Академический Документы

Профессиональный Документы

Культура Документы

BarCap July8 The Emerging Markets Weekly Sunshine Behind The Clouds

Загружено:

r3vansИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

BarCap July8 The Emerging Markets Weekly Sunshine Behind The Clouds

Загружено:

r3vansАвторское право:

Доступные форматы

EMERGING MARKETS RESEARCH

7 July 2011

THE EMERGING MARKETS WEEKLY Sunshine behind the clouds

Investor confidence in EM suggests that summer price dips are likely to be bought into. Recent events and volatility in Europe and the US are likely to produce discounted prices in EM, and we think investors should look to go long, albeit cautiously. There is sunshine behind the clouds, and we are waiting for a breeze to blow them away.

EM Views on a Page EM Dashboard EM FX Views on a Page EM Credit Portfolio Data Review & Preview FX Forecasts and Forwards Official Interest Rates What we like Local Bonds Buy long-dated MGS FX Short EUR/RON via 6m T-bills

2 22 23 25 26 32 33

Macro Outlooks

Emerging Asia: Inflation headaches 6 The PBoC raised benchmark rates for the third time this year, as inflation remains elevated. Inflation concerns are likely to persist in Emerging Asia, with core price pressures increasing and persistent. EEMEA: Doves rule as inflation peaks and growth slows 8 Moderating global commodity prices and prospects for good local harvests, combined with slowing growth and greater risks of a harder landing globally, seem to have lent support to more dovish attitudes at central banks across the region. Latin America: At war again? Yes, but not for long 10 As commodity price pressures dissipate and headline inflation moves south, the crusade against currency appreciation is starting to re-emerge in the Latin region. Emerging Markets Corporate Credit: Top of the range warrants cautious longs 12 We recommended taking profits on shorts during what we believed was going to be a volatile June. Spreads are wider now, having priced in further peripheral European turmoil and ongoing weak US data.

Credit

Add convexity exposure at the long end of the PDVSA curve (PD 27, 37s

Weekly EM Asset Performance

ZAR/USD MXN/USD CLP/USD INR/USD BRL/USD KRW/USD TRY/USD RUB/USD TWD/USD -0.1% -0.3% 0.2% 0.3% 0.6% 0.6% EM FX 1.4% 1.3% 1.2%

Strategy Focus

Thailand: A tactical long 15 The Puea Thai party election win paves the way for Yingluck Shinawatra to become the new PM. While we view the result as constructive in the near term, as it reduces uncertainty, we do not believe it resolves the longer-term issues in Thai politics. But in the short term, we expect the markets focus to switch back to the economy. China rates: 1y deposit rate to act as a floor for 7d fixing; curve to remain flat 17 We expect the curve to remain flat in the near term on tight systemic liquidity. The 1y deposit rate will serve as a floor for money market rates in a tight liquidity environment. EM sovereign credit: Beta-driven shifts in positioning 19 A comparison of Barclays Capital EM sovereign Overweight/Underweight views with market positioning as of end-May reveals some interesting insights. We recommend adding exposure to Philippines versus Indonesia and, driven by the recent developments with President Chavez, suggest adding risk to Venezuela. For all three credits, defensive positioning should constitute an important anchor over the next few weeks.

PLEASE SEE ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES STARTING AFTER PAGE 34

CLP 2yr IRS EM Rates Kor 2yr IRS Mex TIIE 5yr India 2yr IRS Braz Jan 12 -3 bp Pol 5yr IRS -5 bp SA 2yr IRS -7 bp CZK 5yr IRS -9 bp Hun 5yr IRS Indo 5yr Gov -15 bp Hun 5yr CDS Turk 5yr CDS EM Credit SA 5yr CDS Rus 5yr CDS Braz 5yr CDS Mex 5yr CDS Phils 5yr Indo 5yr CDS -23 bp Veni 5yr CDS Arg 5yr CDS-28 bp Kospi Russia RTS S&P JSE All share FTSE JSE Turkey ISE Sensex Shanghai Bovespa Bolsa

6 bp 4 bp 4 bp 3 bp 3 bp

2 bp 2 bp 0 bp -5 bp -5 bp -5 bp -7 bp -9 bp

3.8% 3.7% 2.4% 1.4% 1.3% 1.3% 1.2% 1.2% 0.6% 0.3% EM Equity

Note: EM Assets Performance charts as of 07July 2011 except CDS spreads, which are as of 06 July 2011. Source: Bloomberg, Markit, Barclays Capital

Barclays Capital | The Emerging Markets Weekly

EM VIEWS ON A PAGE

What happened Markets The risk-rally continued from last week, with positive news flow from the US in the form of a better-than-expected ADP employment report and ISM manufacturing report. The EUR slid against the USD on concerns over Portugal and Peripheral Europe. EM FX appreciated. EM credit was modestly tighter, particularly Venezuela, after President Hugo Chavez confirmed that he has been diagnosed with cancer and is undergoing treatment. Fitch upgraded Romania from BB+ to BBB-, putting the credit back to investment grade as Moodys already rates the credit Baa3. Global macro The ECB increased the repo rate 25bp to 1.50% today and signalled that rates may rise again in the coming months. Moodys downgraded Portugals sovereign credit rating four notches to Ba2 from Baa1, putting it at junk status. The current opposition party in Thailand, Puea Thai, which is linked to ex-PM Thaksin Shinawatra, won elections on July 3 by a simple majority.

Monetar PBoC raised its deposit/lending rates by 25bp effective July 7. This is the third rise in benchmark interest rates this year, bringing the oney policy year lending rate to 6.56%. Malaysia left its policy rate on hold at 3.0%, contrary to our and market expectations for a 25bp hike. Poland kept its policy rate unchanged at 4.5% as expected by us and consensus. What we think EM assets Investor confidence in EM suggests that summer price dips are likely to be bought into. Recent events and volatility in Europe and the US are likely to produce discounted prices in EM, and we think investors should look to go long, albeit cautiously. We believe there is sunshine behind the clouds, and we are waiting for a breeze to move them away.

What we like Asset class Local Bonds FX Trade Buy long-dated MGS Short EUR/RON via 6m T-bills Rationale News about the divestment programme has started to improve in Malaysia, and we expect proceeds from the governments asset sales to help to reduce the fiscal deficit to 4.3% of GDP. The demand for FX from local Greek bank subsidiaries in Romania remains the main risk for the currency but EUR/RON has managed to stabilize below 4.25, suggesting that investor positioning is now significantly lighter. Moreover, the recent endorsement by the IMF and Fitch of Romania's improving fundamentals, in our view, further supports the appealing RON catch-up potential relative to other CEE currency peers. Chavez health issues represent a challenge for the government ahead of the presidential election, as the illness will likely limit his ability to address his declining popularity. Also, any possible successors will be at a disadvantage with respect to the main opposition leaders, who have shown more solid leadership. The possibility of a democratic transition may continue to increase, providing additional support to Venezuelan assets. Against this background, we look to add convexity exposure at the long end of the curve.

Credit

Add convexity exposure at the long end of the PDVSA curve (PD 27, 37s)

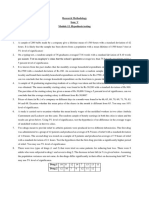

Figure 1: Recent rally in risky assets has been impressive

Figure 2: PD 17Ns still our top pick, however convexity of PD 27/37s may spur outperformance if momentum continues

Recovery Adjusted Spread (bp) 1,400 1,350 1,300 PD15 1,250 1,200 1,150 PD17N PD22 PD17 PD16 PD14 PD27 1,100 1,050 0 5 10 15 Average Life 20 25 30 PD37

3,000 2,900 2,800 2,700 2,600 2,500 2,400 Nov-10

Jan-11

Mar-11 Nasdaq

May-11

Jul-11

Source: Bloomberg

Source: Bloomberg

7 July 2011

Barclays Capital | The Emerging Markets Weekly

EMERGING MARKETS OUTLOOK

Sunshine behind the clouds

Kumar Rachapudi +65 6308 3383 kumar.rachapudi@barcap.com Ju Wang +65 6308 2801 ju.wang@barcap.com Nick Verdi +65 6308 3093 nick.verdi@barcap.com

Investor confidence in EM suggests that summer price dips are likely to be bought into. Recent events and volatility in Europe and the US are likely to produce discounted prices in EM, and we think investors should look to go long, albeit cautiously. There is sunshine behind the clouds, and we are waiting for a breeze to blow them away.

What happened?

