Академический Документы

Профессиональный Документы

Культура Документы

Oji 2

Загружено:

brent_barthanyИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Oji 2

Загружено:

brent_barthanyАвторское право:

Доступные форматы

PAYER'S name, street address, city, state, ZIP code, and telephone number 1. Unemployment compensation OMB No.

ation OMB No. 1545-0120

OHIO DEPARTMENT OF JOB & FAMILY SERVICES $10,085.00 Certain

P.O. BOX 182059

COLUMBUS, OH 43218 2. State or local income tax

2009 Government

1-877-644-6562 refunds, credits, or offsets Payments

\A37228288B1288810010G\

Form 1099-G

A37228288B0128881001

PAYER'S Federal identification number RECIPIENT'S identification number 3. Box 2 amount is for tax year 4. Federal income tax withheld

Copy B

31-1334373 302-68-6995 $0.00 - For Recipient:

This is important tax

RECIPIENT'S name, address and zip code 5. ATAA payments 6. Taxable grants information and is being

furnished to the Internal

$0.00 Revenue Service. If you

NELLIE M. ALLEN are required to file a

return, a negligence

11308 KINSMAN RD 7. Agriculture payments 8. Box 2 is trade or

penalty or other sanction

business income

APT 1 may be imposed on you

if this income is taxable

CLEVELAND, OH 44104 9. Market gain and the IRS determines

that it has not been

reported.

Account number (see instructions)

Form 1099-G (keep for your records) Department of the Treasury - Internal Revenue Service

Instructions for Recipient

Account number. May show an account or other unique number the Box 4. Shows backup withholding or withholding you requested on

payer has assigned to distinguish your account. unemployment compensation, Commodity Credit Corporation (CCC)

loans, or certain crop disaster payments. Generally, a payer must

Box 1. Shows the total unemployment compensation paid to you this backup withhold on certain payments at a 28% rate if you did not

year. Combine the box 1 amounts from all Forms 1099-G, and report give your taxpayer identification number to the payer. See Form W-9,

the amount in excess of $2,400 as income on the unemployment Request for Taxpayer Identification Number and Certification, for

compensation line of your tax return. Except as explained below, this is information on backup withholding. Include this amount on your income

your taxable amount. If you expect to receive these benefits in the tax return as tax withheld.

future, you can ask the payer to withhold federal income tax from each

payment. Or, you can make estimated tax payments. For details, see Box 5. Shows alternative trade adjustment assistance (ATAA)

Form 1040-ES, Estimated Tax for Individuals. If you made payments you received. Include on Form 1040 on the "Other income"

contributions to a governmental unemployment compensation program line. See the Form 1040 instructions.

and received a payment from that program, the payor must issue a

separate Form 1099-G to report this amount to you. If you itemized Box 6. Shows taxable grants you received from a federal, state, or

deductions, you may deduct your contributions on Schedule A (Form local government.

1040) as taxes paid. If you do not itemize, reduce your taxable amount

(but not below zero) by the amount of your contributions. Box 7. Shows Department of Agriculture payments that are taxable to

you. If the payer shown is anyone other than the Department of

Box 2. Shows refunds, credits, or offsets of state or local income tax Agriculture, it means the payer has received a payment, as a nominee,

you received. It may be taxable to you if you deducted the state or local that is taxable to you. This may represent the entire agricultural subsidy

income tax paid on Schedule A (Form 1040). Even if you did not payment received on your behalf by the nominee, or it may be your pro

receive the amount shown, for example, because it was credited to your rata share of the original payment. See Pub. 225 and the instructions

state or local estimated tax, it is still taxable if it was deducted. If you for Schedule F (Form 1040) for information about where to report this

received interest on this amount, you should receive Form 1099-INT for income. Partnerships, see Form 8825 for how to report.

the interest. However, the payer may include interest of less than $600

in the blank box on Form 1099-G. Regardless of whether the interest is Box 8. If this box is checked, the amount in box 2 is attributable to an

reported to you, report it as interest income on your tax return. See income tax that applies exclusively to income from a trade or business

your tax return instructions. and is not a tax of general application. If taxable, report the amount in

box 2 on Schedule C, C-EZ, or F (Form 1040) as appropriate.

Box 3. Identifies the tax year for which the refunds, credits, or offsets

shown in box 2 were made. If there is no entry in this box, the refund is Box 9. Shows market gain on CCC loans whether repaid using cash

for 2008 taxes. or CCC certificates. See the instructions for Schedule F (Form 1040)

for how to report.

Si usted no puede leer esto, llame por favor a 1-877-644-6562 para una traduccion.

