Академический Документы

Профессиональный Документы

Культура Документы

Ops Amw Gde D en Your Am Way Earnings and The Us Income Tax

Загружено:

changhyeОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Ops Amw Gde D en Your Am Way Earnings and The Us Income Tax

Загружено:

changhyeАвторское право:

Доступные форматы

Your Amway Earnings & The U.S. Income Tax I. II. III. Introduction . . . . . . . Record Keeping Requirements . . . .

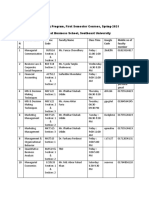

Filing Requirements . . . . . . A. Overview of Pertinent Tax Forms . . . 1. Form 1040-Schedule C . . . . 2. Form 1099-MISC . . . . . 3. Form 1040-ES . . . . . 4. Schedule SE . . . . . B. Filing Deadlines . . . . . . Form 1099-MISC . . . . . . A. General Information . . . . . B. FAQs About Form 1099-MISC . . . . C. Backup Withholding . . . . . Schedule C . . . . . . . . A. General Information . . . . . B. Part IIncome . . . . . . 1. Gross Receipts . . . . . 2. Cost of Goods Sold . . . . 3. Gross Profit . . . . . C. Part IIExpenses . . . . . . 1. Advertising and Promotion . . . a. Promotional Items b. Personal Use Items c. Business Gifts 2. Automobile Expenses . . . . a. Keeping a Mileage and Expense Log b. Standard Mileage Allowance Method c. Actual Out-of-Pocket Expense Method 3. Office in Your Home . . . . a. Principal Place of Business b. Calculating Home Office Deduction 4. Taxes . . . . . . Real Estate Property Tax Personal Property Tax Business Tax . . . . . . . . . . . . . . . . . . . . . 1 1 2 2 2 2 3 3 3 4 4 4 6 7 7 7 7 8 9 9 9

IV.

V.

11

12

14

Version 1.1 Updated 05/31/2010

Travel, Meals, and Entertainment . . . a. Entertainment Expense Records b. Travel Expense Records c. Conventions d. Travel Outside the U.S. and on Cruise Ships 6. Telephone . . . . . . . 7. Salaries, Wages, and Other Compensation . . a. Payments to Your Children 8. Miscellaneous Expenses . . . . . D. Capital Expenditures and Depreciation . . . E. Tax Credits . . . . . . . . VI. Schedule SESelf-Employment Tax . . . . VII. Tax Planning . . . . . . . . A. Selecting an Income Tax Advisor . . . . B. Health Insurance Costs for Self-Employed Individuals . C. Retirement . . . . . . . . 1. Social Security . . . . . . 2. Retirement Plans . . . . . . 3. Individual Retirement Accounts . . . VIII. Not-for-Profit Activities . . . . . . IX. Sources of Additional Information . . . . . X. Taxpayer Bill of Rights . . . . . .

5.

15

17 17 17 18 18 19 20 20 21 21 21 21 21 22 22 23

Version 1.1 Updated 05/31/2010

ii

I.

Introduction

This guide addresses basic federal income tax requirements affecting Amway-affiliated Independent Business Owners (IBOs). Operating a trade or business necessarily requires a few additional record keeping and reporting exercises in order to receive fair treatment of business income and expenses under the Internal Revenue Code. This guide discusses only federal income tax requirements, as each state has its own separate and different tax laws. You should become familiar with your states requirements as well. The Corporation provides this guide for its IBOs as an educational resource only. Nothing contained in this guide shall be construed as legal, accounting, or other professional counsel or advice, nor shall it imply a recommendation by the Corporation of any course or method of regulatory compliance. Readers and users who intend to take, or refrain from taking, any action based on information contained herein should first consult with their qualified tax advisor, preferably a CPA, or the appropriate regulatory authorities. While every effort is made to provide accurate and current information, the materials provided here are given for purposes of explanation only and should not be relied upon as the most recent material available. Subsequent changes in the federal tax law, such as congressional amendments or IRS interpretation, may change some of the material covered. Accordingly, your own qualified tax advisor should be your final authority on these matters.

II.

Record Keeping Requirements

As an IBO, you should maintain separate accounts for your business and personal needs. A separate checking account for your business will actually simplify your record keeping responsibilities. Also, if you use a credit card for your business, we suggest that you have a separate credit card account that is used only for business items. Adequate records of business income and expenses are essential for proper reporting for federal income tax purposes. Utilizing separate accounts makes it easier to track business income and expenses. Maintaining a regular income statement is also important. Your income statement allows you to evaluate business performance on a monthly and annual basis. It makes possible better year-end tax-planning decisions, and it will be a source of needed information for your income tax return. It also allows you to compare your business with other similar businesses, so you can discover ways to improve performance and maximize profitability. Consult your qualified tax advisor for assistance with preparing your income statement. In addition to accounting for all of your business income and expenses, you must also substantiate them using original source documents. Original source documents substantiating revenue include: Form 1099-MISC (issued by Amway or your upline) Bank deposit slips (identify the nature of each item being deposited, especially funds transferred from your personal account to your business account) Bank statements Sales invoices and receipts Monthly Business Information Summaries (received from Amway or your upline)

Version 1.1 Updated 05/31/2010

Original source documents substantiating expenses include: Forms 1099-MISC (issued to your downline and others) Canceled checks Bank statements Purchase invoices Receipts for out-of-pocket cash expenses Automobile mileage and expense logs Appointment books, agendas, and ticket stubs evidencing attendance at business meetings and seminars You will need your supporting documentation if ever the Internal Revenue Service selects your return(s) for audit. Under certain circumstances, you may be required to produce documents for only the prior three years. However, you could be required to produce records for as far back as seven years. Consult with your qualified tax advisor before discarding any supporting documentation or tax returns.

III.

A.

Filing Requirements

Overview of Pertinent Tax Forms

You should be aware of the tax forms and schedules that are relevant to your business. These forms and schedules are briefly summarized below. Some forms and schedules, such as Form 1099-MISC, are also discussed in more detail later in this guide. 1. Form 1040 Schedule CProfit or Loss from Business

Each year the IRS issues a Form 1040 package to taxpayers, which contains essentially the same forms the taxpayer used in prior tax years. In the years prior to becoming an IBO, you may have filed short forms 1040EZ or 1040A. After becoming an IBO, engaged in the operation of a trade or business, you now have business income and expenses to report. These business income and expense items must be summarized separately on the Form 1040, which you will most likely do using the Schedule C, or C-EZ, if you file as a sole proprietorship. Even if you operate your business as a husband-and-wife team, you may still use Schedule C to report business income and expense deductions. The current Instructions for Schedule C indicate that husband-wife businesses are automatically deemed partnerships and should be reported using Form 1065 (U.S. Partnership Return). However, these Instructions are not binding law, and, in this case, they are misleading. Whether a partnership exists for tax purposes depends on the parties intent, which is determined by looking at all the facts and circumstances of the business relationship. Moreover, the IRS has previously ruled that it will not penalize partnerships with 10 or fewer partners that do not file Form 1065 if all individual partners fully report their share of the income, deductions, and credits on their own timely filed individual tax returns (Rev. Proc. 84-35). [see also, IRC 6231 (a)(1)(B)(i)] 2. Form 1099-MISCMiscellaneous Income

The Form 1099-MISC is an informational return that is filed with the Internal Revenue Service. You are required to issue Form 1099-MISC by January 31 to each downline IBO that you paid directly if the total payments exceed the requirements of the Internal Revenue Service. To determine the requirements for issuing a 1099 log onto the IRS website at: http://www.irs.gov/formspubs/index.htmll, click on Forms and Publications, click on Form