In Europe: The approval of the Greek austerity plan and its implementation law, which included a privatisation package, boosted market sentiment last week. However, on Wednesday, Moodys disturbed the seemingly calm waters by downgrading Portugals longterm government bond ratings to Ba2, or junk, from Baa1. This move put Ireland back on the radar as well, with some market participants now expecting a downgrade of its rating. Newswires reported that Germany may revive a proposal that involves a voluntary exchange of debt for bonds with a longer maturity. Markets are likely to be watchful until further clarity materialises. In the US: Approval of the Greek austerity plan coincided with the end of QE2 and strongerthan-expected US data, and resulted in US 10y yields moving higher. Recent Treasury auction results indicate weaker demand for the 2y, 5y and 7y tenors. Our US economists view the increase in yields as a reflection of increased risk appetite and better economic data rather than the end of QE2. The drop in yields after Portugals downgrade could be seen as supporting our economists view. In China: On Wednesday, the PBoC announced the third benchmark interest rate hike in 2011, the fifth hike in the current tightening cycle, which began in October 2010. The increase was in line with expectations, and we do not rule out the possibility of one more rate hike in Q3 11. In EM: Financial assets have performed relatively well in the past month, with only EM equities clearly underperforming advanced economies. EM FX remained resilient, moving in line with the DXY. EM credit significantly outperformed in June, with the BarCap sovereign and corporate USD credit indices returning +1.2% and -0.6%, respectively, compared with -

Figure 1: EM bonds outperformed despite sell-off in USTs

101.5 101.0 100.5 100.0 99.5 99.0 98.5 98.0 1-Jun Barcap EM LCY Bond Index Barcap EM Asia LCY Bond Index 10y UST (%, RHS) 3.3 3.2 3.2 3.1 3.1 3.0 3.0 2.9 2.9 2.8 11-Jun 21-Jun 1-Jul

Figure 2: buoyed by FX returns

10y UST (%, RHS) Barcap EM Asia LCY Bond Index (FX hedged) Barcap EM LCY Bond Index (FX hedged) 100.3 100.2 100.2 100.1 100.1 100.0 100.0 99.9 99.9 99.8 99.8 1-Jun 11-Jun 21-Jun 1-Jul 3.20 3.15 3.10 3.05 3.00 2.95 2.90 2.85

Source: Bloomberg, Barclays Capital

Source: Bloomberg, Barclays Capital

7 July 2011

Barclays Capital | The Emerging Markets Weekly

0.9% and -1.0% for US IG and HY (total returns). In local markets, FX-hedged bond portfolios were stable during the risk-off period and gained significantly even as USTs sold off in the last week of June. However, this outperformance is largely a result of the buffer provided by EM FX, especially in Asia.

What we think?

EM assets have become something of a safe haven and we recommend buying into any price dips

EM assets seem to have become something of a safe haven. Along with stronger growth fundamentals, we believe the near-term outlook for EM is positive compared with developed markets. Investors seem to agree, as shown by inflows to the asset class. Although we do not recommend taking on significant directional risk in EM at the moment, given current valuations, the apparent investor confidence in various EM market segments suggests that during a potentially noisy summer, price dips are likely to be bought into. Moreover, once the summer storms have passed, EM assets, especially currencies and sovereign credit, look poised to do well. The current volatility in Europe and the US will likely create discounts on some of these assets. Barring an increase in systemic risk aversion, we think investors should use these opportunities to go long. That said, investors need to be mindful of risks. The situation in Europe, assuming it does not worsen, is likely to result in EM assets trading sideways, in our view. However, any sustained deterioration in peripheral Euro zone debt markets could lead to some pressures in wholesale funding markets, particularly if investors nervousness about European bank balance sheets increases. In fact, Portugals four-notch downgrade has already unsettled market confidence. This is particularly important as the Fed is no longer supplying dollars via QE2. However, the extension of the Feds swap lines with various foreign central banks through August 2012 should serve as a backstop against these pressures. In any case, any potential stress in funding will result in a bid for the USD. This channel of global liquidity could mean tighter conditions for EM, and result in EM FX underperforming, which, in turn, could see EM bonds weakening, especially where foreign participation is high. A sell-off in US Treasuries, either because of heightened debt ceiling concerns or because of better-than-expected data, is a risk to watch. The latter would likely be positive for risk, and both EM equities and FX are likely to outperform. Even if this results in higher UST yields, EM bond portfolios are likely to do well, especially after taking into account the buffer provided by expected FX gains. However, heightened concerns about a US debt ceiling agreement would likely result in increased risk aversion and steeper rate curves.

However, risks remain. Further deterioration in peripheral Europe would imply a need to monitor potential funding concerns

A sell-off in USTs because of better-than-expected data is likely to be positive for risk assets. However, sell-offs due to debt ceiling concerns would likely result in risk aversion

What we like?

Given the current risk sentiment, we prefer either countries with strong idiosyncratic dynamics or low beta trades.

We recommend going long SGD (vs a basket of USD and EUR) and ILS as low beta trades

In EM FX, as a low-beta trade, we recommend going long the SGD against a basket of the USD (60%) and EUR (40%). In EEMEA, we recommend longs in ILS (a low beta currency with the backstop of a C/A surplus) and RON. The demand for FX from local Greek bank subsidiaries in Romania remains the main risk for the currency but EUR/RON has managed to stabilise below 4.25, suggesting that investor positioning is now significantly lighter. Moreover, the recent endorsement by the IMF and Fitch of Romania's improving fundamentals, in our view, further supports the appealing RON catch-up potential relative to other CEE currency peers.

7 July 2011

Barclays Capital | The Emerging Markets Weekly

Pay 1y India OIS, and buy longdated MGS in Asia

In rates, we recommend paying the front-end and positioning for curve flattening. Ahead of the RBI policy review on 26 July, India 1y remains a pay, in our view. Loan-to-deposit ratios in HKD-denominated lending are rising, which has likely driven the Hibor underperformance versus Libor in recent months. Although we do not expect an imminent funding squeeze in Hong Kong, we recommend hedging that risk via a low-beta spread trade. We suggest paying 5y HK rates and receiving 0.88x DV01 in US 5y. In general, we continue to recommend owning long-end bonds across Asia and, in particular, we highlight Malaysia this week. News about the divestment programme has started to improve in Malaysia, and we expect proceeds from the governments asset sales to help to reduce the fiscal deficit to 4.3% of GDP (the governments forecast is 5.4% of GDP). We recommend owning long-end Malaysian government bonds. We see room in EEMEA rates for some good RV trades right now and one we especially favour is paying PLN 5y/5y against EUR in swaps. This is different from our global rates theme but is still ultimately a defensive trade that suits the current environment: a continuing soft patch in European cyclical data should pull down back-end yields in Europe but PLN yields will probably underperform as the latter has become reliant on foreign capital inflows that could dry up. There are some leverage challenges in Poland as well that, we think, will probably prevent back-end yields from rallying as much as EUR yields. In credit we highlight Romania's upgrade back to investment grade this week, which contrasts with the downgrades in Western Europe and is a further reminder of the diverging paths of CEE and the Western European periphery. Against the backdrop of medium-term uncertainties around the 2012 elections and the developments in Greece/Greek banks, we view the regained IG status as supportive of Romania credit and we recommend adding exposure to Romania's EUR-denominated bonds (EUR 16s, 18s), potentially as a switch from the expensive Croatia EUR 14s. Recent positioning data (see Focus piece) suggests that investors are very defensively positioned in Turkey cash credit. Given Turkey's solid longer-term credit profile and the flatness of the spread curve, we continue to think that the 5y sector (Turkey 16s, 17s) offers value at current levels.

And in EEMEA, we like paying PLN 5y5y against EUR as a defensive trade

We like switching out of Croatias EUR denominated bonds in to Romania...

and think Turkey 16s, 17s offer value at current levels

7 July 2011

Barclays Capital | The Emerging Markets Weekly

MACRO OUTLOOK: EMERGING ASIA

Inflation headaches

Rahul Bajoria +65 6308 2153 rahul.bajoria@barcap.com Jian Chang +852 2903 2654 jian.chang@barcap.com

The PBoC raised benchmark rates for the third time this year, as inflation remains elevated. Inflation concerns are likely to persist in Emerging Asia, with core price pressures increasing and persistent. Next week, Chinese data are expected to show slower growth and sticky inflation. We also have monetary policy meetings in Korea, Thailand and Indonesia.

China: Another rate hike points to restrictive monetary conditions

PBoC delivers another rate hike this week, the third increase in 2011

On Wednesday, the PBoC announced the third benchmark interest rate hike of 2011. This is the fifth increase in the current tightening cycle, which began in October 2010. The structure of the hike is symmetrical a 25bp increase in the ending and deposit rates across all tenors, except the demand deposit rate, which was left unchanged. While we have been calling for the third rate hike in early to mid-July in the past month, the June rate pause (versus a widely expected hike) suggested to us increasing domestic concerns about "policy over-tightening", a view that has been widely debated in the last month. The June RRR hike, which resulted in a surge in interbank rates and liquidity hoarding/shortage, in our view, has helped bring some consensus that price-based tools, i.e. interest rates, should be utlised. Also, given likely 6%-plus June CPI (BarCap: 6.3%), we believe that the PBoC will remain vigilant and will prefer to use interest rates rather than RRR hikes to tighten policy, if needed. In the PBoC monetary policy committee Q2 meeting minutes, they adjusted the wording on the operational focus to "Stability, targeted and flexibility" in Q2 from "targeted, flexibility, and effectiveness" as in the Q1 11 and Q4 10 minutes, and added back "to properly manage the pace and intensity of policies". We maintain our comment that "the policy rate hiking cycle looks close to an end", but we do not rule out the possibility of a fourth interest rate hike in Q3 11. We currently forecast CPI inflation will ease to below 6% in July (5.8%) and below 5% in September. However, if inflation turns out to be higher, it would make another rate hike more likely, in our opinion. Figure 2: Chinas inflation/growth mix warrants a rate hike

16 14 12 10 2 8 6 4 GDP (% y/y) CPI (% y/y, RHS) 1y benchmark deposit (%pa, RHS) 01 02 03 04 05 06 07 08 09 10 11 12 0 -2 -4 Projection June 10 8 6 4

Monetary Policy focus is on stability,flexibility and the pace and intensity

We see outside risks of another 25bps rate hike in Q3

Figure 1: 7d repo rate surged following Chinas June RRR hike

10.0 9.0 8.0 7.0 6.0 5.0 4.0 3.0 2.0 1.0 0.0 Jul-10 Sep-10 Nov-10 Jan-11 Mar-11 May-11 Jul-11 % 3m CB bill issue rate 7d Interbank repo rate

