Академический Документы

Профессиональный Документы

Культура Документы

SEBAC Agreement Summary: Pension Changes

Загружено:

Patricia DillonИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

SEBAC Agreement Summary: Pension Changes

Загружено:

Patricia DillonАвторское право:

Доступные форматы

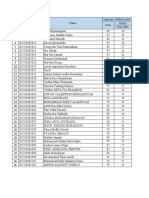

SEBAC Agreement Summary

FY 2012 FY 2013 20-Year Projection

Pension Changes

Cap salary that can be considered as part of an individual’s pension benefit as

$ 2,400,000 $ 2,500,000 $ 62,000,000

provided under the Internal Revenue Code

Pension savings due to 2 year wage freeze $ 69,316,000 $ 71,198,000 $ 140,000,000

Change the minimum COLA for individuals who retire after 9/2/11 from 2.5% to

2.0% with the highest amount going from 6.0% to 7.5% $ 32,525,000 $ 34,315,000 $ 1,342,000,000

Change the Early retirement reduction factor from 3% to 6% for each year

before eligible to take Normal Retirement with associated health care savings $ 35,000,000 $ 32,400,000 $ 662,000,000

Increase the Employee Contribution to 3% for Retiree health care trust fund for

all employees (not just new employees) phased in beginning 7/1/13. $ - $ - $ 871,000,000

For current employees who retire after 7/1/2022, Normal Retirement eligibility

increase from Age 60 and 25 YOS or Age 62 and 10 YOS to Age 63 and 25 YOS $ 22,000,000 $ 22,000,000 $ 677,000,000

or Age 65 and 10 YOS. By 7/1/13, present employees may elect to pay the

actuarial pension costs of maintaining the normal retirement eligibility that

exists in the present plan which is scheduled to change effective July 1, 2022.

New Tier III for individuals hired after 7/1/11, Normal Retirement eligibility

Age 63 and 25 YOS or Age 65 and 10 YOS and salary based on Final five year

average; HD 20 Years of HD service and age 50 or 25 Years of HD Service

regardless of age and salary based on final five year average pay; Early $ - $ 9,649,000 $ 2,982,000,000

Retirement Age 60 and 15 YOS; Ten year cliff vesting.

Increase number of retirees due to absence of ERIP; reduce refills $ 65,000,000 $ 65,000,000 $ 1,300,000,000

Provide the availability of individuals in the Alternate Retirement Plan to switch

to a Hybrid-Defined benefit/Defined contribution type plan. $ 10,750,000 $ 11,190,000 $ 235,000,000

Pension Total $ 236,991,000 $ 248,252,000 $ 8,271,000,000

May 13, 2011 1

Health Care Changes

Plan Changes value and non value based: $35 Emergency Room copay;

Certain cost savings changes wherein individuals would have to get $ 1,200,000 $ 3,700,000 $ 75,000,000

preauthorization before a second MRI would be paid for, etc.

Value based health and dental - Provide a Value based health and dental

care plan under which individuals and their families could chose to participate

and agree to follow all plan and physician recommended physicals, disease

management protocols and diagnostic testing. Failure to comply would result $ 102,500,000 $ 102,500,000 $ 2,378,000,000

in the individual and their families being placed in the Nonvalue added plan

with the concomitant cost increase. The cost for this plan would the same as the

current plan plus any scheduled experience determined increases. Value Added

for Retirees – Voluntary for current Retirees; Mandatory for individuals who

retire on and after 9/2/11. If new retirees elect nonvalue added, cost is $100

per month.

Nonvalue based health and dental - If the employee chose not to

participate their cost for health care would be the same as calculated in the first $ 18,000,000 $ 18,000,000 $ 249,000,000

year for Value based, plus $100.00 per month additional. Institute a $350

Medical Deductible per year per individual.

Reduce Costs with Generics - drugs coming off patent $ 1,500,000 $ 12,000,000 $ 380,000,000

Tobacco and Obesity - reduce costs through voluntary referral Program $ 1,000,000 $ 2,000,000 $ 85,000,000

Other Health Cost Containment Initiatives - the Healthcare Cost

$ 40,000,000 $ 35,000,000 $ 420,000,000

Containment Committee will identify additional cost savings through

renegotiation of contracts and improved service delivery

Pharmacy Copays and Mandatory Mail Order for Active Employees

and New Retirees: Increase to $5, $20 and $35 for non maintenance drugs.

