Академический Документы

Профессиональный Документы

Культура Документы

May 2011

Загружено:

karan251Исходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

May 2011

Загружено:

karan251Авторское право:

Доступные форматы

Alpha Invesco Research Private Limited

BULLSbook

Stock Of The Month : Honda Siel Power Products Limited

May 2011

Alpha Invesco Research Pvt Ltd

www.bullsbook.com

Editors Desk Dear Investor, Here is a brief of what you will come across in this edition of BULLSbook. First section of this edition elaborates on the difference between consolidated & standalone results & why they are important. Indian food & beverage industry is growing like never before. Next 5 to 8 years are going be a golden period for this industry. Here in the second section, we have included an article from IBEF on Indian food & beverage industry. We are keeping a track on this sector to find out interesting investment opportunities in the times to come. Third section has the stock of the month. We are recommending Honda Siel Power Products Limited for this month. The company is into water pumps, engines, generators. The company is leader into its segment. With growing demand for its products across all categories & with a tag of HONDA behind its back, it is an extremely lucrative investment opportunity for the next few years. All the best.

May 2011

Alpha Invesco Research Pvt Ltd

www.bullsbook.com

Our Approach Standalone Results OR Consolidated Results ? Most investors find it very difficult when it comes to valuation of a company. The issue becomes even more complicated in case of companies which have large or several subsidiaries. As the financial results published in newspapers generally show the standalone results the investors often ignore the fact that it is the consolidated results and not the standalone result which should be taken into account while valuing a company.

Standalone Results : These are the results which include performance of only the parent company. Financial performance of the subsidiaries where the parent firm holds majority stake are not considered in these results. For Example : Tata Steel has bought a UK based Corus Steel few years back. Tata Steel is the parent & Corus is its subsidiary. In standalone results, the performance of Tata Steel will be shown and financial performance of Corus will not be shown. This does not give us a full picture of the companys performance while valuing a company.

Consolidated Results : These results include the financial performance of the parent company as well as all its subsidiaries where the company holds majority stake, or are wholly owned subsidiaries. Consolidated results treat all activities of a company as one company.

Subsidiaries can be of many types: 1. Wholly owned 2. Majority owned : The parent owns 100% shares of the subsidiary. : The parent owns more than 50% shares of the subsidiary.

3. Company holding greater than or equal to 20% shares but less than 50% shares of a subsidiary or company holding less than 20% shares of a subsidiary.

May 2011

Alpha Invesco Research Pvt Ltd

www.bullsbook.com

When a company publishes consolidated financial results, it ideally follows the following rules: 1. If a company holds more than 50% stake in a subsidiary company, the consolidated financial results of the company should add all the revenue, expenditure, profits and other items to its financial results in respective items but the profits; that does not belong to the company due to minority shareholders owning shares of subsidiary, should be shown as minority interest. Thus if a company owns 100% in a subsidiary company, minority interest is 0. 2. If a company holds more than 20% stake in a subsidiary company but less than 50%, the consolidated financial results of the company should add the proportionate revenue, expenditure, profits and other items to its financial results in respective items, i.e. If a company A owns 25% stake in company B, B's 25% revenue, 25% expenditure, 25% profits etc. should be added to the respective items of A's standalone results to get the consolidated results. 3. If a company holds less than 20% stake in a subsidiary company, the consolidated financial results of the company should not be any different from its standalone results.

The subsidiaries can affect the financials in the following manner.

If a company has a subsidiary then it has same % share in its assets as it has in the company's equity. The same holds good for liabilities as well although the liability is limited to the extent of parent company's exposure in the subsidiary.

Parent companies often give loans to the subsidiaries and to that extent they are exposed to the risk of default as a creditor.

Parent companies get dividends by virtue of their stake and are liable to get rewards if the worth of the subsidiary grows.

It is important to note here that the value of the investment in the subsidiaries is shown at book value in the balance sheet of the parent company. The actual value of

May 2011

Alpha Invesco Research Pvt Ltd

www.bullsbook.com

the investment can be substantially different.

Also the income of the subsidiary is reflected only to the extent of dividend and if the dividend payout ratio is low then the income of the subsidiary is not correctly reflected.

The business and the business prospects of the subsidiary can be quite different from the parent and the earnings attributed to the subsidiary can not be discounted at the same rate as the earnings of the parent.