Version 1.1 Updated 05/31/2010

number, scroll down to Inst 1099-Misc Instructions. Those IBOs ordering products and/or receiving their bonus payments directly from Amway would receive a Form 1099-MISC from Amway under the same requirements. IBOs are independently responsible for keeping accurate records of all bonus payments and merchandise sales to their downline. You will need this information to satisfy your reporting requirements at year-end. 3. Form 1040-ESEstimated Tax

The Form 1040-ES is used to pay estimated tax. Estimated tax payments may be required if you do not otherwise have enough withheld from your income to cover your estimated tax liability. Substantial penalties and interest may accrue in this instance. Subject to certain exceptions, you must make estimated tax payments using Payment-Voucher Form 1040-ES if your estimated tax, including self-employment tax, will be at least $1,000 in excess of any withholding you may have as an employee. You should consult your qualified tax advisor about calculating your estimated tax, especially if you operate your independent business fulltime, and, thus have no income withholding from other employment. You can pay your estimated tax in quarterly installments. 4. Schedule SESelf-Employment Tax

Schedule SE is used to calculate the amount of Social Security tax you must pay on any earnings from self-employment. You must complete a Schedule SE if the net profit from your business is $400 or more. B. Jan. 1 Summarize Amway business activities from the year ending Dec. 31. Begin preparing Forms 1099-MISC. Begin preparing Forms W-2 for employees (if any). Individuals begin preparing Form 1040 (Schedule C). Jan. 31 Distribute Forms 1099-MISC. Distribute Forms W-2 to any employees. Feb. 28 File with the IRS copies of all Forms 1099-MISC distributed in January, along with a summary Form 1096. File with the Social Security Administration copies of all Forms W-2 distributed in January, along with a summary Form W-3. Apr. 15 Individuals file with the IRS Form 1040, your federal income tax return. Alternatively, file Form 4868 to extend the time to file Form 1040 by four months. Note that you must still pay the estimated tax due with Form 4868. Aug. 15 Filing DeadlinesTax Planning Calendar

Version 1.1 Updated 05/31/2010

Individuals filing an extension on Apr. 15 must file Form 1040, or request additional extension until Oct. 15. Oct. 15 Final date to file Form 1040 after extension.

IV.

A.

Form 1099-MISC

General Information

As discussed earlier in Section III.A.2., you are required to issue Form 1099-MISC by Jan. 31 to each downline IBO if the threshold dollar amounts have been met. Gross bonuses are the bonuses earned before any adjustments. Residuals include monies earned from Services Partners (e.g., MCI, Visa, etc.), as well as RDC and Catalog gross profit. Residual income amounts are reported on your monthly statements. Residual income items are denoted on the Consolidated Invoice Activity Report by an RA, GC or GN. RA denotes service residuals, and GC or GN denotes gross profit. Important note: the $600 amount would also include any bonus differential from downline IBOs paid directly to you under the Client Volume Rule. Again, if at the end of the year your records reflect that you paid your downline IBO gross bonuses plus residuals of more than the threshold dollar amount, you must issue a Form 1099-MISC to them by January 31. Include only the bonuses paid during the calendar year. Therefore, December bonuses paid in January would be included on next years Form 1099MISC. Assume now that your downline IBO did not earn more than the threshold dollar amount for 1099 reporting in bonuses during the year, yet still purchased directly from you merchandise totaling more than the amount required for a 1099. You are still required to issue a Form 1099MISC to that individual. You need only place a check mark in the appropriate box on the Form 1099-MISC, which is labeled for your convenience. You need not report a specific dollar figure for merchandise sold. Note, however, that if you place an order to be drop-shipped to a downline IBO, Amway will report the order as a sale from Amway to you. Nevertheless, your records should reflect a sale to that IBO for purposes of determining at year-end how much you sold in merchandise to that IBO. Finally, you may show the amount of bonuses earned and check the appropriate box for merchandise sales on the same Form 1099-MISC. B. 1. FAQs About Form 1099-MISC Who issues the form to whom?

If the IBO is incorporated, then Form 1099-MISC does not apply, as payments or sales made to incorporated IBOs are currently exempt from all 1099 reporting requirements. Amway similarly will issue Form 1099-MISC, as required, to those whom it pays bonuses directly and/or sells merchandise directly. Do not wait until you receive your own 1099s from Amway before issuing Forms 1099-MISC to others.

2.

What items are included as income on the form?

Version 1.1 Updated 05/31/2010

For purposes of calculating the income to report on Form 1099-MISC, you must include the gross income earned before any subtractions or deductions for shortages, charges, adjustments, or expenses. Valid business expenses, although they may be properly deductible on your income tax return, should not be used to subtract or otherwise adjust the income for purposes of Form 1099-MISC reporting. 3. What about bonus differential under the Client Volume Rule?

Any bonus differential from downline IBOs paid directly to you under the Client Volume Rule will be included in your 1099 income from Amway. 4. Why did we receive forms from both Amway and Amway International Inc.?

If you received earnings from foreign countries, you may receive multiple 1099s due to new IRS rules that became effective January 1, 2001. The new IRS rules now require Amways foreign affiliates to report bonuses that were paid to you as a result of your international sponsoring activities on Form 1099-MISC. Therefore, it is possible that you may receive a 1099 not only from Amway, but also from Amway Canada, Amway International Inc. (if it paid bonuses on behalf of a foreign affiliate), and/or certain Amway foreign affiliates that pay U.S. IBOs directly. Some foreign countries may impose a withholding tax based upon these bonuses. If so, the amount of this withholding tax will be reported on the Form 1099-MISC and may be creditable against your U.S. income taxes. The ability to utilize this foreign tax credit should be discussed with your qualified tax advisor. 5. Whose name and Social Security number should appear on the form?

All names listed on the business should be included in the box labeled Recipients. However, because only one Social Security number can be listed, use the Social Security number of the first person listed. Regardless of which Social Security number the income gets reported to, each person listed on the business is still required to report their share on their own income tax return. 6. What if I pay bonuses to IBOs who are not frontline to me?

If you paid them part of the time, and your frontliner paid them part of the time, you are each responsible for issuing a Form 1099-MISC for the portion you paid, if the threshold dollar amounts have been met. 7. What about service fees paid?

On rare occasion, you might find that you have to issue a Form 1099-MISC to report payments to another IBO for services performed during the year, rather than for bonus payments or merchandise sales. For example, if another Platinum IBO was servicing one of your downline IBOs in another part of the country, and you paid more than the threshold dollar amount during the calendar year for this service, then you would be required to issue a Form 1099-MISC showing the total amount paid. You would enter the amount in box 7.

8.

Where do I get the forms?

Version 1.1 Updated 05/31/2010

Form 1099-MISC and Form 1096 may be obtained free of charge from your nearest IRS office, by calling the IRS at 1-800-TAX FORM, or they can be purchased through most office supply stores. You can also obtain this information on the IRS Web page at www.ustreas.gov 9. Where do I send the completed forms, and when are they due?

Forms 1099-MISC must be issued by January 31 of each year, reporting for the prior year ending December 31. The Forms 1099-MISC that you issue to others are not dependent upon any information contained in those that you might receive, so you are encouraged not to wait. A copy of each Form 1099-MISC you issue must be mailed to the IRS by February 28, along with a transmittal Form 1096. Form 1096 asks how many forms you are sending and the total amount of all the forms. It is mailed to the IRS Service Center assigned to your state. Check the instructions for where to send them for your state. Finally, be aware that the IRS can assess penalties for non-filing, late filings, or incorrect filings. Some state governments require that you also send a copy to the appropriate state government office. Check with your state office to verify its requirements and also, if a copy is required, you should ask whether a separate state form must be used. 10. If I dont receive any Forms 1099-MISC, do I need to file a tax return?

