Академический Документы

Профессиональный Документы

Культура Документы

US Internal Revenue Service: fw5 - 1994

Загружено:

IRSИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

US Internal Revenue Service: fw5 - 1994

Загружено:

IRSАвторское право:

Доступные форматы

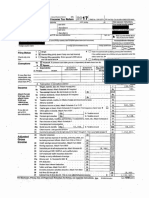

Form W-5 Earned Income Credit

Department of the Treasury

Advance Payment Certificate

Internal Revenue Service

Instructions able to claim the EIC, answer the Note: An adopted child includes a child

questions on page 2. If you expect to placed with you by an authorized

Changes To Note file Form 2555, Foreign Earned Income, placement agency for legal adoption

If you do not have a qualifying child or Form 2555-EZ, Foreign Earned even if the adoption isn’t final. A foster

(defined later), you may be able to claim Income Exclusion, for 1994, you cannot child is any child you cared for as your

the earned income credit on your 1994 claim the EIC. own child.

tax return. But you cannot get advance 2. The child is under age 19 or a

payments of the credit unless you have

How Do I Get Advance EIC full-time student under age 24 at the

a qualifying child. Also, the extra credit Payments? end of 1994, or is permanently and

for a child born during the year and the If you are eligible to get advance EIC totally disabled.

health insurance credit are no longer payments for 1994, you may be able to 3. The child either lives with you in the

allowed. get up to $102 a month added to your United States for more than half of 1994

take-home pay. To get advance EIC (for all of 1994 if a foster child) OR was

Purpose payments, fill in the Form W-5 at the born, or died, in 1994 and your home in

Use Form W-5 if you are eligible to get bottom of this page. Then, detach it and the United States was the child’s home

part of the earned income credit (EIC) in give it to your employer. If you get for the entire time he or she was alive.

advance with your pay and choose to do advance payments, you must file a 1994

Form 1040A or Form 1040. Note: Temporary absences such as for

so. If you choose not to get advance school, medical care, or vacation count

payments, you can still claim the EIC on You may have only one Form W-5 in as time lived with you.

your 1994 tax return. effect with a current employer at one

time. If you and your spouse are both Married Child.—If the child is married at

What Is the EIC? employed, each of you should file a the end of 1994, the child is a qualifying

The EIC is a refundable tax credit for separate Form W-5. child only if you may claim the child as

certain workers. For 1994, the EIC can your dependent or the Exception below

This Form W-5 expires on December applies to you.

be as much as $2,038 if you have one 31, 1994. If you are eligible to get

qualifying child; $2,528 if you have more advance EIC payments for 1995, you Exception. You are the custodial

than one qualifying child; $306 if you do must file a new Form W-5 next year. parent and would be able to claim the

not have a qualifying child. child as your dependent but the

Note: You may be able to get a larger

noncustodial parent claims the child as a

Who Is Eligible To Get Advance credit when you file your 1994 retur n.

dependent because—

For details, see Additional Credit on

EIC Payments? page 2. ● You signed Form 8332, Release of

You are eligible to get advance EIC Claim to Exemption for Child of Divorced

payments if all three of the following Who Is a Qualifying Child? or Separated Parents, or a similar

apply: Any child who meets all three of the statement, agreeing not to claim the

following conditions is a qualifying child for 1994, or

1. You have a qualifying child. child: ● You have a pre-1985 divorce decree

2. You expect that your 1994 earned 1. The child is your son, daughter, or separation agreement that allows the

income and adjusted gross income will adopted child, stepchild, foster child, or noncustodial parent to claim the child

each be less than $23,755 (including a descendant (for example, your and he or she gives at least $600 for the

your spouse’s income if you expect to grandchild) of your son, daughter, or child’s support in 1994.

file a joint return). adopted child.

3. You expect to be able to claim the (Continued on page 2)

EIC for 1994. To find out if you may be

Ä Give the lower part to your employer; keep the top part for your records. Ä

Detach along this line

Form W-5 Earned Income Credit OMB No. 1545-1342

Advance Payment Certificate

Department of the Treasury

Internal Revenue Service © This certificate expires on December 31, 1994.

Type or print your full name Your social security number

Note: If you get advance payments of the earned income credit for 1994, you must file a 1994 Form 1040A or Form 1040. To get advance

payments, your filing status must be any status except married filing a separate return and you must have a qualifying child.

1 I expect to be able to claim the earned income credit for 1994, I do not have another Form W-5 in effect with any Yes No

other current employer, and I choose to get advance EIC payments

2 Do you have a qualifying child?

3 Are you married?

4 If you are married, does your spouse have a Form W-5 in effect for 1994 with any employer?

Under penalties of perjury, I declare that the information I have furnished above is, to the best of my knowledge, true, correct, and complete.