$ 19,876,000 $ 20,500,000 $ 698,000,000

Additional drugs coming off patent which will now be available as generics.

Mandatory Mail Order - maintenance drugs for active employees, future

retirees and current retirees under 65 must be ordered through the mail.

Voluntary for current retirees over 65 (mandatory once enrolled).

Minimum Service for Retiree Medical – Increase to 15 years of actual

$ 3,822,000 $ 9,705,000 $ 987,000,000

state service for Normal, early retirement and HD retirement with continuation

of Rule of 75 for Deferred Vested.

Health Care Total $ 187,898,000 $ 203,405,000 $ 5,272,000,000

May 13, 2011 2

May 13, 2011 3

Other Changes and Cost Savings

Hard Wage Freeze – FY 2012 and FY 2013

No state employee would receive any increase in salary for either of the next

two fiscal years, including no payment for individuals who were at their top step $ 138,852,400 $ 309,549,857 $ 6,330,000,000

as a bonus.

Adjust break point in 2, Tier 2A and Tier 3 $ - $ - $ (458,000,000)

Salary Increases - FY2013-14, FY 2014-15 and FY2015-16 - provide $ (600,000,000)

Three Percent plus step increases or their equivalent in those units with them

Technology Initiatives - utilize new technologies and reduced licensing

$ 40,000,000 $ 50,000,000 $ 1,000,000,000

procurement and consulting costs

SEBAC Budget Savings Initiative - implement savings ideas proposed by

employees to reduce costs in agencies through reduced procurement costs,

$ 90,000,000 $ 90,000,000 $ 1,800,000,000

more efficient agency operations and other initiatives.

Longevity – No longevity payment would be made in October, 2011 to those

units with capped longevity and an equivalent savings amount would be

negotiated from those with uncapped longevity. No one during the biennium

$ 7,000,000 $ - $ 53,000,000

will have those years count for that period. Individuals first hired on or after

7/1/11 (military service counts) would never receive a longevity payment.

Other Changes and Cost Savings Total $ 275,852,400 $ 449,549,857 $ 8,125,000,000

Grand Total $ 700,741,400 $ 901,206,857 $ 21,668,000,000

Agreement also includes the following:

Extension of SEBAC through 2022

Extension of Job Security through FY 2015, with increased flexibility on geographic limits for reassignment

New Retirement rules effective 9/2/2011

Comparable provisions for managers

Beginning July 1, 2017, the state will match employee contributions to the Retiree Health Care Trust Fund

May 13, 2011 4

Вам также может понравиться

- SEBAC Agreement Summary: Pension ChangesДокумент8 страницSEBAC Agreement Summary: Pension ChangesHour NewsroomОценок пока нет

- Overlapping Policies and Estimated Savings Across Fiscal PlansДокумент12 страницOverlapping Policies and Estimated Savings Across Fiscal PlansCommittee For a Responsible Federal BudgetОценок пока нет

- HB4285 - SB255 Cost ImpactДокумент2 страницыHB4285 - SB255 Cost ImpactRob LawrenceОценок пока нет

- Overlapping Policies and Estimated Savings Across Fiscal PlansДокумент13 страницOverlapping Policies and Estimated Savings Across Fiscal PlansCommittee For a Responsible Federal BudgetОценок пока нет

- Mr. Shaikabdulkhadar JilaniДокумент4 страницыMr. Shaikabdulkhadar JilaniAbdulkhadarJilani ShaikОценок пока нет

- Mr. Vitlesh PanditaДокумент4 страницыMr. Vitlesh PanditaVitlesh PanditaОценок пока нет

- TCS AnniversaryДокумент5 страницTCS AnniversaryVitlesh PanditaОценок пока нет

- TCS Anniversary2Документ4 страницыTCS Anniversary2Vitlesh PanditaОценок пока нет

- 5 Big Social Security Changes Took Effect in January 2024Документ4 страницы5 Big Social Security Changes Took Effect in January 2024617249399Оценок пока нет

- HSC403R Final ExamsДокумент6 страницHSC403R Final ExamsAchu Miranda 'MahОценок пока нет

- Personal Financial PlanningДокумент10 страницPersonal Financial PlanningTam PhamОценок пока нет

- 5 Big Social Security Changes Took Effect in January 2024Документ4 страницы5 Big Social Security Changes Took Effect in January 2024617249399Оценок пока нет

