Академический Документы

Профессиональный Документы

Культура Документы

US Internal Revenue Service: I1040sr - 1991

Загружено:

IRS0 оценок0% нашли этот документ полезным (0 голосов)

49 просмотров2 страницыCredit is based on filing status, age, and income. If you are married filing a joint return, it is also based on your spouse's income. Credit not available if your income is equal to or more than a certain dollar amount.

Исходное описание:

Оригинальное название

US Internal Revenue Service: i1040sr--1991

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документCredit is based on filing status, age, and income. If you are married filing a joint return, it is also based on your spouse's income. Credit not available if your income is equal to or more than a certain dollar amount.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

49 просмотров2 страницыUS Internal Revenue Service: I1040sr - 1991

Загружено:

IRSCredit is based on filing status, age, and income. If you are married filing a joint return, it is also based on your spouse's income. Credit not available if your income is equal to or more than a certain dollar amount.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

Department of the Treasury

Internal Revenue Service

1991 Instructions for Schedule R (Form 1040)

Use Schedule R (Form 1040) to figure the credit for the elderly or the disabled.

Credit for the Additional Information. Get Pub. 524, Credit for the Elderly or the Disabled, for

more details.

Elderly or the

Disabled

and totally disabled to take the credit. A employer’s convenience. Mary is consid-

person is permanently and totally disabled ered engaged in a substantial gainful ac-

Who Can Take the if both of the following apply: tivity and cannot take the credit.

Credit 1. He or she cannot engage in any sub-

stantial gainful activity because of a phys-

Example 3 shows a person who might

not be considered engaged in a substan-

Some people age 65 or older and certain ical or mental condition, and tial gainful activity.

disabled people may take this credit and 2. A physician determines that the condi- Example 3. John, who retired on disabil-

pay less tax. The credit is based on your tion (a) has lasted or can be expected to ity, took a job with a former employer on

filing status, age, and income. If you are last continuously for at least a year, or (b) a trial basis. The purpose of the job was

married filing a joint return, it is also based can lead to death. to see if John could do the work. The trial

on your spouse’s age and income. Examples 1 and 2 below show situa- period lasted for some time during which

You may be able to take the credit for tions in which the individuals are consid- John was paid at a rate equal to the mini-

1991 if either of the following applies: ered engaged in a substantial gainful mum wage. However, because of John’s

● You were age 65 or older at the end of activity. Note: In each example, the disability, only light duties of a nonproduc-

1991, OR person was under age 65 at the end of the tive, make-work nature were given him.

● You were under age 65 at the end of year. Unless the activity is both substantial and

1991 and you meet all three of the follow- Example 1. Sue retired on disability as a gainful, John is not engaged in a substan-

ing tests: sales clerk. She now works as a full-time tial gainful activity. The activity was gainful

1. You were permanently and totally dis- babysitter at a rate of pay equal to the because John was paid at a rate at or

abled on the date you retired; or if you minimum wage. Although she does differ- above the minimum wage. However, the

retired before January 1, 1977, you were ent work, Sue babysits on ordinary terms activity was not substantial because the

permanently and totally disabled on Jan- for the minimum wage. She cannot take duties were of a nonproductive, make-

uary 1, 1976, or January 1, 1977; and the credit. work nature. These facts do not, by them-

2. You received taxable disability income Example 2. Mary, the president of XYZ selves, establish John’s ability to engage

for 1991; and Corporation, retired on disability because in a substantial gainful activity.

3. On January 1, 1991, you had not of her terminal illness. On her doctor’s Disability income.—Generally, disability

reached mandatory retirement age (the advice, she works part-time as a manager income is the total amount you were paid

age when your employer’s retirement pro- and is paid more than the minimum wage. under your employer’s accident and

gram would have required you to retire). Her employer sets her days and hours. health plan or pension plan that is includ-

Although Mary’s illness is terminal and she ed in your income as wages or payments

For the definition of permanent and total

works part-time, the work is done at her in lieu of wages for the time you were

disability, see What is permanent and

absent from work because of permanent

total disability? below. Also, see the in-

and total disability. However, any payment

structions for Part II.

