Академический Документы

Профессиональный Документы

Культура Документы

US Internal Revenue Service: I1099g - 2003

Загружено:

IRS0 оценок0% нашли этот документ полезным (0 голосов)

29 просмотров1 страницаGeneral Instructions for Forms 1099, 1098, 5498, and W-2G are also available. For unincorporated businesses, you must furnish a Form 1099-G or substitute statement. For interest payments of less than $600, you may choose to enter the amount with an appropriate designation.

Исходное описание:

Оригинальное название

US Internal Revenue Service: i1099g--2003

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документGeneral Instructions for Forms 1099, 1098, 5498, and W-2G are also available. For unincorporated businesses, you must furnish a Form 1099-G or substitute statement. For interest payments of less than $600, you may choose to enter the amount with an appropriate designation.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

29 просмотров1 страницаUS Internal Revenue Service: I1099g - 2003

Загружено:

IRSGeneral Instructions for Forms 1099, 1098, 5498, and W-2G are also available. For unincorporated businesses, you must furnish a Form 1099-G or substitute statement. For interest payments of less than $600, you may choose to enter the amount with an appropriate designation.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

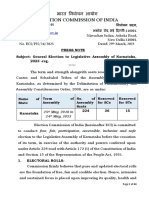

Userid: ________ Leading adjust: -10% ❏ Draft ❏ Ok to Print

PAGER/SGML Fileid: I1099G.cvt (22-Oct-2002) (Init. & date)

Page 1 of 1 Instructions for Form 1099-G 16:03 - 22-OCT-2002

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

2003 Department of the Treasury

Internal Revenue Service

Instructions for Form

1099-G

Section references are to the Internal Revenue Code.

unincorporated businesses, you must furnish a Form 1099-G or

An Item To Note substitute statement to the recipient in all cases, as this is a tax

In addition to these specific instructions, you should also use that applies exclusively to income from a trade or business. See

the 2003 General Instructions for Forms 1099, 1098, 5498, Box 8, Trade or Business Income (Checkbox), below and

and W-2G. Those general instructions include information Rev. Rul. 86-140, 1986-2 C.B. 195.

about: If you pay interest of $600 or more on the refund, you must

• Backup withholding file Form 1099-INT, Interest Income, and furnish a statement to

• Magnetic media and electronic reporting requirements the recipient. For interest payments of less than $600, you may

• Penalties choose to enter the amount with an appropriate designation

• Who must file (nominee/middleman) such as “Interest Income” in the blank box on Copy B of the

• When and where to file Form 1099-G.

• Taxpayer identification numbers

• Statements to recipients Box 3. Box 2 Amount Is For Tax Year

• Corrected and void returns No entry is required in box 3 if the refund, credit, or offset is for

• Other general topics the 2002 tax year. If it is for any other tax year, enter the year

You can get the general instructions from the IRS Web Site for which the refund, credit, or offset was made. Also, if the

at www.irs.gov or by calling 1-800-TAX-FORM refunds, credits, or offsets are for more than 1 tax year, report

(1-800-829-3676). the amount for each year on a separate Form 1099-G. Use the

format “YYYY” to make the entry in this box. For example, enter

2002, not ’02.

Specific Instructions for Form 1099-G Box 4. Federal Income Tax Withheld

File Form 1099-G, Certain Government Payments, if you made

certain payments as a unit of a Federal, state, or local Backup withholding. Enter backup withholding at a 30% rate

government. on payments required to be reported in box 6 or 7. For

example, if a recipient does not furnish its taxpayer

Statements to Recipients identification number (TIN) to you, you must backup withhold.

If you are required to file Form 1099-G, you must provide a Voluntary withholding. Enter any voluntary Federal

statement to the recipient. Furnish a copy of Form 1099-G or an withholding on unemployment compensation, Commodity Credit

acceptable substitute statement to each recipient, except as Corporation loans, and certain crop disaster payments. If you

explained below under Box 2, State or Local Income Tax withheld state income tax, you may label it and report it on the

Refunds, Credits, or Offsets. Also, see part H in the 2003 statement to the recipient. However, you are not required to

General Instructions for Forms 1099, 1098, 5498, and W-2G. report state withholding to the IRS.