- Personal Income Tax Under The New Regime and Old RegimeДокумент4 страницыPersonal Income Tax Under The New Regime and Old RegimeAiswarya BОценок пока нет

- Economic TsunamiДокумент9 страницEconomic Tsunamidolite61Оценок пока нет

- Member and Fund ImpactДокумент2 страницыMember and Fund ImpactWCCO - CBS MinnesotaОценок пока нет

- Federal Budget 2021Документ4 страницыFederal Budget 2021api-227304535Оценок пока нет

- Coupe AgreementДокумент9 страницCoupe AgreementjroneillОценок пока нет

- WVU's Budget For FY 2024Документ37 страницWVU's Budget For FY 2024Anna SaundersОценок пока нет

- Assignment 4 - SolutionsДокумент2 страницыAssignment 4 - SolutionsEsther LiuОценок пока нет

- Your 2013 Income Taxes Have Gone UP Folks!Документ2 страницыYour 2013 Income Taxes Have Gone UP Folks!mikerogeroОценок пока нет

- BAC 2 - PRELIMS - PAYROLL AccountingДокумент10 страницBAC 2 - PRELIMS - PAYROLL AccountingReynalyn GalvezОценок пока нет

- Wash Workers' Compensation BriefДокумент2 страницыWash Workers' Compensation BriefPatti TomОценок пока нет

- Deduction ProvisionsДокумент11 страницDeduction ProvisionsdevasrisaivОценок пока нет

- Mr. Vitlesh PanditaДокумент5 страницMr. Vitlesh PanditaVitlesh PanditaОценок пока нет

- Pay Equity Factsheet: Care and Support Workers (Pay Equity) Settlement AgreementДокумент7 страницPay Equity Factsheet: Care and Support Workers (Pay Equity) Settlement AgreementRadith ShakindaОценок пока нет

- NMIMS Global Access School For Continuing Education (NGA-SCE) Course: Taxation-Direct and Indirect Internal Assignment Applicable For June 2020 ExaminationДокумент10 страницNMIMS Global Access School For Continuing Education (NGA-SCE) Course: Taxation-Direct and Indirect Internal Assignment Applicable For June 2020 ExaminationAnkit SharmaОценок пока нет

- Criteria and Evaluation: 1) Cost ReductionДокумент3 страницыCriteria and Evaluation: 1) Cost Reductionpradyum kumarОценок пока нет

- Addendum 121922 BOEДокумент3 страницыAddendum 121922 BOEAlexis TarraziОценок пока нет

- Ongc Pension&MediДокумент17 страницOngc Pension&MediNatarajan HariharanОценок пока нет

- LetterДокумент5 страницLetterJyotirmay SahuОценок пока нет

- Preparation of Legal OpinionДокумент5 страницPreparation of Legal OpinionNereus Sanaani CAñeda Jr.Оценок пока нет

- Flow Chart To Help Eligible Professionals (EP) Determine Eligibility For The Medicare and Medicaid Electronic Health Record (EHR) Incentive ProgramsДокумент2 страницыFlow Chart To Help Eligible Professionals (EP) Determine Eligibility For The Medicare and Medicaid Electronic Health Record (EHR) Incentive Programspicchu144Оценок пока нет

- Welcome To Business Math Class: Mr. Aron Paul San MiguelДокумент37 страницWelcome To Business Math Class: Mr. Aron Paul San MiguelPatrice Del MundoОценок пока нет

- FDA Guide To Pension Tax Relief 2021Документ15 страницFDA Guide To Pension Tax Relief 2021FDAunionОценок пока нет

- 10 7 Baucus LetterДокумент27 страниц10 7 Baucus LetterBrian AhierОценок пока нет

- Healthcare Reform ActДокумент3 страницыHealthcare Reform Actpeterlouisanthony7859Оценок пока нет

- City of Naples 2021 Pension Note Issuance AGM - 05192021Документ5 страницCity of Naples 2021 Pension Note Issuance AGM - 05192021Omar Rodriguez OrtizОценок пока нет

- Paul Ryan Comparison TableДокумент3 страницыPaul Ryan Comparison TableCommittee For a Responsible Federal BudgetОценок пока нет

- The Pensions Lifetime Allowance: Adviser GuideДокумент7 страницThe Pensions Lifetime Allowance: Adviser GuidesrowbothamОценок пока нет

- LFB UW System SummaryДокумент8 страницLFB UW System SummaryMichelle FelberОценок пока нет