DSN: 128881 THIS SPACE FOR OFFICIAL USE ONLY PSN: 0128881

Page 1 of 1 ID: 000000298993771 NOTICE: JI17N1

Вам также может понравиться

- PUA 1099G tax form summaryДокумент1 страницаPUA 1099G tax form summaryClifton WilsonОценок пока нет

- ICF FORMДокумент4 страницыICF FORMFrank ValenzuelaОценок пока нет

- MV 441 EdlДокумент4 страницыMV 441 Edltuan nguyenОценок пока нет

- Confirmation Number and Date for Illinois Business RegistrationДокумент7 страницConfirmation Number and Date for Illinois Business RegistrationMohammed HussainОценок пока нет

- Windward Fund's 2018 Tax FormsДокумент49 страницWindward Fund's 2018 Tax FormsJoe SchoffstallОценок пока нет

- Vba 21 674 AreДокумент3 страницыVba 21 674 AreCynthia StovallОценок пока нет

- PDC - 2009 Tax ReturnДокумент19 страницPDC - 2009 Tax ReturnNC Policy WatchОценок пока нет

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Документ1 страницаW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Andres AlcantarОценок пока нет

- 1481546265426Документ3 страницы1481546265426api-370784582Оценок пока нет

- MyComputerCareercom at Raleigh LLC-Aretha J BosireДокумент1 страницаMyComputerCareercom at Raleigh LLC-Aretha J BosireAretha JBОценок пока нет

- 2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - RecordsДокумент42 страницы2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - Recordsellen guthrie100% (1)

- Kenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. DeptДокумент2 страницыKenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. Depttaylorizabella1Оценок пока нет

- DD 2870 Health Release Form - Scan PDFДокумент1 страницаDD 2870 Health Release Form - Scan PDFremolacha147Оценок пока нет

- FIRE 2011 Form 990Документ36 страницFIRE 2011 Form 990FIREОценок пока нет

- App A - Enlistment or Appointment ApplicationДокумент9 страницApp A - Enlistment or Appointment ApplicationMark CheneyОценок пока нет

- 2013 AgriSafe 990Документ28 страниц2013 AgriSafe 990AgriSafeОценок пока нет

- 2014 Alabama Possible 990Документ39 страниц2014 Alabama Possible 990Alabama PossibleОценок пока нет

- DocumentДокумент1 страницаDocumentMulletHawkSunshyneBrownОценок пока нет

- P010 636211442428322820 T14385011dupD1 PDFДокумент1 страницаP010 636211442428322820 T14385011dupD1 PDFAnonymous pY5EUXUpaОценок пока нет

- Return of Organization Exempt From Income Tax: WWW - Irs.gov/form990 For Instructions and The Latest InformationДокумент50 страницReturn of Organization Exempt From Income Tax: WWW - Irs.gov/form990 For Instructions and The Latest InformationNBC MontanaОценок пока нет

- Request for Taxpayer ID FormДокумент4 страницыRequest for Taxpayer ID FormMichael RamirezОценок пока нет

- DD Form 293, Application For The Review of Discharge From The Armed Forces of The United States, August 2015 PDFДокумент4 страницыDD Form 293, Application For The Review of Discharge From The Armed Forces of The United States, August 2015 PDFAnonymous X5KSnnNztOОценок пока нет

- CertainGovernmentPaymentsPUA 1099G CharrisePhelps 654202101193245Документ1 страницаCertainGovernmentPaymentsPUA 1099G CharrisePhelps 654202101193245c phelpsОценок пока нет

- Signature Card InfoДокумент1 страницаSignature Card Infosadik lawanОценок пока нет

- NCJC 561348186 - 200712 - 990Документ28 страницNCJC 561348186 - 200712 - 990A.P. DillonОценок пока нет

- Vba 21 4192 AreДокумент2 страницыVba 21 4192 AreGene GloverОценок пока нет

- Desmand Whitson 7423 Groveoak Dr. Orlando, Florida 32810: ND NDДокумент2 страницыDesmand Whitson 7423 Groveoak Dr. Orlando, Florida 32810: ND NDRed RaptureОценок пока нет

- 1098T17Документ2 страницы1098T17RegrubdiupsОценок пока нет

- 5 XVFPSVKДокумент1 страница5 XVFPSVKIrma AsaroОценок пока нет

- MLFA Form 990 - 2016Документ25 страницMLFA Form 990 - 2016MLFAОценок пока нет

- Cash FlowДокумент1 страницаCash Flowpawan_019Оценок пока нет

- Think Computer Foundation 2009 Tax ReturnДокумент10 страницThink Computer Foundation 2009 Tax ReturnTaxManОценок пока нет