So if you trying to evaluate the worth of a company then it would be a mistake to evaluate the financials of the parent on standalone basis. In America, the investors in Enron discovered this too late when the company fooled not only common public but almost all the wall street analysts by showing good standalone results whereas all its subsidiaries were bleeding and had huge holes in their balance sheets.

Indian accounting laws mandate that the companies publish this information in their annual report. This means that all this information is available to the investor. All depends on how we take it.

May 2011

Alpha Invesco Research Pvt Ltd

www.bullsbook.com

BULLSbook Corner In this section we will keep you updating about latest sector updates, market updates, interviews & thoughts of investing legends, significant events & much more. Food & Beverages A sector to look out for in next 5 years Propelled by the increasing disposable income, the food sector has been witnessing a marked change in consumption pattern. Currently, India is the worlds second largest producer of food in the world and the food processing industry is the one of the largest industries in India. In terms of production, consumption, export and expected growth, India is ranked fifth in the world. Indias food industry is valued at US$ 180 billion of which the food processing industry is estimated at US$ 67 billion, according to a report Food Processing and Agri Business, done by KPMG. The industry size has been estimated at US$ 70 billion by the Ministry of Food Processing, Government of India. The food processing industry contributed 6.3 per cent to Indias GDP in 2003 and had a share of 6 per cent in total industrial production. The industry employs 1.6 million workers directly. The industry is estimated to be growing at 9-12 per cent during the period 2002 to 2007. Value addition of food products is expected to increase from the current 8 per cent to 35 per cent by the end of 2025. Fruit & vegetable processing, which is currently around 2 per cent of total production will increase to 10 per cent by 2010 and to 25 per cent by 2025. The highest share of processed food is in the dairy sector, where 37 per cent of the total produce is processed, of this only 15 per cent is processed by the organized sector. The food processing industry in the country is on track to ensure profitability in the coming decades. The sector is expected to attract phenomenal investments of about Rs 1,400 billion in the next decade.

May 2011

Alpha Invesco Research Pvt Ltd

www.bullsbook.com

Exports Exports of agricultural products from India are expected to cross around US$ 22 billion mark by 2014 and account for 5 per cent of the worlds agriculture exports, according to the Agricultural and Processed Food Products Export Development Authority (APEDA). Exports of floriculture, fresh fruits and vegetables, processed fruits and vegetables, animal products, other processed foods and cereals stood at Rs 17728.71 from September 2010-2011, according to DGCIS annual data published by APEDA. India will be setting up a global platform for spice trade. The organization named World Spice Organisation (WSO) will be headquartered in the Kochi, Kerela. Spice related organizations across the world will be coordinating prices across the world and address the issue of food safety regulations through WSO. Spices The export of spices and spice-based value added products during April-February 2010-11 was US$ 1,323.28 compared to the US$ 1,063.44 in the same period last year.

Fishery Fish production of the country has been growing continuously with improvement in productivity and utilisation of untapped resources. The total fish production is 6.4 million metric tonnes (mmt) of which 3.4 mmt is inland and 3.0 mmt is marine production. The Fishery sector contributes about 1.21 per cent of the total GDP and 5.37 per cent of the GDP from agriculture sector and provides employment to 14 million people.

May 2011

Alpha Invesco Research Pvt Ltd

www.bullsbook.com

Food Processing FDI inflows to Food Processing Industries has set a target of USD 25.07 billion to be achieved by 2015. Food processing industry is accounts for 32 per cent share in the entire food industry. It comprises of 2 per cent of fruits and vegetables and 15 per cent of processed milk. This industry contributes to 6.3 per cent of the GDP and about 13 per cent to export production. The food processing industry is expected to witness a growth of 10 per cent in the recent years to come. The food processing sector attracted US$ 130 million of foreign direct investment (FDI) in the first eight months of the fiscal as compared to total FDI of US$ 1.2 billion. Besides attracting FDI through schemes like mega food park, the government has also extended several fiscal incentives during this financial year to enhance FDI in food processing sector, including full exemption from excise duty for specified equipments to preserve, store or transport apiary , horticultural, dairy, poultry, aquatic and marine produce and meat and its processing products. Beverages According to a report published by market research firm RNCOS in August 2009, titled "Indian Non-Alcoholic Drinks Forecast to 2012", the Indian non-alcoholic drinks market was estimated at around US$ 4.43 billion in 2008 and is expected to grow at a CAGR of around 15 per cent during 2009-2012. As per the report, the fruit/vegetable juice market will grow at a CAGR of around 30 per cent in value terms during 2009-2012, followed by the energy drinks segment which will grow at a CAGR of around 29 per cent during the same period.

