Академический Документы

Профессиональный Документы

Культура Документы

Slowdown

Загружено:

Manjunath PrasadИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Slowdown

Загружено:

Manjunath PrasadАвторское право:

Доступные форматы

China slowdown may lead to 75% dip in commodities

BLOOMBERG London, 4 June

last month, exceeding the governments full-year target of 4 per cent.

A SUDDEN slowdown in China may lead commodity prices to fall as much as 75 per cent from current levels, Standard & Poors said. Unexpected shifts in government policies or problems in the banking sector may trigger such a slowdown, S&P said in a report e-mailed today. The floor for aluminum is 65 cents to 70 cents a pound ($1,433 to $1,543 a metric ton), compared with about $1.20 a pound now and coppers floor is $1.50 to $1.75 a pound, compared with $4.10 a pound currently, S&P said. Given the extent to which China has bolstered commodity prices, thats something that we have to be concerned about, S&P analyst Scott Sprinzen said by telephone from New York. The efforts by the government in China to slow growth are having an effect on commodity prices. Its been a pretty modest correction so far. The Standard & Poors GSCI index of 24 commodities dropped 6.8 per cent last month, the first decline since August, as accelerating inflation in China fanned speculation growth will slow. Chinas central bank has raised benchmark interest rates four times and boosted lenders reserverequirement ratios by three percentage points since September. The central bank may raise rates ahead of a public holiday on June 6 because consumer prices are expected to rise to a new high in May, the Shanghai Daily said May 31, citing UBS AG. Inflation rose 5.3 per cent

MODERATING GROWTH

Chinas gross domestic product may grow 9.5 per cent this year, down from 10.3 per cent in 2010, according to a median of 11 analyst estimates compiled by Bloomberg. Under S&Ps base- case scenario, Chinas economic growth will moderate, while private consumption will remain strong, according to the report. The current situation isnt a bubble and its not going to burst, but there is a risk, Sprinzen said. In case of a sudden slowdown in the worlds biggest consumer of commodities, iron ores floor is $85 to $95 a metric ton compared with about $170 now, seaborne coking coal at the mine has a floor of $100 to $120 a ton, compared with about $180 now, and hot rolled coil steels floor is $475 to $525 a ton compared with about $750 now, according to the report. In considering the downside for metals, we generally assume that the global industry production cost curve would set a pricing floor, Sprinzen wrote. Specifically, we assume that prices are unlikely to fall for an extended period below the level at which 10-20 per cent of world capacity cannot generate positive operating cash flow before investment. Commodities may easily drop 25 to 40 per cent in the next 12 months, presenting an enormous opportunity for investors, David Stroud, chief executive officer of TS Capital, a hedge fund manager in New York, said in an e-mail.

Вам также может понравиться

- 021SAACK Burner Operating Instructions PDFДокумент136 страниц021SAACK Burner Operating Instructions PDFmekidmu tadesse100% (1)

- Daily Report 20150112Документ3 страницыDaily Report 20150112Joseph DavidsonОценок пока нет

- Energy & Commodities - October 16, 2012Документ4 страницыEnergy & Commodities - October 16, 2012Swedbank AB (publ)Оценок пока нет

- Will It Really Fall Further or It Will Bounce Back?Документ13 страницWill It Really Fall Further or It Will Bounce Back?shalmaОценок пока нет

- Energy & Commodities - November 16, 2012Документ4 страницыEnergy & Commodities - November 16, 2012Swedbank AB (publ)Оценок пока нет

- Global Steel Demand Poised To Grow Along With GDPДокумент8 страницGlobal Steel Demand Poised To Grow Along With GDPmarija kОценок пока нет

- Tracking Copper - Glass Half Full?: Global Macro ResearchДокумент3 страницыTracking Copper - Glass Half Full?: Global Macro ResearcheliforuОценок пока нет

- Commodities and Energy SepДокумент6 страницCommodities and Energy SepSwedbank AB (publ)Оценок пока нет

- HSBC Steel Weekly: Price Rise Expectations Amidst Subdued ConsumptionДокумент14 страницHSBC Steel Weekly: Price Rise Expectations Amidst Subdued Consumptionbillcarson001Оценок пока нет

- Australia To Benefit From China Ties For Some Time Yet: Economic Research NoteДокумент2 страницыAustralia To Benefit From China Ties For Some Time Yet: Economic Research Notealan_s1Оценок пока нет

- Energy & Commodities - December 18, 2012Документ4 страницыEnergy & Commodities - December 18, 2012Swedbank AB (publ)Оценок пока нет