Signature © Date ©

Cat. No. 10227P

Form W-5 (1994) Page 2

Questions To See If You May Be Able To Claim the EIC for 1994

1 Do you have a qualifying child? Read Who Is A Qualifying Child? on page 1 before you answer this question. Yes No

If the child is married, be sure you also read Married Child on page 1

● If you answered No, stop here. You may be able to claim the EIC but you cannot get advance EIC payments.

● If you answered Yes, continue.

Caution: If the child is a qualifying child for both you and another person, the child is your qualifying child only

if you expect your 1994 adjusted gross income to be higher than the other person’s adjusted gross income. If

the other person is your spouse and you expect to file a joint retur n for 1994, this rule doesn’t apply.

2 Do you expect your 1994 filing status to be Single, Married filing a joint return, Head of household, or Qualifying

widow(er) with dependent child?

● If you answered No because you expect your 1994 filing status to be Married filing a separate return, stop

here. You cannot claim the EIC.

● If you answered Yes, continue.

3 Do you expect that your 1994 earned income and adjusted gross income will each be less than $23,755 (less

than $25,296 if you have more than one qualifying child)? If you expect to file a joint return for 1994, include

your spouse’s income when answering this question

TIP: To find out what is included in adjusted gross income, you can look at page 1 of your 1993 Form 1040EZ,

Form 1040A, or Form 1040.

● If you answered No, stop here. You cannot claim the EIC.

● If you answered Yes, continue. But remember, you cannot get advance EIC payments if you expect your 1994

earned income or adjusted gross income will be $23,755 or more.

4 Do you expect to be a qualifying child of another person for 1994?

● If you answered No, you may be able to claim the EIC.

● If you answered Yes, you cannot claim the EIC.

(Instructions continued)

Qualifying Child of More Than One ● Your spouse files Form W-5 with his the United States. Internal Revenue

Person.—If the child is a qualifying child or her employer. On line 4 of your new Code sections 3507 and 6109 and their

of more than one person, only the Form W-5, check the “Yes” box. regulations require you to provide the

person with the highest adjusted gross Note: If you get the EIC in advance with information requested on Form W-5 and

income for 1994 may treat that child as your pay and later find out that you are give the form to your employer if you

a qualifying child. If the other person is not eligible, you must pay it back when want advance payment of the EIC. As

your spouse and you expect to file a you file your 1994 Federal income tax provided by law, we may give the

joint return for 1994, this rule doesn’t retur n. information to the Department of Justice

apply. and other Federal agencies. In addition,

Reminder.—You must usually get a Additional Information we may give it to cities, states, and the

social security number for a qualifying District of Columbia so they may carry

How To Claim the EIC out their tax laws.

child born before 1994.

Fill in and attach Schedule EIC to your

The time needed to complete this

What If My Situation Changes? 1994 Form 1040 or Form 1040A. In

form will vary depending on individual

addition to other information, the social

If your situation changes in 1994 after circumstances. The estimated average

security number of your qualifying child

you give Form W-5 to your present time is: Recordkeeping, 7 min.;

born before 1994 must generally be

employer, you usually will have to file a Learning about the law or the form,

shown on Schedule EIC.

new Form W-5. For example, you should 9 min.; and Preparing the form,

file a new Form W-5 if any of the Additional Credit 26 min.

following applies: If you have comments concerning the

You may be able to claim a larger credit

● Your situation changes so that your when you file your 1994 tax return accuracy of these time estimates or

answer to question 1 above becomes because you may not get more than suggestions for making this form more

“No.” On line 2 of your new Form W-5, $1,223 of the EIC in advance with your simple, we would be happy to hear from

check the "No" box. pay. You may also be able to claim a you. You can write to both the Internal

● Your situation changes so that your larger credit if you have more than one Revenue Service, Attention: Reports

answer to question 2 or 3 above qualifying child. But you must file your Clearance Officer, PC:FP,

becomes “No,” or your answer to 1994 tax return to claim any additional Washington, DC 20224; and the Office

question 4 becomes “Yes.” On line 1 of credit. of Management and Budget,

your new Form W-5, check the "No" Paperwork Reduction Project

box. Privacy Act and Paperwork (1545-1342), Washington, DC 20503. DO

● You no longer want to get advance Reduction Act Notice NOT send this form to either of these

payments. On line 1 of your new Form offices. Instead, give it to your employer.

