Академический Документы

Профессиональный Документы

Культура Документы

US Internal Revenue Service: f8829 - 1992

Загружено:

IRSИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

US Internal Revenue Service: f8829 - 1992

Загружено:

IRSАвторское право:

Доступные форматы

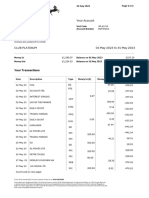

OMB No.

1545-1266

Form 8829 ©

Expenses for Business Use of Your Home

File with Schedule C (Form 1040). Use a separate Form 8829 for each

home you used for business during the year.

Department of the Treasury Attachment

Internal Revenue Service © See instructions on back. Sequence No. 66

Name(s) of proprietor(s) Your social security number

Part I Part of Your Home Used for Business

1 Area used exclusively for business (see instructions). Include area that does not meet exclusive

use test and either used for inventory storage or regularly used as part of a day-care facility 1

2 Total area of home 2

3 Divide line 1 by line 2. Enter the result as a percentage 3 %

● For day-care facilities not used exclusively for business, also complete lines 4–6.

● All others, skip lines 4–6 and enter the amount from line 3 on line 7.

4 Multiply days used for day care during year by hours used per day 4 hr.

5 Total hours available for use during the year (366 days 3 24 hours). See instructions 5 8,784 hr.

6 Divide line 4 by line 5. Enter the result as a decimal amount 6 .

7 Business percentage. For day-care facilities not used exclusively for business, multiply line 6 by

line 3 (enter the result as a percentage). All others, enter the amount from line 3 © 7 %

Part II Figure Your Allowable Deduction

8 Enter the amount from Schedule C, line 29, plus any net gain or (loss) derived from the business use of

your home and shown on Schedule D or Form 4797. If more than one place of business, see instructions 8

See instructions for columns (a) and (b) before (a) Direct expenses (b) Indirect expenses

completing lines 9–20.

9 Casualty losses. See instructions 9

10 Deductible mortgage interest. See instructions 10

11 Real estate taxes. See instructions 11

12 Add lines 9, 10, and 11 12

13 Multiply line 12, column (b) by line 7 13

14 Add line 12, column (a) and line 13 14

15 Subtract line 14 from line 8. If zero or less, enter -0- 15

16 Excess mortgage interest. See instructions 16

17 Insurance 17

18 Repairs and maintenance 18

19 Utilities 19

20 Other expenses. See instructions 20

21 Add lines 16 through 20 21

22 Multiply line 21, column (b) by line 7 22

23 Carryover of operating expenses from 1991 Form 8829, line 41 23

24 Add line 21 in column (a), line 22, and line 23 24

25 Allowable operating expenses. Enter the smaller of line 15 or line 24 25

26 Limit on excess casualty losses and depreciation. Subtract line 25 from line 15 26

27 Excess casualty losses. See instructions 27

28 Depreciation of your home from Part III below 28

29 Carryover of excess casualty losses and depreciation from 1991 Form 8829, line 42 29

30 Add lines 27 through 29 30

31 Allowable excess casualty losses and depreciation. Enter the smaller of line 26 or line 30 31

32 Add lines 14, 25, and 31 32

33 Casualty loss portion, if any, from lines 14 and 31. Carry amount to Form 4684, Section B 33

34 Allowable expenses for business use of your home. Subtract line 33 from line 32. Enter here

and on Schedule C, line 30. If your home was used for more than one business, see instructions © 34

Part III Depreciation of Your Home

35 Enter the smaller of your home’s adjusted basis or its fair market value. See instructions 35

36 Value of land included on line 35 36

37 Basis of building. Subtract line 36 from line 35 37

38 Business basis of building. Multiply line 37 by line 7 38

39 Depreciation percentage. See instructions 39 %

40 Depreciation allowable. Multiply line 38 by line 39. Enter here and on line 28 above. See instructions 40

Part IV Carryover of Unallowed Expenses to 1993

41 Operating expenses. Subtract line 25 from line 24. If less than zero, enter -0- 41

42 Excess casualty losses and depreciation. Subtract line 31 from line 30. If less than zero, enter -0- 42

For Paperwork Reduction Act Notice, see back of form. Cat. No. 13232M Form 8829 (1992)

Form 8829 (1992) Page 2

General Instructions day. Enter 3,400 hours on line 4 (3,000 hours for 4684 to deduct the personal portion of your

weekdays plus 400 hours for Saturdays). casualty losses.