If you did not earn more than the threshold dollar amount for 1099 reporting from a single source, then you likely will not receive a Form 1099-MISC. Nevertheless, any earnings you do receive must be reported on your income tax return. C. Backup Withholding

IBOs who do not furnish their Social Security number, or other form of taxpayer identification number, to their sponsor (or to Amway, if they are paid directly by Amway) will find their bonuses and other payments subject to withholding if: the aggregate amount of such payments equals or exceeds the threshold for 1099 reporting for the current calendar year; or your payer was required to file a Form 1099-MISC for the preceding calendar year; or your payer was required to withhold on any of the preceding calendar years payments. The IRS cross-references the name and taxpayer identification numbers listed on the Form 1099-MISC with the names and taxpayer identification numbers it has on file. The IRS then sends letters to any payers who filed Form 1099-MISC with mismatched information. These letters require the payers to send B Notices to those payees, informing them of the possibility of backup withholding and asking for certification of their taxpayer identification numbers. The taxpayer identification number for a sole proprietor filing a Schedule C may be either a Social Security number or an Employer Identification Number. For a partnership filing a Form 1065, it is its Employer Identification Number. Payments to attorneys or corporations, other than those providing medical and health care services, are not subject to backup withholding. The penalty for failure to withhold tax when instructed is equal to the amount of tax not withheld.

V.

A.

Schedule C

General Information

Version 1.1 Updated 05/31/2010

The purpose of Schedule C to the IRS Form 1040 is to summarize and report business income and expenses. The net profit or loss from the Schedule C is carried to the front page of your Form 1040 and Schedule SE. The heading of the Schedule C requests several factual pieces of information regarding your business. Some of the boxes may be described as follows: Box A Principal Business or Profession including product or service The proper description here would be, distribute consumer products. Box B Principal Business Code The proper code would be 454390, which describes other direct selling establishments (including door-to-door retailing, frozen food plan providers, party plan merchandisers, and coffee-break service providers). Box D Employer Identification Number As a proprietorship, you normally do not need to have an Employer Identification Number (EIN), unless you have employees. If so, you must obtain an EIN by applying for one using Form SS-4. If you have an EIN, include it along with your Social Security number on your Schedule C. Box F Accounting Method The two most commonly used methods of accounting for your business income and expenses are the cash and accrual methods. The cash method is generally easier to apply, where income is reported when received and deductions when paid. However, there are exceptions to this general rule. You should discuss your accounting method with your qualified tax adviser. Box H First Schedule C Check this box only if you started your Amway business in the tax year being reported. B. Part IIncome

Report ALL of your business income and expenses on the Schedule C. Although you may think it useful to report only the NET proceeds of a sale, you are required to report the full amount of the sale in Gross Receipts and the cost of the merchandise in Cost of Goods Sold. For example, you might sell a bottle of L.O.C. Multi-Purpose Cleaner to a customer for $7.10, and your cost was 4.96. The $7.10 would be your Gross Receipts from the sale, while your Cost of Goods Sold would be $4.96. Even though the net proceeds (gross profit) would be $2.14, the entire transaction must be reflected on the Schedule C. 1. Gross Receipts

The first step in calculating the profit or loss from your business (for the Schedule C) is to summarize your revenue. Revenue includes all gross receipts from your business including: Retail sales (the gross proceeds from sales of AMWAY products to persons who are not Amway-affiliated IBOs). Wholesale sales (the gross proceeds from sales of AMWAY products to your downline IBOs). Performance Bonuses and any other monthly or annual IBO bonuses received. Any other income received from operating your Amway business. Note that any Performance Bonuses paid to your personally sponsored IBOs, as well as the cost of goods sold to them, should not be subtracted from gross receipts. These outlays should be separately reported in the Expenses section (Part II) of your Schedule C. 2. Cost of Goods Sold The second step in calculating the profit and loss from your business (for the Schedule

Version 1.1 Updated 05/31/2010

C) is to determine the cost of goods sold during the year. The cost, including shipping, handling, service charges, and sales tax of Amway-produced merchandise purchased for resale, can be deducted only when resoldnot when purchased. This is true no matter how much inventory you have available for resale at the end of a calendar year. The key to properly computing cost of goods sold is to make an accurate year-end inventory of items held for resale. First, make a physical count of the number and type of items you have in stock at the end of the year. Next, multiply the quantity of each inventory item on hand by the price paid. For example, suppose you count ten bottles of L.O.C. Multi-Purpose Cleaner on hand December 31. If the individual cost to you was $5.74 per bottle (assuming a 5% state sales tax rate), your total inventory cost for L.O.C. Multi-Purpose Cleaner is $57.40. When you have calculated the cost of each inventory item, add up all of your inventory product cost totals to determine your ending inventory. This ending inventory cost is important because it represents your beginning inventory figure for the next year. For example, assume that at the end of year 1 your ending inventory is $1,500. This $1,500 is now your beginning inventory for year 2 (note that in your first year of business, your beginning inventory figure will be zero). The standard equation for computing cost of goods sold is: Beginning of year inventory plus (+) cost of goods purchased during the year less (-) ending inventory equals (=) Cost of Goods Sold. If during the year you use some inventory items for yourself or your family (which you do not treat as a sale to yourself) or, alternatively, for demonstration or promotional purposes (which you deduct as an advertising and promotional expense), then you would deduct their cost from the total cost of goods purchased during the year. For example, assume that during year 1 you purchase $1,600 in products. At the end of that year, your physical inventory shows $300 in products on hand. Because this is your first year in business, your beginning inventory amount is zero. To that figure (0), you add the cost of goods purchased during the year ($1,600). However, lets assume that you withdrew $100 in products for your own use. Unless you treat such use as a sale to yourself, subtract your year-end inventory ($300) and the cost of the goods you personally used ($100) from the cost of goods purchased during the year ($1,600). The result ($1,200) is the amount you may deduct on your tax return as the cost of goods sold that year. Heres a continuation of the above example to show how the cost of goods sold is calculated during the second year. Please note also below that what occurs if you dispose of obsolete or damaged inventory. During year 2, you purchase goods costing $4,700. At the end of the year, you take another inventory and discover that you have stock on hand that costs $700. To find your cost of goods sold for year 2, add the beginning inventory amount ($300) to your purchases ($4,700) to arrive at the total value of goods available for sale during your second year in business ($5,000). Now assume that you personally used $200 worth of products that year and did not treat yourself as a customer. You would subtract that amount ($200) and the year-end inventory figure ($700) from the value of goods available for sale that year ($5,000). The result ($4,100) is the amount you may deduct on your tax return as the cost of goods sold for year #2.

Version 1.1 Updated 05/31/2010

In the event you dispose of damaged, obsolete, or otherwise unusable inventory during the year, you may take a deduction for the disposed inventory. In general, there is no specific time to deduct damaged inventory. Instead, the damaged inventory is not included in your ending inventory. As you may note from the Cost of Goods Sold formula above, if the damaged inventory is not included in ending inventory, your Cost of Goods Sold (an expense) increases. Before deducting damaged inventory, you should consult with your qualified tax adviser. 3. Gross Profit

After you have calculated your Gross Receipts and Cost of Goods Sold, you can determine Gross Profit. First, calculate net receipts. This is done by subtracting any returns and allowances from gross receipts. Such returns and allowances include cash refunds to retail customers or personally sponsored IBOs. After determining your net receipts, subtract the cost of goods sold to arrive at your gross profit. C. Part IIExpenses

Deduct from gross profit all ordinary and necessary expenses of your business to arrive at the net profit (or loss) for your business. Ordinary means an expense that is common and accepted in your type of business. A necessary expense is one that is appropriate and helpful in developing your business. Following are eight common expense categories, which must still qualify as ordinary and necessary to be properly deductible: Advertising Automobile expenses Office in the home Taxes and licenses Travel, meals, and entertainment Telephone Salaries, wages, and other compensation Other expenses 1. Advertising and Promotion There are three categories of deductible advertising and promotional expenses: Paid advertisements (listings in the phone directory, classified ads placed in the newspaper, etc.). The cost of AMWAY products used in demonstrations and sales presentations. The cost of product samples given to customers and prospects to interest them in the product.

a.

