Академический Документы

Профессиональный Документы

Культура Документы

D V P W

Загружено:

DinSFLAОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

D V P W

Загружено:

DinSFLAАвторское право:

Доступные форматы

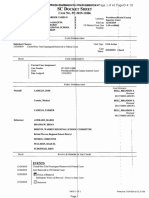

Short Form Order NEW YORK STATE SUPREME COURT QUEENS COUNTY Present: HONORABLE BERNICE D.

. SIEGAL IAS TERM, PART 19 Justice --------------------------------------------------------------------X DEUTSCHE BANK TRUST COMPANY AMERICAS Index No: 1070/08 AS TRUSTEE, Motion Date: 2/9/11 9350 Waxie Way Motion Cal. No.: 4 San Diego, CA 92123 Motion Seq. No.: 4 Plaintiff, -againstDANILO PICON, MAGALYS T. PICON, MORTGAGE ELECTRONIC REGISTRATION SYSTEMS, INC., AS NOMINEE FOR FIRST NATIONAL BANK OF ARIZONA, NEW YORK CITY ENVIRONMENTAL CONTROL BOARD, NEW YORK CITY TRANSIT ADJUDICATION BUREAU, NEW YORK STATE DEPARTMENT OF TAXATION AND FINANCE, JOHN DANIELS, YVETTE DOE Defendants. -----------------------------------------------------------------X The following papers numbered 1 to 16 read on this motion by defendant for an order (1) to vacate the default judgment issued in the above captioned action and to have the above captioned action dismissed for lack of jurisdiction over the defendant due to a lack of standing; (2) to vacate the default judgment issued in the above captioned action and to have the above captioned dismissed for lack of jurisdiction over the defendant due to improper service of process; (3) to vacate the default judgment issued in the above action and to allow Danilo E. Picon, to appear and file an answer in connection with the above captioned action; and to allow him to proceed upon the merits to trial so that he may defend his interest in the property located at 4908 99th Street, Corona, N.Y. 11368; (4) to dismiss the above captioned action pursuant to CPLR 3211 for failure to state a cause of action upon which relief can be granted; (5) to dismissed the action with prejudice for fraud; (6) to dismiss with prejudice against the plaintiff, Deutsche Bank Trust Company Americas as Trustee, as well as their successors and assigns forever.

w.

St

op Fo

re

clo

su re

PAPERS NUMBERED 1 - 4 5 - 9 10 - 12 13 - 14

ww

Notice of Order to Show Cause- Affidavits-Exhibits............. Affirmation in Opposition - Affidavits-Exhibits................... Reply Affirmation .................................................................. Affirmation of Rule 202.7......................................................

Fr au d. co

Emergency Affidavit..................................................................

15 - 16

PROCEDURAL HISTORY

Plaintiff Deutsche Bank Trust Company Americas as Trustee (Plaintiff) commenced

the present action by filing a Lis Pendens and a Summons and Complaint and contends that on

January 28, 2008 it effectuated service on Defendant Danilo E. Picon (hereinafter Defendant) by nail and mail service pursuant to CPLR 308 (4). Defendant now moves to vacate his default in answering the complaint and dismiss the foreclosure action on the grounds that Plaintiff lacks standing to commence the action. Defendant claims that service was directed to what was previously his marital home, a home in which he did not reside at the time of the purported service as a result of his then pending divorce and the issuance of an associated order

of protection; that he never received the summons and complaint either in person or by mail and that he did not receive a copy of the judgment of foreclosure with notice of entry and only

January 2010. Defendant thus claims he did not receive notice of the lawsuit and the court lacks personal jurisdiction. As a result of Defendants failure to interpose an answer, an Order of Reference was granted on December 1, 2008 and a default Judgment of Foreclosure and Sale was granted on July 1, 2009.

St

op Fo

learned about the foreclosure after he returned to the subject property after he returned in

ww

fulfill the due diligence requirements necessary to provide Defendant with sufficient notice of

w.

Defendant was not properly served under CPLR 308 (4) because Plaintiff failed to

re

clo

RULING

su re

2

Fr au d. co

Upon the foregoing papers, it is hereby ordered that the motion to vacate his default is granted and upon vacatur, the complaint is dismissed as more fully set forth below:

the action for foreclosure. Consequently, the default judgment of foreclosure against the Defendant is vacated pursuant to CPLR 5015 (a) (4) and the case is dismissed for lack of personal jurisdiction.