- The Article Identifies Five Factors Affecting The World Demand For Gold. List at Least Two of ThemДокумент4 страницыThe Article Identifies Five Factors Affecting The World Demand For Gold. List at Least Two of ThemAmit JindalОценок пока нет

- JP Morgan - North America Metals & MiningДокумент17 страницJP Morgan - North America Metals & MiningPT Ujatek BaruОценок пока нет

- Commodities and EnergyДокумент5 страницCommodities and EnergySwedbank AB (publ)Оценок пока нет

- Minerals and Metal Review August 2012 - 4Документ20 страницMinerals and Metal Review August 2012 - 4Sundaravaradhan IyengarОценок пока нет

- Silver Is Also at The Mercy of Stocks. Wave of Buying Own SilverДокумент8 страницSilver Is Also at The Mercy of Stocks. Wave of Buying Own SilverAbhi BansalОценок пока нет

- Base Metals Continue Selling Rout on Weak Demand FearsДокумент6 страницBase Metals Continue Selling Rout on Weak Demand FearsluckydhruvОценок пока нет

- Iron Ore PrimerДокумент301 страницаIron Ore Primeruser121821100% (1)

- A Primer at The PumpДокумент8 страницA Primer at The PumpKumar Gaurab JhaОценок пока нет

- Commodities and Energy, January 2014Документ4 страницыCommodities and Energy, January 2014Swedbank AB (publ)Оценок пока нет

- Weekly OverviewДокумент4 страницыWeekly Overviewapi-150779697Оценок пока нет

- Sprott On Oil and Gold Where Do We Go From HereДокумент12 страницSprott On Oil and Gold Where Do We Go From HereCanadianValueОценок пока нет

- China's August Inflation Eases As Economy RecoversДокумент2 страницыChina's August Inflation Eases As Economy RecoversDzz Zeet OonnОценок пока нет

- Oil, coal, iron ore prices at financial crisis lows signal global economic weaknessДокумент2 страницыOil, coal, iron ore prices at financial crisis lows signal global economic weaknessRohan MalusareОценок пока нет

- Weekly OverviewДокумент4 страницыWeekly Overviewapi-150779697Оценок пока нет

- The Volatility of Commodity Prices PDFДокумент6 страницThe Volatility of Commodity Prices PDFNishatОценок пока нет

- US warns China on steel overcapacityДокумент2 страницыUS warns China on steel overcapacityFlavio Sanchez GuerreroОценок пока нет

- 20150210-Wallstreet Journal Europe PDFДокумент28 страниц20150210-Wallstreet Journal Europe PDFframar572112Оценок пока нет

- METALS-Aluminium Hits 13-Year Peak On China and Guinea Supply Fears - Reuters NewsДокумент3 страницыMETALS-Aluminium Hits 13-Year Peak On China and Guinea Supply Fears - Reuters NewsLucas JangОценок пока нет

- Base Metals Update December 2012Документ9 страницBase Metals Update December 2012Angel BrokingОценок пока нет

- Energy & Commodities - February 14, 2013Документ4 страницыEnergy & Commodities - February 14, 2013Swedbank AB (publ)Оценок пока нет

- Demand and Supply of Certain Resources in Australia and Factors Other Than Price Which Affect Demand and SupplyДокумент6 страницDemand and Supply of Certain Resources in Australia and Factors Other Than Price Which Affect Demand and Supplyfatemah zahidОценок пока нет

- MM AnnualReport10092016 PDFДокумент20 страницMM AnnualReport10092016 PDFsalmaniОценок пока нет

- 8633 - International Cost Construction Report FINAL2Документ9 страниц8633 - International Cost Construction Report FINAL2shabina921Оценок пока нет

- International Financial ManagementДокумент17 страницInternational Financial ManagementRahil AndleebОценок пока нет

- Global Investor: Highlights of The International Arena: Executive SummaryДокумент7 страницGlobal Investor: Highlights of The International Arena: Executive SummarySulakshana De AlwisОценок пока нет

- Sucden Financial Quarterly Report April 2015Документ33 страницыSucden Financial Quarterly Report April 2015ronak2484bhavsarОценок пока нет

- Ranges (Up Till 11.40am HKT) : Currency CurrencyДокумент4 страницыRanges (Up Till 11.40am HKT) : Currency Currencyapi-290371470Оценок пока нет

- Commodities and EnergyДокумент5 страницCommodities and EnergySwedbank AB (publ)Оценок пока нет

- Morning News Notes:2010-09-28Документ2 страницыMorning News Notes:2010-09-28glerner133926Оценок пока нет