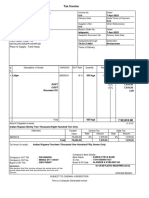

Married persons.—If you were married at Income Limits for Credit for the Elderly or the Disabled

the end of 1991, generally you must file a If you are: You generally cannot take the credit if:

joint return to take the credit. However, if

your filing status on Form 1040 is married Single, Head of household, or The amount on Form 1040, line 32, is

filing a separate return, you may take the Qualifying widow(er) $17,500 or more; or you received $5,000

credit only if you lived apart from your or more of nontaxable social security or

spouse ALL year. other nontaxable pensions

Nonresident aliens.—If you were a non- Married filing a joint return and The amount on Form 1040, line 32, is

resident alien at any time during 1991, you only one spouse is eligible for $20,000 or more; or you received $5,000

may be able to take the credit only if you the credit or more of nontaxable social security or

were married to a U.S. citizen or resident other nontaxable pensions

alien at the end of 1991 and you and your

spouse elect to file a joint return. Married filing a joint return and The amount on Form 1040, line 32, is

Income limits.—Generally, you cannot both spouses are eligible for $25,000 or more; or you received $7,500

take the credit if your income is equal to the credit or more of nontaxable social security or

or more than a certain dollar amount. See other nontaxable pensions

the chart on this page for details. Married filing a separate The amount on Form 1040, line 32, is

What is permanent and total return and you did not live $12,500 or more; or you received $3,750

disability?—If you were under age 65 at with your spouse all year or more of nontaxable social security or

the end of 1991, you must be permanently other nontaxable pensions

Cat. No. 11357O

you received from a plan that does not you must check the box on line 2 in Part generally the difference between line 21a

provide for disability retirement is not dis- II to certify that (1) you filed a physician’s and line 21b of Form 1040.

ability income. In figuring the credit, dis- statement in an earlier year, (2) you were Note: If your social security or equivalent

ability income does not include any permanently and totally disabled during railroad retirement benefits are reduced

amount you received from your employ- 1991, and (3) you were unable to engage because of workers’ compensation bene-

er’s pension plan after you have reached in any substantial gainful activity during fits, the workers’ compensation benefits

mandatory retirement age. For more de- 1991 because of your physical or mental are treated as social security benefits for

tails on disability income, get Pub. 525, condition. If you checked Box 4, 5, or 6 in purposes of completing line 13a.

Taxable and Nontaxable Income. Part I, write in the space above the box Line 13b.—Enter any of the following

on line 2 in Part II the first name(s) of the amounts of income that you (and your

spouse(s) for whom the box is checked. spouse if you file a joint return) received

How To Figure the If the Department of Veterans Affairs for 1991:

(VA) certifies that you are permanently and ● Veterans’ pensions (but not military dis-

Credit totally disabled, you can file VA Form ability pensions).

If you want us to, in most cases we will 21-0172 instead of the physician’s state- ● Any other pension, annuity, or disability

figure the credit for you. For more details, ment. VA Form 21-0172 must be signed benefit that is excluded from income

see the Form 1040 instructions on page by a person authorized by the VA to do under any provision of Federal law other

24 under The IRS Will Figure Your Tax so. You can get VA Form 21-0172 from than the Internal Revenue Code. (Do not

and Some of Your Credits. your local VA regional office. include amounts that are treated as a

If you figure the credit yourself, first fill return of your cost of a pension or annuity.)

out Form 1040 through line 41. Then read Part III. Figure Your Do not include on line 13b any pension,

the following instructions. annuity, or similar allowance for personal

Credit injuries or sickness resulting from active

Line 11.—If you checked Box 2, 4, 5, 6,

Part I. Filing Status and or 9 in Part I, complete line 11 as follows:

service in the armed forces of any country,

or in the Coast and Geodetic Survey or

Age ● If you checked Box 6, add $5,000 to the the Public Health Service, or as a disability

Check the box for your filing status and amount of disability income that you re- annuity payable under section 808 of the

age. Check only one box. In general, the ported on Form 1040 for the spouse who Foreign Service Act of 1980.

largest amount you can use to figure the was under age 65. Enter the total on line Line 21.—You may not be able to take the

credit is based on your filing status and 11. full amount of the credit you figured on

age and, if you are married and file a joint ● If you checked Box 2, 4, or 9, enter on line 21 if both of the following apply:

return, on your spouse’s age. line 11 the total amount of disability ● You file Schedule C, D, E, or F (Form

income that you reported on Form 1040. 1040), and

Part II. Statement of ● If you checked Box 5, enter on line 11 ● The amount on Form 1040, line 23, is

the total amount of disability income for more than:

Permanent and Total both you and your spouse that you report- — $30,000 if single or head of house-

