Академический Документы

Профессиональный Документы

Культура Документы

Re Insurance

Загружено:

Rahul MaratheИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Re Insurance

Загружено:

Rahul MaratheАвторское право:

Доступные форматы

REINSURANCE

STRUCTURE 1. Introduction 2. Reinsurance: Meaning, Definition and Concept 3. History of Reinsurance 4. Risk Distribution through Reinsurance 5. Risk Management through Reinsurers 6. Benefits of Reinsurance 7. Categories of Reinsurance 8. Proportional Reinsurance 9. Non-Proportional Reinsurance: Excess Of Loss (XL) Reinsurance 10. Transfer of Risks: From Insurers to Reinsurers 11. Comparative Analysis: Direct Insurers and Reinsurers 12. Life Reinsurance 13. Summary 14. Keywords 1. INTRODUCTION One of the major risk and capital management tools available to insurers is Reinsurance. Its significance is however hardly known outside the insurance sector. Reinsurance is insurance for insurers. Insurers buy reinsurance for the risks they cannot or do not wish to retain fully themselves. Reinsurers help the industry to provide protection for a wide range of risks, including the largest and most complex risks covered by the insurance system. They have wide ranging benefits in other areas of insurance too, including underwriting, asset management and capital management. Reinsurance also makes insurance less expensive and more secure, thus benefiting policyholders who get more protection at a lower cost. Reinsurers apply sophisticated risk management processes, including risk monitoring and risk modelling to ensure that the promise to pay future possible claims is honoured. In this unit, we discuss various issues relating to reinsurance; including its concept, benefits, applications, methods, functions, forms, types, and how reinsurers deal with risk. The unit concludes with a snapshot of how reinsurance applies to life insurers. 2. REINSURANCE: MEANING, DEFINITION AND CONCEPT Reinsurance simply means Insurance for Insurance Companies. More precisely Reinsurance transfers insurance underwriting risk to third-party organizations. Reinsurance is an insurance of insured risk where the insurer retains a part and cedes the balance of a risk to the reinsurer. This is done to facilitate a greater spread and reduce liability on the part of the insurer. In other words, reinsurance is insurance of insured risk taken by insurance companies to protect their liability commitments beyond their net capacity. It is the foundation on which the whole edifice of insurance rests. This is a widely used risk transfer mechanism and provides the backbone to insurance industry. Reinsurance is one of the major risk and capital management tools available to primary insurance companies. Need For Reinsurance A Direct insurer needs reinsurance for the following reasons: To limit (as much as possible) annual fluctuations in the losses he must bear on his own account; and To be protected in case of catastrophe. Reinsurance allows direct insurers to free themselves from the part of a risk that exceeds their underwriting capacity, or risks which, they do not wish to bear alone, for some reasons. Direct insurers find relief from particularly large individual risks by ceding them individually in the form of facultative reinsurance. However, entire portfolios containing all of the insurers risks; for example, all of the insurers fire, motor or marine insurance policies are also object of reinsurance. These insurance portfolios are covered by blanket agreements, so-called obligatory reinsurance treaties. Who buys reinsurance? Reinsurers deal with professional corporate counterparties such as primary insurers, reinsurance intermediaries, multinational corporations and their captive insurers of banks. The main clients of reinsurers are primary insurers, from all classes of insurance. The amount of business an insurer will reinsure depends on the insurers business model, its capital strength and risk appetite, and prevailing market conditions. Among those who buy reinsurance includes: Insurers whose portfolios are heavily exposed to catastrophic events such as earthquakes, storms etc. Small local insurance players having low client base need more reinsurance than larger international insurers who can diversify their insurance covers over a bigger client base. Insurers writing many different lines of business (Multiline insurers) need relatively less reinsurance covers than those that focus on a few business lines or sell to a specific customer group Commercial lines portfolios with a small number of risks with large exposures (e.g. aviation industry) need more reinsurance than personal lines portfolios with a large number of small and homogeneous risks (e.g. motor insurance)

Life insurers with a greater proportion of term cover contracts including mortality or disability risk element tend to cede more than life insurers with a high level of savings premium (i.e endowment and unit linked portfolios). Insurers expanding into new products or entering new geographical regions use reinsurance to benefit from reinsurers expertise and financing Regulatory and rating agency considerations also significantly influence the individual demand for reinsurance cover, as reinsurance is a means to provide capital relief and to improve balance sheet strength. How much reinsurance is necessary? The question of how much reinsurance is necessary to buy is a matter of judgement; every direct insurer must answer that as part of his entrepreneurial decision-making. His final decision will depend on factors such as willingness to take risks, his companys financial strength, and market practice. However, there is no absolute security against bankruptcy. Reinsurance is merely an instrument that can help a company reduce its probability of ruin (Swiss Re: An introduction of reinsurance). Reinsurance Financial strategies: The following strategies are used by Reinsurers: Pooling: Large number of small risks are pooled, where individual premiums are inadequate to cover individual losses Funding: Individual risks premiums are set high enough to cover likely losses (plus expenses and profit) Speculating: Securitization strategy applied in case of large, unique exposure; low chance of loss; potential value loss is very high; Low enough likelihood that expected return will be greater than cost of capital.

3. HISTORY OF REINSURANCE It was mans desire for security, both present and future; for himself and his family; that he started living in groups, developed clans, and later the concept of society. It is this notion of community, of one for all and all for onethat forms the base of insurance. In the early days of insurance, as there was no facility of reinsurance, an insurer accepted only those risks that could be entirely handled by him. The origin of reinsurance dates back to the fourteenth Century when the Lombardians began to develop the concept of reinsurance. The need for reinsurance was first felt in marine business, where there was a concentrated risk with a recognized catastrophe hazard. The oldest known contract with the legal characteristics of a reinsurance contract occurred in Genoa in 1370. Soon marine insurance developed rapidly and became a common practice throughout Europe. Marine insurance was the first great step in the history of the insurance industry, the second was insurance against fire. A number of serious fires struck Hamburg between 1672 and 1676, after which the Hamburger Feuerkasse (Hamburg Fire Fund) was set up. Even today, it is the oldest existing insurance company. In 1706, the Amicable or Perpetual Assurance was founded in London, signaling the breakthrough of actuarial sciences as a means of assessing risks and setting rates. The 19th century saw the rapid evolution of technology, the remodelling of society, the change in ways of thinking and the increased need for security brought by the new age. This paved for the origin of the insurance business as we know it today. Beginning of Reinsurance As trade expanded in the late middle ages and the economy flourished especially in the Italian city-states; the need for insurance grew. Insurers of the period worked without statistics, rates or calculations of probability, relying solely on their personal assessment of the risks. Thus, when news of a loss came through, many an insurer had to ask himself fearfully whether he had taken on too much risk. To protect himself against such situations, he soon learned to transfer all or part of the risk to another insurer willing to accept it by way of reinsurance. Besides reinsurance, which at that time covered only individual risks, the periods other main risk-sharing instrument was co-insurance. English law virtually prohibited reinsurance and as such direct insurers had to band together into syndicates if they were to cover risks beyond their individual financial means. Thus the law unintentionally strengthened Lloyds of London, the worlds most famous insurance institution. One of the earliest reinsurance companies; the Cologne Reinsurance Company was established in 1846 and started operations six years later. The Company is still in existence and is thus the oldest professional reinsurance company. The company was founded as an immediate impulse as a result of another catastrophic fire in Hamburg in 1842. The reserves of the locally-based Hamburg Fire Fund (only 5,00,000 German marks), had not been sufficient to cover the loss of 18 million marks. Thus, as a result of this event, insurers finally addressed the need to distribute entire portfolios of policies among several risk carriers. Though at first it was the financially stronger direct insurers who engaged in reinsurance, the Cologne Reinsurance Company was the first in a long line of professional reinsurance companies founded soon after; among these were the Aachen Re in 1853, Frankfurt Re in 1857, Swiss Re in 1863, and Munich Re in 1880. The Swiss Reinsurance company was the first reinsurance company to be founded in Switzerland. The disruption of the two world wars resulted in London developing into a substantial reinsurance market. The development was further aided by Lloyds increased involvement in reinsurance and the spread of excess of loss covers which were

predominantly written by Lloyds. Of the total significant proportion.

