Академический Документы

Профессиональный Документы

Культура Документы

Forex Asgmnt

Загружено:

annie4321Исходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Forex Asgmnt

Загружено:

annie4321Авторское право:

Доступные форматы

Forex

Life is a roller coaster ride and is full of twists and turns. You cannot take anything for granted in life. Insurance policies are a safeguard against the uncertainties of life. Insurance is system by which the losses suffered by a few are spread over many, exposed to similar risks. Insurance is a protection against financial loss arising on the happening of an unexpected event. Insurance policy helps in not only mitigating risks but also provides a financial cushion against adverse financial burdens suffered. What Is Insurance? Insurance is a contract between two parties, the insurer or the insurance company, and the insured, the person seeking the cover. Within this contract, the insurer agrees to pay the insurer for financial losses arising out of any unforeseen events or risk in return for a regular payment of premium. Thus, these insurance plans are also called as a Risk Cover Plans, which means to financially compensate for losses that occur uncertainly through accident, illness, theft, natural disaster. As you can not fight against these man-made and natural calamities, so at least be prepared for them and their aftermath by taking insurance policies. Insurance Kind of Investment Insurance is an attractive option for investment but most people are not aware of its advantages as an investment option. Remember that first and foremost, insurance is about risk cover and protection. By buying life insurance, you buy peace of mind. Insurance also serves as an excellent tax saving mechanism. The Government of India has offered tax incentives to life insurance products in order to facilitate the flow of funds into productive assets. Types of Insurance Insurance policies cover the risk of life as well as other assets and valuables, such as, home, automobiles, jewelry et al. On the basis of the risk they cover, insurance policies can be classified into two categories: Life Insurance and General Insurance. As the term suggests, Life Insurance covers the risk involved in a person's life, while General Insurance provides financial protection against unforeseen events, like accident, flood, earthquake, disease, etc. Insurance Regulatory & Development Authority Insurance Regulatory & Development Authority is regulatory and development authority under Government of India in order to protect the interests of the policyholders and to regulate, promote and ensure orderly growth of the insurance industry.

Insurance

Services

Insurance is system by which the losses suffered by a few are spread over many, exposed to similar risks. Insurance is a protection against financial loss arising on the happening of an unexpected event. Insurance policy helps in not only mitigating risks but also provides a financial cushion against adverse financial burdens suffered. Insurance policies cover the risk of life as well as other assets and valuables such as home, automobiles, jewelery. The functions of Insurance can be bifurcated into two parts:

y y y

Primary Functions Secondary Functions Other Functions

Primary Functions

Provide Protection:The primary function of insurance is to provide protection against future risk, accidents and uncertainty. Insurance cannot check the happening of the risk, but can certainly provide for the losses of risk. Insurance is actually a protection against economic loss, by sharing the risk with others. Collective Bearing of Risk:Insurance is a device to share the financial loss of few among many others. Insurance is a mean by which few losses are shared among larger number of people. All the insured contribute the premiums towards a fund and out of which the persons exposed to a particular risk is paid. Assessment of Risk:Insurance determines the probable volume of risk by evaluating various factors that give rise to risk. Risk is the basis for determining the premium rate also Provide Certainty:Insurance is a device, which helps to change from uncertainty to certainty. Insurance is device whereby the uncertain risks may be made more certain.

Secondary Functions

y y

Prevention of Losses:Insurance cautions individuals and businessmen to adopt suitable device to prevent unfortunate consequences of risk by observing safety instructions; installation of automatic sparkler or alarm systems, etc. Prevention of losses cause lesser payment to the assured by the insurer and this will encourage for more savings by way of premium. Reduced rate of premiums stimulate for more business and better protection to the insured. Small Capital to cover Larger Risks:Insurance relieves the businessmen from security investments, by paying small amount of premium against larger risks and uncertainty. Contributes towards the Development of Larger Industries:Insurance provides development opportunity to those larger industries having more risks in their setting up. Even the financial institutions may be prepared to give credit to sick industrial units which have insured their assets including plant and machinery.

Other Functions

Means of Savings and Investment:Insurance serves as savings and investment, insurance is a compulsory way of savings and it restricts the unnecessary expenses by the insured's For the purpose of availing income-tax exemptions also, people invest in insurance. Source of Earning Foreign Exchange:Insurance is an international business. The country can earn foreign exchange by way of issue of marine insurance policies and various other ways. Risk Free Trade:Insurance promotes exports insurance, which makes the foreign trade risk free with the help of different types of policies under marine insurance cover.