May 2011

Alpha Invesco Research Pvt Ltd

www.bullsbook.com

Major Investments

Himalaya International, an agriculture export-oriented company, its setting up the first unit of its food processing plant set up at Vadnagar in Gujarats Mehsana district with an investment of US$ 29 million. The unit has started commercial production.

Nestle India has opened its ninth manufacturing facility in Himachal Pradesh. The overall investment in the facility will be anywhere between US$ 90-110 million and will manufacture chocolates and noodles.

CG Foods set up by Singapore-based Cinnovation Group will US$ 9 million for establishing a manufacturing plant in Gujarat. The investment will be made over the period of next three years.

Spar hypermarkets and supermarkets, the worlds largest food retail chain, will be opening its outlest in Delhi after having set up five stores in southern cities such as Bangalore, Mangalore and Hyderabad.

Government Initiatives In the budget 2011-12, the Union Finance Minister, Shri Pranab Mukherjee announced to set up 15 more mega food parks (MFPs) and also urged that the states should reform the Agriculture Produce Marketing Act (APMC) to improve the supply chain. He also added that in the 11th Five year plan, the number of food parks will be increased to a total of 30. The budget also allocated US$ 135 million to the Food Processing Ministry from the existing US$ 90 million. As a measure to boost investment in agriculture the minister extended the Viability Gap Funding Scheme (VGFS) for public private partnerships (PPP) for setting up modern storage capacity besides giving infrastructure status to cold chains. Vision 2015 was announced by the Government of India, which suggested the strategy to ensure faster growth of the food processing sector. The Vision 2015 provides for enhancing the level of processing of perishable to 20 per cent, enhancing value addition to 35 per cent.

May 2011

Alpha Invesco Research Pvt Ltd

www.bullsbook.com

Stock Of The Month

Honda Siel Power Products Limited

BSE NSE Market Cap Dividend CMP

: 522064 : HONDAPOWER : 420 : 10% : 415 : 1000 : 18-24 Months

BSE Group ISIN Face Value PE Ratio

:B : INE634A01018 : 10 : 11.6

52 Week H/L : 648/326

BULLSbook Target Holding Period

BUYING STRATEGY

We recommend buying the stock around current levels of 415 & on all declines to 350 if any.

To get latest updates on this stock, type BB HPOWER on your mobile & send SMS to 56767. The status of the recommendation will be updated in case of a significant change in the overall strategy.

May 2011

Alpha Invesco Research Pvt Ltd

www.bullsbook.com

ABOUT THE COMPANY Honda Engine Technology is considered the best in every corner of the world. Any doubts ? Absolutely not ! Honda Siel Power Products Limited (HSPP) is a joint venture between Honda Motor Co. Japan (67% equity stake) and Siel Ltd. Honda Motor Co. Japan is a US $ 84.3 Billion Enterprise with over 19.6 million products sold annually. 95 Production Facilities in 34 countries. Over 5.9 million Portable Power Products are sold annually by Honda. And over 46 million Portable Power Products have been already sold worldwide worldwide.

The Company was earlier known as 'Shriram Honda Power Equipment Limited'. HSPPL is engaged in the manufacturing and sales of Portable Generators, Water Pumping Sets, General Purpose Engines, Lawnmowers and Brushcutters. It has plants located in Greater Noida and Pondicherry.

HSPP benefits from the rich experience of Honda Motors, Japan, the second largest engine manufacturer in the world. Indias first LPG based Generator along with the Super Silent Key Start Generator portable kerosene generators are some of the products which display Hondas pursuit of technological excellence. The product range of Generators conforms to the most stringent phase II Noise & Emission norms as laid down by the Central Pollution Control Board (CPCB), Government of India.

With strength of over 800 dealers and 15 Area Offices spread across the country, HSPPL has reached to more than 1.5 million users and this makes HSPPL the undisputed leader in the field of portable generators.

Products : Generators Some of these are kerosene based while others run on petrol. The Company has also recently started a range of generators that run on LPG. Power output for different models ranges from 350VA to 5500VA. These products are made to minimize noise levels. They meet the national standards for air emission regulation. Nearly half of the business comes from this segment.