- Sample 1 SNAPSHOT-Vietnam Dong, Gold and Interbank Rates-Oct 1-0243 GMTДокумент5 страницSample 1 SNAPSHOT-Vietnam Dong, Gold and Interbank Rates-Oct 1-0243 GMTkedarkОценок пока нет

- Untitled DocumentДокумент6 страницUntitled DocumentTANVI ARORAОценок пока нет

- Weekly OverviewДокумент3 страницыWeekly Overviewapi-150779697Оценок пока нет

- Copper Drops To 9 Month Low Level On Europe Concerns: Commodities-Copper, Crude Oil Lead Commodities LowerДокумент4 страницыCopper Drops To 9 Month Low Level On Europe Concerns: Commodities-Copper, Crude Oil Lead Commodities LowerNityanand GopalikaОценок пока нет

- Weekly Commodity Review - 7 - 11 May 2012Документ1 страницаWeekly Commodity Review - 7 - 11 May 2012gordjuОценок пока нет

- Chapter 1 Industry Profile - 1.1 Global Overview PDFДокумент4 страницыChapter 1 Industry Profile - 1.1 Global Overview PDFbabidqnОценок пока нет

- Business Environment: Stewart & Mackertich I The Steel ReportДокумент7 страницBusiness Environment: Stewart & Mackertich I The Steel Reportvicky.sajnaniОценок пока нет

- Commodities Daily: US Natural Gas Price Climbs To 2 - Year HighДокумент6 страницCommodities Daily: US Natural Gas Price Climbs To 2 - Year HighScoobydo1001Оценок пока нет

- BAM101 Business News ResearchДокумент15 страницBAM101 Business News ResearchMohammad Hammoudeh100% (1)

- NB DK 06169168Документ4 страницыNB DK 06169168Nuklir Energi Massa DepanОценок пока нет

- Morning News Notes:2010-11-11Документ1 страницаMorning News Notes:2010-11-11glerner133926Оценок пока нет

- China Sneezes and World Catches C... 4 Min Read. Updated: May 29 2021, 12:00 AmДокумент4 страницыChina Sneezes and World Catches C... 4 Min Read. Updated: May 29 2021, 12:00 AmAmit SharmaОценок пока нет

- Natural Gas/ Power News: Shale's Bounty Goes Beyond Oil and GasДокумент10 страницNatural Gas/ Power News: Shale's Bounty Goes Beyond Oil and GaschoiceenergyОценок пока нет

- Minerals and Metal Review July 2012 - 2Документ20 страницMinerals and Metal Review July 2012 - 2Sundaravaradhan IyengarОценок пока нет

- Market OutlookДокумент12 страницMarket Outlookwaseem1986Оценок пока нет

- The Global Crash of 2015 and What You Can Do to Protect YourselfОт EverandThe Global Crash of 2015 and What You Can Do to Protect YourselfОценок пока нет

- The Economist Guide to Commodities 2nd edition: Producers, players and prices; markets, consumers and trendsОт EverandThe Economist Guide to Commodities 2nd edition: Producers, players and prices; markets, consumers and trendsРейтинг: 3 из 5 звезд3/5 (1)

- How to Invest in Gold: A guide to making money (or securing wealth) by buying and selling goldОт EverandHow to Invest in Gold: A guide to making money (or securing wealth) by buying and selling goldРейтинг: 3 из 5 звезд3/5 (1)

- PepperДокумент2 страницыPepperManjunath PrasadОценок пока нет

- Pulses Monthly Overview by NCDEX - May 2011Документ5 страницPulses Monthly Overview by NCDEX - May 2011Manjunath PrasadОценок пока нет

- Steel ProductionДокумент1 страницаSteel ProductionManjunath PrasadОценок пока нет

- Basic StatisticsДокумент1 страницаBasic StatisticsManjunath PrasadОценок пока нет

- Photography TipsДокумент53 страницыPhotography TipsManjunath PrasadОценок пока нет

- Srimad Bhagvad GitaДокумент1 129 страницSrimad Bhagvad GitaCentre for Traditional Education100% (1)

- (Hand Yoga) : (Details Collected From Internet)Документ11 страниц(Hand Yoga) : (Details Collected From Internet)Manjunath Prasad100% (2)

- Bayesian RevisionДокумент5 страницBayesian RevisionManjunath PrasadОценок пока нет

- Base Metals Sluggish on Greek Debt CrisisДокумент2 страницыBase Metals Sluggish on Greek Debt CrisisManjunath PrasadОценок пока нет

- Recent Advances in Active Metal Brazing of Ceramics and Process-S12540-019-00536-4Документ12 страницRecent Advances in Active Metal Brazing of Ceramics and Process-S12540-019-00536-4sebjangОценок пока нет