business written at Lloyds now, reinsurance constitutes a

From 1863 to the World War I, is considered the pioneering age of Reinsurance. After the Hamburg fire of 1842 and the Glarus fire in 1861, Switzerland made it clear that the reserves normally set aside by insurance companies were inadequate for severe catastrophes. To better prepare for such risks, the Swiss Reinsurance company was founded in 1863 by the Helvitia General Insurance Company, Credit Suisse of Zurich and the Basle Commercial Bank. The Swiss Reinsurance companys reputation gained worldwide after the devastating San Francisco earthquake and fire of 1906. Swiss Re settled its claims promptly and fairly. The result was a substantial increase in business. In the beginning, reinsurance was done mostly in the area of facultative transactions. With the progress of industry and commerce in 19th Century the innovative forms of coverage came into operation, giving rise to automatic forms of reinsurance known as treaties, which has become an indispensable part of a companys operations today. By the time of World War-I, proportional treaties became the main vehicle replacing facultative reinsurance that proved costly to administer and slow to operate besides being inflexible. The invention and technique of excess of loss cover (non-proportional reinsurance) was the most significant development in reinsurance in the past 100 years. This form of reinsurance filled a real gap for property policies which were extended to cover catastrophe hazards. Reinsurance too, in its modern form, was the product of the technological changes that changed insurance. Industrialization produced ever greater concentrations of value, prompting insurance companies to demand ever more reinsurance cover. Treaty reinsurance, which provided cover for portfolios (group of risks), took its place beside the single-risk, facultative form of reinsurance that had been customary until that time.

4. RISK DISTRIBUTION THROUGH REINSURANCE Risk is transferred from policyholder to a retrocessionaire, through a series of distribution strategies collectively referred to as the risk distribution strategy in insurance. Concept of Reinsurance Reinsurance may be defined as a contractual arrangement under which one insurer, known as the primary insurer, transfers to another insurer, known as the reinsurer, some or all of the losses to be incurred by the primary insurer under insurance contracts it has issued or will issue in the future. Reinsurance is a contract of indemnity, even in life insurance and personal accident insurance. The primary insurer is sometimes referred to as the ceding insurer, ceding company, cedent, or reinsured. Reinsurers also may reinsure some of the loss exposures they assume under reinsurance contracts. Such a transaction is known as retrocession. The insurer or reinsurer to which the exposure is transferred is known as a retrocessionaire and the reinsurer transferring the exposure is called the retrocedent. Retrocession agreements do not differ greatly in detail from reinsurance agreements. In almost all cases, the reinsurer does not assume all of the liability of the primary insurer. The reinsurance agreement usually requires the primary insurer to keep or retain a portion of the liability. This is known as the insurers retention and may be expressed as a percentage of the original sum insured or a specified quantum. In other words, reinsurance is insurance of the insured risk taken by insurance companies to protect their liability commitments beyond their limit. Reinsurance premium: Consideration paid by a ceding company to a reinsurer for the coverage provided by the reinsurer. Treaty: A reinsurance contract under which the reinsured company agrees to cede and the reinsurer agrees to assume a particular class or classes of insurance business automatically. The entire process of reinsurance can be described in a schematic diagram as given in Figure 1 below.

Risk Distribution with Reinsurance

Insurance Contract Reinsurer Retrocessionaire

R1

R2

Policyholders

1. 2. 3. 4.

Direct Insurer (Cedent)

Direct insurer accepts the risk, fully liable to policyholder Cession/ transfer of a share of the risk to a reinsurance company, the reinsurer accepts a share of the ceded risk, thus liable to the direct insurer Retrocession: transfer of a share of the risk by reinsurer to other reinsurers Retrocessionaire: accepts a share of the retroceded risk, and becomes liable to the reinsurer.

Figure 1 shows the distribution of risk through reinsurance: Authors own representation

DIFFERENCE BETWEEN COINSURANCE AND REINSURANCE Coinsurance, a form of reinsurance, is a system whereby reinsurer shares direct responsibility for a risk with one or more insurance companies. The Cedents liability is limited to the amount it underwrites on the original policy. The system is used especially for covering big industrial risks and certainly has many advantages. However, to apply it to the underwriting of thousands of medium and small risks would only mean high administrative costs and inconvenience. In co-insurance the relationships are between the primary insured and each insurance company separately. If one company/insurer fails to pay its share of a claim, the others are not liable to pay more than their share of claims. In other words, their liability is limited to extent of share accepted by them individually. Reinsurance is basically passing on the risk to some other insurer and therefore it does not absolve the insurance company from making payment irrespective of receipt of payment from reinsurer. In reinsurance the reinsured has a contractual relationship with the reinsurers. The insurer must pay valid claims, even if he fails to recover from his reinsurers. 5. RISK MANAGEMENT THROUGH REINSURERS The concept of risk management When insurers cede part of their business to reinsurers, they reduce their underwriting risk. In exchange they assume counterparty credit risk which is the risk that the reinsurer cannot honour its financial obligations. For the insurer it is, therefore, crucial that its reinsurers are financially secure. Core Competence: Risk management is the core competence of any reinsurer. Reinsurers have implemented sophisticated risk management processes to ensure their ability to honour financial obligations. The overarching role of risk management is to guarantee the long term survival of the reinsurance company. The role of risk management is to identify, monitor, and model the risks and their interdependence and to ensure that risks are in line with what the company can bear. To meet its tasks, close cooperation with the underwriting units, assets management, and capital management is the key. Figure 2 depicts the three main concerns of risk management.

Underwriting

RISK MANAGEMENT

Capital Management

Asset Management

Figure 2 depicts the 3 main concerns of risk management (Source: Swiss Re publications: Understanding Reinsurance: How reinsurers create value and manage risks)

Risk modelling: the basis of risk management In risk modelling, different forms of quantitative and qualitative analysis are applied. A list of risks affecting reinsurers include all risks that affect direct insurers, such as credit risk, insurance risk, market risk, interest rates risk, terrorism risks, inflation risks, epidemic risks etc . Based on the analysis of these risks, a sufficiently representative subset is chosen and mapped using stochastic models which take into account possible interdependencies among various sources of risk. Finally, these models are used to quantify the impact of the risk factors on the reinsurers balance sheet. Quantitative modelling has to be complemented by the analysis of risks which are less suited to formal modelling. These include socio-political risks, regulatory risks and most prominently operational risks. Operational risk is the risk of loss resulting from external events such as fires and power failures. Internal guidelines and appropriate management processes are used to minimize such risks. UNDERWRITING - Assessment, Capacity allocation and Pricing Underwriting is the process of examining, classifying and pricing risks, for example a book of motor business, or a single risk that is submitted by the primary insurer for reinsurance, as well as concluding the contract for risks which are accepted. The main task of the underwriting process is to ensure that -- Risks are assessed properly, and terms and conditions are adequate; The limits of assigned capacity are respected; There are controls for accumulation and peak risks, and Pricing and wording are appropriate Risk assessment and terms and conditions Risk assessment starts with assessing the data provided by the primary insurer and determining whether additional information about the characteristics of the insured objects or persons is required. In life reinsurance, risk assessment will consider information that helps to determine the risk of death or illness, such as age, gender, smoker status, medical and lifestyle factors. Only risks which meet the general conditions of insurability can be reinsured. Terms and conditions under which the risks are insured have an important function in making risks insurable, as they limit the cover provided in such a way that the process of insurability are met. Principles of insurability (Re)insurance can only operate within the limits of insurability. Insurability has no strict formula; rather it is set of basic criteria which risk must fulfill to be (re)insurable. These criteria can be broadly classified as follows: Assessability: It must be possible to quantify the probability that the insured event will occur, as well as its severity, in order to calculate the potential exposure and the premium necessary to cover it. In addition, it must be possible to allocate the loss to a particular insurance period.