- Payroll Register PD01-31-13 PDFДокумент26 страницPayroll Register PD01-31-13 PDFJoseph ManriquezОценок пока нет

- New Hire Paperwork 2021aДокумент27 страницNew Hire Paperwork 2021aTom BondalicОценок пока нет

- OjiДокумент2 страницыOjiMiram BeasleyОценок пока нет

- Medical ClaimДокумент3 страницыMedical Claimpipul36Оценок пока нет

- Show 2Документ2 страницыShow 2Lexi BrownОценок пока нет

- ECDC 2009 Tax ReturnДокумент27 страницECDC 2009 Tax ReturnNC Policy WatchОценок пока нет

- Jaleica Coding and Billing LLC.: 437 Melissa Circle Romeoville IL.60446Документ8 страницJaleica Coding and Billing LLC.: 437 Melissa Circle Romeoville IL.60446Julius MasiganОценок пока нет

- Tabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingДокумент3 страницыTabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingJerikah Jec HernandezОценок пока нет

- 2007 Carl & Ruth Shapiro Family Foundation 990 (Includes Madoff Investment)Документ42 страницы2007 Carl & Ruth Shapiro Family Foundation 990 (Includes Madoff Investment)jpeppard100% (4)

- Payroll Insights - Farsight IT SolutionsДокумент1 страницаPayroll Insights - Farsight IT SolutionsyogeshОценок пока нет

- Request For Taxpayer Identification Number and CertificationДокумент4 страницыRequest For Taxpayer Identification Number and CertificationYut ChiaОценок пока нет

- Duplicate: Certain Government PaymentsДокумент2 страницыDuplicate: Certain Government PaymentsPrincewill OdenigboОценок пока нет

- U.S. Individual Income Tax Return: Filing StatusДокумент2 страницыU.S. Individual Income Tax Return: Filing Statusfelix angomasОценок пока нет

- Corrected Tuition Statement SummaryДокумент2 страницыCorrected Tuition Statement Summaryed redfОценок пока нет

- 2019 California Tax Return RefundДокумент18 страниц2019 California Tax Return RefundPolo PoloОценок пока нет

- Printing H - FORMFLOW - SF3107.FRPДокумент10 страницPrinting H - FORMFLOW - SF3107.FRPKeller Brown JnrОценок пока нет

- Please To Do Not Use The Back ButtonДокумент2 страницыPlease To Do Not Use The Back ButtonDavid MillerОценок пока нет

- Barack Obama Foundation Annual Filing Statement New York 2014Документ54 страницыBarack Obama Foundation Annual Filing Statement New York 2014Jerome CorsiОценок пока нет

- DeniedQuitSep Quit Personal TerraMyers20170316Документ3 страницыDeniedQuitSep Quit Personal TerraMyers20170316TERRA MYERSОценок пока нет

- Hillside Children's Center, New York 2014 IRS ReportДокумент76 страницHillside Children's Center, New York 2014 IRS ReportBeverly TranОценок пока нет

- RPPL F 054 Easa Form 19Документ8 страницRPPL F 054 Easa Form 19Sohail KhalidОценок пока нет

- Capital One TaxДокумент2 страницыCapital One Tax16baezmcОценок пока нет

- FD 941 Apr-Jun 2017 PDFДокумент3 страницыFD 941 Apr-Jun 2017 PDFScott WinklerОценок пока нет

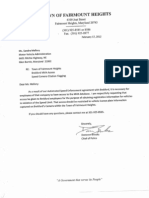

- Fairmount Heights - Documents 1 PDFДокумент88 страницFairmount Heights - Documents 1 PDFAri AsheОценок пока нет

- Monetary Determination Pandemic Unemployment Assistance: Michael L PresleyДокумент3 страницыMonetary Determination Pandemic Unemployment Assistance: Michael L PresleyDylan VanslochterenОценок пока нет

- Loan Doc Changes & CostsДокумент11 страницLoan Doc Changes & CostsMelissa JonesОценок пока нет

- Unemployment compensation and state tax infoДокумент1 страницаUnemployment compensation and state tax infoJackson kaylaОценок пока нет

- DSP Inc 1099-11 Print - CFMДокумент1 страницаDSP Inc 1099-11 Print - CFMKenneth BarcottОценок пока нет

- How To Play Monopoly - The Mega Edition OfficiaДокумент3 страницыHow To Play Monopoly - The Mega Edition OfficiaDarius MicluţaОценок пока нет

- Non-Integrated, Integrated & Reconciliation of Cost and Financial AccountsДокумент107 страницNon-Integrated, Integrated & Reconciliation of Cost and Financial Accountsanon_67206536267% (3)

