Академический Документы

Профессиональный Документы

Культура Документы

Subject: Financial Accounts: Topic: Financial Statements of Not For Profit Organizations

Загружено:

Questionscastle FriendИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Subject: Financial Accounts: Topic: Financial Statements of Not For Profit Organizations

Загружено:

Questionscastle FriendАвторское право:

Доступные форматы

Subject: Financial Accounts

Topic: Financial Statements of Not for Profit Organizations

By: Questionscastle Academic Team Document Code: CA/IPCC/ACC/0006

A Not for Profit Organization (NPO) is an organisation which does not work for profit purpose instead it works completely for social welfare and serving the society. For example: Public Hospitals, Public Educational Institutions, Clubs, and Resident Welfare Societies etc. Types of Accounts prepared: A NPO prepares three types of statements in its Financial Statements: 1. Receipt and Payment Account. 2. Income and Expenditure Account. 3. Balance Sheet. Receipt and Payment Account: A Receipt and Payment Account is a summary of Cash Book. In a receipt and payment account a NPO records all cash transactions occurred in a year irrespective of the year these cash transactions relates to. Just like cash account all inwards are recorded on left side and all payments are mentioned on right side. Also it shows the opening and closing balance of cash with the organization. Income and Expenditure Account: An Income and Expenditure Account is like a Profit And Loss Account for a NPO. In an Income and Expenditure Account a NPO records all transactions of nominal nature for a relevant financial year. Unlike Receipt and Payment Account it requires an adjustment of prepaid and outstanding balances related to all nominal accounts. It shows the profit earned or loss incurred by the NPO during a relevant financial year. But unlike P&L A/c it represents profit by the name of Surplus and loss by Deficit.

Balance Sheet: A balance sheet of NPO serves the same purpose as of any other financial organization. It is prepared in the same way as all other balance sheets are. Preparation of Receipt and Payment Account: As we discussed earlier a Receipt and Payment Account is a summary of Cash Book. All cash received by the NPO, no matter what they are related to are just debited to a receipt and payment account and all cash payment for any nature are to be credited. The following example will make it more clear to you: Ques 1: The following transactions occurred in Swaraj Club for the year ended December 31st, 2008: Entrance Fees `300, Subscription Fees `4,000, Donation for Club Pavilion `10,000, Foodstuff sales `1,200, Salaries and Wages `1,500, Purchase of Food Stuff `800, Construction of Club Pavilion `11,000, General Expenses `600, Rent and Taxes `400, Bank Charges `160. Cash in hand Jan 1st `200, Dec 31st 350 Cash in bank Jan 1st `400, Dec 31st 1290.

Subscription fees include `500 received for the year ended 31st Dec 2007, while `700 are still in arrear for year ended Dec 31st 2008. Salaries and Wages paid include `300 paid in advance for year 2009. Solution: Swaraj Club Receipt and Payment Account For the year ended 31st Dec 2008 Dr Cr Receipts To Cash in hand (b/d) To Cash in bank (b/d) To Entrance Fees To Subscription Fees To Donation for Club Pavilion To Food Stuff Sales ` 200 400 300 4,000 10,000 Payments ` 1,500 800 11,000 600 400 160 350 1290 16,100

By Salaries and Wages By Purchased of Food Stuff By Construction of Club Pavilion By General Expenses By Rent and Taxes 1,200 By Bank Charges By Cash in hand (c/d) By Cash in bank (c/d) 16,100

Students to please note: All transactions resulting in inflow of cash are debited in Receipt and Payment A/c i.e. in the receipts column on the left side. All transactions resulting in outflow of cash are credited in Receipt and Payment A/c i.e. in the Payments column on the right side. In case of Subscription Fees received a sum of `500 was for last year and `700 are still in arrear, still total `4000 are included in the Receipt and Payment A/c of year 2008 irrespective of their year. In case of Salaries and Wages paid `300 are paid in advance for year 2009, still total of `1500 is included in current years Receipt and Payment A/c. Capital Receipts and Capital Payments related to Club Pavilion are also included in Receipt and Payment A/c. Opening and Closing balances of cash are also mentioned. Preparation of Income and Expenditure A/c form Receipt and Payment A/c: Income and Expenditure A/c is prepared form Receipt and Payment A/c. The procedure is mentioned below: 1. All the items of nominal nature in Receipt and Payment A/c are transferred to Income and Expenditure A/c. 2. Before transferring balances from Receipt and Payment A/c to Income and Expenditure A/c all accounts are first adjusted i.e. the balances related to current year only are to be transferred. 3. Total amount of all transactions related to current year are to be included, whether the cash for such transaction has been received earlier or is still outstanding. 4. Transfer the items mentioned on left hand side of receipt and payment a/c to right hand side of Income and Expenditure a/c. And balances on right hand side of receipt and payment account to left hand side of Income and Expenditure a/c. 5. Any amount raised for a special activity e.g. sale of match ticket etc. is deducted from the expenditure of that activity and net amount is shown in income and expenditure account. 6. Amount received for any specific purpose is not included in Income and Expenditure a/c as it is transferred to special fund a/c. For ex. Donation received for construction of building is transferred to Building Fund A/c.