Furthermore, Defendants motion to dismiss is granted on the ground that Plaintiffs

acquisition of the Mortgage without the underlying Note is insufficient to sustain a foreclosure action because the Plaintiff lacks standing.

However, Defendant fails to substantiate a case under either Judiciary Law 489,

General Business Law 349 or common law fraud. Consequently, Defendants motion to

MOTION TO VACATE THE DEFAULT JUDGMENT

at the address upon which purported service took place and thus never received notice of the

Under CPLR 5015 (a) (4), a default judgment can be vacated due to the courts lack of jurisdiction in rendering an order or judgment (CPLR 5015 [a] [4]). A judgment or order granted in the absence of personal jurisdiction over a party is a nullity that must be set aside unconditionally (Ismailov v Cohen, 26 AD3d 412, 413, 414 [2d Dept 2006]) ([defendant]

was a nullity and vacatur of the judgment was required as a matter of law and due process even in the absence of a demonstration of a meritorious defense).

ww

CPLR 308 (4), commonly referred to as nail and mail service. Service under CPLR 308 (4) 3

w.

Plaintiffs Affidavit of Service attests to the fact that service was effectuated pursuant to

St

demonstrated that he was not served with process (see CPLR 5015 [a] [4]). Thus, his "default"

op Fo

re

action.

clo

Defendant contends that the action should be dismissed because he did not reside or live

su re

dismiss the present action with prejudice is denied.

Fr au d. co

is effectuated "by affixing the summons to the door of either the actual place of business, dwelling place or usual place of abode within the state of the person to be served along with

additional, statutorily-mandated mailing requirements (CPLR 308 [4]). However, such service is only permitted in cases where personal service under CPLR 308 (1), or substituted service

under CPLR 308 (2) ("to a person of suitable age and discretion at the actual place of business, dwelling place or usual place of abode") cannot be achieved after due diligence (Estate of Waterman v Jones, 46 AD3d 63, 65 [2d Dept 2007]).

The due diligence requirement as set forth in CPLR 308 (4) must be strictly observed

received (O'Connell v Post, 27 AD3d 630, 631 [2d Dept 2006]).

Although "due diligence" is not statutorily defined, it has been interpreted by the courts

York, 70 AD2d 580, 580 [1979]) and thus merely demonstrating that a few attempts were made

necessary to use nail and mail service (Estate of Waterman v Jones, 46 AD3d 63, 66 [2d Dept 2007]).

The party effectuating service, in order to satisfy the "due diligence" requirement of CPLR 308 (4), must demonstrate that the server of process made genuine efforts and/or

Corp., 267 AD2d 209, 210 [2d Dept 1999]).

ww

service failed to describe the efforts of the process server made to ascertain the defendant's current dwelling place and provided no evidence that the process server made inquiries to the 4

w.

The due diligence" requirement of CPLR 308 (4) is not satisfied when the affidavit of

St

inquiries to adduce the location of the party to be served (see e.g., Kurlander v A Big Stam

op Fo

re

at the Defendants residence may not satisfy the prerequisite "due diligence" requirements

clo

as referring to the quality of the efforts made to effect personal service" (Barnes v City of New

su re

due to the reduced likelihood that a summons served by nail and mail will be properly

Fr au d. co

defendants neighbors, checked telephone listings, or conducted a search with the Department of Motor Vehicles (Estate of Waterman v Jones, 46 AD3d at 67]) or attempts to locate a business address (Sanders -v- Elie, 29 AD3d 773 (2nd Dept 2006]).

If the court determines that the due diligence requirement of CPLR 308 (4) was not

satisfied, service by nail and mail will be deemed jurisdictionally defective, and it is irrelevant if the defendant may later come into physical possession of the pleadings (Raschel v Rish, 69 NY2d 694, 697 [1986]).

In the instant matter, Plaintiffs process server asserts that service occurred on January

Defendant and his wife and co-defendant. However, as a result of a divorce action filed in May, 2007, Defendant moved out from the 49 - 08 address on June 6, 2007,( relocating to a residence

not return until December, 2009. In fact, Defendants wife was issued a one-year order of

established that the purported nail and mail service took place during the period when the order of protection was still in place.