Source: CEIC, Barclays Capital

Source: CEIC, Barclays Capital

7 July 2011

Barclays Capital | The Emerging Markets Weekly

Emerging Asia: Inflation remains sticky

Strong momentum in growth is spilling over into higher wages and rising core price pressures in Taiwan

There are more signs that regional inflation remains sticky. In Taiwan, consumer prices rose 1.93% y/y in June, exceeding expectations. It also accelerated from the 1.66% print in May and was the highest reading since November 2008. On a 3m/3m saar basis, our estimate of core inflation held steady at 1.4% m/m, the same pace as May. Even so, we believe the trend for core inflation is up, driven by the structural revival in discretionary consumer spending, which is being fuelled by nine consecutive quarters of q/q growth (five in double digits), stronger job prospects, resurgent property values and an influx of tourist from mainland China. We expect the trajectory of inflation to worsen, with headline readings likely to top out at above 2% in the coming months. The main factor is the fading of the downward distortion from lower agricultural prices. Also, importantly, given the recent hot weather, peak utility rates took effect from June. In the Philippines, while headline inflation surprised on the downside, core price pressures continue to build. Given the acceleration in core inflation, we maintain our view that Bangko Sentral ng Pilipinas will raise the policy rate 25bp, to 4.75%, in July given the uptrend in core prices and the risk that headline inflation will breach the top end of the 3-5% target band in the coming months.

Core inflation is also rising in the Philippines

The week ahead: Focus on inflation and central bank meetings

Next week: Monetary policy meetings in Korea, Indonesia and Thailand

We expect Chinas June inflation to rise to 6.3% y/y, on higher food prices and a low base. We think PPI inflation is likely to remain elevated, at 7.1% y/y. We believe growth is moderating at the margin, and look for GDP to expand 9.4% y/y in Q2. We expect Junes trade data to show ongoing moderation in China, but nominal imports may hold up given elevated commodity prices. On the monetary policy front, we expect the Bank of Korea and Bank Indonesia to leave rates unchanged, but expect the BoK to sound hawkish as the governments focus shifts to cost-of-living concerns with the start of the election campaign. In Indonesia, we expect BI to stay on hold, but we expect it to raise rates in Q3, given rising core price pressures. We expect the Bank of Thailand to deliver a 25bp rate hike, in line with the consensus view. Finally, in India, we expect May industrial production to show modest improvement, but inflation is likely to rise to 9.5% in June, given the recent hike in domestic fuel prices.

Figure 3: Core inflation is above historical levels in Taiwan

5 4 3 2 1 0 -1 -2 -3 Jun-07 TW: Core CPI, % 3m/3m saar

Figure 4: Inflation expectations are elevated in Korea

0.7 0.5 0.3 140 0.1 -0.1 -0.3 Jun-08 \ 130 160

150

Jun-08

Jun-09

Jun-10

Jun-11

120 Jun-09 Jun-10 Jun-11 KR: Core inflation (% m/m, sa) Expected change in prices in 6 mths (RHS)

Source: CEIC, Barclays Capital

Source: CEIC, Barclays Capital

7 July 2011

Barclays Capital | The Emerging Markets Weekly

MACRO OUTLOOK: EMERGING EUROPE, MIDDLE EAST & AFRICA

Doves rule as inflation peaks and growth slows

Gina Schoeman +27 1189 55403 gina.schoeman@absacapital.com Christian Keller +44 (0) 20 7773 2031 christian.keller@barcap.com

Global commodity prices are moderating and prospects for local harvests are improving. This, along with slowing growth and greater risks of a harder landing globally, seems to have lent support to more dovish attitudes at central banks across the region. We had highlighted in our recent Emerging Market Quarterly: Summer Storms, 21 June that central banks in the region now face a different outlook than earlier this year. While monetary policy in core markets remains generally dovish, pressures from commodity prices seem to have abated and growth is clearly slowing, with an increased risk of a harder landing in H2. Against the backdrop of ongoing rate setting meetings and many CPI and IP releases this week and next, we review the monetary policy and growth-inflation developments in the region below. In Russia this week, June headline CPI surprised to the downside, with inflation slowing to 9.4% y/y (9.6% y/y in May) on the back of further moderation in food price inflation. This is likely to continue for a few more months, as last summers food price shock created favourable base effects and this years harvest for the region (including central Europe) should be good. Although we remain watchful of the still rising core inflation, we now expect the CBR to pause, keeping policy rates on hold through 2011. Aside from inflation, we anticipate that Russias IP will moderately accelerate next week. However, overall IP growth has disappointed, given the strong support from oil, and the growth outlook remains mixed. Food prices also surprised to the downside in Turkey, where the m/m decline in June of over 6% more than compensated for the increase in May, bringing the headline print to 6.2% y/y, significantly below expectations. Although core inflation measures are still rising, the CBTs communication on the back of June inflation has turned seemingly more dovish than before, increasing the chance that the policy rate may not rise this year (but note we still expect a 75bp in Q4). However, while high food price increases last summer also provide a favourable base effect in Turkey, pass-through from the weaker TRY could partly offset this. Next weeks data are likely to reflect another dilemma for Turkeys policymakers - May IP could slow further due to weaker external demand, while the May current account deficit is likely to widen even more due to still strong domestic demand. Figure 2: and growth is slowing as well

30% 20% 10% 0% -10%

Russia inflation decelerated slightly last month; we now expect the CBR to keep rates on hold for the remainder of 2011 amid disappointing growth

The Turkish central bank appears to have turned more dovish on a surprise drop in June inflation due to lower food prices

Figure 1: EEMEA food inflation expected to have peaked

25% 20% 15% 10% 5% 0%

Food inflation (% y/y)

Industrial production (% y/y)

-20% -5% Jul-07 Jul-08 Hungary

Source: Haver Analytics

Jul-09 Poland

Jul-10 Russia

Jul-11 Turkey

Hungary Poland Russia Turkey May-08 May-09 May-10 May-11

-30% May-07

Source: Have Analytics

7 July 2011

Barclays Capital | The Emerging Markets Weekly

Polands NBP kept rates on hold having raised them by 100bp already this year

Polands NBP kept rates on hold last week (at 4.5%), as was widely expected, indicating that it first wanted to assess the impact of the measures taken so far, having hiked policy rates by 100bp this year (we expect one more 25bp hike this year). We note that real rates remain in negative territory with May headline CPI at 5.0 y/ywe expect a slightly lower print of 4.8% for next weekand core inflation still rising. This also fits into the pattern of central banks behaviour we discussed in our most recent EM Quarterly, namely that actual inflation may not moderate towards official targets rather, central banks may become increasingly willing to look through above-target prints as their concerns about growth increase, and the prospects for lower commodity prices rise. Last but not least, Serbias NBS even cut its policy rate by 25bp this week to 11.75% on the back of an improved risk premium (EU accession candidacy), moderating inflation, and as it had hiked rates by 450bp from August 2010 to April 2011. For next week, we expect favourable food price base effects to also support some moderation in Hungarian June inflation to 3.7% y/y. Against the backdrop of still very weak domestic demand, we estimate that inflation will moderate towards the 3.0% target in 2012. Indeed, Hungarys May IP surprised to the downside this week, with its print suggesting a m/m production decline of 0.8% on seasonally adjusted terms. While this may spark a debate about possible rate cuts later this year, the NBHs MC minutes released this week suggest that this is not very likely. The NBH seems concerned not only about inflation expectations (which have still not adjusted downward) but also about the implications a reduction in carry could have on HUF. We maintain our view that rates will likely remain on hold (at 6.0%) for the remainder of the year. In Israel, we expect a slight moderation in CPI inflation to 4.0% y/y (4.1% y/y previously). However, given the still robust growth, we forecast that the BoIwhich started its hiking cycle in August 2009will further hike rates to bring inflation expectations into the middle of the 1-3% range. We estimate the policy rate will rise by another 75bp (25bp each quarter) to a final rate of 4.0% in Q1 12. In South Africa, we expect the SARB to start hiking rates only in January 2012 (far later than most EEMEA countries). We then estimate 200bp in magnitude for the hiking cycle, but caution that the SARB may chose a stop-and-go pattern, rather than the traditional hike at every meeting. Similarly to other central banks in the region, it could consider the still below-potential GDP and the low core inflation.

Hungarian inflation is declining, but remains above the target; and we expect the central bank to remain on hold for the remainder of 2011

We expect a slight moderation in Israel inflation; gradual rate hikes to continue

Figure 3: Turkey: June CPI fell, but C/A deficit still an issue

13 12 11 10 9 8 7 6 5 4 3 Jun-07 70 60 50 40 30 20 10 0 Jun-11

Figure 4: The SARB is expected to stay on hold in 2011

12 10 8 6 4 2 0 Jan 09 Jul 09 Jan 10 Jul 10 Jan 11 Core inflation Headline CPI Repo rate %

Source: Datastream

The SA Reserve Bank has not hik we only expect this in January 20 will the pace be consecutive or s

6% ceiling 3% floor

Jun-08

Jun-09

Jun-10

CPI inflation (%, y/y) Turkey CA deficit (12 months ma; USD bn) RHS

Source: Datastream

7 July 2011

Barclays Capital | The Emerging Markets Weekly

MACRO OUTLOOK: LATIN AMERICA

At war again? Yes, but not for long.