May 2011

Alpha Invesco Research Pvt Ltd

www.bullsbook.com

Water Pumps Portable water pumps that are designed for irrigating small land holdings up to 5 acres. Its easy portability makes it useful for irrigating distant fields. It is most applicable to small and marginal farmers who cultivate paddy, vegetables and various other seasonal crops. The range of power output for different models is 1.5HP to 4 HP. Most of these run on petrol-kerosene. The Company also has a model that runs on LPG. Nearly 30% business comes from this segment.

Engines For General Purpose These are petrol-kerosene engines that find many different

applications. Some of these are in High Tree Power Sprayer, Air Compressor, Rail Drilling Machine, Rail Cutting Machine, Pump sets, Reaper, Concrete Needle Vibrators, Power Trowel, Soil Compactor, Concrete Saw Cutting machine, etc. The power output for different models ranges from 1.8 HP to 5.4HP. 12 to 14% business comes from this segment.

Other Products Company also sells lawnmowers and brushcutters. Brushcutters are ideal for cutting dense

undergrowth, unwanted weeds, pruning trees & trimming hedges. They are well suited for

agriculture,

horticulture,

lawn/garden

maintenance & landscaping sectors. Relatively the income from this business is small around 5%.

May 2011

Alpha Invesco Research Pvt Ltd

www.bullsbook.com

BOARD OF DIRECTORS

Sr. No 1 2 3 4 6 7 8 9 10 Name Siddharth Shriram D V Kapur O P Khaitan Ravi V Gupta Payal Chaddha Takashi Hamasaki Takashi Nagai Masato Saito Seiichi Yotsumoto Designation Chairman Director Director Director Company Secretary Director President & CEO Director Director Vice President & WTD

FINISHED PRODUCTS

Product Name Brush Cutters Engines - IC- Traded Engines-IC Generator SetsPortable Generator SetsTraded Job Charges Lawn Movers Miscellaneous Others-Traded Spares & Tools Water Pumps Value 13.05 1.6 49.7 117.43 30.67 2.61 2.43 4.25 1.36 7.08 92.56 Qty 7510 1203 61913 46710 2064 N.A. 792 N.A. N.A. N.A. 70363 % Sales Turnover 4.04 0.5 15.4 36.39 9.5 0.81 0.75 1.32 0.42 2.19 28.68

RAW MATERIAL

Product Name Aluminium Alloys Brush Cutters-Purchases Components CRNGO Sheets I C Engines-Purchased Lawn Mowers-Purchases Magnet Wires Others (Purchases) Portable Gen.SetsPurchased Steel Sheets Unit MT No NA MT No No MT NA No MT Qty 8.46 8190 N.A. 516.13 1250 680 0.88 N.A. 1380 24640.25 Value 7.63 8.73 138.57 3.69 1.23 1.32 3.95 1.36 19.42 5.76

May 2011

Alpha Invesco Research Pvt Ltd

www.bullsbook.com

INDUSTRY OVERVIEW The Government focus on IT based projects such as E-Governance and computerization of schools provides opportunities for generator sales growth. In the country, power availability is short by about 13% and on a peaking basis by about 17%. This state of affairs is expected to continue. Besides this, robust economic growth has resulted in demand which is more than current supply. The Government is most likely to continue with its support to the agriculture sector and farming community. The Company's water pumps as well as engines for pumps are in huge demand. Sales were also helped by the Government commitment to support the farming community by offering subsidy for equipment purchases under the National Food Security Mission (NFSM) scheme. During the year 2010, NFSM support was extended to more states and with coverage of additional crops. Business for water pumps was noteworthy in the Western and Eastern parts of the country. Together with its channel expansion strategy, company plans leverage the NFSM and other Government sponsored schemes for promoting business of its Pumps and Engines.

With increasing urbanization, investments on farm mechanization and infrastructure development is rising significantly. The demand for engine based OEM (Original Equipment Manufacturer) appliances which promote mechanization will increase considerably. Since the company deals in different segments across different markets, it is tough to determine the exact market size as a whole for its products. However due to high growth forecasts for agriculture sector, the water pumps segment is expected to witness steady growth over the years. The company owns more than 70% market share in Gensets/Generators segment. Birla Power earlier known as Birla Yamaha is the main competitor for the company. Greaves Cotton & Bajaj Electricals have entered the market lately. The company also faces competition from same kind of cheap Chinese unbranded equipments.