Furthermore, the Affidavit of Service indicates that only minimal efforts were made to locate the Defendant before resorting to nail and mail service under CPLR 308(4). The Plaintiff

initiating nail and mail service. Significantly, the Plaintiff provides no evidence that it checked Defendants place of employment, spoke to neighbors, returned during morning hours (or on a

ww

Saturday), performed a skip trace or conducted a public records search. Service by nail and mail is designed to be a last ditch effort to provide service when all 5

w.

St

made only two attempts, both during work or commuting hours, to serve the Defendant before

op Fo

re

protection against the Defendant effective September 21, 2007. Therefore, Defendant as

clo

for which he filed a change of address and the Postal Service issued a forwarding order), and did

su re

28, 2008 at 49 - 08 99th Street, Corona, NY 11368, which was the marital address of the

Fr au d. co

else fails. In a situation as sensitive and important as the foreclosure upon a partys primary residence, the due diligence requirement represents an essential safeguard to protect

homeowners from being dispossessed without proper notice and an opportunity to be heard. The Plaintiffs failure to undertake even minimal efforts to locate the Defendant is a breach of both the substance and spirit of the law and renders the purported service defective.

Plaintiff further argues that both CPLR 5015(a)(1) and 317 contain periods of

limitation if exceeded, a court may not grant the relief requested. However, pursuant to CPLR 317, the one year time limitation is calculated from when the aggrieved party has knowledge of

Significantly, CPLR 5015 provides that a motion to vacate judgment must be made within one year from when defendant is served with a copy of the judgment with notice of entry. Plaintiff

despite Defendant filing a change of address with the United States Postal Service, Defendant

evidence adduced by Defendant is sufficient to conclude that the motion to vacate the default is timely. Accordingly, Defendants motion withstands the limitation. Since the Defendant was not properly served with process and never received a copy of the judgment, the Defendant's motion to vacate the judgment of foreclosure under CPLR 5015

Defendant.

ww

jurisdiction, to have the case dismissed on the ground that the Plaintiff does not own the 6

w.

The Defendant seeks, if vacatur is granted without finding a failure of personal

St

(a) (4) is granted and the complaint is dismissed for lack of personal jurisdiction over the

op Fo

MOTION TO DISMISS DUE TO LACK OF STANDING

re

claims he never received a copy of the judgment because the forwarding order had expired. The

clo

avers that it mailed a copy of the judgment to Defendant at the original residence. However,

su re

the judgment, so long as it does not exceed five years from the date the judgment was entered.

Fr au d. co

underlying Note and therefore lacks standing to prosecute the present foreclosure action. Standing to sue requires an interest in the claim at issue that the law will recognize as a sufficient predicate for determining the issue at the litigant's request (Caprer v Nussbaum, 36

AD3d 176, 182 [2d Dept 2006]). In general, the right to contest the issue of standing is waived if it is not raised in the Defendants answer or pre-answer motion to dismiss (Countrywide Home Loans, Inc. v Delphonse, 64 AD3d 624, 625 [2d Dept 2009]). However, such waiver does not apply if the Defendant has not appeared or filed an answer (Deutsche Bank Nat'l Trust Co. v McRae, 27 Misc 3d 247, 252 (Sup Ct, Allegany County 2010]).

Plaintiff to prove, as in the instant matter, that it owns the Note underlying the action and the validity of any associated assignment (TPZ Corp. v Dabbs, 25 AD3d 787, 789 [2d Dep't 2006]).

the Note is a nullity and any action for foreclosure based on the ownership of the mortgage alone

because the mortgage is but an incident to the debt which it is intended to secure, and without more, it provides the holder with no actionable interest on which to commence a foreclosure action (Merritt v Bartholick, 36 NY 44, 45 [1867]. While a written assignment or physical transfer of the Note is sufficient to result in an

assignment of the Note, will not result in an assignment of that Note (U.S. Bank, N.A. v Collymore, 68 AD3d 752, 754 [2d Dept 2009]).

ww

to the Plaintiff (through MERS, as nominee for Firs National Bank of Arizona [Arizona]) via 7

w.

