Академический Документы

Профессиональный Документы

Культура Документы

Gross Total Income (1+2c) 4: System Calculated

Загружено:

DHARAMSONIОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Gross Total Income (1+2c) 4: System Calculated

Загружено:

DHARAMSONIАвторское право:

Доступные форматы

SAHAJ

FORM

INDIAN INCOME TAX RETURN

[For Individuals having Income from Salary / Pension / Income from One House Property (excluding loss brought forward from previous years) / Income from Other Sources (Excluding Winning from Lottery and Income from Race Horses)]

ITR-1

Assessment Year Year

(Please see rule 12 of the Income-tax Rules,1962) (Also see attached instructions)

2011-12

PAN AADPS8844B

PERSONAL INFORMATION

First Name PRANAV Flat / Door / Building 20/22 NUSSER HOUSE

Middle Name Last Name HARKISHANDAS SONI Status

I - Individual Area / Locallity OPERA HOUSE State 19-MAHARASHTRA Pin Code 400004 Date of birth (DD/MM/YYYY) 09/09/1972 Sex (Select) M-Male

Road / Street MAMA PARMANAND MARG Town/City/District MUMBAI Email Address soni.ph@gmail.com Income Tax Ward / Circle WARD 16(3) (1) Whether original or revised return?

FILING STATUS

Mobile no (Std code) Phone No Employer Category (if in 9892250097 022 23677510 employment) OTH Return filed under section [Pl see Form Instruction] 11 - u/s 139(1) O-Original Date 1 2 3 4 104,000 959 92,299

If revised, enter Receipt no / Date Residential Status RES - Resident 1 Income from Salary / Pension (Ensure to fill Sch TDS1) Income from one House Property 2 3 Income from Other Sources (Ensure to fill Sch TDS2)

4 Gross Total Income (1+2c) 5 Deductions under Chapter VI A (Section) a 80 C 5a b 80 CCC 5b c 80 CCD 5c d 80 CCF 5d e 80 D 5e f 80 DD 5f g 80 DDB 5g h 80 E 5h i 80 G 5i j 80 GG 5j k 80 GGA 5k l 80 GGC 5l m 80 U 5m 6 Deductions (Total of 5a to 5m) 6 7 Total Income (4 - 6) 8 Tax payable on Total Income 9 Education Cess, including secondary and higher secondary cess on 8 10 Total Tax, Surcharge and Education Cess (Payable) (8 + 9) 11 Relief under Section 89 11 12 Relief under Section 90/91 12 13 Balance Tax Payable (10 - 11 - 12) 14 Total Interest Payable 15 Total Tax and Interest Payable (13 + 14) For Office Use Only Receipt No/ Date

60,990

15,000

0 0

75,990

TAX COMPUTATION

197,258 System Calculated 60,990 0 0 0 15,000 0 0 0 0 0 0 0 0 6 75,990 7 121,268 8 0 9 0 10 0

INCOME & DEDUCTIONS

0 0 13 14 15 Seal and Signature of Receiving Official 0 0 0

23 Details of Tax Deducted at Source from Salary [As per Form 16 issued by Employer(s)] SI.No (1) 1 2 3 Tax Deduction Account Number (TAN) of the Employer (2) Name of the Employer (3) Income charg eable under the head Salaries (4) Total tax Deducted (5)

(Click + to add more rows to 23) TDS on Salary above. Do not delete blank rows. ) 24 Details of Tax Deducted at Source Other than Salary Tax Deduction Account Number (TAN) of the Deductor (2) Name of the Deductor (3) Total tax Deducted (4) Amount out of (6) claimed for this year (5)

SI.No

(1) 1 2 3 4

(Click + to add more rows ) TDS other than Salary above. Do not delete blank rows. )

25 Sl No 1 2 3 4 5 6

Details of Advance Tax and Self Assessment Tax Payments Date of Deposit (DD/MM/YYYY) Serial Number of Challan

BSR Code

Amount (Rs)

(Click '+' to add more rows ) Tax Payments. Do not delete blank rows. )