May 2011

Alpha Invesco Research Pvt Ltd

www.bullsbook.com

STRENGHTS, OPPORTUNITIES AND THREATS The company has a strong brand name of Honda. The company plans to continue expanding its scalability & benefit from this huge untapped potential in the sector. Honda has emphasis on R&D setup & proven technical expertise in engines. Enabling it to remain above competition.

Honda Siel is the undisputed leader in the portable generator segment & has the largest dealer network in India which enables it to provide excellent after sales services as well. This has resulted in strong brand loyalty & sales particularly in rural-semi rural areas.

Increasing labor shortage is a big factor in rising farm mechanization. Government is promoting higher farm mechanization & providing subsidies and benefits along with credit availability to purchase & use such products. Various schemes are leaving more money in the hands of the farming community which is helping the sales of the company. The company enjoys greater financial stability over last decade. This enables Honda Siel to undergo any expansion plan without hassle.

Risk/Threat Factors Appreciation of Indian Rupee against the US Dollar is impacts the margins of export business.

The import of lightweight diesel Engine and petrol/kerosene Engines from China have continued to register growth. These engines do not comply with the 'BIS' standards, and hence do not meet the criteria for Government subsidy sale or Bank Loans. In addition, these non compliant Chinese products are being marketed at very low prices.

Kerosene availability in some rural markets continues to be a cause of concern for the farmers and can affect sale of kerosene based Pumps and Engines made by the Company. Availability of substitutes like Invertors has made the generator market stagnant lately. Since low power applications can be supported by using invertors, the usage of generators is done where there is need to support only for applications which demand high power / electricity. A rise In raw material prices can affect the margins as well.

May 2011

Alpha Invesco Research Pvt Ltd

www.bullsbook.com

SHAREHOLDING PATTERN

shareholding

Promoters 67.67% Public 32.33%

Public Shareholding Pattern

FIIs & Mutual Funds/UTI/Financial /Financial Institutions/Banks/Insurance Companies Corporate Bodies Individual Shareholders up to 1 Lac Individual Shareholders more than 1 lac Others ( NRIs, Clearing Members) Total

0.37%

10.10% 16.91% 3.71% 1.21% 32.33%

Promoters hold majority stake in the company. Their stake is consistent around 67% company over the years.

Alpha Invesco Research Pvt Ltd

www.bullsbook.com

BALANCESHEET

in Cr. SOURCES OF FUNDS : Share Capital Reserves & Surplus Secured Loans Unsecured Loans Total Debt Total Liabilities APPLICATION OF FUNDS : Gross Block Less: Accum. Depreciation Net Block Capital Work in Progress Current Assets, Loans & Advances Inventories Sundry Debtors Cash and Bank Balance Loans and Advances Less: Current Liab. & Prov. Current Liabilities Provisions Net Current Assets Total Assets Contingent Liabilities 10.14 192.21 0 0 0 202.35 10.14 184.27 0 0 0 194.41 10.14 173.37 0 0 0 183.51 10.14 153.62 0 0 0 163.76 10.14 140.99 0 0 0 151.13 Mar-10 Mar-09 Mar-08 Mar-07 Mar-06

148.31 84.88 63.43 3.43

144.56 83.25 61.31 3.59

113.51 77.62 35.89 9.26

111.86 74.69 37.17 0.52

109.72 70.02 39.7 1.45

47.87 15.33 100.86 25.72 47.19 7.1 135.49 202.35 47.92

57.88 8.44 83.13 18.98 31.39 7.53 129.51 194.41 52.89

41.54 22.25 108.03 14.94 39.59 8.81 138.36 183.51 37.03

30.68 22.65 108.34 87.76 40.21 83.15 126.07 163.76 34.51

38.76 25.05 77.16 76.43 36.09 71.33 109.98 151.13 28.74

The company has maintained healthy & steady reserves. Also it has a cash balance of more than 100 crore rupees i.e. nearly 100 Rs per share. The company has no debt. Hence it leaves no scope to get impacted by high interest rates. Inventories are in tandem with the sales & are at healthy levels. The company will not need any equity dilution for growth. This is again a good sign for investors since the entire profit growth will be reflected in earning per share.