Disability ed on Form 1040. hold,

Example 1. Bill, age 63, retired on perma- — $40,000 if married filing jointly or qual-

If you checked Box 2, 4, 5, 6, or 9 in Part

nent and total disability in 1991. He re- ifying widow(er), or

I and you did not file a physician’s state-

ceived $4,000 of taxable disability income

ment for 1983 or an earlier year, or you — $20,000 if married filing separately.

that he reported on Form 1040, line 7. He

filed a statement for tax years after 1983 Note: For purposes of the above test, any

filed a joint return with his wife who was

and your physician signed on line A of the tax-exempt interest from private activity

age 67 in 1991. On line 11, Bill enters

statement, you must have your physician bonds issued after August 7, 1986, and

$9,000 ($5,000 plus the $4,000 of disabil-

complete a statement certifying that: any net operating loss deduction must be

ity income he reported on Form 1040).

● You were permanently and totally disa- added to the amount from Form 1040, line

Example 2. John checked Box 2 in Part I

bled on the date you retired, or 23.

and enters $5,000 on line 10. He received

● If you retired before January 1, 1977, $3,000 of taxable disability income, which If both of the above conditions do not

you were permanently and totally disabled he enters on line 11. John also enters apply, enter on Form 1040, line 42, the

on January 1, 1976, or January 1, 1977. $3,000 on line 12 (the smaller of line 10 or amount from Schedule R, line 21. If both

You must attach this statement to Form line 11). The largest amount he can use to of the above conditions do apply, get

1040. You can use the physician’s state- figure the credit is $3,000. Form 6251, Alternative Minimum Tax—

ment in Part II for this purpose. The phy- Individuals, and complete it through line

Lines 13a through 18.—The amount on

sician should show on the statement 18. Then, figure the amount of credit you

which you figure your credit may be re-

whether the disability has lasted or can be may take as follows:

duced if you received certain types of non-

expected to last continuously for at least taxable pensions and annuities, OR if your a. Enter amount from Form

a year, or whether there is no reasonable adjusted gross income on Form 1040, line 1040, line 40, minus any

probability that the disabled condition will 32, is more than a certain dollar amount, dependent care credit on

ever improve. If you file a joint return and depending on which box you checked in Form 1040, line 41 a.

you checked Box 5 in Part I, you and your Part I. Complete lines 13a through 18 as b. Enter amount from Form

spouse must each file a statement. If both applicable. 6251, line 18 b.

you and your spouse use the statement in

Line 13a.—Enter any social security ben- c. Maximum credit. Sub-

Part II, attach a separate Schedule R for

efits (before deduction of Medicare premi- tract line b from line a. If

your spouse with only Part II filled out.

ums) you (and your spouse if you file a zero or less, enter -0- c.

Keep copies of these statements with your

joint return) received for 1991 that are not Compare the credit you first figured on

tax records.

taxable. Also enter any tier 1 railroad re- Schedule R, line 21, with the amount on

If you filed a physician’s statement for tirement benefits treated as social security line c above. Enter the smaller of the two

1983 or an earlier year, or you filed a state- that are not taxable. amounts on Schedule R, line 21, and on

ment for tax years after 1983 and your

If any of your social security or equiva- Form 1040, line 42. If the amount on line

physician signed on line B of the state-

lent railroad retirement benefits are taxa- c is the smaller amount, also write “AMT”

ment, you do not have to attach another

ble, the amount to enter on this line is on the dotted line next to line 42.

physician’s statement for 1991. However,

Page 2

Вам также может понравиться

- Instructions For Schedule 3 (Form 1040A) : Internal Revenue ServiceДокумент4 страницыInstructions For Schedule 3 (Form 1040A) : Internal Revenue ServiceIRSОценок пока нет

- US Internal Revenue Service: I1040sr - 1995Документ2 страницыUS Internal Revenue Service: I1040sr - 1995IRSОценок пока нет

- US Internal Revenue Service: I1040sr - 1996Документ2 страницыUS Internal Revenue Service: I1040sr - 1996IRSОценок пока нет

- US Internal Revenue Service: I1040sr - 1994Документ2 страницыUS Internal Revenue Service: I1040sr - 1994IRSОценок пока нет

- US Internal Revenue Service: I1040sr - 1992Документ2 страницыUS Internal Revenue Service: I1040sr - 1992IRSОценок пока нет