In the case before us, Plaintiff only proffers evidence that the mortgage was transferred

St

implicit transfer of an associated Mortgage, an assignment of the Mortgage, without an explicit

op Fo

re

must fail (Kluge v Fugazy, 145 AD2d 537, 538 [2d Dept 1988]). This result is mandated

clo

A demonstration by the Plaintiff that it owns the Mortgage, without a showing that it also owns

su re

Once the issue of standing is raised by the Defendant, the burden is placed on the

Fr au d. co

an Assignment of Mortgage dated January 7, 2008. It does not, critically, provide evidence that the Note itself was transferred to the Plaintiff.

The only documents the Plaintiff submits in connection with the issue of the ownership

and assignment of the Note are a copy of the original Adjustable Rate Note Agreement between Arizona and the Defendant dated March 8, 2006, and a copy of an undated allonge between

Arizona and the First National Bank of Nevada [Nevada], seemingly transferring Arizonas

interest in the Note to Nevada. Although not dated, it is only logical for the court to assume that the allonge was executed prior to any purported assignment of the Note to the Plaintiff. If we

did not own (since such Note had already been purportedly assigned to the Plaintiff). Critically, Plaintiff does not provide documents demonstrating that the Note itself was

a third-party such as Nevada.

possible that Nevada may own both the Mortgage and the Note since a valid transfer of a Note (in this case through the undated allonge), effectively transfers an associated Mortgage, the assignment of the Mortgage from MERS (as nominee for Arizona) to Plaintiff, under New York law, definitively did not transfer ownership of the Note to Plaintiff.

Arizona was never in a position to assign the Note to Plaintiff. Therefore, even if Plaintiff holds the Mortgage, without evidence that it also owns the Note, it lacks standing to pursue the

ww

foreclosure action at bar. Consequently, Plaintiffs acquisition of the Mortgage without the underlying Note is insufficient to sustain a foreclosure action and Defendants motion to dismiss 8

w.

St

Since the allonge indicates that the Note is the property of Nevada and not Arizona,

op Fo

re

The only interpretation the court can adduce from such evidence is that although it is

clo

assigned to Plaintiff, such as from MERS (as nominee for Arizona), from Arizona itself, or from

su re

were to assume otherwise, it would imply that Arizona was assigning to Nevada a Note that it

Fr au d. co

based on the Plaintiffs lack of standing is granted. MOTION TO DISMISS WITH PREJUDICE DUE TO FRAUD

The Defendant seeks to have the default judgment dismissed with prejudice on the ground of fraud. To this end, the Defendant asserts three primary causes of action: 1)

Champerty, under Judiciary Law 489, in which the Plaintiff is accused of buying the debt

primarily for the purpose of bringing a lawsuit; 2) violation of General Business Law 349); and 3) common law fraud.

Defendant first argues that Plaintiffs purported purchase of the Mortgage violated

with the primary purpose of bringing a lawsuit (see Limpar Realty Corp. v Uswiss Realty Holding, Inc., 112 AD2d 834, 835 - 836 [1st Dept 1985]). Although Defendant offers some

the property was already well into default and was subject to foreclosure within days of its

assertion that the purchase represented a prudent mortgage investment. Since Defendant failed to make the requisite showing that the purported purchase of the note was made primarily for the purposes of bringing a lawsuit, Defendants request to dismiss the case with prejudice under Judiciary Law 489 is denied.

and that the Plaintiff is liable for common law fraud. Defendant, however, fails to flesh out his argument or provide any substantial evidence backing his claim. Consequently, the Defendants

ww

motion to dismiss the present foreclosure action with prejudice due a violation of GBL 349 or under the theory of common law fraud is denied. 9

w.

St

The Defendant also contends that the Plaintiff violated both General Business Law 349,

op Fo

re

purchase, the Defendant fails to provide the degree of evidence necessary to overcome Plaintiffs

clo

convincing evidence to this end, including the fact that the debt was purportedly purchased when

su re

Judiciary Law 489 which prohibits a corporation or collection agency from purchasing a debt

Fr au d. co

REMAINING ISSUES The other issues raised in Defendants Order to Show Cause including the 1) motion to dismiss due to a failure to state a cause of action under CPLR 3211, and 2) a motion to vacate the default judgment and allow an answer under CPLR 317 are deemed moot as they are subsumed or deemed irrelevant in light of this courts decision above. Based on the forgoing, it is

ORDERED that Defendants motion to vacate the default judgment and dismiss the action is granted; it is further

fraud is denied.