May 2011

Alpha Invesco Research Pvt Ltd

www.bullsbook.com

PROFIT & LOSS ACCOUNT

in Cr. INCOME : Sales Turnover Other Income Stock Adjustments Total Income EXPENDITURE : Raw Materials Excise Duty Power & Fuel Cost Other Manufacturing Expenses Employee Cost Selling and Administration Expenses Miscellaneous Expenses Less: Preoperative Expenditure Capitalised Profit before Interest, Depreciation & Tax Interest & Financial Charges Profit before Depreciation & Tax Depreciation Profit Before Tax Tax Profit After Tax P & L Balance brought forward Appropriations P & L Bal. carried down Equity Dividend Corporate Dividend Tax Equity Dividend (%) Earning Per Share (Rs.) Book Value Mar-10 322.74 8.86 1.64 333.24 Mar-09 250.54 13.74 2.14 266.42 Mar-08 279.12 15.55 10.27 304.94 Mar-07 253.16 9.58 -4.83 257.91 Mar-06 217.59 8.24 0.96 226.79

191.79 15.75 4.12 6.29 24.94 40.92 22 0 27.43 0.44 26.99 7.43 19.56 6.87 12.69 72.56 6.01 79.24 4.06 0.69 40 11.83 199.56

152.77 14.31 3.11 3.42 20.56 37.94 3.68 0 30.63 0.56 30.07 5.79 24.28 8.64 15.64 63.24 6.32 72.56 4.06 0.69 40 14.74 191.73

150.82 28.56 3.51 4.96 22.98 46.38 3.62 0 44.11 0.47 43.64 5.37 38.27 13.54 24.73 45.75 7.24 63.24 4.06 0.68 40 23.72 180.98

130.93 22.72 3.67 5.66 19.01 36.85 3.75 0 35.32 0.43 34.89 7.87 27.02 9.64 17.38 34.86 6.49 45.75 4.06 0.69 40 16.46 161.5

115.96 21.06 4.08 5.18 18.78 34.31 3.06 0 24.36 0.64 23.72 6.55 17.17 6.8 10.37 30 5.51 34.86 4.06 0.57 40 9.66 149.04

From the P&L account we can observe; The sales of the company have grown to Rs 322 crores in 2010 from Rs 250 crores in 2009 i.e. 30%. However rising raw material prices & employee cost has increased the expense. The company shifted its manufacturing from its Rudrapur plant to Noida plant. Workers & employees at Rudrapur plant were offered voluntary retirement scheme due to which onetime expense of nearly 20 crore rupees occurred during the year. Hence sales have gone up but the profits came down. Company shall return to normalcy during current financial year.

May 2011

Alpha Invesco Research Pvt Ltd

www.bullsbook.com

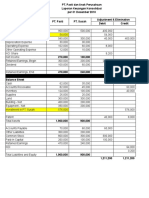

in Cr. Net Sales Turnover Other Income Total Income Total Expenses EBITDA Depreciation EBIT Interest PBT Tax Net Profit Equity Basic EPS Face Value Dividend (%)

April-Dec 2010 315.43 5.97 321.4 276.2 45.2 5.78 39.42 0.07 39.35 13.1 26.25 0 10.14 25.88 10 0

In the above table, are the 9 month results of the company. I.e. April 2010 to December 2010. The company has posted revenue of 315 crores in the first 9 months compared to 322 crores for the entire year 2009-2010. This indicates a continual upward growth in the current financial year. Operating profit margins stood at 14% & net profit margins at 8%. The operating margins have been steady. The company is expected to announce the same performance in the last quarter i.e. March 2011.

May 2011

Alpha Invesco Research Pvt Ltd

www.bullsbook.com

RATIOS

in Cr. Debt-Equity Ratio (x) Long Term Debt-Equity Ratio (x) Current Ratio (x) Fixed Assets (x) Inventory (x) Debtors (x) Interest Cover Ratio (x) Operating Profit Margin (%) Profit Before Interest And Tax Margin (%) Gross Profit Margin (%) Cash Profit Margin (%) Ajdusted Net Profit Margin (%) Return On Capital Employed (%) Return On Net Worth (%) Mar-10 0 0 3.84 2.2 6.1 27.16 90.16 14.59 12.29 14.46 8.88 6.58 20 10.7 Mar-09 0 0 4.07 1.94 5.04 16.33 44.36 12.23 9.91 12 8.55 6.24 13.15 8.28 Mar-08 0 0 2.54 2.48 7.73 12.43 82.43 15.8 13.88 15.63 10.78 8.86 22.31 14.24 Mar-07 0 0 2.02 2.29 7.29 10.61 63.84 13.95 10.84 13.78 9.97 6.87 17.43 11.04 Mar-06 0.03 0.03 1.99 1.99 5.33 7.51 27.83 11.2 8.19 10.9 7.78 4.77 11.62 6.99

The company is completely debt free. This leaves Honda Siel in an extremely beneficial position while its competition is facing high interest costs due to high interests. Company has a very high cash balance as well. The company has everything that it takes to take massive expansion plans in hand if the situation demands.