Paperwork Reduction Act Notice.—We ask for Line 5.—If you started or stopped using your On line 10, include only mortgage interest

the information on this form to carry out the home for day care in 1992, you must prorate the that would be deductible on Schedule A and

Internal Revenue laws of the United States. You number of hours based on the number of days that qualifies as a direct or indirect expense. Do

are required to give us the information. We need the home was available for day care. Cross out not include interest on a mortgage loan that did

it to ensure that you are complying with these the preprinted entry on line 5. Multiply 24 hours not benefit your home (e.g., a home equity loan

laws and to allow us to figure and collect the by the number of days available and enter the used to pay off credit card bills, to buy a car, or

right amount of tax. result. to pay tuition costs).

The time needed to complete and file this form Line 8.—If all of the gross income from your If you itemized your deductions, be sure to

will vary depending on individual circumstances. trade or business is from the business use of claim only the personal portion of your

The estimated average time is: Recordkeeping, your home, enter on line 8 the amount from deductible mortgage interest and real estate

52 min.; Learning about the law or the form, 7 Schedule C, line 29, plus any net gain or (loss) taxes on Schedule A. For example, if your

min.; Preparing the form, 1 hr., 13 min.; and derived from the business use of your home and business percentage on line 7 is 30%, you can

Copying, assembling, and sending the form to shown on Schedule D or Form 4797. If you file claim 70% of your deductible mortgage interest

the IRS, 20 min. more than one Form 8829, include only the and real estate taxes on Schedule A.

If you have comments concerning the income earned and the deductions attributable Line 16.—If the amount of home mortgage

accuracy of these time estimates or suggestions to that income during the period you owned the interest you deduct on Schedule A is limited,

for making this form more simple, we would be home for which Part I was completed. enter the part of the excess mortgage interest

happy to hear from you. You can write to both If part of the income is from a place of that qualifies as a direct or indirect expense. Do

the IRS and the Office of Management and business other than your home, you must first not include mortgage interest on a loan that did

Budget at the addresses listed in the instructions determine the part of your gross income not benefit your home (explained above).

for Form 1040. (Schedule C, line 7, and gains from Schedule D Line 20.—If you rent rather than own your home,

Purpose of Form.—Use Form 8829 to figure the and Form 4797) from the business use of your include the rent you paid on line 20, column (b).

allowable expenses for business use of your home. In making this determination, consider the Line 27.—Multiply your casualty losses in excess

home on Schedule C (Form 1040) and any amount of time you spend at each location as of the amount on line 9 by the business

carryover to 1993 of amounts not deductible in well as other facts. After determining the part of percentage of those losses and enter the result.

1992. If all of the expenses for business use of your gross income from the business use of your

Line 34.—If your home was used in more than

your home are properly allocable to inventory home, subtract from that amount the total

one business, allocate the amount shown on line

costs, do not complete Form 8829. Expenses expenses shown on Schedule C, line 28, plus

34 to each business using any method that is

properly includible in inventory are figured in Part any losses from your business shown on

reasonable under the circumstances. For each

III of Schedule C and not on Form 8829. Schedule D or Form 4797. Enter the result on

business, enter on Schedule C, line 30, only the

You must meet specific requirements to line 8 of Form 8829.

amount allocated to that business.

deduct expenses for the business use of your Columns (a) and (b).—Enter as direct or indirect