The foregoing constitutes the decision and order of the court.

Dated: June 22, 2011

re

op Fo

clo

ww

w.

St

10

su re

ORDERED that Defendants motion to have the case dismissed with prejudice due to

___________________________ Bernice D. Siegal, J. S. C.

Fr au d. co

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- CAAP 18 0000477sdoДокумент15 страницCAAP 18 0000477sdoDinSFLA100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- CAAP 14 0001115mopДокумент21 страницаCAAP 14 0001115mopDinSFLAОценок пока нет

- Electronically Filed Intermediate Court of Appeals CAAP-15-0000734 13-MAY-2019 08:14 AMДокумент15 страницElectronically Filed Intermediate Court of Appeals CAAP-15-0000734 13-MAY-2019 08:14 AMDinSFLAОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Supreme CourtДокумент15 страницSupreme CourtDinSFLA100% (1)

- CAAP 17 0000553sdoДокумент5 страницCAAP 17 0000553sdoDinSFLAОценок пока нет

- Electronically Filed Intermediate Court of Appeals CAAP-17-0000402 22-MAY-2019 08:23 AMДокумент7 страницElectronically Filed Intermediate Court of Appeals CAAP-17-0000402 22-MAY-2019 08:23 AMDinSFLAОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- SCWC 16 0000319Документ29 страницSCWC 16 0000319DinSFLAОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- (J-67-2018) in The Supreme Court of Pennsylvania Eastern District Saylor, C.J., Baer, Todd, Donohue, Dougherty, Wecht, Mundy, JJДокумент18 страниц(J-67-2018) in The Supreme Court of Pennsylvania Eastern District Saylor, C.J., Baer, Todd, Donohue, Dougherty, Wecht, Mundy, JJDinSFLAОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Electronically Filed Intermediate Court of Appeals CAAP-18-0000298 19-MAR-2019 08:43 AMДокумент7 страницElectronically Filed Intermediate Court of Appeals CAAP-18-0000298 19-MAR-2019 08:43 AMDinSFLA100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Filed 4/2/19 On Transfer: Enner LockДокумент39 страницFiled 4/2/19 On Transfer: Enner LockDinSFLAОценок пока нет

- Califorina ForeclosuresДокумент48 страницCaliforina ForeclosuresCelebguard100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Case: 14-14544 Date Filed: 05/03/2019 Page: 1 of 76Документ76 страницCase: 14-14544 Date Filed: 05/03/2019 Page: 1 of 76DinSFLAОценок пока нет

- Certified For Publication: Filed 4/30/19 Reposted With Page NumbersДокумент10 страницCertified For Publication: Filed 4/30/19 Reposted With Page NumbersDinSFLAОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Electronically Filed Intermediate Court of Appeals CAAP-15-0000442 28-FEB-2019 08:04 AMДокумент6 страницElectronically Filed Intermediate Court of Appeals CAAP-15-0000442 28-FEB-2019 08:04 AMDinSFLAОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Electronically Filed Intermediate Court of Appeals CAAP-15-0000316 21-MAR-2019 07:51 AMДокумент3 страницыElectronically Filed Intermediate Court of Appeals CAAP-15-0000316 21-MAR-2019 07:51 AMDinSFLAОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Electronically Filed Intermediate Court of Appeals CAAP-17-0000848 28-DEC-2018 07:54 AMДокумент7 страницElectronically Filed Intermediate Court of Appeals CAAP-17-0000848 28-DEC-2018 07:54 AMDinSFLAОценок пока нет

- Electronically Filed Intermediate Court of Appeals CAAP-14-0001093 28-JAN-2019 07:52 AMДокумент13 страницElectronically Filed Intermediate Court of Appeals CAAP-14-0001093 28-JAN-2019 07:52 AMDinSFLAОценок пока нет