7. At last just follow the principles of preparing a Profit and Loss account while preparing an Income and Expenditure A/c. The following example will make it more clearly to you: Ques 2: Jan Sevak Hospital provides you the following data for the year ended 31st Mar 2008. You are required to prepare an Income and Expenditure A/c. Dr Cr Receipts Payments ` ` To Balances Cash 400 Bank 2,600 To Subscription For 2007 For 2008 For 2009 To Govt Grant For Building For Maintenance Fees from Sundry Patient To Donations (not to be capitalised) Net Proceeds from benefit shows By Salaries (`3,600 for 2007) By Hospital Equipment By Furniture By Additions to building By Printing and Stationery By Diet Expenses By Rent and Rates (`150 for 2009) By Electricity and Water charges By Office Expenses By Investment By Balances Cash Bank 15,600 8,500 3,000 25,000 1,200 7,800 1,000 1,200 1,000 10,000 700 3,400 78,400 ` 70,000 25,500 40,000 3,250

3,000 2,550 12,250 1,200 40,000 10,000 2,400 4,000 3,000 78,400

Additional Information: Value of building under construction as on 31.12.2008 Value of hospital equipment on 31.12.200 Building Fund as on 1.1.20 Subscription in arrears as on 31.12.2 Investments in 8% govt securities were made on 1st July 2008. Solution: Jan Sevak Hospital Income and Expenditure A/c For the year ended 31st Dec 2008 Expenditure Amt Income To Salaries 12,000.00 By Subscription To Diet Expenses 7,800.00 By Govt. Grants (Maint) To Rent and Rates 850.00 By Fees from Sundry To Printing and Stationery 1,200.00 Patients To Electricity and Water 1,200.00 By Donations Charges By Benefit Shows To Office Expenses 1,000.00 By Interest on Invst. To Surplus 8,000.00 32,050.00

Amt 12,250.00 10,000.00 2,400.00 4,000.00 3,000.00 400.00 32,050.00

Students to please note: The amount of salary debited in Income and Expenditure A/c is `12,000 which is only for current year i.e. 2008 irrespective of `15,600 shown in Receipt and payment a/c which also includes `3,600 of 2007.

Similarly Rent and Rates shows only `850 in Income and Expenditure A/c while the same reflects `1,000 in receipt and payment a/c which includes `150 for next year also. Subscription of `3250 is outstanding for year 2007 but same has not been shown in income and expenditure a/c instead a sum of `2550 is recovered from it. This is also because it does not belong to current year of 2008. Expenses such as hospital equipment and furniture purchased, grant for building and additions to building are not included in income and expenditure a/c because these are not of revenue (nominal) nature but of capital nature and will move to Balance Sheet. Preparation of Balance Sheet: Like any other financial organization the Balance Sheet of a NPO also gives an estimate of financial position of the organisation. It includes all the items of capital nature either brought forward from preceding year or is transacted during the year. A balance sheet is prepared by the following procedure: 1. All the liabilities are to be mentioned on left hand side while assets are shown on right hand side. 2. Assets and liabilities which are not settled in current year (e.g. Receivables, payables, outstanding bills etc) are also to be mentioned. 3. Assets acquired during current year are to be mentioned. 4. Liabilities generated during current year to be mentioned. 5. Opening capital fund is to be calculated from the previous year balance sheet. It is calculated by deducting all the liabilities from all the assets in the previous year balance sheet. 6. Surplus/Deficit is to be shown by adjusting in to Opening Capital Fund which is calculated above in step 5. The following example will make it more clear to you: Ques 3: In Ques 2 prepare a Balance Sheet. Solution: Jan Sevak Hospital Balance Sheet As on 31st Dec 2008 Liabilities Amt Assets Capital Fund: Building Opening Bal Opening Bal 45,000 24,650 32,650 Addition 25,000 Add: Surplus Hospital Equipment 8,000 Opening Bal 17,000 8,500 Building Fund 80,000 Addition Opening Bal Furniture 40,000 1,200 8% Investment Add: Govt Grant Subscription Receivable 40,000 Accrued Interest Subscription received in Prepaid Exp. (Rent) advance Cash at Bank Cash in hand 1,13,850

