Академический Документы

Профессиональный Документы

Культура Документы

US Internal Revenue Service: f5884 - 1995

Загружено:

IRSИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

US Internal Revenue Service: f5884 - 1995

Загружено:

IRSАвторское право:

Доступные форматы

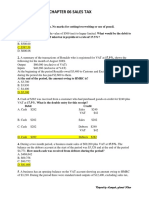

5884

OMB No. 1545-0219

Form

Jobs Credit

Department of the Treasury © Attachment

Attach to your return. 77

Internal Revenue Service Sequence No.

Name(s) shown on return Identifying number

Part I Current Year Jobs Credit

1 Enter the total qualified wages paid or incurred during the tax year for services of employees who are

certified as members of a targeted group and who began work for you before January 1, 1995 1

2 Current year credit. Multiply line 1 by 40% (.40). You must subtract this amount from the deduction

on your return for salaries and wages. (Members of a controlled group, see instructions.) 2

If you are a— Then enter total of current year jobs credit(s) from—

%

3 Jobs credits from a Shareholder Schedule K-1 (Form 1120S), lines 12d, 12e, or 13

flow-through b Partner Schedule K-1 (Form 1065), lines 13c, 13d, or 14 3

c Beneficiary Schedule K-1 (Form 1041), line 13

entities d Patron Written statement from cooperative

4 Total current year jobs credit. Add lines 2 and 3. (S corporations, partnerships, estates, trusts, and

cooperatives, see instructions.) 4

Part II Tax Liability Limit (See Who Must File Form 3800 to find out if you complete Part II or file Form 3800.)

%

5a Individuals. Enter amount from Form 1040, line 40

b Corporations. Enter amount from Form 1120, Schedule J, line 3 (or Form 1120-A, Part I, line 1) 5

c Other filers. Enter regular tax before credits from your return

6a Credit for child and dependent care expenses (Form 2441, line 10) 6a

b Credit for the elderly or the disabled (Schedule R (Form 1040), line 20) 6b

c Mortgage interest credit (Form 8396, line 11) 6c

d Foreign tax credit (Form 1116, line 32, or Form 1118, Sch. B, line 12) 6d

e Possessions tax credit (Form 5735) 6e

f Orphan drug credit (Form 6765) 6f

g Credit for fuel from a nonconventional source 6g

h Qualified electric vehicle credit (Form 8834, line 19) 6h

i Add lines 6a through 6h 6i

7 Net regular tax. Subtract line 6i from line 5 7

8 Tentative minimum tax (see instructions):

%

a Individuals. Enter amount from Form 6251, line 26

b Corporations. Enter amount from Form 4626, line 13 8

c Estates and trusts. Enter amount from Form 1041, Schedule I, line 37

9 Net income tax:

%

a Individuals. Add line 7 above and line 28 of Form 6251

b Corporations. Add line 7 above and line 15 of Form 4626 9

c Estates and trusts. Add line 7 above and line 41 of Form 1041, Schedule I

10 If line 7 is more than $25,000, enter 25% (.25) of the excess (see instructions) 10

11 Subtract line 8 or line 10, whichever is greater, from line 9. If less than zero, enter -0- 11

12 Jobs credit allowed for the current year. Enter the smaller of line 4 or line 11. This is your General

Business Credit for 1995. Enter here and on Form 1040, line 44; Form 1120, Schedule J, line 4d;

Form 1120-A, Part I, line 2a; or the appropriate line of other income tax returns 12

Paperwork Reduction Act Notice If you have comments concerning the 1-800-TAX-FORM (1-800-829-3676). It is also

accuracy of these time estimates or available electronically through our bulletin

We ask for the information on this form to

suggestions for making this form simpler, we board or via the Internet.

carry out the Internal Revenue laws of the

would be happy to hear from you. You can

United States. You are required to give us the

write to the IRS at the address listed in the

information. We need it to ensure that you are

instructions of the tax return with which this

General Instructions

complying with these laws and to allow us to Section references are to the Internal

form is filed.

figure and collect the right amount of tax. Revenue Code.

