Академический Документы

Профессиональный Документы

Культура Документы

Objective 4.01 Key Terms

Загружено:

Heather CovingtonИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Objective 4.01 Key Terms

Загружено:

Heather CovingtonАвторское право:

Доступные форматы

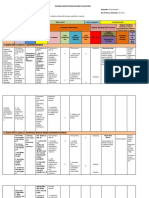

Appendix 4.

01G

Key Terms: Work Compensation and Forms

Term wage salary commission tip bonus Forms of Payment paycheck direct deposit payroll card A form of payment to an employee An employer deposits the employees paycheck dirctly into the authorized employees depository institution account. A prepaid card that is offered to employees as an alternative to paper paychecks or directly depositing wages into an employees depostiory institution Explanation The amount of money paid for a specified quantity of labor. A set amount of money paid for a set period of time worked. Income paid as a percentage of sales made by a salesman Money paid by customers to those who provide services. Money paid in addition to base pay, either as a reward for performance or as a share of profit. Types of Compensation for Work

Contents of Paycheck Stub paycheck stub pay period gross pay net pay deduction federal withholding tax state withholding tax This part lists the paycheck deductions as well as other important information. The length of time for which an employees wages are calculated. The total amount of money earned during the pay period before deductions. The amount of money left after all the deductions have been taken from the gross pay earned in the pay period. Money subtracted from gross pay for required taxes, employee insurance, and retirement benefits. The amount required by law for employers to withhold from earned wages to pay federal income taxes. The percentage deducted from an individuals paycheck to assist in funding government agencies within the state.

7086 Personal Finance

Unit B: Preparing to Earn a Living

Summer 2010 148

Appendix 4.01G, continued

Key Terms: Work Compensation and Forms

Contents of Paycheck Stub, continued FICA Federal Insurance Contributions Act. This tax includes Social Security and Medicare. Social Security taxes are based on a 6.2 percentage of the employees gross income. Medicare is 1.45% of gross income. The amount an employee contributed each pay period to a retirement plan. The amount taken from the employees paycheck for medical benefits. The total of all deductions which have been withheld from an individuals paycheck from January 1 to the last day of the pay period A compulsory charge imposed on citizens by local, state, or federal governments. The higher the income, the higher the amount of taxes paid They impose a higher tax rate on those with lower incomes than those with higher States the amount of money earned and taxes paid throughout the previous year An employees withholding certificate---the information provided on this form determines the percentage of gross pay to be withheld for taxes Employment Eligibility Verification Form---the information on this form is for employers to verify the eligibility of individuals for employment. Tax forms that report other sources of income earned during a tax year. x x x 1099-INT- Interest income earned on savings and/or investment accounts during the previous year. 1099-DIV- Dividends earned on investments during the previous year. 1099-MISC- Income earned from self-employment, royalties, rent payments, unemployment compensation, and other sources.

retirement plan medical year-to-date deductions tax progressive tax regressive tax Form W-2 Form W-4 Form I-9 1099 Forms

Forms and Resources for Managing Income Taxes

7086 Personal Finance

Unit B: Preparing to Earn a Living

Summer 2010 149

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- 450i User ManualДокумент54 страницы450i User ManualThượng Lê Văn0% (2)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- HSBC in A Nut ShellДокумент190 страницHSBC in A Nut Shelllanpham19842003Оценок пока нет

- The Art of Blues SolosДокумент51 страницаThe Art of Blues SolosEnrique Maldonado100% (8)

- Apm p5 Course NotesДокумент267 страницApm p5 Course NotesMusumbulwe Sue MambweОценок пока нет

- State Immunity Cases With Case DigestsДокумент37 страницState Immunity Cases With Case DigestsStephanie Dawn Sibi Gok-ong100% (4)

- Objective 8.03Документ3 страницыObjective 8.03Heather CovingtonОценок пока нет

- Objective 9.02Документ3 страницыObjective 9.02Heather CovingtonОценок пока нет

- Objective 7.01Документ4 страницыObjective 7.01Heather CovingtonОценок пока нет

- Competency 7.00 ProjectДокумент2 страницыCompetency 7.00 ProjectHeather CovingtonОценок пока нет

- Competency 5.00 ProjectДокумент2 страницыCompetency 5.00 ProjectHeather CovingtonОценок пока нет

- Competency 9.00 ProjectДокумент2 страницыCompetency 9.00 ProjectHeather CovingtonОценок пока нет

- Competency 4.0 ProjectДокумент2 страницыCompetency 4.0 ProjectHeather CovingtonОценок пока нет