Lines 35 through 37.—Enter on line 35 the cost

home. Even if you meet these requirements, your expenses only expenses for the business use of

or other basis of your home, or if less, the fair

deductible expenses are limited. For details, get your home (i.e., expenses allowable only

market value of your home on the date you first

Pub. 587, Business Use of Your Home. because your home is used for business). Other

used the home for business. Do not adjust this

Note: If you file Schedule F (Form 1040) or you expenses not allocable to the business use of

amount for depreciation claimed or changes in

are an employee, do not use this form. Instead, your home such as salaries, supplies, and

fair market value after the year you first used

use the worksheet in Pub. 587. business telephone expenses, are deductible

your home for business. Allocate this amount

Who May Deduct Expenses for Business Use elsewhere on Schedule C and should not be

between land and building values on lines 36

of a Home.—Generally, you may deduct entered on Form 8829.

and 37.

business expenses that apply to a part of your Direct expenses benefit only the business

Show on an attached schedule the cost or

home only if that part is exclusively used on a part of your home. They include painting or

other basis of additions and improvements

regular basis: repairs made to the specific area or room used

placed in service after you began to use your

● As your principal place of business for any of for business. Enter 100% of your direct

home for business. Do not include any amounts

your trades or businesses; or expenses on the appropriate expense line in

on lines 35 through 38 for these expenditures.

● As a place of business used by your patients, column (a).

Instead, see the instructions for line 40.

clients, or customers to meet or deal with you in Indirect expenses are for keeping up and

Line 39.—If you first used your home for

the normal course of your trade or business; or running your entire home. They benefit both the

business in 1992, enter the percentage for the

● In connection with your trade or business if it business and personal parts of your home.

month you first used it for business.

is a separate structure that is not attached to Generally, enter 100% of your indirect expenses

your home. on the appropriate expense line in column (b). Jan. 3.042% May 1.984% Sept. 0.926%

Exception: If the business percentage of an

Exception for storage of inventory.—You may Feb. 2.778% June 1.720% Oct. 0.661%

indirect expense is different from the percentage

also deduct expenses that apply to space within March 2.513% July 1.455% Nov. 0.397%

on line 7, enter only the business part of the

your home if it is the only fixed location of your

expense on the appropriate line in column (a), April 2.249% Aug. 1.190% Dec. 0.132%

trade or business. The space must be used on a

and leave that line in column (b) blank. For

regular basis to store inventory from your trade

example, your electric bill is $800 for lighting, If you first used your home for business before

or business of selling products at retail or

cooking, laundry, and television. If you 1992 and after 1986, enter 3.175%. If the

wholesale.

reasonably estimate $300 of your electric bill is business use began before 1987 or you stopped

Exception for day-care facilities.—If you use for lighting and you use 10% of your home for using your home for business before the end of

space in your home on a regular basis in your business, enter $30 on line 19 in column (a). Do the year, see Pub. 534, Depreciation, for the

trade or business of providing day care, you may not make an entry on line 19 in column (b) for percentage to enter.

be able to deduct the business expenses even any part of your electric bill.

though you use the same space for nonbusiness Line 40.—Include on line 40 depreciation on

Lines 9, 10, and 11.—Enter only the amounts

purposes. additions and improvements placed in service

that would be deductible whether or not you

after you began using your home for business.

used your home for business (i.e., amounts

Specific Instructions allowable as itemized deductions on Schedule A

See Pub. 534 to figure the amount of

depreciation allowed on these expenditures.

Lines 1 and 2.—To determine the area on lines 1 (Form 1040)).

Attach a schedule showing how you figured

and 2, you may use square feet or any other Treat casualty losses as personal expenses depreciation on any additions or improvements.

reasonable method if it accurately figures your for this step. Figure the amount to enter on line Write “See attached” below the entry space.

business percentage on line 7. 9 by completing Form 4684, Section A. When

Do not include on line 1 the area of your home figuring line 17, enter 10% of your adjusted Complete and attach Form 4562, Depreciation

you used to figure any expenses allocable to gross income excluding the gross income from and Amortization, if you first used your home for

inventory costs. The business percentage of business use of your home and the deductions business in 1992 or you are depreciating

these expenses should have been taken into attributable to that income. Include on line 9 of additions or improvements placed in service in

account in Part III of Schedule C. Form 8829 the amount from Form 4684, line 18. 1992. If you first used your home for business in

See line 27 to deduct part of the casualty losses 1992, enter on Form 4562, in column (c) of line

Line 4.—Enter the total number of hours the

not allowed because of the limits on Form 4684. 14h, the amount from line 38 of Form 8829.

facility was used for day care during the year.