- Instructions For Schedule 3 (Form 1040A)Документ4 страницыInstructions For Schedule 3 (Form 1040A)IRSОценок пока нет

- US Internal Revenue Service: I1040sr - 1993Документ2 страницыUS Internal Revenue Service: I1040sr - 1993IRSОценок пока нет

- Instructions For Schedule 3 (Form 1040A) : Internal Revenue ServiceДокумент3 страницыInstructions For Schedule 3 (Form 1040A) : Internal Revenue ServiceIRSОценок пока нет

- Instructions For Schedule 3 (Form 1040A)Документ4 страницыInstructions For Schedule 3 (Form 1040A)IRSОценок пока нет

- Instructions For Schedule 3 (Form 1040A)Документ4 страницыInstructions For Schedule 3 (Form 1040A)IRSОценок пока нет

- US Internal Revenue Service: I1040sr - 1998Документ4 страницыUS Internal Revenue Service: I1040sr - 1998IRSОценок пока нет

- US Internal Revenue Service: I1040as3 - 2004Документ4 страницыUS Internal Revenue Service: I1040as3 - 2004IRSОценок пока нет

- US Internal Revenue Service: I1040as3 - 2003Документ4 страницыUS Internal Revenue Service: I1040as3 - 2003IRSОценок пока нет

- US Internal Revenue Service: p524 - 1995Документ12 страницUS Internal Revenue Service: p524 - 1995IRSОценок пока нет

- US Internal Revenue Service: I1040as3 - 2006Документ4 страницыUS Internal Revenue Service: I1040as3 - 2006IRSОценок пока нет

- US Internal Revenue Service: I1040as3Документ4 страницыUS Internal Revenue Service: I1040as3IRSОценок пока нет

- US Internal Revenue Service: p524 - 1994Документ12 страницUS Internal Revenue Service: p524 - 1994IRSОценок пока нет

- US Internal Revenue Service: I1040sr - 2004Документ4 страницыUS Internal Revenue Service: I1040sr - 2004IRSОценок пока нет

- Instructions For Schedule 2 (Form 1040A)Документ3 страницыInstructions For Schedule 2 (Form 1040A)IRSОценок пока нет

- US Internal Revenue Service: I2441 - 1994Документ3 страницыUS Internal Revenue Service: I2441 - 1994IRSОценок пока нет

- Instructions For Schedule 2 (Form 1040A)Документ4 страницыInstructions For Schedule 2 (Form 1040A)IRSОценок пока нет

- US Internal Revenue Service: I1040as2 - 2005Документ3 страницыUS Internal Revenue Service: I1040as2 - 2005IRSОценок пока нет

- US Internal Revenue Service: I2441 - 1997Документ3 страницыUS Internal Revenue Service: I2441 - 1997IRSОценок пока нет

- US Internal Revenue Service: I2441 - 1999Документ3 страницыUS Internal Revenue Service: I2441 - 1999IRSОценок пока нет

- US Internal Revenue Service: I2441 - 1995Документ3 страницыUS Internal Revenue Service: I2441 - 1995IRSОценок пока нет

- US Internal Revenue Service: I2441 - 1996Документ3 страницыUS Internal Revenue Service: I2441 - 1996IRSОценок пока нет

- US Internal Revenue Service: I1040as2Документ3 страницыUS Internal Revenue Service: I1040as2IRSОценок пока нет

- US Internal Revenue Service: f1040sr - 1991Документ2 страницыUS Internal Revenue Service: f1040sr - 1991IRSОценок пока нет

- Module 4Документ9 страницModule 4Beaumont RiegoОценок пока нет

- Instructions For Schedule 2 (Form 1040A)Документ4 страницыInstructions For Schedule 2 (Form 1040A)IRSОценок пока нет

- Credit For The Elderly or The Disabled: Publication 524Документ16 страницCredit For The Elderly or The Disabled: Publication 524api-115350234Оценок пока нет

- US Internal Revenue Service: fw4 - 2000Документ2 страницыUS Internal Revenue Service: fw4 - 2000IRSОценок пока нет

- US Internal Revenue Service: fw4 - 1994Документ2 страницыUS Internal Revenue Service: fw4 - 1994IRSОценок пока нет

- US Internal Revenue Service: I1040as2 - 2004Документ3 страницыUS Internal Revenue Service: I1040as2 - 2004IRSОценок пока нет

- US Internal Revenue Service: f1040sr - 1993Документ2 страницыUS Internal Revenue Service: f1040sr - 1993IRSОценок пока нет