Randomness: The time at which an insured event occurs must not be predictable, and the occurrence itself must be independent of the will of the insured. Economic efficiency: Primary insurers and reinsurers must be able to charge a premium commensurate with the accepted risk. Capacity allocation, accumulation control and peak risks Reinsurers only accept risks if these are in line with the capacity limits they have set. Capacity is the maximum amount of coverage that can be offered by a reinsurer over a given period. In the case of risks with low accumulation potential, such as a portfolio of different fire policies, underwriters are generally able to commit a defined amount of capacity for a certain line of product and client/country. Risk demanding more capacity is typically escalated for special approval by senior underwriters for risk committees. Some risks especially in the field of natural perils have a greater accumulation potential. In order to control these risks successfully, it is important that they be identified and dealt with in the underwriting process. Natural catastrophe loss potentials On a worldwide scale, the exposure to natural catastrophe is rising due to higher population density at locations exposed to natural perils, as well as due to the increasingly complex economic environment. Reinsurers play an important role in managing these risks. Pricing and wording The price has to be sufficient to cover the expected cost of acquiring the business, administering it and paying claims. Clearly the price must also provide the reinsurer with an appropriate return on the capital allocated to the risk. To arrive at a price, underwriters employ experience- and exposure based models. Experience based models use historical claims experience applied to price risks, e.g. fire risks where a long history of incidents exists or mortality risks where the pricing can be based on mortality tables and experience studies. When such data series are missing for instance in the case of natural perils where events are relatively rare the correct price has to be determined by using exposure-based modelling. These models use scientific information and expert opinion. Claims experience is only used to check and calibrate the model. When the primary insurer accepts the price and the terms and conditions offered by the reinsurer, a contract is drawn up between the two parties. This document, often called a wording, describes the rights and duties of the contract parties, as well as the terms and conditions that accompany it. When the agreement is reached, the risk is accepted into the reinsurers portfolio. ASSET MANAGEMENT Reinsurers invest the premiums they receive for providing reinsurance cover in the capital markets, which is the responsibility of the asset management department. Asset management is part of the risk management process as it delivers portfolio data to risk management and has to respect limits and guidelines on where to invest. This is to ensure that assets are allocated in a way that matches the characteristics of the corresponding liabilities. CAPITAL MANAGEMENT A reinsurers capital has to be appropriate for its specific risk profile and appetite. Capital is needed for those adverse situations when payments exceed premiums and investment income, or when shocks from inadequate reserving or asset impairments, such as the severe stock market slump experienced in 2001-2003, and 2008, have to be absorbed. Capital thus acts as a buffer against unexpected losses. In the risk management process, capital management has the significant task of aligning capital and risks assumed through insurance and investment activities. If risk monitoring reveals a gap between risk assumed and the maximum risk bearing capacity of the insurer (that can be borne by the existing capital base), then either the necessary capital must be increased or underwriting and investment risks have to be reduced. The latter can be achieved by reducing underwriting and investment capacity or transferring the risks outside the company using retrocession or securitization. RETROCESSION AND SECURITIZATION Reinsurers normally also may wish to transfer some of the risks they have absorbed outside their company. For this, they can use either traditional retrocession agreements or capital market techniques such as securitization. Retrocession: It is defined as the transfer of ceded premiums to other reinsurers or insurers. It provides reinsurers with a means of spreading their risks more broadly, but it also entails taking a credit risk. Counterparty assessment is critical to ensure that the mitigation of underwriting risk is not offset by the assumed credit risk. Securitization: It is an alternative to retrocession through which peak risks are transferred to the capital market in the form of securities. In the case of reinsurance, securitization has been used for natural catastrophe exposures, such as hurricanes, windstorms, and earthquakes or extreme mortality risks such as lethal epidemics or pandemics. DIVERSIFICATION A well established risk management process will result in a reinsurers portfolio where underwriting and investment risks are aligned with the capital available; thus ensuring the long-term survival of the reinsurer. Reinsurers achieve a high degree of diversification by operating internationally, across a wide range of many lines of business, and by assuming a large number of independent risks. Diversification across time also is an

important factor. The basic principle behind diversification is the law of large numbers. This statistical principle states that the more independent risks are added to a reinsurers portfolio, the less volatile its results become. In terms of capital, lower volatility translates into lower capital needs and in turn lower capital costs, for the same protection level. Better diversification helps reinsurers to offer reinsurance at lower price and; given the level of capital; provide a higher level of protection (see figure 3)

Benefits of Diversification

Less expensive reinsurance covers Higher level of protection due to high level of capital

Lower capital needs and capital cost

Better Diversification

Figure 3 shows the benefits of diversification; leading to lower covers and higher level of protection

6. BENEFITS OF REINSURANCE Main benefits include stabilization of underwriting results, financial flexibility and expertise. Stabilization of underwriting results is a dominant driver for non-life insurers to buy reinsurance. Reinsurance allows insurers to benefit from economies of scale Reinsurance expertise supports insurers in controlling their risks Reinsurance provides long-term security as a benefit for primary life insurers Benefiting from reinsurers expertise is a major driver to buying life reinsurance Reinsurance helps to ease insurers capital strains Reinsurance allows efficient risk and capital management Reinsurance facilitates economic growth and social welfare

How reinsurance affects the direct insurer The reinsurer adds value in many ways to the services a direct insurer provides to his clients. The reinsurer reduces the probability of the direct insurers ruin by assuming his catastrophe risks. He stabilizes the direct insurers balance sheet by taking on a part of the risk of random fluctuation, risk of change, and risk of error. He improves the balance of the direct insurers portfolio by covering large sums insured and highly exposed risks. He enlarges the direct insurers underwriting capacity by accepting a proportional share of the risks and by providing part of the necessary reserves. He increases the amount of capital effectively available to the direct insurer by freeing equity that was tied up to cover risks. He enhances the effectiveness of the direct insurers operations by providing many kinds of services How reinsurance benefits the direct insurer Through Through Through Through facultative reinsurance non-proportional treaty reinsurance proportional treaty reinsurance financial reinsurance

--Through facultative reinsurance, he: Reduces his commitments for large individual risks such as car factories and large department stores Protects himself against large liability exposures, whose extent often cannot be properly estimated before a loss occurs, as in the case of product liability for pharmaceuticals. --Through non-proportional treaty reinsurance, he: Receives cover for catastrophe risks such as windstorm, earthquake, tsunami, floods as well as large road, aviation and marine accidents -- Through proportional treaty reinsurance, he: Finds protection against major deviations in the loss experience of entire portfolios (risk of random fluctuation, or risk of change due to economic cycles; or new laws and regulations, or social change) --Through financial reinsurance, he: Procures cover for difficult-to-insure or marginally insurable individual risks or portfolios in order to guarantee liquidity and income. The majority of claims incurred are balanced on a medium to long term basis by the direct insurer and reinsurer operating in tandem.