- Mercury QCДокумент23 страницыMercury QCMarcus MeyerОценок пока нет

- Twitch V CruzzControl CreatineOverdoseДокумент19 страницTwitch V CruzzControl CreatineOverdoseAndy ChalkОценок пока нет

- Farm mechanization subsidy applications invitedДокумент2 страницыFarm mechanization subsidy applications inviteddraqbhattiОценок пока нет

- 7 Equity Futures and Delta OneДокумент65 страниц7 Equity Futures and Delta OneBarry HeОценок пока нет

- Arcelor Mittal - Bridges PDFДокумент52 страницыArcelor Mittal - Bridges PDFShamaОценок пока нет

- Heads of Departments - 13102021Документ2 страницыHeads of Departments - 13102021Indian LawyerОценок пока нет

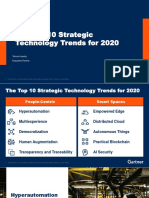

- The Top 10 Strategic Technology Trends For 2020: Tomas Huseby Executive PartnerДокумент31 страницаThe Top 10 Strategic Technology Trends For 2020: Tomas Huseby Executive PartnerCarlos Stuars Echeandia CastilloОценок пока нет

- KG ResearchДокумент257 страницKG ResearchMuhammad HusseinОценок пока нет

- LДокумент32 страницыLDenОценок пока нет

- Past Paper Booklet - QPДокумент506 страницPast Paper Booklet - QPMukeshОценок пока нет

- Veolia Moray Outfalls Repair WorksДокумент8 страницVeolia Moray Outfalls Repair WorksGalih PutraОценок пока нет

- Indra: Detail Pre-Commissioning Procedure For Service Test of Service Water For Unit 040/041/042/043Документ28 страницIndra: Detail Pre-Commissioning Procedure For Service Test of Service Water For Unit 040/041/042/043AnhTuấnPhanОценок пока нет

- 2019 ASME Section V ChangesДокумент61 страница2019 ASME Section V Changesmanisami7036100% (4)

- Module 2 What It Means To Be AI FirstДокумент85 страницModule 2 What It Means To Be AI FirstSantiago Ariel Bustos YagueОценок пока нет

- Project On International BusinessДокумент18 страницProject On International BusinessAmrita Bharaj100% (1)

- Bosch Committed to Outsourcing to Boost CompetitivenessДокумент4 страницыBosch Committed to Outsourcing to Boost CompetitivenessPriya DubeyОценок пока нет

- Lte Numbering and AddressingДокумент3 страницыLte Numbering and AddressingRoderick OchiОценок пока нет

- Windows Keyboard Shortcuts OverviewДокумент3 страницыWindows Keyboard Shortcuts OverviewShaik Arif100% (1)

- Describing An Object - PPTДокумент17 страницDescribing An Object - PPThanzqanif azqaОценок пока нет

- Table of Contents and Executive SummaryДокумент38 страницTable of Contents and Executive SummarySourav Ojha0% (1)

- Product Data: T T 13 SEER Single - Packaged Heat Pump R (R - 410A) RefrigerantДокумент36 страницProduct Data: T T 13 SEER Single - Packaged Heat Pump R (R - 410A) RefrigerantJesus CantuОценок пока нет

- Assessment (L4) : Case Analysis: Managerial EconomicsДокумент4 страницыAssessment (L4) : Case Analysis: Managerial EconomicsRocel DomingoОценок пока нет

- Amma dedicates 'Green Year' to environmental protection effortsДокумент22 страницыAmma dedicates 'Green Year' to environmental protection effortsOlivia WilliamsОценок пока нет

- Module 7 - Assessment of Learning 1 CoursepackДокумент7 страницModule 7 - Assessment of Learning 1 CoursepackZel FerrelОценок пока нет

- Design Your Loyalty Program in 2 WeeksДокумент53 страницыDesign Your Loyalty Program in 2 WeeksLorena TacuryОценок пока нет

- FRABA - Absolute - Encoder / PLC - 1 (CPU 314C-2 PN/DP) / Program BlocksДокумент3 страницыFRABA - Absolute - Encoder / PLC - 1 (CPU 314C-2 PN/DP) / Program BlocksAhmed YacoubОценок пока нет

- Solidwork Flow Simulation TutorialДокумент298 страницSolidwork Flow Simulation TutorialMilad Ah100% (8)

- Alpha Phi Omega National Service Fraternity Strategic PlanДокумент1 страницаAlpha Phi Omega National Service Fraternity Strategic Planlafay3tteОценок пока нет