Promotional Items

Products from your inventory that you use exclusively for demonstrations and promotion may be deductible as advertising and promotional expenses as consumed, but you should

Version 1.1 Updated 05/31/2010

maintain a record of these items and their cost (including sales tax based on cost) so that you can subtract their value in computing your cost of goods sold. If you claim them as advertising and promotional deductions, but do not reduce the amount of purchases used in computing Cost of Goods Sold accordingly, you will be taking an improper double deduction for these items. By the same token, if you include these items in your Cost of Goods Sold, you cannot deduct them again as an advertising and promotional expense. For example, the cost of your original registration materials is deductible less the cost of products consumed for personal use. If you used all of the products in the Product Intro Pack for personal use, then the deductible portion would be the purchase price less the cost of the products. If you use a non-consumable demonstrator or sample for more than one year, its cost is a capital expenditure. Treatment of capital expenditures is discussed below. However, if you expect to eventually sell the demonstrator or sample rather than exhaust its value in your business through depreciation or otherwise, you should carry the demonstrator or sample as part of your inventory until sold or otherwise disposed of later. b. Personal Use Items

Products purchased for your own personal use are not deductible. Any significant personal use of an item disqualifies its deductibility, even if, when you purchased it, you did so with the idea of preparing sales-boosting testimonials from your use of the product. Here are some examples that help clarify this matter. Example 1You hold an open house at your home, and during the presentation of the Amway Independent Business Ownership Plan, you demonstrate the effectiveness of L.O.C. Multi-Purpose Cleaner. The cost of the L.O.C. used in the demonstration is deductible as a promotional expense. However, if you use the rest of the bottle for personal cleaning purposes, you cannot deduct the entire cost of the bottle only the cost of what was used in demonstrations. Example 2You give several Amway laundry products to a prospective commercial retail customer to allow the customer to evaluate product quality and effectiveness. Your total cost for these products is deductible as a promotional expense. Example 3You purchase a box of SA8 with BIOQUEST Concentrated Detergent and use it to wash your sheets and then hang them on a clothesline in the backyard. A neighbor comes by, and you point out how white the sheets are and tell her that you can supply her with SA8 with Bioquest, too. The cost of the box of SA8 with Bioquest you used to do your sheets is considered a personal expense and is not deductible. Example 4You buy a microwave oven from the STORE FOR MORE Catalog. At a party in your home, you point out your new oven to guests and mention how useful it is. You also say that you can sell the same oven to them. Even though you use the microwave oven as a display item for your business, the cost of purchasing the oven is a non-deductible personal expense. Keeping a Record of Personal Use Items There are two acceptable methods of keeping track of products that you remove from your inventory for personal use, and the price paid for those products: 1. Whenever you use any products personally, prepare a bill to yourself at cost plus sales tax based on cost and pay your business account from your personal account. This method requires no adjustment to Cost of Goods Sold because you are treating the personal use as a sale to yourself; OR 2. Maintain a complete record of all personal use items and their cost as you remove them

Version 1.1 Updated 05/31/2010

10

from your inventory. Subtract the cost plus sales tax based on cost of the personal-use items from the Cost of Goods Purchased during the year before you determine your Cost of Goods Sold. For example, you purchase $6,000 in goods during the year. You take $500 worth of products (including sales tax based on cost) from your stock for personal use during the year. You should reduce your Cost of Goods Purchased total by that amount ($500) when you compute the Cost of Goods Sold ($6,000 - $500 = $5,500). Note that you may claim a refund on the difference between the sales tax paid on suggested retail and the tax computed on cost for personal and promotional use items. Submit sales tax refund claims to the Sales Tax Department on the Sales Tax Adjustment Form, or contact the Sales Tax Department for further information at 616-787-5322. c. Business Gifts

The cost of business gifts is deductible; however, to find the amount the IRS will allow as a gift expense, log onto the IRS website at: http://www.irs.gov/formspubs/index.html, click on Forms and Publications, click on Publication number, scroll down to Publ 463 Travel, Entertainment, Gift and Car Expenses. 2. Automobile Expenses

When you operate your automobile in connection with your business, those expenses (when properly documented) are generally deductible. a. Keeping a Mileage and Expense Log

Keeping a logbook in your car is helpful to track the number of miles driven for business purposes, as well as other expenses. Record the mileage on your cars odometer at the beginning of the year, and again at the end of the year. During the year, write down the miles driven on business trips, the dates, and the purpose of each trip. You will also want to document your out-of-pocket costs for gasoline, oil changes, and other auto expenses if you plan to use the actual out-of-pocket method of computing your business mileage costs (see below). Keeping your mileage log handy is especially helpful when your travel includes both business and personal destinations along the route. The IRS indicated in Revenue Ruling 94-47 that there may be circumstances where a taxpayer may deduct travel expenses from the taxpayers home to a temporary work location. Where a taxpayers home office satisfies the principal place of business requirements (see Office in the Home), the business activity overcomes the personal nature of the residence, and the daily transportation expenses of going between the home and work locations becomes central to the business. However, you should consult your qualified tax adviser to determine if this Revenue Ruling applies to your particular business. ExampleAssume that you drive 15 miles from your home to your job. After work, you drive 10 miles from work to your sponsors home for a meeting. From there, you drive another 10 miles back to your home. In all, you drive 35 miles. Of that 35 miles, 10 miles (the travel from your place of work to your sponsors home) are deductible as business miles. The other 25 miles are personal miles. Your log should show this travel mileage. You should also note that the special substantiation rules applicable to entertainment and out-of-town travel apply to the use of automobiles, computers, and other personal use property. Under those rules, you must substantiate business use by adequate records or sufficient corroborating evidence. Adequate records could include account books, diaries, logs,

Version 1.1 Updated 05/31/2010

11

documentary evidence (such as receipts or paid bills), trip sheets or expense reports. In addition, while records need not be kept contemporaneously with each use, and trip-by-trip records are not required, records kept currently will have more weight than those developed later. The IRS also requests certain information on the tax return. For automobiles, this information which may take the form of specific questions will relate to the mileage driven (total business, commuting, and other personal), the percentage of business use, the date the automobile was placed in service, the use of other vehicles, after-work use, whether you have evidence to support the business use claimed, and whether that evidence is written. b. Standard Mileage Allowance Method

To find the standard mileage allowance log onto the IRS website at: http://www.irs.gov/formspubs/index.html, click on Forms and Publications, click on Publication number, scroll down to Publ 463 Travel, Entertainment, Gift and Car Expenses. You cannot use the standard mileage rate if you operate two or more cars at the same time. However, you may not be considered as using more than one car for business simultaneously if you alternate the use of each car for business. Additional information is available from the IRS in Publication 463, Travel, Entertainment, Gift, and Car Expenses. c. Actual Out-of-Pocket Expense Method