- Supreme Court of The State of New York Appellate Division: Second Judicial DepartmentДокумент6 страницSupreme Court of The State of New York Appellate Division: Second Judicial DepartmentDinSFLA100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Not To Be Published in Official Reports: Filed 2/14/19 The Bank of New York Mellon v. Horner CA4/3Документ10 страницNot To Be Published in Official Reports: Filed 2/14/19 The Bank of New York Mellon v. Horner CA4/3DinSFLA100% (1)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Electronically Filed Intermediate Court of Appeals CAAP-16-0000178 27-DEC-2018 07:55 AMДокумент13 страницElectronically Filed Intermediate Court of Appeals CAAP-16-0000178 27-DEC-2018 07:55 AMDinSFLAОценок пока нет

- Supreme Court of Florida: Marie Ann GlassДокумент15 страницSupreme Court of Florida: Marie Ann GlassDinSFLAОценок пока нет

- Electronically Filed Intermediate Court of Appeals CAAP-17-0000884 29-JAN-2019 08:15 AMДокумент7 страницElectronically Filed Intermediate Court of Appeals CAAP-17-0000884 29-JAN-2019 08:15 AMDinSFLA50% (2)

- Electronically Filed Supreme Court SCWC-15-0000005 09-OCT-2018 07:59 AMДокумент44 страницыElectronically Filed Supreme Court SCWC-15-0000005 09-OCT-2018 07:59 AMDinSFLA100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Califorina ForeclosuresДокумент48 страницCaliforina ForeclosuresCelebguard100% (1)

- Electronically Filed Intermediate Court of Appeals CAAP-16-0000042 21-DEC-2018 08:02 AMДокумент4 страницыElectronically Filed Intermediate Court of Appeals CAAP-16-0000042 21-DEC-2018 08:02 AMDinSFLA100% (1)

- United States Court of Appeals For The Ninth CircuitДокумент17 страницUnited States Court of Appeals For The Ninth CircuitDinSFLAОценок пока нет

- Obduskey Brief in Opposition 17-1307Документ30 страницObduskey Brief in Opposition 17-1307DinSFLA100% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- D C O A O T S O F: Merlande Richard and Elie RichardДокумент5 страницD C O A O T S O F: Merlande Richard and Elie RichardDinSFLAОценок пока нет

- CAAP 16 0000806sdoДокумент5 страницCAAP 16 0000806sdoDinSFLAОценок пока нет

- Obduskey - Cert. Reply - FILEDДокумент15 страницObduskey - Cert. Reply - FILEDDinSFLAОценок пока нет

- Capuz vs. Court of Appeals PDFДокумент4 страницыCapuz vs. Court of Appeals PDFJoshua CuentoОценок пока нет

- Shane Gates V Sheriff Jack Strain Randy Smith ST Tammany 22nd Clerk of Court Louisiana 5th Circuit - Case No 17-30519Документ3 445 страницShane Gates V Sheriff Jack Strain Randy Smith ST Tammany 22nd Clerk of Court Louisiana 5th Circuit - Case No 17-30519Shane GatesОценок пока нет

- Memorandum of Law of Defendant-Appellant Scott M. DonnenbergДокумент36 страницMemorandum of Law of Defendant-Appellant Scott M. DonnenbergKenneth SandersОценок пока нет

- Case 01-DefaultДокумент5 страницCase 01-DefaultBig BoysОценок пока нет

- Tewhey DecisionДокумент8 страницTewhey DecisionRichard VetsteinОценок пока нет

- Yap vs. Lagtapon Full TextДокумент10 страницYap vs. Lagtapon Full TextfreezoneОценок пока нет

- Litigation: Commencement of An Action For The Paralegal GLC-101Документ31 страницаLitigation: Commencement of An Action For The Paralegal GLC-101April ShowersОценок пока нет

- Request For Default JudgmentДокумент12 страницRequest For Default Judgmenthimself2462100% (2)

- All Civil Drafting Documents-1Документ97 страницAll Civil Drafting Documents-1Karen MainaОценок пока нет

- Conflicts Case DigestДокумент16 страницConflicts Case DigestMelki Lozano100% (1)

- Hawley V Luminar Leisure PLC Hawley V Luminar Leisure PLCДокумент29 страницHawley V Luminar Leisure PLC Hawley V Luminar Leisure PLCTyler ReneeОценок пока нет

- Neumont University Begs Judge To Seal Financial RecordsДокумент3 страницыNeumont University Begs Judge To Seal Financial RecordscollegetimesОценок пока нет

- Brito, Sr. vs. DianalaДокумент2 страницыBrito, Sr. vs. DianalaPACОценок пока нет