- US Internal Revenue Service: fw4 - 2002Документ2 страницыUS Internal Revenue Service: fw4 - 2002IRSОценок пока нет

- Generic Form Preview DocumentДокумент4 страницыGeneric Form Preview Documentelena.69.mxОценок пока нет

- US Internal Revenue Service: F1040esn - 2005Документ6 страницUS Internal Revenue Service: F1040esn - 2005IRSОценок пока нет

- Basic Certification - Study Guide (For Tax Season 2017)Документ6 страницBasic Certification - Study Guide (For Tax Season 2017)Center for Economic ProgressОценок пока нет

- State Tax FormДокумент2 страницыState Tax FormRon SchingsОценок пока нет

- Module 4: Income Tax On Individuals - Part 2 Learning Objectives 2. Additional Personal Exemptions (APE)Документ14 страницModule 4: Income Tax On Individuals - Part 2 Learning Objectives 2. Additional Personal Exemptions (APE)Sh1njo SantosОценок пока нет

- My1099 Notice703Документ1 страницаMy1099 Notice703Selina WalkerОценок пока нет

- US Internal Revenue Service: I1040as2 - 2003Документ3 страницыUS Internal Revenue Service: I1040as2 - 2003IRSОценок пока нет

- Beckley Motorsports Park: Application For EmploymentДокумент4 страницыBeckley Motorsports Park: Application For EmploymentNRG WEB DESIGNS100% (1)

- Tax Impact of Job LossДокумент7 страницTax Impact of Job LossbullyrayОценок пока нет

- fw4 PDFДокумент2 страницыfw4 PDFbikash PrajapatiОценок пока нет

- Instructions For Form 1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No DependentsДокумент12 страницInstructions For Form 1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No DependentsIRSОценок пока нет

- US Internal Revenue Service: p4128Документ6 страницUS Internal Revenue Service: p4128IRSОценок пока нет

- US Internal Revenue Service: fw4 - 1993Документ2 страницыUS Internal Revenue Service: fw4 - 1993IRSОценок пока нет

- US Internal Revenue Service: p501 - 1994Документ21 страницаUS Internal Revenue Service: p501 - 1994IRSОценок пока нет

- US Internal Revenue Service: fw4 - 1995Документ2 страницыUS Internal Revenue Service: fw4 - 1995IRSОценок пока нет

- IRS Debt ForgivenssДокумент3 страницыIRS Debt ForgivenssJohn McMillan100% (4)

- Onboarding Package - AB - Hourly - NewДокумент6 страницOnboarding Package - AB - Hourly - Newyumie canivelОценок пока нет

- US Internal Revenue Service: fw4 - 1998Документ2 страницыUS Internal Revenue Service: fw4 - 1998IRSОценок пока нет

- Regulation 1: Individual TaxationДокумент14 страницRegulation 1: Individual TaxationFaten AlraiiОценок пока нет

- 2013 Instructions For Schedule SE (Form 1040) : Self-Employment TaxДокумент6 страниц2013 Instructions For Schedule SE (Form 1040) : Self-Employment TaxJames D. SassОценок пока нет

- Tax and Pensions: Made EasyДокумент10 страницTax and Pensions: Made Easymails4vipsОценок пока нет

- Form W-4 (2009) : Employee's Withholding Allowance CertificateДокумент1 страницаForm W-4 (2009) : Employee's Withholding Allowance Certificateezra242Оценок пока нет

- Dwnload Full Fundamentals of Taxation 2014 7th Edition Cruz Solutions Manual PDFДокумент10 страницDwnload Full Fundamentals of Taxation 2014 7th Edition Cruz Solutions Manual PDFsachiko811z100% (10)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Objectives Report To Congress v2Документ153 страницы2008 Objectives Report To Congress v2IRSОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Документ6 страницUS Internal Revenue Service: 2290rulesty2007v4 0IRSОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Credit Card Bulk Provider RequirementsДокумент112 страниц2008 Credit Card Bulk Provider RequirementsIRSОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Data DictionaryДокумент260 страниц2008 Data DictionaryIRSОценок пока нет

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- BAR QUESTIONS (From 2005 To 2012 Bar Exams)Документ60 страницBAR QUESTIONS (From 2005 To 2012 Bar Exams)Em LayronОценок пока нет