- White House Fiscal Commission - Healthcare Recommendations - 2010-11-10Документ6 страницWhite House Fiscal Commission - Healthcare Recommendations - 2010-11-10Rich ElmoreОценок пока нет

- CFG Reference GuideДокумент38 страницCFG Reference GuideStefan IonescuОценок пока нет

- Douglas W. Elmendorf, Director U.S. Congress Washington, DC 20515Документ50 страницDouglas W. Elmendorf, Director U.S. Congress Washington, DC 20515josephragoОценок пока нет

- BILLS 112hconres112ehДокумент70 страницBILLS 112hconres112ehMichael PancierОценок пока нет

- UAW Contract Summary With GMДокумент20 страницUAW Contract Summary With GMWXYZ-TV Channel 7 Detroit100% (7)

- Why Are Healthy Employers Freezing Their PensionsДокумент13 страницWhy Are Healthy Employers Freezing Their Pensionsnyman49Оценок пока нет

- BUS. MATH Q2 - Week4Документ5 страницBUS. MATH Q2 - Week4DARLENE MARTIN100% (1)

- State Budget SummaryДокумент6 страницState Budget SummarymelissacorkerОценок пока нет

- CalSTRS AB 340 Fact SheetДокумент2 страницыCalSTRS AB 340 Fact Sheetjon_ortizОценок пока нет

- VishalДокумент0 страницVishalVishal AggawalОценок пока нет

- Comparing Medicare Reform ProposalsДокумент1 страницаComparing Medicare Reform ProposalsDonald SjoerdsmaОценок пока нет

- UTI Retirement Benefit Pension Fund - UTI Mutual FundДокумент32 страницыUTI Retirement Benefit Pension Fund - UTI Mutual FundRinku MishraОценок пока нет

- Budget Brief Head 55Документ36 страницBudget Brief Head 55Anonymous UpWci5Оценок пока нет

- Case Study - Blackhawk Urology - Groupe 4Документ10 страницCase Study - Blackhawk Urology - Groupe 4mohamed00007Оценок пока нет

- Windes 2021 Year End Year Round Tax Planning GuideДокумент20 страницWindes 2021 Year End Year Round Tax Planning GuideBrian SneeОценок пока нет

- Proposed Budget CutsДокумент2 страницыProposed Budget CutsIsaac GuerreroОценок пока нет

- Rep Pat Dillon: ECA Eligibiliy, Whalley Billboard, Sally's Reopens, Rally For Families From Puerto RicoДокумент3 страницыRep Pat Dillon: ECA Eligibiliy, Whalley Billboard, Sally's Reopens, Rally For Families From Puerto RicoPatricia DillonОценок пока нет

- Osprey Nation 2017 Report 2.16Документ11 страницOsprey Nation 2017 Report 2.16Patricia DillonОценок пока нет

- CT: Biennial Report On School Districts' EffortsДокумент108 страницCT: Biennial Report On School Districts' EffortsPatricia DillonОценок пока нет

- CT Ag Jan 24: Maple SeasonДокумент4 страницыCT Ag Jan 24: Maple SeasonPatricia DillonОценок пока нет

- College Goal Sunday (CSG) New Haven Oct 22Документ1 страницаCollege Goal Sunday (CSG) New Haven Oct 22Patricia DillonОценок пока нет

- Rep Pat Dillon: Heroes Tunnel ConstructionДокумент2 страницыRep Pat Dillon: Heroes Tunnel ConstructionPatricia DillonОценок пока нет

- Rep Pat Dillon:: Mental Health Benefits OHA Free WebinarДокумент1 страницаRep Pat Dillon:: Mental Health Benefits OHA Free WebinarPatricia DillonОценок пока нет

- Fare Increase Hearing Presentation Sept 2016Документ18 страницFare Increase Hearing Presentation Sept 2016Patricia DillonОценок пока нет

- AOM NO. 01-Stale ChecksДокумент3 страницыAOM NO. 01-Stale ChecksRagnar Lothbrok100% (2)

- Mitsubishi Electric Corporation V Westcode IncДокумент5 страницMitsubishi Electric Corporation V Westcode IncLespassosОценок пока нет

- Moro Islamic Liberation FrontДокумент5 страницMoro Islamic Liberation FrontNourmieenah Dagendel LptОценок пока нет