Box 1. Unemployment Compensation Box 5. Blank Box

Enter payments of $10 or more in unemployment compensation Make no entry in this box.

including Railroad Retirement Board payments for

unemployment. Enter the total amount before any income tax Box 6. Taxable Grants

was withheld. If you withhold Federal income tax at the request Enter any amount of a taxable grant administered by a Federal,

of the recipient, enter it in box 4. state, or local program to provide subsidized energy financing

Box 2. State or Local Income Tax Refunds, or grants for projects designed to conserve or produce energy,

but only with respect to section 38 property or a dwelling unit

Credits, or Offsets located in the United States. Also, enter any amount of a

Enter refunds, credits, or offsets of state or local income tax of taxable grant administered by an Indian tribal government.

$10 or more you made to recipients. If recipients deducted the Report amounts of other taxable grants of $600 or more. A

tax paid to a state or local government on their Federal income Federal grant is ordinarily taxable unless stated otherwise in the

tax returns, any refunds, credits, or offsets may be taxable to legislation authorizing the grant. Do not report scholarship or

them. You are not required to furnish a copy of Form 1099-G or fellowship grants. See Scholarships in the Instructions for

a substitute statement to the recipient if you can determine that Form 1099-MISC.

the recipient did not claim itemized deductions on the recipient’s

Federal income tax return for the tax year giving rise to the Box 7. Agriculture Payments

refund, credit, or offset. However, you must file Form 1099-G Enter USDA agricultural subsidy payments made during the

with the IRS in all cases. year. If you are a nominee that received subsidy payments for

A tax on dividends, a tax on net gains from the sale or another person, file Form 1099-G to report the actual owner of

exchange of a capital asset, and a tax on the net taxable the payments, and report the amount of the payments in box 7.

income of an unincorporated business are taxes on gain or

profit rather than on gross receipts. Therefore, they are income

Box 8. Trade or Business Income (Checkbox)

taxes, and any refund, credit, or offset of $10 or more of these If the amount in box 2 is a refund, credit, or offset attributable to

taxes is reportable on Form 1099-G. In the case of the an income tax that applies exclusively to income from a trade or

dividends tax and the capital gains tax, if you determine that the business and is not a tax of general application, enter an “X” in

recipient did not itemize deductions, as explained above, you this box.

are not required to furnish a Form 1099-G or substitute

statement to the recipient. However, in the case of the tax on

Cat. No. 27979M

Вам также может понравиться

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Документ6 страницUS Internal Revenue Service: 2290rulesty2007v4 0IRSОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- 2008 Objectives Report To Congress v2Документ153 страницы2008 Objectives Report To Congress v2IRSОценок пока нет

- 2008 Data DictionaryДокумент260 страниц2008 Data DictionaryIRSОценок пока нет

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- 2008 Credit Card Bulk Provider RequirementsДокумент112 страниц2008 Credit Card Bulk Provider RequirementsIRSОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- KEY DEFINITIONS IN COMPANIES ORDINANCE 1984Документ204 страницыKEY DEFINITIONS IN COMPANIES ORDINANCE 1984Muhammad KamranОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Full Current Address: Name of Company #1Документ2 страницыFull Current Address: Name of Company #1Saurabh ChoudharyОценок пока нет

- in Re Petition To Sign in The Roll of Attorneys, Michael Medado, BM 2540, 2013Документ6 страницin Re Petition To Sign in The Roll of Attorneys, Michael Medado, BM 2540, 2013Christia Sandee SuanОценок пока нет

- 9 Lopez vs. RamosДокумент2 страницы9 Lopez vs. Ramosmei atienzaОценок пока нет

- Public Corp Cases FulltextДокумент96 страницPublic Corp Cases FulltextJose MasarateОценок пока нет

- Affidavit of Consent Exhumation 2 (BONG)Документ3 страницыAffidavit of Consent Exhumation 2 (BONG)Tonton Reyes100% (1)

- TYBCom Five Heads Theory 89 PgsДокумент90 страницTYBCom Five Heads Theory 89 PgsPrabhu Gabriel0% (1)

- 2016 Ballb (B)Документ36 страниц2016 Ballb (B)Vicky D0% (1)

- Disability Discrimination Act 1992: Compilation No. 30Документ84 страницыDisability Discrimination Act 1992: Compilation No. 30api-294360574Оценок пока нет

- NoticeOfLiability To USA Agents Mrs. Alvarado PDFДокумент16 страницNoticeOfLiability To USA Agents Mrs. Alvarado PDFMARSHA MAINESОценок пока нет

