup for

A’s negligence, than the injured party (affects P’s level of care);

7) Appearances – Liability if principal creates appearance of responsibility (affects injured

party’s level of care).

2. Flaws in the justifications: Counter-Arguments to Tort Liability of Principal to 3rd

Parties

1) Make injured party whole

a. Deep Pockets/Risk Spreading – No guidance as to which deep pocket should

cover the loss. Why shouldn’t government pick the tab?

2) Mitigate likelihood of future injuries by creating incentives for an efficient level of care

a. Liability forces P to control A more than he would otherwise want; result – less

hybrid business structures.

b. Control/Interest – Insolvency problem can be solved by forcing A to insure

liability. Insurer will then have incentive to control A;

c. Appearances – Same result could be achieved without liability (P’s that want T’s

to rely on their reputation would provide express guarantee).

3) One can make counter-counter arguments…

3. Counter-Counter-Arguments to Tort Liability of a Principal to 3rd Parties

1) Make injured party whole

a. Deep Pockets/Risk Spreading – This interest can be coupled with the control or

appearances arguments, which indicate what deep pocket should bear the

burden.

2) Mitigate likelihood of future injuries by creating incentives for an efficient level of care

a. Less hybrid business structures – P doesn’t consider T’s interests in choosing

the business structure (externality).

b. Insurance – Who will monitor A’s to ensure that they have insurance?

c. Appearances – Often an express guarantee is awkward to provide (how do you

know that A has authority to provide P’s guarantee?)

The bottom line: Law regards control as a decisive factor.

More Free Outlines: http://c.finamore.home.comcast.net or http://finamore.net

56932621.doc The Last FUCKING CORPORATIONS CLASS I’LL EVER TAKE! Page 17 of 255

BUSINESS ASSOCIATIONS OUTLINE

4. Format for Analysis – Focus on Control Elements

1) Is A an agent of P?

a. Yes – Is A as servant of P, or an independent contractor? [General Rule: §220(1);

specific tests: §220(2)]

i. Servant – Was the tort committed within the scope of A’s employment?

[General Rule: §228; specific tests: §229(2)]

1. Yes – P is liable for A’s tort [Rest. §219(1)].

2. No – Does situation fall into an exception [Rest. §219(2)]?

a. Yes - P is liable for A’s tort.

b. No - P is not liable in agency law for A’s tort.

ii. Independent Contractor – Does situation fall into an exception?

1. Yes - P is liable for A’s tort.

2. No - P is not liable in agency law for A’s tort.

2) No Not an Agent of P = P is not liable in agency law for A’s tort.

K. Servant Versus Independent Contractor

1. Humble Oil & Refining Co. v. Martin

Master-Servant Relationship - …strict system of financial control with little or no business

discretion.

FACTS: M hit by an unoccupied car left at the station. The court held Humble responsible,

because it owned the station, and the principal products sold there. Despite fact that the station

employees did not consider Humble master, employees were paid and directed by Schneider as

their “boss”, and part of the agreement repudiates any authority of Humble over the employees.

The deal was terminable by Humble at will.

HELD: Schneider is a commission salesman and not the sole proprietor. Litttle control for

Schneider (who hired, fired, & supervised). There was a provisions for Schneider to make

reports and perform other duties required of him by the company. Humble is required to pay 75%

of the public utility bills. The title of the products remained with Humble until delivery to the

consumer. Humble furnished the location, equipment, and advertising. The hours of operation

were determined by Humble as well.

Low cost avoider of accidents (“Leonard” Hand theory)

-argument can be made that Schneider or Humble had the lowest cost. Schneider is on site and

deals with the actual employees on a daily basis.

-Humble could enact stricter regulations (rules), and also could purchase insurance. However

checking up on these rules would be a difficult task for Humble because spot checks are

inefficient.

-An alternative is to have Humble buy insurance and Schneider contribute or have Schneider

indernify Humble.

2. Hoover v. Sun Oil Company

Independent Contractor – lease agreement and dealer’s agreement fail to establish any

relationship other than landlord-tenant

FACTS: P’s car caught fire and suit was brought against Sunoco. Sunoco owned the station and

almost all the equipment. Sunoco and Barone entered an agreement where petroleum products

were to be purchased from Sunoco, and Sunoco was to lend equipment and advertising

materials. Barone could have sold competitive products. Barone could have sold competitive

products. Barone could only sell Sunoco products under their label, and could not blend them

with other products.

The station had large Sunoco signs and advertised under a Sunoco heading in the telephone

book, employees wore uniforms with Sunoco’s emblem. Barone attended a service school for

Sunoco service operators. Sunoco sent a representative to inspect weekly, and allowed Barone

to meet local competition by offering rebates on gas. Either party can terminate lease on 30 days

notice.