HOW REINSURANCE AFFECTS THE REINSURER The reinsurer is offered highly exposed risks, catastrophe risks and other severe or hazardous business. The reinsurance companys task is to give the client the cover he wants (as much as possible) and at the same time to structure and safeguard its own reinsurance portfolio to achieve balance and to make a profit doing it. The reinsurer thus seeks to balance his portfolio by spreading his activities over many countries (geographical distribution) and throughout all branches of the insurance business. The reinsurer keeps its probability of ruin low by: Exposure and accumulation control together with a suitable acceptance and underwriting policy, Maintaining long-term client relationships, to achieve compensation in time; Underwriting, when possible, the more balanced portions of the direct insurers business (e.g. motor insurance, third party liability, personal third party liability, home insurance etc.); Further reinsuring (retroceding) those risks which exceeds its own capacity WHO OFFERS REINSURANCE? A number of large direct insurers write reinsurance business, either through their own reinsurance departments or through reinsurance subsidiaries. However, it is the professional reinsurance companies that offer reinsurance services on a major scale. Lloyds of London has established a reputation for marine insurance and the coverage of unusual risks. For special types of risks, such as aviation or nuclear energy, insurance pools have been created. These are mainly designed to balance risks as well as possible at the national level, while attempting to secure further international cover with reinsurers or foreign pools. Reinsurance brokers act as intermediaries in providing direct insurers with reinsurance cover. They play an especially significant role in the worlds English speaking markets. Standard & Poor, the rating major; lists approximately 250 reinsurance firms in 50 countries (Global Reinsurance Highlights 2004 edition), along with many small companies including primary insurers offering reinsurance. The volume of business ceded amounted to USD 176 billion. The figure for life reinsurance was roughly USD 30 billion or 1.9% of total life insurance premiums. The market share of the top ten reinsurance companies amounted to about 54% in terms of premium volume. The capital strength of reinsurance companies is usually above investment grade, having financial strength rating of at least AA-, as measured by S&P. The stable and sound capital base of the reinsurance industry is also reflected in the small number of bankruptcies among reinsurance companies: between 1980 and 2007, just 24 reinsurers failed. Even these were of smaller size, the affected premium volume accounting for only 0.24% of total cessions over this time. The worlds top 10 reinsurance companies listed in order of net premium volume (year 2006) is given in table (Source: Swiss Re publication: An introduction to Reinsurance).

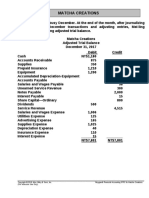

Worlds top 10 reinsurance companies listed (In order of net premium volume) Reinsurer Total Property/ casualty Life/ Health Swiss Re 26014 16439 9575 Munich Re 24526 16358 8168 Berkshire Hathaway 11051 8687 2364 Hannover Re 8886 5912 2974 SCOR 4520 1907 2613 RGA 4346 4346 Everest Re 3853 3853 Partner Re 3667 3180 487 Transatlantic Re 3604 3604 XL Re 3151 2592 559 shows rankings of top professional reinsurers ranked by net premiums written in 2006 (source: Swiss Re)

1 2 3 4 5 6 7 8 9 10 Table

FUNCTIONS OF REINSURANCE There are four main functions of reinsurance Finance: Financial strength to Insurers Capacity: to offer capacity to given risks Stabilization (net income protection) Catastrophe (surplus protection) Functions: i) Finance An insurance companys growth may be limited because of unearned premium reserve requirement(s). A company is forced to put all written premium into a reserve account while still paying business (acquisition) costs, (agents commissions must be paid on written premium). The premium on an annual policy is earned at the rate of 1/12th per month. Because acquisition costs must be paid immediately, there can be a substantial drain on surplus, particularly when premium volume is expanding rapidly. The accounting system used by insurance companies is designed to enhance financial strength, with state insurance regulators monitoring such items as the ratio of written premium to surplus. A general rule of thumb used to be 3 to 1, but now 2 to 1 is more often used. A ratio above 2.5 to 1 (varies by Company) could result in a company being viewed as over extended, leading to rating agency action. Pro rata reinsurance enables a company to continue to write polices without draining capital and surplus. It reduces written premium and increases the surplus, by means of a ceding commission recouping pre-paid acquisition expenses. Functions: ii) Capacity The ability to offer significant capacity on any given risk allows an insurance company to compete in the market. Most companies require greater capacity than their own resources can provide. By reinsuring portions of risk, through pro rata and/or excess of loss, a company can compete in the market. A company writing to a maximum policy limit of, say, $10,000,000 could double that capacity by arranging a surplus share reinsurance treaty. Thus, a $20,000,000 policy can be written with 50% of $10,000,000 ceded to a surplus share reinsurer(s). Alternatively, a per risk excess of loss contract of $10,000,000 has similar effect. On a $20,000,000 policy, all losses over $10,000,000 are paid by the reinsurers for a predetermined premium. Functions: iii) Stabilization Insurance companies generally prefer stable year-to-year underwriting results, rather than wide fluctuations. Excess of loss reinsurance enables a company to determine the loss it will assume on any one risk, in any one occurrence, or in the aggregate for the entire year. Thus, losses are stopped at a certain level above which reinsurers pay. Functions: iv) Catastrophe Surplus needs to be protected against severity of major catastrophe, such as hurricanes, tornadoes, floods, earthquakes, hail, etc. Most reinsurance arrangements provide some degree of coverage for these occurrences, but catastrophe excess of loss specifically addresses the accumulation of small losses, some or all or which would not be covered under any of the companys other reinsurance.

7. CATEGORIES OF REINSURANCE I) Basic forms of reinsurance: Facultative and Treaty (Obligation) Facultative: There is no single kind of reinsurance that effectively serves all purposes. While reinsurance contracts can be categorized in several ways, one basic categorization is between facultative reinsurance and treaty reinsurance. Facultative form of reinsurance is the oldest form and still used in certain cases. In facultative

reinsurance, the primary insurer and reinsurer negotiate reinsurance contract for each risk separately. There is no compulsion for the primary insurer that it should purchase reinsurance on a policy that it does not wish to insure. Likewise, there is no obligation on the part of the reinsurer to reinsure proposals submitted to it. That is why it is termed as facultative. The reinsurer has the option of either accepting or declining a proposal. Today, however, facultative reinsurance is used mainly as a complement to treaty (obligatory) reinsurance, in which entire portfolios of risks are ceded according to standing agreements called treaties; which are much more convenient and efficient than the facultative method. However, treaty method is not suitable for all risks and therefore it is still necessary to reinsure some risks facultatively. Facultative reinsurance may be either proportional or non-proportional type. When seeking proportional facultative reinsurance, the direct insurer must offer the risk at original conditions: that is, on the same terms and for the same premium that he himself received from the policyholder. Thus, the conditions of the reinsurance agreement largely correspond with those of the original policy, even though the two contracts are entirely independent. There is no contractual relationship of any kind between the policyholder and the reinsurer, and thus there is no legal obligation at all between them. In short, Basic forms of reinsurance are: Facultative and Treaty (Obligatory) Facultative reinsurance It is reinsurance for individual risks. Treaty/ Obligatory reinsurance -- Is treaty reinsurance for entire portfolios: automatic reinsurance. Facultative reinsurance is now widely used for reinsuring hazardous risks not covered by treaty arrangements, for the purpose of reducing the insurance in certain area, for reducing the treaty reinsurers liability, to augment risk capacity and to get advice of the reinsurer on risks that are considered new and complicated.

Categories of Reinsurance

Reinsurance

Treaty (Obligatory)

Basic forms of reinsurance

Facultative

Financial

Pro-rata (Proportional)

Basic types of reinsurance

Excess of Loss (Nonproportional)

Pro-rata (Proportional)

Excess of Loss (Nonproportional)

Quota Share

Surplus Share

Per Risk (per policy)

Per Occurrence (Catastrophe)

Aggregate Excess

Basic forms of reinsurance: Treaty & Facultative Basic types of reinsurance: Proportional & Non-proportional

Figure

5 shows the different categories of reinsurance, the primary form being facultative and treaty reinsurance.