Amt

70,000 25,500 3,000 10,000 700 400 150 3,400 700 1,13,850

Students to please note: Opening capital fund is shown by deducting liabilities from assets as standing in last year balance sheet. Surplus is shown by adding in Capital Fund.

Building Fund is shown by adding to the amount standing to the credit of Building Fund a/c during the last year i.e. `40,000. Subscription received in advance is shown as liability generated during the current year. Building a/c is shown by adding sum of `25,000 to last year total of `45,000. (See `70,000 are shown in Additional info. and `25,000 are added during current year. Hence we assume that opening bal of building is `45000). Same is in the case of Hospital Equipment. 8% investments are asset acquired during the year. And `400 is interest on investment which is earned but not received in cash. Rent of `150 paid during current year is for next year is an asset and hence included in Balance sheet. Rest is closing balance of cash and of bank.

Вам также может понравиться

- 1988-1998 Chevrolet Chevy Truck PDFДокумент84 страницы1988-1998 Chevrolet Chevy Truck PDFAriel67% (3)

- Bookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthОт EverandBookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthОценок пока нет

- 11 Accountancy Notes Ch08 Financial Statements of Sole Proprietorship 02Документ9 страниц11 Accountancy Notes Ch08 Financial Statements of Sole Proprietorship 02Anonymous NSNpGa3T93100% (1)

- Statement of Change in Financial Position-5Документ32 страницыStatement of Change in Financial Position-5Amit SinghОценок пока нет

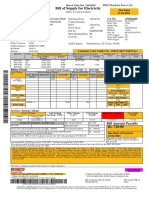

- Bill of Supply For Electricity: Due Date: 13-04-2021Документ1 страницаBill of Supply For Electricity: Due Date: 13-04-2021Aditya RajОценок пока нет

- 21St Century Computer Solutions: A Manual Accounting SimulationОт Everand21St Century Computer Solutions: A Manual Accounting SimulationОценок пока нет

- Financial Policy and Procedure Manual TemplateДокумент30 страницFinancial Policy and Procedure Manual TemplateJanani shree JanuОценок пока нет

- Note Exam Law 299Документ5 страницNote Exam Law 299nurulfahizah50% (2)

- Cash Flow TutorialДокумент6 страницCash Flow TutorialEric Chambers100% (1)

- F3 Study NotesДокумент251 страницаF3 Study NotesHamza AliОценок пока нет

- Week 3Документ46 страницWeek 3BookAddict721Оценок пока нет

- Chapter 13 PowerPointДокумент89 страницChapter 13 PowerPointcheuleee100% (1)

- QuickBooks SyllabusДокумент10 страницQuickBooks SyllabusNot Going to Argue Jesus is KingОценок пока нет

- Statement of Cash FlowsДокумент30 страницStatement of Cash FlowsNocturnal Bee100% (1)

- Accounts of Non Profit OrganisationДокумент21 страницаAccounts of Non Profit OrganisationJayakrishnan Er E RОценок пока нет

- Accounting For Non Profit Making Organisations PDFДокумент23 страницыAccounting For Non Profit Making Organisations PDFrain06021992Оценок пока нет

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОт EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОценок пока нет

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyОт EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyОценок пока нет

- Lecture 3 Week 3 PPT 3Документ39 страницLecture 3 Week 3 PPT 3Li Lin100% (1)

- Single Entry SystemДокумент6 страницSingle Entry SystemQuestionscastle Friend67% (3)

- FundamentalsofABM2 Q1 M5Revised.-1Документ12 страницFundamentalsofABM2 Q1 M5Revised.-1Jomein Aubrey Belmonte60% (5)

- Datecs FPrintДокумент125 страницDatecs FPrintcristian1972100% (2)