Caution: The targeted jobs credit expired for

The time needed to complete and file this

employees who began work for you after

form will vary depending on individual

December 31, 1994. Purpose of Form

circumstances. The estimated average time

At the time this form was printed, Congress Use Form 5884 if you had targeted group

is:

was considering legislation that would extend employees and claim the jobs credit for

Recordkeeping 4 hr., 4 min. wages you paid or accrued for them during

and change the credit. Get Pub. 553,

Learning about the law Highlights of 1995 Tax Changes, for more the tax year.

or the form 35 min. information. You can get it by calling

Preparing and sending

the form to the IRS 41 min.

Cat. No. 13570D Form 5884 (1995)

Form 5884 (1995) Page 2

Mutual savings institutions, regulated 6. The employee must have worked for you ● You capitalized any salaries and wages

investment companies, and real estate for at least 90 days or completed at least 120 on which you figured the credit. In this case,

investment trusts can take a limited credit. hours of service; and reduce your depreciable basis by the amount

See section 52(e) and the related regulations. 7. The wages cannot be for services of of the jobs credit on those salaries and

You can claim or elect not to claim the jobs replacement workers during a strike or wages.

credit any time within 3 years from the due lockout. ● You used the full absorption method of

date of your return on either your original To claim a tax credit, the employer must inventory costing that required you to reduce

return or on an amended return. request and be issued a certification from the your basis in inventory for the jobs credit.

How To Figure the Credit State Employment Security Agency (Job If either of the above exceptions applies,

Service). The certification proves that the attach a statement explaining why the line 2

In general, figure your jobs credit based on employee is in an eligible targeted group, and amount differs from the amount by which you

the employee’s wages subject to the Federal that a timely request for certification was reduce your salary and wage deduction.

Unemployment Tax Act (FUTA). Jobs credit made. A certification must be requested on or Line 3.—Enter the amount of credit that was

wages, however, are limited to $6,000 for before the date the individual begins work (or allocated to you as a shareholder, partner,

each employee. Special rules apply in the within 5 days if the employee presents a beneficiary, or patron of a cooperative.

following cases: voucher showing that eligibility has been Line 4.—If you have a credit from a passive

1. You can take a jobs credit for agricultural determined). The employer must certify that a activity, stop here and go to Form 3800.

employees who meet the other tests if their good-faith effort was made to determine S corporations and partnerships.—

services qualify under FUTA as agricultural whether an employee (not vouchered) is an Prorate the jobs credit on line 4 among the

labor during more than half of any pay period. eligible targeted group member. shareholders or partners. Attach Form 5884

Base your credit for each employee on the Certification of a youth in a cooperative to the return and on Schedule K-1 show the

first $6,000 in wages subject to social education program.—The certification is credit for each shareholder or partner.

security and Medicare taxes paid or accrued completed by the school administering the

for that person during the year. Estates and trusts.—The jobs credit on

cooperative program. The school gives the line 4 is allocated between the estate or trust

2. You can take a credit for railroad employer a completed Form 6199, and the beneficiaries in proportion to the

employees who meet the other tests if their Certification of Youth Participating in a income allocable to each. On the dotted line

wages qualify under the Railroad Qualified Cooperative Education Program. next to line 4, the estate or trust should enter

Unemployment Insurance Act (RUIA). Base its part of the total credit. Label it “1041

your credit for each employee on the first Specific Instructions PORTION” and use this amount in Part II (or

$6,000 in wages subject to RUIA tax paid or Note: If you only have a jobs credit allocated Form 3800, if required) to figure the credit to

accrued for that person during the year. to you from a flow-through entity, skip lines 1 claim on Form 1041.

3. Wages for youths in a cooperative and 2 and go to line 3. Cooperatives.—Most tax-exempt

education program are not subject to FUTA, Line 1.—Enter the remainder of the first-year organizations cannot take the jobs credit; but

but you can include their wages in the wages paid to qualified employees who a cooperative described in section 1381(a)

amount you use to figure your jobs credit. began work for you before January 1, 1995. takes the jobs credit to the extent it has tax

Base your jobs credit for each youth on the The wages are limited to $6,000 of first-year liability. Any excess is shared among its

first $6,000 in wages you paid or accrued for wages paid. Subtract the amount of the first patrons.