Low growth companies with no expansion plans or with declining business can also have low debt to equity ratio, since they dont need to raise debt. Investors should stay away from such companies. Debt to Equity ratio is not the only tool to Measure Companys financial strength. Rather, investors should look for companies which are growing without taking excessive debt/loans. Also, it is a bad sign if a company starts raising lot of debt when the industry is in boom. It shows over enthusiasm & short sightedness of the promoters.

Companys operating profit margins have remained in the range of 12-14% in last 4 years. We expect the margins to remain steady in the same range.

Always look for Operating Profit Margins rather than Net Profit Margins. Since OPM gives the actual business picture & companies profitability. NPM (Net Profit Margin) is calculated after deducting taxes, duties, depreciation, interest cost etc. All of these factors are variable, so they may not give a clear idea about company performance.

May 2011

Alpha Invesco Research Pvt Ltd

www.bullsbook.com

Sometimes we see sudden growth in a particular companys net profits but not in operating profit. This increase comes by tax refunds, depreciation effect etc. Also, sometimes we see a sudden rise in companys income but not in companys net sales. This rise in income comes through an asset sale, extraordinary gain etc. Such type of gain is one time & not permanent. Hence investors should always find an answer to this question, from where the income & profits are coming ?

We expect 20% growth per annum in sales for the next 3 years. Even if we consider conservative estimates, Honda Siel should post a sales turnover / net sales of 400 crores in financial year 2010-11, 480 crores in 2011-12 & around 560 crores in 201213. Companys OPM (operating profit margin) is most likely to remain in the range of 12 to 14%. Net profit margins are expected to remain around 8%.

By this logic, Honda Siel will post a net profit of around 32 crores in 2011 & around 38 crores in 2012 & around 44 crores in 2013. This will result into an EPS (Earning per Share) of 31 in financial year 2010-11, around 37 Rs in 2011-12 & around 44 Rs in 2012-13.

May 2011

Alpha Invesco Research Pvt Ltd

www.bullsbook.com

WHY INVEST IN THIS COMPANY

Honda is undoubtedly one of the biggest brands in the world. Company enjoys a very high reputation for its engines & a strong brand recall.

The rapidly growing demand in agriculture sector & power deficits is likely to continue for another decade or so. The company will benefit from the above factors since it is well positioned above its competitors in the same category.

Company has a healthy balance sheet which enables it to go aggressive if needed for expansion. Especially in the high interest rate scenario, the company shall stand comfortable.

FIIs & Mutual Funds have little exposure to the stock & is yet to catch the mass investor attention. Sooner or later the stock is poised to attract large institutional / individual investors, which is likely to result in further acceleration of stock price.

The company will maintain its growth rate of more than 20% in the coming years. We expect the PE to get re-rated from current levels of 11 to higher range of 20, over the next two years.

This is the approximate estimated stock price movement in the next 24 months. This is an overall view. Short term fluctuations in the market may take the prices up or down than our expected levels.

Financial Year 2011 2012 2013

Stock HSPPL HSPPL HSPPL

EPS 32 37 44

PE 10-14 14-15 20

Stock Price 350-450 600 1000+

May 2011

Alpha Invesco Research Pvt Ltd

www.bullsbook.com

NOTES

DISCLAIMER:- The views/opinions expressed in this report are personal opinions. Calculations and estimates are based on certain assumptions. It should be noted that the information contained herein is from publicly available data or other sources believed to be reliable. The user assumes the entire risk of any use made of this information.