- 19674ipcc Acc Vol1 Chapter-9Документ44 страницы19674ipcc Acc Vol1 Chapter-9Sonu KamalОценок пока нет

- Non Trading ConcernsДокумент27 страницNon Trading ConcernsMuhammad Salim Ullah Khan0% (1)

- 67185bos54090 cp9Документ42 страницы67185bos54090 cp9Esha JoshiОценок пока нет

- 11 Accountancy Notes Ch09 Financial Statement For Non Profit Organizations 02Документ14 страниц11 Accountancy Notes Ch09 Financial Statement For Non Profit Organizations 02Rishabh SethiaОценок пока нет

- BM Group Work AccountsДокумент6 страницBM Group Work AccountsprimroseОценок пока нет

- Financial Statements of Not-For-Profit Organisations: Learning ObjectivesДокумент44 страницыFinancial Statements of Not-For-Profit Organisations: Learning ObjectivesShubham JalanОценок пока нет

- Ebook - Financial Statements of Not-for-Profit OrganizationsДокумент38 страницEbook - Financial Statements of Not-for-Profit OrganizationsRahulОценок пока нет

- Accounting DefinitionДокумент6 страницAccounting DefinitionMahesh JagadaleОценок пока нет

- Ignou Solved Assignment Eco - 02 - 2014-15Документ11 страницIgnou Solved Assignment Eco - 02 - 2014-15NandanUpamanyu50% (4)

- FUNDAMENTALS OF ACCOUNTANCY BUSINESS AND MANAGEMENT PPP 1Документ185 страницFUNDAMENTALS OF ACCOUNTANCY BUSINESS AND MANAGEMENT PPP 1Janelle Dela Cruz100% (1)

- Accountancy HOTSДокумент47 страницAccountancy HOTSYash LundiaОценок пока нет

- Accounting For NPO PDFДокумент31 страницаAccounting For NPO PDFNicole TaylorОценок пока нет

- Study Note - 7: Accounting For Non-Profit Making OrganisationsДокумент143 страницыStudy Note - 7: Accounting For Non-Profit Making OrganisationsharonsimithОценок пока нет

- Npo Class 12 Ncert AnswersДокумент61 страницаNpo Class 12 Ncert Answersrxcha.josephОценок пока нет

- CBSE Class 11 Accountancy Sample Paper 2013 (4) - 0 PDFДокумент12 страницCBSE Class 11 Accountancy Sample Paper 2013 (4) - 0 PDFsivsyadavОценок пока нет

- Class 12 Study Material AccountancyДокумент54 страницыClass 12 Study Material AccountancyUmesh JaiswalОценок пока нет

- Homework QuestionsДокумент17 страницHomework QuestionsAОценок пока нет

- ACFrOgBfohBN8hE0dT33pLz5eb756Gdk6-qUJtyRFFaNNpNtAmTzQTgrEBH nTVcyGWWRNNrWxMRVKZjAPpUNRm61nvXxp7znKrN66nYDb3 C vHsDdyxlX0UEi5hlCV8kPr0sH321Yhy5zg7UFДокумент8 страницACFrOgBfohBN8hE0dT33pLz5eb756Gdk6-qUJtyRFFaNNpNtAmTzQTgrEBH nTVcyGWWRNNrWxMRVKZjAPpUNRm61nvXxp7znKrN66nYDb3 C vHsDdyxlX0UEi5hlCV8kPr0sH321Yhy5zg7UFColdBruОценок пока нет

- This Activity Contains 30 QuestionsДокумент19 страницThis Activity Contains 30 QuestionsSylvan Muzumbwe MakondoОценок пока нет

- Non Trading OrganisationДокумент70 страницNon Trading OrganisationDivyansh TripathiОценок пока нет

- Financial Statements of Not For Profit Organisations BBEДокумент27 страницFinancial Statements of Not For Profit Organisations BBEanirudh.dubey10001Оценок пока нет

- 3 CFSДокумент65 страниц3 CFSRocky Bassig100% (1)

- Receipt and Payment AccountДокумент3 страницыReceipt and Payment AccountAl FahriОценок пока нет

- Hsslive Xii Ch1 Accouting For Nop Organisation SignedДокумент4 страницыHsslive Xii Ch1 Accouting For Nop Organisation SignedChandreshОценок пока нет