Treaty (Obligatory) Reinsurance Treaty reinsurance is also referred to as Obligatory reinsurance. In Treaty reinsurance, the direct insurer is obliged to cede to the reinsurer a contractually agreed share of the risks defined in the reinsurance treaty; the reinsurer is obliged to accept that share; hence the term obligatory. In the treaty reinsurance there is a prior agreement between the primary insurer and reinsurer whereby the former reinsures certain lines of business in accordance with the terms and conditions of the treaty and the latter agrees to accept the business that falls within the scope of the agreement. An obligation is imposed that all policies that come within the terms of the treaty are required to be placed with the reinsurer. Similarly, the reinsurer can not decline risks that come within the terms of the treaty. Given that the treaty reinsurance

10

guarantees a definite amount of reinsurance protection on every risk which the primary insurer accepts, treaty reinsurance works out to the cheaper than the facultative reinsurance. Treaty reinsurance has become popular with primary insurers because of its several advantages over facultative reinsurance. As the reinsurer has to necessarily accept all business that falls within the terms of the treaty, the primary insurer, with no prior consultation with the reinsurer, can underwrite, accept and reinsure such business on each application submitted to him. As a rule, treaty reinsurance is terminable on an annual basis. Because of the absence of prior negotiations with the reinsurer, the transaction cost on each policy is lower under treaty reinsurance than under facultative reinsurance.

II) Basic types of reinsurance: proportional and non-proportional Both forms of reinsurance (facultative and treaty) may be either proportional or non-proportional in type. 14.8 PROPORTIONAL REINSURANCE In all varieties of proportional reinsurance, the direct insurer and the reinsurer divide premiums and losses (claims) between them at a contractually defined ratio. According to the type of treaty, this ratio may be the same for all risks covered by the contract (quota share reinsurance), or it may vary from risk to risk (all other proportional reinsurance types). In all cases, however, the reinsurers share of the premiums is directly proportional to his obligation to pay any losses. For example, if the reinsurer accepts 75% of a particular risk and the direct insurer retains 25%, the premium is apportioned at a ratio of 75:25. As shown in Fig. 5 Treaty Reinsurance is subdivided into (i) Pro Rata Treaties (Proportional Reinsurance), and (ii) Excess of Loss Reinsurance Treaties (Non-proportional Reinsurance)

TYPES OF PROPORTIONAL REINSURANCE TREATIES There are two kinds of treaties in the proportional reinsurance category; namely a) Quota Share Reinsurance and b) Surplus Share Reinsurance Quota share reinsurance Reinsurer assumes an agreed-upon, fixed quota (percentage) of all the insurance policies written by a direct insurer within the particular branch or branches defined in the treaty. This quota determines how liability, premiums and losses are distributed between the direct insurer and the reinsurer. The quota share arrangement is simple as well as cost-effective. The disadvantage is that it does not sufficiently address the direct insurers various reinsurance requirements, since it measures everything by the same yardstick. These treaties cannot be used to balance portfolios; that is, they do not limit the exposure posed by peak risks (i.e high sum assured risks). Such a treaty may also provide covers where strictly speaking none is needed; thus restricting the direct insurers profit-making options. However, quota share reinsurance is suitable for young, developing companies or new companies to a certain class of business. As their loss experience is limited, they often have difficulties in defining the correct premium; with a quota share treaty, the reinsurer takes the risk of any correct estimates. It is also suited for limiting the risk of random fluctuation and risk of change across an entire portfolio of risks. Table shows how premium and losses are shared under this method. Example (explained in Figure 7)

Division of Insurance, Premium and Losses Under Quota Share Treaty Quota shares in premiums & losses Primary/ Direct Insurers retention 60% Reinsurance quota share Sum insured (SI) of the insured object Direct insurer retains 60% of exposure Reinsurer assumes 40% of exposure Premium rate is Rs. 2 per thousand SI Direct insurer retains 60% Reinsurer receives 40% Loss (Claim) Direct insurer pays 60% Reinsurer pays 40% 40% 10 million 6 million 4 million 20,000 12,000 8,000 5 million 3 million 2 million

11

Liability

C u r r e n c y

4

m i l l i o n

10 million

Risk sharing: Quota share treaty method

Reinsurers quota share 40%

6 mill ion

Direct insurers retention 60%

Policies

7 depicts risk sharing using the quota share treaty method of reinsurance.

Figure

Surplus reinsurance Surplus reinsurance is more sophisticated form of proportional reinsurance. In this case, the reinsurer does not participate in all risks; as in the quota share treaty. Instead, the direct insurer himself retains all risks up to a certain amount of liability (his retention). This retention may be defined differently for each type (class) of risk. The reinsurer will accept the surplus: the amount that exceeds the direct insurers retention. This limit is usually defined as a certain multiple of the direct insurers retention, known as lines. For each reinsured risk, the ratio that results between the risk retained and the risk ceded is the criterion for distributing liability, premiums and losses between the direct insurer and the reinsurer. Surplus reinsurance is usually arranged in terms of number of lines of retention. The amount retained by the ceding company for its own account is called the net retention or a line. Thus a surplus treaty may be of ten or twenty lines capacity, which means that the ceding company can assume cover on risks with sums insured ten or twenty times its own retained line. Example No.1 ABC insurance company has purchased from XYZ Reinsurance Company a surplus treaty with a retention of Rs. 2, 00,000 and a limit of Rs. 20, 00,000. This is referred to as a ten-line surplus treaty. The primary insurer (ABC Insurance Company) will cede coverage upto ten times the retention amount. The table given below illustrates how the surplus share treaty would apply to the same three policies in different cases. Division of Insurance, Premium and Losses Under Surplus Share Treaty ABC Insurance Co. (%) (Rs) Policy No. 1 Insurance Premium Loss Policy No.2 Insurance Premium Loss Policy No. 3 Insurance Premium Loss 2,00,000 (66.67%) 1000 53,333 2,00,000 850 45,000 1,00,000 (50%) 500 26,667 2,00,000 (100%) 850 45,000 3,00,000 1,500 80,000 4,00,000 1,700 90,000 2,00,000 (100%) 800 50000 0 (0%) 0 0 2,00,000 800 50000 XYZ Reinsurance (% ceded) (Rs) Total

12

As is seen in case of Policy No.1, there is no ceding as the amount of insurance is equal to Rs. 2,00,000 retention. For Policy No.2, the proportion in which premium and losses are shared between ABC Company and XYZ Company is determined by retention divided by the insurance amount. Similarly with Policy No. 3, it is again seen that under a surplus share treaty for insurance amounts above the retention, the rupee amount of retention remains constant while the percentage retention decreases as the amount of insurance increases. Example No.2 Another example of how surplus treaties work is if we assume that a primary insurer has issued a life insurance policy in the amount of $ I million subject to a four-line first surplus share treaty, a three-line second share treaty, and a third-line surplus share treaty. The insurer retains $ 100,000 of the risk. The risk is divided as follows: Original policy limits: Retention by primary insurer: Surplus: 1st surplus retention (4 lines): 2nd surplus retention (3 lines): 3rd surplus retention (2 lines): Total cession: $ 10,00,000 $ 100,000 $ 9,00,000 $ 4,00,000 $ 3,00,000 $ 2,00,000 $ 9,00,000

Each reinsurer divides the premium and any losses in proportion to its share of the total limit of coverage. Thus, the primary insurer and the 1st, 2 nd, and 3rd surplus reinsurers would divide premiums and losses on the basis of 1/10, 4/10/, 3/10 and 2/10 respectively. If a $100,000 loss occurred, these four parties would pay $10,000, $40,000, $30,000, and $ 20,000 respectively. Premiums and losses on policies written for less than $1 million would be divided on the basis of the insurers involved. For example, a $5,00,000 policy would be divided by the primary insurer and the 1st surplus reinsurer on a 1/5, 4/5 basis. In this case, the capacity of the primary insurer and the first surplus reinsurer is sufficient to cover the $5,00,000 exposure. The second and third surplus retention policies are not needed. The reinsurer also pays the primary insurer a ceding commission to help pay for the first year acquisition expense paid by the primary insurer. The main advantage to the primary insurer of the surplus share treaty is the avoidance of ceding insurance on small loss exposures as he can afford to retain them. The primary disadvantage in comparison with quota share treaty is the increased administrative expense.