Using this method, you must keep track of all out-of-pocket expenses associated with maintaining and operating your automobile, and then deduct the business portion of those actual costs. Such expenses generally include gasoline, oil changes, repairs, insurance, taxes, license fees, and depreciation. If you lease an automobile and use it in your business, you may be able to use the standard mileage allowance, under certain circumstances, subject to IRS limitations on leased automobiles. You should consult with your qualified tax advisor to determine if Revenue Procedure 97-58 applies to you. As noted above, you should keep a logbook in your car to record mileage and the purpose of your driving (business or personal). Based on your beginning and ending odometer readings, determine the total miles driven during the year. Use your logbook to determine the number of business miles driven, and convert it to a percentage of total miles. (To find the percentage of business miles driven, first divide the number of business miles by the total miles driven that year, and then multiply the result by 100.) Next, take the total out-of-pocket costs for your car and multiply that amount by your business mileage percentage. This will give you the amount of deductible expense you can report on your income tax return. Parking fees and tolls incurred in connection with your business travels are also deductible. If you use more than one vehicle in your business, keep separate records for each. 3. Office in Your Home a. Principal Place of Business

An IBO may deduct the cost of having an office in the home if the IBO can show that the home office is the principal place of business. The principal place of business includes a place used for administrative or management activities conducted in a trade or business when there is no other fixed location to conduct such activities. If an IBO conducts business activities from fixed locations other than the home, then two primary factors determine if a deduction for the home office will be allowed: (1) the relative importance of the activities performed at each business location, and (2) the amount of time spent at each location. Each IBOs particular

Version 1.1 Updated 05/31/2010

12

situation may vary, and some IBOs may not be able to show that their home office is the principal place of business. If not the principal place of business, an IBO may only deduct the cost of the home office if: The home office is used by clients or customers in meeting or dealing with the taxpayer in the normal course of the taxpayers trade or business, or The home office used in connection with the taxpayers trade or business is a separate structure that is not attached to the dwelling unit, or The home office is used on a regular basis as an inventory storage unit in connection with the business, but only if the home office is the sole fixed location of the trade or business. It is not necessary in the first point that every client or customer be serviced through the home office. The home office need only be used by clients or customers in the normal course of business. An IBO who actually welcomes prospective or current downline IBOs or customers into his home office to transact business may have his home office deduction allowed. Even though an IBO may transact a large portion of his business outside the home office, as long as there are clients or customers that are dealt with within the home office in the normal course of business, on a regular basis, the deduction should be allowed. You should keep a logbook to account for the business use of your home office, similar to the way you track the business use of your automobile. The requirements of the second point are straightforward and easily met by many IBOs. A home office in a building not connected to the dwelling unit (garage, workshop, outbuilding, coach house, etc.) is generally a valid deduction. Your ability to deduct home-office expenses may vary from other IBOs because each individual IBOs facts are unique. You should contact your qualified tax adviser for assistance. b. Calculating Home Office Deduction

If you have a home office that qualifies as a deductible business expense, then you must (1) calculate your total home expenses (heat, light, insurance, depreciation, etc.), (2) determine the percentage of your homes area that is represented by the home office portion and (3) deduct that percentage of your homes expenses as a business expense. For assistance, IRS Form 8829 will help you in computing this deduction, and it also should be filed with your Form 1040, Schedule C. ExampleYou own a four-bedroom house with 3,000 square feet of living space. You use a 450 square foot area in your basement for inventory storage and office purposes. The business use portion of your home is calculated as follows450 divided by 3,000 equals .15 or 15%thus 15% of your home office expenses are deductible subject to the deduction limitation, which is the amount of your business net income. Qualified home office expenses are deducted in the following order until you reach the deduction limitation: 1. The business percentage of the expenses that would otherwise be allowable as deductions, regardless of the business use, that is, mortgage interest, real estate taxes, and deductible casualty losses. 2. Other business expenses for the business use of your home that are allocable to the use of the unit itself such as maintenance, utilities, and insurance. Deductions that adjust the basis of your home are taken last.

Version 1.1 Updated 05/31/2010

13

Home office deductions will not create a business loss or increase a net loss from your business. Deductions in excess of the current years limitation may be carried forward to your next tax year subject to the deduction limitation from the business use of your home in that year. Deductions carried to such a later year retain their character. ExampleIn year #1, assuming the following gross income, non-allocable business expenses, and allocable home office expenses, computation of your deduction and carryover amounts would be as follows: Gross income from business use of your home Expenses for your business in your home that are not allocable to the home itself (cost of goods sold, telephone, supplies, bonuses paid, etc.) Deductible mortgage interest and real estate taxes ($10,667 * 15% = $1,600) Net Income/Deduction Limitation Other expenses attributable to the business use of your home (maintenance, insurance, utilities, depreciation) ($12,000 * 15% - $1,800) Carryover expenses to year #2 (subject to deduction limitation in year #2) $11,600

($9,000) ($1,600) $1,000

($1,800)

$ 800

If you sell your house while operating your business out of it, you may not be able to exclude tax on the gain on that portion of the house that was being used for business purposes. You should discuss this matter with your qualified tax adviser. 4. Taxes

You may be able to deduct some of the state and local taxes that you paid during the year, provided that you keep adequate records. Some of these taxes are summarized below. a. Real Estate Property Tax. The property tax upon the portion of your home used for business purposes may be deductible if you qualify for the home-office deduction (discussed earlier). b. Personal Property Tax. If you use the actual out-of-pocket expense method of accounting for your automobile expenses, then the business portion of the property tax (license plate fees, etc.) on your automobile may be deductible. c. Business Tax. If your state or local government charges or assesses a business tax, you should be able to deduct the amount that you paid. 5. Travel, Meals, and Entertainment

Business expenses resulting from travel away from home, local transportation, and entertainment can be important deductions on your tax return. Entertainment (including meal)

Version 1.1 Updated 05/31/2010

14

expense deductions, however, are limited to only 50% of the amount actually spent. Travel expense deductions are not subject to this limitation. To be deductible, entertainment (including meal) expenses must be directly related to or associated with your business. Entertainment directly related to your business includes entertainment costs connected with actual business meetings you conduct. Entertainment associated with your business includes entertainment enjoyed immediately before or immediately after a substantial and bona fide business discussion. Accurate records and proof (original source documentsreceipts, canceled checks, etc.) are strictly required. Be sure to record the business purpose for every travel, meal, or entertainment-related expense. The IRS will disallow travel and entertainment deductions that are approximations or estimates, as well as expenses for travel, meals, or entertainment that appears lavish or extravagant. a. Entertainment Expense Records

For each entertainment expense you deduct, you must be able to substantiate: Each separate amount spent for entertainment (except for incidental items such as phone calls and cab fares, which may be totaled daily). The date the entertainment took place. The name, address, or location and type of entertainment (if not apparent from the name of the place). The reason for the entertainment or the business benefit from it, and what business activity or discussion took place at that time. The business relationship of the person(s) entertained must be shown (name, occupation, title, etc.). Paying for business and entertainment expenses by credit card provides a charge slip that will document most of the details required. On the back of the charge slip you can record the identity of people entertained, the business purpose, and whether the people were prospects, personally sponsored IBOs, or customers. A daily planner or appointment book is also helpful for maintaining a record of all the necessary details. b. Travel Expense Records

You have the burden of proving that your travel is for a business purpose rather than personal pleasure. The amount of time that you spend on business activities may be compared to the amount of time you spend on personal activities. For travel expense deductions, you must be able to substantiate: Each separate amount spent for travel away from home (except for daily totals of incidental items in reasonable categories such as mealsonly 50% deductible gas & oil, taxi fares, etc.) The date you left and the date you returned from each trip, and the number of days spent on business away from home. The travel destination (name of city, town, or other appropriate description). The business reason for your travel or the business benefit gained or expected from the travel.