- Dacer v. LacsonДокумент6 страницDacer v. LacsonJennilyn TugelidaОценок пока нет

- Solidarity Obo Wehncke V Surf4cars (Pty) LTD (2014) 7 BLLR 702 (LAC)Документ6 страницSolidarity Obo Wehncke V Surf4cars (Pty) LTD (2014) 7 BLLR 702 (LAC)KHA RI BIKEОценок пока нет

- Chantel Blunk V Lynne Fenton, Et AlДокумент10 страницChantel Blunk V Lynne Fenton, Et AlMichael_Lee_RobertsОценок пока нет

- Robert Kissh Judgement For $37,503Документ3 страницыRobert Kissh Judgement For $37,503Hudson Valley Reporter- PutnamОценок пока нет

- Default JudgmentДокумент49 страницDefault Judgmentmoo6moo100% (2)

- Malaysian Civil Court Procedure Note 2 of 4 Notes: Universiti Kebangsaan Malaysia Fakulti Undang-UndangДокумент54 страницыMalaysian Civil Court Procedure Note 2 of 4 Notes: Universiti Kebangsaan Malaysia Fakulti Undang-Undangmusbri mohamedОценок пока нет

- Plaintiff-Appellee Vs Vs Defendant-Appellant Benjamin Pineda Ceasar R. MonteclarosДокумент6 страницPlaintiff-Appellee Vs Vs Defendant-Appellant Benjamin Pineda Ceasar R. MonteclarosAnne AjednemОценок пока нет

- Santiago Syjuco, Inc. Vs CA (Case Digest)Документ2 страницыSantiago Syjuco, Inc. Vs CA (Case Digest)Kennedy Gacula100% (3)

- Camelo V BWRSD ComplaintДокумент42 страницыCamelo V BWRSD ComplaintWJAR NBC 10Оценок пока нет

- Subordinate Court Civil Procedure Manual 8Документ78 страницSubordinate Court Civil Procedure Manual 8hftysndt2jОценок пока нет

- Micheal Goland MOTION OF VEXATIOUS LITIGANTДокумент50 страницMicheal Goland MOTION OF VEXATIOUS LITIGANTDaniel Cooper100% (2)

- CIP3701-mcq 2004Документ44 страницыCIP3701-mcq 2004GladstoneОценок пока нет

- L-CRLJ 66 Eff 9.1.19Документ2 страницыL-CRLJ 66 Eff 9.1.19Kevin SuitsОценок пока нет

- United States Court of Appeals, Fourth CircuitДокумент6 страницUnited States Court of Appeals, Fourth CircuitScribd Government DocsОценок пока нет

- USDC Doc. #62 Through 62-17 - Renewed Notice of Motion and Motin For Entry of Default JudgmentДокумент184 страницыUSDC Doc. #62 Through 62-17 - Renewed Notice of Motion and Motin For Entry of Default JudgmentSYCR ServiceОценок пока нет

- Palma Vs Galvez - DigestДокумент2 страницыPalma Vs Galvez - DigestJubelle Angeli100% (1)

- 1 - de Dios VS CaДокумент14 страниц1 - de Dios VS CaMaita Jullane DaanОценок пока нет

- The Art of Fact Investigation: Creative Thinking in the Age of Information OverloadОт EverandThe Art of Fact Investigation: Creative Thinking in the Age of Information OverloadРейтинг: 5 из 5 звезд5/5 (2)

- Greed on Trial: Doctors and Patients Unite to Fight Big InsuranceОт EverandGreed on Trial: Doctors and Patients Unite to Fight Big InsuranceОценок пока нет

- Courage to Stand: Mastering Trial Strategies and Techniques in the CourtroomОт EverandCourage to Stand: Mastering Trial Strategies and Techniques in the CourtroomОценок пока нет

- Litigation Story: How to Survive and Thrive Through the Litigation ProcessОт EverandLitigation Story: How to Survive and Thrive Through the Litigation ProcessРейтинг: 5 из 5 звезд5/5 (1)

- Plaintiff 101: The Black Book of Inside Information Your Lawyer Will Want You to KnowОт EverandPlaintiff 101: The Black Book of Inside Information Your Lawyer Will Want You to KnowОценок пока нет