- Rule 44 Ordinary Appealed CasesДокумент21 страницаRule 44 Ordinary Appealed CasesJenely Joy Areola-TelanОценок пока нет

- Tax Invoice SummaryДокумент1 страницаTax Invoice SummaryDashing DealОценок пока нет

- Family Code of The PhilippinesДокумент31 страницаFamily Code of The Philippinesautumn moon100% (1)

- Regional Memorandum Re Guidance On The Conduct of CSO ConferenceДокумент2 страницыRegional Memorandum Re Guidance On The Conduct of CSO ConferenceDILG IBAJAYОценок пока нет

- United States v. Matsinger, 191 F.2d 1014, 3rd Cir. (1951)Документ6 страницUnited States v. Matsinger, 191 F.2d 1014, 3rd Cir. (1951)Scribd Government DocsОценок пока нет

- Statutory Construction Midterm ReviewerДокумент7 страницStatutory Construction Midterm ReviewerJohn Eric Fujie100% (1)

- Vakalatnama Supreme CourtДокумент2 страницыVakalatnama Supreme CourtSiddharth Chitturi80% (5)

- Rajesh V Choudhary Vs Kshitij Rajiv Torka and OrsMH201519091519125799COM279936Документ23 страницыRajesh V Choudhary Vs Kshitij Rajiv Torka and OrsMH201519091519125799COM279936Shubhangi SinghОценок пока нет

- C 7,8 Offer or ProposalДокумент20 страницC 7,8 Offer or ProposalPrabha DoraiswamyОценок пока нет

- Press Note For General Election To Karnataka-FinalДокумент46 страницPress Note For General Election To Karnataka-FinalRAKSHITH RОценок пока нет

- Q. Write A Short Note On FIR. Discuss The Guidelines Laid Down by The Supreme Court For Mandatory Registration of FIR in Lalita Kumari's CaseДокумент3 страницыQ. Write A Short Note On FIR. Discuss The Guidelines Laid Down by The Supreme Court For Mandatory Registration of FIR in Lalita Kumari's CaseshareenОценок пока нет

- F4bwa 2010 Dec QДокумент4 страницыF4bwa 2010 Dec QMuhammad Kashif RanaОценок пока нет

- CCXCXCXДокумент9 страницCCXCXCXJeffrey Constantino PatacsilОценок пока нет

- People vs Cagoco - Murder conviction upheld for fatal blow to victim's headДокумент72 страницыPeople vs Cagoco - Murder conviction upheld for fatal blow to victim's headGerard Anthony Teves RosalesОценок пока нет

- List of Taxpayers For Deletion in The List of Top Withholding Agents (Twas)Документ217 страницList of Taxpayers For Deletion in The List of Top Withholding Agents (Twas)Hanabishi RekkaОценок пока нет

- Francisco Vs TRBДокумент3 страницыFrancisco Vs TRBFranz KafkaОценок пока нет

- All Forms by Atty TeДокумент77 страницAll Forms by Atty TeJep Acido100% (1)

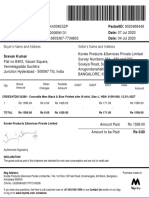

- Gstin Number: Packetid: 9020468448 Invoice Number: Date: 07 Jul 2020 Order Number: Date: 04 Jul 2020Документ1 страницаGstin Number: Packetid: 9020468448 Invoice Number: Date: 07 Jul 2020 Order Number: Date: 04 Jul 2020Sravan KumarОценок пока нет

- Uson v. Del RosarioДокумент4 страницыUson v. Del RosarioPrincess Trisha Joy UyОценок пока нет

- Nism Series 8 Pay SlipДокумент2 страницыNism Series 8 Pay SlipHritik SharmaОценок пока нет

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesОт EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesРейтинг: 4 из 5 звезд4/5 (9)

- Tax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsОт EverandTax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsРейтинг: 4 из 5 звезд4/5 (1)

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesОт EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesРейтинг: 3 из 5 звезд3/5 (3)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОт EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОценок пока нет

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyОт EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyОценок пока нет

- The Payroll Book: A Guide for Small Businesses and StartupsОт EverandThe Payroll Book: A Guide for Small Businesses and StartupsРейтинг: 5 из 5 звезд5/5 (1)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProОт EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProРейтинг: 4.5 из 5 звезд4.5/5 (43)