- CA Approves Rehabilitation Plan for Fastech CompaniesДокумент10 страницCA Approves Rehabilitation Plan for Fastech CompaniesMark Ebenezer BernardoОценок пока нет

- Compensation and Reward ManagementДокумент3 страницыCompensation and Reward ManagementMeghana LohumiОценок пока нет

- Espy Q3 2018Документ894 страницыEspy Q3 2018Russ LatinoОценок пока нет

- Investment Under CertaintyДокумент4 страницыInvestment Under CertaintymohaОценок пока нет

- CREDIT MANAGEMENT A Case Study of Wegage PDFДокумент115 страницCREDIT MANAGEMENT A Case Study of Wegage PDFJeziel felipeОценок пока нет

- Zarro Inference 1 Report of The Special Master Concerning Jpmorgan Chase Bank and Chase Home Finance - Aug 15, 2011Документ30 страницZarro Inference 1 Report of The Special Master Concerning Jpmorgan Chase Bank and Chase Home Finance - Aug 15, 2011DeontosОценок пока нет

- Stock Audit Report Bank FormatДокумент18 страницStock Audit Report Bank FormatVikash AgrawalОценок пока нет

- Bank L0 DumpДокумент503 страницыBank L0 Dumpdhootankur60% (5)

- Civil-Preweek 2018 DДокумент50 страницCivil-Preweek 2018 DMary Ann AguilaОценок пока нет

- Someone Elses Pay Off I Put The Link Here N A TexДокумент3 страницыSomeone Elses Pay Off I Put The Link Here N A Texjulianthacker100% (1)

- Mortgages and Charges Over Land PDFДокумент49 страницMortgages and Charges Over Land PDFKnowledge GuruОценок пока нет

- Accenture Everyday BankДокумент8 страницAccenture Everyday Bankstudboy99100% (1)

- Banking Awareness PDFДокумент213 страницBanking Awareness PDFsrikant ganaluОценок пока нет

- Chapter-16 Audit of Co-Operative Societies: CA Ravi Taori Co-Op SocietyДокумент8 страницChapter-16 Audit of Co-Operative Societies: CA Ravi Taori Co-Op SocietyArpit ShuklaОценок пока нет

- Educational New Power of AttorneyДокумент3 страницыEducational New Power of AttorneyChristian FernandezОценок пока нет

- 17 Transfers It Takes TwoДокумент51 страница17 Transfers It Takes TwoJoe BuntОценок пока нет

- StanbicIBTC PresentationДокумент14 страницStanbicIBTC PresentationadoekitiОценок пока нет

- Sales Full Text Reyes v. Tuparan Spouses Beltran V Spouses CangaydaДокумент130 страницSales Full Text Reyes v. Tuparan Spouses Beltran V Spouses CangaydaMikkaEllaAnclaОценок пока нет

- Guinggona v. City FiscalДокумент3 страницыGuinggona v. City Fiscal001nooneОценок пока нет

- A Study On Farmers' Choice of Agricultural Finance in Vellore District, Tamil NaduДокумент11 страницA Study On Farmers' Choice of Agricultural Finance in Vellore District, Tamil NaduVishnu NarayananОценок пока нет

- RBI Format ROI PCДокумент6 страницRBI Format ROI PCSandesh ManeОценок пока нет

- United States Court of Appeals, Tenth CircuitДокумент4 страницыUnited States Court of Appeals, Tenth CircuitScribd Government DocsОценок пока нет

- The Sale of Goods Act, 1930Документ5 страницThe Sale of Goods Act, 1930Atif RehmanОценок пока нет

- Foreclosure Actions and Cases Lawfully Dismissed (Not Letting Bank Foreclose Without Lawful Validation and Production)Документ25 страницForeclosure Actions and Cases Lawfully Dismissed (Not Letting Bank Foreclose Without Lawful Validation and Production)PhilОценок пока нет

- 9 Laxmi Asu Making MachineДокумент5 страниц9 Laxmi Asu Making MachineAnonymous qCp7pCОценок пока нет

- Proposed Sewerage of BlessedvilleДокумент12 страницProposed Sewerage of BlessedvilleEnp Titus VelezОценок пока нет

- Basic Points: Homeicide: The Crime of The CenturyДокумент40 страницBasic Points: Homeicide: The Crime of The Centuryvb12wxОценок пока нет

- Judicial Foreclosures and Constitutional Challenges: What Every Estate Planning Attorney Needs To KnowДокумент9 страницJudicial Foreclosures and Constitutional Challenges: What Every Estate Planning Attorney Needs To KnowElaine Diane EtingoffОценок пока нет