Version 1.1 Updated 05/31/2010

15

If the primary purpose of your travel is to benefit your business, most resulting travel expenses are deductible. However, there is no simple test that can be applied to determine primary purpose. Your qualified tax adviser should review all of your expenses and documentation to help you decide what expenses may be deducted. The most common method for deciding whether the primary purpose of a trip was business or not is to compare the amount of time spent on business matters with the amount of time spent on pleasure or recreation. If the major part of the day is spent in business activity, it is counted as a business day and vice-versa. If you use this method, be sure to keep an agenda, appointment book, or other record to substantiate the amount of time spent on business. When you receive a program or agenda for functions and events that you attend, save it as further evidence of your trips business purpose. Prepare agendas and programs for IBOs that attend your functions and events, carefully detailing the business nature of each session meeting. The IRS permits taxpayers to alternatively deduct a specified per diem amount for meals while traveling away from home for business purposes without having to substantiate the actual costs of each meal. For example, the per diem rate in Grand Rapids, Michigan, effective for travel after 10/1/03, is $39 (city/state information can be found in IRS Publication number 1542). Keep in mind that these per diem amounts are subject to the 50% deduction limitations. Deducting the cost of your spouse or other family members traveling with you is not always allowed, even if you can show a valid business purpose for their presence. You should discuss the deduction of travel expenses for a spouse with your qualified tax adviser. It is important, then, to be sure to separate your own deductible portion of the travel costs from theirs. Remember, too, that any non-business expenses for personal items (new clothes, jewelry, etc.) that you incur while on a business trip are not deductible. c. Conventions

You can deduct your travel expenses when you attend a convention if you can show that your attendance benefits your trade or business. You cannot deduct the travel expenses for your family. If the convention is for investment, political, social, or other purposes unrelated to your trade or business, you cannot deduct the expenses. Other non-business related expenses incurred during your travel, such as social events or sightseeing, are personal expenses and therefore not deductible. d. Travel Outside the U.S. and on Cruise Ships

Different, more complex rules govern the deductibility of business travel outside the United States and on cruise ships. It is important for you to consult with your tax adviser before you arrange any foreign travel or attend a meeting on a cruise ship in order to be sure you understand the specific rules that apply to your type of trip.

6.

Telephone

If you have a separate phone line strictly for business use, all your charges for this phone line (local and long-distance) are deductible. If you have just one phone line for both business and personal use, you are denied a deduction for any portion of the basic monthly

Version 1.1 Updated 05/31/2010

16

service charge, but you may fully deduct any long-distance charges for business calls. The best way to document the business use expense is by keeping a telephone log of all long-distance calls, dates, persons talked with, and the topics discussed. To qualify as a business call, the conversation must relate to the operation of your business. 7. Salaries, Wages, and Other Compensation

Deductible payments of compensation to others include reasonable salaries and wages paid to employees. Your payments of salaries and wages to employees must also be properly handled and documented. This means you must (1) withhold payroll taxes, (2) furnish each employee with a year-end Form W-2 that shows the amount of wages or salaries paid and the amount of tax withheld, and (3) make periodic payroll reports. a. Payments to Your Children

Even if you do not have other employees, you may be able to deduct reasonable compensation paid to your children for necessary services that they perform for your business, subject to certain restrictions. The amount paid must be reasonable in relation to the childs age and the duties performed. Deciding what is reasonable for such deductions requires prudent judgment. We recommend that you discuss this matter fully with your qualified tax adviser. As a general rule, the younger the child, the fewer responsibilities that he or she is capable of handling, and, consequently, the smaller the wage deduction you can justify. The wages paid to a child should be based on the number of hours worked and the value of the childs services to your business. The kinds of tasks typically performed by children of IBOs include: Helping you prepare for a meeting to show the Amway Independent Business Ownership Plan. Unloading and stocking inventory. Filling and delivering orders for products. Helping you take year-end inventory. Office tasks such as filing or answering the phone.

If your child uses the wages which you paid for his or her own support, your claim for a dependency exemption on your own federal income tax may be threatened. You should, therefore, encourage your child to save this money or use it for purely personal purchases. Also, if your business is unincorporated and your child is under age 18, then his/her wages are exempt from Social Security tax (under 21 for Federal Unemployment tax). 8. Miscellaneous Expenses The following expenses, when related to your business, may also be deductible: Bad debts Accounting costs Stationery and printing Legal/Professional expenses Business Registration and Annual Renewal fees Subscriptions to IBO publications such as The Loop Newsletter and Achieve Magazine Interest paid on business debts

Version 1.1 Updated 05/31/2010

17

Office supplies Postage and shipping (not included in the cost of inventory) Fees for preparing your business tax return (Schedule C or Form 1065) D. Capital Expenditures and Depreciation Not all money paid out as a business expense is deductible in the year it is spent. Capital expense items have a useful life that extends for over one year, and you must claim your deductible expense over the life of the item. Capital expense items typically purchased by Amway-affiliated IBOs include automobiles and office equipment (calculators, desks, computers, telephone answering equipment, etc.). The Modified Accelerated Cost Recovery System (MACRS) is generally mandatory for all types of eligible property, unless a special election is made to use an alternative method. Eligible property includes all types of tangible property (both real and personal). MACRS, like Accelerated Cost Recovery System (ACRS) under prior law, requires you to recover the cost of qualifying property over a specified number of years. MACRS differs from ACRS in that the recovery periods have been extended for most property. This extension requires you to write off an asset over a longer period. Under certain circumstances, you can elect to deduct all or a portion of the asset costs in the year they are purchased and placed in service, rather than depreciating them over a specified number of years. To qualify for expensing, the assets must be tangible personal property used in an active business. To determine how much of the asset can be deducted, log onto the IRS website at: http://www.irs.gov/formspubs/index.html, click on Forms and Publications, click on Publication number, scroll down to Publ 946 How to Depreciate Property. Also, the otherwise allowable expense deduction for this type of property is limited to the amount of taxable income from your business. In order to take advantage of this election, it must be made on your original return for that year, not by an amended return filed after the due date. Once made, the election may not be revoked, except with IRS consent. The amount of sales tax paid on the acquisition of depreciable property for use in a business should be added to the basis of the property and treated as part of its cost for depreciation purposes. Note that stricter rules apply to automobiles, computers, cellular telephones, and certain other types of personal property. If this property is used 50 percent or less for business purposes, depreciation will be determined on the straight line method over a period of years that is generally longer than the minimum period otherwise permitted. You should consult your qualified tax adviser concerning these restrictions. E. Tax Credits

After you have reported all income, deducted all allowable expenses, and calculated the amount of federal income tax due, your next step is to reduce your tax liability by applying any tax credits to which you are entitled. Each dollar in tax credits reduces the amount of tax owed by that same amount. By comparison, your deductible business expenses reduce only the amount of income on which you are taxed. Your qualified tax adviser can help you determine which tax credit possibilities apply to your situation. a. Child Care Credit

You might wish to keep a record of child care expenses incurred throughout the year,

Version 1.1 Updated 05/31/2010

18

since a tax credit may be available for some of the baby-sitting and other child (under 13) care costs you incur in order to operate your business. However, you must be gainfully employed by your business in order to take credit for your child care expenses. Consequently, if your business does not show a profit on Schedule C, there will be no child care credit for the costs associated with the operation of your business. Additionally, the amount of child care payments used to calculate the credit is limited to your earned income (in a joint return, limited to the earned income of the spouse with lesser earnings). Thus, if your business generated net income of $1,000, and you had child care payments of $2,000 associated with your business, the amount of payments eligible for the credit would be limited to $1,000. If the business were run by you and your spouse, the eligible payment would be $500 (the lesser of the two earned incomes) if you had equal ownership in your business. Note that these child care expenses are not deductible; rather, a percentage of qualifying child care expenses are eligible for a tax credit. The eligibility requirements are as follows: If you are married, both you and your spouse must be working. To find the maximum amount of child care expense that can be taken in computing the credit, log onto the IRS website at: http://www.irs.gov/formspubs/index.html, click on Forms and Publications, click on Publication number, scroll down to Publ 503 Child and Dependent Care Expenses.