Alejandro Arreaza +1 212 412 3021 Alejandro.Arreaza@barcap.com Marcelo Salomon +1 212 412 5717 marcelo.salomon@barcap.com

As commodity price pressures dissipate and headline inflation moves south, the crusade against currency appreciation is starting to re-emerge in the Latin region. The outlook for core is not as rosy as headline CPI, and in countries such as Brazil and Colombia, we doubt the governments will use the FX channel to control inflation. The Brazilian Finance Minister, Guido Mantega, was once again at the forefront of economic news this week, claiming that the currency wars were not over. Food and fuel prices are now helping bring headline inflation down across most of the region. Furthermore, there has been some risk decompression due to positive developments in the Greek sovereign debt crisis, which reignited some capital flows towards the region leading to FX strength.. While this is unquestionably the backdrop for Minister Mantegas comments, we think the statement express more than just an attempt to control the appreciation of the currency. In our view, they also state that inflation has moved to the back burner and is not at the top of the priority list of the Brazilian government. While other central banks across the region may have a much more comfortable inflationary backdrop, we believe the Brazilian case is different, with only a temporary respite on the inflation front. Hence, a stronger BRL is not only welcome, but necessary to keep inflation within the target range. Figure 1 shows that with the exception of Chile, m/m inflation prints have been losing momentum this year. Lower food and fuel prices have been making their way out of the index, helping bring headline inflation down and/or keep it low. These effects are lagging in Chile, but we expect them to start appearing as of the June release (due out Friday, July 8). In contrast, a common trend of rising core has been observed across the region (Figure 2). And, even though in Peru the core trend spiked due to a strong 5.0% (SAAR) reading in June, from 2.1% in May and 1.0% in April, shifting it above the 2.0% official target, it is in Brazil that the risks of missing the target remain high.

The good season of low inflation in Brazil is only temporary, and the government still needs the FX channel to help fight inflation

Figure 1: Less headline inflation.

1.5 1.0 0.5 0.0 -0.5 -1.0 Jan-10 % m/m

Figure 2: with core trend sturdy or moving up

8.5 6.5 4.5 2.5 0.5 -1.5 -3.5 -5.5 Jan-09 Jul-09 Brazil Mexico

Source: Haver, Barclays Capital

3MMA % m/m saar

May-10 Brazil Mexico

Sep-10 Chile Peru

Jan-11

May-11 Colombia

Jan-10 Chile Peru

Jul-10

Jan-11 Colombia

Source: Haver, Barclays Capital

7 July 2011

10

Barclays Capital | The Emerging Markets Weekly

In Brazil, headline inflation dropped to 0.15% in June (slightly above what we and the markets were expecting: 0.10% and 0.07%, respectively), but core remained very sticky. The average of the three measures of core inflation tracked by the BCB rose to 6.5% (SAAR), from 6.1% in May. We believe headline inflation should gradually move back to the 0.50% range in AugustSeptember and that core will remain stubbornly high. This means that we do not expect downward surprises as we head out of the northern hemisphere summer.

Food and fuel prices are helping bring headline inflation down, but core measures are not following suit

It is also interesting to note that the downward inflation surprises of the past months have been smaller and shorter lived than the ones observed last year. Figure 3 shows that only in Colombia and Mexico were markets really caught by surprise by the intensity of the downward movement of inflation. And quite differently from last year, in this case the index is moving back up just as fast as it moved down. Meanwhile, in Chile and Brazil, there was little, if any, downward deviation from the expected outcome. So can authorities really dispose of the tightening effects that come with further exchange rate appreciation? We believe not. Figure 4 shows that the COP and BRL experienced the strongest bouts of appreciation in the very short term (a period in which we believe Latin central bankers started to use the FX channel in the fight against inflation). Given our more bearish outlook for inflation in Brazil, we believe it is unlikely that Minister Mantega will resort to further capital control in the short to medium run, and we continue to see the USD/BRL slipping to the 1.50 level.

Despite the rhetorical component, we believe Colombia and Brazil will continue to use the FX channel to help fight inflation

In Colombia, even though inflation remains well behaved and close to target, we do see signs that the recent pressure is related more to domestic demand than to global commodity cycles. President Santos has already signalled his concern with peso appreciation were Banrep to continue tightening monetary policy. This seems to be reviving internal board discussions on macro-prudential measures, at a time when, in our view, Banrep will need to continue to tighten and lift the target rate to 5.0% by year-end. If the demand-driven inflationary pressures become more intense, we believe Colombian authorities would prioritize this over fighting the stronger peso. Hence, despite the pickup in rhetoric, we believe Mantegas second wave of currency wars may be much shorter than originally planned.

Figure 3: Inflation surprised less than last year

1.5 1.0 0.5 0.0 -0.5 SD

Figure 4: COP and BRL experiencing the largest appreciations

104 102 100 98 96 94

-1.0 -1.5 Jan-10 Brazil

Source: Barclays Capital

92 Jun-10 Mexico Nov-10 Chile Apr-11 Colombia 90 Mar-11 BRL

Apr-11 CLP

May-11 COP

Jun-11 MXN

Jul-11 PEN

Source: Bloomberg, Barclays Capital

7 July 2011

11

Barclays Capital | The Emerging Markets Weekly

MACRO OUTLOOK: EMERGING MARKETS CORPORATE CREDIT

Top of the range warrants cautious longs

Aziz Sunderji +1 212 412 2218 aziz.sunderji@barcap.com Juan C. Cruz +1 212 412 3424 juan.cruz@barcap.com Krishna Hegde +65 6308 2979 krishna.hegde@barcap.com Avanti Save +65 6308 3116 avanti.save@barcap.com

We recommended taking profits on shorts during what we believed was going to be a volatile June (see Trimming the Bears Claws: Scale back shorts into global weakness, May 27 2011). Spreads are wider now, having priced in further peripheral European turmoil and ongoing weak US data. US data are gradually improving (especially versus lowered expectations), and although the European problems linger, risk of a near-term Greek debt restructuring has abated. Cautiously legging into some high grade credit now makes sense. That said, macroeconomic uncertainties, the limited selloff, and dwindling policy options should cap ultimate upside. By the beginning of Q4, we expect the outlook for total returns to begin to look more muted, as spreads should be too tight to rally enough to compensate investors for rising Treasury yields.

Week in review

Better sentiment compared with last week was more evident in the opening of the primary market than in spreads, which were roughly unchanged. Cosan tapped its 8.25% perp for $200mn, Cemex came to market for $650mn after pulling a deal two weeks ago amid market volatility, and a number of new deals were announced. In line with our expectation, Asian borrowers took advantage of a period of strength to tap the primary market. We expect the supply pipeline to build up quickly. While high cash levels should absorb some of this potential issuance, we think expectations of a deluge of supply will likely cap performance of the asset class. We published a constructive view on Cemex (Cemex Credit Story Intact: Earnings weak but assets valuable) and Pacific Rubiales (Pacific Rubiales upgraded by S&P bond offer value to Ecopetrol).

Figure 1: Peripheral problems will stay in the headlines for many more quarters

30 25 Financing gap (to be met with cash, asset sales, private market financing)

Figure 2: but the sensitivity of EM corporate credit to these headlines is diminishing

EM corporates OAS 500 450 May 2010 May 2011-now

20 400 15 350 10 300 5 250 0 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 Public Sector Financing Need (EUR bn) EU/IMF Disbursements (EUR bn)

Source: Barclays Capital

Current

200 0 50 100 150 SovX

Source: Markit, Barclays Capital

200

250

300

7 July 2011

12

Barclays Capital | The Emerging Markets Weekly

EM corporate credits declining beta to Greece

The Greek government passing a vote of confidence and the Medium Term Fiscal Programme (MTFP) have diminished the probability of a near-term restructuring. However, ultimately, a substantial reduction in the NPV of outstanding Greek debt will likely be required. Between now and then, Greece will have to pass quarterly monitoring imposed by the IMF in order to continue to receive funding. After only nine months, Greece was unable to meet IMF targets set a year ago; a similar progression cannot be ruled out this time. Investors should therefore expect Greek headlines to cause spread volatility every three months from now until an NPV reduction is agreed. However, in our view, this does not warrant sitting on the sidelines in EM corporate credit. In particular, we believe the sensitivity of the asset class to the problems in the European periphery is diminishing (Figure 2). Thus, although we expect a number of short- and long-term disruptive developments from Greece and other European sovereigns, we do not think this justifies an underweight in EM corporate credit.

Corporates versus sovereigns: Cheap, but cheap enough?

EM corporates have been underperforming sovereigns since mid-April (Figure 3). We believe this was a function of a reversal of EM inflation concerns, which caused EM fixed income outflows late last year and throughout Q1 this year and coincided with corporate outperformance versus sovereigns. Moreover, recent corporate underperformance has been exacerbated by a sharp pullback in risk appetite, which hurt higher beta EM corporates more than sovereigns. In our view, the performance of corporates versus sovereigns in EM is captured by the flows data in particular, the stronger the US HY corporate credit flows relative to EM fixed income, the better the performance of EM corporates (whose price action follows global credit more closely than EM sovereigns) versus EM sovereigns (Figure 4). While US flows have a contemporaneous relationship with credit performance, there is some evidence (Figure 4) to suggest that US HY flows versus EM fixed income flows have a slightly (three-week) leading effect on the performance of EM corporates versus EM sovereigns. This relationship and recent flows data suggest there is room for further cheapening of corporates against sovereigns, though last weeks uptick in US HY inflows hints at an end to this trend.