- Blue Print: Accounting: Class XI Weightage Difficulty Level of QuestionsДокумент12 страницBlue Print: Accounting: Class XI Weightage Difficulty Level of Questionssirsa11Оценок пока нет

- Acct 2600 Exam 1 Study SheetДокумент8 страницAcct 2600 Exam 1 Study Sheetapi-236442317Оценок пока нет

- CBSE Class 11 Accountancy Sample Paper 2013 PDFДокумент12 страницCBSE Class 11 Accountancy Sample Paper 2013 PDFsivsyadav100% (1)

- Budgeting and Finance CourseДокумент64 страницыBudgeting and Finance CourseRobert DeliaОценок пока нет

- Cash Flow StatementДокумент38 страницCash Flow StatementSatyajit Ghosh100% (2)

- Accounting Principle - Ujian NasionalДокумент115 страницAccounting Principle - Ujian Nasionalosusant0100% (1)

- AKДокумент9 страницAKAnonymous cJogAxQnОценок пока нет

- Clubs and SocietyДокумент7 страницClubs and SocietyJAPHET NKUNIKAОценок пока нет

- Accounting Equation For A Sole ProprietorshipДокумент11 страницAccounting Equation For A Sole Proprietorshipjobeson100% (1)

- Cash Flow StatementДокумент23 страницыCash Flow StatementJayci LeiОценок пока нет

- Ch3 For Myself v2 AccountingДокумент83 страницыCh3 For Myself v2 AccountinglamdamuОценок пока нет

- Accounting QuestionsДокумент8 страницAccounting Questionspaulo dela cruzОценок пока нет

- Cash Flow Statement Wit SumДокумент27 страницCash Flow Statement Wit SumSunay KhaireОценок пока нет

- Accy 517 HW PB Set 1Документ30 страницAccy 517 HW PB Set 1YonghoChoОценок пока нет

- Cash Flows AccountingДокумент9 страницCash Flows AccountingRosa Villaluz BanairaОценок пока нет

- Accounting Chapter 13 Summary Statement of Cash FlowsДокумент5 страницAccounting Chapter 13 Summary Statement of Cash FlowsAndrew PhilipsОценок пока нет

- Review Questions For Chapter 6 (Statement ofДокумент19 страницReview Questions For Chapter 6 (Statement ofNick Corrosivesnare40% (5)

- Npo CompiledДокумент17 страницNpo Compiledaneupane465Оценок пока нет

- Acct 2301 FinaДокумент42 страницыAcct 2301 FinaFabian NonesОценок пока нет

- Accounting For Decision Making Mid TermДокумент5 страницAccounting For Decision Making Mid Termumer12Оценок пока нет

- Practical Project: Subject:-Fundamentals of AccountancyДокумент14 страницPractical Project: Subject:-Fundamentals of AccountancyVkОценок пока нет

- Average Due Date Question BankДокумент2 страницыAverage Due Date Question BankQuestionscastle Friend67% (6)

- Self Balancing Ledger Question BankДокумент4 страницыSelf Balancing Ledger Question BankQuestionscastle Friend50% (2)

- Self Balancing Ledger Question BankДокумент4 страницыSelf Balancing Ledger Question BankQuestionscastle Friend50% (2)

- Self Balancing Ledger Question BankДокумент4 страницыSelf Balancing Ledger Question BankQuestionscastle Friend50% (2)

- Hire PurchaseДокумент3 страницыHire PurchaseQuestionscastle FriendОценок пока нет

- Account Current Question BankДокумент2 страницыAccount Current Question BankQuestionscastle Friend0% (1)

- Theory Question 3 Cost AccountsДокумент1 страницаTheory Question 3 Cost AccountsQuestionscastle FriendОценок пока нет

- Theory Questions 1 FMДокумент3 страницыTheory Questions 1 FMQuestionscastle Friend100% (1)

- Capital Structure Question BankДокумент5 страницCapital Structure Question BankQuestionscastle FriendОценок пока нет

- Theory Questions 2 FMДокумент1 страницаTheory Questions 2 FMQuestionscastle FriendОценок пока нет

- Leverages Question BankДокумент3 страницыLeverages Question BankQuestionscastle Friend60% (5)

- MaterialДокумент5 страницMaterialQuestionscastle FriendОценок пока нет

- Theory Question 2 Cost AccountsДокумент2 страницыTheory Question 2 Cost AccountsQuestionscastle FriendОценок пока нет