Brief History Of Insurance Sector In India The insurance sector in India has come a full circle from being an open competitive market to nationalization and back to a liberalized market again.Tracing the developments in the Indian insurance sector reveals the 360-degree turn witnessed over a period of almost 190 years.The business of life insurance in India in its existing form started in India in the year 1818 with the establishment of the Oriental Life Insurance Company in Calcutta. Milestone of Life Insurance in India

y y

1912:The Indian Life Assurance Companies Act enacted as the first statute to regulate the life insurance business. 1928:The Indian Insurance Companies Act enacted to enable the government to collect statistical information about both life and non-life insurance businesses.

y y

1938:Earlier legislation consolidated and amended to by the Insurance Act with the objective of protecting the interests of the insuring public. 1956:245 Indian and foreign insurers and provident societies taken over by the central government and nationalized. LIC formed by an Act of Parliament, viz. LIC Act, 1956, with a capital contribution of Rs. 5 crore from the Government of India.

The General insurance business in India, on the other hand, can trace its roots to the Triton Insurance Company Ltd., the first general insurance company established in the year 1850 in Calcutta by the British. Some of the important milestones in the general insurance business in India are:

y y y y

1907 - The Indian Mercantile Insurance Ltd. set up, the first company to transact all classes of general insurance business. 1957 - General Insurance Council, a wing of the Insurance Association of India, frames a code of conduct for ensuring fair conduct and sound business practices. 1968 - The Insurance Act amended to regulate investments and set minimum solvency margins and the Tariff Advisory Committee set up. 1972 - The General Insurance Business (Nationalization) Act, 1972 nationalized the general insurance business in India with effect from 1st January 1973.

107 insurers amalgamated and grouped into four companies viz. the National Insurance Company Ltd., the New India Assurance Company Ltd., the Oriental Insurance Company Ltd. and the United India Insurance Company Ltd. GIC incorporated as a company. On the basis of the risk they cover, insurance policies can be classified into two categories:

y y

Life Insurance Policies General Insurance Policies

Life Insurance, India Life is very fragile and death is a certainty. We cannot control the uncertainties of life. But, we can cover the risks surrounding us. Life insurance, simply put, is the cover for the risks that we run during our lives. It protects us from the contingencies that could affect us. Life insurance is not for the person who passes away, it for those who survive. It is the responsibility of every bread earner to guard against the events that could affect the family in the unfortunate circumstance of his / her demise. Thus, having a life insurance policy is very vital. Before going for a life insurance policy it is imperative that you know about various types of life insurance policies. Major among them are:

y y y y y y y y y

Endowment Policy Whole Life Policy Term Life Policy Money-back Policy Joint Life Policy Group Insurance Policy Loan Cover Term Assurance Policy Pension Plan or Annuities Unit Linked Insurance Plan

General Insurance, India General Insurance provides much-needed protection against unforeseen events such as accidents, illness, fire, burglary et al. Unlike Life Insurance, General Insurance is not meant to

offer returns but is a protection against contingencies. Almost everything that has a financial value in life and has a probability of getting lost, stolen or damaged, can be covered through General Insurance policy. Property (both movable and immovable), vehicle, cash, household goods, health, dishonesty and also one's liability towards others can be covered under general insurance policy. Under certain Acts of Parliament, some types of insurance like Motor Insurance and Public Liability Insurance have been made compulsory. Major insurance policies that are covered under General Insurance are:

y y y y

Home Insurance Health Insurance Motor Insurance Travel Insurance

Insurance Companies in India Before insurance sector was opened to the private sector Life Insurance Corporation (LIC) was the only insurance company in India. After the opening up of Insurance sector in India there has been a glut of insurance companies in India. These companies have come up with innovative and flexible insutrance policies to cater to varying needs of the individual. Opening up of the Insurance sector has also forced the Lic to tighten up its belt and deliver better service. All in all it has been a bonanza for the consumer. Major Life Insurance Companies

y y y y y y y y y y y y y y

Aviva Life Insurance Bajaj Allianz Birla S un Life Insurance HDFC Standard Life Insurance ICICI Prudential ING Vysya Kotak Mahindra LIC Max New York Life Insurance Metlife India Insurance Reliance Life Insurance SBI Life Insurance Shriram Life Insurance Tata AIG Life Insurance

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Service MRKTG 03Документ17 страницService MRKTG 03annie4321Оценок пока нет