Figure 3: EM corporates have underperformed EM sovereigns

450 400 350 300 250 200 Apr-10

Figure 4: This trend has room to run but the end is in sight: US HY inflows should recover along with risk appetite

1.5 1.0 0.5 0.0 -0.5 -1.0 -1.5 -2.0 -2.5 -3.0 Apr-10 Jun-10 Sep-10 Dec-10 Mar-11 Jun-11 0 20 40 60 80 100 120 140 160 EM Corp OAS minus EM Sov OAS (3wk lag, RHS) US HY flow minus EM bond flow (USD bn)

Source: Barclays Capital, EPFR

Jul-10

Oct-10

Jan-11

Apr-11

EM: Sovereigns - OAS

Source: Barclays Capital

EM: Corporates - OAS

7 July 2011

13

Barclays Capital | The Emerging Markets Weekly

Figure 5: The mid-late recovery stage of the previous cycle had low total returns (US high grade credit shown)

Figure 6: In 2011, spread widening has been offset by riskfree yields falling; this should cease once spreads hit a floor, perhaps near 250bp

350 330 310 290 270 250 230 210 190 170 450 430 410 390 370 350 330 310 290 270 Oct-10 Jan-11 Apr-11 250 Jul-11

% return 30 25 20 15 10 5 0 -5 -10 -15 -20 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

150 Jan-10 Apr-10 Jul-10

Corp credit return

Source: Barclays Capital

Risk free return

Total Return

Maturity matched UST

Source: Barclays Capital

EM corporates OAS (RHS)

Breaking the yield window

Over the longer term perhaps by the beginning of Q4 we expect the outlook for EM corporate credit total returns to begin to look less promising. Rates rallied sufficiently in 2011 to offset bouts of spread widening, leading most EM corporate investors to register modest performance on a total return basis (the Barclays Capital EM corporate index returned (total) 3.92% YTD). But we expect that as spreads tighten and approach a level from which further tightening is more limited, total returns will diminish (and potentially turn negative) due to rising UST yields. If the current soft patch is indeed a mid-cycle slowdown, 2011 may look somewhat like 2004. During that year and the next two (2004-06), total returns were positive, but low, as spreads tightened little and yields rose. 2011-13 could be similar, though we also note that our rates strategists expect only modest (and gradual) rising UST yields (3.5% in Q1 and Q2 2012 in UST 10y).

7 July 2011

14

Barclays Capital | The Emerging Markets Weekly

STRATEGY FOCUS: THAILAND

A tactical long

Rahul Bajoria +65 6308 3511 rahul.bajoria@barcap.com Ju Wang +65 6308 2801 ju.wang@barcap.com Avanti Save +65 6308 3116 avanti.save@barcap.com Puea Thai wins general election by a simple majority New government will be a coalition of five parties

Puea Thai party election win paves the way for Yingluck Shinawatra to become the new PM. While we view the election result as constructive in the near term by reducing uncertainty, we do not believe it resolves the longer-term issues in Thai politics. But in the short term, we expect the markets focus to switch back to the economy. The Yingluck Shinawatra-led Puea Thai party (supported by the red shirts), which is linked to ex-PM Thaksin Shinawatra, emerged victorious from the July 3 general election, winning a simple majority of 265 seats out of 500, according to the preliminary results. This was below the 313-seat win forecast by some exit polls and fewer than the 460 seats the Thaksin-led party won in 2006. The official results are expected to be released on 12 July, according to the Election Commission. We do not expect any major change from the initial results. Although the election was peaceful, the national police adviser said that the police would remain vigilant and provide protection to over 400 candidates to counter any post election-related violence (see EC: Election is transparent, official result will be known in a week, NNT, 3 July 2011.) In the lead up to the voting, Puea Thai was already courting coalition partners. According to PM-elect Yingluck, four smaller parties including Chart Thai Pattana and Chart Pattana Puea Pandin will join Puea Thai in government adding 34 more seats, giving it 299 seats and a larger majority in parliament. Other smaller parties may also join later. The selection of cabinet members is likely to begin soon and could be completed within the next two weeks. Despite Puea Thai's victory, the political outlook remains unclear. Some of the main issues in Thai politics, especially the granting of an amnesty to former members of the 2006 government of Thaksin Shinawatra, are unlikely to be resolved in the near term. But given Puea Thai's clear win, the risks of intervention by the judiciary or military in the near term have reduced significantly. Shortly after the initial poll results were announced, Defence Minister Prawit Wongsuwon reiterated that the armed forces would accept the peoples decision, and would not intervene in the electoral process (All eyes turn to army's reaction, Bangkok Post, 5 July 2011). Figure 1: Election results and proposed combination of Puea Thai-led government

Near-term stability is unlikely to signal long-term reconciliation

Others, 8 Bhumjaithai, 34

Government, 299

Chart Thai Pattana, 19 Puea Pandin, 7 Puea Thai, 265 Others, 8

Democrats, 159

Source: Bangkok Post, Barclays Capital

7 July 2011

15

Barclays Capital | The Emerging Markets Weekly

We see upside risks to our BoT rate hike projections in H2

Beyond the election, we continue to believe that economic growth momentum in Thailand is likely to slow in H2 11, given global growth concerns, weaker consumer confidence and moderating investment. Negative newsflow around the recent election could also mean that tourist arrivals do not pick up meaningfully in H2, which could, in turn, contribute to a period of sluggish domestic demand. In this scenario, we believe the Bank of Thailand would adopt a more cautious approach to further monetary normalisation. For now, we expect the BoT to raise rates by 25bp in the meeting on 13 July, and possibly a further one or two more hikes if inflation pressures were to increase significantly. We believe the THB is likely to outperform in the coming month, helped by a resumption of equity inflows. But the upside is likely to remain limited given deteriorating support from the balance of payments and the likelihood of intervention by the central bank to moderate the pace of appreciation. Given the decline in near-term risk premia we expect Thai government bonds to outperform swaps and recommend paying 5y IRS versus buying 5y Thai government bonds (entry: 2bp; current: 15bp; target: 32bp; stop: -12bp). Further, the risk of pro-growth fiscal policies and a large expansion in spending programs by the new government is likely to trigger expectations that monetary policy may need to stay tight, in our view. We believe an increase in such expectations would keep IRS rates elevated. If implemented, increased government fiscal spending could also imply higher bond supply in the next fiscal year, though the near-term impact would likely be limited given the low government debt burden. In addition, if the THB started to outperform in a significant manner we think the BoT would be likely to step in, which in turn implies that FX forward points could remain elevated, enhancing the performance of bond-swap spread trades. From a credit perspective, we recommend scaling into a long Thailand position via selling 5y CDS, if spreads widen again to 130bp (on, say, an adverse reaction by the military; not our base case). However, if the new government moves towards raising the issue of granting an amnesty to former PM Thaksin Shinawatra and other politicians banned in 2007, the political risks could start to rise again.

We expect 5y bonds to outperform swaps

We see good risk-reward in selling protection on Thailand if spreads widen again to 130bp

Figure 2: We expect bonds to outperform swaps

100 80 60 40 20 0 -20 -40 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11

Source: Bloomberg, Barclays Capital

Figure 3: Near term decline in risk premia

180 160 140 120 30 100 80 60 Jul-2010 20 10 0 Jul-2011 bp bp 70 60 50 40

20d m.a. of 5y bond swap spread

Oct-2010

Jan-2011

Apr-2011

Malaysia (5yr CDS)

Source: Bloomberg, Barclays Capital

Thailand

Difference (RHS)

7 July 2011

16

Barclays Capital | The Emerging Markets Weekly

STRATEGY FOCUS: CHINA

China rates: 1y deposit rate to act as a floor for 7d fixing; curve to remain flat

Ju Wang +65 6308 2801 ju.wang@barcap.com

This is an excerpt from an Instant Insight of the same name, published 7 July 2011. We expect the curve to remain flat in the near term on tight systemic liquidity. The 1y deposit rate will serve as a floor for money market rates in a tight liquidity environment. We suggest holding short-end paid positions for carry but would look for opportunities to enter receive positions around 4.2-4.3%.

Rate hike was not a surprise

After market closed yesterday, China announced a 25bp increase in the 1y deposit and lending rates, the fifth hike in the current cycle and the third in 2011. The increase takes the 1y deposit rate to 3.5% and 1y lending rate to 6.56%. The hike was symmetrical (although there was no increase in the demand deposit rate), which, in our view, signals an effort to protect banks' earnings, given the recent negative news affecting the banking sector (see our equities analysts' report, China banks: symmetrical interest rate hike positive for China banks' NIM/earnings, July 6, 2011). For the rates market, the hike was not unexpected given: 1) the recent run-up in pork prices has led to widespread expectations that June CPI inflation will exceed 6% y/y; 2) the upward adjustment in the PBoC's 1y central bank bill yield to 3.4982% over recent auctions, almost 25bp rate over 1y deposit rates, was widely taken as a preparation for rate hike; and 3) the PBoC's emphasis on inflation pressure in its regular Q2 policy meeting sent a hawkish signal to the market. However yesterday's increase came earlier than expected - it was widely expected in mid-July, when the June CPI is scheduled to be released and the State Council will hold its mid-year meeting to assess the economic situation. In our economists' view, this suggests yesterday's rate hike was an overdue rate hike.