- Cost of Capital Question BankДокумент4 страницыCost of Capital Question BankQuestionscastle Friend100% (1)

- Labour CostДокумент3 страницыLabour CostQuestionscastle FriendОценок пока нет

- Direct Material CostДокумент4 страницыDirect Material CostQuestionscastle Friend100% (1)

- Theory Question 1Документ2 страницыTheory Question 1Questionscastle FriendОценок пока нет

- Hire PurchaseДокумент2 страницыHire PurchaseQuestionscastle FriendОценок пока нет

- Investment AccountДокумент2 страницыInvestment AccountQuestionscastle Friend67% (3)

- Reconciliation of Cost and Financial AccountsДокумент4 страницыReconciliation of Cost and Financial AccountsQuestionscastle FriendОценок пока нет

- Cost SheetДокумент4 страницыCost SheetQuestionscastle FriendОценок пока нет

- Key Features of Budget 2010-2011Документ14 страницKey Features of Budget 2010-2011api-25886395Оценок пока нет

- Single Entry SystemДокумент2 страницыSingle Entry SystemQuestionscastle FriendОценок пока нет

- Gcash Transaction History: Date and Time Description Reference No. Debit Credit BalanceДокумент3 страницыGcash Transaction History: Date and Time Description Reference No. Debit Credit BalanceJessica CraveОценок пока нет

- Functions of Central BankДокумент22 страницыFunctions of Central BankMd Rabbi KhanОценок пока нет

- CV ReaДокумент1 страницаCV ReaAerinkashiki HyeОценок пока нет

- 2022 Updated MOOE ChecklistДокумент32 страницы2022 Updated MOOE ChecklistRYAN JOHN LIBAGOОценок пока нет

- SOP Part 1 PDFДокумент340 страницSOP Part 1 PDFudi9690% (2)

- Impulse Marketing Group, Inc. v. National Small Business Alliance, Inc. Et Al - Document No. 22Документ22 страницыImpulse Marketing Group, Inc. v. National Small Business Alliance, Inc. Et Al - Document No. 22Justia.com100% (2)

- NoteДокумент3 страницыNotePandrayar MaruthuОценок пока нет

- Cases - PersonsДокумент230 страницCases - PersonsKay MiraflorОценок пока нет

- Ed - PPP - COA Circular 2012 001Документ148 страницEd - PPP - COA Circular 2012 001Melissa Mae GumaposОценок пока нет

- 18229918Документ1 страница18229918Mohan JhaОценок пока нет

- ASSOCHAM - MSME InputsДокумент8 страницASSOCHAM - MSME Inputsdeepak dubeyОценок пока нет

- Fob Procedure 2%PB UpfrontДокумент4 страницыFob Procedure 2%PB UpfrontfemiОценок пока нет

- SOP Howard PDFДокумент110 страницSOP Howard PDFfidiaОценок пока нет

- Spectre Dapp Terms v13Документ19 страницSpectre Dapp Terms v13Surya BirdnestОценок пока нет

- Scope: Project - IДокумент61 страницаScope: Project - IshivamОценок пока нет

- Abbreviation DefinitionДокумент14 страницAbbreviation DefinitionsaluruОценок пока нет

- Crewe Alexandra FCДокумент2 страницыCrewe Alexandra FCAnonymous Cw1DGmRfОценок пока нет

- 2307 Jan 2018 ENCS v3Документ3 страницы2307 Jan 2018 ENCS v3Jomar Reveche PalmaОценок пока нет

- RFBT 04 03 Law On Obligation For Discussion Part TwoДокумент15 страницRFBT 04 03 Law On Obligation For Discussion Part TwoStephanieОценок пока нет

- Integrated Accounting Learning Module Attachment (Do Not Copy)Документ15 страницIntegrated Accounting Learning Module Attachment (Do Not Copy)Jasper PelicanoОценок пока нет

- Bank Guarantees: Your Protection Against Non-Performance and Non-PaymentДокумент37 страницBank Guarantees: Your Protection Against Non-Performance and Non-PaymentDuyên Trần Thị QuỳnhОценок пока нет

- The Kerala Account Code Vol IДокумент145 страницThe Kerala Account Code Vol IHIVETECHОценок пока нет

- Kassel UniversityДокумент19 страницKassel UniversityMind PropsОценок пока нет