that person during the year. year wages you paid to qualified employees

Your credit is based on a percentage of the in 1994 from the $6,000 limit. Who Must File Form 3800

wages for each employee in the following For example, if a jobs credit employee If for this year you have more than one of the

targeted groups: began working in your business on May 1, credits included in the general business credit

● Vocational rehabilitation referrals. 1994, and you are a calendar year taxpayer, listed below, have a carryback or

● Economically disadvantaged youth. you would have figured your 1994 jobs credit carryforward of any of the credits, or have a

● Economically disadvantaged Vietnam-era based on the first-year wages you paid jobs credit from a passive activity, you must

veterans. between May 1 and December 31, 1994. You complete Form 3800, General Business

● Supplemental Security Income (SSI) would figure your 1995 credit on the rest of Credit, instead of completing Part II of Form

recipients. the first-year wages you paid between 5884 to figure the tax liability limitation.

January 1 and April 30, 1995. The general business credit consists of the

● General assistance recipients.

Controlled groups.—The group member following credits: investment, jobs, alcohol

● Youth in a cooperative education program,

proportionately contributing the most used as fuel, research, low-income housing,

who belong to an economically

first-year wages figures the group credit in enhanced oil recovery, disabled access,

disadvantaged family.

Part I and skips Part II. See sections 52(a) renewable electricity production, Indian

● Economically disadvantaged ex-convicts. and 1563. employment, employer social security and

● Eligible aid to families with dependent On separate Forms 5884, that member and Medicare taxes paid on certain employee

children (AFDC) recipients. every other member of the group should skip tips, contributions to certain community

In addition, to claim a jobs credit on an line 1 and enter its share of the group credit development corporations, and trans-Alaska

employee’s wages: on line 2. Each member then completes lines pipeline liability fund.

1. More than half the wages received from 3 and 4, and 5 through 12 (or Form 3800, if The empowerment zone employment credit,

you must be for working in your trade or required) on its separate form. Each group while a component of the general business

business; member must attach to its Form 5884 a credit, is figured separately on Form 8844

2. The employee must be certified, as schedule showing how the group credit was and is never carried to Form 3800.

explained below, as belonging to a targeted divided among all the members. The Line 8.—Enter the tentative minimum tax

group; members share the credit in the same (TMT) that was figured on the appropriate

3. You may not claim a credit on wages proportion that they contributed qualifying alternative minimum tax (AMT) form or

that were repaid by a federally funded wages. schedule. Although you may not owe AMT,

on-the-job training program, or for which you Line 2.—In general, you must subtract your you must still compute the TMT to figure your

received work supplementation payments current year jobs credit on line 2 from the credit.

under the Social Security Act; deduction on your return for salaries and Line 10.—See section 38(c)(3) for special

4. The employee cannot be your relative or wages you paid or accrued for 1995. This is rules for married couples filing separate

dependent (see section 51(i) for other required even if you cannot take the full credit returns, for controlled corporate groups, and

restrictions); this year and must carry part of it back or for estates and trusts.

5. The employee cannot be your rehired forward. The following exceptions to this rule Line 12.—If you cannot use part of the credit

employee if he or she was not a targeted are: because of the tax liability limitations (line 12

group member when employed earlier; is smaller than line 4), carry it back 3 years,

then forward 15 years. See the separate

Instructions for Form 3800 for details.

Printed on recycled paper

Вам также может понравиться

- US Internal Revenue Service: f5884 - 1992Документ2 страницыUS Internal Revenue Service: f5884 - 1992IRSОценок пока нет

- US Internal Revenue Service: f5884 - 1993Документ2 страницыUS Internal Revenue Service: f5884 - 1993IRSОценок пока нет

- US Internal Revenue Service: f8845 - 1995Документ2 страницыUS Internal Revenue Service: f8845 - 1995IRSОценок пока нет

- US Internal Revenue Service: f5884 - 2001Документ3 страницыUS Internal Revenue Service: f5884 - 2001IRSОценок пока нет

- US Internal Revenue Service: f5884 - 2003Документ3 страницыUS Internal Revenue Service: f5884 - 2003IRSОценок пока нет

- US Internal Revenue Service: f8830 - 1994Документ2 страницыUS Internal Revenue Service: f8830 - 1994IRSОценок пока нет