If you are single and have dependents, or if you are married and both you and your spouse work, you may be eligible for a tax credit if you have to pay for child care in order to conduct your business. Consult your qualified tax adviser for further details. VI. Schedule SESelf-Employment Tax

You must pay self-employment tax on the net income of your business. The selfemployment tax is a Social Security and Medicare tax imposed on people who work for themselves. To calculate the amount of Social Security that you will be required to pay, log onto the IRS website at: http:/www.irs.gov/formspubs/index.html. click on Forms and Instructions, click on Form and Instruction number, scroll to Form 1040 SE Instructions. The maximum dollar amount subject to the 12.4 percent Social Security tax may be reduced dollar for dollar by salaries and wages you received as an employee (on which you and your employer have paid the Social Security tax). In addition, to the extent you are liable for self-employment tax, you may deduct one-half of it when determining your adjusted gross income. If your business is a husband and wife partnership, remember that both spouses may have income subject to self-employment tax based upon the formula you use for dividing profits. The amount of self-employment tax you owe is computed on Schedule SE. To determine the amount of self-employment tax you will owe in the upcoming year, we advise filling out a proforma Schedule SE. This will also assist you in properly calculating any estimated payments you might have to make in the upcoming year.

VII.

Tax Planning

While the Amway Independent Business Ownership Plan is not to be represented as a tax shelter, this does not mean that you should not engage in tax planning with your personal tax adviser to defer or permanently reduce your tax liability. Tax planning becomes more

Version 1.1 Updated 05/31/2010

19

important as you approach the end of your taxable year, for it is near year-end that you can most easily influence your tax liability. For example, you can increase your deductible business expenses by paying certain bills before the end of the year. You can hold income down by postponing delivery and collection of retail sales income until after year-end. Adherence to the following three principles will go a long way toward helping you to develop an effective tax planning strategy: Maintain a reliable, up-to-date income statement. A tax planning strategy is only as good as your income statement. If your objective is to minimize federal income tax liability, you cannot do so unless you know how profitable your business has been for the year. Be constantly aware of changes in tax laws that may affect your business. Unless you are current, it is difficult to decide whether or not the timing of certain actions is in your best interests. Keep in constant touch with your qualified tax adviser.

A.

Selecting an Income Tax Adviser

Independent business people, such as Amway-affiliated IBOs, are somewhat more likely than others to be audited by the IRS. This is due, in large part, to the degree of freedom that independent business people have over the conduct of their business. If you receive notification from the IRS of its intent to audit your tax return, you will be told to produce selected documents to explain areas of concern. An examination will be conducted, which could occur at a variety of locations including your home or place of business, an IRS office, the office of your attorney or accountant, or entirely by correspondence. An IRS examination of your return should not suggest a suspicion of dishonesty or criminal liability. In fact, some cases are closed without changing reported tax liability. Your two greatest assets in an audit situation are a good record keeping system and a competent tax adviser. For these and other reasons, Amway recommends that you have a competent personal tax adviser. Your upline IBO or sponsor may know a qualified tax professional in your area. How can you tell who is qualified to advise you? Look for these important criteriaYour tax adviser should: Be an attorney or CPA who specializes in personal and corporate income tax matters. Maintain a local office. It should be within reasonable driving distance to help assure closer communication during the year and your advisers presence and representation at any IRS examinations. Show a willingness to take the time needed to understand the Amway Independent Business Ownership Plan, and learn how direct selling differs from other more conventional independent businesses. Demonstrate a commitment to providing you with a complete, professional tax service. This includes: Preparation of your tax return Tax planning Representation at meetings with the IRS (this is particularly important; your adviser should be experienced in dealing with IRS auditors) Fully explain, and you should clearly understand, fees and costs before you agree to

Version 1.1 Updated 05/31/2010

20

use the services. For instance, you should know in advance what the basic fee is for preparing your tax return and whether that charge includes representation if you are audited by the IRS. If fees are based on an hourly rate, you should know what that rate is. B. Health Insurance Costs for Self-Employed Individuals

Under certain conditions, a self-employed individual, such as a Amway-affiliated IBO, can deduct 100% of the amount paid for health insurance. However, this deduction does not reduce the income base for computing a self-employed individuals Social Security tax. Consult with your qualified tax advisor to find out if this deduction is available to you. C. 1. Retirement Social Security For those retired IBOs who have a considerable amount of income from their Amway-affiliated business, the amount of their Amway income could affect the taxability of their Social Security benefits. A portion of your Social Security income could be taxable. To find out the taxable amount log onto the IRS website at: http://www.irs.gov/formspubs/index.html, click on Forms and Publications, click on Form and Publication number, scroll down to Form 1040 Instructions and complete the Social Security Benefits worksheet.

2.

Retirement Plans

Your contributions to qualified retirement plans may be deductible. These can include self-employed (Keogh or HR-10) retirement plans, corporate retirement plans (if you conduct your business as a corporation), and individual (IRA) retirement arrangements. Benefits from these types of retirement plans include: (1) your contributions to qualified retirement plans are tax-deductible, and (2) you enjoy tax-deferred earnings from money you invest in your retirement account during the accumulation period. By meeting complicated requirements set forth in the Internal Revenue Code, such plans established for your business can qualify for this treatment. An example of a qualified retirement plan is the Activa Mutual Fund Master Profit Sharing Plan offered through the Activa Mutual Fund. For information, contact Activa Mutual Fund, Inc., 2905 Lucerne SE, Grand Rapids, MI 49546. Because of the complexity of this area, we recommend that you consult with a qualified tax adviser and/or financial planner to determine your best course of action before adopting a retirement plan. 3. Individual Retirement Accounts

Individual retirement arrangements can be set up through most banks, credit unions and other financial institutions. You should consult your qualified tax adviser and/or financial planner for assistance. VIII. Not-for-Profit Activities

A Amway business is a profit-making venture, not a tax shelter. Your business profits are taxablelike the profits of any legitimate enterprise. Of course, you may claim permissible tax deductions to reduce your taxable income. Your business may even show a tax loss in its early

Version 1.1 Updated 05/31/2010

21

years, which is deductible against other sources of income (e.g., salary), as long as you run the business as a legitimate business engaged in for profit. As an independent businessperson, your business may be subject to scrutiny by the IRS. Individuals who conduct their own businesses often have a great deal of freedom and the IRS will sometimes review the way the business is conducted to be sure there is an actual and honest profit objective. Therefore, your business may be the subject of an audit whether you have a loss or profit from the operation of your business. An audit does not necessarily mean that you have done something improper. The tax law doesnt clearly define what constitutes a trade or business engaged in for profit. It depends on whether you conduct your business with the objective of making a profit. Whether a profit motive exists rests on all the facts and circumstancesincluding the nine factors listed in IRS regulations. These factors are: 1. 2. 3. 4. 5. 6. 7. 8. 9. Whether you carry on your activity in a businesslike manner. Whether you, or your advisers, have the knowledge needed to carry on the activity as a successful business. Whether the time and effort you spend on the activity indicates that you intend to make it profitable. Whether you can expect to make a future profit from the appreciation of the assets used in the activity. Whether you have been successful in making a profit in similar activities in the past. Whether the activity makes a profit in some years, and how much profit it makes. The amount of profits earned when compared to losses in other years and profit potential. Whether you depend on income from the activity for your livelihood. The presence of personal elements or recreation.