May 2011

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1091)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- ACC 308 Final Project WorkbookДокумент45 страницACC 308 Final Project WorkbookBREANNA JOHNSON0% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Module 4 BASIC CONSOLIDATION PROCEDURESДокумент21 страницаModule 4 BASIC CONSOLIDATION PROCEDURESJuliana ChengОценок пока нет

- Part 1 - Recognition, Measurement, Valuation & Disclosure (Current Assets) - Qs 17 Oct 2021Документ20 страницPart 1 - Recognition, Measurement, Valuation & Disclosure (Current Assets) - Qs 17 Oct 2021Rox accountОценок пока нет

- PSEB 12th Accountancy-2 Solved Question Papers Mar-2017Документ24 страницыPSEB 12th Accountancy-2 Solved Question Papers Mar-2017Guruprasad MoolyaОценок пока нет

- SP IMMIGRATION SERVICES INC. Fiancail Plan - Rough DraftДокумент24 страницыSP IMMIGRATION SERVICES INC. Fiancail Plan - Rough Draftmalik_saleem_akbarОценок пока нет

- Good Year Tax Case Word DocumentДокумент12 страницGood Year Tax Case Word DocumentJD BallosОценок пока нет

- Equity PricingДокумент4 страницыEquity PricingMichelle ManuelОценок пока нет

- MPAC523 WIP A 2020Документ8 страницMPAC523 WIP A 2020Tawanda Tatenda HerbertОценок пока нет

- T3 Ans.. (RA)Документ8 страницT3 Ans.. (RA)KY LawОценок пока нет

- Problems and Prospect of Brokerage Houses in BangladeshДокумент29 страницProblems and Prospect of Brokerage Houses in BangladeshAkter Uz ZamanОценок пока нет

- A Project Report Sales AnalysisДокумент71 страницаA Project Report Sales Analysisayushchawla681Оценок пока нет

- United States v. Chemical Foundation, Inc., 272 U.S. 1 (1926)Документ13 страницUnited States v. Chemical Foundation, Inc., 272 U.S. 1 (1926)Scribd Government DocsОценок пока нет

- Equity Test BanksДокумент34 страницыEquity Test BanksHea Jennifer AyopОценок пока нет

- BAT4M Grade 12 University College Accounting Chapter 14 Test Study NotesДокумент4 страницыBAT4M Grade 12 University College Accounting Chapter 14 Test Study NotesBingyi Angela Zhou100% (1)

- Treasury Wine Estates 2012 Annual ReportДокумент128 страницTreasury Wine Estates 2012 Annual ReportnshamapОценок пока нет

- Wacc Practice 1Документ3 страницыWacc Practice 1Ash LayОценок пока нет

- Financial Management Test 2: Answer ALL QuestionsДокумент3 страницыFinancial Management Test 2: Answer ALL Questionshemavathy100% (1)

- Solusi Inventory Downstream-UpstreamДокумент19 страницSolusi Inventory Downstream-UpstreamKurrniadi AndiОценок пока нет

- Tutorial Questions Week 7Документ4 страницыTutorial Questions Week 7Revatee HurilОценок пока нет

- CTP BooksДокумент3 страницыCTP BooksuzernaamОценок пока нет

- fm2 3Документ20 страницfm2 3Rahul SrivastavaОценок пока нет

- BramДокумент2 страницыBramIshidaUryuuОценок пока нет

- Mock Quiz 3 FAR InvestmentSecutities X InventoriesДокумент11 страницMock Quiz 3 FAR InvestmentSecutities X InventoriesMARISA SYLVIA CAALIMОценок пока нет

- MCQ SampleДокумент6 страницMCQ Samplewilliam1988821Оценок пока нет

- Case Scenarios For Taxation Exams ACCT 3050 by RC (2020)Документ5 страницCase Scenarios For Taxation Exams ACCT 3050 by RC (2020)TashaОценок пока нет

- HDFC Bank Limited Group BALANCE SHEET AS AT 31-03-2006Документ7 страницHDFC Bank Limited Group BALANCE SHEET AS AT 31-03-2006Sunny_Chatlani_8157Оценок пока нет

- Dabur Annual RepДокумент188 страницDabur Annual RepsameerkmrОценок пока нет

- OAITA's Response Memorandum To ODI Motion For Summary JudgmentДокумент18 страницOAITA's Response Memorandum To ODI Motion For Summary JudgmentOAITAОценок пока нет

- AnnualReport BuanaFinance 2020Документ326 страницAnnualReport BuanaFinance 2020meidy anharОценок пока нет

- New Microsoft Word DocumentДокумент4 страницыNew Microsoft Word DocumentMasudRanaОценок пока нет