Policy stance has yet to loosen

Our economists maintain their view that monetary policy is not yet in a position to be loosened. They see room for one more rate hike, but think the near-term risk of an RRR increase is limited given tight interbank liquidity conditions (and the backdrop of a record high reserve requirement ratio), strict CBRC regulations (daily L/D ratio since June) and the lower amount of maturing OMOs in H2 11. However, one or two more RRR hikes are possible in the second half of the year, depending on the size of FX inflows (see China: The much-anticipated interest rate hike to end the tightening cycle, or not?, July 6 2011).

Tight systemic liquidity to keep interest rate curve flat for now

Accordingly, we reiterate our view that the curve will stay flat in the near term given tight systemic liquidity. A temporary easing in liquidity could occur, but likely will not last until the current policy stance is reversed. Interestingly, post-decision market moves have shown more upward pressure on short-end rates than long-end rates, which tends to happen when systemic liquidity is tight and the rate-hike cycle is close to end. In our view, the upward adjustment in short-end IRS indicates that investors believe the 1y deposit rate will serve as firm floor for money market rates in a tight liquidity environment, as there is little excess liquidity to be lent out below banks' long-term funding cost. As the same time, we

7 July 2011 17

Barclays Capital | The Emerging Markets Weekly

believe the relatively muted reaction in the long end probably reflects concerns about growth, as well as relatively sanguine view towards longer-dated bonds now that the ratehike shoe has finally dropped. We see limited upside in long-end yields, as tight credit and monetary conditions are likely to cap growth and inflation expectations. Figure 1: 7-day repo fixing, 1y deposit rate, 1y central bank bill yield, and 1s5s ND IRS slope

12.0 10.0 8.0 100 6.0 50 4.0 2.0 Sep-06 Mar-07 Sep-07 Mar-08 Sep-08 Mar-09 Sep-09 Mar-10 Sep-10 Mar-11

Source: CEIC, Bloomberg, Barclays Capital

7day repo 1y CB yield (primary market)

1y depo 1s5s repo IRS slope (bp, RHS)

200 150

-50

Investors should still watch out for receivers

We suggest holding short-end paid positions as carry is favourable. The 4% level reached in late February is likely to serve as the near-term peak for 1y paid positions, but downside should be floored by the higher funding cost. As the 1y deposit rate is 3.5%, we think it is unlikely that 7day fixing can fall below 4% in the near term, which implies a floor for the 1y IRS at 3.75%. We think liquidity conditions will eventually ease in H2 11, once inflation peaks after July on favourable base effects, particularly as the PBoC emphasised "stability" and the "pace and intensity" of polices in the minutes of its policy committee's Q2 meeting. We believe 4.2-4.3% is good level to position for 5y receivers. We also think receiving the 1s2s5s butterfly is a low-beta strategy to position for such a scenario and offers good carry in a tight liquidity environment. However, considering the high transaction costs in China's NDIRS market, we feel investors need to build such a position via different steps. Figure 2: 1s5s slope and 1s2s5s butterfly, bp

60 40 20 -20 -40 -60 -80 -100 Dec-06 -50 Jun-11 50 150 100 1s2s5s IRS butterflies 1s5s repo IRS slope, RHS 200

Jun-07 Dec-07

Jun-08 Dec-08

Jun-09

Dec-09 Jun-10

Dec-10

Source: Bloomberg, Barclays Capital

7 July 2011

18

Barclays Capital | The Emerging Markets Weekly

STRATEGY FOCUS: EM SOVEREIGN CREDIT

Beta-driven shifts in positioning

George Christou +44 (0) 20 7773 1472 george.christou@barcap.com Andreas Kolbe +44 (0)20 3134 3134 andreas.kolbe@barcap.com Avanti Save +65 6308 3116 avanti.save@barcap.com Donato Guarino +1 212 412 5564 donato.guarino@barcap.com Alanna Gregory +1 212 412 5938 alanna.gregory@barcap.com

We update our EM benchmark credit Overweight/Underweight analysis to incorporate data up to the end of May, based on benchmarked EM dedicated real money mutual fund allocations (the data are published with a one month lag). The difficult risk environment in May, with a further deterioration in the euro area periphery situation and softer global economic data, has clearly affected allocations. Higher-beta credits such as Venezuela and Argentina in LatAm, Ukraine and Russia in EEMEA and Indonesia in Asia saw their allocations decrease while lower-beta credits benefitted, with Brazil and Mexico the largest beneficiaries. Venezuela has joined Turkey, Philippines and Lebanon as the largest Underweights. A comparison of Barclays Capital EM sovereign Overweight/Underweight views with market Overweight/Underweight positioning as of end-May reveals some interesting insights (Figure 1). As advocated in our Emerging Markets Quarterly: Summer Storms, 21 June 2011, we think that a prudent view on risk taking is warranted over the next weeks. We believe, however, that investors positions are overly defensive on the Philippines, Venezuela and Turkey, providing technical support for our positive view on these credits. Specifically, we recommend adding exposure to Philippines versus Indonesia and, driven by the recent developments around President Chavez, also suggest adding risk to Venezuela (with a preference for cheap shorter-dated paper, such as the PDVSA 17N, at present). We recently upgraded Turkey to Overweight and, given the flatness of the curve, continue to recommend the 5y sector in particular. For all three credits, defensive positioning should constitute an important anchor over the next few weeks. Figure 1: BarCap views vs market positioning

BarCap/Market UW El Salvador Vietnam Bulgaria Gabon Egypt Russia Mexico BarCap OW, Market UW Philippines Turkey Venezuela Panama

BarCap UW, Market OW Indonesia

BarCap/Market OW Brazil Ukraine Ghana Sri Lanka Dom. Republic

Note: Credits with Barclays Capital Market Weight recommendations are not shown. Source: EPFR Global , Barclays Capital

7 July 2011

19

Barclays Capital | The Emerging Markets Weekly

Allocation changes mirror risk environment

Investors have re-allocated from higher-beta credits

The difficult global risk environment in May was clearly reflected in Global EM credit investors risk allocations. The highest beta credits, Venezuela and Argentina, both saw decreases in allocations. While in the case of Argentina, investors still hold a significant Overweight, Venezuela has become one of the largest Underweights in the Global EM credit space. In the EEMEA region, Ukraine has been negatively affected, similarly to Russia which is significantly exposed to commodity prices and historically, has had high correlations to global market drivers. In Asia, while investors remain marginally Overweight Indonesia, positions have been reduced. Among the re-allocation winners some safe-haven credits stand out, most notably low-beta credits in LatAm such as Brazil, as well as some names with particularly low correlations to global markets/events, such as Lebanon (although the political developments and tail risks in the latter would make us reluctant to hold more than a Market Weight allocation). Brazils status as a safehaven credit manifested itself in recent periods of risk aversion and crises. For example, Brazil outperformed notably during the Lehman crisis, holding up remarkably well compared with other high grade credits. These historical performance patterns have likely underpinned the reallocations into Brazil in the fragile market environment in May, as investors switched into Brazil and out of higher-beta credits such as Argentina. The increase in allocations to Brazil was also likely fuelled by the significant buy-backs of the Brazilian Treasury (especially at the short end of the curve) which further attracted investors to this name. We maintain our Overweight recommendation on Brazil and highlight that the recently announced supply (expected to be USD1.52bn) is likely to be easily absorbed by the market.

into safe havens such as Brazil and into some credits with low correlations to global market drivers

Helpful positioning: Add to Philippines, Turkey, Venezuela

While we think that a prudent approach to risk-taking over the likely volatile summer period seems justified, we believe investors positions on selected credits are overly cautious.

Philippines bonds are better anchored by onshore investors than Indonesian bonds

Among the Asian sovereigns, we switched to an Overweight position in the Philippines from an Underweight in our Emerging Markets Quarterly: Summer Storms, June 2011, with a corresponding Underweight in Indonesia. Given our assumption for benchmark spread widening, Indonesian bonds tend to be relatively more vulnerable to the downside, while the Philippines is better anchored by onshore investors. Also, we expect the Philippines sovereign to receive an outlook upgrade in H2 11, as fiscal consolidation and debt reduction remain on track.

Figure 2: Over/Underweights in EM credit space as of endMay 2011

3.0 2.0 1.0 0.0 -1.0 -2.0 -3.0 -4.0 Arge SOAF Ukra Indo Ghan Peru Dom. Sril Braz Mala Nige Colo Gabo Egyp Croa Bulg Viet Elsa Pana Hung Chil Pola Russ Mexi Vene Leba Turk Phil underweight overweight

Figure 3: Investors have re-allocated from higher-beta credits into more defensive and lower-beta credits

0.8 0.6 0.4 0.2 0.0 -0.2 -0.4 -0.6 Mexi Braz Hung Peru Leba SOAF Nige Phil Colo Bulg Viet Elsa Gabo Sril Egyp Turk Croa Ghan Dom. Chil Pana Mala Indo Russ Vene Arge Pola Ukra Diff btw May and April 2011

Source: EPFR Global, Barclays Capital Indices

more OW/less UW

more UW/less OW

OW/UW May

Source: EPFR Global, Barclays Capital Indices

7 July 2011

20

Barclays Capital | The Emerging Markets Weekly

and we expect the Philippines sovereign to receive an outlook upgrade in H2 11

The Philippine cabinet approved the 2012 national budget last week. The budget is 10.4% larger than this years. The administration also extended the conditional cash transfer program (4Ps) to 3mn households in 2012 from 2.3mn in 2011. The press release highlights that the disbursements to target households this year are to be completed by September. Overall, we believe the budget will further improve confidence in the administrations ability to continue the fiscal consolidation process and ensure quality spending on infrastructure projects. Budget and Management Secretary Abad provided some clarity on government spending, saying a review of costs and efficiencies among government agencies will result in better quality government spending. Disbursements for May were up 15.7% m/m. In LatAm, given the recent idiosyncratic developments (it was confirmed that President Chavez has been diagnosed with cancer), we have upgraded Venezuela to Overweight. Although the credit has already outperformed significantly, Chavez health issues represent a challenge for the government ahead of the presidential election, as the illness will likely limit his ability to recover his declining popularity. Additionally, any possible successors would be at a disadvantage with respect to the main opposition leaders, who have seemingly shown more solid leadership. The possibility of a democratic transition may continue to increase, providing additional support to Venezuelan assets. Against this background, while we prefer cheap shorter-dated bonds at present, we would ultimately look to add (convexity) exposure at the long end of the curve. Finally, we think that the defensive investor positioning in Turkey should provide an important anchor for valuations. While Turkeys macro imbalances remain a cause for concern and we remain cautious on Turkey local markets, we think that the countrys longer-term credit profile remains strong and expect the sensitivity of credit markets to local markets, as seen earlier in the year, to abate. Given the underperformance of the short-end of the Turkey cash curve versus other global benchmark credits earlier in the year, partly driven by selling interest from local banks in need of short-term FX liquidity, we continue to recommend the Turkey 16s, 17s. The underperformance has only been very partially reversed recently and we think that, taking into account the continued flatness of the Turkey cash spread curve, the 5y sector in particular has further catch-up potential (Figure 5).