IRS examiners, appeals officers, and the Tax Court often review the application of these factors to an IBOs business. Particular attention is generally given to the IBOs recordkeeping habits. If records are absent or poorly kept, it is a sign that the business was not conducted with the requisite intent to make a profit. Keeping timely, accurate, and complete records is imperative insofar as demonstrating your profit motive. Good records begin with a business plan, budgets, profit and loss statements, and breakeven projections, in addition to the original source documents necessary to substantiate items of revenue and expense. Although not the only important element to an IBOs business success, maintaining professional business records allows you to monitor your business activity throughout the year and make necessary adjustments to meet your objectives. IX. Sources of Additional Information

There is no substitute for competent advice from a qualified tax advisor, preferably a CPA specializing in tax matters or a tax attorney; however, the following IRS publications are available at your local IRS office or by calling the IRS toll-free number, 1-800-TAX-FORM, or online at www.ustreas.gov: Publication 1 Your Rights as a Taxpayer Publication 17 Your Federal Income Tax Publication 334 Tax Guide For Small Business Publication 463 Travel, Entertainment, Gift and Car Expenses Publication 505 Tax Withholding and Estimated Tax

Version 1.1 Updated 05/31/2010

22

Publication 535 Business Expenses Publication 541 Partnerships Publication 552 Record keeping for Individuals Publication 560 Retirement Plans for the Small Businesses Publication 583 Starting a Business and Keeping Records Publication 587 Business Use of Your Home Publication 910 Guide to Free Tax Services

Caution: Internal Revenue Code requirements are subject to change. Make sure that any tax publications to which you refer are current and have not been made obsolete by recent changes in the tax laws. X. Taxpayer Bill of Rights

The Technical and Miscellaneous Revenue Act of 1988 contained a section designated as the Omnibus Taxpayer Bill of Rights which incorporated many pro-taxpayer programs voluntarily initiated by the IRS during the past few years as well as some new ones. This guarantees that these programs will be continued by the IRS, unless specifically repealed by Congress. The Taxpayer Bill of Rights requires the IRS to explain the audit and collection process to the taxpayer before any initial audit or collection interviews and to include on all tax notices a description of the basis for taxes due, interest and penalties. Taxpayers are permitted to make audio tapes of audit or collection interviews if advance notice is given to the IRS. The Bill also gives taxpayers the right to execute powers of attorney to be represented before the IRS by a qualified representative and gives the IRS the statutory right to enter into installment agreements for taxpayers to pay tax liabilities. In addition, the Bill requires the IRS to abate any penalty assessed against a taxpayer who relied on erroneous written advice furnished by the IRS. Other provisions give the Taxpayer Advocate the statutory right to intervene on the part of taxpayers and allow taxpayers to sue the IRS for certain unreasonable actions and failure to release liens. In 1996, Congress enacted the Taxpayer Bill of Rights 2 and increased the power of the Taxpayer Advocate. Changes were made to the period of time in which payment of tax after notice and demand was made without interest accruing. Further, the IRSs authority to abate certain interest was widened. Many other changes have been made which could impact your business. Accordingly, you should consult your tax adviser regarding this Act. The 1998 IRS Restructuring and Reform Act extends the power of the Taxpayer Advocate when the IRS is not following applicable published administrative guidance. The Taxpayer Advocate shall construe the factors taken into account in determining whether to issue a taxpayer assistance order in a way that is favorable to the taxpayer. In addition, the 1998 Act provides greater due process protections to taxpayers who are undergoing collection actions by the IRS. Taxpayers are encouraged to discuss these new provisions with their tax adviser.

Version 1.1 Updated 05/31/2010

23

Вам также может понравиться

- Where Can I Find An Excel Template That Measures Credit RiskДокумент13 страницWhere Can I Find An Excel Template That Measures Credit RiskSirak AynalemОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Armenia Pharma Market: Pharmexcil HyderabadДокумент9 страницArmenia Pharma Market: Pharmexcil HyderabadAayushi TomarОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Nadine Brown Resume 500Документ1 страницаNadine Brown Resume 500Randy MakoОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Discussion Forum 4.4B SolutionsДокумент5 страницDiscussion Forum 4.4B SolutionsSidra UmairОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- SBA 7a Loan Guaranty ProgramДокумент37 страницSBA 7a Loan Guaranty Programed_nycОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Corporatisation and Demutualisation of Stock Exchanges: I. What Is Corporatis-Ation and Demutuali - Sation?Документ5 страницCorporatisation and Demutualisation of Stock Exchanges: I. What Is Corporatis-Ation and Demutuali - Sation?Ashish UpadhyayaОценок пока нет

- Management Accounting: Student EditionДокумент27 страницManagement Accounting: Student EditionPutri RahmatikaОценок пока нет

- Problem Solving A3Документ2 страницыProblem Solving A3Sead ZejnilovicОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- 7110 s18 QP 23Документ24 страницы7110 s18 QP 23Shahzaib ShahbazОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Entrepreneurship All Definations For FinalzДокумент5 страницEntrepreneurship All Definations For FinalzYaseen SaleemОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- A Study On Customer Awareness On E-Banking Services at Union Bank of India, MangaloreДокумент74 страницыA Study On Customer Awareness On E-Banking Services at Union Bank of India, MangaloreThasleem Athar95% (40)

- Module 3 Luke JohnsonДокумент4 страницыModule 3 Luke Johnsonapi-558290570Оценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Financial Analysis of Krishna Maruti LTDДокумент7 страницFinancial Analysis of Krishna Maruti LTDAnsh SardanaОценок пока нет

- Marketing MythsДокумент2 страницыMarketing MythsMuhammad Hasbi BaharuddinОценок пока нет

- 2-Notes On Banking Products & Services-Part 1Документ16 страниц2-Notes On Banking Products & Services-Part 1Kirti GiyamalaniОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Faculty - Business Management - 2023 - Session 1 - Degree - HRM581Документ4 страницыFaculty - Business Management - 2023 - Session 1 - Degree - HRM581FARAIZAM AZUAN HAFIZ JAFFARОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Ecobank Ghana IPO Prospectus 2006Документ102 страницыEcobank Ghana IPO Prospectus 2006x4pxvyppn6Оценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- ABC MCQ'sДокумент10 страницABC MCQ'sMuhammad FaizanОценок пока нет

- Process CostingДокумент3 страницыProcess CostingEllah MaeОценок пока нет

- 1 Introduction To BankingДокумент8 страниц1 Introduction To BankingGurnihalОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- IQ&a - SAP MM Book by Mukesh ShuklaДокумент4 страницыIQ&a - SAP MM Book by Mukesh ShuklarajivkshriОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1091)

- Week7 Afar06Документ11 страницWeek7 Afar06Hermz ComzОценок пока нет

- Exam in Accounting-FinalsДокумент5 страницExam in Accounting-FinalsIyarna YasraОценок пока нет

- Effectiveness Analysis of Drone Use For Rice Production in Central ThailandДокумент8 страницEffectiveness Analysis of Drone Use For Rice Production in Central ThailandMuhamad AbdullahОценок пока нет

- Part 3. Write An Essay of 300-350 Words On The Following TopicДокумент3 страницыPart 3. Write An Essay of 300-350 Words On The Following TopicVo Quynh ChiОценок пока нет