Do not file or use that Form 4684 to figure the Then enter on Form 4562, in column (g) of line

Example. Your home is used Monday through 14h, the amount from line 40 of Form 8829 (but

Friday for 12 hours per day for 250 days during the amount of casualty losses to deduct on

Schedule A. Instead, complete a separate Form do not include it on Schedule C, line 13).

year. It is also used on 50 Saturdays for 8 hours per

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Objectives Report To Congress v2Документ153 страницы2008 Objectives Report To Congress v2IRSОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- US Internal Revenue Service: 2290rulesty2007v4 0Документ6 страницUS Internal Revenue Service: 2290rulesty2007v4 0IRSОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Credit Card Bulk Provider RequirementsДокумент112 страниц2008 Credit Card Bulk Provider RequirementsIRSОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Data DictionaryДокумент260 страниц2008 Data DictionaryIRSОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- Grindly Gases Petrochemicals PVT LTD - 270 - 11!09!2021Документ2 страницыGrindly Gases Petrochemicals PVT LTD - 270 - 11!09!2021Pragnesh PrajapatiОценок пока нет

- Eastern Telecommunications Philippines vs. CIRДокумент2 страницыEastern Telecommunications Philippines vs. CIRAnneОценок пока нет

- Books ListДокумент21 страницаBooks ListitsgutsyОценок пока нет

- Appendix 9D - Instructions - RAODCOДокумент1 страницаAppendix 9D - Instructions - RAODCOdinvОценок пока нет

- Usman Dan Fodio University, Sokoto - 1000130: Payer InformationДокумент1 страницаUsman Dan Fodio University, Sokoto - 1000130: Payer InformationOdunlami DamilolaОценок пока нет

- Sept Dec2019Документ9 страницSept Dec2019shivaОценок пока нет

- Lynette Moss An Architect Opened An Office On April 1Документ1 страницаLynette Moss An Architect Opened An Office On April 1Amit PandeyОценок пока нет

- AFNANДокумент2 страницыAFNANAmalia KamilaОценок пока нет

- Donor's Tax TRAIN LAWДокумент4 страницыDonor's Tax TRAIN LAWJenMarlon Corpuz Aquino100% (1)

- Drozynski MaciejДокумент3 страницыDrozynski MaciejITОценок пока нет

- XXXX XXXX XXXX 5026: Han Cai Account Number: XXXX XXXX XXXX 5026 Closing Date: September 2, 2023Документ4 страницыXXXX XXXX XXXX 5026: Han Cai Account Number: XXXX XXXX XXXX 5026 Closing Date: September 2, 2023finape6897Оценок пока нет

- Ss2 2Документ1 страницаSs2 2Avya BrutusОценок пока нет

- Covid-19 - Loan Instalment /credit Card Dues Deferment Terms and ConditionsДокумент3 страницыCovid-19 - Loan Instalment /credit Card Dues Deferment Terms and ConditionsGeetha LeninОценок пока нет

- Online TISSForm Instruction Revenue GatewayДокумент7 страницOnline TISSForm Instruction Revenue GatewayisayaОценок пока нет

- Invoice: Email Info@greensoul - Online Website Greensoul - OnlineДокумент1 страницаInvoice: Email Info@greensoul - Online Website Greensoul - OnlineANIL KUMAR REDDYОценок пока нет

- Proforma Invoice: No-61, Om Sakthi Nagar, Madagadipet, Gstin/Uin: 34ABBFM1856E1ZK State Name: Puducherry, Code: 34Документ1 страницаProforma Invoice: No-61, Om Sakthi Nagar, Madagadipet, Gstin/Uin: 34ABBFM1856E1ZK State Name: Puducherry, Code: 34surajdoraОценок пока нет