- Tax Invoice: Plot No. 837, Udyog Vihar Phase - 5, Gurgaon-122016, HaryanaДокумент1 страницаTax Invoice: Plot No. 837, Udyog Vihar Phase - 5, Gurgaon-122016, HaryanaMazhar KhanОценок пока нет

- Station EmmanДокумент35 страницStation EmmanEmmanuel San Pedro Jr.Оценок пока нет

- Dizon V CTA G.R. No. 140944 April 30, 2008Документ11 страницDizon V CTA G.R. No. 140944 April 30, 2008Emil BautistaОценок пока нет

- Lesson 1-4 FOA1&2Документ40 страницLesson 1-4 FOA1&2Rica Mae ParamОценок пока нет

- 1600 Tax RatesДокумент2 страницы1600 Tax RatesmelizzeОценок пока нет

- Lima Declaration Tax Justice Human RightsДокумент5 страницLima Declaration Tax Justice Human RightsSalvatore VillaniОценок пока нет

- World Zakat Performance Index - A Conceptual FrameworkДокумент57 страницWorld Zakat Performance Index - A Conceptual FrameworkKang HolikОценок пока нет

- Day AlanДокумент1 страницаDay AlanTechnetОценок пока нет

- Commercial Proposal - Synzeal Research Pvt. Ltd. - v1.0Документ25 страницCommercial Proposal - Synzeal Research Pvt. Ltd. - v1.0HEMISHA LADОценок пока нет

- The Baby Boomer BustДокумент13 страницThe Baby Boomer BustPeter MaverОценок пока нет

- Opgcl Amc Document PDFДокумент260 страницOpgcl Amc Document PDFmammu_222Оценок пока нет

- FAC 3764 - Assessment 9 - QP - Final - 10 October 2023Документ9 страницFAC 3764 - Assessment 9 - QP - Final - 10 October 2023mandisanomzamo72Оценок пока нет

- Estafa Through Falsification of Public Documents. in Particular, TheДокумент27 страницEstafa Through Falsification of Public Documents. in Particular, TheRochelle Ann ReyesОценок пока нет

- IOIPROPДокумент40 страницIOIPROPSaifuliza Omar83% (6)

- 1 26053 1 Verbal Reasoning Exercise Day 01Документ13 страниц1 26053 1 Verbal Reasoning Exercise Day 01AmitYadavОценок пока нет

- GWHT PDFДокумент22 страницыGWHT PDFAndinetОценок пока нет

- The Customs Value of Imported Goods &: Advance Valuation RulingДокумент8 страницThe Customs Value of Imported Goods &: Advance Valuation RulingYanisa M. OscarОценок пока нет

- Taxation Law NotesДокумент15 страницTaxation Law NotesKuracha LoftОценок пока нет

- Individual Income TaxДокумент6 страницIndividual Income Taxira concepcionОценок пока нет

- Bottom CoverДокумент11 страницBottom CoverSSE BOGIE STORESОценок пока нет

- CFS FATCA - & - CRS - Declaration - (Individual) - CDSLДокумент1 страницаCFS FATCA - & - CRS - Declaration - (Individual) - CDSLAkash AgarwalОценок пока нет

- Accenture Statement of WorkДокумент35 страницAccenture Statement of WorkAnonymous Pb39klJ100% (5)

- Quotation NestleДокумент2 страницыQuotation NestleLeslie HollandОценок пока нет

- TAXATION - Republic-CIR Vs Team Energy Corp - Tax Refund Credit PDFДокумент12 страницTAXATION - Republic-CIR Vs Team Energy Corp - Tax Refund Credit PDFNatura ManilaОценок пока нет

- Islamabad Electric Supply Company (LTD) .: Electricity Consumer BillДокумент2 страницыIslamabad Electric Supply Company (LTD) .: Electricity Consumer BillArslan ShabbirОценок пока нет

- Salary Slip FTMO Nov-2021Документ1 страницаSalary Slip FTMO Nov-2021Ahsan Bin AsimОценок пока нет

- Tax 2 - Compilation - Case DigestДокумент51 страницаTax 2 - Compilation - Case DigestAndrea Patricia DaquialОценок пока нет

- 10E - Build A Spreadsheet 02-43Документ2 страницы10E - Build A Spreadsheet 02-43MISRET 2018 IEI JSCОценок пока нет

- Was The French Revolution of 1789 A Bourgeois RevolutionДокумент8 страницWas The French Revolution of 1789 A Bourgeois RevolutionSarah GalvinОценок пока нет