- US Internal Revenue Service: f8586 - 1992Документ2 страницыUS Internal Revenue Service: f8586 - 1992IRSОценок пока нет

- US Internal Revenue Service: f5884 - 2002Документ3 страницыUS Internal Revenue Service: f5884 - 2002IRSОценок пока нет

- US Internal Revenue Service: f8830 - 1995Документ2 страницыUS Internal Revenue Service: f8830 - 1995IRSОценок пока нет

- US Internal Revenue Service: f8830 - 1992Документ2 страницыUS Internal Revenue Service: f8830 - 1992IRSОценок пока нет

- US Internal Revenue Service: f5884 - 1999Документ3 страницыUS Internal Revenue Service: f5884 - 1999IRSОценок пока нет

- US Internal Revenue Service: f8861 - 1998Документ3 страницыUS Internal Revenue Service: f8861 - 1998IRSОценок пока нет

- US Internal Revenue Service: f8830 - 1993Документ2 страницыUS Internal Revenue Service: f8830 - 1993IRSОценок пока нет

- US Internal Revenue Service: f8830 - 1996Документ2 страницыUS Internal Revenue Service: f8830 - 1996IRSОценок пока нет

- US Internal Revenue Service: f8861 - 2002Документ3 страницыUS Internal Revenue Service: f8861 - 2002IRSОценок пока нет

- US Internal Revenue Service: f8845 - 1996Документ3 страницыUS Internal Revenue Service: f8845 - 1996IRSОценок пока нет

- US Internal Revenue Service: f8586 - 1996Документ2 страницыUS Internal Revenue Service: f8586 - 1996IRSОценок пока нет

- US Internal Revenue Service: f8861 - 2003Документ3 страницыUS Internal Revenue Service: f8861 - 2003IRSОценок пока нет

- US Internal Revenue Service: f8845 - 1997Документ3 страницыUS Internal Revenue Service: f8845 - 1997IRSОценок пока нет

- US Internal Revenue Service: f8881 - 2002Документ2 страницыUS Internal Revenue Service: f8881 - 2002IRSОценок пока нет

- US Internal Revenue Service: f8820 - 1996Документ2 страницыUS Internal Revenue Service: f8820 - 1996IRS0% (1)

- US Internal Revenue Service: f8860 - 1998Документ2 страницыUS Internal Revenue Service: f8860 - 1998IRSОценок пока нет

- US Internal Revenue Service: f8844 - 1995Документ4 страницыUS Internal Revenue Service: f8844 - 1995IRSОценок пока нет

- US Internal Revenue Service: f8847 - 2002Документ2 страницыUS Internal Revenue Service: f8847 - 2002IRSОценок пока нет

- US Internal Revenue Service: f8861 - 2005Документ3 страницыUS Internal Revenue Service: f8861 - 2005IRSОценок пока нет

- US Internal Revenue Service: f8830 - 2000Документ2 страницыUS Internal Revenue Service: f8830 - 2000IRSОценок пока нет

- US Internal Revenue Service: f8830 - 1998Документ2 страницыUS Internal Revenue Service: f8830 - 1998IRSОценок пока нет

- US Internal Revenue Service: f8845 - 2000Документ3 страницыUS Internal Revenue Service: f8845 - 2000IRSОценок пока нет

- US Internal Revenue Service: f8861 - 2004Документ3 страницыUS Internal Revenue Service: f8861 - 2004IRSОценок пока нет

- US Internal Revenue Service: f8820 - 1998Документ2 страницыUS Internal Revenue Service: f8820 - 1998IRSОценок пока нет

- US Internal Revenue Service: f8834 - 1992Документ2 страницыUS Internal Revenue Service: f8834 - 1992IRSОценок пока нет

- US Internal Revenue Service: f8874 - 2003Документ3 страницыUS Internal Revenue Service: f8874 - 2003IRSОценок пока нет

- US Internal Revenue Service: f8845 - 2004Документ3 страницыUS Internal Revenue Service: f8845 - 2004IRSОценок пока нет

- US Internal Revenue Service: f8874 - 2002Документ2 страницыUS Internal Revenue Service: f8874 - 2002IRSОценок пока нет