16 Taxes Paid 0 a Advance Tax (from item 25) 16a b TDS (column 7 of item 23 +column 7 16b 0 of item 24) 0 c Self Assessment Tax (item 25) 16c 0 17 Total Taxes Paid (16a+16b+16c) 17 0 18 Tax Payable (15-17) (if 15 is greater than 17) 18 0 19 Refund (17-15) if 17 is greater than 15 19 20 Enter your Bank Account number 04230100007469 (Mandatory ) 21 Select Yes if you want your refund by direct deposit into your bank account, No Select No if you want refund by Cheque 22 In case of direct deposit to your bank account give additional details MICR Code Type of Account(As applicable) 26 Exempt income for reporting purposes only (from Dividends, Agri. income < 5000) VERIFICATION I, (full name in block letters), PRANAV son/daughter of HARKISHAN DAS solemnly declare that to the best of my knowledge and belief, the information given in the return thereto is correct and complete and that the amount of total income and other particulars shown therein are truly stated and are in accordance with the provisions of the Income-tax Act, 1961, in respect of income chargeable to Income-tax for the previous year relevant to the Assessment Year 2011-12 Place REFUND TAXES PAID MUMBAI Date 21/05/2011 Sign here ->

PAN AADPS8844B 27 If the return has been prepared by a Tax Return Preparer (TRP) give further details as below: Identification No of TRP Name of TRP Counter Signature of TRP

28

If TRP is entitled for any reimbursement from the Government, amount thereof (to be filled by TRP)

Вам также может понравиться

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesОт EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesОценок пока нет

- IT Return 2011 2012Документ3 страницыIT Return 2011 2012swapnil6121986Оценок пока нет

- 2011 ITR1 r2Документ3 страницы2011 ITR1 r2Zafar IqbalОценок пока нет

- Sachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Документ3 страницыSachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Sachin KumarОценок пока нет

- Assessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DateДокумент3 страницыAssessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DatethakurrobinОценок пока нет

- Gross Total Income (1+2c) 4: Import Previous VersionДокумент4 страницыGross Total Income (1+2c) 4: Import Previous Versionbalajiv_mailОценок пока нет

- Income TaxДокумент6 страницIncome TaxKuldeep HoodaОценок пока нет

- Assessment Year Indian Income Tax Return SahajДокумент7 страницAssessment Year Indian Income Tax Return SahajallipraОценок пока нет

- 2012 Itr1 Pr21Документ5 страниц2012 Itr1 Pr21MRLogan123Оценок пока нет

- Assessment Year Sahaj Indian Income Tax ReturnДокумент7 страницAssessment Year Sahaj Indian Income Tax Returnrajshri58Оценок пока нет

- ITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamДокумент11 страницITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamcachandhiranОценок пока нет

- Form ITR-1Документ3 страницыForm ITR-1Rajeev PuthuparambilОценок пока нет

- Indian Income Tax Return Assessment Year SahajДокумент7 страницIndian Income Tax Return Assessment Year SahajSubrata BiswasОценок пока нет

- Assessment Year Indian Income Tax Return: I - IndividualДокумент6 страницAssessment Year Indian Income Tax Return: I - IndividualManjunath YvОценок пока нет

- 2015 Itr1 PR3Документ18 страниц2015 Itr1 PR3shubham sharmaОценок пока нет

- Sahaj Individual Income Tax Return Assessment Year 2 0 16 - 1 7Документ22 страницыSahaj Individual Income Tax Return Assessment Year 2 0 16 - 1 7rahul srivastavaОценок пока нет

- ITR Form 1Документ7 страницITR Form 1gj29hereОценок пока нет

- Gross Total Income (1+2+3) 4: System CalculatedДокумент8 страницGross Total Income (1+2+3) 4: System CalculatedShunmuga ThangamОценок пока нет

- 2013 Itr1 PR11Документ9 страниц2013 Itr1 PR11Akshay Kumar SahooОценок пока нет

- Enter Necessary Data For Income Tax CalculationДокумент15 страницEnter Necessary Data For Income Tax Calculationsa_mishraОценок пока нет

- 1701 Bir FormДокумент12 страниц1701 Bir Formbertlaxina0% (1)