- ACARA 2 InggriДокумент12 страницACARA 2 InggriSyahrul Maulana As'ari HabibiОценок пока нет

- Bilingualism: Definitions and Distinctions: CHAPTER 1Документ8 страницBilingualism: Definitions and Distinctions: CHAPTER 1liaОценок пока нет

- Supreme Court DecisionДокумент9 страницSupreme Court DecisionWSYX/WTTEОценок пока нет

- Sales Representatives TrainingДокумент27 страницSales Representatives Trainingsteve@air-innovations.co.zaОценок пока нет

- Malaysian Legislation: Cheng Hoon Teng Temple (Incorporation) Act 1949 (Revised 1994)Документ42 страницыMalaysian Legislation: Cheng Hoon Teng Temple (Incorporation) Act 1949 (Revised 1994)邱尔民Оценок пока нет

- CLDDP Lca Constitution 20210726Документ6 страницCLDDP Lca Constitution 20210726Mcolisi GinindzaОценок пока нет

- Pre-Commencement Meeting and Start-Up ArrangementsДокумент1 страницаPre-Commencement Meeting and Start-Up ArrangementsGie SiegeОценок пока нет

- Motion To Release The CICLДокумент4 страницыMotion To Release The CICLLariza AidieОценок пока нет

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledДокумент12 страницBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledBryan Paulo CatiponОценок пока нет

- Transfer of Cases: Deputy Public Prosecutor (DPP) Can Transfer The Case Thru by The SC/MC/PP)Документ6 страницTransfer of Cases: Deputy Public Prosecutor (DPP) Can Transfer The Case Thru by The SC/MC/PP)Bobo KhoОценок пока нет

- 6 Vikas Sud ABДокумент15 страниц6 Vikas Sud ABkrishanОценок пока нет

- Criminal Procedure Code: List of Subsidiary LegislationДокумент33 страницыCriminal Procedure Code: List of Subsidiary Legislationmotego 1Оценок пока нет

- h1b Request Form UpdatedДокумент4 страницыh1b Request Form UpdatedAnthony Gelig MontemayorОценок пока нет

- An Inspector Calls Tasks and Answers Crofton AcademyДокумент34 страницыAn Inspector Calls Tasks and Answers Crofton AcademyelezabethОценок пока нет

- Human Development Index: Origins Dimensions and CalculationДокумент11 страницHuman Development Index: Origins Dimensions and CalculationSanthosh PОценок пока нет

- Enclosure No. 6: Election Application PacketДокумент9 страницEnclosure No. 6: Election Application PacketJocet Generalao100% (2)

- Contract Labour (Regulation and Abolition) Act, 1970Документ140 страницContract Labour (Regulation and Abolition) Act, 1970retika yadavОценок пока нет

- Cooperatives Perspectives in TanzaniaДокумент10 страницCooperatives Perspectives in TanzaniaMichael NyaongoОценок пока нет

- Campaign 2022 NclopДокумент3 страницыCampaign 2022 NclopRhandell De JesusОценок пока нет

- List of Designated Microscopy Centres (DMC) 2019-Delhi RNTCPДокумент7 страницList of Designated Microscopy Centres (DMC) 2019-Delhi RNTCPraman100% (2)

- Kepastian Hukum Dan Upaya Pertanggungjawaban Pemerintah Terhadap Perlindungan Hak Tanah Ulayat Di Pulau RempangДокумент20 страницKepastian Hukum Dan Upaya Pertanggungjawaban Pemerintah Terhadap Perlindungan Hak Tanah Ulayat Di Pulau Rempangnfazzahra06Оценок пока нет

- Tamilnadu Money Lenders ActДокумент7 страницTamilnadu Money Lenders ActSiva Rama Krishnan50% (2)

- Cases 3rd Page PDFДокумент166 страницCases 3rd Page PDFBANanaispleetОценок пока нет

- Earnings Release Sleep-Well ProductsДокумент2 страницыEarnings Release Sleep-Well Productsapi-589152156Оценок пока нет

- Hoer 1Документ21 страницаHoer 1Ranjeet SinghОценок пока нет

- Robert Vincent Crifasi: Self-Executing AgreementДокумент6 страницRobert Vincent Crifasi: Self-Executing Agreementheaddoggs1Оценок пока нет

- DG 3 Answer-Key 22-23 Ex2-4 2-6Документ10 страницDG 3 Answer-Key 22-23 Ex2-4 2-6SylwiaОценок пока нет