The idiosyncratic developments in Venezuela should continue to support Venezuelan assets

We think the short end of the Turkey curve has further catchup potential

Figure 4: Beta considerations seem to have been a driving force behind re-allocations

1.0 Excess return beta to SPX since 2010 0.9 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 Ukra Russ Indo Peru Braz Mexi Arge Vene

Figure 5: Turkey shorter-dated bonds have catch-up potential given ytd underperformance

40 30 20 10 0 -10 -20 -30 Russia SOAF Turkey short-end (Turkey 16s, SOAF 14s, Russia 15s) belly (Turkey 20s, SOAF 20s, Russia 20s) long-end (Turkey 40s, SOAF 41s*, Russia 28s)

Note: *SOAF 41s since 31 March 2011. Source: Bloomberg, Barclays Capital

Change in Z-sprd since 31-Dec

SOAF Hung

Leba 0.0 -0.6 -0.4 -0.2 0 0.2 0.4 0.6 Chg in OW/UW between May and April (ppt)

0.8

Note: Allocation changes in May (x-axis) plotted versus betas of weekly excess returns of countries in the Barclays Capital Global EM Sovereign index, since 2010 (y-axis). Source: EPFR, Barclays Capital

7 July 2011

21

Barclays Capital | The Emerging Markets Weekly

EM DASHBOARD

George Christou Alanna Gregory +44 (0)20 777 31472 212 412 5938 george.christou@barcap.com alanna.gregory@barcap.com

P&L to target/ P&L to stop Analyst

Description Credit (11) Long Boden 15 Long Lith 17s, buy Bulgaria, Latvia 5y CDS Long Turkey 16s, 17s Long Morocco 20s Buy Panama Sell Brazil 5yr CDS Long PDVSA 17 New Sell Brazil Buy Mexico 10yr CDS Hungary 2s7s CDS steepener (DV01-neutral) Long Ghana 17s Long Ukraine 13s Long Argentina EUR Warrant FX (14) Buy 1m 1x1.5 USD/TWD put spread and sell 0.5 x USD Buy 3m 1x2 USD/CNY put spread Buy USD-EUR basket (60%-40%) vs. SGD outright Buy 1M and 3M PLN call digitals (strikes 3.90/85) Buy 3M 1x2 CZK call sprd (strikes 23.95/00) Long ILS vs. EUR, USD equal basket Sell AUD/BRL Sell USDCLP Short CHF/MXN Short USDMXN Long EGP carry trade via 3M T-bills Buy 3M USD call/TRY put spread (1.60, 1.70) Long RON vs. EUR via 6M T-bills FX unhedged Long Ghana 3y bond (FX unhedged) Rates (9) Thailand 5y ASW Pay PLN vs. EUR 5y5y FWD Long RUB CCS 2s5s Steepener Own 6y ASW spread vs. (Apr 17 bond) pay ZAR 12*15 FRA Receive 5y OIS TRY Aug13 Linker (FX hedged) Pay 1y OIS Receive 5y China Brazil: Buy call ATMF, sell 2calls (13.15),buy call CZK 2s10s IRS dv01 flattener Pay TRY CCS 1y1y FWD Closed Trades (14) 5y10y DV01-neutral UDI-TIIE steepener Buy Russia 5y CDS

Entry date

Entry

Current

Target

Stop

22-Jun-11 21-Jun-11 21-Jun-11 01-Jun-11 11-May-11 28-Apr-11 04-Apr-11 28-Mar-11 22-Mar-11 07-Dec-10 06-Jun-10 22-Jun-11 22-Jun-11 22-Jun-11 21-Jun-11 21-Jun-11 21-Jun-11 21-Jun-11 21-Jun-11 21-Jun-11 21-Jun-11 19-May-11 04-May-11 22-Mar-11 07-Dec-10 04-Jul-11 21-Jun-11 21-Jun-11 21-Jun-11 21-Jun-11 09-Jun-11 08-Jun-11 02-Jun-11 24-May-11

690bp 30bp 205bp 260bp 24bp 72 15bp 68bp 427bp 525bp 6.05 0.15bp 0.17bp 100 3.98 24.23 4.16 1.68 471.6 14.01 11.78 5.95 1.55 4.16 13% 2bp 130bp 115bp 70% 6.8% 7.8% 123 8% 3.8%

652.3bp 10bp 205bp 245bp 10.4bp 74.93 7.1bp 84bp 360bp 420bp 14 0.48bp 0.43bp 100.6 3.95 24.26 4.14 1.69 463.95 13.78 11.62 5.96 1.63 4.21 12.45% 20bp 139bp 130bp 65% 6.7% 7.73% 122 8.07% 4.08% 12.56% 105bp 8.64% 78bp 150bp

600bp -10bp 170bp 220bp 0bp 78 -5bp 95bp 320bp 320bp 16 1.58bp 1.65bp 103 3.85 23 4 1.62 450 13.5 11.5 5.93 1.75 4 9% 32bp 170bp 140bp 30% 7.5% 7.55% 124 8.2% 3.5% 13.05 % 70bp 9% 80bp 170bp

750bp 50bp 230bp 300bp 34bp 67 30bp 65bp 420bp 450bp 9 0bp 0bp 98.5 4.24 1.71 488 14.2 12.12 5.98 4.3 16% -12bp 115bp 101bp 110% 6.4% 8.25% 120 7.9% 4.2% 12.6% 120bp 8% 74bp 120bp

0.54 0.5 1.4 0.45 3.8 0.39 0.53 0.58 0.67 3.33 0.27 2.25 2.83 1.14 5 5 1.4 3.5 0.58 0.67 0.24 1.5 5 2.33 0.97 0.38 1.29 0.34 0.78 2.33 0.35 1 0.76 4.63 2.33 0.56 30-Jun-11 30-Jun-11

Guarino Kolbe, Keller Kolbe Kolbe, Moubayed Arreaza, Grisanti, Guarino Arreaza, Cruz, Grisanti, Guarino Guarino Kolbe Kolbe, Markus Kolbe Guarino, Mondino Verdi Verdi Verdi Chow Christou Chow Melzi Melzi Melzi Melzi Christou Chow Chow, Chwiejczak Markus Wang, Rachapudi Chwiejczak Chwiejczak Chwiejczak Gable, Chwiejczak Rachapudi Chwiejczak, Chow Rachapudi Wang Melzi, Salomon, Loureiro Chwiejczak Chwiejczak Melzi Kolbe

28-Apr-11 12.75% 22-Mar-11 22-Mar-11 21-Jun-11 16-Mar-11 105bp 8.34% 64bp 138bp

Note: As of 06-07 July 2011 (trades are updated regionally). Methodology: P&L to target/P&L to stop is a measure of how much can be gained relative to how much can be lost. Both are calculated from the current value and reported in dollars. This measure does not take probabilities into account. Source: Barclays Capital

7 July 2011

22

Barclays Capital | The Emerging Markets Weekly

EM FX VIEWS ON A PAGE

Currency Tactical bias Strategic directional view Current strategy/ trades we like Vol adj 6m returns Score (1-5)

Emerging Asia CNY Bullish We expect the USD/CNY to move lower as the government authorities react to elevated inflation. Stronger growth, rising commodity prices, a healthy fiscal position, and improved equity flows should lend support to the currency. We believe that still-sizeable current account surpluses and a preference to contain imported inflationary pressures will drive USD/KRW towards 1025 by yearend. The CBC is more open to currency appreciation than in the past. The TWD is likely to benefit from broad-based USD weakness. The MASs concern relating to near-term inflation pressures is likely to support the SGD NEER. We do not expect this years THB underperformance to reverse any time soon. Range-bound conditions are most likely. We think the central bank believes the REER is close to fair value. We expect a modest move lower in USD/PHP towards 42.0 by year-end. Increasing CNY deposits onshore may result in the RMB-isation of the economy. The INR remains fairly well supported, although mediumterm issues related to the BoP persist. A shrinking current account surplus and high valuation on a REER basis point to IDR underperformance. Buy 1x1.5 USD/TWD put spread (strikes 28.90 and 28.40) and sell 0.5x USD call/TWD put (strike 29.30) Buy USD-EUR basket (60%40%) versus SGD outright Buy 1x2 USD/CNY put spread (strikes 6.47 and 6.35) 0.58 4.20