ACTIVITY A 1. Assume that ABC Insurance Company has purchased from XYZ Reinsurance Company a quota share treaty a retention of 30 percent and a cession of 70 percent with a limit of Rs. 8,00,000. Policy No.1 insures a building for Rs. 2,00,000 for a premium of Rs. 800. A loss of Rs. 50,000 is reported. Policy No.2 insures a building for Rs. 3,00,000 for a premium of Rs. 1,500. A loss of Rs. 80,000 is reported. Policy No.3 insures a building for Rs. 4,00,000 for a premium of Rs. 1,700. A loss of Rs. 90,000 is reported. Show how the insurance, premiums, and losses under these policies will be divided between the primary insurer and reinsurer. Munich insurance company entered into two surplus treaty contracts with the reinsurers. The first surplus treaty consisted 10 lines with a maximum liability of Rs. 30,00,000. The second surplus treaty consists of 20 lines with a maximum liability of Rs. 50,00,000. Risk Gross Sum Assured (Rs) 2,00,000 3,00,000 12,00,000 30,00,000 65,00,000 Retention Applicable (Rs) 2,00,000 1,00,000 2,00,000 4,00,000 2,00,000

2.

1 2 3 4 5

Calculate the cessions to first surplus treaty and second surplus treaty.

9. NON-PROPORTIONAL REINSURANCE: EXCESS OF LOSS (XL) REINSURANCE Non-proportional reinsurance is structured like a conventional insurance policy: the reinsurer pays all or a predetermined percentage of the claims which fall between a defined lower and upper cover limit. For the parts of claims below or above limits, the primary insurer has to carry the risk on its own or it may reinsure it under other contracts. Different to proportional reinsurance, the premium is set independently of the original business. Non-proportional reinsurance arrangements are characterized by a distribution of liability between the cedent and the reinsurer on the basis of losses rather than sums insured, as in case of proportional arrangements. In

13

fact, no insurance amount is ceded under excess of loss treaties; what is ceded is losses and premiums. As compensation for the cover granted, the Reinsurer receives part of the original premiums and not part of the premium corresponding to the sum reinsured as in proportional reinsurance. The following common characteristics differentiate them from proportional treaties. 1. The size of cession is not determined case by case. 2. Administrative costs are substantially reduced. 3. Usually there is no profit commission. 4. Reinsurance premium is worked out on the basis of exposure and past loss experience. In this type of reinsurance, there is no set, pre-determined ratio for dividing premiums and losses between the direct insurer and the reinsurer. The share of losses that each pays will vary depending on the actual amount of loss incurred. The treaty defines an amount up to which the direct insurer will pay all losses; that is the excess point (other terms used include deductible/net retention/ priority). For his part, the reinsurer obliges himself to pay all losses above the deductible (excess point) amount, upto a contractually defined cover limit. As a price for this cover, the reinsurer demands a suitable portion of the original premium. In defining this price, the reinsurer considers the loss experience of past years (experience rating) as well as the losses to be expected from that type and composition of risk (exposure rating). Excess of loss (or XL) reinsurance is structured quite differently from the proportional types of treaty discussed above. Cessions, in case of proportional treaties are linked to the sums insured, whereas in case of excess of loss reinsurance, it is the loss that is the deciding factor. No matter what the sum insured, the direct insurer carries for his own account all losses incurred in the line of business named in the treaty up to a certain limit known as the deductible (excess point). The reinsurer pays the entire loss in excess of this amount, upto the agreed cover limit. Thus, it differs from proportional reinsurance in that the reinsurer pays only when the loss exceeds the deductible or excess point. When this happens, he will pay that part of the loss in excess of the deductible, upto the agreed cover limit. CLASSES OF EXCESS OF LOSS (XL) REINSURANCE There are three general classes of excess of loss treaties (sometimes referred to as non-proportional treaties). They are -a) Per risk excess treaty or per policy excess treaty (WXL/R) b) Per occurrence of loss treaty (CatXL) c) Aggregate excess treaty Excess of loss treaties meets the needs of those direct insurers who want reinsurance protection (at least against large losses); while retaining as much as of their gross premium as possible. However, these insurers are also buying a risk that is greater than with proportional insurance, for the reinsurer provides no relief from losses below the deductible amount. Thus, non-proportional insurance covers greatly increase the danger that the direct insurer will actually have to pay in full, and for his own account, any losses near or at the agreed deductible amount. XL reinsurance has a much shorter history than proportional insurance, and established itself only after the 1970s. One of the main disadvantages is that treaty wordings do not explicitly define the way premiums are to be shared by the direct insurer and the reinsurer. Excess of loss reinsurance written on a facultative basis is always per risk or per policy excess basis. Per occurrence and aggregate excess of loss reinsurance relate to a class of business, a territory, or the primary insurers entire book of business rather than a specific policy or a specific loss exposure. A financial reinsurance agreement can be written for any of the above types of reinsurance. a) Per risk excess treaty or per policy excess treaty (WXL/R) A per risk excess treaty is applicable to property insurance; the retention and limit apply separately to each risk insured by the primary insurer. A per policy excess treaty applies to liability insurance; the retention and limit apply separately to each policy sold by the primary insurer. The retention under each of these policies is specified as a rupee amount of loss. Further, the reinsurer is obligated for all or part of a loss to any single exposure in excess of the retention and up to the accepted reinsurance limit. b) Per occurrence of loss treaty (CatXL) Per occurrence excess of loss reinsurance gives indemnity against loss sustained in excess of the net retention of the primary insurer, subject to the reinsurance limit, irrespective of the number of risks involved in respect of one accident, event or occurrence. This kind of reinsurance when applied to property coverage is called catastrophe excess and when applied to liability coverage is called clash cover. c) Aggregate excess treaty Aggregate excess treaties, also called excess of loss ratio or stop loss treaties are not common. They are used generally in crop hail insurance and for small insurers in other lines.

14

10. TRANSFER OF RISKS: FROM INSURERS TO REINSURERS Reinsurers products are designed to meet primary insurers needs for balance sheet protection and capital relief. Usually a primary insurer will structure its reinsurance programme by making use of virtually all forms and types of contracts. Traditional reinsurance contracts primarily accept insurers underwriting risks in return for the payment of a reinsurance premium. These covers are closely linked to the original policies underwritten by the insurer, following their terms and conditions. These are two forms of traditional cover: treaty and facultative. Treaty reinsurance is used to reinsure entire precisely defined portfolios. These contracts are dominant in both non-life and life insurance. Facultative reinsurance encompasses mainly large scale risks that do not fit in the treaty portfolio and need to be individually evaluated and reinsured in both forms, a distinction is made between proportional and non-proportional coverage. The types of contracts are the same for non-life and life insurance. What usually differs is the scope of the reinsurance contracts with regard to the timeframe. A non-life insurance contract is usually renewed every year, while a life insurance contract normally has the same contract period as the original policy written in the year the reinsurance was contracted. We have already seen that there are two basic types of traditional reinsurance: proportional and nonproportional. Insurers transfer risks to reinsurers through these two basic types of reinsurance. In recent years, new risk transfer techniques have emerged, which are broadly summarized under the term alternative risk transfer (ART). The most important instruments include finite reinsurance for both non-life and life insurance, and multi-year, multi property/casualty contracts. Both types of contracts are natural extensions of traditional reinsurance. By their nature, finite contracts contain major profit (loss) sharing elements, which limit the risk transfer of the reinsurer. The origin of finite contracts goes back to the US liability crisis of the mid1980s. Finite reinsurance was designed to facilitate the transfer of certain risks which would have become uninsurable following the crisis. Under the multi-risk/ multi-year contracts, reinsurers commit to paying claims only if the accumulated losses for several different risks over an extended period (often three years) exceed a fairly high threshold, premiums for these contracts are low, because they are generally designed to cover only low frequency, high severity cumulative losses that could place excessive strain on insurers or large corporations. These kinds of contracts also reduce administrative costs. Premiums from non-traditional cover, predominantly finite reinsurance, account for 10-15% of overall reinsurance premiums. However, the importance of non-traditional covers is substantially lower than implied by the 10-15% share, because finite contracts usually contain a major capital management element.