- US Internal Revenue Service: f8586 - 1997Документ2 страницыUS Internal Revenue Service: f8586 - 1997IRSОценок пока нет

- US Internal Revenue Service: f8860 - 2003Документ2 страницыUS Internal Revenue Service: f8860 - 2003IRSОценок пока нет

- US Internal Revenue Service: f8826 - 1992Документ2 страницыUS Internal Revenue Service: f8826 - 1992IRSОценок пока нет

- US Internal Revenue Service: f8860 - 2002Документ2 страницыUS Internal Revenue Service: f8860 - 2002IRSОценок пока нет

- US Internal Revenue Service: f8845 - 2003Документ3 страницыUS Internal Revenue Service: f8845 - 2003IRSОценок пока нет

- US Internal Revenue Service: f8830 - 2002Документ2 страницыUS Internal Revenue Service: f8830 - 2002IRSОценок пока нет

- US Internal Revenue Service: f8845 - 2002Документ3 страницыUS Internal Revenue Service: f8845 - 2002IRSОценок пока нет

- US Internal Revenue Service: f8844 - 1994Документ3 страницыUS Internal Revenue Service: f8844 - 1994IRSОценок пока нет

- US Internal Revenue Service: f3800 - 1992Документ2 страницыUS Internal Revenue Service: f3800 - 1992IRSОценок пока нет

- US Internal Revenue Service: f3800 - 1993Документ2 страницыUS Internal Revenue Service: f3800 - 1993IRSОценок пока нет

- US Internal Revenue Service: f3468 - 2004Документ4 страницыUS Internal Revenue Service: f3468 - 2004IRSОценок пока нет

- US Internal Revenue Service: f8834 - 1994Документ2 страницыUS Internal Revenue Service: f8834 - 1994IRSОценок пока нет

- US Internal Revenue Service: f8820 - 2003Документ2 страницыUS Internal Revenue Service: f8820 - 2003IRSОценок пока нет

- US Internal Revenue Service: f8881 - 2004Документ2 страницыUS Internal Revenue Service: f8881 - 2004IRSОценок пока нет

- US Internal Revenue Service: f8845 - 2005Документ3 страницыUS Internal Revenue Service: f8845 - 2005IRSОценок пока нет

- US Internal Revenue Service: f8884 - 2003Документ4 страницыUS Internal Revenue Service: f8884 - 2003IRSОценок пока нет

- US Internal Revenue Service: f8820 - 2002Документ2 страницыUS Internal Revenue Service: f8820 - 2002IRSОценок пока нет

- US Internal Revenue Service: f8860 - 2000Документ2 страницыUS Internal Revenue Service: f8860 - 2000IRSОценок пока нет

- US Internal Revenue Service: f8882 - 2002Документ3 страницыUS Internal Revenue Service: f8882 - 2002IRSОценок пока нет

- Empowerment Zone and Renewal Community Employment Credit: OMB No. 1545-1444 FormДокумент4 страницыEmpowerment Zone and Renewal Community Employment Credit: OMB No. 1545-1444 FormIRSОценок пока нет

- US Internal Revenue Service: f8882 - 2005Документ3 страницыUS Internal Revenue Service: f8882 - 2005IRS100% (1)

- US Internal Revenue Service: f8586 - 2003Документ2 страницыUS Internal Revenue Service: f8586 - 2003IRSОценок пока нет

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineОт EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Objectives Report To Congress v2Документ153 страницы2008 Objectives Report To Congress v2IRSОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Документ6 страницUS Internal Revenue Service: 2290rulesty2007v4 0IRSОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Credit Card Bulk Provider RequirementsДокумент112 страниц2008 Credit Card Bulk Provider RequirementsIRSОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Data DictionaryДокумент260 страниц2008 Data DictionaryIRSОценок пока нет

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- Bill NarzoДокумент1 страницаBill Narzomunnu2461Оценок пока нет

- Comparative Income Statement For The Year 17-18 & 18-19 Profit & Loss - Reliance Industries LTDДокумент23 страницыComparative Income Statement For The Year 17-18 & 18-19 Profit & Loss - Reliance Industries LTDManan Suchak100% (1)