MYR

Bullish

0.38

3.85

KRW

Bullish

0.30

3.40

TWD

Bullish

0.27

3.30

SGD THB

Bullish Neutral

0.29 0.24

3.15 3.00

PHP

Neutral

0.21

3.00

HKD INR IDR

Neutral Neutral Bearish

0.04 0.19 -0.01

3.00 2.70 2.35

Latin America CLP PEN BRL Bullish Neutral Bullish Supportive fundamentals: strong domestic demand, monetary tightening and rising copper prices. We see political uncertainty and FX intervention limiting upside, while technicals are supportive. We see supportive fundamentals and government acknowledgement of limitations of FX intervention, improved positioning and better risk environment. US activity has hit a soft patch, while domestic demand continues to improve. Improved positioning and risk aversion is fading. Sell USD/BRL, sell AUD/BRL Sell USD/CLP 3m NDF 0.32 0.07 0.27 3.40 3.20 2.85

MXN

Bullish

Sell CHF/MXN

0.11

2.50

7 July 2011

23

Barclays Capital | The Emerging Markets Weekly

Currency

Tactical bias

Strategic directional view

Current strategy/ trades we like

Vol adj 6m returns

Score (1-5)

Emerging EMEA EGP TRY Neutral/ Bullish Neutral/ Bearish CBE should have enough of a reserve buffer to keep the EGP stable in the months prior to the elections. Dovish monetary policy and a still-large C/A deficit will weigh on TRY in periods of risk aversion. However, CBT concerns related to imported price pressures will likely limit any significant sell-off. Continued MinFIn EUR selling, improving fiscal and C/A outlook and a resurgence in local government bond inflows are all positive for PLN. A dovish NBP may cap appreciation potential, however. Abating euro periphery risks, improving C/A dynamics, CPI pressures, conversion of Eurobond proceeds, potential privatization flows, lighter positioning and appealing catch up all argue for RON appreciation. A structurally robust BoP, further (though slower) policy rate hikes, relatively more tolerance to FX strength and potential repatriation of foreign equity holdings by locals (particularly in periods of risk aversion) are all positive for ILS. C/A surplus and a credible central bank are positive for HUF, but stretched positioning in local bonds, more possibility of rate cuts (than hikes) and a likely slowing of flow momentum argue for a buy-on-dips strategy. Limited future tightening, less favorable seasonal BoP trends, persistent capital outflows, a moderation in oil prices and upcoming elections all point to slower RUB momentum. Positive seasonal BoP income account effects, solid macro balances, a healthy banking system and abating euro periphery risks should trigger the resurgence of a CZK structural appreciation trend. A renewed interest in SOAF assets leaves YTD flows net positive, and although the narrow C/A deficit should be easily funded through 2011, we expect some widening as investment starts to contribute more to the economy. Depressed yields, uncertainties about the IMF program and the balance of risks on the BoP leave the UAH more exposed. Low/negative carry and dissipating oil momentum should keep KZT range-bound in the coming months. Buy 1x2 3M EUR put/CZK call spread (strikes 23.95, 23.00) Long EGP carry trade via 3m Tbills Buy USD call/TRY put spread, 3m, 1.60-1.70 strikes 0.58 0.22 3.70 2.90

PLN*

Bullish

Short EUR/PLN via 1m (3.90) and 3m (3.85) digitals

0.37

3.20

RON*

Bullish

Hold 6m T-bills FX unhedged

0.39

3.30

ILS

Bullish

Long ILS vs. equally weighted EUR, USD basket

0.31

2.80

HUF*

Neutral

0.23

2.80

RUB

Neutral

0.05

1.95

CZK*

Bullish

0.16

2.20

ZAR

Neutral

-0.04

1.85

UAH

Neutral

KZT

Neutral

Note: * Versus EUR. The variable score is an index that ranks EM currencies according to the vol-adjusted returns, PPP valuation, carry, systemic risk, basic balance/GDP and reserves accumulated over the past 5y/GDP. For more details on the trade recommendations, please see the EM Dashboard. Source: Barclays Capital

7 July 2011

24

Barclays Capital | The Emerging Markets Weekly

EM CREDIT PORTFOLIO

OAS (bp) 31-Dec-10 EM Portfolio Arg, Ven, Ukr Other EM Asia Philippines Indonesia Sri Lanka Vietnam EMEA Turkey Russia Qatar Poland Lebanon Ukraine Hungary South Africa Lithuania Croatia Egypt Latin America Brazil Mexico Venezuela Argentina Colombia Peru Panama Uruguay El Salvador Dominican Republic Off-Index Allocations Abu Dhabi Bulgaria Gabon Pakistan Ghana Tunisia 258 778 182 164 139 166 304 359 222 168 197 152 165 303 444 416 152 259 311 197 321 136 146 1065 571 169 162 158 173 303 372 245 130 221 246 727 361 170 6-Jul-11 242 745 169 163 141 162 320 339 222 198 190 151 161 348 457 271 147 241 288 282 286 99 112 1011 541 121 161 123 131 290 409 258 113 222 283 870 383 158 3mF 277 853 205 195 170 196 363 384 242 212 218 154 188 372 486 293 170 253 313 332 335 128 142 1187 627 152 194 155 155 327 435 415 130 229 330 899 410 208 7.0 5.8 7.2 7.4 8.0 7.0 4.4 5.2 6.3 7.3 6.0 6.4 5.6 4.2 4.9 7.3 7.2 5.5 7.0 8.5 7.8 7.8 8.1 5.5 6.6 7.7 10.5 9.1 10.1 9.2 5.0 3.8 3.7 3.1 5.1 4.2 4.8 2.8 OAD Weights (%) Benchmark Model 100 13 87 15 7.6 6.3 0.6 0.5 39 10.3 10.0 3.5 2.7 2.6 2.4 2.2 2.1 1.5 1.2 0.4 43 11.4 9.5 5.9 4.3 4.0 2.7 2.4 1.7 1.1 0.4 1.4 1.2 0.4 0.3 0.3 0.2 0.2 100 13 87 14 10.0 3.2 0.7 0.4 43 13.2 9.5 4.9 2.5 2.4 2.7 2.2 2.1 2.1 1.2 0.0 42 15.9 6.0 6.6 3.7 1.7 2.7 2.7 2.4 0.3 0.5 0.6 0.0 0.0 0.0 0.3 0.3 0.0 Neutral Neutral Neutral Over Under Over Under Over Over Under Over Under Neutral Over Neutral Neutral Over Neutral Under Neutral Over Under Over Neutral Under Neutral Over Over Under Over Under Under Under Under Neutral Over Under Returns (%) 1w 2011 QTD 2011 YTD 3mF* 0.3 1.3 0.2 0.6 0.4 0.8 0.1 0.9 0.1 -0.2 0.3 0.2 0.6 0.1 0.7 0.3 -0.8 0.5 -0.2 0.3 0.4 -0.1 0.3 1.2 1.7 -0.1 0.6 0.1 0.2 0.2 0.4 0.3 0.1 -0.1 0.9 0.2 0.6 -0.1 0.2 0.8 0.1 0.5 0.5 0.5 0.1 0.9 -0.1 -0.5 0.1 0.2 0.4 -0.1 0.2 0.2 -0.6 0.5 -0.3 -0.2 0.3 0.0 0.3 1.2 0.7 -0.1 0.6 0.1 0.2 0.2 0.4 0.1 0.1 0.0 0.2 0.1 0.1 0.0 5.4 7.8 5.0 4.5 4.3 4.6 2.9 6.8 4.2 1.9 5.0 3.9 4.3 1.9 4.8 11.2 4.5 6.9 6.2 -2.5 6.8 6.1 6.4 11.8 3.9 7.4 4.3 7.2 8.4 4.8 3.7 2.9 3.4 3.2 3.7 1.2 4.6 2.0 -0.6 -2.9 -0.3 0.4 0.4 0.3 0.2 0.7 -0.9 1.0 0.7 1.9 0.4 0.7 1.1 0.7 0.6 1.5 0.9 -1.3 -0.8 0.0 0.1 -4.9 -2.5 0.0 0.3 -0.1 0.9 0.1 1.3 0.8 0.6 1.2 -0.1 2.1 1.0 -0.1 Bonds we recommend Buying Selling

Philippines 20s, 31s Indo 20s, 21s Sri Lanka 20s

Turkey 16s, 17s Russia 28s Qatar 30s,40s

Russia 15s Poland 19s

Ukr 13s, 15s Hungary 15s, EUR 19s SoAf 41s Lithuania 17s, 20s, 21s Croatia EUR 18s

SoAf EUR13s, 14s, EUR16s Croatia EUR 14s/15s, 19s Egypt 20s BR19 MX 40 USD Discount

BR27, BR30 MX 20 PD 17N, PD 13, PD14 Boden 15, Bonar 17 CO 33, CO27 PE33, PE50 PA 36 UY25 EL Salv 35 DR21

DR27

Bulgaria 15s

Ghana 17s

*Benchmark forecast. Benchmark is a variant of the Barclays Capital Global EM Sovereigns index, featuring USD only bonds. Note: Changes in view denoted in bold. Source: Barclays Capital

7 July 2011

25

Barclays Capital | The Emerging Markets Weekly

DATA REVIEW & PREVIEW: ASIA

Rahul Bajoria, Jian Chang, Lingxiu Yang Review of last weeks data releases