11. COMPARATIVE ANALYSIS: DIRECT INSURERS AND REINSURERS The Swiss Re report titled Understanding Reinsurance sums up the main points of difference between direct or primary insurers and reinsurers as given in the table below. It demonstrates that the relationship between the two risk carriers is founded primarily on mutual trust, as is the founding principle of insurance itself, involving the policyholder and the primary insurer.

15

Comparisons: Direct Insurer and Reinsurer Sr. No. 1 Points of Difference Company Organisation Contractual Obligation Direct Insurer Internal (own staff) and External Organisation ( agents) Direct obligation to the policyholder Reinsurer No external organisation (network of individual agents) Obligation solely to the direct insurer, for a part of the direct insurers guarantee obligation. No contractual relationship with the policyholder. No right to claim for the policyholder, since there is no contractual relationship with the reinsurer.

Right to claim for policyholder

Yes, right to claim is the essence of the contractual relationship between the policyholder and the direct insurer. Risk assessment of the subject matter of insurance is done directly before insuring the risk

Risk Assessment

Makes assessment using information given by direct insurer on basis of Utmost good faith. Assessment is based on an entire portfolio from one or more insurance lines, and not the individual risk (except in facultative reinsurance) Normally no direct influence on individual risk. However, reinsurer can include participation clauses and exclusions, as well as the refusal to grant cover. Relies on data from the direct insurer. On claim notification, reinsurer transfers the reinsured portion of the indemnity to the direct insurer. The right to participate in claims adjustment negotiations may be reserved by the reinsurer in case of large losses.

Underwriting policy

Directly influences individual risk through acceptance or refusal; and risk distribution through selection.

Loss Occurrence

Direct contact with the policyholder and the loss location. Claim settlement easier in case of life and personal lines business (based on sum assured) and in case of non-life insurance; based on loss estimation (motor insurance) or actual expenses incurred (mediclaim).

ACTIVITY B I) Name the following, from the options given (Risk modelling, Retrocession, Reinsurance, Surplus reinsurance, securitization) 1. 2. 3. 4. 5. Insurance for Insurance Companies Different forms of quantitative and qualitative analysis are applied Alternative to retrocession through which peak risks are transferred to the capital market in the form of securities A reinsurer cedes all or part of the reinsurance risk it has assumed to another reinsurer Form of reinsurance in which the reinsurer will accept the surplus i.e the amount that exceeds the direct insurers retention

II) Storm causes Rs. 1,000 losses of Rs.3,000 on policies covering private houses, which are all retained within the companies retention. The company having concluded an excess of loss reinsurance cover on its retention for an amount of Rs.20,00,000 excess Rs.5,00,000. In other words the reinsurer has to bear Rs.20,00,000. Discuss how the total loss would be distributed among the parties to the reinsurance contract.

12. LIFE REINSURANCE Life reinsurance differs from other classes of reinsurance. The nature of risks assumed by the life insurance has necessitated the development of various forms of reinsurance. The proportion of total life insurance premiums reinsured is small in comparison with most of the non-life insurance classes. The demand for life reinsurance arises on account of a) difference in the number of deaths and b) death strain. Life insurers mortality risks arise on account of uncertain calculations of death claims made by him with the help of mortality tables. However in practice, the actual number may differ resulting in wide dispersion. Such divergence will have impact on the

16

earnings of a Life Insurance Company. The cost to a life insurance company in case of a claim is the sum assured plus bonus, if allowed. Cost minus reserves applicable to the policy gives the amount of Death Strain. This results in creating an impact on operating results. Life insurers generally seek reinsurance to reduce the impact of such death strain on operating results of the company. Three life reinsurance plans are in general use under both facultative and treaty agreements. Coinsurance Plan: The reinsurer assumes a proportionate share of the risk according to the terms that govern the original policy. The reinsurer is liable for an amount determined by the size of the insurance assumed in relation to the original insurance amount. Thus, if the reinsurer has accepted one-half of the original insurance, it becomes liable for one-half of any loss. In return for this guarantee, the reinsurer receives a pro-rata share of the original premium less a ceding commission and allowance. The ceding company and the reinsurer share the risk (premiums and claims) according to agreed proportions; with the reinsurance rates derived from the original rates charged the policy owner. Yearly Renewable Term Plan: Under this the reinsurer assumes the reinsured policys net amount at risk in excess of the ceding companys retention. The ceding company pays premium on a yearly renewable term basis. This plan is particularly appropriate for smaller ceding companies because it results in larger assets for these companies and is simpler to administer than coinsurance plan. Thus, for policies with declining net amounts at risk, decreasing amount reinsurance is purchased every year. If a loss occurs, the reinsurer is liable for the amount that it assumed that year and the ceding insurer is liable for its retention plus the full reserve on the reinsured portion of the policy. Premium rates for yearly renewable term reinsurance are established independently of the premium charged to the policyholder. Modified Coinsurance Plan: In the interest of permitting a company to retain control over the funds arising out of its own policies, a modified coinsurance plan has been developed. Under this arrangement, the ceding company pays the reinsurer a proportionate part of the gross premium, as under the conventional coinsurance plan, less commissions and other allowances, premium taxes and overhead allocable to reinsured policies. At the end of each policy year, the reinsurer pays to the ceding company a reserve adjustment that is equal to the net increase in the reserve during the year, less one years interest on the total reserve held at the beginning of the year. The net effect of the plan is to return to the ceding company the bulk of the funds developed by its policies. Modified coinsurance can be considered as yearly renewable term on a calendar year basis because the reinsurer, after paying the reserve adjustment, cash surrender values, and commissions and allowances, is left with only the risk premium. Aside from the reserve adjustment, the modified coinsurance plan follows that of the regular coinsurance plan. A key element, under life reinsurance, is in assessing the true value of assets recoverable from a reinsurer. A direct insurer who relies too heavily on one reinsurer faces a substantial risk of default. A life insurer who totally depends on reinsurance and retains a small percentage of his total portfolio is generally considered to be an increased risk to the insuring public. Very little reinsurance is affected by Life Insurance Corporation of India. Its reinsurance is a surplus treaty, which takes sum insured exposures on individuals in excess of US $ 100,000. The substantial part of LICs business is not reinsured. Key-man insurance, and accumulation are two risk exposures of significance to a life insurer for arranging his reinsurance. Key-man insurance protects business debts of a firm, which is dependant on a key individual for continuing its business. The sum insured would not be related to the value of a person (Human Life Value) but the value of loss to his firm in case of his leaving the company and the premium is paid by the firm is treated as business expense. This has become a big controversy in India and IRDA suspended operation of this policy for some time. Accumulation is when several people are affected by a loss and there is an accumulation of insured persons; also, where several policies arranged in respect of one and the same individual are affected, one speaks of a policy accumulation. Accumulation control is therefore essential to determine need for reinsuring.

13. SUMMARY Reinsurance is insurance of insured risk taken by insurance companies to protect their liability commitments beyond their net capacity. The Cologne Reinsurance Company was the first in a long line of professional reinsurance companies founded soon after; among these were the Aachen Re in 1853, Frankfurt Re in 1857, Swiss Re in 1863, and Munich Re in 1880. Risk is transferred from policyholder to a retrocessionaire, through a series of distribution strategies collectively referred to as the risk distribution strategy in insurance. The primary insurer is sometimes referred to as the ceding insurer, ceding company, cedent, or reinsured. Reinsurers also may reinsure some of the loss exposures they assume under reinsurance contracts. Such a transaction is known as retrocession. The insurer or reinsurer to which the exposure is transferred is known as a retrocessionaire and the reinsurer transferring the exposure is called the retrocedent. When insurers cede part of their business to reinsurers, they reduce their underwriting risk. In exchange they assume counterparty credit risk which is the risk that the reinsurer cannot honour its financial obligations. To meet its tasks, reinsurers need to have close cooperation with the underwriting units, assets management, and capital management units. Securitization is an alternative to retrocession through which peak risks are transferred to the capital market in the form of securities. Better diversification helps reinsurers to offer reinsurance at lower price and; given the level of capital; provide a higher level of protection.