More Free Outlines: http://c.finamore.home.comcast.net or http://finamore.net

56932621.doc The Last FUCKING CORPORATIONS CLASS I’LL EVER TAKE! Page 18 of 255

BUSINESS ASSOCIATIONS OUTLINE

Barone made no written reports to Sunoco, and assumed overall risk of loss. He determined

the hours of operation (and was held o be liable, where in Humble Schneider did not control

hours of operation and Humble was responsible), pay scale and working conditions, and it was

his name listed as the proprietor.

HELD: Barone is an independent contractor, because Sunoco had no control over the details

of the day to day operation.

CARNEY: A strong point can be made for Sunoco’s control. Sunoco does not explicitly reserve

the right to tell Barone what to do, but they can still “strongly” suggest things, and Barone will

jump.

The contract (independent contractor) is intentionally written so that language is at odds with the

relationship (master-servant) which the company wants.

3. Murphy v. Holiday Inns, Inc.

Agency Relationship – franchise agreement did not give defendant sufficient control to

form an agency relationship

FACTS: P sued Holiday Inn for injuries suffered when she slipped on an area of a walk

Betsy-Len used name Holiday Inn, trade marks, architectural designs, color designs,

equipment, advertisements, & method of operation. For this Betsy-Len had to pay sum of $5,000

and construct inn in accordance to plans of a contractor . The business is conducted under a

system, in which a manual or handbook provides a tremendous level of detail and specificity.

Holiday Inn is not the owner, but Betsy-Len is. Betsy-Len had control “where it counted” over

profits, business expenditures, rates, hiring and firing, and actual ownership of building

and lot. Therefore the end of the franchise relationship would not be disaster for Betsy-Len.

A franchisee relationshop (the franchise enjoys the right to profit and runs the risk of loss). But

Holiday Inn does get a cut of the per-day charge for rooms and this money is used for

advertisements, etc….

HELD: Holiday Inn had no control or right to control the method or detail of doing the

work, therefore no principal-agent or master-servant relationship. No control of day-to-day

operation of hotel. No power to fix expenditures, fix rates, or demand part of profits. Maintaining

and regulating the architectual style is not enough.

If franchisor desires to have full control, but also to limit its liablity, it can force franchisee to “save

and hold harmless” franchisor (which is not an attempt to limit franchisor’s liability but is merely a

means by which franchisee will reimburse franchisor in the event of a judgment against the

franchisor). Blen extensive freedom to run its business as long as it abides by quality

control issues.

*Risk: hi Risk ; Return:Blen; Control: Blen ultimate control; Duration:

* even if disclaimer master/servant relationship can arise as matter of law if franchisor reg/control

active of f’ee w/in def of agency-agency rel arises

*diff w/Humble is that Schneider only rt to occupy; Blen owns own motel &has ultimate control

Murphy v. Holiday Inn (19; Va. 1975): slip-and-fall case, hotel guest sues HI chain, which

disclaims liability b/c of franchise K b/w HI and franchisor (Betsey-Len Corp.)

held: even though a franchise K, and parties expressly deny existence of agency relationship,

agency relationship may be created if the franchisor has control with respect to regulation of the

franchise

application: here, insufficient indicia of HI’s control of the operation of the hotel

no agency relationship b/w HI and Betsey-Len, ∴ HI not liable to guest in tort

liability in contract revolves around whether there is authority

L. Tort Liability and Apparent Agency

1. Billops v. Magness Construction Co. p. 58 (Ballroom Banquet Bust)

Apparent Authority – franchisor found to exercise day-to-day control via detailed

operating manual, enforceable by unilateral termination of the operating agreement for

violations. Manifestations by the alleged principal which create a reasonable belief in a

More Free Outlines: http://c.finamore.home.comcast.net or http://finamore.net

56932621.doc The Last FUCKING CORPORATIONS CLASS I’LL EVER TAKE! Page 19 of 255

BUSINESS ASSOCIATIONS OUTLINE

third party that the alleged agent is authorized to bind the principal create an apparent

agency…franchisee is the agent of the franchisor.

FACTS: The banquet direct of Brandywine Hilton Inn wrongfully attempted to extort funds in

addition to those previously paid by Plaintiffs for the use of one of the Inn’s ballrooms (by

inadequately heating the ballroom…).

ISSUE: Did a principal/ agency relationship existed between The Brandywine Hilton Inn and the

Hilton Corporation?

HELD: Because of ample evidence of authority, franchisee was the agent of the franchisor.

This evidence for actual authority is: a corporate manual, regulating advertisement, office and

cleaning staff procedures, financial records, inspection of hotel by franchisor. More substantial

evidence for apparent authority includes, the Hilton logo and sign displayed exclusively, and more

importantly, the reliance of the plaintiffs for the quality of the Hilton name. There can not be

apparent authority to commit a tort. This is not, in the realm of tort, a principal-agent relationship,

but a master-servant relationship. Therefore it is important to determine how much physical

control Hilton Inc. had over Brandywine Hilton.

If Hilton wanted to disassociate themselved from the Brandywine they could have taken steps to