- Service MRKTG 03Документ17 страницService MRKTG 03annie4321Оценок пока нет

- Plant Location Factors & TypesДокумент40 страницPlant Location Factors & Typesannie4321Оценок пока нет

- Globalisation in Indian EconomyДокумент6 страницGlobalisation in Indian Economyannie4321Оценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Tutorial - The Time Value of MoneyДокумент6 страницTutorial - The Time Value of MoneyFahmi CAОценок пока нет

- Performance Appraisal System of AB Bank LTDДокумент67 страницPerformance Appraisal System of AB Bank LTDMahmud Abdullah100% (1)

- Plastene India Ltd.Документ326 страницPlastene India Ltd.Ganesh100% (1)

- Basic Sales TrainingДокумент36 страницBasic Sales TrainingManraj Singh100% (1)

- Export Finance: Presented By: Tamanna M.FTECH 2010-12 NIFT, GandhinagarДокумент19 страницExport Finance: Presented By: Tamanna M.FTECH 2010-12 NIFT, Gandhinagartamanna88Оценок пока нет

- CashBook (SEM2)Документ4 страницыCashBook (SEM2)Xavier University- Economics SocietyОценок пока нет

- June 14 PDFДокумент4 страницыJune 14 PDFSusan Romdenne100% (1)

- World Retail Banking Report 2020 PDFДокумент36 страницWorld Retail Banking Report 2020 PDFBui Hoang Giang100% (1)

- Running Errands #2: Lesson 16Документ14 страницRunning Errands #2: Lesson 16Camila ReyesОценок пока нет

- Implied Authority of A Partner: A Comparative Study: Assistant Professor of LawДокумент20 страницImplied Authority of A Partner: A Comparative Study: Assistant Professor of LawHimanshuОценок пока нет

- Diamond Bank: Makes A Success Story ofДокумент36 страницDiamond Bank: Makes A Success Story ofGaurav Shashi SaxenaОценок пока нет

- High Sea Sales Agreement FormatДокумент2 страницыHigh Sea Sales Agreement FormatMradul Bansal43% (7)

- R DJVFuh 3 Ri LB 7 Ep RДокумент13 страницR DJVFuh 3 Ri LB 7 Ep RKondayya JuttigaОценок пока нет

- IcotermsДокумент3 страницыIcotermsMiguel Estrada DíazОценок пока нет

- 21.) UCPB V Samuel and BelusoДокумент2 страницы21.) UCPB V Samuel and BelusojoyceОценок пока нет

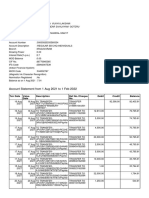

- Statement of Axis Account No:919010012738847 For The Period (From: 08-09-2020 To: 07-09-2021)Документ2 страницыStatement of Axis Account No:919010012738847 For The Period (From: 08-09-2020 To: 07-09-2021)Sayan SarkarОценок пока нет

- Transforming Rural YouthДокумент340 страницTransforming Rural Youthudi9690% (2)

- Maphar Constructions Private LimitedДокумент2 страницыMaphar Constructions Private LimitedSWARUPAОценок пока нет

- Sumit Black BookДокумент51 страницаSumit Black BookSuraj BenbansiОценок пока нет

- Resume-Sherry ThayerДокумент2 страницыResume-Sherry Thayerapi-315331717Оценок пока нет

- Proof of Cash: Intermediate Accounting Part 1Документ1 страницаProof of Cash: Intermediate Accounting Part 1Steffanie Olivar0% (1)

- Insurance Law-ContributionДокумент5 страницInsurance Law-ContributionDavid FongОценок пока нет

- CEO Analysis of Cherat Cement CompanyДокумент30 страницCEO Analysis of Cherat Cement Companyfaisal aminОценок пока нет

- Performance of Mutual FundsДокумент79 страницPerformance of Mutual FundsSrujan KadarlaОценок пока нет

- Phil Guaranty v. CIR DigestsДокумент2 страницыPhil Guaranty v. CIR Digestspinkblush717100% (1)

- VW Approved Used Cover BookletДокумент18 страницVW Approved Used Cover BookletagathianОценок пока нет

- 05DEC2023Документ4 страницы05DEC2023Fakruul HaZminОценок пока нет

- EB Rainer wl11 IIS3 WM PDFДокумент580 страницEB Rainer wl11 IIS3 WM PDFran_chanОценок пока нет

- Isa 805Документ13 страницIsa 805baabasaamОценок пока нет

- Suite Talk Web Services Records GuideДокумент194 страницыSuite Talk Web Services Records GuideZettoX0% (1)