17

Basic forms of reinsurance are Facultative and Treaty (Obligation). In facultative reinsurance, the primary insurer and reinsurer negotiate reinsurance contract for each risk separately. There is no compulsion for the primary insurer that it should purchase reinsurance on a policy that it does not wish to insure. Treaty/ Obligatory reinsurance is treaty reinsurance for entire portfolios: automatic reinsurance. In Treaty reinsurance, the direct insurer is obliged to cede to the reinsurer a contractually agreed share of the risks defined in the reinsurance treaty; the reinsurer is obliged to accept that share; hence the term obligatory. Both forms of reinsurance (facultative and treaty) may be either proportional or non-proportional in type. There are two kinds of treaties in the proportional reinsurance category; namely Quota Share Reinsurance and Surplus Share Reinsurance. There are three general classes of non-proportional treaties a) Per risk excess treaty or per policy excess treaty (WXL/R) b) Per occurrence of loss treaty (CatXL) c) Aggregate excess treaty. Coinsurance, a form of reinsurance, is a system whereby reinsurer shares direct responsibility for a risk with one or more insurance companies.

14. KEYWORDS Cede: To give away or transfer all or part of risk to another company or companies. Cedent: The reinsurers client (i.e the insurer) who passes on (cedes) risks to the reinsurer against payment of a premium Line: The amount of retention of the direct insurer; reinsurer may accept one or more lines or fraction of a line Portfolio: The liability of an insurer for the unexpired portion of the policies in force or outstanding losses or both for a particular segment of the insurers business. Reinstatement: A provision in an excess of loss reinsurance contract, (especially catastrophe and clash covers) that stipulates for a reinstatement of a limit that is reduced by the occurrence of a loss/losses. Reserves: The portion of premiums/losses retained by the insurer for the due performance of the obligations of the reinsurer under the treaty. Retention: The amount of liability the ceding company keeps for its account of a risk. Retrocession: When a reinsurer (retrocedent) cedes all or part of the reinsurance risk it has assumed to another reinsurer (retrocessionaire). Coinsurance: A form of reinsurance, wherein a number of insurers and/ or reinsurers share a risk. Facultative reinsurance: Reinsurance of the insurers risks on an individual, by-risk basis. Direct insurer: Insurance company in a direct contractual relationship with the policyholder Reinsurer: Company which accepts a share of the insurers risks in return for payment of a premium. Retrocession premium: Premium paid to the retrocessionaire for the part of the risk accepted Retention: The amount of a risk which the insurer does not reinsure but keeps for own account Retrocessionaire: Company which accepts risks by way of retrocession Treaty reinsurance (also obligatory reinsurance): Reinsurance in which the reinsurer participates in certain sections of the insurers business as agreed by treaty. Contrast with facultative reinsurance. Financial reinsurance: Form of reinsurance treaty with reduced transfer of risk and special consideration of the insurers specific accounting features. Non-proportional reinsurance (excess of loss reinsurance): Form of reinsurance in which the reinsurer assumes the part of the insurers claims that exceed a certain amount, against payment of a specially calculated premium. Proportional reinsurance: Forms of reinsurance in which the premium as well as the losses are shared between the primary insurer and reinsurer in the agreed proportions. Quota share reinsurance: Form of reinsurance where reinsurer assumes an agreed-upon, fixed quota (percentage) of all the insurance policies written by a direct insurer within the particular branch or branches defined in the treaty. Surplus reinsurance: Form of reinsurance in which the reinsurer will accept the surplus i.e the amount that exceeds the direct insurers retention.

Knowledge Series REINSURANCE Copyright: P. Santosh

18

Вам также может понравиться

- Demonetisation and AdvertisingДокумент68 страницDemonetisation and AdvertisinghelloОценок пока нет

- Lembar Kerja Jurnal Pt. Anindya JayaДокумент18 страницLembar Kerja Jurnal Pt. Anindya JayaNadyaОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- Finon - Week6 - Banking SystemДокумент30 страницFinon - Week6 - Banking SystemivanОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- ACT15 Intermediate Accounting 1 Pre-Final Quiz ReviewДокумент9 страницACT15 Intermediate Accounting 1 Pre-Final Quiz ReviewJan MarcosОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Top 10 Indian Equity Diversified Mutual FundsДокумент18 страницTop 10 Indian Equity Diversified Mutual FundsShashwat ShrivastavaОценок пока нет

- Wipro Consolidated Balance SheetДокумент2 страницыWipro Consolidated Balance SheetKarthik KarthikОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Ac 1104 - Partnership LiquidationДокумент46 страницAc 1104 - Partnership LiquidationNarikoОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Revised Miles CMA RoadmapДокумент24 страницыRevised Miles CMA RoadmapAsad MahmoodОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Lecture 2 - FMДокумент37 страницLecture 2 - FMJack JackОценок пока нет

- Ethiopian Financial Institution and Capital Market: Term PaperДокумент23 страницыEthiopian Financial Institution and Capital Market: Term Paperhabtamu0% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Payout Request FormДокумент2 страницыPayout Request FormKANGSA banikОценок пока нет

- GO2 BankДокумент1 страницаGO2 Bank邱建华Оценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Bajaj Allianz Life InsuranceДокумент1 страницаBajaj Allianz Life InsuranceMirzaОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- 16 BPI V LaingoДокумент2 страницы16 BPI V LaingoKim CajucomОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Construction Company Audit StrategyДокумент2 страницыConstruction Company Audit Strategynicole bancoroОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Overage Vessel Approval FormДокумент2 страницыOverage Vessel Approval Formgp_shortnsweetОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Functions of Banking Sectors in Bangladesh.Документ2 страницыFunctions of Banking Sectors in Bangladesh.Omar FarukОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- MC4 Matcha Creations: (For Instructor Use Only)Документ2 страницыMC4 Matcha Creations: (For Instructor Use Only)Reza eka PutraОценок пока нет

- Egyptian International Pharmaceutical Industries Company (EIPICO)Документ1 страницаEgyptian International Pharmaceutical Industries Company (EIPICO)yasser massryОценок пока нет

- District Court of Record Adams County, Colorado: PartiesДокумент13 страницDistrict Court of Record Adams County, Colorado: PartiesBanОценок пока нет

- Mojaloop AssessmentДокумент15 страницMojaloop AssessmentJeoffrey LimОценок пока нет

- PRДокумент26 страницPRAayush ShrivastavОценок пока нет

- Ac20 Quiz 1 - DGCДокумент10 страницAc20 Quiz 1 - DGCMaricar PinedaОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Unit 1: An Overview of AuditingДокумент12 страницUnit 1: An Overview of AuditingYonasОценок пока нет

- Optimise capital and reduce risk with 30+ years of structured reinsuranceДокумент2 страницыOptimise capital and reduce risk with 30+ years of structured reinsuranceManuela ZahariaОценок пока нет

- Financial Sector Development in AfricaДокумент254 страницыFinancial Sector Development in AfricadonoegОценок пока нет

- Important Yt LinksДокумент3 страницыImportant Yt Linksrosesingh00610Оценок пока нет

- Section BДокумент56 страницSection BForeclosure Fraud100% (1)

- Insurance - A Brief Overview: Chapter-1Документ58 страницInsurance - A Brief Overview: Chapter-1Sreeja Sahadevan75% (4)

- Linda Monkland Established Monkland LTD in Mid 2013 As The SoleДокумент1 страницаLinda Monkland Established Monkland LTD in Mid 2013 As The SoleHassan JanОценок пока нет