- Taxation Pilot QuestionsxДокумент14 страницTaxation Pilot QuestionsxEmmanuel ObafemmyОценок пока нет

- Reward Current Account Statement: Nabeel AhmedДокумент1 страницаReward Current Account Statement: Nabeel AhmedAlex Beldiman100% (1)

- Tax Compilation 2Документ85 страницTax Compilation 2Michelle Valdez AlvaroОценок пока нет

- The Negotiable Instruments Act 1881Документ55 страницThe Negotiable Instruments Act 1881Ashish Mishra100% (1)

- Chapter 12: Assessment of Various Entities: Section - A: Statutory UpdateДокумент49 страницChapter 12: Assessment of Various Entities: Section - A: Statutory UpdateAmol TambeОценок пока нет

- Income Tax (Module2)Документ12 страницIncome Tax (Module2)Ella Marie LopezОценок пока нет

- CPAR TAX - Other Percentage Taxes PDFДокумент13 страницCPAR TAX - Other Percentage Taxes PDFJohn Carlo CruzОценок пока нет

- Transaction Codes - FIДокумент26 страницTransaction Codes - FINikunj JainОценок пока нет

- Cae05-Chapter 4 Notes Receivables & Payable Problem DiscussionДокумент12 страницCae05-Chapter 4 Notes Receivables & Payable Problem DiscussionSteffany RoqueОценок пока нет

- Authorization For Credit Card Transactions: U.S. Citizenship and Immigration ServicesДокумент1 страницаAuthorization For Credit Card Transactions: U.S. Citizenship and Immigration ServicesDIEGO BUSTOSОценок пока нет

- Profits and Gains From Business and ProfessionДокумент78 страницProfits and Gains From Business and ProfessionNidhi GuptaОценок пока нет

- TAX - Individual TaxationДокумент40 страницTAX - Individual TaxationErika Mae LegaspiОценок пока нет

- Wa0000.Документ1 страницаWa0000.nikhil buddaОценок пока нет

- 21072023, 010608 PDFДокумент2 страницы21072023, 010608 PDFCatalina-Elena100% (1)

- The Great Alone by Kristin Hannah (Trivia-On-Books)От EverandThe Great Alone by Kristin Hannah (Trivia-On-Books)Рейтинг: 4.5 из 5 звезд4.5/5 (2)

- Alchemy Elementals: A Tool for Planetary Healing: An Immersive Audio Experience for Spiritual AwakeningОт EverandAlchemy Elementals: A Tool for Planetary Healing: An Immersive Audio Experience for Spiritual AwakeningРейтинг: 5 из 5 звезд5/5 (4)

- The Psychic Workbook: A Beginner's Guide to Activities and Exercises to Unlock Your Psychic SkillsОт EverandThe Psychic Workbook: A Beginner's Guide to Activities and Exercises to Unlock Your Psychic SkillsРейтинг: 4.5 из 5 звезд4.5/5 (2)

- Lost in a Good Game: Why we play video games and what they can do for usОт EverandLost in a Good Game: Why we play video games and what they can do for usРейтинг: 4.5 из 5 звезд4.5/5 (31)

- Thinking, Fast and Slow: By Daniel Kahneman (Trivia-On-Book)От EverandThinking, Fast and Slow: By Daniel Kahneman (Trivia-On-Book)Рейтинг: 5 из 5 звезд5/5 (2)

- How to Win the Lottery: Simple Lottery Strategies for Beginners and the Very UnluckyОт EverandHow to Win the Lottery: Simple Lottery Strategies for Beginners and the Very UnluckyОценок пока нет

- Embrace Your Weird: Face Your Fears and Unleash CreativityОт EverandEmbrace Your Weird: Face Your Fears and Unleash CreativityРейтинг: 4.5 из 5 звезд4.5/5 (124)

- The SNES Encyclopedia: Every Game Released for the Super Nintendo Entertainment SystemОт EverandThe SNES Encyclopedia: Every Game Released for the Super Nintendo Entertainment SystemРейтинг: 4.5 из 5 звезд4.5/5 (3)