- Objective 8.02 Unpacked ContentДокумент2 страницыObjective 8.02 Unpacked ContentHeather CovingtonОценок пока нет

- Competency 3.00 ProjectДокумент3 страницыCompetency 3.00 ProjectHeather CovingtonОценок пока нет

- Competency 1.00 ProjectДокумент2 страницыCompetency 1.00 ProjectHeather CovingtonОценок пока нет

- Objective 4.02 Unpacked ContentДокумент4 страницыObjective 4.02 Unpacked ContentHeather CovingtonОценок пока нет

- Objective 7.01 Key TermsДокумент3 страницыObjective 7.01 Key TermsHeather CovingtonОценок пока нет

- Basic DfwmacДокумент6 страницBasic DfwmacDinesh Kumar PОценок пока нет

- 4th Sem Electrical AliiedДокумент1 страница4th Sem Electrical AliiedSam ChavanОценок пока нет

- 004-PA-16 Technosheet ICP2 LRДокумент2 страницы004-PA-16 Technosheet ICP2 LRHossam Mostafa100% (1)

- Data Sheet WD Blue PC Hard DrivesДокумент2 страницыData Sheet WD Blue PC Hard DrivesRodrigo TorresОценок пока нет

- Ishares Core S&P/TSX Capped Composite Index Etf: Key FactsДокумент2 страницыIshares Core S&P/TSX Capped Composite Index Etf: Key FactsChrisОценок пока нет

- Sterling B2B Integrator - Installing and Uninstalling Standards - V5.2Документ20 страницSterling B2B Integrator - Installing and Uninstalling Standards - V5.2Willy GaoОценок пока нет

- Group 1 Disaster Management Notes by D. Malleswari ReddyДокумент49 страницGroup 1 Disaster Management Notes by D. Malleswari Reddyraghu ramОценок пока нет

- Functions of Commercial Banks: Primary and Secondary FunctionsДокумент3 страницыFunctions of Commercial Banks: Primary and Secondary FunctionsPavan Kumar SuralaОценок пока нет

- Tanzania Finance Act 2008Документ25 страницTanzania Finance Act 2008Andrey PavlovskiyОценок пока нет

- ARUP Project UpdateДокумент5 страницARUP Project UpdateMark Erwin SalduaОценок пока нет

- Office Storage GuideДокумент7 страницOffice Storage Guidebob bobОценок пока нет

- Specialty Arc Fusion Splicer: FSM-100 SeriesДокумент193 страницыSpecialty Arc Fusion Splicer: FSM-100 SeriesSFTB SoundsFromTheBirdsОценок пока нет

- Fedex Service Guide: Everything You Need To Know Is OnlineДокумент152 страницыFedex Service Guide: Everything You Need To Know Is OnlineAlex RuizОценок пока нет

- Environmental Auditing For Building Construction: Energy and Air Pollution Indices For Building MaterialsДокумент8 страницEnvironmental Auditing For Building Construction: Energy and Air Pollution Indices For Building MaterialsAhmad Zubair Hj YahayaОценок пока нет

- Fidp ResearchДокумент3 страницыFidp ResearchIn SanityОценок пока нет

- 2.1 Components and General Features of Financial Statements (3114AFE)Документ19 страниц2.1 Components and General Features of Financial Statements (3114AFE)WilsonОценок пока нет

- Catalog Celule Siemens 8DJHДокумент80 страницCatalog Celule Siemens 8DJHAlexandru HalauОценок пока нет

- Historical Development of AccountingДокумент25 страницHistorical Development of AccountingstrifehartОценок пока нет

- Notifier AMPS 24 AMPS 24E Addressable Power SupplyДокумент44 страницыNotifier AMPS 24 AMPS 24E Addressable Power SupplyMiguel Angel Guzman ReyesОценок пока нет

- Google App EngineДокумент5 страницGoogle App EngineDinesh MudirajОценок пока нет

- What Is Retrofit in Solution Manager 7.2Документ17 страницWhat Is Retrofit in Solution Manager 7.2PILLINAGARAJUОценок пока нет

- JAZEL Resume-2-1-2-1-3-1Документ2 страницыJAZEL Resume-2-1-2-1-3-1GirlieJoyGayoОценок пока нет

- NOP PortalДокумент87 страницNOP PortalCarlos RicoОценок пока нет

- M2 Economic LandscapeДокумент18 страницM2 Economic LandscapePrincess SilenceОценок пока нет

- Efs151 Parts ManualДокумент78 страницEfs151 Parts ManualRafael VanegasОценок пока нет