- Bir Forms PDFДокумент4 страницыBir Forms PDFgaryОценок пока нет

- Bir Form 1701Документ12 страницBir Form 1701miles1280Оценок пока нет

- 82255BIR Form 1701Документ12 страниц82255BIR Form 1701Leowell John G. RapaconОценок пока нет

- 1702-EX June 2013 Pages 1 To 2 PDFДокумент2 страницы1702-EX June 2013 Pages 1 To 2 PDFJulio Gabriel AseronОценок пока нет

- Improperly Accumulated Earnings Tax Return: Kawanihan NG Rentas Internas For Corporations May 2001 BIR Form NoДокумент6 страницImproperly Accumulated Earnings Tax Return: Kawanihan NG Rentas Internas For Corporations May 2001 BIR Form NofatmaaleahОценок пока нет

- Bir Form 1702-RtДокумент8 страницBir Form 1702-RtShiela PilarОценок пока нет

- Tax Applicable (Tick One) 2 8 1Документ7 страницTax Applicable (Tick One) 2 8 1Gaurav BajajОценок пока нет

- Form 16, Tax Deduction at Source... Income Tax of IndiaДокумент2 страницыForm 16, Tax Deduction at Source... Income Tax of IndiaDrAnilkesar GohilОценок пока нет

- Form 16Документ4 страницыForm 16Aruna Kadge JhaОценок пока нет

- ITR-3 Indian Income Tax Return: Part A-GENДокумент12 страницITR-3 Indian Income Tax Return: Part A-GENmehtakvijayОценок пока нет

- Form2FandInstructions 06062006Документ11 страницForm2FandInstructions 06062006Mnaoj PatelОценок пока нет

- Sahaj Assessment Year Indian Income Tax Return Year: Receipt No/ Date Seal and Signature of Receiving OfficialДокумент10 страницSahaj Assessment Year Indian Income Tax Return Year: Receipt No/ Date Seal and Signature of Receiving OfficialAjit KumarОценок пока нет

- Indian Income Tax Challan Payment of Tds and TCS: Form by FinotaxДокумент2 страницыIndian Income Tax Challan Payment of Tds and TCS: Form by Finotaxbrayan uyОценок пока нет

- Itr-V: Indian Income Tax Return Verification FormДокумент1 страницаItr-V: Indian Income Tax Return Verification Formbha_goОценок пока нет

- 82202BIR Form 1702-MXДокумент9 страниц82202BIR Form 1702-MXRen A EleponioОценок пока нет

- 1601 CДокумент16 страниц1601 CROGELIO QUIAZON100% (1)

- Form 16: Wipro LimitedДокумент5 страницForm 16: Wipro Limiteddeepak9976Оценок пока нет

- Form 16 Word FormatДокумент4 страницыForm 16 Word FormatVenkee SaiОценок пока нет

- BIR FormДокумент4 страницыBIR FormfyeahОценок пока нет

- ITR-3 Indian Income Tax Return: Part A-GENДокумент7 страницITR-3 Indian Income Tax Return: Part A-GENSudeha ShirkeОценок пока нет

- Taxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchОт EverandTaxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchРейтинг: 5 из 5 звезд5/5 (1)

- Accounting, Tax Preparation, Bookkeeping & Payroll Service Revenues World Summary: Market Values & Financials by CountryОт EverandAccounting, Tax Preparation, Bookkeeping & Payroll Service Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- J.K. Lasser's Your Income Tax 2024, Professional EditionОт EverandJ.K. Lasser's Your Income Tax 2024, Professional EditionОценок пока нет

- J.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnОт EverandJ.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnОценок пока нет

- Accounting, Tax Preparation, Bookkeeping & Payroll Service Lines World Summary: Market Values & Financials by CountryОт EverandAccounting, Tax Preparation, Bookkeeping & Payroll Service Lines World Summary: Market Values & Financials by CountryОценок пока нет

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionОт EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionОценок пока нет

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCОт EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCРейтинг: 4 из 5 звезд4/5 (5)

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionОт EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionОценок пока нет