- Acuite Ratings & Research LimitedДокумент1 страницаAcuite Ratings & Research LimitedBharat YadavОценок пока нет

- Taxation Notes - DimaampaoДокумент115 страницTaxation Notes - DimaampaoNLainie OmarОценок пока нет

- 05 Aashirwad Medical Agency - Blplup05-05.01.15Документ10 153 страницы05 Aashirwad Medical Agency - Blplup05-05.01.15Suraj RajbharОценок пока нет

- Taxes Are Enforced Proportional Contributions From Persons andДокумент5 страницTaxes Are Enforced Proportional Contributions From Persons andNate AlfaroОценок пока нет

- Sample Exam Questionnaire and Answer in TaxationДокумент6 страницSample Exam Questionnaire and Answer in TaxationKJ Vecino Bontuyan75% (4)

- CBK POWER LTD Vs CIRДокумент2 страницыCBK POWER LTD Vs CIRJM Ragaza67% (3)

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruДокумент1 страницаIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruASHISAОценок пока нет

- The Importance of Taxes To The Government and The EconomyДокумент3 страницыThe Importance of Taxes To The Government and The EconomyClarice Kee100% (5)

- Diamond ChemicalsДокумент3 страницыDiamond ChemicalsJohn RiveraОценок пока нет

- InvoiceДокумент1 страницаInvoiceAmit PrajapatiОценок пока нет

- Assignment 2.1 Taxable Income and Income Tax Payable of Individual TaxpayerДокумент2 страницыAssignment 2.1 Taxable Income and Income Tax Payable of Individual TaxpayerKate HerederoОценок пока нет

- Principle of Taxation LawДокумент3 страницыPrinciple of Taxation LawTaraChandraChouhanОценок пока нет

- Easy Peasy Trucking ProfileДокумент7 страницEasy Peasy Trucking ProfileGabby SinghОценок пока нет

- BIR Form 2307Документ3 страницыBIR Form 2307Jocere LopezОценок пока нет

- Invoice PDFДокумент1 страницаInvoice PDFAniket Ghosh0% (1)

- E13.2 (LO 1) (Accounts and Notes Payable) The Following Are Selected 2022 Transactions ofДокумент4 страницыE13.2 (LO 1) (Accounts and Notes Payable) The Following Are Selected 2022 Transactions ofChupa HesОценок пока нет

- First Division: Republic of The Philippines Court of Tax Appeals Quezon CityДокумент16 страницFirst Division: Republic of The Philippines Court of Tax Appeals Quezon CityMark Anthony Roy ÜОценок пока нет

- Chapter 1 of Introduction With Margin 1111-1-2Документ33 страницыChapter 1 of Introduction With Margin 1111-1-2YogiОценок пока нет

- H01 - Principles of TaxationДокумент9 страницH01 - Principles of TaxationRachel FuentesОценок пока нет

- Eastern Telecommunications PhilippinesДокумент3 страницыEastern Telecommunications PhilippinesTheodore0176Оценок пока нет

- Tax - Income Tax Individuals (Easy)Документ28 страницTax - Income Tax Individuals (Easy)Kristine Lirose BordeosОценок пока нет

- Sales Tax Test - SolutionДокумент4 страницыSales Tax Test - SolutionBilal GouriОценок пока нет

- Fabm2 12 Q2 1002 SGДокумент27 страницFabm2 12 Q2 1002 SGTin CabosОценок пока нет

- CARIÑO - Republic V ParañaqueДокумент1 страницаCARIÑO - Republic V ParañaqueGail CariñoОценок пока нет

- GST Module 1 Compiled PDFДокумент285 страницGST Module 1 Compiled PDFRahul DoshiОценок пока нет

- Non Individual Tax Clearance Certificate Application FormДокумент1 страницаNon Individual Tax Clearance Certificate Application FormNwogboji EmmanuelОценок пока нет

- Kashato Shirts SolutionsДокумент10 страницKashato Shirts SolutionsCriselda Mercado100% (1)

- Concentrix Services India Private Limited Payslip For The Month of March - 2022Документ1 страницаConcentrix Services India Private Limited Payslip For The Month of March - 2022Farhin Laskar100% (1)