We ask for the information on this form

W-5, check the “No” box. to carry out the Internal Revenue laws of

Printed on recycled paper

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- 2024 - Tax Slayer MethodДокумент67 страниц2024 - Tax Slayer Methodtechnicaldepartment48100% (10)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Nonprofit Law OutlineДокумент38 страницNonprofit Law OutlineAlex Sherman100% (8)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Drivewealth, LLC 97 Main ST 2Nd Floor CHATHAM, NJ 07928: For Your Investing Account With Cash App Investing LLCДокумент8 страницDrivewealth, LLC 97 Main ST 2Nd Floor CHATHAM, NJ 07928: For Your Investing Account With Cash App Investing LLCAdib RashidОценок пока нет

- 2016 Algeri C Form 1040 Individual Tax Return - RecordsДокумент10 страниц2016 Algeri C Form 1040 Individual Tax Return - RecordsbrynsteinОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Abdi 2022 - TaxReturnДокумент19 страницAbdi 2022 - TaxReturnAbdu AbabiloОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Wages Vs IncomeДокумент8 страницWages Vs Incomesakins9429Оценок пока нет

- Manual Payroll Processing Free Doc TemplateДокумент55 страницManual Payroll Processing Free Doc TemplateSwaminathan NatarajanОценок пока нет

- CorporationsДокумент68 страницCorporationsPaoОценок пока нет

- Wage and Tax Statement: OMB No. 1545-0008Документ3 страницыWage and Tax Statement: OMB No. 1545-0008h6bnyrr9mrОценок пока нет

- English-Spanish Glossary of Tax Words and Phrases: Used in Publications Issued by The IRSДокумент45 страницEnglish-Spanish Glossary of Tax Words and Phrases: Used in Publications Issued by The IRSdaniela herreroОценок пока нет

- W-8BEN Form - Frequently Asked QuestionsДокумент2 страницыW-8BEN Form - Frequently Asked QuestionsAnkit ChhabraОценок пока нет

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- 2008 Data DictionaryДокумент260 страниц2008 Data DictionaryIRSОценок пока нет

- US Internal Revenue Service: 2290rulesty2007v4 0Документ6 страницUS Internal Revenue Service: 2290rulesty2007v4 0IRSОценок пока нет

- 2008 Credit Card Bulk Provider RequirementsДокумент112 страниц2008 Credit Card Bulk Provider RequirementsIRSОценок пока нет

- 2008 Objectives Report To Congress v2Документ153 страницы2008 Objectives Report To Congress v2IRSОценок пока нет

- 2016 California Resident Income Tax Return Form 540 2ezДокумент4 страницы2016 California Resident Income Tax Return Form 540 2ezapi-354477702Оценок пока нет

- US Internal Revenue Service: p575 - 1997Документ39 страницUS Internal Revenue Service: p575 - 1997IRSОценок пока нет

- Computation of Taxable Income of A Company: Four HeadsДокумент3 страницыComputation of Taxable Income of A Company: Four HeadsMrigendra MishraОценок пока нет

- Order For Tax Forms Outlet Program (TFOP)Документ3 страницыOrder For Tax Forms Outlet Program (TFOP)redhighlanderОценок пока нет

- NTA Annual ReportДокумент293 страницыNTA Annual ReportAustin DeneanОценок пока нет

- Chapter 17Документ42 страницыChapter 17Dyllan HolmesОценок пока нет

- A Donor's Guide: Vehicle DonationДокумент10 страницA Donor's Guide: Vehicle Donationriki187Оценок пока нет

- PROFILE - Customized Pre-Application WorksheetДокумент19 страницPROFILE - Customized Pre-Application WorksheetShadid KhanОценок пока нет

- Pearsons Federal Taxation 2019 Comprehensive 32nd Edition Rupert Solutions ManualДокумент15 страницPearsons Federal Taxation 2019 Comprehensive 32nd Edition Rupert Solutions Manualbannerolglycide41uud100% (24)

- Racquet Sports IndustryДокумент44 страницыRacquet Sports IndustryLiya DavidovОценок пока нет

- 미국 회계 용어Документ20 страниц미국 회계 용어jenifferОценок пока нет

- South Dakota State FRSДокумент80 страницSouth Dakota State FRSMatt BrownОценок пока нет

- Amended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesДокумент2 страницыAmended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesKel TranОценок пока нет

- Sri InternationalДокумент46 страницSri InternationalKshitij PalОценок пока нет

- Sanders IRS Filing 2017Документ21 страницаSanders IRS Filing 2017Stephanie Dube DwilsonОценок пока нет

- Amazon Tax Information InterviewДокумент2 страницыAmazon Tax Information InterviewPrecious AdeboboyeОценок пока нет

- Passive Activity Loss Audit Technique GuideДокумент154 страницыPassive Activity Loss Audit Technique GuidePeter Ben EzraОценок пока нет

- DonorsTrust522166327 2010 07d49e69searchableДокумент103 страницыDonorsTrust522166327 2010 07d49e69searchablecmf8926Оценок пока нет

- Are World Bank Salaries Tax Free: Click Here To DownloadДокумент3 страницыAre World Bank Salaries Tax Free: Click Here To Downloadkovi mОценок пока нет