- Position Description FormДокумент4 страницыPosition Description FormRandomized Minds82% (11)

- FIDIC ImpДокумент60 страницFIDIC ImpSajad WaniОценок пока нет

- Measuring Economic Activity: Measuring Economic ActivityДокумент42 страницыMeasuring Economic Activity: Measuring Economic ActivityWAC_BADSECTORОценок пока нет

- Final Population Age Structure, Sex Composition and Rural - Urban CompositionДокумент6 страницFinal Population Age Structure, Sex Composition and Rural - Urban CompositionMaraQuezОценок пока нет

- Ideology and Methodology Duncan FoleyДокумент11 страницIdeology and Methodology Duncan Foley신재석Оценок пока нет

- Internship ReporДокумент55 страницInternship ReporRaj GaneshОценок пока нет

- Very Condensed IGCSE Revision Notes PDFДокумент11 страницVery Condensed IGCSE Revision Notes PDFshahabОценок пока нет

- Acctg 201 - Assignment 2Документ11 страницAcctg 201 - Assignment 2sarahbee75% (4)

- Missing Pieces by Kevin CurtisДокумент9 страницMissing Pieces by Kevin CurtisJim Pence100% (1)

- Molabola - Career Vs GodinezДокумент4 страницыMolabola - Career Vs Godinezvincent gianОценок пока нет

- Cases Fulltext Compiled 1-22 Batch 1Документ108 страницCases Fulltext Compiled 1-22 Batch 1MikMik UyОценок пока нет

- Research ProjectДокумент55 страницResearch ProjectRio De LeonОценок пока нет

- Spring Forward or Fall Back-Issues in New Appraisal SystemДокумент4 страницыSpring Forward or Fall Back-Issues in New Appraisal SystemZuhair RiazОценок пока нет

- IGCSE Economics U1 AnsДокумент4 страницыIGCSE Economics U1 AnsChristy SitОценок пока нет

- Parent Expectations SurveyДокумент6 страницParent Expectations SurveyAiza BabaoОценок пока нет

- MASCA Conference 2014Документ60 страницMASCA Conference 2014Larry GloverОценок пока нет

- Take A Test Equality, Diversity and IncluionДокумент3 страницыTake A Test Equality, Diversity and Incluionmtkhan52-1Оценок пока нет

- TCS Salary SlipДокумент1 страницаTCS Salary Slipkrishna100% (1)

- Test Bank: Human Resource Management, 9 EditionДокумент19 страницTest Bank: Human Resource Management, 9 EditionThuận PhạmОценок пока нет

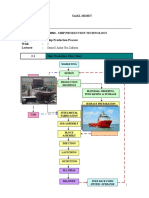

- Topic - 2 Ship Production ProcessДокумент24 страницыTopic - 2 Ship Production ProcessMuhamad Nazren Mohamed Zaidi100% (1)

- Barangay Ordinance Number 1 Series of 2019 PWD DeskДокумент4 страницыBarangay Ordinance Number 1 Series of 2019 PWD DeskArniel Fred Tormis Fernandez100% (2)

- Job Description: King's College King's Parade Cambridge CB2 1STДокумент3 страницыJob Description: King's College King's Parade Cambridge CB2 1STsiva8000Оценок пока нет

- Cost of Goods SoldДокумент14 страницCost of Goods Soldmuhammad irfan50% (2)

- HRD Summit 2018 Brochure 12pg 1FДокумент15 страницHRD Summit 2018 Brochure 12pg 1FAfaq SanaОценок пока нет

- Nike SweatshopsДокумент5 страницNike SweatshopsMichelle I. Smith0% (1)

- Income AffidavitДокумент19 страницIncome Affidavitpramod kumarОценок пока нет

- Employee EngagementДокумент16 страницEmployee EngagementPrashant ParalikarОценок пока нет

- Maersk Vs RamosДокумент3 страницыMaersk Vs RamosSheryl Ogoc100% (1)

- Project Management UK College AssignmentДокумент21 страницаProject Management UK College AssignmentAhnafTahmidОценок пока нет

- Payslip - FormatДокумент2 страницыPayslip - Formathemantfauzdar75% (4)